|

|

市場調査レポート

商品コード

1301797

EV(電気自動車)用保険市場:世界の市場規模、シェア、動向分析、機会、予測レポート、2019年~2029年Electric Vehicle Insurance Market - Global Size, Share, Trend Analysis, Opportunity and Forecast Report, 2019-2029, Segmented By Propulsion Type (Battery Electric Vehicles, Hybrid); By Vehicle Type; By Coverage Type; By Distribution Channel; Region |

||||||

|

|||||||

| EV(電気自動車)用保険市場:世界の市場規模、シェア、動向分析、機会、予測レポート、2019年~2029年 |

|

出版日: 2023年06月21日

発行: Blueweave Consulting

ページ情報: 英文 400 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

EV(電気自動車)用保険の世界市場規模が10倍以上に急拡大、2029年には4,016億米ドルに達する

世界のEV用保険市場は、EV導入の増加、電気モビリティを促進する政府の奨励策や規制、環境問題の高まり、車両技術の進歩、EVに特化した保険へのニーズの高まりなどを背景に活況を呈しています。

大手戦略コンサルティング・市場調査会社のBlueWeave Consultingは最近の調査で、2022年の世界のEV用保険市場規模を389億3,000万米ドルと推定しました。2023年から2029年の予測期間中、世界のEV用保険市場規模はCAGR 39.68%で成長し、2029年には4,015億9,000万米ドルに達するとBlueWeaveは予測しています。世界中でEVの普及が進んでいるため、EV専用の保険に対する需要が高まっています。規制機関によって施行された厳しい排ガス規制と環境に対する関心の高まりが、排ガスを出さないEVの採用を加速させ、EV用保険の需要をさらに押し上げています。また、包括的な補償やカスタマイズされた保険プランなど、EV用保険のメリットに対する顧客の意識が高まっていることも、EV用保険の需要増につながっています。保険会社はまた、無料充電、バッテリー交換、安全運転による保険料引き下げといった独自の特典を提供しており、これがEV用保険の普及にさらに拍車をかけています。

本レポートの詳細な分析により、成長の可能性、今後の動向、世界のEV用保険市場の統計に関する情報を提供します。また、総市場規模の予測を促進する要因も取り上げています。当レポートは、世界のEV用保険市場における最近の技術動向を、業界考察とともに提供し、意思決定者が健全な戦略的意思決定を行えるよう支援します。さらに、市場の成長促進要因・課題・競争力学についても分析しています。

目次

第1章 調査の枠組み

第2章 エグゼクティブサマリー

第3章 世界のEV用保険市場に関する洞察

- 業界のバリューチェーン分析

- DROC分析

- 成長の原動力

- EVの導入を促進するための政府のさまざまな奨励金

- 環境と炭素排出削減の必要性についての意識の高まり

- 抑制要因

- 従来の自動車保険よりもEV用保険の費用が高い

- 機会

- 新興経済国へのEV市場の拡大

- 課題

- EV用保険市場はまだ発展途上であり、明確な規制枠組みは未整備

- EV用保険商品の標準化の欠如

- 成長の原動力

- 技術の進歩/最近の開発

- 規制の枠組み

- ポーターのファイブフォース分析

第4章 世界のEV用保険市場概要

- 市場規模と予測、2019~2029年

- 金額別

- 市場シェアと予測

- 推進タイプ別

- バッテリーEV(BEV)

