|

|

市場調査レポート

商品コード

1108400

住宅用水処理の世界市場 (2018年~2028年):デバイス・技術・用途・地域別の動向分析・競合市場シェア・予測Global Residential Water Treatment Market, By Device, By Technology, By Application, By Region Trend Analysis, Competitive Market Share & Forecast, 2018-2028 |

||||||

| 住宅用水処理の世界市場 (2018年~2028年):デバイス・技術・用途・地域別の動向分析・競合市場シェア・予測 |

|

出版日: 2022年07月19日

発行: Blueweave Consulting

ページ情報: 英文 114 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 図表

- 目次

世界の住宅用水処理の市場規模は、2021年の213億8,000万米ドルから、予測期間中は7.1%のCAGRで推移し、2028年末には約342億9,000万米ドルの規模に成長すると予測されています。

水質汚染や都市部の人口増加により、住宅用水処理システムへの需要が高まっており、同市場は活況を呈しています。また、淡水資源の不足から、先進国、新興国を問わず水不足の問題が発生しています。その結果、各国政府は清潔で使いやすい水を提供するために、水処理技術への注力を強めており、予測期間中の市場を支える見通しです。

当レポートでは、世界の住宅用水処理の市場を調査し、市場概要、市場成長への各種影響因子の分析、法規制環境、技術動向、市場規模の推移・予測、各種区分・地域/主要国別の内訳、競合環境、市場シェア、主要企業のプロファイルなどをまとめています。

目次

第1章 調査の枠組み

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 世界の住宅用水処理市場の洞察

- 産業バリューチェーン分析

- DROC分析

- 促進要因

- 抑制要因

- 機会

- 課題

- 技術の進歩/最近の開発

- 規制の枠組み

- ポーターのファイブフォース分析

第5章 世界の住宅用水処理市場の概要

- 市場規模・予測

- 市場シェア・予測

- デバイス別

- テーブルトップ型

- 蛇口取り付け型

- カウンタートップ型

- その他

- 技術別

- RO

- 限外濾過

- 蒸留

- 消毒

- 濾過

- その他

- 用途別

- 住宅/アパート

- 個人住宅

- ヴィラ

- その他

- 地域別

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

- デバイス別

第6章 北米の住宅用水処理市場

- 市場規模・予測

- 市場シェア・予測

- デバイス別

- 技術別

- 用途別

- 国別

第7章 欧州の住宅用水処理市場

- 市場規模・予測

- 市場シェア・予測

- デバイス別

- 技術別

- 用途別

- 国別

第8章 アジア太平洋の住宅用水処理市場

- 市場規模・予測

- 市場シェア・予測

- デバイス別

- 技術別

- 用途別

- 国別

第9章 ラテンアメリカの住宅用水処理市場

- 市場規模・予測

- 市場シェア・予測

- デバイス別

- 技術別

- 用途別

- 国別

第10章 中東・アフリカの住宅用水処理市場

- 市場規模・予測

- 市場シェア・予測

- デバイス別

- 技術別

- 用途別

- 国別

第11章 競合情勢

- 主要企業・製品のリスト

- 市場シェア分析

- 競合ベンチマーキング

- 主要な戦略的展開 (M&A・提携)

第12章 COVID-19が世界の住宅用水処理産業に与える影響

第13章 企業プロファイル (会社概要・財務マトリックス・競合情勢・主な人材・主要競合企業・連絡先・戦略的展望)

- A.O Smith Corporation

- Kent Supreme

- Eureka Forbes

- Panasonic

- Aqua Care

- 3M

- Aquasana

- Waterwise Inc

- Everpure

- GE Appliances

- 他の有力企業

第14章 主要な戦略的推奨事項

List of Figures

- Figure 1: Global Residential Water Treatment Market Segmentation

- Figure 2: Global Residential Water Treatment Industry Value Chain Analysis

- Figure 3: Global Residential Water Treatment Market Size, By Value (USD Million), 2018-2028

- Figure 4: Global Residential Water Treatment Market Share (%), By Device, By Value, 2018-2028

- Figure 5: Global Residential Water Treatment Market Share (%), By Technology, By Value, 2018-2028

- Figure 6: Global Residential Water Treatment Market Share (%), By Application, By Value, 2018-2028

