|

|

市場調査レポート

商品コード

1237141

消費者金融の世界市場 - 規模、シェア、動向分析、機会、予測(2019年~2029年):製品タイプ別、有担保製品別、無担保製品別Consumer Finance Market - Global Size, Share, Trend Analysis, Opportunity and Forecast Report, 2019-2029, Segmented By Type ; By Secured Products ; By Unsecured Products |

||||||

| 消費者金融の世界市場 - 規模、シェア、動向分析、機会、予測(2019年~2029年):製品タイプ別、有担保製品別、無担保製品別 |

|

出版日: 2023年03月07日

発行: Blueweave Consulting

ページ情報: 英文 400 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

世界の消費者金融の市場規模は、2022年の1兆2,213億8,000万米ドルから2029年までに1兆9,586億2,000万米ドルに達し、2023年~2029年の予測期間中にCAGRで7.07%の成長が予測されています。政府銀行とプライベートバンクまたは金融機関からの融資要請が迅速に処理され、住宅ローン、自動車ローン、学資ローンなどのさまざまなローンが簡単に利用できるようになったことが、世界の消費者金融ビジネスの大きな発展要因となっています。

当レポートでは、世界の消費者金融市場について調査分析し、市場規模と予測、セグメント分析、地域分析、企業プロファイルなどを提供しています。

目次

第1章 調査の枠組み

第2章 エグゼクティブサマリー

第3章 世界の消費者金融市場の考察

- 業界バリューチェーン分析

- DROC分析

- 成長促進要因

- 抑制要因

- 機会

- 課題

- 技術の進歩/最近の発展

- 規制の枠組み

- ポーターのファイブフォース分析

第4章 世界の消費者金融市場の概要

- 市場規模と予測(2019年~2029年)

- 金額

- 市場シェアと予測

- タイプ別

- 有担保消費者金融

- 無担保消費者金融

- 有担保製品別

- 住宅ローン

- 自動車ローン

- 住宅ローン

- その他

- 無担保商品別

- 個人ローン

- クレジットカード

- リフォームローン

- 教育ローン

- その他

- 地域別

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

- タイプ別

第5章 北米の消費者金融市場

- 市場規模と予測(2019年~2029年)

- 金額

- 市場シェアと予測

- タイプ別

- 有担保製品別

- 無担保商品別

- 国別

- 米国

- カナダ

第6章 欧州の消費者金融市場

- 市場規模と予測(2019年~2029年)

- 金額

- 市場シェアと予測

- タイプ別

- 有担保製品別

- 無担保商品別

- 国別

- ドイツ

- 英国

- イタリア

- フランス

- スペイン

- オランダ

- その他の欧州

第7章 アジア太平洋の消費者金融市場

- 市場規模と予測(2019年~2029年)

- 金額

- 市場シェアと予測

- タイプ別

- 有担保製品別

- 無担保商品別

- 国別

- 中国

- インド

- 日本

- 韓国

- オーストラリア・ニュージーランド

- インドネシア

- マレーシア

- シンガポール

- フィリピン

- ベトナム

- その他のアジア太平洋

第8章 ラテンアメリカの消費者金融市場

- 市場規模と予測(2019年~2029年)

- 金額

- 市場シェアと予測

- タイプ別

- 有担保製品別

- 無担保商品別

- 国別

- ブラジル

- メキシコ

- アルゼンチン

- ペルー

- その他のラテンアメリカ

第9章 中東・アフリカの消費者金融市場

- 市場規模と予測(2019年~2029年)

- 金額

- 市場シェアと予測

- タイプ別

- 有担保製品別

- 無担保商品別

- 国別

- サウジアラビア

- アラブ首長国連邦

- カタール

- クウェート

- 南アフリカ

- ナイジェリア

- アルジェリア

- その他の中東・アフリカ

第10章 競合情勢

- 主要企業とその製品のリスト

- 世界の消費者金融企業の市場シェア分析(2022年)

- 競合ベンチマーキング:経営パラメーター別

- 主な戦略的展開(合併、買収、パートナーシップなど)

第11章 世界の消費者金融市場に対するCOVID-19の影響

第12章 企業プロファイル(企業の概要、財務マトリックス、競合情勢、主な人材、主な競合、連絡先、戦略的見通し、SWOT分析)

- Citigroup Inc.

