|

|

市場調査レポート

商品コード

1170028

放射線量管理市場 - 世界および地域別分析:製品別、モダリティ別、展開モード別、エンドユーザー別、国別 - 分析と予測(2022年~2032年)Radiation Dose Management Market - A Global and Regional Analysis: Focus on Product, Modality, Mode of Deployment, End User, and Country Analysis - Analysis and Forecast, 2022-2032 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 放射線量管理市場 - 世界および地域別分析:製品別、モダリティ別、展開モード別、エンドユーザー別、国別 - 分析と予測(2022年~2032年) |

|

出版日: 2022年12月08日

発行: BIS Research

ページ情報: 英文 329 Pages

納期: 1~5営業日

|

- 全表示

- 概要

- 図表

- 目次

世界の放射線量管理の市場規模は、2021年に2億1,280万米ドルとなりました。

同市場は、2022年~2032年にかけて、10.30%のCAGRで拡大し、2032年には5億8,670万米ドルに達すると予測されています。

当レポートでは、世界の放射線量管理市場について調査し、市場の概要とともに、製品別、モダリティ別、展開モード別、エンドユーザー別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

第1章 市場

- 世界市場の見通し

- 業界の見通し

- 世界の放射線量管理市場に対するCOVID-19の影響

- ビジネスダイナミクス

第2章 世界の放射線量管理市場(モダリティ別)

- 機会評価

- 成長-シェアマトリクス

- CTスキャナー

- X線、CR、およびDR

- マンモグラフィシステム

- インターベンショナルアンギオシステム/Angio CT

- 透視システム

- PETスキャナーとSPECT

- ハイブリッドイメージング

第3章 世界の放射線量管理市場(製品別)

- Radimetricsエンタープライズプラットフォーム

- DoseWatch、DoseWatch Explore

- teamplay Dose

- NEXO [DOSE]

- tqm/DoseおよびDoseMonitor

- 放射線量モニター

- Imalogixプラットフォーム

- Syncro-Dose

- NovaDose

- DoseWiseポータル

- SafeCT

- MyXrayDose

- DoseM

- 線量追跡システム

- DoseTrack

第4章 世界の放射線量管理市場(展開モード別)

- 機会評価

- 成長-シェアマトリクス

- ウェブベース

- オンプレミス

- クラウドベース

第5章 世界の放射線量管理市場(エンドユーザー別)

- 機会評価

- 成長-シェアマトリクス

- 病院

- 診断センター

- その他

第6章 世界の放射線量管理市場(地域別)

- 北米の放射線量管理市場

- 欧州の放射線量管理市場

- アジア太平洋の放射線量管理市場

- ラテンアメリカの放射線量管理市場

- 中東・アフリカの放射線量管理市場

第7章 市場-競合ベンチマーキングと企業プロファイル

- 競合ベンチマーキングと企業プロファイル

- 企業シェア分析

- 企業プロファイル

- Agfa-Gevaert Group

- Bracco

- Bayer AG

- Canon Inc.

- FUJIFILM Holdings Corporation

- Guerbet

- General Electric Company

- Imalogix

- Infinitt Healthcare Co., Ltd.

- Koninklijke Philips N.V.

- LANDAUER

- Medic Vision Imaging Solutions Ltd.

- Medsquare

- MyXrayDose Ltd.

- Novarad Corporation

- PACSHealth, LLC

- Qaelum NV

- Sectra AB

- SST Group Inc.

- Siemens Healthineers AG

- Virtual Phantoms Inc.

List of Figures

- Figure 1: Global Radiation Dose Management Market, Impact Analysis

- Figure 2: Global Radiation Dose Management Market (by Modality), % Share, 2021 and 2032

- Figure 3: Global Radiation Dose Management Market (by Region), $Million, 2022 and 2032

- Figure 4: Global Radiation Dose Management Market Segmentation

- Figure 5: Global Radiation Dose Management Market Research Methodology

- Figure 6: Primary Research

- Figure 7: Secondary Research

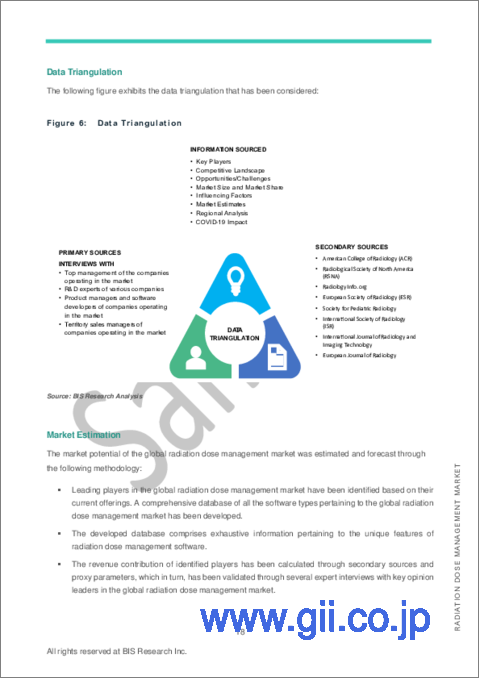

- Figure 8: Data Triangulation

- Figure 9: Global Radiation Dose Management Market, Research Process

- Figure 10: Assumptions and Limitations

- Figure 11: Global Radiation Dose Management Market, Potential Forecast Scenarios

- Figure 12: Global Radiation Dose Management Market Size and Growth Potential (Realistic Scenario), $Million, 2020-2032

- Figure 13: Global Radiation Dose Management Market Size and Growth Potential (Optimistic Scenario), $Million, 2020-2032

- Figure 14: Global Radiation Dose Management Market Size and Growth Potential (Pessimistic Scenario), $Million, 2020-2032

- Figure 15: Sources of Radiation Exposure in the U.S.

- Figure 16: Share of Examinations Conducted by Different Imaging Modalities, %

- Figure 17: Contribution to Collective Effective Dose, %

- Figure 18: Different Types of Radiation Doses

- Figure 19: Trend in Radiation Exposure from Medical Imaging, mSv, 2000, 2008, and 2020

- Figure 20: Global Radiation Dose Management Market Key Trends, Market Shift, 2022-2032

- Figure 21: Global Radiation Dose Management Market, Patent Analysis (by Country), January 2018-November 2022

- Figure 22: Global Radiation Dose Management Market, Patent Analysis (by Year), January 2018-November 2022

- Figure 23: Global Radiation Dose Management Market, Product Benchmarking (by Mode of Deployment)

- Figure 24: Global Radiation Dose Management Market, Product Benchmarking (Methods of Data Acquisition)

- Figure 25: Global Radiation Dose Management Market, Product Benchmarking (Compatible Modalities)

- Figure 26: Global Radiation Dose Management Market, Fishbone Tool Market Gap Analysis

- Figure 27: Workflow of the DoseM Software

- Figure 28: Global Radiation Dose Management Market (Without COVID-19), $Million, 2020-2032

- Figure 29: Number of CT Scans Per One Million Inhabitants in the U.S., 2015, 2017, and 2019

- Figure 30: Number of CT Scans Per One Million Inhabitants in Europe (by Country), 2015, 2017, and 2019

- Figure 31: Number of CT Scans Per One Million Inhabitants in Asia-Pacific (by Country), 2015, 2017, and 2019

- Figure 32: Number of CT Scans Per One Million Inhabitants, 2018-2021

- Figure 33: Number of Scans by Imaging Modalities in the U.K. from 2015-2016 to 2020-2021, Million

- Figure 34: Automated Workflow in a Radiation Dose Management Software

- Figure 35: Recommendations: Key Areas for Market Players to Focus on

- Figure 36: Global Radiation Dose Management Market, Impact Analysis

- Figure 37: Number of CT Scanners Per 1,000,000 Inhabitants (by Country), Million, 2018-2020

- Figure 38: Major Concerns Related to Overexposure to Radiation in Medical Imaging Devices and Procedures