- Figure 7: Global Residential Water Treatment Market Share (%), By Country, By Value, 2018-2028

- Figure 8: North America Residential Water Treatment Market Size, By Value (USD Million), 2018-2028

- Figure 9: North America Residential Water Treatment Market Share (%), By Device, By Value, 2018-2028

- Figure 10: North America Residential Water Treatment Market Share (%), By Technology, By Value, 2018-2028

- Figure 11: North America Residential Water Treatment Market Share (%), By Application, By Value, 2018-2028

- Figure 12: North America Residential Water Treatment Market Share (%), By Country, By Value, 2018-2028

- Figure 13: Europe Residential Water Treatment Market Size, By Value (USD Million), 2018-2028

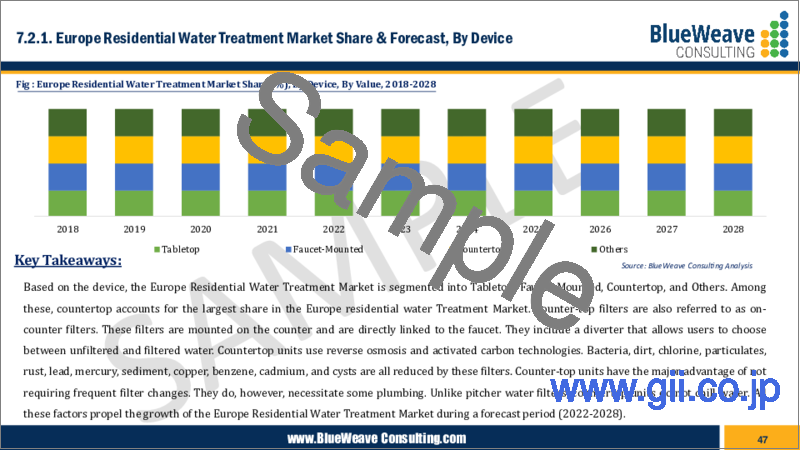

- Figure 14: Europe Residential Water Treatment Market Share (%), By Device, By Value, 2018-2028

- Figure 15: Europe Residential Water Treatment Market Share (%), By Technology, By Value, 2018-2028

- Figure 16: Europe Residential Water Treatment Market Share (%), By Application, By Value, 2018-2028

- Figure 17: Europe Residential Water Treatment Market Share (%), By Country, By Value, 2018-2028

- Figure 18: The Asia-Pacific Residential Water Treatment Market Size, By Value (USD Million), 2018-2028

- Figure 19: The Asia-Pacific Residential Water Treatment Market Share (%), By Device, By Value, 2018-2028

- Figure 20: The Asia-Pacific Residential Water Treatment Market Share (%), By Technology, By Value, 2018-2028

- Figure 21: The Asia-Pacific Residential Water Treatment Market Share (%), By Application, By Value, 2018-2028

- Figure 22: The Asia-Pacific Residential Water Treatment Market Share (%), By Country, By Value, 2018-2028

- Figure 23: Latin America Residential Water Treatment Market Size, By Value (USD Million), 2018-2028

- Figure 24: Latin America Residential Water Treatment Market Share (%), By Device, By Value, 2018-2028

- Figure 25: Latin America Residential Water Treatment Market Share (%), By Technology, By Value, 2018-2028

- Figure 26: Latin America Residential Water Treatment Market Share (%), By Application, By Value, 2018-2028

- Figure 27: Latin America Residential Water Treatment Market Share (%), By Country, By Value, 2018-2028

- Figure 28: The Middle East & Africa Residential Water Treatment Market Size, By Value (USD Million), 2018-2028

- Figure 29: The Middle East & Africa Residential Water Treatment Market Share (%), By Device, By Value, 2018-2028

- Figure 30: The Middle East & Africa Residential Water Treatment Market Share (%), By Technology, By Value, 2018-2028

- Figure 31: The Middle East & Africa Residential Water Treatment Market Share (%), By Application, By Value, 2018-2028

- Figure 32: The Middle East & Africa Residential Water Treatment Market Share (%), By Country, By Value, 2018-2028

- Figure 33: Global Residential Water Treatment Market Share Analysis, 2021

List of Tables

- Table 1: Global Residential Water Treatment Market Size, By Device, By Value (USD Million), 2018-2028

