|

|

市場調査レポート

商品コード

1804859

航空宇宙グレードヘリウム市場- 世界および地域分析:タイプ別、用途別、地域別 - 分析と予測(2025年~2034年)Aerospace Grade Helium Market - A Global and Regional Analysis: Focus on Type, Application, and Regional Analysis - Analysis and Forecast, 2025-2034 |

||||||

カスタマイズ可能

|

|||||||

| 航空宇宙グレードヘリウム市場- 世界および地域分析:タイプ別、用途別、地域別 - 分析と予測(2025年~2034年) |

|

出版日: 2025年09月05日

発行: BIS Research

ページ情報: 英文 120 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

航空宇宙グレードヘリウム市場は、より広範な産業ガスおよび宇宙開発産業において重要なセグメントです。

ヘリウムは、ロケット燃料タンクの加圧剤、極低温システムの冷却剤、リーク検知とパージ用の媒体として、航空宇宙用途に不可欠な役割を果たしています。航空宇宙技術が進歩し、宇宙ミッションの頻度が高まるにつれ、高純度ヘリウムの需要は、ミッションの安全性と効率を確保するためにますます不可欠になっています。

この業界は、宇宙探査、衛星配備、再使用可能な打ち上げロケット技術への投資の増加によって着実な成長を遂げているのが特徴です。ヘリウムの供給は、その有限な天然埋蔵量と超高純度の必要性から、高度な抽出・精製方法に大きく依存しています。主要サプライヤーは、航空宇宙産業の顧客の厳しい基準を満たすため、統合された生産・流通ネットワークを運営しています。地政学的要因とサプライチェーンの複雑さが継続的な課題となっているため、各社はヘリウム回収・貯蔵技術の革新を進めると同時に、戦略的パートナーシップを確保して安定供給を維持しています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2025年~2034年 |

| 2025年の評価 | 18億1,000万米ドル |

| 2034年の予測 | 33億2,000万米ドル |

| CAGR | 6.97% |

航空宇宙グレードヘリウム市場のライフサイクル段階

航空宇宙グレードヘリウム市場は力強い成長段階にあり、初期の商業化から航空宇宙用途での幅広い採用へと移行しています。生産能力の拡大、ヘリウム抽出・精製技術の向上、安定供給体制の確保に重点が置かれ、宇宙探査、衛星配備、再使用ロケット分野からの需要増に対応しています。各企業は、供給の信頼性を高め、有限なヘリウム埋蔵量がもたらす課題に対処するため、技術のアップグレードや戦略的パートナーシップに積極的に投資しています。

持続可能なヘリウム調達と高度なハンドリング・ソリューションの開発には、主要産業ガス・サプライヤー、航空宇宙メーカー、政府機関の協力が不可欠です。安全で効率的なヘリウムの流通をサポートするために、輸出規制や資源管理に関する規制上の配慮が進化しています。

航空宇宙グレードヘリウムの商業的展開は、軌道打ち上げの増加と技術の進歩に牽引され、2020年代を通じて急速に拡大しています。市場が成熟するにつれて、ヘリウムは航空宇宙ミッションに不可欠な標準化された資源となり、将来の宇宙探査と先進航空宇宙技術を下支えすることが期待されます。