- Figure 39: Steps for Optimizing Radiation Dose

- Figure 40: Global Prevalence of Cardiovascular Diseases, Million, 2017-2019,

- Figure 41: Number of Incidence Cases of Cancer (by Region), 2018 and 2040

- Figure 42: Important Technical Considerations for Pediatric Imaging

- Figure 43: Global Radiation Dose Management Market (by Modality)

- Figure 44: Global Radiation Dose Management Market, Incremental Opportunity (by Modality), $Million, 2022-2032

- Figure 45: Global Radiation Dose Management Market, Growth-Share Matrix (by Modality), 2022-2032

- Figure 46: Global Radiation Dose Management Market (CT Scanners), $Million, 2020-2032

- Figure 47: Global Radiation Dose Management Market (X-Ray, CR, and DR), $Million, 2020-2032

- Figure 48: Global Radiation Dose Management Market (Mammography Systems), $Million, 2020-2032

- Figure 49: Global Radiation Dose Management Market (Interventional Angiography Systems/Angio CT), $Million, 2020-2032

- Figure 50: Global Radiation Dose Management Market (Fluoroscopy Systems), $Million, 2020-2032

- Figure 51: Global Radiation Dose Management Market (PET Scanners and SPECT), $Million, 2020-2032

- Figure 52: Global Radiation Dose Management Market (Hybrid Imaging), $Million, 2020-2032

- Figure 53: Global Radiation Dose Management Market (Radimetrics Enterprise Platform), $Million, 2020-2032

- Figure 54: Global Radiation Dose Management Market (Radimetrics Enterprise Platform), Installed Base, 2018 and 2019

- Figure 55: Global Radiation Dose Management Market (Radimetrics Enterprise Platform), Compatible Modalities

- Figure 56: Global Radiation Dose Management Market (DoseWatch and DoseWatch Explore), $Million, 2020-2032

- Figure 57: Global Radiation Dose Management Market (DoseWatch and DoseWatch Explore), Installed Base, 2018 and 2019

- Figure 58: Global Radiation Dose Management Market (DoseWatch and DoseWatch Explore), Compatible Modalities

- Figure 59: Global Radiation Dose Management Market (teamplay Dose), $Million, 2020-2032

- Figure 60: Global Radiation Dose Management Market (teamplay Dose), Installed Base, 2018 and 2019

- Figure 61: Global Radiation Dose Management Market (teamplay Dose), Compatible Modalities

- Figure 62: Global Radiation Dose Management Market (NEXO [DOSE]), $Million, 2020-2032

- Figure 63: Global Radiation Dose Management Market (NEXO [DOSE]), Installed Base, 2018 and 2019

- Figure 64: Global Radiation Dose Management Market (NEXO [DOSE]), Compatible Modalities

- Figure 65: Global Radiation Dose Management Market (tqm/Dose and DoseMonitor), $Million, 2020-2032

- Figure 66: Global Radiation Dose Management Market (tqm/Dose and DoseMonitor), Installed Base, 2018 and 2019

- Figure 67: Global Radiation Dose Management Market (tqm/Dose and DoseMonitor), Compatible Modalities

- Figure 68: Global Radiation Dose Management Market (Radiation Dose Monitor), $Million, 2020-2032

- Figure 69: Global Radiation Dose Management Market (Radiation Dose Monitor), Installed Base, 2018 and 2019

- Figure 70: Global Radiation Dose Management Market (Radiation Dose Monitor), Compatible Modalities

- Figure 71: Global Radiation Dose Management Market (Imalogix Platform), $Million, 2020-2032

- Figure 72: Global Radiation Dose Management Market (Imalogix Platform), Installed Base, 2018 and 2019

- Figure 73: Global Radiation Dose Management Market (Imalogix Platform), Compatible Modalities

- Figure 74: Global Radiation Dose Management Market (Syncro-Dose), $Million, 2020-2032

- Figure 75: Global Radiation Dose Management Market (Syncro-Dose), Installed Base, 2018 and 2019

- Figure 76: Global Radiation Dose Management Market (Syncro-Dose), Compatible Modalities

- Figure 77: Global Radiation Dose Management Market (NovaDose), $Million, 2020-2032

- Figure 78: Global Radiation Dose Management Market (NovaDose), Installed Base, 2018 and 2019

- Figure 79: Global Radiation Dose Management Market (NovaDose), Compatible Modalities

- Figure 80: Global Radiation Dose Management Market (DoseWise Portal), $Million, 2020-2032

- Figure 81: Global Radiation Dose Management Market (DoseWise Portal), Installed Base, 2018 and 2019

- Figure 82: Global Radiation Dose Management Market (DoseWise Portal), Compatible Modalities

- Figure 83: Global Radiation Dose Management Market (SafeCT), $Million, 2020-2032

- Figure 84: Global Radiation Dose Management Market (SafeCT), Installed Base, 2018 and 2019

- Figure 85: Global Radiation Dose Management Market (SafeCT), Compatible Modalities

- Figure 86: Global Radiation Dose Management Market (MyXrayDose), $Million, 2020-2032

- Figure 87: Global Radiation Dose Management Market (MyXrayDose), Installed Base, 2018 and 2019

- Figure 88: Global Radiation Dose Management Market (MyXrayDose), Compatible Modalities

- Figure 89: Global Radiation Dose Management Market (DoseM), $Million, 2020-2032

- Figure 90: Global Radiation Dose Management Market (DoseM), Installed Base, 2018 and 2019

- Figure 91: Global Radiation Dose Management Market (DoseM), Compatible Modalities

- Figure 92: Global Radiation Dose Management Market (Dose Tracking System), $Million, 2020-2032

- Figure 93: Global Radiation Dose Management Market (Dose Tracking System), Installed Base, 2018 and 2019

- Figure 94: Global Radiation Dose Management Market (Dose Tracking System), Compatible Modalities

- Figure 95: Global Radiation Dose Management Market (DoseTrack), $Million, 2020-2032

- Figure 96: Global Radiation Dose Management Market (DoseTrack), Installed Base, 2018 and 2019

- Figure 97: Global Radiation Dose Management Market (DoseTrack), Compatible Modalities

- Figure 98: Global Radiation Dose Management Market (by Mode of Deployment)

- Figure 99: Global Radiation Dose Management Market, Incremental Opportunity (by Mode of Deployment), $Million, 2022-2032

- Figure 100: Global Radiation Dose Management Market, Growth-Share Matrix (by Mode of Deployment), 2022-2032

- Figure 101: Global Radiation Dose Management Market (Web-Based), $Million, 2020-2032

- Figure 102: Global Radiation Dose Management Market (On-Premise), $Million, 2020-2032

- Figure 103: Global Radiation Dose Management Market (Cloud-Based), $Million, 2020-2032

- Figure 104: Global Radiation Dose Management Market (by End User)

- Figure 105: Global Radiation Dose Management Market, Incremental Opportunity (by End User), $Million, 2022-2032

- Figure 106: Global Radiation Dose Management Market, Growth-Share Matrix (by End User), 2022-2032

- Figure 107: Global Radiation Dose Management Market (Hospitals), $Million, 2020-2032

- Figure 108: Global Radiation Dose Management Market (Diagnostic Centers), $Million, 2020-2032

- Figure 109: Global Radiation Dose Management Market (Others), $Million, 2020-2032

- Figure 110: Global Radiation Dose Management Market Share (by Region), 2022-2032

- Figure 111: North America Radiation Dose Management Market, Incremental Opportunity (by Country), $Million, 2022-2032

- Figure 112: North America Radiation Dose Management Market, $Million, 2020-2032

- Figure 113: North America Radiation Dose Management Market (by Modality), $Million, 2020-2032

- Figure 114: North America Radiation Dose Management Market (by End User), $Million, 2020-2032

- Figure 115: North America Radiation Dose Management Market (by Mode of Deployment), $Million, 2020-2032

- Figure 116: North America Radiation Dose Management Market (by Country), % Share, 2021 and 2032