- Table 2: Global Residential Water Treatment Market Size, By Technology, By Value (USD Million), 2018-2028

- Table 3: Global Residential Water Treatment Market Size. By Application, By Value (USD Million), 2018-2028

- Table 4: Global Residential Water Treatment Market Size. By Country, By Value (USD Million), 2018-2028

- Table 5: North America Residential Water Treatment Market Size, By Device, By Value (USD Million), 2018-2028

- Table 6: North America Residential Water Treatment Market Size, By Technology, By Value (USD Million), 2018-2028

- Table 7: 28 North America Residential Water Treatment Market Size (USD Million), By Application, By Value 2018-2028

- Table 8: 28 North America Residential Water Treatment Market Size (USD Million), By Country, By Value 2018-2028

- Table 9: Europe Residential Water Treatment Market Size, By Device, By Value (USD Million), By Value 2018-2028

- Table 10: Europe Residential Water Treatment Market Size, By Technology, By Value (USD Million), By Value 2018-2028

- Table 11: 40 Europe Residential Water Treatment Market Size (USD Million), By Application, By Value 2018-2028

- Table 12: 40 Europe Residential Water Treatment Market Size (USD Million), By Country, By Value 2018-2028

- Table 13: The Asia-Pacific Residential Water Treatment Market Size, By Device, By Value (USD Million), By Value 2018-2028

- Table 14: The Asia-Pacific Residential Water Treatment Market Size (USD Million), By Technology, By Value 2018-2028

- Table 15: The Asia-Pacific Residential Water Treatment Market Size (USD Million), By Application, By Value 2018-2028

- Table 16: The Asia-Pacific Residential Water Treatment Market Size (USD Million), By Country, By Value 2018-2028

- Table 17: Latin America Residential Water Treatment Market Size, By Device, By Value (USD Million), By Value 2018-2028

- Table 18: Latin America Residential Water Treatment Market Size, By Technology, By Value (USD Million), 2018-2028

- Table 19: Latin America Residential Water Treatment Market Size (USD Million), By Application, By Value 2018-2028

- Table 20: Latin America Residential Water Treatment Market Size (USD Million), By Country, By Value 2018-2028

- Table 21: The Middle East & Africa Residential Water Treatment Market Size, By Device, By Value (USD Million), 2018-2028

- Table 22: The Middle East & Africa Residential Water Treatment Market Size, By Technology, By Value (USD Million), 2018-2028

- Table 23: The Middle East & Africa Residential Water Treatment Market Size (USD Million), By Application, By Value 2018-2028

- Table 24: The Middle East & Africa Residential Water Treatment Market Size (USD Million), By Country, By Value 2018-2028

- Table 25: List of Key Players and Their offerings

- Table 26: Competitive Benchmarking, by Operating Parameters

- Table 27 A.O Smith Corporation Company Overview

- Table 28 A.O Smith Corporation Financial Overview

- Table 29 Kent Supreme Company Overview

- Table 30 Kent Supreme Financial Overview

- Table 31 Eureka Forbes Company Overview

- Table 32 Eureka Forbes Financial Overview

- Table 33 Panasonic Company Overview

- Table 34 Panasonic Financial Overview

- Table 35 Aqua Care Company Overview

- Table 36 Aqua Care Financial Overview

- Table 37 3M Company Overview

- Table 38 3M Financial Overview

- Table 39 Aquasana Company Overview

- Table 40 Aquasana Financial Overview

- Table 41 Waterwise Inc. Company Overview

- Table 42 Waterwise Inc. Financial Overview

- Table 43 Everpure Company Overview

- Table 44 Everpure Financial Overview

- Table 45 GE Appliances Company Overview

- Table 46 GE Appliances Financial Overview

Global Residential Water Treatment Market to Cross USD 34 Billion by 2028

Global Residential Water Treatment Market is flourishing owing to the growing public health concerns, continuous improvement of water purifier technology along with the expanding residential constructions…

