|

|

市場調査レポート

商品コード

1428495

金属ケイ素市場:世界の市場規模、シェア、動向分析、機会、予測レポート 2019-2030年Silicon Metal Market - Global Size, Share, Trend Analysis, Opportunity and Forecast Report, 2019-2030, Segmented By Product ; By Application ; By Region (North America, Europe, Asia Pacific, Latin America, Middle East and Africa ) |

||||||

|

|||||||

| 金属ケイ素市場:世界の市場規模、シェア、動向分析、機会、予測レポート 2019-2030年 |

|

出版日: 2024年02月03日

発行: Blueweave Consulting

ページ情報: 英文 400 Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

金属ケイ素の世界市場規模は2024-2030年にCAGR 5%で大幅に拡大し、2030年には97億8,000万米ドルに達する予測

金属ケイ素の世界市場は、主要な最終用途産業からの製品需要の増加、再生可能エネルギーと環境持続可能性に対する各国政府の支援イニシアティブ、ケイ素生産技術の進歩の採用増加により活況を呈しています。

戦略コンサルティングと市場調査の大手企業であるBlueWeave Consulting社は、最近の調査で、2023年の世界の金属ケイ素市場規模を73億米ドルと推定しました。2024年から2030年にかけての予測期間において、BlueWeaveは世界の金属ケイ素市場規模がCAGR 5%で成長し、2030年には97億8,000万米ドルに達すると予測しています。金属ケイ素の世界市場は、自動車産業におけるアルミニウム合金の需要増に後押しされています。アルミニウム-シリコン合金に対する需要の急増は、電気自動車に対する世界の需要の高まりと自動車生産の増加によって、金属ケイ素の消費を押し上げると予測されます。また、スマート携帯電話、ラップトップ、タブレット、その他の電子機器の利用が増加していることも、分析期間中の世界金属ケイ素市場の推進力になると予想されます。さらに、シリコーンの用途の広がり、エネルギー貯蔵分野からの需要の増加、世界の化学産業による金属ケイ素の採用の増加によって、市場の成長が促進されると予想されます。

機会-EVと再生可能エネルギーにおける高純度シリコンの需要拡大

シリコンの従来の精製方法では、電気エネルギーと熱エネルギーを大量に必要とするため、生産コストが高くなります。例えば、シーメンス法は高温を必要とし、シリコン1キログラム当たり200キロワット時の電力が必要です。アリゾナ州立大学の研究開発者は、よりエネルギー効率の高いプロセスの必要性を認識し、冶金グレードのシリコンから直接超高純度シリコンを製造するための2段階、3電極アプローチである電解精製を開発しました。純度99.99999%以上を誇るこの技術革新は、シーメンス法に比べてエネルギー消費を90%大幅に削減します。電気自動車(EV)や再生可能エネルギーといった先端分野での応用の可能性は、これらの分野における高純度シリコンの需要の高まりと一致しています。

地政学的緊張が世界の金属ケイ素市場に与える影響

世界の金属ケイ素市場は、様々な次元で地政学的緊張の影響を大きく受けています。中東における最近の紛争に代表される地政学的な出来事は、政治力学と経済的影響との間の複雑な相互作用を浮き彫りにしています。このセクターは、特に必須原材料に関して、地域紛争によるサプライチェーンの潜在的混乱に直面しており、生産と価格設定の不確実性を助長しています。特に中東のような金属ケイ素の生産に不可欠な地域での地政学的緊張の激化は、世界サプライチェーンを混乱させ、生産コストを上昇させる可能性を秘めています。また、現在進行中のロシアとウクライナの紛争は直接的な経済的影響を及ぼし、金属ケイ素市場に影響を与えます。地政学的緊張が続く中、ロシアは経済的・金融的孤立に直面し、金属ケイ素生産に不可欠な部品の供給に影響を及ぼす可能性があります。米国と中国の貿易摩擦は、バイデン政権が中国への半導体販売に対する関税と制限を維持しているため、さらに複雑な要因となっています。これらの緊張は、金属ケイ素市場の貿易パターンと市場力学を再構築し、世界の需給に影響を与えます。要するに、地政学的緊張が世界の金属ケイ素市場に与える多面的な影響は、サプライチェーンの脆弱性、生産コストの変動、世界貿易力学の変化を包含し、政治的動向が業界全体に大きく響く状況を作り出しています。

金属ケイ素の世界市場-用途別

用途別に見ると、金属ケイ素の世界市場はアルミニウム合金、半導体、ソーラーパネル、ステンレス鋼の各セグメントに分けられます。アルミニウム合金セグメントは、金属ケイ素の世界市場においてアプリケーション別で最も高いシェアを占めています。アルミニウム合金は、自動車、建設、海洋、輸送産業で広く応用されていることから、世界金属ケイ素市場で最大のサブセグメントとなっています。特に自動車と建築では、軽量アルミニウム合金が燃費向上に重要な役割を果たしています。複雑な形状に鋳造できることから、鋳鉄や鋼鉄製のような重量のある部品の代替品として期待されています。様々な合金の中でも、アルミニウムシリコンは、優れた鋳造性、高耐食性、熱伝導性、機械加工性など、その卓越した品質により際立っています。