- Figure 117: Annual New Cancer Cases in the U.S., Million, 2014-2019

- Figure 118: U.S. Radiation Dose Management Market, $Million, 2020-2032

- Figure 119: U.S. Radiation Dose Management Market (by End User), $Million, 2020-2032

- Figure 120: Key Features of Imaging Devices in Canada

- Figure 121: Canada Radiation Dose Management Market, $Million, 2020-2032

- Figure 122: Canada Radiation Dose Management Market (by End User), $Million, 2020-2032

- Figure 123: Europe Radiation Dose Management Market, Incremental Opportunity (by Country), $Million, 2022-2032

- Figure 124: Europe Radiation Dose Management Market, $Million, 2020-2032

- Figure 125: Europe Radiation Dose Management Market (by Modality), $Million, 2020-2032

- Figure 126: Europe Radiation Dose Management Market (by End User), $Million, 2020-2032

- Figure 127: Europe Radiation Dose Management Market (by Mode of Deployment), $Million, 2020-2032

- Figure 128: Europe Radiation Dose Management Market (by Country), % Share, 2021 and 2032

- Figure 129: Germany Radiation Dose Management Market, $Million, 2020-2032

- Figure 130: Germany Radiation Dose Management Market (by End User), $Million, 2020-2032

- Figure 131: France Radiation Dose Management Market, $Million, 2020-2032

- Figure 132: France Radiation Dose Management Market (by End User), $Million, 2020-2032

- Figure 133: Number of CT Scanners in Italy Per One Million Inhabitants, 2014-2021

- Figure 134: Italy Radiation Dose Management Market, $Million, 2020-2032

- Figure 135: Italy Radiation Dose Management Market (by End User), $Million, 2020-2032

- Figure 136: Number of Scans by Imaging Modalities in the U.K. from 2015-2016 to 2020-2021, Million

- Figure 137: Installed Base of Imaging Modalities in the U.K., 2018 and 2020

- Figure 138: U.K. Radiation Dose Management Market, $Million, 2020-2032

- Figure 139: U.K. Radiation Dose Management Market (by End User), $Million, 2020-2032

- Figure 140: Number of CT Scanners in Spain Per One Million Inhabitants, 2014-2021

- Figure 141: Spain Radiation Dose Management Market, $Million, 2020-2032

- Figure 142: Spain Radiation Dose Management Market (by End User), $Million, 2020-2032

- Figure 143: Number of CT Scanners in the Netherlands Per One Million Inhabitants, 2017-2020

- Figure 144: Netherlands Radiation Dose Management Market, $Million, 2020-2032

- Figure 145: Netherlands Radiation Dose Management Market (by End User), $Million, 2020-2032

- Figure 146: Number of CT Scanners in Rest-of-Europe Per One Million Inhabitants, 2017-2020

- Figure 147: Rest-of-Europe Radiation Dose Management Market, $Million, 2020-2032

- Figure 148: Rest-of-Europe Radiation Dose Management Market (by End User), $Million, 2020-2032

- Figure 149: Asia-Pacific Radiation Dose Management Market, Incremental Opportunity (by Country), $Million, 2022-2032

- Figure 150: Asia-Pacific Radiation Dose Management Market, $Million, 2020-2032

- Figure 151: Asia-Pacific Radiation Dose Management Market (by Modality), $Million, 2020-2032

- Figure 152: Asia-Pacific Radiation Dose Management Market (by End User), $Million, 2020-2032

- Figure 153: Asia-Pacific Radiation Dose Management Market (by Mode of Deployment), $Million, 2020-2032

- Figure 154: Asia-Pacific Radiation Dose Management Market (by Country), % Share, 2021 and 2032

- Figure 155: Japan Radiation Dose Management Market, $Million, 2020-2032

- Figure 156: Japan Radiation Dose Management Market (by End User), $Million, 2020-2032

- Figure 157: China Radiation Dose Management Market, $Million, 2020-2032

- Figure 158: China Radiation Dose Management Market (by End User), $Million, 2020-2032

- Figure 159: Number of CT Scanners in Australia Per One Million Inhabitants, 2014-2021

- Figure 160: Australia and New Zealand Radiation Dose Management Market, $Million, 2020-2032

- Figure 161: Australia and New Zealand Radiation Dose Management Market (by End User), $Million, 2020-2032

- Figure 162: South Korea Radiation Dose Management Market, $Million, 2020-2032

- Figure 163: South Korea Radiation Dose Management Market (by End User), $Million, 2020-2032

- Figure 164: India Radiation Dose Management Market, $Million, 2020-2032

- Figure 165: India Radiation Dose Management Market (by End User), $Million, 2020-2032

- Figure 166: Rest-of-Asia-Pacific Radiation Dose Management Market, $Million, 2020-2032

- Figure 167: Rest-of-Asia-Pacific Radiation Dose Management Market (by End User), $Million, 2020-2032

- Figure 168: Latin America Radiation Dose Management Market, Incremental Opportunity (by Country), $Million, 2022-2032

- Figure 169: Latin America Radiation Dose Management Market, $Million, 2020-2032

- Figure 170: Latin America Radiation Dose Management Market (by Modality), $Million, 2020-2032

- Figure 171: Latin America Radiation Dose Management Market (by End User), $Million, 2020-2032

- Figure 172: Latin America Radiation Dose Management Market (by Mode of Deployment), $Million, 2020-2032

- Figure 173: Latin America Radiation Dose Management Market (by Country), % Share, 2021 and 2032

- Figure 174: Number of CT Scanners in Brazil Per One Million Inhabitants, 2014-2021

- Figure 175: Brazil Radiation Dose Management Market, $Million, 2020-2032

- Figure 176: Brazil Radiation Dose Management Market (by End User), $Million, 2020-2032

- Figure 177: Number of CT Scanners in Mexico Per One Million Inhabitants, 2018-2020

- Figure 178: Mexico Radiation Dose Management Market, $Million, 2020-2032

- Figure 179: Mexico Radiation Dose Management Market (by End User), $Million, 2020-2032

- Figure 180: Rest-of-Latin America Radiation Dose Management Market, $Million, 2020-2032

- Figure 181: Rest-of-Latin America Radiation Dose Management Market (by End User), $Million, 2020-2032

- Figure 182: Middle East and Africa Radiation Dose Management Market, Incremental Opportunity (by Country), $Million, 2022-2032

- Figure 183: Middle East and Africa Radiation Dose Management Market, $Million, 2020-2032

- Figure 184: Middle East and Africa Radiation Dose Management Market (by Modality), $Million, 2020-2032

- Figure 185: Middle East and Africa Radiation Dose Management Market (by End User), $Million, 2020-2032

- Figure 186: Middle East and Africa Radiation Dose Management Market (by Mode of Deployment), $Million, 2020-2032

- Figure 187: Middle East and Africa Radiation Dose Management Market (by Country), % Share, 2021 and 2032

- Figure 188: Middle East Radiation Dose Management Market, $Million, 2020-2032

- Figure 189: Middle East Radiation Dose Management Market (by End User), $Million, 2020-2032

- Figure 190: Africa Radiation Dose Management Market, $Million, 2020-2032

- Figure 191: Africa Radiation Dose Management Market (by End User), $Million, 2020-2032

- Figure 192: Share of Key Developments and Strategies, January 2018-November 2022

- Figure 193: New Offerings (by Company), January 2018-November 2022

- Figure 194: Partnerships, Alliances, and Business Expansions (by Company), January 2018-November 2022

- Figure 195: Regulatory and Legal Activities (by Company), January 2018-November 2022

- Figure 196: Global Radiation Dose Management Market, Company Share Analysis, % Share, 2021