- JPMorgan Chase & Co.

- Wells Fargo & Company

- Bank of America Corporation

- American Express Company

- HSBC Holdings plc

- Industrial and Commercial Bank of China

- U.S. Bancorp

- BNP Paribas

- TD Bank, N.A.

- その他の著名な企業

第13章 主な戦略的推奨事項

第14章 調査手法

Global Consumer Finance Market Size Booming to Reach USD 2 Trillion by 2029.

Global consumer finance market is gaining traction because of the quick clearance of loan requests from several government, private banks, and financial organizations and expanding access to loans and credits via digital payment systems.

BlueWeave Consulting, a leading strategic consulting and market research firm, in its recent study, estimated the global consumer finance market size at USD 1,221.38 billion in 2022. During the forecast period between 2023 and 2029, the global consumer finance market size is projected to grow at an impressive CAGR of 7.07% reaching a value of USD 1,958.62 billion by 2029. The quick clearance of loan requests from several governmental and private banks or financial organizations, as well as the easy accessibility of various loans including house loans, vehicle loans, and school loans, are significant development factors for the global consumer finance business. Also, expanding access to loans and credits via digital payment systems is providing the global consumer finance market with abundant development prospects.

Global Consumer Finance Market - Overview:

Consumer financial services are products and services including current and savings accounts, online payment options, credit & debit cards, mortgage & commercial loans, and securitizations. Consumer finance refers to the decisions that individuals and households make over time about borrowing, saving, and investing. These financial choices can be difficult and impact one's financial security both now and in the future. The loan procedure that takes place between a customer and a lender is referred to as consumer finance. The lender could occasionally be a bank or other financial organization. In other cases, the lender could be a company that grants internal credit in return for the consumer's patronage.

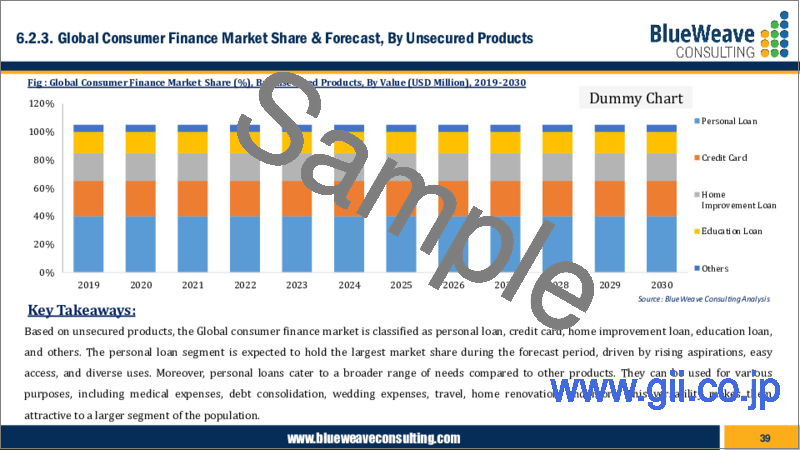

Global Consumer Finance Market - By Unsecured Products:

Based on unsecured products, the global consumer finance market is segmented into personal loans, credit cards, home improvement loans, education loans, and others. The personal loan segment accounts for the highest market share. Personal loans only need a little documentation to be submitted because they're unsecured loans. As opposed to house loans, personal loans do not require any asset verification from banks or other financial lending agencies, which is fueling its market growth. The education load also covers a substantial market share as it is reducing the strain on the consumers to liquidate their investments.

Impact of COVID-19 on Global Consumer Finance Market

The overall economic growth across the countries was adversely affected by the COVID-19 pandemic. The economic downturn also affected the consumer finance market. In the medium and long term, COVID-19 is anticipated to have a significant influence on banking and lending, compounding recent changes in consumer behavior, technology developments, and market investments and capital. Overall, banks saw a decline in demand for consumer loans as consumers adopted more prudent spending practices for large purchases and used government stimulus funds to settle outstanding debts.