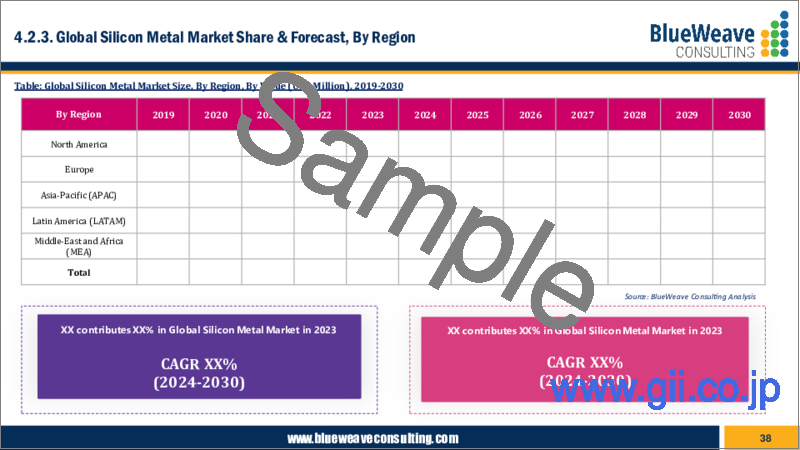

金属ケイ素の世界市場-地域別

金属ケイ素の世界市場に関する詳細な調査レポートは、5地域にわたる主要国の市場をカバーしています:北米、欧州、アジア太平洋、ラテンアメリカ、中東アフリカの5地域です。予測期間中、アジア太平洋地域が世界の金属ケイ素市場で最も高いシェアを占めると予想されています。この地域の優位性は、インドや中国のような国々での産業拡大によって推進されています。予測期間中、アルミニウム合金は、特にパッケージング、自動車、エレクトロニクスなどの新興アプリケーションにおいて、シリコン需要の維持に重要な役割を果たすと予想されます。特に、日本、台湾、インドはインフラ整備が著しく、通信インフラ、ネットワーク・ハードウェア、医療機器の販売増につながっています。金属ケイ素の需要は、特にシリコーンやシリコン・ウエハーのようなシリコン系材料の需要が増加しています。アジアを拠点とする自動車メーカーによる金属ケイ素消費の増加は、予測期間中にアルミニウム-シリコン合金の生産を促進し、この地域の金属ケイ素市場、特に自動車セクターに成長機会をもたらすと予想されます。

競合情勢

世界の金属ケイ素市場は断片化されており、多数の企業が市場に参入しています。金属ケイ素の世界市場を独占している主な企業は、Ferroglobe、Elkem、Dow、Wacker Chemie AG、Hoshine Silicon、Rusal、Simcoa、RW Silicium、G.S. Energy、Liasaなどです。各企業が採用する主なマーケティング戦略は、顧客リーチを拡大し、市場全体における競争力を獲得するための施設拡張、製品の多様化、提携、協力、パートナーシップ、買収です。

本レポートの詳細な分析により、成長の可能性、今後の動向、世界の金属ケイ素市場の統計に関する情報を提供します。また、総市場規模の予測を促進する要因も取り上げています。当レポートは、世界の金属ケイ素市場における最近の技術動向と、意思決定者が健全な戦略的意思決定を行えるよう、業界考察力を提供することをお約束します。さらに、市場の成長促進要因・課題・競争力についても分析しています。

目次

第1章 調査の枠組み

第2章 エグゼクティブサマリー

第3章 世界の金属ケイ素市場に関する洞察

- 業界のバリューチェーン分析

- DROC分析

- 成長促進要因

- 主要な最終用途産業からの需要の増加

- 再生可能エネルギーと環境の持続可能性に対する政府の取り組み

- シリコン製造技術の進歩

- 抑制要因

- 不安定な原材料価格

- 地政学的不安定と貿易の混乱

- 機会

- 先端用途(EV、再生可能エネルギー)における高純度シリコンの需要の拡大

- 電気自動車(EV)と再生可能エネルギー市場の拡大

- 課題

- 世界市場での競合激化

- 循環型産業の需要変動

- 成長促進要因

- 技術の進歩/最近の開発

- 規制の枠組み

- ポーターのファイブフォース分析

第4章 世界の金属ケイ素市場概要

- 市場規模と予測、2019~2030年

- 金額別

- 市場シェアと予測

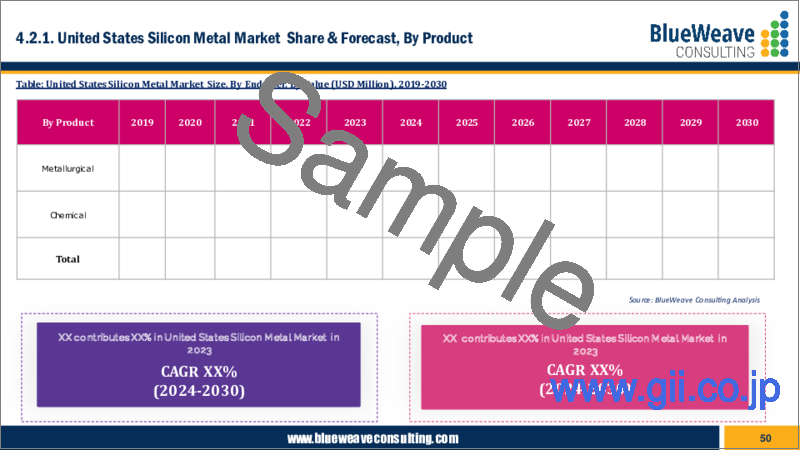

- 製品別

- 冶金グレード

- 化学グレード

- 用途別

- アルミニウム合金

- 半導体

- ソーラーパネル

- ステンレス鋼

- その他

- 地域別

- 北米

- 欧州

- アジア太平洋(APAC)

- ラテンアメリカ(LATAM)

- 中東およびアフリカ(MEA)

- 製品別

第5章 北米の金属ケイ素市場

- 市場規模と予測、2019~2030年

- 金額別

- 市場シェアと予測

- 製品別

- 用途別

- 国別

- 米国

- カナダ

第6章 欧州の金属ケイ素市場

- 市場規模と予測、2019~2030年

- 金額別

- 市場シェアと予測

- 製品別

- 用途別

- 国別

- ドイツ

- 英国

- イタリア

- フランス

- スペイン

- ベルギー

- ロシア

- その他

第7章 アジア太平洋地域の金属ケイ素市場

- 市場規模と予測、2019~2030年

- 金額別

- 市場シェアと予測

- 製品別

- 用途別

- 国別

- 中国

- インド

- 日本

- 韓国

- オーストラリアとニュージーランド

- インドネシア

- マレーシア

- シンガポール

- ベトナム

- その他

第8章 ラテンアメリカの金属ケイ素市場

- 市場規模と予測、2019~2030年

- 金額別

- 市場シェアと予測

- 製品別

- 用途別

- 国別

- ブラジル

- メキシコ

- アルゼンチン

- ペルー

- その他

第9章 中東およびアフリカの金属ケイ素市場

- 市場規模と予測、2019~2030年

- 金額別

- 市場シェアと予測

- 製品別

- 用途別

- 国別

- サウジアラビア

- アラブ首長国連邦

- カタール

- クウェート

- 南アフリカ

- ナイジェリア

- アルジェリア

- その他

第10章 競合情勢

- 主要企業とその製品のリスト

- 世界の金属ケイ素市場シェア分析、2023年

- 経営パラメータによる競合ベンチマーキング

- 主要な戦略的展開(合併、買収、パートナーシップなど)