- Figure 197: Agfa-Gevaert Group: Overall Product Portfolio

- Figure 198: Agfa-Gevaert Group: Overall Financials, $Million, 2019-2021

- Figure 199: Agfa-Gevaert Group: Net Revenue (by Segment), $Million, 2019-2021

- Figure 200: Agfa-Gevaert Group: Net Revenue (by Region), $Million, 2019-2021

- Figure 201: Agfa-Gevaert Group: R&D Expenditure, $Million, 2019-2021

- Figure 202: Bracco: Overall Product Portfolio

- Figure 203: Bayer AG: Overall Product Portfolio

- Figure 204: Bayer AG: Overall Financials, $Million, 2019-2021

- Figure 205: Bayer AG: R&D Expenditure, $Million, 2019-2021

- Figure 206: Canon Inc.: Overall Product Portfolio

- Figure 207: Canon Inc.: Overall Financials, $Million, 2019-2021

- Figure 208: Canon Inc.: Net Revenue (by Segment), $Million, 2019-2021

- Figure 209: Canon Inc.: Net Revenue (by Region), $Million, 2019-2021

- Figure 210: Canon Inc.: R&D Expenditure, $Million, 2019-2021

- Figure 211: FUJIFILM Holdings Corporation: Overall Product Portfolio

- Figure 212: FUJIFILM Holdings Corporation: Overall Financials, $Million, 2019-2021

- Figure 213: FUJIFILM Holdings Corporation: Net Revenue (by Segment), $Million, 2020-2021

- Figure 214: Guerbet: Overall Product Portfolio

- Figure 215: Guerbet: Overall Financials, $Million, 2019-2021

- Figure 216: Guerbet: Net Revenue (by Segment), $Million, 2019-2021

- Figure 217: Guerbet: Net Revenue (by Region), $Million, 2019-2021

- Figure 218: Guerbet: R&D Expenditure, $Million, 2019-2021

- Figure 219: General Electric Company: Overall Product Portfolio

- Figure 220: General Electric Company: Overall Financials, $Million, 2019-2021

- Figure 221: General Electric Company: Net Revenue (by Segment), $Million, 2019-2021

- Figure 222: General Electric Company: Net Revenue (by Region), $Million, 2019-2021

- Figure 223: General Electric Company: R&D Expenditure, $Million, 2019-2021

- Figure 224: Imalogix: Overall Product Portfolio

- Figure 225: Infinitt Healthcare Co., Ltd.: Overall Product Portfolio

- Figure 226: Koninklijke Philips N.V.: Overall Product Portfolio

- Figure 227: Koninklijke Philips N.V.: Overall Financials, $Million, 2019-2021

- Figure 228: Koninklijke Philips N.V.: Net Revenue (by Segment), $Million, 2019-2021

- Figure 229: Koninklijke Philips N.V.: Revenue (by Region), $Million, 2019-2021

- Figure 230: Koninklijke Philips N.V.: R&D Expenditure, $Million, 2019-2021

- Figure 231: LANDAUER: Overall Product Portfolio

- Figure 232: Medic Vision Imaging Solutions Ltd.: Overall Product Portfolio

- Figure 233: Medsquare: Overall Product Portfolio

- Figure 234: MyXrayDose Ltd.: Overall Product Portfolio

- Figure 235: Novarad Corporation: Overall Product Portfolio

- Figure 236: PACSHealth, LLC: Overall Product Portfolio

- Figure 237: Qaelum NV: Overall Product Portfolio

- Figure 238: Sectra AB: Overall Product Portfolio

- Figure 239: Sectra AB: Overall Financials, $Million, 2019-2021

- Figure 240: Sectra AB: Net Revenue (by Segment), $Million, 2019-2021

- Figure 241: Sectra AB: Net Revenue (by Region), $Million, 2019-2021

- Figure 242: Sectra AB: R&D Expenditure, $Million, 2019-2021

- Figure 243: SST Group Inc.: Overall Product Portfolio

- Figure 244: Siemens Healthineers AG: Overall Product Portfolio

- Figure 245: Siemens Healthineers AG: Overall Financials, $Million, 2019-2021

- Figure 246: Siemens Healthineers AG: Net Revenue (by Segment), $Million, 2019-2021

- Figure 247: Siemens Healthineers AG: Net Revenue (by Region), $Million, 2019-2021

- Figure 248: Siemens Healthineers AG: R&D Expenditure, $Million, 2019-2021

- Figure 249: Virtual Phantoms Inc.: Overall Product Portfolio

List of Tables

- Table 1: Global Radiation Dose Management Market, Key Developments Analysis, January 2018-November 2022

- Table 2: Key Questions Answered in the Report

- Table 3: Global Radiation Dose Management Market, Comparison of Key Parameters across the Potential Growth Scenarios

- Table 4: Average Annual Radiation from Imaging Modalities, mSv

- Table 5: Global Radiation Dose Management Market, Key Partnerships and Business Alliances

- Table 6: Global Radiation Dose Management Market, Key Partnerships and Business Alliances

- Table 7: Global Radiation Dose Management Market, Awaited Technologies

- Table 8: Annual Number of Diagnostic Radiology Examinations in a Large Hospital in Poland, 2018-2020

- Table 9: Cost Comparison of Manual Dose Recording vs. Use of Dose Management Software

- Table 10: Average Effective Radiation Dose for Adults for Common Radiology Procedures, mSv

- Table 11: Global Radiation Dose Management Market (Radimetrics Enterprise Platform), Competitive Benchmarking

- Table 12: Global Radiation Dose Management Market (DoseWatch and DoseWatch Explore), Competitive Benchmarking

- Table 13: Global Radiation Dose Management Market (teamplay Dose), Competitive Benchmarking

- Table 14: Global Radiation Dose Management Market (NEXO [DOSE]), Competitive Benchmarking

- Table 15: Global Radiation Dose Management Market (tqm/Dose and DoseMonitor), Competitive Benchmarking

- Table 16: Global Radiation Dose Management Market (Radiation Dose Monitor), Competitive Benchmarking

- Table 17: Global Radiation Dose Management Market (Imalogix Platform), Competitive Benchmarking

- Table 18: Global Radiation Dose Management Market (Syncro-Dose), Competitive Benchmarking

- Table 19: Global Radiation Dose Management Market (NovaDose), Competitive Benchmarking

- Table 20: Global Radiation Dose Management Market (DoseWise Portal), Competitive Benchmarking

- Table 21: Global Radiation Dose Management Market (SafeCT), Competitive Benchmarking

- Table 22: Global Radiation Dose Management Market (MyXrayDose), Competitive Benchmarking

- Table 23: Global Radiation Dose Management Market (DoseM), Competitive Benchmarking

- Table 24: Global Radiation Dose Management Market (Dose Tracking System), Competitive Benchmarking

- Table 25: Global Radiation Dose Management Market (DoseTrack), Competitive Benchmarking

- Table 26: North America Radiation Dose Management Market, Impact Analysis

- Table 27: Current Status of DRLs at the National Level in Europe

- Table 28: Europe Radiation Dose Management Market, Impact Analysis

- Table 29: Asia-Pacific Radiation Dose Management Market, Impact Analysis

- Table 30: Latin America Radiation Dose Management Market, Impact Analysis

- Table 31: Middle East and Africa Radiation Dose Management Market, Impact Analysis

- Table 32: List of Facility and National DRLs Established in Africa

“Global Radiation Dose Management Market to Reach $586.7 Million by 2032.”

Industry Overview

The global radiation dose management market was valued at $212.8 million in 2021 and is anticipated to reach $586.7 million by 2032, witnessing a CAGR of 10.30% during the forecast period 2022-2032. The growth in the global radiation dose management market is expected to be driven by the rising prevalence of chronic disorders requiring diagnostic intervention, the growing focus on interventional radiology (IR), and the growing awareness surrounding patient safety and the harmful and biological effects of overexposure to ionizing radiation.

Market Lifecycle Stage

The radiation dose management market is in the developing phase. The development of on-cloud dose management solutions and the growing initiatives on radiation dose management for pediatric procedures are some of the major opportunities in the global radiation dose management market. Furthermore, some of the key trends going on in the market include the increasing development of imaging modalities with technologies that lower radiation dose, partnerships and strategic business alliances dominating the market, and various collaborations among market players.