A recent study conducted by the strategic consulting and market research firm, BlueWeave Consulting, revealed that the Global Residential Water Treatment Market was worth USD 21.38 billion in the year 2021. The market is projected to grow at a CAGR of 7.1%, earning revenues of around USD 34.29 billion by the end of 2028. The Global Residential Water Treatment Market is booming due to the growing demand for water treatment systems in households as a result of rising water pollution and urban population growth. Moreover, because of the shortage of freshwater resources, both developed and emerging nations experience water scarcity issues. As a result, governments have increased their focus on water treatment technology to provide clean and usable water. This supported the market for residential water treatment during the forecast period (2022-2028). Furthermore, Global Residential Water Treatment Market is one of the most emerging markets that grow continuously owing to the fast integration of new technologies such as the Internet of Things (IoT), Artificial Intelligence (AI), cloud computing, and others. However, due to the high cost of water treatment equipment, the price of water treatment technology has gone up recently. Additionally, there are several steps in the technology used to cleanse water that needs powerful devices that can only be operated by qualified experts. The market for water treatment technologies is thus hampered by expensive equipment and a lack of qualified workers.

People's Growing Concern about their Health Propels the Market Forward

With the rise in health issues caused by water-borne diseases such as Typhoid, Cholera, and Malaria, all of which are caused by ingesting contaminated water, the market is expected to boost water purifier sales around the world. Water purifiers disinfect and clean the water, making it safe to drink. This precautionary trend is expected to benefit the global residential water purifiers market during the forecast period. Moreover, continuous improvements to water purifier technology reinforce the market growth. Because of the abundance of talent available around the world, R&D units are encouraged to develop products at a lower cost. Manufacturers of water purifiers are experimenting with cutting-edge water filtration technologies like carbon nanotubes and sophisticated membrane systems.

Rising Government Support to Raise Public Awareness is Driving Market Growth

According to the UN Environmental Program, the water quality of aquifers, rivers, and lakes puts roughly 3 billion people in the world at risk of developing diseases. Dramatic changes in water availability are occurring in one-fifth of the world's river basins, and 2.3 billion people live in "water-stressed" countries, including 721 million in regions where the water situation is "serious." Events are being held by several government entities to raise public awareness of the harmful effects of contaminated water. For instance, the United Nations honors World Water Day on March 22 every year to increase public awareness of the value of water in ensuring food security, producing energy, advancing industry, and other areas of social, economic, and human development.

In addition, there is a growing need for effective and equitable water management around the globe. Thus, market participants are spending money on product development and technological breakthroughs to guarantee a sufficient supply of these goods. Due to the introduction of new, technologically advanced solutions to the market, product demand is on the rise. For instance, refrigerator water treatment systems provide instant access to chilled, drinkable, and reviving filtered water as well as ice cubes made from that water. Compared to many other water filters on the market, General Electric's new smart household water treatment systems have been approved to minimize a larger variety of contaminants. Artificial intelligence (AI) and other connected technologies are facilitating the delivery of efficiency and convenience. Additionally, these goods increase energy efficiency, support product effectiveness, and enhance consumer satisfaction.

Challenge: Expensive Installation, Equipment, and Operation

Despite the numerous benefits of residential water treatment, the installation of residential water treatment systems is costly. A water softener, for example, which is used to convert hard water to soft water, can cost between USD 2,000 and USD 4,000. The installation of a water softener necessitates the use of technicians and installers, which results in high installation costs. Some residential water treatment systems have high operating and maintenance costs. Distillation systems, for example, use a significant amount of energy for both cooling and heating. Some Asian and African countries have highlighted these issues. Water distribution and storage infrastructure are also lacking in underdeveloped Asian and African countries. This could be a problem.

Segmental Coverage

Global Residential Water Treatment Market - By Application

Based on application, the Global Residential Water Treatment Market is segmented into Residential Buildings/Apartments, Individual Housing, Villas, Others. The residential sector is expected to be the largest segment of the Global Residential Water Treatment Market. The residential application is primarily concerned with the use of water treatment systems to generate potable water for domestic consumption. Because of the growing demand for treated drinking water, removal of unpleasant taste, odor, and discoloration, suspended solids, biodegradable organics, and pathogenic bacteria, the residential water treatment application is expected to grow rapidly.