第11章 地政学的緊張の高まりが世界の金属ケイ素市場に与える影響

第12章 企業プロファイル

- Ferroglobe

- Elkem

- Dow

- Wacker Chemie AG

- Hoshine Silicon

- Rusal

- Simcoa

- RW Silicium

- GS Energy

- Liasa

- その他の主要企業

第13章 主要な戦略的推奨事項

第14章 調査手法

List of Figures

- Figure 1 Global Silicon Metal Market Segmentation

- Figure 2 Global Silicon Metal Market Value Chain Analysis

- Figure 3 Company Market Share Analysis, 2023

- Figure 4 Global Silicon Metal Market Size, By Value (USD Billion), 2019-2030

- Figure 5 Global Silicon Metal Market Share, By Product, By Value, 2019-2030

- Figure 6 Global Silicon Metal Market Share, By Application, By Value, 2019-2030

- Figure 7 Global Silicon Metal Market Share, By Region, By Value, 2019-2030

- Figure 8 North America Silicon Metal Market Size, By Value (USD Billion), 2019-2030

- Figure 9 North America Silicon Metal Market Share, By Product, By Value, 2019-2030

- Figure 10 North America Silicon Metal Market Share, By Application, By Value, 2019-2030

- Figure 11 North America Silicon Metal Market Share, By Country, By Value, 2019-2030

- Figure 12 United States Silicon Metal Market Size, By Value (USD Billion), 2019-2030

- Figure 13 United States Silicon Metal Market Share, By Product, By Value, 2019-2030

- Figure 14 United States Silicon Metal Market Share, By Application, By Value, 2019-2030

- Figure 15 Canada Silicon Metal Market Size, By Value (USD Billion), 2019-2030

- Figure 16 Canada Silicon Metal Market Share, By Product, By Value, 2019-2030

- Figure 17 Canada Silicon Metal Market Share, By Application, By Value, 2019-2030

- Figure 18 Europe Silicon Metal Market Size, By Value (USD Billion), 2019-2030

- Figure 19 Europe Silicon Metal Market Share, By Product, By Value, 2019-2030

- Figure 20 Europe Silicon Metal Market Share, By Application, By Value, 2019-2030

- Figure 21 Europe Silicon Metal Market Share, By Country, By Value, 2019-2030

- Figure 22 Germany Silicon Metal Market Size, By Value (USD Billion), 2019-2030

- Figure 23 Germany Silicon Metal Market Share, By Product, By Value, 2019-2030

- Figure 24 Germany Silicon Metal Market Share, By Application, By Value, 2019-2030

- Figure 25 United Kingdom Silicon Metal Market Size, By Value (USD Billion), 2019-2030

- Figure 26 United Kingdom Silicon Metal Market Share, By Product, By Value, 2019-2030

- Figure 27 United Kingdom Silicon Metal Market Share, By Application, By Value, 2019-2030

- Figure 28 Italy Silicon Metal Market Size, By Value (USD Billion), 2019-2030

- Figure 29 Italy Silicon Metal Market Share, By Product, By Value, 2019-2030

- Figure 30 Italy Silicon Metal Market Share, By Application, By Value, 2019-2030

- Figure 31 France Silicon Metal Market Size, By Value (USD Billion), 2019-2030

- Figure 32 France Silicon Metal Market Share, By Product, By Value, 2019-2030

- Figure 33 France Silicon Metal Market Share, By Application, By Value, 2019-2030

- Figure 34 Spain Silicon Metal Market Size, By Value (USD Billion), 2019-2030

- Figure 35 Spain Silicon Metal Market Share, By Product, By Value, 2019-2030

- Figure 36 Spain Silicon Metal Market Share, By Application, By Value, 2019-2030

- Figure 37 Belgium Silicon Metal Market Size, By Value (USD Billion), 2019-2030

- Figure 38 Belgium Silicon Metal Market Share, By Product, By Value, 2019-2030

- Figure 39 Belgium Silicon Metal Market Share, By Application, By Value, 2019-2030

- Figure 40 Rest of Europe Silicon Metal Market Size, By Value (USD Billion), 2019-2030

- Figure 41 Rest of Europe Silicon Metal Market Share, By Technology, By Value, 2019-2030

- Figure 42 Rest of Europe Silicon Metal Market Share, By Application, By Value, 2019-2030

- Figure 43 Asia Pacific Silicon Metal Market Size, By Value (USD Billion), 2019-2030

- Figure 44 Asia Pacific Silicon Metal Market Share, By Product, By Value, 2019-2030

- Figure 45 Asia Pacific Silicon Metal Market Share, By Deployment, By Value, 2019-2030

- Figure 46 Asia Pacific Silicon Metal Market Share, By Country, By Value, 2019-2030

- Figure 47 China Silicon Metal Market Size, By Value (USD Billion), 2019-2030

- Figure 48 China Silicon Metal Market Share, By Product, By Value, 2019-2030

- Figure 49 China Silicon Metal Market Share, By Application, By Value, 2019-2030

- Figure 50 India Silicon Metal Market Size, By Value (USD Billion), 2019-2030

- Figure 51 India Silicon Metal Market Share, By Product, By Value, 2019-2030

- Figure 52 India Silicon Metal Market Share, By Application, By Value, 2019-2030

- Figure 53 Japan Silicon Metal Market Size, By Value (USD Billion), 2019-2030

- Figure 54 Japan Silicon Metal Market Share, By Product, By Value, 2019-2030

- Figure 55 Japan Silicon Metal Market Share, By Application, By Value, 2019-2030

- Figure 56 South Korea Silicon Metal Market Size, By Value (USD Billion), 2019-2030

- Figure 57 South Korea Silicon Metal Market Share, By Product, By Value, 2019-2030

- Figure 58 South Korea Silicon Metal Market Share, By Application, By Value, 2019-2030

- Figure 59 Australia & New Zealand Silicon Metal Market Size, By Value (USD Billion), 2019-2030

- Figure 60 Australia & New Zealand Silicon Metal Market Share, By Product, By Value, 2019-2030

- Figure 61 Australia & New Zealand Silicon Metal Market Share, By Application, By Value, 2019-2030

- Figure 62 Indonesia Silicon Metal Market Size, By Value (USD Billion), 2019-2030