Impact of COVID-19

The decline in imaging volumes during the COVID-19 pandemic impacted the utilization of radiation diagnostic equipment. All radiology equipment had to be thoroughly disinfected using ethanol owing to the strict protocols to minimize the risk of transmission of COVID-19.

In the post-COVID-19 scenario, imaging volumes are expected to return gradually to pre-pandemic levels. As the severity of the COVID-19 pandemic declines, hospitals are expected to reallocate resources toward radiology and pursue diagnostic imaging with renewed vigor. Moreover, in the long term, radiology practices could be permanently redesigned as radiologists become more comfortable treating patients remotely. Furthermore, hospitals and other healthcare institutions are expected to be better equipped to deal with unprecedented events that may disrupt their businesses.

The COVID-19 pandemic placed high importance on automating tasks requiring manual intervention. While conventionally, data transfer and dose recording were done manually, the advent of advanced dose management software (DMS) has enabled automated data transfer from imaging systems into the DMS as well as automated dose recording. This helps eliminate human error and reduces the need for human intervention, which was a concept that gained momentum as a result of the COVID-19 pandemic.

Market Segmentation:

Segmentation 1: by Modality

- CT Scanners

- X-Ray, CR, and DR

- Mammography Systems

- Interventional Angiography Systems/Angio CT

- Fluoroscopy Systems

- PET Scanners and SPECT

- Hybrid Imaging

The global radiation dose management market (by modality) was dominated by the CT scanners segment in 2021, and the trend is expected to continue till the end of the forecast period 2022-2032.

Segmentation 2: by Product

- Radimetrics Enterprise Platform

- DoseWatch and DoseWatch Explore

- teamplay Dose

- NEXO [DOSE]

- tqm/Dose and DoseMonitor

- Radiation Dose Monitor

- Imalogix Platform

- Syncro-Dose

- NovaDose

- DoseWise Portal

- SafeCT

- MyXrayDose

- DoseM

- Dose Tracking System

- DoseTrack

The global radiation dose management market (by product) is dominated by the Radimetrics Enterprise Platform, followed by DoseWatch.

Segmentation 3: by Mode of Deployment

- Web-Based

- On-Premise

- Cloud-Based

The global radiation dose management market (by mode of deployment) is dominated by the web-based segment.

Segmentation 4: by End User

- Hospitals

- Diagnostic Centers

- Others

The global radiation dose management market (by end user) is dominated by the hospitals segment.

Segmentation 5: by Region

- North America - U.S. and Canada

- Europe - Germany, France, U.K., Italy, Spain, Netherlands, and Rest-of-Europe

- Asia-Pacific - Japan, China, India, Australia and New Zealand, South Korea, and Rest-of-Asia-Pacific

- Latin America - Brazil, Mexico, and Rest-of-Latin America

- Middle East and Africa

North America held the largest share of 43.71% in 2022, followed by Europe at 24.45%. Additionally, Asia-Pacific is anticipated to grow considerably at high growth, registering a CAGR of 11.83%, respectively, during the forecast period 2022-2032.

Recent Developments in the Global Radiation Dose Management Market

- In December 2020, Bayer AG launched Radimetrics v3.0, the latest evolution of its enterprise dose management utility.

- In December 2020, FUJIFILM Holdings Corporation launched the unique SYNAPSE Dose 2.0 to provide a comprehensive system for managing patient radiation exposure across several imaging modalities.

- In January 2020, Agfa HealthCare collaborated with Maasstad Hospital in the Netherlands to support advancements in the consistency and optimization of radiation doses.

- In April 2019, Qaelum NV signed an agreement with TOYO Corporation to distribute its dose monitoring solution, DOSE, in Japan.

- In January 2019, SST Group, Inc. partnered with Intermountain Healthcare to implement a software platform for the Radiation Dose Monitor (RDM). The software platform permits medical professionals to manage, examine, and optimize the dose delivered to a patient during interventional procedures, medical imaging examinations, and image-guided surgery.

- In August 2018, Imalogix launched a newer version of its radiation dose management platform with additional fluoroscopy capabilities. The software solution can automatically calculate the peak skin dose for the patient during a fluoroscopic procedure.

- In August 2018, Guerbet LLC USA, a subsidiary of the Guerbet Group, partnered with Imalogix to decrease inconsistency and advance the quality, safety, and competence of care around radiation dose management, to enable the network health system and member facilities to monitor patient radiation dose on a per-procedure and cumulative basis.

- In March 2018, PACSHealth, LLC launched DoseMonitor, a radiation dose management software for tracking radiation dose absorption.

Demand - Drivers and Limitations

Following are the drivers for the global radiation dose management market:

- Increasing installed bases of radiology equipment and the number of scans lead to a higher risk of radiation exposure, thus creating demand for dose management solutions.

- The increasing prevalence of cardiovascular diseases and growing occupational hazards in cath labs lead to the growing concern surrounding the effects of radiation exposure.

- Growing focus on interventional radiology (IR) is expected to increase demand for IR imaging systems and subsequently lead to a higher risk of radiation exposure.

- Increasing concern related to radiation overexposure is leading to higher adoption of dose management solutions.

- Growing awareness and initiatives for radiation dose management are expected to push the adoption of dose management software.

- Advancements in dose optimization and benchmarking in various countries will encourage healthcare institutions to adopt dose management software.

The market is expected to face some limitations as well due to the following challenges:

- The lack of awareness among the population and the shortage of skilled and trained professionals leading to a steep learning curve hinders the adoption of dose management software.

- The lack of diagnostic reference levels (DRLs) for radiation dose benchmarking in low-income countries causes healthcare institutions to not pursue the adoption of dose management software with vigor.

How can this report add value to an organization?

- Product/Innovation Strategy: The product segment helps the reader understand the different types of radiation dose management software available for use in hospitals and diagnostic centers. Moreover, the study provides the reader with a detailed understanding of the different radiation dose products based on the modalities they are compatible with (CT scanners, X-Ray, CR, and DR, mammography system, interventional angiography systems/angio CT, fluoroscopy systems, PET scanners and SPECT, and hybrid imaging), the modes on which they can be deployed (cloud-based, web-based, and on-premises), and the end users who can adopt such software (hospitals, diagnostic centers, and others).

- Growth/Marketing Strategy: The global radiation dose management market has seen developments by key players operating in the market, such as partnerships, collaborations and business expansions, and new product launches. Partnerships accounted for the maximum number of key developments, i.e., nearly 70.00% of the total developments in the global radiation dose management market.

- Competitive Strategy: Key players in the global radiation dose management market analyzed and profiled in the study involve players that offer radiation dose software. Moreover, a detailed market share analysis of the players operating in the global radiation dose management market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, and market penetration.

Some of the prominent names established in this market are:

|

|

Companies that are not a part of the previously mentioned pool have been well represented across different sections of the report (wherever applicable).