- ハイブリッド

- 車種別

- 乗用車

- 商用車

- 保障タイプ別

- 偶発的損害

- 盗難または悪意ある損害

- カーバッテリー・自動車部品の交換

- その他

- 流通チャネル別

- 保険会社

- 銀行

- 保険代理店/ブローカー

- その他

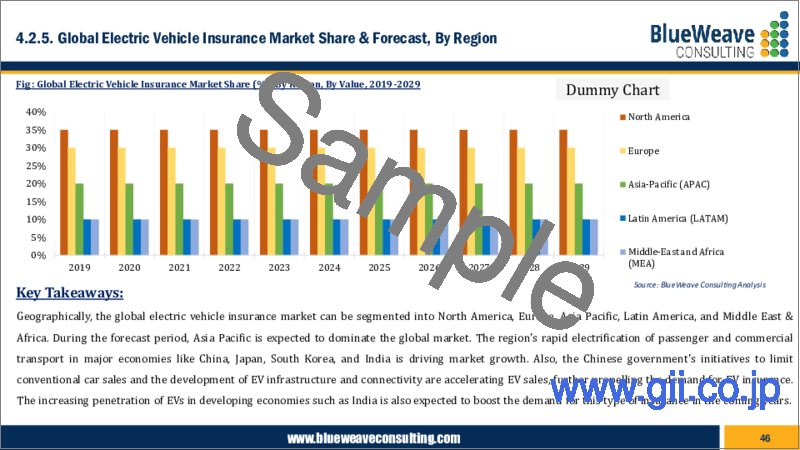

- 地域別

- 北米

- 欧州

- アジア太平洋(APAC)

- ラテンアメリカ(LATAM)

- 中東・アフリカ(MEA)

- 推進タイプ別

第5章 北米のEV用保険市場

- 市場規模と予測、2019~2029年

- 金額別

- 市場シェアと予測

- 推進タイプ別

- 車種別

- 保障タイプ別

- 流通チャネル別

- 国別

- 米国

- カナダ

第6章 欧州のEV用保険市場

- 市場規模と予測、2019~2029年

- 金額別

- 市場シェアと予測

- 推進タイプ別

- 車種別

- 保障タイプ別

- 流通チャネル別

- 国別

- ドイツ

- 英国

- イタリア

- フランス

- スペイン

- ベルギー

- ロシア

- オランダ

- その他欧州

第7章 アジア太平洋のEV用保険市場

- 市場規模と予測、2019~2029年

- 金額別

- 市場シェアと予測

- 推進タイプ別

- 車種別

- 保障タイプ別

- 流通チャネル別

- 国別

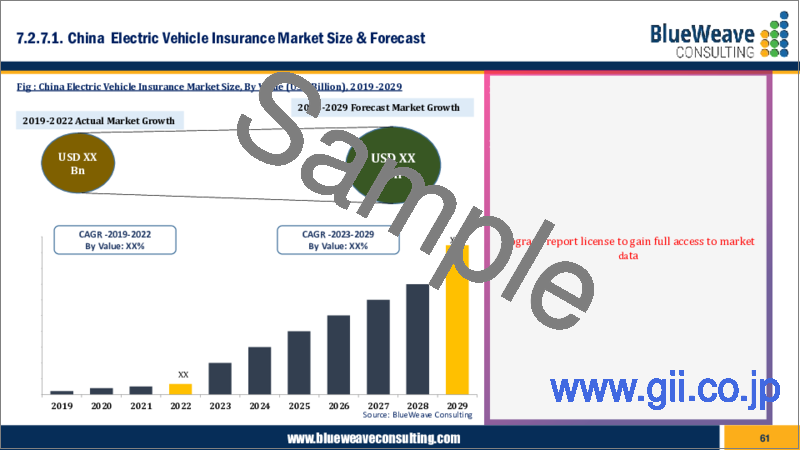

- 中国

- インド

- 日本

- 韓国

- オーストラリアとニュージーランド

- インドネシア

- マレーシア

- シンガポール

- ベトナム

- APACのその他諸国

第8章 ラテンアメリカのEV用保険市場

- 市場規模と予測、2019~2029年

- 金額別

- 市場シェアと予測

- 推進タイプ別

- 車種別

- 保障タイプ別

- 流通チャネル別

- 国別

- ブラジル

- メキシコ

- アルゼンチン

- ペルー

- 中南米の残りの地域

第9章 中東・アフリカのEV用保険市場

- 市場規模と予測、2019~2029年

- 金額別

- 市場シェアと予測

- 推進タイプ別

- 車種別

- 保障タイプ別

- 流通チャネル別

- 国別

- サウジアラビア

- アラブ首長国連邦

- カタール

- クウェート

- 南アフリカ

- ナイジェリア

- アルジェリア

- MEAの残りの部分

第10章 競合情勢

- 主要企業とその製品のリスト

- 世界のEV用保険市場シェア分析、2022年

- 動作パラメータ別競合ベンチマーキング

- 主要な戦略的展開(合併、買収、パートナーシップなど)

第11章 EV用保険市場に対するCOVID-19の影響

第12章 企業プロファイル(会社概要、財務マトリックス、競合情勢、主要な人材、主要な競合、連絡先住所、戦略的展望、 SWOT分析)

- Allianz SE

- AXA SA

- Berkshire Hathaway Inc.

