|

|

市場調査レポート

商品コード

1802930

精密植栽市場- 世界および地域別分析:作物タイプ別、展開タイプ別、地域別 - 分析と予測(2025年~2035年)Precision Planting Market - A Global and Regional Analysis: Focus on Market by Crop Type, Deployment Type, and Region - Analysis and Forecast, 2025-2035 |

||||||

カスタマイズ可能

|

|||||||

| 精密植栽市場- 世界および地域別分析:作物タイプ別、展開タイプ別、地域別 - 分析と予測(2025年~2035年) |

|

出版日: 2025年09月03日

発行: BIS Research

ページ情報: 英文 161 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

精密植栽市場は、世界的な食糧生産に対する需要の高まりと、種子コストの高騰を主な要因として急成長しており、普及の原動力となっています。

2050年までに100億人近くになると予想される世界人口の増加は、農地を拡大することなく農業生産高を増加させる必要性を強め、精密植栽技術を不可欠なものにしています。精密プランターとマルチハイブリッドプランターは、種子の深さと間隔を最適化して発芽と収量を向上させ、種子品種を土壌のばらつきに適応させることで多様な圃場での回復力を高める。例えば、中国は2024年10月、国内の食糧生産を強化することを目的とした、農業のデジタル化に関する5カ年行動計画を開始しました。この計画では、2028年までにデジタル植栽技術フレームワークと国家農業ビッグデータ・プラットフォームを確立することに重点が置かれています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2025年~2035年 |

| 2025年の評価 | 16億5,810万米ドル |

| 2035年の予測 | 35億220万米ドル |

| CAGR | 7.76% |

しかし、用途が拡大した後も、新興国地域での認知度やインフラの不足、精密植栽ソリューションの導入コストの高さなど、特定の要因によって市場の成長は妨げられています。発展途上地域における認識不足とインフラ不足は、精密植栽技術の採用と展開に大きな課題をもたらし、市場成長と技術浸透を阻害しています。精密植栽ソリューションの導入コストが高いことは、主要な展開技術全体の採用と成長を直接制約する重大な市場課題となっています。

市場概要

精密植栽市場の収益は、2024年には15億2,970万米ドルでしたが、2035年には35億220万米ドルに達し、予測期間中(2025年~2035年)のCAGRは7.76%で推移すると予測されます。市場が拡大しているのは、農家が収量の最大化、投入コストの削減、持続可能性目標の遵守を迫られているためです。種子と肥料の価格上昇により、畝ごとの正確な植え付けが経済的に魅力的になっている一方、北米、欧州、新興市場の政府政策により、より高い資源効率と二酸化炭素排出量の削減が推進されています。同時に、センサー、GPS、テレマティクス、AI主導の農学分析における急速な進歩は、精密植栽をより信頼性が高く、使いやすく、農場規模を問わず適応可能なものにしています。このような経済的必要性、規制支援、技術的成熟の融合が、特にトウモロコシ、大豆、小麦などの大規模連作作物での採用を促進しています。

産業界への影響

精密植栽技術は、従来の農業機械製造と農業機器のバリューチェーンを再構築しているため、精密植栽市場に産業界が与える影響は大きいです。John Deere、CNH Industrial、AGCOなどのOEMは、精密ハードウェアとソフトウェアをプランターに統合するために多額の投資を行っており、レトロフィットキット、データサブスクリプション、アフターサービスを通じて新たな継続的収益源を生み出しています。このシフトは、大企業が競争力を維持するために専門技術企業(例えば、AGCOのPrecision Planting)を買収することで、機器業界の統合を促進しています。また、センサー、油圧、制御システムのサプライヤーは、精密植栽の精度と信頼性の要求を満たすために、提供する製品をアップグレードする必要に迫られています。

同時に、精密植栽の台頭は、より広範な産業革新とエコシステムの統合を刺激しています。農業技術の新興企業やドローンベースの播種企業は、ニッチ技術を商業化するために産業パートナーを見つけており、一方、大手機器メーカーは、フルスタックの植栽ソリューションを構築するために衛星やデータ分析企業と協力しています。デジタル化と電化に向けた業界全体の動きは、精密植栽システムにも合致しています。データ駆動型の植栽は、自動化、そして最終的には自律型機械をサポートするからです。これらの産業力学を総合すると、精密植栽は単なる農業慣行ではなく、農業機械とハイテク産業全体の戦略的促進要因となっています。

市場セグメンテーション

セグメンテーション1:作物タイプ別

- 穀物・穀類

- 油糧種子と豆類

- 果物・野菜

- その他

穀物・穀類が市場をリードする(作物タイプ別)

穀物・穀類分野が市場を独占しています。これらの作物は世界の食糧供給の基礎であり、効率的な栽培が不可欠です。精密植え付け技術は、種子の配置、深さ、間隔を穀物の種類ごとに固有のニーズに合わせて調整し、発芽、均一性、収量を向上させます。

精密植え付け市場は、食糧需要の増加、持続可能性の目標、経済的意義によって、このセグメントの成長から利益を得ています。正確な植え付けは種子の無駄を削減し、作物のパフォーマンスを向上させるため、穀物と穀物を精密農業の採用と技術革新の重要な推進力として位置づけています。