航空宇宙グレードヘリウム市場のセグメンテーション

セグメンテーション1:タイプ別

- 4N

- 5N

- 6N

セグメント2:用途別

- 飛行船シェルフィラー

- ロケット推進剤

- その他

セグメント3:地域別

- 北米- 米国、カナダ、メキシコ

- 欧州- ドイツ、フランス、イタリア、スペイン、英国、その他

- アジア太平洋- 中国、日本、韓国、インド、その他

- その他の地域- 南米、中東・アフリカ

需要- 促進要因と抑制要因

航空宇宙グレードヘリウム市場の需要促進要因は以下の通りです。

- 宇宙探査と衛星打ち上げの成長

- 再使用ロケットにおける進歩

- 極低温用途での使用の増加

航空宇宙グレードヘリウム市場は、以下の課題によっていくつかの抑制要因にも直面すると予想されます。

- 有限のヘリウム埋蔵量と供給制約

- 高い抽出・精製コスト

航空宇宙グレードヘリウム市場の主要プレーヤーと競合の概要

航空宇宙グレードヘリウム市場は、世界的な産業ガス大手と各地域に特化したサプライヤーが混在する、競争の激しい情勢が特徴です。Air Liquide S.A.、Air Products and Chemicals Inc.、Linde plcなどの大手多国籍企業が、航空宇宙およびその他の高純度用途に対応する大規模なヘリウム生産施設と強固なグローバル流通網を擁し、市場を独占しています。岩谷産業や大陽日酸のような日本企業は、高度な精製技術と信頼性の高い供給に注力し、アジア太平洋地域で強みを発揮しています。その他の主要企業としては、Matheson Tri-Gas Inc.、Messer Group GmbH、Gulf Cryo S.A.L.などがあり、極低温技術、漏洩検知、航空宇宙推進システム向けに高品質のヘリウム・ソリューションを提供することに尽力しています。ヘリウム抽出・液化技術の改善、持続可能なヘリウム源の確保、サプライチェーンの回復力の最適化を目指した研究開発への継続的な投資を通じて、競合は激化しています。航空宇宙、宇宙探査、衛星配備活動の拡大により世界的な需要が増大する中、リンデ・プラクセアの統合のような戦略的提携や合併が市場ポジションをさらに強化します。安定した高純度ヘリウムの供給競争が加速する中、これらの企業は、厳しい航空宇宙規格を満たし、世界的なこの分野の技術進化を支える上で重要な役割を果たしています。

航空宇宙グレードヘリウム市場で確立された著名な企業は以下の通りです。

- Linde plc

- Air Products and Chemicals, Inc.

- Air Liquide S.A.

- Messer Group GmbH

- Taiyo Nippon Sanso Corporation

- ORLEN

- SIAD

- Coregas

- Matheson Tri-Gas Inc.

- Gulf Cryo S.A.L.

- Iwatani Corporation

- AirLife

目次

エグゼクティブサマリー

第1章 市場:業界展望

- 動向:現状と将来への影響評価

- 市場力学の概要

- 市場促進要因

- 市場抑制要因

- 市場機会

- 規制および政策影響分析

- 特許分析

- スタートアップの情勢

- 投資情勢と研究開発動向

- 将来展望と市場ロードマップ

- バリューチェーン分析

- グローバル価格分析

- 業界の魅力

第2章 航空宇宙グレードヘリウム市場(タイプ別)

- 4N

- 5N

- 6N

第3章 航空宇宙グレードヘリウム市場(用途別)

- 飛行船シェルフィラー

- ロケット推進剤

- その他

第4章 航空宇宙グレードヘリウム市場(地域別)

- 航空宇宙グレードヘリウム市場(地域別)

- 北米

- 欧州

- アジア太平洋

- その他の地域

第5章 市場-競合ベンチマーキングと企業プロファイル

- 今後の見通し

- 地理的評価

- 企業プロファイル

- Linde plc

- Air Products and Chemicals, Inc.

- Air Liquide S.A.

- Messer Group GmbH

- Taiyo Nippon Sanso Corporation

- ORLEN

- SIAD

- Coregas

- Matheson Tri-Gas Inc.

- Gulf Cryo S.A.L.

- Iwatani Corporation

- AirLife

- その他の主要企業

第6章 調査手法

List of Figures

- Figure 1: Aerospace Grade Helium Market (by Scenario), $Billion, 2025, 2028, and 2034

- Figure 2: Aerospace Grade Helium Market (by Region), $Billion, 2024, 2027, and 2034

- Figure 3: Aerospace Grade Helium Market (by Application), $Billion, 2024, 2028, and 2034

- Figure 4: Aerospace Grade Helium Market (by Type), $Billion, 2024, 2025, and 2034