- Figure 63 Indonesia Silicon Metal Market Share, By Product, By Value, 2019-2030

- Figure 64 Indonesia Silicon Metal Market Share, By Application, By Value, 2019-2030

- Figure 65 Malaysia Silicon Metal Market Size, By Value (USD Billion), 2019-2030

- Figure 66 Malaysia Silicon Metal Market Share, By Product, By Value, 2019-2030

- Figure 67 Malaysia Silicon Metal Market Share, By Application, By Value, 2019-2030

- Figure 68 Singapore Silicon Metal Market Size, By Value (USD Billion), 2019-2030

- Figure 69 Singapore Silicon Metal Market Share, By Product, By Value, 2019-2030

- Figure 70 Singapore Silicon Metal Market Share, By Application, By Value, 2019-2030

- Figure 71 Vietnam Silicon Metal Market Size, By Value (USD Billion), 2019-2030

- Figure 72 Vietnam Silicon Metal Market Share, By Product, By Value, 2019-2030

- Figure 73 Vietnam Silicon Metal Market Share, By Application, By Value, 2019-2030

- Figure 74 Rest of APAC Silicon Metal Market Size, By Value (USD Billion), 2019-2030

- Figure 75 Rest of APAC Silicon Metal Market Share, By Product, By Value, 2019-2030

- Figure 76 Rest of APAC Silicon Metal Market Share, By Application, By Value, 2019-2030

- Figure 77 Latin America Silicon Metal Market Size, By Value (USD Billion), 2019-2030

- Figure 78 Latin America Silicon Metal Market Share, By Product, By Value, 2019-2030

- Figure 79 Latin America Silicon Metal Market Share, By Application, By Value, 2019-2030

- Figure 80 Latin America Silicon Metal Market Share, By Country, By Value, 2019-2030

- Figure 81 Brazil Silicon Metal Market Size, By Value (USD Billion), 2019-2030

- Figure 82 Brazil Silicon Metal Market Share, By Product, By Value, 2019-2030

- Figure 83 Brazil Silicon Metal Market Share, By Application, By Value, 2019-2030

- Figure 84 Mexico Silicon Metal Market Size, By Value (USD Billion), 2019-2030

- Figure 85 Mexico Silicon Metal Market Share, By Product, By Value, 2019-2030

- Figure 86 Mexico Silicon Metal Market Share, By Application, By Value, 2019-2030

- Figure 87 Argentina Silicon Metal Market Size, By Value (USD Billion), 2019-2030

- Figure 88 Argentina Silicon Metal Market Share, By Product, By Value, 2019-2030

- Figure 89 Argentina Silicon Metal Market Share, By Application, By Value, 2019-2030

- Figure 90 Peru Silicon Metal Market Size, By Value (USD Billion), 2019-2030

- Figure 91 Peru Silicon Metal Market Share, By Product, By Value, 2019-2030

- Figure 92 Peru Silicon Metal Market Share, By Application, By Value, 2019-2030

- Figure 93 Rest of LATAM Silicon Metal Market Size, By Value (USD Billion), 2019-2030

- Figure 94 Rest of LATAM Silicon Metal Market Share, By Product By Value, 2019-2030

- Figure 95 Rest of LATAM Silicon Metal Market Share, By Application, By Value, 2019-2030

- Figure 96 Middle East and Africa Silicon Metal Market Size, By Value (USD Billion), 2019-2030

- Figure 97 Middle East and Africa Silicon Metal Market Share, By Product, By Value, 2019-2030

- Figure 98 Middle East and Africa Silicon Metal Market Share, By Application, By Value, 2019-2030

- Figure 99 Middle East and Africa Silicon Metal Market Share, By Country, By Value, 2019-2030

- Figure 100 Saudi Arabia Silicon Metal Market Size, By Value (USD Billion), 2019-2030

- Figure 101 Saudi Arabia Silicon Metal Market Share, By Product, By Value, 2019-2030

- Figure 102 Saudi Arabia Silicon Metal Market Share, By Application, By Value, 2019-2030

- Figure 103 UAE Silicon Metal Market Size, By Value (USD Billion), 2019-2030

- Figure 104 UAE Silicon Metal Market Share, By Product, By Value, 2019-2030

- Figure 105 UAE Silicon Metal Market Share, By Application, By Value, 2019-2030

- Figure 106 Qatar Silicon Metal Market Size, By Value (USD Billion), 2019-2030

- Figure 107 Qatar Silicon Metal Market Share, By Product, By Value, 2019-2030

- Figure 108 Qatar Silicon Metal Market Share, By Application, By Value, 2019-2030

- Figure 109 Kuwait Silicon Metal Market Size, By Value (USD Billion), 2019-2030

- Figure 110 Kuwait Silicon Metal Market Share, By Product, By Value, 2019-2030

- Figure 111 Kuwait Silicon Metal Market Share, By Application, By Value, 2019-2030

- Figure 112 Iran Silicon Metal Market Size, By Value (USD Billion), 2019-2030

- Figure 113 Iran Silicon Metal Market Share, By Product, By Value, 2019-2030

- Figure 114 Iran Silicon Metal Market Share, By Application, By Value, 2019-2030

- Figure 115 South Africa Silicon Metal Market Size, By Value (USD Billion), 2019-2030

- Figure 116 South Africa Silicon Metal Market Share, By Product, By Value, 2019-2030

- Figure 117 South Africa Silicon Metal Market Share, By Application, By Value, 2019-2030

- Figure 118 Nigeria Silicon Metal Market Size, By Value (USD Billion), 2019-2030

- Figure 119 Nigeria Silicon Metal Market Share, By Product, By Value, 2019-2030

- Figure 120 Nigeria Silicon Metal Market Share, By Application, By Value, 2019-2030

- Figure 121 Kenya Silicon Metal Market Size, By Value (USD Billion), 2019-2030

- Figure 122 Kenya Silicon Metal Market Share, By Product, By Value, 2019-2030

- Figure 123 Kenya Silicon Metal Market Share, By Application, By Value, 2019-2030

- Figure 124 Egypt Silicon Metal Market Size, By Value (USD Billion), 2019-2030

- Figure 125 Egypt Silicon Metal Market Share, By Product, By Value, 2019-2030

- Figure 126 Egypt Silicon Metal Market Share, By Application, By Value, 2019-2030