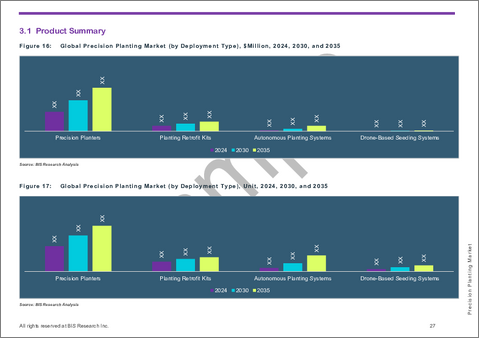

セグメンテーション2:展開タイプ別

- 精密プランター

- 植え付け改造キット

- 自律型播種システム

- ドローンベース播種システム

市場を独占する精密プランター(展開タイプ別)

精密プランターは、種子の配置、深さ、間隔を最適化し、作物の均一な出芽を確保し、収量を最大化するように設計された高度な機械です。GPS、センサー、自動化機能を備え、土壌や作物の状態に適応して植え付け精度を高め、種子の無駄を減らします。これにより資源効率が向上し、持続可能な農業が促進されます。

精密植付市場は、より高い生産性とコスト削減を可能にすることで、これらの技術から利益を得ています。精密プランターは労働力を削減し、作物の品質を向上させ、より良い投入物管理をサポートし、食糧需要の増加と技術の進歩の中で市場の成長を促進します。

セグメンテーション3:地域別

- 北米

- 欧州

- アジア太平洋

- その他の地域

市場をリードする北米(地域別)

北米が市場をリードしています。これは、GPS技術とデータ分析の採用が増加しているため、作物管理と資源効率の向上が促進され、オンタリオ州などの地域でGPSが広く使用されているように、農家が十分な情報に基づいた意思決定を行えるようになっているためです。また、AGCOによるTrimbleの農業資産の買収(2023年9月)により、強力なミックスドフリート精密農業プラットフォームが構築され、複数の機器ブランドにおけるテクノロジーへのアクセスが拡大し、市場の成長が促進されます。

北米の精密植栽市場は、技術革新、持続可能性の要求、農場のデジタル化の進展に牽引され、強固で急速に進化しています。例えば、AGCO、John Deere、Trimbleなどの主要企業は、さまざまな規模の農場で作物の生産性と資源効率を高める統合ソリューションを開発しています。この地域は、インフラ格差や規制の複雑さといった課題に直面しながらも、強力なアグリテック・エコシステム、AI、自律型機械、データ分析への多額の投資から利益を得ています。このようなダイナミクスにより、北米は精密農業のグローバルリーダーとして位置づけられ、持続可能で効率的な農業を促進しています。

精密植栽市場の最近の動向

- 2023年、AGCOはTrimbleとの戦略的合弁事業により、北米の混合フリート精密農業能力を大幅に拡大し、2028年までに売上高20億米ドル突破を目指します。さらに、2024年6月のVaderstadの高速Tempoプランターの導入やPrecision AIの自律型除草剤散布ドローンなどの革新は、効率改善と化学物質使用量削減への継続的な取り組みを強調しています。

- 2023年、カナダの新興企業Precision AIは、植物レベルの除草剤散布が可能な自律型ドローンを開発し、化学薬品の過剰使用と労働力依存を大幅に削減しました。このブレークスルーは、農業における労働力不足や環境への影響といった課題に対処するため、最先端技術の活用を重視するカナダの姿勢を反映しています。

- 2023年、ドイツの研究では、ジャガイモ栽培に非常に効果的な圃場ロボットとしてRobotti LRとRobotti 150 Dが挙げられ、自律走行、散布、機械的除草機能を提供し、効率を高め、化学薬品の使用を最大25%削減します。

- 2024年、BoomGrowはCelcomDigiと提携し、5GとAIを活用してマレーシアの農場でリアルタイムモニタリングと精密制御を行う。同様に、インドネシアのElevarmは2025年3月に425万米ドルを確保し、零細農家を対象としたAIを活用した農業ソリューションを拡大しています。

当レポートでは、精密植栽市場を作物タイプ別、展開タイプ別に詳細に分析しています。穀物・穀類、油糧種子・豆類、果物・野菜などの作物について、精密プランター、植え付け後付けキット、自律植え付けシステム、ドローンベースの播種システムなど、さまざまな精密植え付けシステムをカバーしています。当レポートは、イノベーターが現在の提供状況のギャップを特定し、製品ロードマップを適応させて、差別化され、拡張可能で、規制状況に準拠したソリューションを提供するのに役立ちます。

精密植栽市場は急速に進化しており、大手企業は市場ポジションを強化するため、生産能力の拡大、戦略的提携、試験的展開に取り組んでいます。当レポートは、こうした開発を追跡し、主要企業がどのように応用分野に参入または拡大しているかについての洞察を提供します。当レポートは、マーケティングチームが高成長分野を特定し、価値提案をエンドユーザーの期待に合致させ、地域力学と技術的準備に基づき的を絞った市場参入戦略を策定する際の支援となります。

徹底的な競合情勢を提供し、製品提供、技術革新のパイプライン、パートナーシップ、拡大計画に基づいて主要プレーヤーをプロファイリングしています。競合ベンチマーキングにより、読者は製品タイプや応用分野での各社の位置付けを評価することができます。

精密植栽は、作物の均一な出芽を確保し、収量の可能性を最大化し、資源の浪費を最小化するために、圃場における種子の配置を最適化することに焦点を当てた、データ駆動型の技術強化型農業慣行です。精密植え付け市場は、IoT、AI、データ分析などの先進技術の普及に後押しされて急成長を遂げようとしています。これらの技術革新は、高精度の種子配置と作物モニタリングを可能にし、収量を大幅に向上させ、コストを削減します。政府の強力なインセンティブと持続可能な農業に対する世界的な関心の高まりにより、先進国市場と新興国市場の両方で投資と展開が加速し、現在のアクセス障壁が克服されると予想されます。その結果、精密植栽は標準的な慣行となり、農業効率と環境への影響に大規模な変革をもたらす可能性があります。