Competitive Landscape:

Major players operating in the global consumer finance market include: Citigroup Inc., JPMorgan Chase & Co., Wells Fargo & Company, Bank of America Corporation, American Express Company, HSBC Holdings plc, Industrial and Commercial Bank of China, U.S. Bancorp, BNP Paribas, and TD Bank, N.A. These companies employ various strategies to further enhance their market share, including mergers and acquisitions, partnerships, joint ventures, license agreements, and new product launches.

The in-depth analysis of the report provides information about growth potential, upcoming trends, and the Global Consumer Finance Market. It also highlights the factors driving forecasts of total market size. The report promises to provide recent technology trends in the Global Consumer Finance Market and industry insights to help decision-makers make sound strategic decisions. Furthermore, the report also analyzes the growth drivers, challenges, and competitive dynamics of the market.

Table of Contents

1. Research Framework

- 1.1. Research Objective

- 1.2. Product Overview

- 1.3. Market Segmentation

2. Executive Summary

3. Global Consumer Finance Market Insights

- 3.1. Industry Value Chain Analysis

- 3.2. DROC Analysis

- 3.2.1. Growth Drivers

- 3.2.1.1. Affordable Interest Rates

- 3.2.1.2. Growing Digital Banking

- 3.2.2. Restraints

- 3.2.2.1. Rise in Customer Acquisition Cost

- 3.2.3. Opportunities

- 3.2.3.1. Rising Marketing Strategies

- 3.2.4. Challenges

- 3.2.4.1. Stringent Government Laws

- 3.2.1. Growth Drivers

- 3.3. Technology Advancements/Recent Developments

- 3.4. Regulatory Framework

- 3.5. Porter's Five Forces Analysis

- 3.5.1. Bargaining Power of Suppliers

- 3.5.2. Bargaining Power of Buyers

- 3.5.3. Threat of New Entrants

- 3.5.4. Threat of Substitutes

- 3.5.5. Intensity of Rivalry

4. Global Consumer Finance Market Overview

- 4.1. Market Size & Forecast, 2019-2029

- 4.1.1. By Value (USD Billion)

- 4.2. Market Share & Forecast

- 4.2.1. By Type

- 4.2.1.1. Secured Consumer Finance

- 4.2.1.2. Unsecured Consumer Finance

- 4.2.2. By Secured Products

- 4.2.2.1. Housing Loan

- 4.2.2.2. Auto Loan

- 4.2.2.3. Mortgage Loan

- 4.2.2.4. Others

- 4.2.3. By Unsecured Products

- 4.2.3.1. Personal Loan

- 4.2.3.2. Credit Card

- 4.2.3.3. Home Improvement Loan

- 4.2.3.4. Education Loan

- 4.2.3.5. Others

- 4.2.4. By Region

- 4.2.4.1. North America

- 4.2.4.2. Europe

- 4.2.4.3. Asia Pacific (APAC)

- 4.2.4.4. Latin America (LATAM)

- 4.2.4.5. Middle East and Africa (MEA)

- 4.2.1. By Type

5. North America Consumer Finance Market

- 5.1. Market Size & Forecast, 2019-2029

- 5.1.1. By Value (USD Billion)

- 5.2. Market Share & Forecast

- 5.2.1. By Type

- 5.2.2. By Secured Products

- 5.2.3. By Unsecured Products

- 5.2.4. By Country

- 5.2.4.1. United States

- 5.2.4.1.1. By Type

- 5.2.4.1.2. By Secured Products

- 5.2.4.1.3. By Unsecured Products

- 5.2.4.2. Canada

- 5.2.4.2.1. By Type

- 5.2.4.2.2. By Secured Products

- 5.2.4.2.3. By Unsecured Products

6. Europe Consumer Finance Market

- 6.1. Market Size & Forecast, 2019-2029

- 6.1.1. By Value (USD Billion)