Table of Contents

1 Markets

- 1.1 Global Market Outlook

- 1.1.1 Product Definition

- 1.1.2 Inclusion and Exclusion Criteria

- 1.1.3 Key Findings

- 1.1.4 Assumptions and Limitations

- 1.1.5 Global Market Scenario

- 1.1.5.1 Realistic Growth Scenario

- 1.1.5.2 Optimistic Growth Scenario

- 1.1.5.3 Pessimistic/Conservative Growth Scenario

- 1.2 Industry Outlook

- 1.2.1 Market Overview

- 1.2.1.1 Natural Radiation Sources

- 1.2.1.2 Biological Effects of Radiation

- 1.2.1.3 Usage of Radiation in Medical Devices

- 1.2.1.4 Radiation Dose

- 1.2.1.5 Effective Radiation Dose

- 1.2.1.6 Factors Contributing to Unnecessary Radiation Exposure

- 1.2.1.7 Radiation Exposure Trend

- 1.2.2 Key Trends

- 1.2.2.1 Increasing Development of Imaging Modalities with Technologies that Lower Radiation Dose

- 1.2.2.2 Partnerships and Strategic Business Alliances - Key Developments in the Global Radiation Dose Management Market

- 1.2.2.3 Significant Number of Collaborations among Market Players

- 1.2.3 Opportunity Assessment

- 1.2.4 Patent Analysis

- 1.2.4.1 Awaited Technological Developments

- 1.2.4.2 Patent Filing Trend (by Country)

- 1.2.4.3 Patent Filing Trend (by Year)

- 1.2.5 Comparative Analysis

- 1.2.5.1 Key Features of Major Players

- 1.2.5.1.1 Software Comparison

- 1.2.5.1.2 Comparison of Modes of Data Acquisition

- 1.2.5.1.3 Compatible Modality Comparison

- 1.2.5.1 Key Features of Major Players

- 1.2.6 Market Gap Analysis

- 1.2.7 Case Studies

- 1.2.7.1 Adoption of Infinitt Healthcare's Web-Based Software, DoseM, by Seoul National University Hospital

- 1.2.7.2 Adoption of GE Healthcare's DoseWatch by One of the Largest Diagnostic Imaging Centers in Europe

- 1.2.8 Pricing Analysis

- 1.2.8.1 Manual Dose Data Recording Cost Per Examination

- 1.2.8.2 Radiation Dose Management Software Pricing

- 1.2.8.3 Server Fee

- 1.2.1 Market Overview

- 1.3 Impact of COVID-19 on the Global Radiation Dose Management Market

- 1.3.1 Pre-COVID-19

- 1.3.1.1 Trend Analysis

- 1.3.1.2 Radiation Diagnostic Examinations Scenario

- 1.3.1.3 Regional Analysis

- 1.3.2 During COVID-19

- 1.3.2.1 Trend Analysis

- 1.3.2.2 Impact on Radiation Diagnostic Examinations

- 1.3.2.3 Regional Analysis

- 1.3.3 Post-COVID-19

- 1.3.3.1 Trend Analysis

- 1.3.3.2 Emerging Opportunities due to COVID-19 in Radiation Dose Management

- 1.3.3.3 Future Perspective

- 1.3.4 Impact of COVID-19 on Key Players

- 1.3.5 Change in Competitive Landscape and Product Demand

- 1.3.1 Pre-COVID-19

- 1.4 Business Dynamics

- 1.4.1 Impact Analysis

- 1.4.2 Business Drivers

- 1.4.2.1 Increasing installed bases of radiology equipment and the number of scans lead to a higher risk of radiation exposure, thus creating demand for dose management solutions.

- 1.4.2.2 Increasing concern related to radiation overexposure is leading to higher adoption of dose management solutions.

- 1.4.2.3 Growing awareness and initiatives for radiation dose management are expected to push the adoption of dose management software.

- 1.4.2.4 Advancements in dose optimization and benchmarking in various countries will encourage healthcare institutions to adopt dose management software.

- 1.4.2.5 Increasing prevalence of cardiovascular diseases and growing occupational hazards in Cath labs lead to growing concern surrounding the effects of radiation exposure.

- 1.4.2.6 Growing focus on interventional radiology (IR) is expected to increase demand for IR imaging systems and subsequently lead to a higher risk of radiation exposure.

- 1.4.3 Business Restraints

- 1.4.3.1 The lack of awareness among the population and the shortage of skilled and trained professionals leading to a steep learning curve hinders the adoption of dose management software.

- 1.4.3.2 The lack of diagnostic reference levels (DRLs) for radiation dose benchmarking in low-income countries causes healthcare institutions to not pursue the adoption of dose management software with vigor.

- 1.4.4 Business Opportunities

- 1.4.4.1 Cloud-based solutions enable easy access and secure sharing of radiation dose data.

- 1.4.4.2 Growing initiatives on radiation dose management for pediatric procedures will enable the development of software solutions catering to dose management in the pediatric population.

2 Global Radiation Dose Management Market (by Modality)

- 2.1 Opportunity Assessment

- 2.2 Growth-Share Matrix

- 2.3 CT Scanners

- 2.4 X-Ray, CR, and DR

- 2.5 Mammography Systems

- 2.6 Interventional Angiography Systems/Angio CT

- 2.7 Fluoroscopy Systems

- 2.8 PET Scanners and SPECT

- 2.9 Hybrid Imaging

3 Global Radiation Dose Management Market (by Product)

- 3.1 Radimetrics Enterprise Platform

- 3.1.1 Key Features

- 3.1.2 Radimetrics Enterprise Platform- Global Market

- 3.1.3 Installed Base

- 3.1.4 Compatible Modalities

- 3.1.5 Competitive Benchmarking

- 3.2 DoseWatch and DoseWatch Explore

- 3.2.1 Key Features

- 3.2.2 DoseWatch and DoseWatch Explore- Global Market

- 3.2.3 Installed Base

- 3.2.4 Compatible Modalities

- 3.2.5 Competitive Benchmarking

- 3.3 teamplay Dose

- 3.3.1 Key Features

- 3.3.2 teamplay Dose- Global Market

- 3.3.3 Installed Base

- 3.3.4 Compatible Modalities

- 3.3.5 Competitive Benchmarking

- 3.4 NEXO [DOSE]

- 3.4.1 Key Features

- 3.4.2 NEXO [DOSE]- Global Market

- 3.4.3 Installed Base

- 3.4.4 Compatible Modalities

- 3.4.5 Competitive Benchmarking

- 3.5 tqm/Dose and DoseMonitor

- 3.5.1 Key Features

- 3.5.2 tqm/Dose and DoseMonitor- Global Market

- 3.5.3 Installed Base

- 3.5.4 Compatible Modalities

- 3.5.5 Competitive Benchmarking

- 3.6 Radiation Dose Monitor

- 3.6.1 Key Features

- 3.6.2 Radiation Dose Monitor- Global Market

- 3.6.3 Installed Base

- 3.6.4 Compatible Modalities

- 3.6.5 Competitive Benchmarking

- 3.7 Imalogix Platform

- 3.7.1 Key Features

- 3.7.2 Imalogix Platform- Global Market

- 3.7.3 Installed Base

- 3.7.4 Compatible Modalities

- 3.7.5 Competitive Benchmarking

- 3.8 Syncro-Dose

- 3.8.1 Key Features

- 3.8.2 Syncro-Dose- Global Market

- 3.8.3 Installed Base

- 3.8.4 Compatible Modalities

- 3.8.5 Competitive Benchmarking

- 3.9 NovaDose

- 3.9.1 Key Features

- 3.9.2 NovaDose- Global Market

- 3.9.3 Installed Base

- 3.9.4 Compatible Modalities

- 3.9.5 Competitive Benchmarking

- 3.1 DoseWise Portal

- 3.10.1 Key Features

- 3.10.2 DoseWise Portal- Global Market

- 3.10.3 Installed Base

- 3.10.4 Compatible Modalities

- 3.10.5 Competitive Benchmarking

- 3.11 SafeCT

- 3.11.1 Key Features

- 3.11.2 SafeCT- Global Market

- 3.11.3 Installed Base

- 3.11.4 Compatible Modalities

- 3.11.5 Competitive Benchmarking

- 3.12 MyXrayDose

- 3.12.1 Key Features

- 3.12.2 MyXrayDose- Global Market

- 3.12.3 Installed Base

- 3.12.4 Compatible Modalities

- 3.12.5 Competitive Benchmarking

- 3.13 DoseM

- 3.13.1 Key Features

- 3.13.2 DoseM- Global Market

- 3.13.3 Installed Base

- 3.13.4 Compatible Modalities

- 3.13.5 Competitive Benchmarking

- 3.14 Dose Tracking System

- 3.14.1 Key Features

- 3.14.2 Dose Tracking System- Global Market

- 3.14.3 Installed Base

- 3.14.4 Compatible Modalities

- 3.14.5 Competitive Benchmarking

- 3.15 DoseTrack

- 3.15.1 Key Features

- 3.15.2 DoseTrack- Global Market

- 3.15.3 Installed Base

- 3.15.4 Compatible Modalities

- 3.15.5 Competitive Benchmarking

4 Global Radiation Dose Management Market (by Mode of Deployment)

- 4.1 Opportunity Assessment

- 4.2 Growth-Share Matrix

- 4.3 Web-Based

- 4.4 On-Premise

- 4.5 Cloud-Based

5 Global Radiation Dose Management Market (by End User)

- 5.1 Opportunity Assessment

- 5.2 Growth-Share Matrix

- 5.3 Hospitals

- 5.4 Diagnostic Centers

- 5.5 Others

6 Global Radiation Dose Management Market (by Region)

- 6.1 North America Radiation Dose Management Market

- 6.1.1 Regulatory Framework

- 6.1.2 Key Findings and Opportunity Assessment

- 6.1.3 Market Dynamics

- 6.1.3.1 Impact Analysis

- 6.1.4 Market Sizing and Forecast

- 6.1.4.1 North America Radiation Dose Management Market (by Modality)