- Figure 5: Competitive Landscape Snapshot

- Figure 6: Supply Chain Analysis

- Figure 7: Value Chain Analysis

- Figure 8: Patent Analysis (by Country), January 2021-June 2025

- Figure 9: Patent Analysis (by Company), January 2021-June 2025

- Figure 10: Impact Analysis of Market Navigating Factors, 2024-2034

- Figure 11: U.S. Aerospace Grade Helium Market, $Billion, 2024-2034

- Figure 12: Canada Aerospace Grade Helium Market, $Billion, 2024-2034

- Figure 13: Mexico Aerospace Grade Helium Market, $Billion, 2024-2034

- Figure 14: Germany Aerospace Grade Helium Market, $Billion, 2024-2034

- Figure 15: France Aerospace Grade Helium Market, $Billion, 2024-2034

- Figure 16: Italy Aerospace Grade Helium Market, $Billion, 2024-2034

- Figure 17: Spain Aerospace Grade Helium Market, $Billion, 2024-2034

- Figure 18: U.K. Aerospace Grade Helium Market, $Billion, 2024-2034

- Figure 19: Rest-of-Europe Aerospace Grade Helium Market, $Billion, 2024-2034

- Figure 20: China Aerospace Grade Helium Market, $Billion, 2024-2034

- Figure 21: Japan Aerospace Grade Helium Market, $Billion, 2024-2034

- Figure 22: India Aerospace Grade Helium Market, $Billion, 2024-2034

- Figure 23: South Korea Aerospace Grade Helium Market, $Billion, 2024-2034

- Figure 24: Rest-of-Asia-Pacific Aerospace Grade Helium Market, $Billion, 2024-2034

- Figure 25: South America Aerospace Grade Helium Market, $Billion, 2024-2034

- Figure 26: Middle East and Africa Aerospace Grade Helium Market, $Billion, 2024-2034

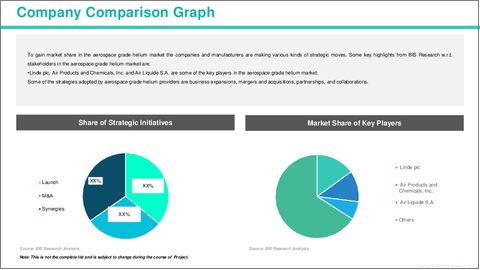

- Figure 27: Strategic Initiatives (by Company), 2021-2025

- Figure 28: Share of Strategic Initiatives, 2021-2025

- Figure 29: Data Triangulation

- Figure 30: Top-Down and Bottom-Up Approach

- Figure 31: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Opportunities across Region

- Table 3: Trends Overview

- Table 4: Aerospace Grade Helium Market Pricing Forecast, 2024-2034

- Table 5: Application Summary (by Application)

- Table 6: Product Summary (by Product)

- Table 7: Aerospace Grade Helium Market (by Region), $Billion, 2024-2034

- Table 8: North America Aerospace Grade Helium Market (by Application), $Billion, 2024-2034

- Table 9: North America Aerospace Grade Helium Market (by Type), $Billion, 2024-2034

- Table 10: U.S. Aerospace Grade Helium Market (by Application), $Billion, 2024-2034

- Table 11: U.S. Aerospace Grade Helium Market (by Type), $Billion, 2024-2034

- Table 12: Canada Aerospace Grade Helium Market (by Application), $Billion, 2024-2034

- Table 13: Canada Aerospace Grade Helium Market (by Type), $Billion, 2024-2034

- Table 14: Mexico Aerospace Grade Helium Market (by Application), $Billion, 2024-2034

- Table 15: Mexico Aerospace Grade Helium Market (by Type), $Billion, 2024-2034

- Table 16: Europe Aerospace Grade Helium Market (by Application), $Billion, 2024-2034

- Table 17: Europe Aerospace Grade Helium Market (by Type), $Billion, 2024-2034

- Table 18: Germany Aerospace Grade Helium Market (by Application), $Billion, 2024-2034

- Table 19: Germany Aerospace Grade Helium Market (by Type), $Billion, 2024-2034

- Table 20: France Aerospace Grade Helium Market (by Application), $Billion, 2024-2034

- Table 21: France Aerospace Grade Helium Market (by Type), $Billion, 2024-2034

- Table 22: Italy Aerospace Grade Helium Market (by Application), $Billion, 2024-2034