- 6.2. Market Share & Forecast

- 6.2.1. By Type

- 6.2.2. By Secured Products

- 6.2.3. By Unsecured Products

- 6.2.4. By Country

- 6.2.4.1. Germany

- 6.2.4.1.1. By Type

- 6.2.4.1.2. By Secured Products

- 6.2.4.1.3. By Unsecured Products

- 6.2.4.2. United Kingdom

- 6.2.4.2.1. By Type

- 6.2.4.2.2. By Secured Products

- 6.2.4.2.3. By Unsecured Products

- 6.2.4.3. Italy

- 6.2.4.3.1. By Type

- 6.2.4.3.2. By Secured Products

- 6.2.4.3.3. By Unsecured Products

- 6.2.4.4. France

- 6.2.4.4.1. By Type

- 6.2.4.4.2. By Secured Products

- 6.2.4.4.3. By Unsecured Products

- 6.2.4.5. Spain

- 6.2.4.5.1. By Type

- 6.2.4.5.2. By Secured Products

- 6.2.4.5.3. By Unsecured Products

- 6.2.4.6. The Netherlands

- 6.2.4.6.1. By Type

- 6.2.4.6.2. By Secured Products

- 6.2.4.6.3. By Unsecured Products

- 6.2.4.7. Rest of Europe

- 6.2.4.7.1. By Type

- 6.2.4.7.2. By Secured Products

- 6.2.4.7.3. By Unsecured Products

7. Asia-Pacific Consumer Finance Market

- 7.1. Market Size & Forecast, 2019-2029

- 7.1.1. By Value (USD Billion)

- 7.2. Market Share & Forecast

- 7.2.1. By Type

- 7.2.2. By Secured Products

- 7.2.3. By Unsecured Products

- 7.2.4. By Country

- 7.2.4.1. China

- 7.2.4.1.1. By Type

- 7.2.4.1.2. By Secured Products

- 7.2.4.1.3. By Unsecured Products

- 7.2.4.2. India

- 7.2.4.2.1. By Type

- 7.2.4.2.2. By Secured Products

- 7.2.4.2.3. By Unsecured Products

- 7.2.4.3. Japan

- 7.2.4.3.1. By Type

- 7.2.4.3.2. By Secured Products

- 7.2.4.3.3. By Unsecured Products

- 7.2.4.4. South Korea

- 7.2.4.4.1. By Type

- 7.2.4.4.2. By Secured Products

- 7.2.4.4.3. By Unsecured Products

- 7.2.4.5. Australia & New Zealand

- 7.2.4.5.1. By Type

- 7.2.4.5.2. By Secured Products

- 7.2.4.5.3. By Unsecured Products

- 7.2.4.6. Indonesia

- 7.2.4.6.1. By Type

- 7.2.4.6.2. By Secured Products

- 7.2.4.6.3. By Unsecured Products

- 7.2.4.7. Malaysia

- 7.2.4.7.1. By Type

- 7.2.4.7.2. By Secured Products

- 7.2.4.7.3. By Unsecured Products

- 7.2.4.8. Singapore

- 7.2.4.8.1. By Type

- 7.2.4.8.2. By Secured Products

- 7.2.4.8.3. By Unsecured Products

- 7.2.4.9. Philippines

- 7.2.4.9.1. By Type

- 7.2.4.9.2. By Secured Products

- 7.2.4.9.3. By Unsecured Products

- 7.2.4.10. Vietnam

- 7.2.4.10.1. By Type

- 7.2.4.10.2. By Secured Products

- 7.2.4.10.3. By Unsecured Products

- 7.2.4.11. Rest of APAC

- 7.2.4.11.1. By Type

- 7.2.4.11.2. By Secured Products

- 7.2.4.11.3. By Unsecured Products

8. Latin America Consumer Finance Market

- 8.1. Market Size & Forecast, 2019-2029

- 8.1.1. By Value (USD Billion)