- Chubb Limited

- Munich Reinsurance Company

- Zurich Insurance Group Ltd.

- The Travelers Companies, Inc.

- Liberty Mutual Group Inc.

- Assicurazioni Generali S.p.A.

- MAPFRE S.A.

- American International Group, Inc.(AIG)

- Aviva plc

- China Pacific Insurance(Group)Co., Ltd.

- Ping An Insurance(Group)Company of China, Ltd.

- Sompo Holdings, Inc.

- Other Prominent Players

第13章 主要な戦略的推奨事項

第14章 調査手法

Global Electric Vehicle (EV) Insurance Market Size Zooming More Than 10X to Reach Whopping USD 401.6 Billion by 2029

Global electric vehicle (EV) insurance market is flourishing due to the increasing adoption of EVs, government incentives and regulations promoting electric mobility, rising environmental concerns, advancements in vehicle technology, and the growing need for specialized insurance coverage for EVs.

BlueWeave Consulting, a leading strategic consulting and market research firm, in its recent study, estimated the global electric vehicle (EV) insurance market size at USD 38.93 billion in 2022. During the forecast period between 2023 and 2029, BlueWeave expects the global electric vehicle (EV) insurance market size to grow at a CAGR of 39.68% reaching a value of USD 401.59 billion by 2029. The increasing adoption of electric vehicles worldwide has resulted in a higher demand for insurance coverage specifically designed for these vehicles. Stringent emission norms enforced by regulatory bodies and rising environmental concerns have accelerated the adoption of emission-free electric vehicles, further driving the demand for EV insurance. Also, the rising awareness among customers about the benefits of EV insurance, such as comprehensive coverage and customized insurance plans, has led to increased demand for these policies. Insurers have also been offering unique benefits such as free charging, battery replacement, and lower premiums for safe driving, which have further fueled the adoption of EV insurance.

Opportunity: Increasing Adoption of Electric Vehicles

As people become more conscious of the environmental impact of traditional gasoline-powered vehicles, they are increasingly turning to electric vehicles as a greener alternative. This shift towards electric vehicles has increased the demand for EV insurance, which provides coverage for the unique risks associated with owning and operating electric vehicles. Companies such as AXA, and Zurich Insurance Group have recognized the growing demand for EV insurance and have developed products specifically tailored to the needs of electric vehicle owners. In addition to insurance companies, government agencies have also recognized the importance of promoting the adoption of electric vehicles. For example, the California Air Resources Board (CARB) has implemented a Zero Emission Vehicle (ZEV) program, which requires automakers to produce a certain percentage of zero-emission vehicles each year. This program has helped to drive the adoption of electric vehicles in California and has contributed to the growth of the EV insurance market. Overall, the increased awareness about the environment and the need to reduce carbon emissions is driving the growth of the EV insurance market. As more and more people switch to electric vehicles, the demand for EV insurance is expected to continue to grow.

Impact of COVID-19 on the Electric Vehicle (EV) Insurance Market

The COVID-19 pandemic significantly impacted the global electric vehicle (EV) insurance market. Initially, the market experienced a slowdown due to disruptions in the automotive industry's supply chain and a decrease in vehicle sales. However, the pandemic also led to an increase in demand for private transport, which accelerated the adoption of EVs and EV insurance. Also, the pandemic has raised awareness of the importance of health and safety, which has led to an increase in demand for insurance coverages such as accidental damage and liability coverage. The pandemic has also accelerated the trend of digitization and the use of technology in the insurance industry. Companies have increasingly adopted digital platforms and processes to facilitate remote work and contactless transactions. Further, the pandemic has led to an increased focus on providing customized and value-added insurance solutions to customers, including usage-based insurance (UBI) and telematics-based insurance.

Global Electric Vehicle (EV) Insurance Market - By Coverage Type:

On the basis of coverage type, the global electric vehicle insurance market is segmented into accidental damage, theft or malicious damage, and car battery & auto parts replacement. The accidental damage segment is the largest contributor to the global electric vehicle (EV) insurance market. This coverage is considered an essential part of standard insurance policies offered by leading players. The demand for accidental damage coverage is rising due to increasing traffic congestion and road crashes, making it a highly in-demand insurance coverage among drivers. This trend is expected to continue to fuel the segment's growth.