2024年4月、国際稲研究所(IRRI)とフィリピン稲研究所(PhilRice)は、田植え、施肥、害虫管理のためのドローンアプリケーションを標準化するDrones4Riceプロジェクトを立ち上げました。このイニシアチブは、零細農家が精密農業を採用できるようにすることで、生産性と持続可能性を高めることを目的としています。このプロジェクトには、作物を監視し、雑草や栄養レベルをマッピングするためのドローンベースのシステムの設置も含まれており、栽培期間中のリアルタイム調整が容易になります。このような進歩は、農業における機械化という広範な傾向の一部であり、労働力不足に対処し、作物の収量を向上させています

この市場に参入している著名な企業は以下の通りです。

- John Deere

- AGCO Corporation

- CNH Industrial N.V.

- Kinze Manufacturing

- Vaderstad Group

- Horsch Maschinen GmbH

- Great Plains Manufacturing

- Kuhn SAS

- AG Leader Technology

- Hylio, Inc.

- Skyseed GmbH

- Yetter Manufacturing Co, Inc

- Stara S/A

- Bourgault Industries Ltd.

- Maschio Gaspardo S.p.A.

目次

エグゼクティブサマリー

第1章 市場:業界展望

- 市場力学

- 動向

- 作物の収穫量向上のための労働力の機械化の必要性の高まり

- 精密情勢におけるスマートセンサー技術の急速な導入

- 価格予測

- R&Dレビュー

- 特許出願動向(件数、年、国別)

- 規制状況

- スタートアップの情勢

- 市場力学

- 市場促進要因

- 市場抑制要因

- 市場機会

第2章 用途

- 用途のサマリー

- 精密植栽市場(作物別)

- 穀物

- 油糧種子と豆類

- 果物と野菜

- その他

第3章 製品

- 製品のサマリー

- 精密植栽市場(導入タイプ別)

- 精密プランター

- 植栽改修キット

- 自律植栽システム

- ドローンによる播種システム

第4章 地域

- 地域サマリー

- 北米

- 地域概要

- 市場成長促進要因

- 市場成長抑制要因

- 米国

- カナダ

- メキシコ

- 欧州

- 地域概要

- 市場成長促進要因

- 市場成長抑制要因

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- オランダ

- デンマーク

- その他

- アジア太平洋

- 地域概要

- 市場成長促進要因

- 市場成長抑制要因

- 中国

- 日本

- インド

- インドネシア

- オーストラリア

- ベトナム

- マレーシア

- その他

- その他の地域

- 地域概要

- 市場成長促進要因

- 市場成長抑制要因

- 南米

- 中東・アフリカ

第5章 市場-競合ベンチマーキングと企業プロファイル

- Deere & Company

- Kinze Manufacturing

- AGCO Corporation

- CNH Industrial N.V.

- Vaderstad Group

- HORSCH Maschinen GmbH

- Great Plains Manufacturing

- KUHN SAS

- Maschio Gaspardo S.p.A.

- Ag Leader Technology

- Hylio, Inc.

- Skyssed GmbH

- Yetter Manufacturing Co, Inc.

- Stara S/A

- Bourgault Industries Ltd. Overview

第6章 調査手法

List of Figures

- Figure 1: Precision Planting Market (by Scenario), $Million, 2025, 2030, and 2035

- Figure 2: Precision Planting Market, 2024-2035

- Figure 3: Global Market Snapshot, 2024

- Figure 4: Global Precision Planting Market, $Million, 2024 and 2035

- Figure 5: Precision Planting Market (by Crop Type), $Million, 2024, 2030, and 2035

- Figure 6: Precision Planting Market (by Crop Type), Unit, 2024, 2030, and 2035

- Figure 7: Precision Planting Market (by Deployment Type), $Million, 2024, 2030, and 2035

- Figure 8: Precision Planting Market (by Deployment Type), Units, 2024, 2030, and 2035

- Figure 9: Precision Planting Market Segmentation

- Figure 10: Pricing Analysis: Global Average Pricing for the Precision Planting Products, $/Units

- Figure 11: Patent Analysis (by Year and by Country), January 2021-December 2024

- Figure 12: Global Precision Planting Market (by Crop Type), $Million, 2024, 2030, and 2035

- Figure 13: Global Precision Planting Market (by Crop Type), Unit, 2024, 2030, and 2035

- Figure 14: Global Precision Planting Market, Cereals and Grains, $Million, 2024-2035

- Figure 15: Global Precision Planting Market, Cereals and Grains, Unit, 2024-2035

- Figure 16: Global Precision Planting Market, Oilseeds and Pulses, $Million, 2024-2035

- Figure 17: Global Precision Planting Market, Oilseeds and Pulses, Unit, 2024-2035

- Figure 18: Global Precision Planting Market, Fruits and Vegetables, $Million, 2024-2035

- Figure 19: Global Precision Planting Market, Fruits and Vegetables, Unit, 2024-2035

- Figure 20: Global Precision Planting Market, Others, $Million, 2024-2035

- Figure 21: Global Precision Planting Market, Others, Unit, 2024-2035

- Figure 22: Global Precision Planting Market (by Deployment Type), $Million, 2024, 2030, and 2035

- Figure 23: Global Precision Planting Market (by Deployment Type), Unit, 2024, 2030, and 2035