- Table 23: Italy Aerospace Grade Helium Market (by Type), $Billion, 2024-2034

- Table 24: Spain Aerospace Grade Helium Market (by Application), $Billion, 2024-2034

- Table 25: Spain Aerospace Grade Helium Market (by Type), $Billion, 2024-2034

- Table 26: U.K. Aerospace Grade Helium Market (by Application), $Billion, 2024-2034

- Table 27: U.K. Aerospace Grade Helium Market (by Type), $Billion, 2024-2034

- Table 28: Rest-of-Europe Aerospace Grade Helium Market (by Application), $Billion, 2024-2034

- Table 29: Rest-of-Europe Aerospace Grade Helium Market (by Type), $Billion, 2024-2034

- Table 30: Asia-Pacific Aerospace Grade Helium Market (by Application), $Billion, 2024-2034

- Table 31: Asia-Pacific Aerospace Grade Helium Market (by Type), $Billion, 2024-2034

- Table 32: China Aerospace Grade Helium Market (by Application), $Billion, 2024-2034

- Table 33: China Aerospace Grade Helium Market (by Type), $Billion, 2024-2034

- Table 34: Japan Aerospace Grade Helium Market (by Application), $Billion, 2024-2034

- Table 35: Japan Aerospace Grade Helium Market (by Type), $Billion, 2024-2034

- Table 36: India Aerospace Grade Helium Market (by Application), $Billion, 2024-2034

- Table 37: India Aerospace Grade Helium Market (by Type), $Billion, 2024-2034

- Table 38: South Korea Aerospace Grade Helium Market (by Application), $Billion, 2024-2034

- Table 39: South Korea Aerospace Grade Helium Market (by Type), $Billion, 2024-2034

- Table 40: Rest-of-Asia-Pacific Aerospace Grade Helium Market (by Application), $Billion, 2024-2034

- Table 41: Rest-of-Asia-Pacific Aerospace Grade Helium Market (by Type), $Billion, 2024-2034

- Table 42: Rest-of-the-World Aerospace Grade Helium Market (by Application), $Billion, 2024-2034

- Table 43: Rest-of-the-World Aerospace Grade Helium Market (by Type), $Billion, 2024-2034

- Table 44: South America Aerospace Grade Helium Market (by Application), $Billion, 2024-2034

- Table 45: South America Aerospace Grade Helium Market (by Type), $Billion, 2024-2034

- Table 46: Middle East and Africa Aerospace Grade Helium Market (by Application), $Billion, 2024-2034

- Table 47: Middle East and Africa Aerospace Grade Helium Market (by Type), $Billion, 2024-2034

- Table 48: Market Share

Aerospace Grade Helium Market: Industry Overview

The aerospace grade helium market is a critical segment within the broader industrial gases and space exploration industries. Helium plays an essential role in aerospace applications, serving as a pressurant for rocket fuel tanks, a coolant for cryogenic systems, and a medium for leak detection and purging. As aerospace technology advances and space missions increase in frequency, the demand for high-purity helium has become increasingly vital to ensuring mission safety and efficiency.

The industry is characterized by steady growth driven by rising investments in space exploration, satellite deployment, and reusable launch vehicle technologies. Helium supply relies heavily on advanced extraction and purification methods due to its finite natural reserves and the need for ultra-high purity. Major suppliers operate integrated production and distribution networks to meet the rigorous standards of aerospace customers. Geopolitical factors and supply chain complexities pose ongoing challenges, prompting companies to innovate in helium recovery and storage technologies while securing strategic partnerships to maintain stable supplies.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2025 - 2034 |

| 2025 Evaluation | $1.81 Billion |

| 2034 Forecast | $3.32 Billion |

| CAGR | 6.97% |

Aerospace Grade Helium Market Lifecycle Stage

The aerospace grade helium market is in a robust growth phase, transitioning from early commercialization to broader adoption across aerospace applications. The focus is on expanding production capacity, improving helium extraction and purification technologies, and securing stable supply chains to meet the rising demand from space exploration, satellite deployment, and reusable launch vehicle sectors. Companies are actively investing in technology upgrades and strategic partnerships to enhance supply reliability and address the challenges posed by finite helium reserves.