The car battery and auto parts replacement segment is expected to witness the fastest growth rate during the forecast period. The car battery is one of the most expensive parts of an EV, and the cost of replacing it is significantly high. Therefore, many EV owners prefer insurance plans that cover car battery replacement, and most standard insurance coverage plans designed for electric vehicles include car battery replacement as an insurance benefit. These factors are likely to boost the growth of this segment.

For instance, Allstate Insurance Company offers coverage options for electric and hybrid vehicles that cover various damages, including accidental damage and battery replacement. Similarly, Liberty Mutual offers coverage for EVs that includes battery and electric motor coverage, as well as other standard coverage options like collision, liability, and comprehensive coverage.

Competitive Landscape:

The global electric vehicle (EV) insurance market is fragmented, with numerous players serving the market. The key players dominating the global electric vehicle (EV) insurance market are Allianz SE, AXA SA, Berkshire Hathaway Inc., Chubb Limited, Munich Reinsurance Company, Zurich Insurance Group Ltd., The Travelers Companies, Inc., Liberty Mutual Group Inc., Assicurazioni Generali S.p.A., MAPFRE S.A., American International Group, Inc. (AIG), Aviva plc, China Pacific Insurance (Group) Co., Ltd., Ping an Insurance (Group) Company of China, Ltd, and Sompo Holdings, Inc. The key marketing strategies adopted by the players are facility expansion, product diversification, alliances, collaborations, partnerships, and acquisition to expand their customer reach and gain a competitive edge in the overall market.

The report's in-depth analysis provides information about growth potential, upcoming trends, and the Global Electric Vehicle (EV) Insurance Market statistics. It also highlights the factors driving forecasts of total market size. The report promises to provide recent technology trends in the Global Electric Vehicle (EV) Insurance Market along with industry insights to help decision-makers make sound strategic decisions. Furthermore, the report also analyses the growth drivers, challenges, and competitive dynamics of the market.

Table of Contents

1. Research Framework

- 1.1. Research Objective

- 1.2. Product Overview

- 1.3. Market Segmentation

2. Executive Summary

3. Global Electric Vehicle (EV) Insurance Market Insights

- 3.1. Industry Value Chain Analysis

- 3.2. DROC Analysis

- 3.2.1. Growth Drivers

- 3.2.1.1. Various government incentives to promote the adoption of electric vehicles

- 3.2.1.2. Increased awareness about the environment and the need to reduce carbon emissions

- 3.2.2. Restraints

- 3.2.2.1. High cost of electric vehicle insurance than traditional car insurance

- 3.2.3. Opportunities

- 3.2.3.1. The expansion of the electric vehicle market to emerging economies

- 3.2.4. Challenges

- 3.2.4.1. The electric vehicle insurance market is still evolving, and there are no clear regulatory frameworks in place

- 3.2.4.2. Lack of standardization of electric vehicle insurance products

- 3.2.1. Growth Drivers

- 3.3. Technology Advancements/Recent Developments

- 3.4. Regulatory Framework

- 3.5. Porter's Five Forces Analysis

- 3.5.1. Bargaining Power of Suppliers

- 3.5.2. Bargaining Power of Buyers

- 3.5.3. Threat of New Entrants

- 3.5.4. Threat of Substitutes

- 3.5.5. Intensity of Rivalry

4. Global Electric Vehicle (EV) Insurance Market Overview

- 4.1. Market Size & Forecast, 2019-2029

- 4.1.1. By Value (USD Million)

- 4.2. Market Share and Forecast

- 4.2.1. By Propulsion Type

- 4.2.1.1. Battery Electric Vehicles (BEV)

- 4.2.1.2. Hybrid

- 4.2.2. By Vehicle Type

- 4.2.2.1. Passenger Cars

- 4.2.2.2. Commercial Vehicles

- 4.2.3. By Coverage Type

- 4.2.3.1. Accidental Damage

- 4.2.3.2. Theft or Malicious Damage

- 4.2.3.3. Car Battery & Auto Parts Replacement

- 4.2.3.4. Others

- 4.2.4. By Distribution Channel

- 4.2.4.1. Insurance Companies

- 4.2.4.2. Banks

- 4.2.4.3. Insurance Agents/ Brokers

- 4.2.4.4. Others

- 4.2.5. By Region

- 4.2.5.1. North America

- 4.2.5.2. Europe

- 4.2.5.3. Asia Pacific (APAC)