Impact of COVID-19 on Global Residential Water Treatment Market

During the COVID-19 pandemic, people are more concerned about their health and are taking extra precautions to ensure their safety. Furthermore, the work-from-home culture has increased residential demand for point-of-use water treatment systems. The primary impediment to market growth, however, is the high installation, equipment, and operation costs. The point-of-use water treatment systems industry is expanding overall due to health concerns, rising demand for high-quality drinking water, and increased customer access to point-of-use devices through retail channels. In response to stringent government regulations imposed by various countries, companies are focusing on manufacturing environmentally friendly point-of-use water treatment systems.

Competitive Landscape

The leading market players in the Global Residential Water Treatment Market are A.O Smith Corporation, Kent Supreme, Eureka Forbes, Panasonic, Aqua Care, 3M, Aquasana, Waterwise Inc, Everpure, GE Appliances, other prominent players. The Global Residential Water Treatment Market is highly fragmented with the presence of several manufacturing companies in the country. The market leaders retain their supremacy by spending on research and development, incorporating cutting-edge technology into their goods, and releasing upgraded items for customers. Various tactics, including strategic alliances, agreements, mergers, and partnerships, are used.

Don't miss the business opportunity in the Global Residential Water Treatment Market. Consult our analysts to gain crucial insights and facilitate your business growth.

The in-depth analysis of the report provides information about growth potential, upcoming trends, and statistics of the Global Residential Water Treatment Market. It also highlights the factors driving forecasts of total market size. The report promises to provide recent technology trends in the Global Residential Water Treatment Market and industry insights to help decision-makers make sound strategic decisions. Furthermore, the report also analyzes the growth drivers, challenges, and competitive dynamics of the market.

About Us

BlueWeave Consulting provides comprehensive Market Intelligence (MI) Solutions to businesses regarding various products and services online and offline. We offer all-inclusive market research reports by analyzing both qualitative and quantitative data to boost the performance of your business solutions. BWC has built its reputation from the scratch by delivering quality inputs and nourishing long-lasting relationships with its clients. We are one of the promising digital MI solutions companies providing agile assistance to make your business endeavors successful.

Table of Contents

1. Research Framework

- 1.1. Research Objective

- 1.2. Product Overview

- 1.3. Market Segmentation

2. Research Methodology

- 2.1. Qualitative Research

- 2.1.1. Primary & Secondary Research

- 2.2. Quantitative Research

- 2.3. Market Breakdown & Data Triangulation

- 2.3.1. Secondary Research

- 2.3.2. Primary Research

- 2.4. Breakdown of Primary Research Respondents, By Region

- 2.5. Assumption & Limitation

3. Executive Summary

4. Global Residential Water Treatment Market Insights

- 4.1. Industry Value Chain Analysis

- 4.2. DROC Analysis

- 4.2.1. Growth Drivers

- 4.2.2. Restraints

- 4.2.3. Opportunities

- 4.2.4. Challenges

- 4.3. Technological Advancement/Recent Development

- 4.4. Regulatory Framework

- 4.5. Porter's Five Forces Analysis

- 4.5.1. Bargaining Power of Suppliers

- 4.5.2. Bargaining Power of Buyers

- 4.5.3. Threat of New Entrants

- 4.5.4. Threat of Substitutes

- 4.5.5. Intensity of Rivalry

5. Global Residential Water Treatment Market Overview

- 5.1. Market Size & Forecast by Value, 2018-2028

- 5.1.1. By Value (USD Million)

- 5.2. Market Share & Forecast

- 5.2.1. By Device

- 5.2.1.1. Tabletop

- 5.2.1.2. Faucet-Mounted

- 5.2.1.3. Countertop

- 5.2.1.4. Others

- 5.2.2. By Technology

- 5.2.2.1. RO

- 5.2.2.2. Ultrafiltration

- 5.2.2.3. Distillation

- 5.2.2.4. Disinfection

- 5.2.2.5. Filtration

- 5.2.2.6. Others

- 5.2.3. By Application

- 5.2.3.1. Residential Buildings/Apartments

- 5.2.3.2. Individual Housing

- 5.2.3.3. Villas

- 5.2.3.4. Others

- 5.2.4. By Region

- 5.2.4.1. North America

- 5.2.4.2. Europe

- 5.2.4.3. The Asia Pacific

- 5.2.4.4. Latin America

- 5.2.4.5. The Middle East and Africa

- 5.2.1. By Device

6. North America Residential Water Treatment Market

- 6.1. Market Size & Forecast by Value, 2018-2028

- 6.1.1. By Value (USD Million)