- Figure 24: Global Precision Planting Market, Precision Planters, $Million, 2024-2035

- Figure 25: Global Precision Planting Market, Precision Planters, Unit, 2024-2035

- Figure 26: Global Precision Planting Market, Planting Retrofit Kits, $Million, 2024-2035

- Figure 27: Global Precision Planting Market, Planting Retrofit Kits, Unit, 2024-2035

- Figure 28: Global Precision Planting Market, Autonomous Planting Systems, $Million, 2024-2035

- Figure 29: Global Precision Planting Market, Autonomous Planting Systems, Unit, 2024-2035

- Figure 30: Global Precision Planting Market, Drone-Based Seeding Systems, $Million, 2024-2035

- Figure 31: Global Precision Planting Market, Drone-Based Seeding Systems, Unit, 2024-2035

- Figure 32: U.S. Precision Planting Market, $Million, 2024-2035

- Figure 33: Canada Precision Planting Market, $Million, 2024-2035

- Figure 34: Mexico Precision Planting Market, $Million, 2024-2035

- Figure 35: Germany Precision Planting Market, $Million, 2024-2035

- Figure 36: France Precision Planting Market, $Million, 2024-2035

- Figure 37: U.K. Precision Planting Market, $Million, 2024-2035

- Figure 38: Italy Precision Planting Market, $Million, 2024-2035

- Figure 39: Spain Precision Planting Market, $Million, 2024-2035

- Figure 40: The Netherlands Precision Planting Market, $Million, 2024-2035

- Figure 41: Denmark Precision Planting Market, $Million, 2024-2035

- Figure 42: Rest-of-Europe Precision Planting Market, $Million, 2024-2035

- Figure 43: China Precision Planting Market, $Million, 2024-2035

- Figure 44: Japan Precision Planting Market, $Million, 2024-2035

- Figure 45: India Precision Planting Market, $Million, 2024-2035

- Figure 46: Indonesia Precision Planting Market, $Million, 2024-2035

- Figure 47: Australia Precision Planting Market, $Million, 2024-2035

- Figure 48: Vietnam Precision Planting Market, $Million, 2024-2035

- Figure 49: Malaysia Precision Planting Market, $Million, 2024-2035

- Figure 50: Rest-of-Asia-Pacific Precision Planting Market, $Million, 2024-2035

- Figure 51: South America Precision Planting Market, $Million, 2024-2035

- Figure 52: Middle East and Africa Precision Planting Market, $Million, 2024-2035

- Figure 53: Strategic Initiatives, January 2022-April 2025

- Figure 54: Data Triangulation

- Figure 55: Top-Down and Bottom-Up Approach

- Figure 56: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Top 10 Countries in the Global Precision Planting Market, 2024

- Table 3: Competitive Landscape Snapshot

- Table 4: Regulatory/Standards Landscape in the Precision Planting Market

- Table 5: Startup Landscape in the Precision Planting Market

- Table 6: Precision Planting Market (by Region), $Million, 2024-2035

- Table 7: Precision Planting Market (by Region), Unit, 2024-2035

- Table 8: North America Precision Planting Market (by Crop Type), $Million, 2024-2035

- Table 9: North America Precision Planting Market (by Crop Type), Unit, 2024-2035

- Table 10: North America Precision Planting Market (by Deployment Type), $Million, 2024-2035

- Table 11: North America Precision Planting Market (by Deployment Type), Unit, 2024-2035

- Table 12: U.S. Precision Planting Market (by Crop Type), $Million, 2024-2035

- Table 13: U.S. Precision Planting Market (by Crop Type), Unit, 2024-2035

- Table 14: U.S. Precision Planting Market (by Deployment Type), $Million, 2024-2035

- Table 15: U.S. Precision Planting Market (by Deployment Type), Unit, 2024-2035

- Table 16: Canada Precision Planting Market (by Crop Type), $Million, 2024-2035

- Table 17: Canada Precision Planting Market (by Crop Type), Unit, 2024-2035

- Table 18: Canada Precision Planting Market (by Deployment Type), $Million, 2024-2035

- Table 19: Canada Precision Planting Market (by Deployment Type), Unit, 2024-2035

- Table 20: Mexico Precision Planting Market (by Crop Type), $Million, 2024-2035

- Table 21: Mexico Precision Planting Market (by Crop Type), Unit, 2024-2035

- Table 22: Mexico Precision Planting Market (by Deployment Type), $Million, 2024-2035

- Table 23: Mexico Precision Planting Market (by Deployment Type), Unit, 2024-2035

- Table 24: Europe Precision Planting Market (by Crop Type), $Million, 2024-2035

- Table 25: Europe Precision Planting Market (by Crop Type), Unit, 2024-2035

- Table 26: Europe Precision Planting Market (by Deployment Type), $Million, 2024-2035

- Table 27: Europe Precision Planting Market (by Deployment Type), Unit, 2024-2035

- Table 28: Germany Precision Planting Market (by Crop Type), $Million, 2024-2035

- Table 29: Germany Precision Planting Market (by Crop Type), Unit, 2024-2035

- Table 30: Germany Precision Planting Market (by Deployment Type), $Million, 2024-2035

- Table 31: Germany Precision Planting Market (by Deployment Type), Unit, 2024-2035

- Table 32: France Precision Planting Market (by Crop Type), $Million, 2024-2035

- Table 33: France Precision Planting Market (by Crop Type), Unit, 2024-2035

- Table 34: France Precision Planting Market (by Deployment Type), $Million, 2024-2035

- Table 35: France Precision Planting Market (by Deployment Type), Unit, 2024-2035