- 4.2.5.4. Latin America (LATAM)

- 4.2.5.5. Middle East and Africa (MEA)

- 4.2.1. By Propulsion Type

5. North America Electric Vehicle (EV) Insurance Market

- 5.1. Market Size & Forecast, 2019-2029

- 5.1.1. By Value (USD Million)

- 5.2. Market Share & Forecast

- 5.2.1. By Propulsion Type

- 5.2.2. By Vehicle Type

- 5.2.3. By Coverage Type

- 5.2.4. By Distribution Channel

- 5.2.5. By Country

- 5.2.5.1. United States

- 5.2.5.1.1. By Propulsion Type

- 5.2.5.1.2. By Vehicle Type

- 5.2.5.1.3. By Coverage Type

- 5.2.5.1.4. By Distribution Channel

- 5.2.5.2. Canada

- 5.2.5.2.1. By Propulsion Type

- 5.2.5.2.2. By Vehicle Type

- 5.2.5.2.3. By Coverage Type

- 5.2.5.2.4. By Distribution Channel

6. Europe Electric Vehicle (EV) Insurance Market

- 6.1. Market Size & Forecast, 2019-2029

- 6.1.1. By Value (USD Million)

- 6.2. Market Share & Forecast

- 6.2.1. By Propulsion Type

- 6.2.2. By Vehicle Type

- 6.2.3. By Coverage Type

- 6.2.4. By Distribution Channel

- 6.2.5. By Country

- 6.2.5.1. Germany

- 6.2.5.1.1. By Propulsion Type

- 6.2.5.1.2. By Vehicle Type

- 6.2.5.1.3. By Coverage Type

- 6.2.5.1.4. By Distribution Channel

- 6.2.5.2. United Kingdom

- 6.2.5.2.1. By Propulsion Type

- 6.2.5.2.2. By Vehicle Type

- 6.2.5.2.3. By Coverage Type

- 6.2.5.2.4. By Distribution Channel

- 6.2.5.3. Italy

- 6.2.5.3.1. By Propulsion Type

- 6.2.5.3.2. By Vehicle Type

- 6.2.5.3.3. By Coverage Type

- 6.2.5.3.4. By Distribution Channel

- 6.2.5.4. France

- 6.2.5.4.1. By Propulsion Type

- 6.2.5.4.2. By Vehicle Type

- 6.2.5.4.3. By Coverage Type

- 6.2.5.4.4. By Distribution Channel

- 6.2.5.5. Spain

- 6.2.5.5.1. By Propulsion Type

- 6.2.5.5.2. By Vehicle Type

- 6.2.5.5.3. By Coverage Type

- 6.2.5.5.4. By Distribution Channel

- 6.2.5.6. Belgium

- 6.2.5.6.1. By Propulsion Type

- 6.2.5.6.2. By Vehicle Type

- 6.2.5.6.3. By Coverage Type

- 6.2.5.6.4. By Distribution Channel

- 6.2.5.7. Russia

- 6.2.5.7.1. By Propulsion Type

- 6.2.5.7.2. By Vehicle Type

- 6.2.5.7.3. By Coverage Type

- 6.2.5.7.4. By Distribution Channel

- 6.2.5.8. Netherlands

- 6.2.5.8.1. By Propulsion Type

- 6.2.5.8.2. By Vehicle Type

- 6.2.5.8.3. By Coverage Type

- 6.2.5.8.4. By Distribution Channel

- 6.2.5.9. Rest of Europe

- 6.2.5.9.1. By Propulsion Type

- 6.2.5.9.2. By Vehicle Type

- 6.2.5.9.3. By Coverage Type

- 6.2.5.9.4. By Distribution Channel

7. Asia-Pacific Electric Vehicle (EV) Insurance Market

- 7.1. Market Size & Forecast, 2019-2029

- 7.1.1. By Value (USD Million)