- Figure 127 Morocco Silicon Metal Market Size, By Value (USD Billion), 2019-2030

- Figure 128 Morocco Silicon Metal Market Share, By Product, By Value, 2019-2030

- Figure 129 Morocco Silicon Metal Market Share, By Application, By Value, 2019-2030

- Figure 130 Algeria Silicon Metal Market Size, By Value (USD Billion), 2019-2030

- Figure 131 Algeria Silicon Metal Market Share, By Product, By Value, 2019-2030

- Figure 132 Algeria Silicon Metal Market Share, By Application, By Value, 2019-2030

- Figure 133 Rest of MEA Silicon Metal Market Size, By Value (USD Billion), 2019-2030

- Figure 134 Rest of MEA Silicon Metal Market Share, By Product, By Value, 2019-2030

- Figure 135 Rest of MEA Silicon Metal Market Share, By Application, By Value, 2019-2030

List of Tables

- Table 1 Global Silicon Metal Market Size, By Product, By Value, 2019-2030

- Table 2 Global Silicon Metal Market Size, By Application, By Value, 2019-2030

- Table 3 Global Silicon Metal Market Size, By Region, By Value, 2019-2030

- Table 4 North America Silicon Metal Market Size, By Product, By Value, 2019-2030

- Table 5 North America Silicon Metal Market Size, By Application, By Value, 2019-2030

- Table 6 North America Silicon Metal Market Size, By Country, By Value, 2019-2030

- Table 7 United States Silicon Metal Market Size, By Product, By Value, 2019-2030

- Table 8 United States Silicon Metal Market Size, By Application, By Value, 2019-2030

- Table 9 Canada Silicon Metal Market Size, By Product, By Value, 2019-2030

- Table 10 Canada Silicon Metal Market Size, By Application, By Value, 2019-2030

- Table 11 Europe Silicon Metal Market Size, By Product, By Value, 2019-2030

- Table 12 Europe Silicon Metal Market Size, By Application, By Value, 2019-2030

- Table 13 Europe Silicon Metal Market Size, By Country, By Value, 2019-2030

- Table 14 Germany Silicon Metal Market Size, By Product, By Value, 2019-2030

- Table 15 Germany Silicon Metal Market Size, By Application, By Value, 2019-2030

- Table 16 United Kingdom Silicon Metal Market Size, By Product, By Value, 2019-2030

- Table 17 United Kingdom Silicon Metal Market Size, By Application, By Value, 2019-2030

- Table 18 Italy Silicon Metal Market Size, By Product, By Value, 2019-2030

- Table 19 Italy Silicon Metal Market Size, By Application, By Value, 2019-2030

- Table 20 France Silicon Metal Market Size, By Product, By Value, 2019-2030

- Table 21 France Silicon Metal Market Size, By Application, By Value, 2019-2030

- Table 22 Spain Silicon Metal Market Size, By Product, By Value, 2019-2030

- Table 23 Spain Silicon Metal Market Size, By Application, By Value, 2019-2030

- Table 24 Belgium Silicon Metal Market Size, By Product, By Value, 2019-2030

- Table 25 Belgium Silicon Metal Market Size, By Application, By Value, 2019-2030

- Table 26 Rest of Europe Silicon Metal Market Size, By Product, By Value, 2019-2030

- Table 27 Rest of Europe Silicon Metal Market Size, By Application, By Value, 2019-2030

- Table 28 Asia Pacific Silicon Metal Market Size, By Product, By Value, 2019-2030

- Table 29 Asia Pacific Silicon Metal Market Size, By Application, By Value, 2019-2030

- Table 30 Asia Pacific Silicon Metal Market Size, By Country, By Value, 2019-2030

- Table 31 China Silicon Metal Market Size, By Product, By Value, 2019-2030

- Table 32 China Silicon Metal Market Size, By Application, By Value, 2019-2030

- Table 33 India Silicon Metal Market Size, By Product, By Value, 2019-2030

- Table 34 India Silicon Metal Market Size, By Application, By Value, 2019-2030

- Table 35 Japan Silicon Metal Market Size, By Product, By Value, 2019-2030

- Table 36 Japan Silicon Metal Market Size, By Application, By Value, 2019-2030

- Table 37 South Korea Silicon Metal Market Size, By Product, By Value, 2019-2030

- Table 38 South Korea Silicon Metal Market Size, By Application, By Value, 2019-2030

- Table 39 Australia & New Zealand Silicon Metal Market Size, By Product, By Value, 2019-2030

- Table 40 Australia & New Zealand Silicon Metal Market Size, By Application, By Value, 2019-2030

- Table 41 Indonesia Silicon Metal Market Size, By Product, By Value, 2019-2030

- Table 42 Indonesia Silicon Metal Market Size, By Application, By Value, 2019-2030

- Table 43 Malaysia Silicon Metal Market Size, By Product, By Value, 2019-2030

- Table 44 Malaysia Silicon Metal Market Size, By Application, By Value, 2019-2030

- Table 45 Singapore Silicon Metal Market Size, By Product, By Value, 2019-2030

- Table 46 Singapore Silicon Metal Market Size, By Application, By Value, 2019-2030

- Table 47 Philippines Silicon Metal Market Size, By Product, By Value, 2019-2030

- Table 48 Philippines Silicon Metal Market Size, By Application, By Value, 2019-2030

- Table 49 Vietnam Silicon Metal Market Size, By Product, By Value, 2019-2030

- Table 50 Vietnam Silicon Metal Market Size, By Application, By Value, 2019-2030

- Table 51 Rest of APAC Silicon Metal Market Size, By Product, By Value, 2019-2030

- Table 52 Rest of APAC Silicon Metal Market Size, By Application, By Value, 2019-2030

- Table 53 Latin America Silicon Metal Market Size, By Product, By Value, 2019-2030

- Table 54 Latin America Silicon Metal Market Size, By Application, By Value, 2019-2030

- Table 55 Latin America Silicon Metal Market Size, By Country, By Value, 2019-2030

- Table 56 Brazil Silicon Metal Market Size, By Product, By Value, 2019-2030

- Table 57 Brazil Silicon Metal Market Size, By Application, By Value, 2019-2030

- Table 58 Mexico Silicon Metal Market Size, By Product, By Value, 2019-2030

- Table 59 Mexico Silicon Metal Market Size, By Application, By Value, 2019-2030

- Table 60 Argentina Silicon Metal Market Size, By Product, By Value, 2019-2030

- Table 61 Argentina Silicon Metal Market Size, By Application, By Value, 2019-2030