- Table 36: U.K. Precision Planting Market (by Crop Type), $Million, 2024-2035

- Table 37: U.K. Precision Planting Market (by Crop Type), Unit, 2024-2035

- Table 38: U.K. Precision Planting Market (by Deployment Type), $Million, 2024-2035

- Table 39: U.K. Precision Planting Market (by Deployment Type), Unit, 2024-2035

- Table 40: Italy Precision Planting Market (by Crop Type), $Million, 2024-2035

- Table 41: Italy Precision Planting Market (by Crop Type), Unit, 2024-2035

- Table 42: Italy Precision Planting Market (by Deployment Type), $Million, 2024-2035

- Table 43: Italy Precision Planting Market (by Deployment Type), Unit, 2024-2035

- Table 44: Spain Precision Planting Market (by Crop Type), $Million, 2024-2035

- Table 45: Spain Precision Planting Market (by Crop Type), Unit, 2024-2035

- Table 46: Spain Precision Planting Market (by Deployment Type), $Million, 2024-2035

- Table 47: Spain Precision Planting Market (by Deployment Type), Unit, 2024-2035

- Table 48: The Netherlands Precision Planting Market (by Crop Type), $Million, 2024-2035

- Table 49: The Netherlands Precision Planting Market (by Crop Type), Unit, 2024-2035

- Table 50: The Netherlands Precision Planting Market (by Deployment Type), $Million, 2024-2035

- Table 51: The Netherlands Precision Planting Market (by Deployment Type), Unit, 2024-2035

- Table 52: Denmark Precision Planting Market (by Crop Type), $Million, 2024-2035

- Table 53: Denmark Precision Planting Market (by Crop Type), Unit, 2024-2035

- Table 54: Denmark Precision Planting Market (by Deployment Type), $Million, 2024-2035

- Table 55: Denmark Precision Planting Market (by Deployment Type), Unit, 2024-2035

- Table 56: Rest-of-Europe Precision Planting Market (by Crop Type), $Million, 2024-2035

- Table 57: Rest-of-Europe Precision Planting Market (by Crop Type), Unit, 2024-2035

- Table 58: Rest-of-Europe Precision Planting Market (by Deployment Type), $Million, 2024-2035

- Table 59: Rest-of-Europe Precision Planting Market (by Deployment Type), Unit, 2024-2035

- Table 60: Asia-Pacific Precision Planting Market (by Crop Type), $Million, 2024-2035

- Table 61: Asia-Pacific Precision Planting Market (by Crop Type), Unit, 2024-2035

- Table 62: Asia-Pacific Precision Planting Market (by Deployment Type), $Million, 2024-2035

- Table 63: Asia-Pacific Precision Planting Market (by Deployment Type), Unit, 2024-2035

- Table 64: China Precision Planting Market (by Crop Type), $Million, 2024-2035

- Table 65: China Precision Planting Market (by Crop Type), Unit, 2024-2035

- Table 66: China Precision Planting Market (by Deployment Type), $Million, 2024-2035

- Table 67: China Precision Planting Market (by Deployment Type), Unit, 2024-2035

- Table 68: Japan Precision Planting Market (by Crop Type), $Million, 2024-2035

- Table 69: Japan Precision Planting Market (by Crop Type), Unit, 2024-2035

- Table 70: Japan Precision Planting Market (by Deployment Type), $Million, 2024-2035

- Table 71: Japan Precision Planting Market (by Deployment Type), Unit, 2024-2035

- Table 72: India Precision Planting Market (by Crop Type), $Million, 2024-2035

- Table 73: India Precision Planting Market (by Crop Type), Unit, 2024-2035

- Table 74: India Precision Planting Market (by Deployment Type), $Million, 2024-2035

- Table 75: India Precision Planting Market (by Deployment Type), Unit, 2024-2035

- Table 76: Indonesia Precision Planting Market (by Crop Type), $Million, 2024-2035

- Table 77: Indonesia Precision Planting Market (by Crop Type), Unit, 2024-2035

- Table 78: Indonesia Precision Planting Market (by Deployment Type), $Million, 2024-2035

- Table 79: Indonesia Precision Planting Market (by Deployment Type), Unit, 2024-2035

- Table 80: Australia Precision Planting Market (by Crop Type), $Million, 2024-2035

- Table 81: Australia Precision Planting Market (by Crop Type), Unit, 2024-2035

- Table 82: Australia Precision Planting Market (by Deployment Type), $Million, 2024-2035

- Table 83: Australia Precision Planting Market (by Deployment Type), Unit, 2024-2035

- Table 84: Vietnam Precision Planting Market (by Crop Type), $Million, 2024-2035

- Table 85: Vietnam Precision Planting Market (by Crop Type), Unit, 2024-2035

- Table 86: Vietnam Precision Planting Market (by Deployment Type), $Million, 2024-2035

- Table 87: Vietnam Precision Planting Market (by Deployment Type), Unit, 2024-2035

- Table 88: Malaysia Precision Planting Market (by Crop Type), $Million, 2024-2035

- Table 89: Malaysia Precision Planting Market (by Crop Type), Unit, 2024-2035

- Table 90: Malaysia Precision Planting Market (by Deployment Type), $Million, 2024-2035

- Table 91: Malaysia Precision Planting Market (by Deployment Type), Unit, 2024-2035

- Table 92: Rest-of-Asia-Pacific Precision Planting Market (by Crop Type), $Million, 2024-2035

- Table 93: Rest-of-Asia-Pacific Precision Planting Market (by Crop Type), Unit, 2024-2035