- 8.2. Market Share & Forecast

- 8.2.1. By Type

- 8.2.2. By Secured Products

- 8.2.3. By Unsecured Products

- 8.2.4. By Country

- 8.2.4.1. Brazil

- 8.2.4.1.1. By Type

- 8.2.4.1.2. By Secured Products

- 8.2.4.1.3. By Unsecured Products

- 8.2.4.2. Mexico

- 8.2.4.2.1. By Type

- 8.2.4.2.2. By Secured Products

- 8.2.4.2.3. By Unsecured Products

- 8.2.4.3. Argentina

- 8.2.4.3.1. By Type

- 8.2.4.3.2. By Secured Products

- 8.2.4.3.3. By Unsecured Products

- 8.2.4.4. Peru

- 8.2.4.4.1. By Type

- 8.2.4.4.2. By Secured Products

- 8.2.4.4.3. By Unsecured Products

- 8.2.4.5. Rest of LATAM

- 8.2.4.5.1. By Type

- 8.2.4.5.2. By Secured Products

- 8.2.4.5.3. By Unsecured Products

9. Middle East & Africa Consumer Finance Market

- 9.1. Market Size & Forecast, 2019-2029

- 9.1.1. By Value (USD Billion)

- 9.2. Market Share & Forecast

- 9.2.1. By Type

- 9.2.2. By Secured Products

- 9.2.3. By Unsecured Products

- 9.2.4. By Country

- 9.2.4.1. Saudi Arabia

- 9.2.4.1.1. By Type

- 9.2.4.1.2. By Secured Products

- 9.2.4.1.3. By Unsecured Products

- 9.2.4.2. UAE

- 9.2.4.2.1. By Type

- 9.2.4.2.2. By Secured Products

- 9.2.4.2.3. By Unsecured Products

- 9.2.4.3. Qatar

- 9.2.4.3.1. By Type

- 9.2.4.3.2. By Secured Products

- 9.2.4.3.3. By Unsecured Products

- 9.2.4.4. Kuwait

- 9.2.4.4.1. By Type

- 9.2.4.4.2. By Secured Products

- 9.2.4.4.3. By Unsecured Products

- 9.2.4.5. South Africa

- 9.2.4.5.1. By Type

- 9.2.4.5.2. By Secured Products

- 9.2.4.5.3. By Unsecured Products

- 9.2.4.6. Nigeria

- 9.2.4.6.1. By Type

- 9.2.4.6.2. By Secured Products

- 9.2.4.6.3. By Unsecured Products

- 9.2.4.7. Algeria

- 9.2.4.7.1. By Type

- 9.2.4.7.2. By Secured Products

- 9.2.4.7.3. By Unsecured Products

- 9.2.4.8. Rest of MEA

- 9.2.4.8.1. By Type

- 9.2.4.8.2. By Secured Products

- 9.2.4.8.3. By Unsecured Products

10. Competitive Landscape

- 10.1. List of Key Players and Their Offerings

- 10.2. Global Consumer Finance Company Market Share Analysis, 2022

- 10.3. Competitive Benchmarking, By Operating Parameters

- 10.4. Key Strategic Developments (Mergers, Acquisitions, Partnerships, etc.)

11. Impact of Covid-19 on Global Consumer Finance Market

12. Company Profile (Company Overview, Financial Matrix, Competitive Landscape, Key Personnel, Key Competitors, Contact Address, Strategic Outlook, SWOT Analysis)

- 12.1. Citigroup Inc.

- 12.2. JPMorgan Chase & Co.

- 12.3. Wells Fargo & Company

- 12.4. Bank of America Corporation

- 12.5. American Express Company

- 12.6. HSBC Holdings plc

- 12.7. Industrial and Commercial Bank of China

- 12.8. U.S. Bancorp

- 12.9. BNP Paribas

- 12.10. TD Bank, N.A.

- 12.11. Other Prominent Players

13. Key Strategic Recommendations

14. Research Methodology

- 14.1. Qualitative Research

- 14.1.1. Primary & Secondary Research

- 14.2. Quantitative Research

- 14.3. Market Breakdown & Data Triangulation

- 14.3.1. Secondary Research

- 14.3.2. Primary Research

- 14.4. Breakdown of Primary Research Respondents, By Region

- 14.5. Assumptions & Limitations