- Table 62 Peru Silicon Metal Market Size, By Product, By Value, 2019-2030

- Table 63 Peru Silicon Metal Market Size, By Application, By Value, 2019-2030

- Table 64 Rest of LATAM Silicon Metal Market Size, By Product, By Value, 2019-2030

- Table 65 Rest of LATAM Silicon Metal Market Size, By Application, By Value, 2019-2030

- Table 66 Middle East and Africa Silicon Metal Market Size, By Product, By Value, 2019-2030

- Table 67 Middle East and Africa Silicon Metal Market Size, By Country, By Value, 2019-2030

- Table 68 Saudi Arabia Silicon Metal Market Size, By Product, By Value, 2019-2030

- Table 69 Saudi Arabia Silicon Metal Market Size, By Application, By Value, 2019-2030

- Table 70 UAE Silicon Metal Market Size, By Product, By Value, 2019-2030

- Table 71 UAE Silicon Metal Market Size, By Application, By Value, 2019-2030

- Table 72 Qatar Silicon Metal Market Size, By Product, By Value, 2019-2030

- Table 73 Qatar Silicon Metal Market Size, By Application, By Value, 2019-2030

- Table 74 Kuwait Silicon Metal Market Size, By Product, By Value, 2019-2030

- Table 75 Kuwait Silicon Metal Market Size, By Application, By Value, 2019-2030

- Table 76 Iran Silicon Metal Market Size, By Product, By Value, 2019-2030

- Table 77 Iran Silicon Metal Market Size, By Application, By Value, 2019-2030

- Table 78 South Africa Silicon Metal Market Size, By Product, By Value, 2019-2030

- Table 79 South Africa Silicon Metal Market Size, By Application, By Value, 2019-2030

- Table 80 Nigeria Silicon Metal Market Size, By Product, By Value, 2019-2030

- Table 81 Nigeria Silicon Metal Market Size, By Application, By Value, 2019-2030

- Table 82 Kenya Silicon Metal Market Size, By Product, By Value, 2019-2030

- Table 83 Kenya Silicon Metal Market Size, By Application, By Value, 2019-2030

- Table 84 Egypt Silicon Metal Market Size, By Product, By Value, 2019-2030

- Table 85 Egypt Silicon Metal Market Size, By Application, By Value, 2019-2030

- Table 86 Morocco Silicon Metal Market Size, By Product, By Value, 2019-2030

- Table 87 Morocco Silicon Metal Market Size, By Application, By Value, 2019-2030

- Table 88 Algeria Silicon Metal Market Size, By Product, By Value, 2019-2030

- Table 89 Algeria Silicon Metal Market Size, By Application, By Value, 2019-2030

- Table 90 Rest of MEA Silicon Metal Market Size, By Product, By Value, 2019-2030

- Table 91 Rest of MEA Silicon Metal Market Size, By Application, By Value, 2019-2030

- Table 92 Ferroglobe Company Overview

- Table 93 Ferroglobe Financial Overview

- Table 94 Elkem Company Overview

- Table 95 Elkem Financial Overview

- Table 96 Dow Company Overview

- Table 97 Dow Financial Overview

- Table 98 Wacker Chemie AG Company Overview

- Table 99 Wacker Chemie AG Financial Overview

- Table 100 Hoshine Silicon Company Overview

- Table 101 Hoshine Silicon Financial Overview

- Table 102 Rusal Company Overview

- Table 103 Rusal Financial Overview

- Table 104 Simcoa Company Overview

- Table 105 Simcoa Financial Overview

- Table 106 RW Silicium Company Overview

- Table 107 RW Silicium Financial Overview

- Table 108 G.S. Energy Company Overview

- Table 109 G.S. Energy Financial Overview

- Table 110 Liasa Company Overview

- Table 111 Liasa Financial Overview

- Table 112 Other Prominent Players Company Overview

- Table 113 Other Prominent Players Financial Overview

Global Silicon Metal Market Size Expands at Significant CAGR of 5% During 2024-2030 to Reach USD 9.78 Billion by 2030

Global Silicon Metal Market is flourishing due to the growing demand for the product from key end use industries, governments' supportive initiatives for renewable energy and environmental sustainability, and increasing adoption of advancements in silicon production technology.

BlueWeave Consulting, a leading strategic consulting and market research firm, in its recent study, estimated the Global Silicon Metal Market size at USD 7.3 billion in 2023. During the forecast period between 2024 and 2030, BlueWeave expects the Global Silicon Metal Market size to grow at a CAGR of 5% reaching a value of USD 9.78 billion by 2030. The Global Silicon Metal Market is propelled by the growing demand for aluminum alloys within the automotive sector. The surge in demand for aluminum-silicon alloys is projected to boost the consumption of silicon metals, driven by the rising global demand for electric vehicles and increased automobile production. The increasing utilization of smart cellular phones, laptops, tablets, and other electronic devices is also expected to propel the Global Silicon Metal Market during the period in analysis. In addition, the market growth is expected to be bolstered by the broadening range of applications for silicones, an increasing demand from energy storage sectors, and growing adoption of silicon metal by the global chemical industry.

Opportunity - Growing Demand for High Purity Silicon in EVs and Renewable Energy)

Conventional refining methods for silicon demand substantial electrical and thermal energy inputs, resulting in high production costs. For instance, the Siemens method requires elevated temperatures and up to 200 kilowatt-hours of electricity per kilogram of silicon. Recognizing the need for more energy-efficient processes, researchers at Arizona State University have developed electro-refining, a two-step, three-electrode approach to produce ultrapure silicon directly from metallurgical-grade silicon. This innovation, boasting over 99.99999% purity, significantly reduces energy consumption by 90% compared to the Siemens method. The potential applications in advanced fields, such as electric vehicles (EVs) and renewable energy, align with the growing demand for high-purity silicon in these sectors.