- Table 94: Rest-of-Asia-Pacific Precision Planting Market (by Deployment Type), $Million, 2024-2035

- Table 95: Rest-of-Asia-Pacific Precision Planting Market (by Deployment Type), Unit, 2024-2035

- Table 96: Rest-of-the-World Precision Planting Market (by Crop Type), $Million, 2024-2035

- Table 97: Rest-of-the-World Precision Planting Market (by Crop Type), Unit, 2024-2035

- Table 98: Rest-of-the-World Precision Planting Market (by Deployment Type), $Million, 2024-2035

- Table 99: Rest-of-the-World Precision Planting Market (by Deployment Type), Unit, 2024-2035

- Table 100: South America Precision Planting Market (by Crop Type), $Million, 2024-2035

- Table 101: South America Precision Planting Market (by Crop Type), Unit, 2024-2035

- Table 102: South America Precision Planting Market (by Deployment Type), $Million, 2024-2035

- Table 103: South America Precision Planting Market (by Deployment Type), Unit, 2024-2035

- Table 104: Middle East and Africa Precision Planting Market (by Crop Type), $Million, 2024-2035

- Table 105: Middle East and Africa Precision Planting Market (by Crop Type), Unit, 2024-2035

- Table 106: Middle East and Africa Precision Planting Market (by Deployment Type), $Million, 2024-2035

- Table 107: Middle East and Africa Precision Planting Market (by Deployment Type), Unit, 2024-2035

- Table 108: Global Market Share, 2024

This report can be delivered within 1 working day.

Introduction of the Precision Planting Market

The precision planting market is growing at a pace mainly due to the heightened demand for global food production and the sharp rise in seed costs, driving adoption. The rising global population, expected to be near 10 billion by 2050, intensifies the need for increased agricultural output without expanding farmland, making precision planting technologies essential. Precision and multi-hybrid planters optimize seed depth and spacing to improve germination and yield, while adapting seed varieties to soil variability enhances resilience in diverse fields. For instance, in October 2024, China launched a five-year action plan to digitize its agricultural industry, aiming to enhance domestic food production. The plan focuses on establishing a digital planting technology framework and a national agricultural big data platform by 2028.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2025 - 2035 |

| 2025 Evaluation | $1,658.1 Million |

| 2035 Forecast | $3,502.2 Million |

| CAGR | 7.76% |

However, even after increasing applications, the market growth has been hampered by certain factors such as the lack of awareness and infrastructure in developing regions and the high cost of implementing precision planting solutions. The lack of awareness and insufficient infrastructure in developing regions significantly challenge the adoption and deployment of precision planting technologies, thereby impeding market growth and technology penetration. The high cost of implementing precision planting solutions presents a significant market challenge that directly constrains adoption and growth across key deployment technologies.

Market Overview

The precision planting market's revenue was $1,529.7 million in 2024, and it is expected to reach $3,502.2 million by 2035, advancing at a CAGR of 7.76% during the forecast period (2025-2035). The market is growing because farmers are under increasing pressure to maximize yields, reduce input costs, and comply with sustainability targets. Rising seed and fertilizer prices make precise, row-by-row planting more economically attractive, while government policies in North America, Europe, and emerging markets are pushing for higher resource efficiency and lower carbon emissions. At the same time, rapid advances in sensors, GPS, telematics, and AI-driven agronomic analytics are making precision planting more reliable, user-friendly, and adaptable across farm sizes. This convergence of economic necessity, regulatory support, and technological maturity is driving adoption, especially in large-scale row crops such as corn, soybeans, and wheat.

Industrial Impact

The industrial impact on the precision planting market is significant because the technology is reshaping traditional farm machinery manufacturing and the ag equipment value chain. OEMs such as John Deere, CNH Industrial, and AGCO are investing heavily in integrating precision hardware and software into planters, creating new recurring revenue streams through retrofit kits, data subscriptions, and after-sales service. This shift is driving consolidation in the equipment industry, as larger players acquire specialized tech firms (e.g., AGCO's Precision Planting) to stay competitive. It also pushes suppliers of sensors, hydraulics, and control systems to upgrade their offerings to meet the accuracy and reliability demands of precision planting.

At the same time, the rise of precision planting is stimulating broader industrial innovation and ecosystem integration. Ag-tech startups and drone-based seeding firms are finding industrial partners to commercialize niche technologies, while big equipment makers are collaborating with satellite and data analytics companies to build full-stack planting solutions. The industry-wide push toward digitalization and electrification is also aligning with precision planting systems, since data-driven planting supports automation and eventually autonomous machinery. Collectively, these industrial dynamics are making precision planting not just a farming practice but a strategic growth driver for the entire agricultural machinery and ag-tech industries.

Market Segmentation

Segmentation 1: by Crop Type

- Cereals and Grains

- Oilseeds and Pulses

- Fruits and Vegetables

- Others

Cereals and Grains to Lead the Market (by Crop Type)

The cereals and grains segment dominates the market. These crops are fundamental to the global food supply, making their efficient cultivation essential. Precision planting technologies tailor seed placement, depth, and spacing to the unique needs of each grain type, improving germination, uniformity, and yield.

The precision planting market benefits from this segment's growth, driven by rising food demand, sustainability goals, and economic significance. Accurate planting reduces seed waste and enhances crop performance, positioning cereals and grains as key drivers for precision agriculture adoption and innovation.