Collaboration among major industrial gas suppliers, aerospace manufacturers, and government agencies is critical to developing sustainable helium sourcing and advanced handling solutions. Regulatory considerations around export controls and resource management are evolving to support secure and efficient helium distribution.

Commercial deployment of aerospace-grade helium is expanding rapidly throughout the 2020s, driven by increasing orbital launches and technological advancements. As the market matures, helium is expected to become an indispensable, standardized resource for aerospace missions, underpinning the future of space exploration and advanced aerospace technologies.

Aerospace Grade Helium Market Segmentation:

Segmentation 1: by Type

- 4N

- 5N

- 6N

Segmentation 2: by Application

- Airship Shell Filler

- Rocket Propellant

- Others

Segmentation 3: by Region

- North America - U.S., Canada, and Mexico

- Europe - Germany, France, Italy, Spain, U.K., and Rest-of-Europe

- Asia-Pacific - China, Japan, South Korea, India, and Rest-of-Asia-Pacific

- Rest-of-the-World - South America and Middle East and Africa

Demand - Drivers and Limitations

The following are the demand drivers for the aerospace grade helium market:

- Growth in Space Exploration and Satellite Launches

- Advancements in Reusable Launch Vehicles

- Increased Use in Cryogenic Applications

The aerospace grade helium market is expected to face some limitations as well due to the following challenges:

- Finite Helium Reserves and Supply Constraints

- High Extraction and Purification Costs

Aerospace Grade Helium Market Key Players and Competition Synopsis

The aerospace grade helium market features a highly competitive landscape shaped by a mix of global industrial gas leaders and specialized regional suppliers. Leading multinational corporations such as Air Liquide S.A., Air Products and Chemicals Inc., and Linde plc dominate the market with extensive helium production facilities and robust global distribution networks catering to aerospace and other high-purity applications. Japanese companies like Iwatani Corporation and Taiyo Nippon Sanso Corporation bring regional strength in Asia-Pacific, focusing on advanced purification technologies and reliable supply. Other notable players including Matheson Tri-Gas Inc., Messer Group GmbH, and Gulf Cryo S.A.L. are committed to delivering high-quality helium solutions for cryogenics, leak detection, and aerospace propulsion systems. Competition intensifies through ongoing investments in research and development aimed at improving helium extraction and liquefaction technologies, securing sustainable helium sources, and optimizing supply chain resilience. Strategic collaborations and mergers-such as the Linde-Praxair consolidation-further reinforce market positions amid increasing global demand driven by expanding aerospace, space exploration, and satellite deployment activities. As the race to ensure a stable, high-purity helium supply accelerates, these players are instrumental in meeting stringent aerospace standards and supporting the sector's technological evolution worldwide.

Some prominent names established in the aerospace grade helium market are:

- Linde plc

- Air Products and Chemicals, Inc.

- Air Liquide S.A.

- Messer Group GmbH

- Taiyo Nippon Sanso Corporation

- ORLEN

- SIAD

- Coregas

- Matheson Tri-Gas Inc.

- Gulf Cryo S.A.L.

- Iwatani Corporation

- AirLife

Companies that are not a part of the previously mentioned pool have been well represented across different sections of the report (wherever applicable).

Table of Contents

Executive Summary

Scope and Definition

Market/Product Definition

Key Questions Answered

Analysis and Forecast Note

1. Markets: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.2 Market Dynamics Overview

- 1.2.1 Market Drivers

- 1.2.2 Market Restraints

- 1.2.3 Market Opportunities

- 1.3 Regulatory & Policy Impact Analysis

- 1.4 Patent Analysis

- 1.5 Start-Up Landscape

- 1.6 Investment Landscape and R&D Trends

- 1.7 Future Outlook and Market Roadmap

- 1.8 Value Chain Analysis

- 1.9 Global Pricing Analysis

- 1.10 Industry Attractiveness

2. Aerospace Grade Helium Market (by Type)

- 2.1 4N

- 2.2 5N

- 2.3 6N

3. Aerospace Grade Helium Market (by Application)

- 3.1 Airship Shell Filler

- 3.2 Rocket Propellant

- 3.3 Others

4. Aerospace Grade Helium Market (by Region)

- 4.1 Aerospace Grade Helium Market (by Region)