Impact of Geopolitical Tensions on Global Silicon Metal Market

The Global Silicon Metal Market is significantly influenced by geopolitical tensions in diverse dimensions. Geopolitical events, exemplified by the recent conflict in the Middle East, underscore the intricate interplay between political dynamics and economic repercussions. The sector faces potential disruptions in its supply chain, particularly concerning essential raw materials, due to regional conflicts, contributing to uncertainties in production and pricing. The intensification of geopolitical tensions, especially in regions vital to silicon metal production, such as the Middle East, holds the potential to disrupt global supply chains and elevate production costs. Also, the ongoing conflict between Russia and Ukraine has direct economic consequences, impacting the Silicon Metal Market. As geopolitical tensions persist, Russia faces economic and financial isolation, potentially affecting the supply of critical components for silicon metal production. The US-China trade tensions contribute additional complexities, with the Biden administration maintaining tariffs and restrictions on semiconductor sales to China. These tensions reshape trade patterns and market dynamics within the silicon metal market, impacting global supply and demand. In essence, the multifaceted impact of geopolitical tensions on the Global Silicon Metal Market encompasses supply chain vulnerabilities, production cost fluctuations, and alterations in global trade dynamics, creating a landscape where political developments resonate significantly throughout the industry.

Global Silicon Metal Market

Segmental Information

Global Silicon Metal Market - By Application

On the basis of application, the Global Silicon Metal Market is divided into Aluminum Alloys, Semiconductors, Solar Panels, and Stainless Steel segments. The aluminum alloys segment holds the highest share in the Global Silicon Metal Market by application. Aluminum alloys' prominence stems from widespread applications in automotive, construction, marine, and transportation industries, making it the largest subsegment in the Global Silicon Metal Market. Particularly crucial in automotive and construction, lightweight aluminum alloys play a key role in enhancing fuel efficiency. Their ability to be cast into intricate shapes positions them as potential replacements for heavier components, such as those made of cast iron and steel. Among various alloys, aluminum silicon stands out due to its exceptional qualities, including superior castability, high corrosion resistance, thermal conductivity, and machinability.

Global Silicon Metal Market - By Region

The in-depth research report on the Global Silicon Metal Market covers the market in a number of major countries across five regions: North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. The Asia Pacific region is expected to hold the highest share in the Global Silicon Metal Market during the forecast period. The region's dominance is propelled by the industrial expansion in countries like India and China. Over the forecast period, aluminum alloys are anticipated to play a vital role in sustaining silicon demand, especially in emerging applications such as packaging, automotive, and electronics. Notably, Japan, Taiwan, and India have experienced significant infrastructure development, leading to heightened sales of communication infrastructure, network hardware, and medical equipment. The demand for silicon metal sees a rise, particularly for silicon-based materials like silicones and silicon wafers. The increased consumption of silicon metal by Asia-based automobile manufacturers is expected to drive the production of aluminum-silicon alloys during the forecast period, presenting growth opportunities in the region's Silicon Metal Market, particularly in the automotive sector.

Competitive Landscape

The Global Silicon Metal Market is fragmented, with numerous players serving the market. The key players dominating the Global Silicon Metal Market include Ferroglobe, Elkem, Dow, Wacker Chemie AG, Hoshine Silicon, Rusal, Simcoa, RW Silicium, G.S. Energy, and Liasa. The key marketing strategies adopted by the players are facility expansion, product diversification, alliances, collaborations, partnerships, and acquisitions to expand their customer reach and gain a competitive edge in the overall market.

The report's in-depth analysis provides information about growth potential, upcoming trends, and the Global Silicon Metal Market statistics. It also highlights the factors driving forecasts of total market size. The report promises to provide recent technology trends in the Global Silicon Metal Market along with industry insights to help decision-makers make sound strategic decisions. Furthermore, the report also analyses the growth drivers, challenges, and competitive dynamics of the market.

Table of Contents

1. Research Framework

- 1.1. Research Objective

- 1.2. Product Overview

- 1.3. Market Segmentation

2. Executive Summary

3. Global Silicon Metal Market Insights

- 3.1. Industry Value Chain Analysis

- 3.2. DROC Analysis

- 3.2.1. Growth Drivers

- 3.2.1.1. Growing demand from key end-use industries

- 3.2.1.2. Government initiatives for renewable energy and environmental sustainability

- 3.2.1.3. Advancements in silicon production technology

- 3.2.2. Restraints

- 3.2.2.1. Volatile raw material prices

- 3.2.2.2. Geopolitical instability and trade disruptions

- 3.2.3. Opportunities

- 3.2.3.1. Growing demand for high-purity silicon in advanced applications (EVs, renewable energy)

- 3.2.3.2. Expansion of electric vehicle (EV) and renewable energy markets

- 3.2.4. Challenges

- 3.2.4.1. Intensifying competition in the global market

- 3.2.4.2. Fluctuating demand from cyclical industries

- 3.2.1. Growth Drivers

- 3.3. Technological Advancements/Recent Developments

- 3.4. Regulatory Framework

- 3.5. Porter's Five Forces Analysis

- 3.5.1. Bargaining Power of Suppliers

- 3.5.2. Bargaining Power of Buyers

- 3.5.3. Threat of New Entrants

- 3.5.4. Threat of Substitutes

- 3.5.5. Intensity of Rivalry

4. Global Silicon Metal Market Overview

- 4.1. Market Size & Forecast, 2019-2030

- 4.1.1. By Value (USD Million)

- 4.2. Market Share and Forecast

- 4.2.1. By Product

- 4.2.1.1. Metallurgy Grade

- 4.2.1.2. Chemical Grade

- 4.2.2. By Application

- 4.2.2.1. Aluminum Alloys

- 4.2.2.2. Semiconductors

- 4.2.2.3. Solar Panels

- 4.2.2.4. Stainless Steel

- 4.2.2.5. Others

- 4.2.3. By Region

- 4.2.3.1. North America

- 4.2.3.2. Europe

- 4.2.3.3. Asia Pacific (APAC)

- 4.2.3.4. Latin America (LATAM)

- 4.2.3.5. Middle East and Africa (MEA)

- 4.2.1. By Product

5. North America Silicon Metal Market

- 5.1. Market Size & Forecast, 2019-2030

- 5.1.1. By Value (USD Million)

- 5.2. Market Share & Forecast

- 5.2.1. By Product

- 5.2.2. By Application

- 5.2.3. By Country

- 5.2.3.1. United States

- 5.2.3.1.1. By Product

- 5.2.3.1.2. By Application

- 5.2.3.2. Canada

- 5.2.3.2.1. By Product

- 5.2.3.2.2. By Application

6. Europe Silicon Metal Market

- 6.1. Market Size & Forecast, 2019-2030

- 6.1.1. By Value (USD Million)