Segmentation 2: by Deployment Type

- Precision Planters

- Planting Retrofit Kits

- Autonomous Planting Systems

- Drone-Based Seeding Systems

Precision Planters to Dominate the Market (by Deployment Type)

Precision planters are advanced machines designed to optimize seed placement, depth, and spacing, ensuring uniform crop emergence and maximizing yield. Equipped with GPS, sensors, and automation, they adapt to soil and crop conditions, enhancing planting accuracy and reducing seed waste. This improves resource efficiency and promotes sustainable farming.

The precision planting market benefits from these technologies by enabling higher productivity and cost savings. Precision planters reduce labor, improve crop quality, and support better input management, driving market growth amid rising food demand and technological advances.

Segmentation 3: by Region

- North America

- Europe

- Asia-Pacific

- Rest-of-the-World

North America to Lead the Market (by Region)

North America is the leader in the market. This is because the rising adoption of GPS technology and data analytics facilitates improved crop management and resource efficiency, enabling farmers to make informed decisions, as seen in widespread GPS use in regions such as Ontario. Also, AGCO's acquisition of Trimble's agricultural assets (September 2023) creates a robust mixed-fleet precision ag platform, expanding technology accessibility across multiple equipment brands and driving market growth.

The North America precision planting market is robust and rapidly evolving, driven by technological innovation, sustainability demands, and increasing farm digitization. For instance, leading companies such as AGCO, John Deere, and Trimble have been developing integrated solutions that enhance crop productivity and resource efficiency across a range of farm sizes. The region benefits from strong agritech ecosystems, significant investments in AI, autonomous machinery, and data analytics, while facing challenges such as infrastructure disparities and regulatory complexities. These dynamics position North America as a global leader in precision agriculture, fostering sustainable and efficient farming practices.

Recent Developments in the Precision Planting Market

- In 2023, AGCO's strategic joint venture with Trimble significantly expanded North America's mixed-fleet precision ag capabilities, aiming to surpass $2 billion in revenue by 2028. Additionally, innovations such as Vaderstad's introduction of high-speed Tempo planters in June 2024 and Precision AI's autonomous herbicide application drones highlight ongoing efforts to improve efficiency and reduce chemical usage.

- In 2023, Canadian startup Precision AI developed autonomous drones capable of plant-level herbicide application, significantly reducing chemical overspend and labor dependency. This breakthrough reflects Canada's growing emphasis on leveraging cutting-edge technology to address challenges such as labor shortages and environmental impact in agriculture.

- In 2023, a German study identified the Robotti LR and Robotti 150 D field robots as highly effective for potato cultivation, offering autonomous driving, spraying, and mechanical weed control capabilities that enhance efficiency and reduce chemical use by up to 25%.

- In 2024, BoomGrow partnered with CelcomDigi to leverage 5G and AI for real-time monitoring and precision control in Malaysian farms. Similarly, Indonesia's Elevarm secured $4.25 million in March 2025 to expand AI-powered farming solutions targeting smallholder farmers.

How can this report add value to an organization?

Product/Innovation Strategy: This report provides a detailed analysis of the precision planting market, segmented by crop type and deployment type. It covers various precision planting systems, such as precision planters, planting retrofit kits, autonomous planting systems, and drone-based seeding systems, for several crops such as cereals and grains, oilseeds and pulses, fruits and vegetables, and others. The report helps innovators identify gaps in the current offering landscape and adapt product roadmaps to deliver differentiated, scalable, and regulatory-compliant solutions.

Growth/Marketing Strategy: The precision planting market has been rapidly evolving, with major players engaging in capacity expansion, strategic alliances, and pilot deployments to strengthen their market position. This report tracks those developments and provides insights into how key companies are entering or expanding into application segments. It supports marketing teams in identifying high-growth sectors, aligning value propositions with end-user expectations, and crafting targeted go-to-market strategies based on regional dynamics and technological readiness.

Competitive Strategy: A thorough competitive landscape is provided, profiling leading players based on their product offerings, innovation pipelines, partnerships, and expansion plans. Competitive benchmarking enables readers to evaluate how companies are positioned across product types and application areas.

Research Methodology

Data Sources

Primary Data Sources

The primary sources involve industry experts from the precision planting market and various stakeholders in the ecosystem. Respondents, including CEOs, vice presidents, marketing directors, and technology and innovation directors, have been interviewed to gather and verify both qualitative and quantitative aspects of this research study.

The key data points taken from primary sources include:

- validation and triangulation of all the numbers and graphs

- validation of report segmentations and key qualitative findings

- understanding the competitive landscape

- validation of the numbers in several categories

- percentage split of individual markets for geographical analysis

Secondary Data Sources

This research study involves the usage of extensive secondary research, directories, company websites, and annual reports. It also makes use of databases, such as Hoovers, Bloomberg, Businessweek, and Factiva, to collect useful and effective information for an extensive, technical, market-oriented, and commercial study of the global market. In addition to core data sources, the study referenced insights from reputable organizations and websites, such as the Food and Agriculture Organization (FAO), United States Department of Agriculture (USDA), National Institute of Food and Agriculture (NIFA), Farm Bureau Federation (FBF), Canadian Agri-Food Automation and Intelligence Network (CAAIN), Smart Agriculture Council Mexico, Ministry of Agriculture, Food and Rural Affairs (MAFRA), Korea National Agricultural Cooperative Federation (NACF), Ministry of Agriculture and Rural Affairs (MARA), International Cooperative Agricultural Organization (ICAO), and others, to understand trends in the adoption of precision planting solutions.

Secondary research was done to obtain crucial information about the industry's value chain, revenue models, the market's monetary chain, the total pool of key players, and the current and potential use cases and applications.