- 6.1.4.2 North America Radiation Dose Management Market (by End User)

- 6.1.4.3 North America Radiation Dose Management Market (by Mode of Deployment)

- 6.1.4.4 North America Radiation Dose Management Market (by Country)

- 6.1.4.4.1 U.S.

- 6.1.4.4.1.1 Market Dynamics

- 6.1.4.4.1.2 Market Size and Forecast

- 6.1.4.4.1.2.1 U.S. Radiation Dose Management Market (by End User)

- 6.1.4.4.2 Canada

- 6.1.4.4.2.1 Market Dynamics

- 6.1.4.4.2.2 Market Size and Forecast

- 6.1.4.4.2.2.1 Canada Radiation Dose Management Market (by End User)

- 6.1.4.4.1 U.S.

- 6.2 Europe Radiation Dose Management Market

- 6.2.1 Regulatory Framework

- 6.2.2 Key Findings and Opportunity Assessment

- 6.2.3 Market Dynamics

- 6.2.3.1 Impact Analysis

- 6.2.4 Market Sizing and Forecast

- 6.2.4.1 Europe Radiation Dose Management Market (by Modality)

- 6.2.4.2 Europe Radiation Dose Management Market (by End User)

- 6.2.4.3 Europe Radiation Dose Management Market (by Mode of Deployment)

- 6.2.4.4 Europe Radiation Dose Management Market (by Country)

- 6.2.4.4.1 Germany

- 6.2.4.4.1.1 Market Dynamics

- 6.2.4.4.1.2 Market Sizing and Forecast

- 6.2.4.4.1.2.1 Germany Radiation Dose Management Market (by End User)

- 6.2.4.4.2 France

- 6.2.4.4.2.1 Market Dynamics

- 6.2.4.4.2.2 Market Size and Forecast

- 6.2.4.4.2.2.1 France Radiation Dose Management Market (by End User)

- 6.2.4.4.3 Italy

- 6.2.4.4.3.1 Market Dynamics

- 6.2.4.4.3.2 Market Size and Forecast

- 6.2.4.4.3.2.1 Italy Radiation Dose Management Market (by End User)

- 6.2.4.4.4 U.K.

- 6.2.4.4.4.1 Market Dynamics

- 6.2.4.4.4.2 Market Size and Forecast

- 6.2.4.4.4.2.1 U.K. Radiation Dose Management Market (by End User)

- 6.2.4.4.5 Spain

- 6.2.4.4.5.1 Market Dynamics

- 6.2.4.4.5.2 Market Size and Forecast

- 6.2.4.4.5.2.1 Spain Radiation Dose Management Market (by End User)

- 6.2.4.4.6 Netherlands

- 6.2.4.4.6.1 Market Dynamics

- 6.2.4.4.6.2 Market Size and Forecast

- 6.2.4.4.6.2.1 Netherlands Radiation Dose Management Market (by End User)

- 6.2.4.4.7 Rest-of-Europe

- 6.2.4.4.7.1 Market Dynamics

- 6.2.4.4.7.2 Market Size and Forecast

- 6.2.4.4.7.2.1 Rest-of-Europe Radiation Dose Management Market (by End User)

- 6.2.4.4.1 Germany

- 6.3 Asia-Pacific Radiation Dose Management Market

- 6.3.1 Regulatory Framework

- 6.3.2 Key Findings and Opportunity Assessment

- 6.3.3 Market Dynamics

- 6.3.3.1 Impact Analysis

- 6.3.4 Market Size and Forecast

- 6.3.4.1 Asia-Pacific Radiation Dose Management Market (by Modality)

- 6.3.4.2 Asia-Pacific Radiation Dose Management Market (by End User)

- 6.3.4.3 Asia-Pacific Radiation Dose Management Market (by Mode of Deployment)

- 6.3.4.4 Asia-Pacific Radiation Dose Management Market (by Country)

- 6.3.4.4.1 Japan

- 6.3.4.4.1.1 Market Dynamics

- 6.3.4.4.1.2 Market Size and Forecast

- 6.3.4.4.1.2.1 Japan Radiation Dose Management Market (by End User)

- 6.3.4.4.2 China

- 6.3.4.4.2.1 Market Dynamics

- 6.3.4.4.2.2 Market Size and Forecast

- 6.3.4.4.2.2.1 China Radiation Dose Management Market (by End User)

- 6.3.4.4.3 Australia and New Zealand

- 6.3.4.4.3.1 Market Dynamics

- 6.3.4.4.3.2 Market Size and Forecast

- 6.3.4.4.3.2.1 Australia and New Zealand Radiation Dose Management Market (by End User)

- 6.3.4.4.4 South Korea

- 6.3.4.4.4.1 Market Dynamics

- 6.3.4.4.4.2 Market Size and Forecast

- 6.3.4.4.4.2.1 South Korea Radiation Dose Management Market (by End User)

- 6.3.4.4.5 India

- 6.3.4.4.5.1 Market Dynamics

- 6.3.4.4.5.2 Market Size and Forecast

- 6.3.4.4.5.2.1 India Radiation Dose Management Market (by End User)

- 6.3.4.4.6 Rest-of-Asia-Pacific

- 6.3.4.4.6.1 Market Dynamics

- 6.3.4.4.6.2 Market Size and Forecast

- 6.3.4.4.6.2.1 Rest-of-Asia-Pacific Radiation Dose Management Market (by End User)

- 6.3.4.4.1 Japan

- 6.4 Latin America Radiation Dose Management Market

- 6.4.1 Regulatory Framework

- 6.4.2 Key Findings and Opportunity Assessment

- 6.4.3 Market Dynamics

- 6.4.3.1 Impact Analysis

- 6.4.4 Market Size and Forecast

- 6.4.4.1 Latin America Radiation Dose Management Market (by Modality)

- 6.4.4.2 Latin America Radiation Dose Management Market (by End User)

- 6.4.4.3 Latin America Radiation Dose Management Market (by Mode of Deployment)

- 6.4.4.4 Latin America Radiation Dose Management Market (by Country)

- 6.4.4.4.1 Brazil

- 6.4.4.4.1.1 Market Dynamics

- 6.4.4.4.1.2 Market Size and Forecast

- 6.4.4.4.1.2.1 Brazil Radiation Dose Management Market (by End User)

- 6.4.4.4.2 Mexico

- 6.4.4.4.2.1 Market Dynamics

- 6.4.4.4.2.2 Market Size and Forecast

- 6.4.4.4.2.2.1 Mexico Radiation Dose Management Market (by End User)

- 6.4.4.4.3 Rest-of-Latin America

- 6.4.4.4.3.1 Market Dynamics

- 6.4.4.4.3.2 Market Size and Forecast

- 6.4.4.4.3.2.1 Rest-of-Latin America Radiation Dose Management Market (by End User)