- 6.2. Market Share & Forecast

- 6.2.1. By Product

- 6.2.2. By Application

- 6.2.3. By Country

- 6.2.3.1. Germany

- 6.2.3.1.1. By Product

- 6.2.3.1.2. By Application

- 6.2.3.2. United Kingdom

- 6.2.3.2.1. By Product

- 6.2.3.2.2. By Application

- 6.2.3.3. Italy

- 6.2.3.3.1. By Product

- 6.2.3.3.2. By Application

- 6.2.3.4. France

- 6.2.3.4.1. By Product

- 6.2.3.4.2. By Application

- 6.2.3.5. Spain

- 6.2.3.5.1. By Product

- 6.2.3.5.2. By Application

- 6.2.3.6. Belgium

- 6.2.3.6.1. By Product

- 6.2.3.6.2. By Application

- 6.2.3.7. Russia

- 6.2.3.7.1. By Product

- 6.2.3.7.2. By Application

- 6.2.3.8. Rest of Europe

- 6.2.3.8.1. By Product

- 6.2.3.8.2. By Application

7. Asia Pacific Silicon Metal Market

- 7.1. Market Size & Forecast, 2019-2030

- 7.1.1. By Value (USD Million)

- 7.2. Market Share & Forecast

- 7.2.1. By Product

- 7.2.2. By Application

- 7.2.3. By Country

- 7.2.3.1. China

- 7.2.3.1.1. By Product

- 7.2.3.1.2. By Application

- 7.2.3.2. India

- 7.2.3.2.1. By Product

- 7.2.3.2.2. By Application

- 7.2.3.3. Japan

- 7.2.3.3.1. By Product

- 7.2.3.3.2. By Application

- 7.2.3.4. South Korea

- 7.2.3.4.1. By Product

- 7.2.3.4.2. By Application

- 7.2.3.5. Australia & New Zealand

- 7.2.3.5.1. By Product

- 7.2.3.5.2. By Application

- 7.2.3.6. Indonesia

- 7.2.3.6.1. By Product

- 7.2.3.6.2. By Application

- 7.2.3.7. Malaysia

- 7.2.3.7.1. By Product

- 7.2.3.7.2. By Application

- 7.2.3.8. Singapore

- 7.2.3.8.1. By Product

- 7.2.3.8.2. By Application

- 7.2.3.9. Vietnam

- 7.2.3.9.1. By Product

- 7.2.3.9.2. By Application

- 7.2.3.10. Rest of APAC

- 7.2.3.10.1. By Product

- 7.2.3.10.2. By Application

8. Latin America Silicon Metal Market

- 8.1. Market Size & Forecast, 2019-2030

- 8.1.1. By Value (USD Million)

- 8.2. Market Share & Forecast

- 8.2.1. By Product

- 8.2.2. By Application

- 8.2.3. By Country

- 8.2.3.1. Brazil

- 8.2.3.1.1. By Product

- 8.2.3.1.2. By Application

- 8.2.3.2. Mexico

- 8.2.3.2.1. By Product

- 8.2.3.2.2. By Application

- 8.2.3.3. Argentina

- 8.2.3.3.1. By Product

- 8.2.3.3.2. By Application

- 8.2.3.4. Peru

- 8.2.3.4.1. By Product

- 8.2.3.4.2. By Application

- 8.2.3.5. Rest of LATAM

- 8.2.3.5.1. By Product

- 8.2.3.5.2. By Application

9. Middle East & Africa Silicon Metal Market

- 9.1. Market Size & Forecast, 2019-2030

- 9.1.1. By Value (USD Million)

- 9.2. Market Share & Forecast

- 9.2.1. By Product

- 9.2.2. By Application

- 9.2.3. By Country

- 9.2.3.1. Saudi Arabia

- 9.2.3.1.1. By Product

- 9.2.3.1.2. By Application

- 9.2.3.2. UAE

- 9.2.3.2.1. By Product

- 9.2.3.2.2. By Application

- 9.2.3.3. Qatar

- 9.2.3.3.1. By Product

- 9.2.3.3.2. By Application

- 9.2.3.4. Kuwait

- 9.2.3.4.1. By Product

- 9.2.3.4.2. By Application

- 9.2.3.5. South Africa

- 9.2.3.5.1. By Product

- 9.2.3.5.2. By Application

- 9.2.3.6. Nigeria

- 9.2.3.6.1. By Product

- 9.2.3.6.2. By Application

- 9.2.3.7. Algeria

- 9.2.3.7.1. By Product

- 9.2.3.7.2. By Application

- 9.2.3.8. Rest of MEA

- 9.2.3.8.1. By Product

- 9.2.3.8.2. By Application

10. Competitive Landscape

- 10.1. List of Key Players and Their Offerings

- 10.2. Global Silicon Metal Market Share Analysis, 2023

- 10.3. Competitive Benchmarking, By Operating Parameters

- 10.4. Key Strategic Developments (Mergers, Acquisitions, Partnerships, etc.)

11. Impact of Escalating Geopolitical Tensions on Global Silicon Metal Market

12. Company Profiles (Company Overview, Financial Matrix, Competitive Landscape, Key Personnel, Key Competitors, Contact Address, Strategic Outlook, and SWOT Analysis)

- 12.1. Ferroglobe

- 12.2. Elkem

- 12.3. Dow

- 12.4. Wacker Chemie AG

- 12.5. Hoshine Silicon

- 12.6. Rusal

- 12.7. Simcoa

- 12.8. RW Silicium

- 12.9. G.S. Energy

- 12.10. Liasa

- 12.11. Other Prominent Players

13. Key Strategic Recommendations

14. Research Methodology

- 14.1. Qualitative Research

- 14.1.1. Primary & Secondary Research

- 14.2. Quantitative Research

- 14.3. Market Breakdown & Data Triangulation

- 14.3.1. Secondary Research

- 14.3.2. Primary Research

- 14.4. Breakdown of Primary Research Respondents, By Region

- 14.5. Assumptions & Limitations

*Financial information of non-listed companies can be provided as per availability.

**The segmentation and the companies are subject to modifications based on in-depth secondary research for the final deliverable