- 7.2. Market Share & Forecast

- 7.2.1. By Propulsion Type

- 7.2.2. By Vehicle Type

- 7.2.3. By Coverage Type

- 7.2.4. By Distribution Channel

- 7.2.5. By Country

- 7.2.5.1. China

- 7.2.5.1.1. By Propulsion Type

- 7.2.5.1.2. By Vehicle Type

- 7.2.5.1.3. By Coverage Type

- 7.2.5.1.4. By Distribution Channel

- 7.2.5.2. India

- 7.2.5.2.1. By Propulsion Type

- 7.2.5.2.2. By Vehicle Type

- 7.2.5.2.3. By Coverage Type

- 7.2.5.2.4. By Distribution Channel

- 7.2.5.3. Japan

- 7.2.5.3.1. By Propulsion Type

- 7.2.5.3.2. By Vehicle Type

- 7.2.5.3.3. By Coverage Type

- 7.2.5.3.4. By Distribution Channel

- 7.2.5.4. South Korea

- 7.2.5.4.1. By Propulsion Type

- 7.2.5.4.2. By Vehicle Type

- 7.2.5.4.3. By Coverage Type

- 7.2.5.4.4. By Distribution Channel

- 7.2.5.5. Australia & New Zealand

- 7.2.5.5.1. By Propulsion Type

- 7.2.5.5.2. By Vehicle Type

- 7.2.5.5.3. By Coverage Type

- 7.2.5.5.4. By Distribution Channel

- 7.2.5.6. Indonesia

- 7.2.5.6.1. By Propulsion Type

- 7.2.5.6.2. By Vehicle Type

- 7.2.5.6.3. By Coverage Type

- 7.2.5.6.4. By Distribution Channel

- 7.2.5.7. Malaysia

- 7.2.5.7.1. By Propulsion Type

- 7.2.5.7.2. By Vehicle Type

- 7.2.5.7.3. By Coverage Type

- 7.2.5.7.4. By Distribution Channel

- 7.2.5.8. Singapore

- 7.2.5.8.1. By Propulsion Type

- 7.2.5.8.2. By Vehicle Type

- 7.2.5.8.3. By Coverage Type

- 7.2.5.8.4. By Distribution Channel

- 7.2.5.9. Vietnam

- 7.2.5.9.1. By Propulsion Type

- 7.2.5.9.2. By Vehicle Type

- 7.2.5.9.3. By Coverage Type

- 7.2.5.9.4. By Distribution Channel

- 7.2.5.10. Rest of APAC

- 7.2.5.10.1. By Propulsion Type

- 7.2.5.10.2. By Vehicle Type

- 7.2.5.10.3. By Coverage Type

- 7.2.5.10.4. By Distribution Channel

8. Latin America Electric Vehicle (EV) Insurance Market

- 8.1. Market Size & Forecast, 2019-2029

- 8.1.1. By Value (USD Million)

- 8.2. Market Share & Forecast

- 8.2.1. By Propulsion Type

- 8.2.2. By Vehicle Type

- 8.2.3. By Coverage Type

- 8.2.4. By Distribution Channel

- 8.2.5. By Country

- 8.2.5.1. Brazil

- 8.2.5.1.1. By Propulsion Type

- 8.2.5.1.2. By Vehicle Type

- 8.2.5.1.3. By Coverage Type

- 8.2.5.1.4. By Distribution Channel

- 8.2.5.2. Mexico

- 8.2.5.2.1. By Propulsion Type

- 8.2.5.2.2. By Vehicle Type

- 8.2.5.2.3. By Coverage Type

- 8.2.5.2.4. By Distribution Channel

- 8.2.5.3. Argentina

- 8.2.5.3.1. By Propulsion Type

- 8.2.5.3.2. By Vehicle Type

- 8.2.5.3.3. By Coverage Type

- 8.2.5.3.4. By Distribution Channel

- 8.2.5.4. Peru

- 8.2.5.4.1. By Propulsion Type

- 8.2.5.4.2. By Vehicle Type

- 8.2.5.4.3. By Coverage Type

- 8.2.5.4.4. By Distribution Channel

- 8.2.5.5. Rest of LATAM

- 8.2.5.5.1. By Propulsion Type

- 8.2.5.5.2. By Vehicle Type

- 8.2.5.5.3. By Coverage Type

- 8.2.5.5.4. By Distribution Channel

9. Middle East & Africa Electric Vehicle (EV) Insurance Market

- 9.1. Market Size & Forecast, 2019-2029

- 9.1.1. By Value (USD Million)