- 4.2 North America

- 4.2.1 Regional Overview

- 4.2.2 Driving Factors for Market Growth

- 4.2.3 Factors Challenging the Market

- 4.2.4 Key Companies

- 4.2.5 Type

- 4.2.6 Application

- 4.2.7 North America (by Country)

- 4.2.7.1 U.S.

- 4.2.7.1.1 Market by Type

- 4.2.7.1.2 Market by Application

- 4.2.7.2 Canada

- 4.2.7.2.1 Market by Type

- 4.2.7.2.2 Market by Application

- 4.2.7.3 Mexico

- 4.2.7.3.1 Market by Type

- 4.2.7.3.2 Market by Application

- 4.2.7.1 U.S.

- 4.3 Europe

- 4.3.1 Regional Overview

- 4.3.2 Driving Factors for Market Growth

- 4.3.3 Factors Challenging the Market

- 4.3.4 Key Companies

- 4.3.5 Type

- 4.3.6 Application

- 4.3.7 Europe (by Country)

- 4.3.7.1 Germany

- 4.3.7.1.1 Market by Type

- 4.3.7.1.2 Market by Application

- 4.3.7.2 France

- 4.3.7.2.1 Market by Type

- 4.3.7.2.2 Market by Application

- 4.3.7.3 Italy

- 4.3.7.3.1 Market by Type

- 4.3.7.3.2 Market by Application

- 4.3.7.4 Spain

- 4.3.7.4.1 Market by Type

- 4.3.7.4.2 Market by Application

- 4.3.7.5 U.K.

- 4.3.7.5.1 Market by Type

- 4.3.7.5.2 Market by Application

- 4.3.7.6 Rest-of-Europe

- 4.3.7.6.1 Market by Type

- 4.3.7.6.2 Market by Application

- 4.3.7.1 Germany

- 4.4 Asia-Pacific

- 4.4.1 Regional Overview

- 4.4.2 Driving Factors for Market Growth

- 4.4.3 Factors Challenging the Market

- 4.4.4 Key Companies

- 4.4.5 Type

- 4.4.6 Application

- 4.4.7 Asia-Pacific (by Country)

- 4.4.7.1 China

- 4.4.7.1.1 Market by Type

- 4.4.7.1.2 Market by Application

- 4.4.7.2 Japan

- 4.4.7.2.1 Market by Type

- 4.4.7.2.2 Market by Application

- 4.4.7.3 India

- 4.4.7.3.1 Market by Type

- 4.4.7.3.2 Market by Application

- 4.4.7.4 South Korea

- 4.4.7.4.1 Market by Type

- 4.4.7.4.2 Market by Application

- 4.4.7.5 Rest-of-Asia-Pacific

- 4.4.7.5.1 Market by Type

- 4.4.7.5.2 Market by Application

- 4.4.7.1 China

- 4.5 Rest-of-the-World

- 4.5.1 Regional Overview

- 4.5.2 Driving Factors for Market Growth

- 4.5.3 Factors Challenging the Market

- 4.5.4 Key Companies

- 4.5.5 Type

- 4.5.6 Application

- 4.5.7 Rest-of-the-World (by Region)

- 4.5.7.1 South America

- 4.5.7.1.1 Market by Type

- 4.5.7.1.2 Market by Application

- 4.5.7.2 Middle East and Africa

- 4.5.7.2.1 Market by Type

- 4.5.7.2.2 Market by Application

- 4.5.7.1 South America

5. Markets - Competitive Benchmarking & Company Profiles

- 5.1 Next Frontiers

- 5.2 Geographic Assessment

- 5.3 Company Profiles

- 5.3.1 Linde plc

- 5.3.1.1 Overview

- 5.3.1.2 Top Products/Product Portfolio

- 5.3.1.3 Top Competitors

- 5.3.1.4 Target Customers

- 5.3.1.5 Key Personnel

- 5.3.1.6 Analyst View

- 5.3.1.7 Market Share

- 5.3.2 Air Products and Chemicals, Inc.