- 6.4.4.4.1 Brazil

- 6.5 Middle East and Africa Radiation Dose Management Market

- 6.5.1 Regulatory Framework

- 6.5.2 Key Findings and Opportunity Assessment

- 6.5.3 Market Dynamics

- 6.5.3.1 Impact Analysis

- 6.5.4 Market Size and Forecast

- 6.5.4.1 Middle East and Africa Radiation Dose Management Market (by Modality)

- 6.5.4.2 Middle East and Africa Radiation Dose Management Market (by End User)

- 6.5.4.3 Middle East and Africa Radiation Dose Management Market (by Mode of Deployment)

- 6.5.4.4 Middle East and Africa Radiation Dose Management Market (by Country)

- 6.5.4.4.1 Middle East

- 6.5.4.4.1.1 Market Dynamics

- 6.5.4.4.1.2 Market Size and Forecast

- 6.5.4.4.1.2.1 Middle East Radiation Dose Management Market (by End User)

- 6.5.4.4.2 Africa

- 6.5.4.4.2.1.1 Market Dynamics

- 6.5.4.4.2.2 Market Size and Forecast

- 6.5.4.4.2.2.1 Africa Radiation Dose Management Market (by End User)

- 6.5.4.4.1 Middle East

7 Market - Competitive Benchmarking and Company Profiles

- 7.1 Competitive Benchmarking and Company Profiles

- 7.1.1 Key Strategies and Developments

- 7.1.1.1 New Offerings

- 7.1.1.2 Partnerships, Alliances, and Business Expansions

- 7.1.1.3 Regulatory and Legal Activities

- 7.1.1 Key Strategies and Developments

- 7.2 Company Share Analysis

- 7.3 Company Profiles

- 7.3.1 Agfa-Gevaert Group

- 7.3.1.1 Company Overview

- 7.3.1.2 Role of Agfa-Gevaert Group in the Global Radiation Dose Management Market

- 7.3.1.3 Financials

- 7.3.1.4 Recent Development

- 7.3.1.5 Regional Perspective

- 7.3.1.6 Analyst Perception

- 7.3.2 Bracco

- 7.3.2.1 Company Overview

- 7.3.2.2 Role of Bracco in the Global Radiation Dose Management Market

- 7.3.2.3 Recent Development

- 7.3.2.4 Regional Perspective

- 7.3.2.5 Analyst Perception

- 7.3.3 Bayer AG

- 7.3.3.1 Company Overview

- 7.3.3.2 Role of Bayer AG in the Global Radiation Dose Management Market

- 7.3.3.3 Financials

- 7.3.3.4 Recent Development

- 7.3.3.5 Regional Perspective

- 7.3.3.6 Analyst Perception

- 7.3.4 Canon Inc.

- 7.3.4.1 Company Overview

- 7.3.4.2 Role of Canon Inc. in the Global Radiation Dose Management Market

- 7.3.4.3 Financials

- 7.3.4.4 Regional Perspective

- 7.3.4.5 Analyst Perception

- 7.3.5 FUJIFILM Holdings Corporation

- 7.3.5.1 Company Overview

- 7.3.5.2 Role of FUJIFILM Holdings Corporation in the Global Radiation Dose Management Market

- 7.3.5.3 Financials

- 7.3.5.4 Recent Development

- 7.3.5.5 Regional Perspective

- 7.3.5.6 Analyst Perception

- 7.3.6 Guerbet

- 7.3.6.1 Company Overview

- 7.3.6.2 Role of Guerbet in the Global Radiation Dose Management Market

- 7.3.6.3 Financials

- 7.3.6.4 Recent Development

- 7.3.6.5 Regional Perspective

- 7.3.6.6 Analyst Perception

- 7.3.7 General Electric Company

- 7.3.7.1 Company Overview

- 7.3.7.2 Role of General Electric Company in the Global Radiation Dose Management Market

- 7.3.7.3 Financials

- 7.3.7.4 Regional Perspective

- 7.3.7.5 Analyst Perception

- 7.3.8 Imalogix

- 7.3.8.1 Company Overview

- 7.3.8.2 Role of Imalogix in the Global Radiation Dose Management Market

- 7.3.8.3 Recent Development

- 7.3.8.4 Regional Perspective

- 7.3.8.5 Analyst Perception

- 7.3.9 Infinitt Healthcare Co., Ltd.

- 7.3.9.1 Company Overview

- 7.3.9.2 Role of Infinitt Healthcare Co., Ltd. in the Global Radiation Dose Management Market

- 7.3.9.3 Regional Perspective

- 7.3.9.4 Analyst Perception

- 7.3.10 Koninklijke Philips N.V.

- 7.3.10.1 Company Overview

- 7.3.10.2 Role of Koninklijke Philips N.V. in the Global Radiation Dose Management Market

- 7.3.10.3 Financials

- 7.3.10.4 Regional Perspective

- 7.3.10.5 Analyst Perception

- 7.3.11 LANDAUER

- 7.3.11.1 Company Overview

- 7.3.11.2 Role of LANDAUER in the Global Radiation Dose Management Market

- 7.3.11.3 Regional Perspective

- 7.3.11.4 Analyst Perception

- 7.3.12 Medic Vision Imaging Solutions Ltd.

- 7.3.12.1 Company Overview

- 7.3.12.2 Role of Medic Vision Imaging Solutions Ltd. in the Global Radiation Dose Management Market

- 7.3.12.3 Regional Perspective

- 7.3.12.4 Analyst Perception

- 7.3.13 Medsquare

- 7.3.13.1 Company Overview

- 7.3.13.2 Role of Medsquare in the Global Radiation Dose Management Market

- 7.3.13.3 Recent Development

- 7.3.13.4 Regional Perspective

- 7.3.13.5 Analyst Perception

- 7.3.14 MyXrayDose Ltd.

- 7.3.14.1 Company Overview

- 7.3.14.2 Role of MyXrayDose Ltd. in the Global Radiation Dose Management Market

- 7.3.14.3 Analyst Perception

- 7.3.15 Novarad Corporation

- 7.3.15.1 Company Overview

- 7.3.15.2 Role of Novarad Corporation in the Global Radiation Dose Management Market

- 7.3.15.3 Regional Perspective

- 7.3.15.4 Analyst Perception

- 7.3.16 PACSHealth, LLC

- 7.3.16.1 Company Overview

- 7.3.16.2 Role of PACSHealth, LLC in the Global Radiation Dose Management Market

- 7.3.16.3 Recent Development

- 7.3.16.4 Regional Perspective

- 7.3.16.5 Analyst Perception

- 7.3.17 Qaelum NV

- 7.3.17.1 Company Overview

- 7.3.17.2 Role of Qaelum NV in the Global Radiation Dose Management Market

- 7.3.17.3 Recent Development

- 7.3.17.4 Regional Perspective

- 7.3.17.5 Analyst Perception

- 7.3.18 Sectra AB

- 7.3.18.1 Company Overview

- 7.3.18.2 Role of Sectra AB in the Global Radiation Dose Management Market

- 7.3.18.3 Financials

- 7.3.18.4 Recent Development

- 7.3.18.5 Regional Perspective

- 7.3.18.6 Analyst Perception

- 7.3.19 SST Group Inc.

- 7.3.19.1 Company Overview

- 7.3.19.2 Role of SST Group Inc. in the Global Radiation Dose Management Market

- 7.3.19.3 Recent Development

- 7.3.19.4 Regional Perspective

- 7.3.19.5 Analyst Perception

- 7.3.20 Siemens Healthineers AG

- 7.3.20.1 Company Overview

- 7.3.20.2 Role of Siemens Healthineers AG in the Global Radiation Dose Management Market

- 7.3.20.3 Financials

- 7.3.20.4 Regional Perspective

- 7.3.20.5 Analyst Perception

- 7.3.21 Virtual Phantoms Inc.

- 7.3.21.1 Company Overview

- 7.3.21.2 Role of Virtual Phantoms Inc. in the Global Radiation Dose Management Market

- 7.3.21.3 Key Developments

- 7.3.21.4 Regional Perspective

- 7.3.21.5 Analyst Perception

- 7.3.1 Agfa-Gevaert Group