- 6.2. Market Share & Forecast

- 6.2.1. By Device

- 6.2.2. By Technology

- 6.2.3. By Application

- 6.2.4. By Country

- 6.2.4.1. United States

- 6.2.4.2. Canada

7. Europe Residential Water Treatment Market

- 7.1. Market Size & Forecast by Value, 2018-2028

- 7.1.1. By Value (USD Million)

- 7.2. Market Share & Forecast

- 7.2.1. By Device

- 7.2.2. By Technology

- 7.2.3. By Application

- 7.2.4. By Country

- 7.2.4.1. Germany

- 7.2.4.2. United Kingdom

- 7.2.4.3. Italy

- 7.2.4.4. France

- 7.2.4.5. Spain

- 7.2.4.6. The Netherlands

- 7.2.4.7. NORDIC Countries

- 7.2.4.8. Rest of Europe

8. The Asia Pacific Residential Water Treatment Market

- 8.1. Market Size & Forecast by Value, 2018-2028

- 8.1.1. By Value (USD Million)

- 8.2. Market Share & Forecast

- 8.2.1. By Device

- 8.2.2. By Technology

- 8.2.3. By Application

- 8.2.4. By Country

- 8.2.4.1. China

- 8.2.4.2. India

- 8.2.4.3. Japan

- 8.2.4.4. South Korea

- 8.2.4.5. Australia

- 8.2.4.6. Indonesia

- 8.2.4.7. Malaysia

- 8.2.4.8. Philippines

- 8.2.4.9. Thailand

- 8.2.4.10. Vietnam

- 8.2.4.11. Rest of Asia Pacific

9. Latin America Residential Water Treatment Market

- 9.1. Market Size & Forecast by Value, 2018-2028

- 9.1.1. By Value (USD Million)

- 9.2. Market Share & Forecast

- 9.2.1. By Device

- 9.2.2. By Technology

- 9.2.3. By Application

- 9.2.4. By Country

- 9.2.4.1. Brazil

- 9.2.4.2. Mexico

- 9.2.4.3. Argentina

- 9.2.4.4. Peru

- 9.2.4.5. Colombia

- 9.2.4.6. Rest of Latin America

10. The Middle East & Africa Residential Water Treatment Market

- 10.1. Market Size & Forecast by Value, 2018-2028

- 10.1.1. By Value (USD Million)

- 10.2. Market Share & Forecast

- 10.2.1. By Device

- 10.2.2. By Technology

- 10.2.3. By Application

- 10.2.4. By Country

- 1.1.1.1. Saudi Arabia

- 1.1.1.2. UAE

- 1.1.1.3. Qatar

- 1.1.1.4. Kuwait

- 1.1.1.5. South Africa

- 1.1.1.6. Iran

- 1.1.1.7. Nigeria

- 1.1.1.8. Kenya

- 1.1.1.9. Egypt

- 1.1.1.10. Morocco

- 1.1.1.11. Algeria

- 1.1.1.12. Tunisia

- 1.1.1.13. Rest of Middle East & Africa

11. Competitive Landscape

- 11.1. List of Key Players and Their offerings

- 11.2. Market Share Analysis, 2021

- 11.3. Competitive Benchmarking, By Operating Parameters

- 11.4. Key Strategic Development (Merger, Acquisition, Partnership, etc.)

12. Impact of Covid-19 on Global Residential Water Treatment Market Industry

13. Company Profile (Company Overview, Financial Matrix, Competitive landscape, Key Personnel, Key Competitors, Contact Address, and Strategic Outlook) **

- 13.1. A.O Smith Corporation

- 13.2. Kent Supreme

- 13.3. Eureka Forbes

- 13.4. Panasonic

- 13.5. Aqua Care

- 13.6. 3M

- 13.7. Aquasana

- 13.8. Waterwise Inc

- 13.9. Everpure

- 13.10. GE Appliances

- 13.11. Other Prominent Players

14. Key Strategic Recommendations

*Financial information in case of non-listed companies will be provided as per availability

**The segmentation and the companies are subjected to modifications based on in-depth secondary for the final deliverable