- 5.3.2.1 Overview

- 5.3.2.2 Top Products/Product Portfolio

- 5.3.2.3 Top Competitors

- 5.3.2.4 Target Customers

- 5.3.2.5 Key Personnel

- 5.3.2.6 Analyst View

- 5.3.2.7 Market Share

- 5.3.3 Air Liquide S.A.

- 5.3.3.1 Overview

- 5.3.3.2 Top Products/Product Portfolio

- 5.3.3.3 Top Competitors

- 5.3.3.4 Target Customers

- 5.3.3.5 Key Personnel

- 5.3.3.6 Analyst View

- 5.3.3.7 Market Share

- 5.3.4 Messer Group GmbH

- 5.3.4.1 Overview

- 5.3.4.2 Top Products/Product Portfolio

- 5.3.4.3 Top Competitors

- 5.3.4.4 Target Customers

- 5.3.4.5 Key Personnel

- 5.3.4.6 Analyst View

- 5.3.4.7 Market Share

- 5.3.5 Taiyo Nippon Sanso Corporation

- 5.3.5.1 Overview

- 5.3.5.2 Top Products/Product Portfolio

- 5.3.5.3 Top Competitors

- 5.3.5.4 Target Customers

- 5.3.5.5 Key Personnel

- 5.3.5.6 Analyst View

- 5.3.5.7 Market Share

- 5.3.6 ORLEN

- 5.3.6.1 Overview

- 5.3.6.2 Top Products/Product Portfolio

- 5.3.6.3 Top Competitors

- 5.3.6.4 Target Customers

- 5.3.6.5 Key Personnel

- 5.3.6.6 Analyst View

- 5.3.6.7 Market Share

- 5.3.7 SIAD

- 5.3.7.1 Overview

- 5.3.7.2 Top Products/Product Portfolio

- 5.3.7.3 Top Competitors

- 5.3.7.4 Target Customers

- 5.3.7.5 Key Personnel

- 5.3.7.6 Analyst View

- 5.3.7.7 Market Share

- 5.3.8 Coregas

- 5.3.8.1 Overview

- 5.3.8.2 Top Products/Product Portfolio

- 5.3.8.3 Top Competitors

- 5.3.8.4 Target Customers

- 5.3.8.5 Key Personnel

- 5.3.8.6 Analyst View

- 5.3.8.7 Market Share

- 5.3.9 Matheson Tri-Gas Inc.

- 5.3.9.1 Overview

- 5.3.9.2 Top Products/Product Portfolio

- 5.3.9.3 Top Competitors

- 5.3.9.4 Target Customers

- 5.3.9.5 Key Personnel

- 5.3.9.6 Analyst View

- 5.3.9.7 Market Share

- 5.3.10 Gulf Cryo S.A.L.

- 5.3.10.1 Overview

- 5.3.10.2 Top Products/Product Portfolio

- 5.3.10.3 Top Competitors

- 5.3.10.4 Target Customers

- 5.3.10.5 Key Personnel

- 5.3.10.6 Analyst View

- 5.3.10.7 Market Share

- 5.3.11 Iwatani Corporation

- 5.3.11.1 Overview

- 5.3.11.2 Top Products/Product Portfolio

- 5.3.11.3 Top Competitors

- 5.3.11.4 Target Customers

- 5.3.11.5 Key Personnel

- 5.3.11.6 Analyst View

- 5.3.11.7 Market Share

- 5.3.12 AirLife

- 5.3.12.1 Overview

- 5.3.12.2 Top Products/Product Portfolio

- 5.3.12.3 Top Competitors

- 5.3.12.4 Target Customers

- 5.3.12.5 Key Personnel

- 5.3.12.6 Analyst View

- 5.3.12.7 Market Share

- 5.3.1 Linde plc

- 5.4 Other Key Companies