- 9.2. Market Share & Forecast

- 9.2.1. By Propulsion Type

- 9.2.2. By Vehicle Type

- 9.2.3. By Coverage Type

- 9.2.4. By Distribution Channel

- 9.2.5. By Country

- 9.2.5.1. Saudi Arabia

- 9.2.5.1.1. By Propulsion Type

- 9.2.5.1.2. By Vehicle Type

- 9.2.5.1.3. By Coverage Type

- 9.2.5.1.4. By Distribution Channel

- 9.2.5.2. UAE

- 9.2.5.2.1. By Propulsion Type

- 9.2.5.2.2. By Vehicle Type

- 9.2.5.2.3. By Coverage Type

- 9.2.5.2.4. By Distribution Channel

- 9.2.5.3. Qatar

- 9.2.5.3.1. By Propulsion Type

- 9.2.5.3.2. By Vehicle Type

- 9.2.5.3.3. By Coverage Type

- 9.2.5.3.4. By Distribution Channel

- 9.2.5.4. Kuwait

- 9.2.5.4.1. By Propulsion Type

- 9.2.5.4.2. By Vehicle Type

- 9.2.5.4.3. By Coverage Type

- 9.2.5.4.4. By Distribution Channel

- 9.2.5.5. South Africa

- 9.2.5.5.1. By Propulsion Type

- 9.2.5.5.2. By Vehicle Type

- 9.2.5.5.3. By Coverage Type

- 9.2.5.5.4. By Distribution Channel

- 9.2.5.6. Nigeria

- 9.2.5.6.1. By Propulsion Type

- 9.2.5.6.2. By Vehicle Type

- 9.2.5.6.3. By Coverage Type

- 9.2.5.6.4. By Distribution Channel

- 9.2.5.7. Algeria

- 9.2.5.7.1. By Propulsion Type

- 9.2.5.7.2. By Vehicle Type

- 9.2.5.7.3. By Coverage Type

- 9.2.5.7.4. By Distribution Channel

- 9.2.5.8. Rest of MEA

- 9.2.5.8.1. By Propulsion Type

- 9.2.5.8.2. By Vehicle Type

- 9.2.5.8.3. By Coverage Type

- 9.2.5.8.4. By Distribution Channel

10. Competitive Landscape

- 10.1. List of Key Players and Their Offerings

- 10.2. Global Electric Vehicle (EV) Insurance Market Share Analysis, 2022

- 10.3. Competitive Benchmarking, By Operating Parameters

- 10.4. Key Strategic Developments (Mergers, Acquisitions, Partnerships, etc.)

11. Impact of Covid-19 on Electric Vehicle (EV) Insurance Market

12. Company Profile (Company Overview, Financial Matrix, Competitive Landscape, Key Personnel, Key Competitors, Contact Address, Strategic Outlook, SWOT Analysis)

- 12.1. Allianz SE

- 12.2. AXA SA

- 12.3. Berkshire Hathaway Inc.

- 12.4. Chubb Limited

- 12.5. Munich Reinsurance Company

- 12.6. Zurich Insurance Group Ltd.

- 12.7. The Travelers Companies, Inc.

- 12.8. Liberty Mutual Group Inc.

- 12.9. Assicurazioni Generali S.p.A.

- 12.10. MAPFRE S.A.

- 12.11. American International Group, Inc. (AIG)

- 12.12. Aviva plc

- 12.13. China Pacific Insurance (Group) Co., Ltd.

- 12.14. Ping An Insurance (Group) Company of China, Ltd.

- 12.15. Sompo Holdings, Inc.

- 12.16. Other Prominent Players

13. Key Strategic Recommendations

14. Research Methodology

- 14.1. Qualitative Research

- 14.1.1. Primary & Secondary Research

- 14.2. Quantitative Research

- 14.3. Market Breakdown & Data Triangulation

- 14.3.1. Secondary Research

- 14.3.2. Primary Research

- 14.4. Breakdown of Primary Research Respondents, By Region

- 14.5. Assumptions & Limitations