The key data points taken from secondary research include:

- segmentations and percentage shares

- data for market value

- key industry trends of the top players in the market

- qualitative insights into various aspects of the market, key trends, and emerging areas of innovation

- quantitative data for mathematical and statistical calculations

Data Triangulation

This research study utilizes extensive secondary sources, including certified publications, articles by recognized authors, white papers, company annual reports, directories, and major databases, to collect useful and effective information for a comprehensive, technical, market-oriented, and commercial study of the precision planting market.

The process of market engineering involves the calculation of the market statistics, market size estimation, market forecast, market crackdown, and data triangulation (the methodology for such quantitative data processes has been explained in further sections). A primary research study has been undertaken to gather information and validate market numbers for segmentation types and industry trends among key players in the market.

Key Market Players and Competition Synopsis

Precision planting is a data-driven, technology-enhanced agricultural practice focused on optimizing seed placement in the field to ensure uniform crop emergence, maximize yield potential, and minimize resource waste. The market for precision planting is set to experience rapid growth fueled by the widespread adoption of advanced technologies such as IoT, AI, and data analytics. These innovations enable highly accurate seed placement and crop monitoring, significantly boosting yields and reducing costs. Strong government incentives and an increasing global focus on sustainable agriculture are expected to accelerate investment and deployment across both developed and emerging markets, overcoming current accessibility barriers. As a result, precision planting could become a standard practice, driving large-scale transformation in farming efficiency and environmental impact.

In April 2024, the International Rice Research Institute (IRRI) and the Philippine Rice Research Institute (PhilRice) launched the Drones4Rice Project to standardize drone applications for rice planting, fertilization, and pest management. This initiative aims to enhance productivity and sustainability by enabling smallholder farmers to adopt precision agriculture practices. The project also includes setting up drone-based systems to monitor crops and map weeds and nutrient levels, facilitating real-time adjustments during the growing season. Such advancements are part of a broader trend toward mechanization in agriculture, addressing labor shortages and improving crop yields.

Some prominent names established in this market are:

- John Deere

- AGCO Corporation

- CNH Industrial N.V.

- Kinze Manufacturing

- Vaderstad Group

- Horsch Maschinen GmbH

- Great Plains Manufacturing

- Kuhn SAS

- AG Leader Technology

- Hylio, Inc.

- Skyseed GmbH

- Yetter Manufacturing Co, Inc

- Stara S/A

- Bourgault Industries Ltd.

- Maschio Gaspardo S.p.A.

Table of Contents

Executive Summary

Scope and Definition

1 Market: Industry Outlook

- 1.1 Market Dynamics

- 1.1.1 Trends, Drivers, Challenges, and Opportunities: Current and Future Impact Assessment

- 1.2 Trends

- 1.2.1 Increased Need for Workforce Mechanization for Better Crop Yield

- 1.2.2 Rapid Adoption of Smart Sensor Technology in Precision Agriculture Landscape

- 1.2.3 Pricing Forecast

- 1.3 R&D Review

- 1.3.1 Patent Filing Trend (by Number of Patents, Year, and Country)

- 1.4 Regulatory Landscape

- 1.5 Startup Landscape

- 1.6 Market Dynamics

- 1.6.1 Market Drivers

- 1.6.1.1 Heightened Demand for Global Food Production

- 1.6.1.2 Sharp Rise in Seed Costs Driving Adoption

- 1.6.2 Market Restraints

- 1.6.2.1 Lack of Awareness and Infrastructure in Developing Regions

- 1.6.2.2 High Cost of Implementing Precision Planting Solutions

- 1.6.3 Market Opportunities

- 1.6.3.1 Adoption of Precision Planting in Specialty and High-Value Crops

- 1.6.3.2 Gaining Traction of Drone Technology

- 1.6.1 Market Drivers

2 Application

- 2.1 Application Summary

- 2.2 Precision Planting Market (by Crop Type)

- 2.2.1 Cereals and Grains

- 2.2.2 Oilseeds and Pulses

- 2.2.3 Fruits and Vegetables

- 2.2.4 Others

3 Products

- 3.1 Product Summary

- 3.2 Precision Planting Market (by Deployment Type)

- 3.2.1 Precision Planters

- 3.2.2 Planting Retrofit Kits

- 3.2.3 Autonomous Planting Systems

- 3.2.4 Drone-Based Seeding Systems

4 Region

- 4.1 Regional Summary

- 4.2 North America

- 4.2.1 Regional Overview

- 4.2.2 Driving Factors for Market Growth

- 4.2.3 Factors Challenging the Market

- 4.2.3.1 Application

- 4.2.3.2 Product

- 4.2.4 U.S.

- 4.2.4.1 Application

- 4.2.4.2 Product

- 4.2.5 Canada

- 4.2.5.1 Application

- 4.2.5.2 Product

- 4.2.6 Mexico

- 4.2.6.1 Application

- 4.2.6.2 Product

- 4.3 Europe

- 4.3.1 Regional Overview

- 4.3.2 Driving Factors for Market Growth

- 4.3.3 Factors Challenging the Market

- 4.3.3.1 Application

- 4.3.3.2 Product

- 4.3.4 Germany

- 4.3.4.1 Application

- 4.3.4.2 Product

- 4.3.5 France

- 4.3.5.1 Application

- 4.3.5.2 Product

- 4.3.6 U.K.

- 4.3.6.1 Application

- 4.3.6.2 Product

- 4.3.7 Italy

- 4.3.7.1 Application

- 4.3.7.2 Product

- 4.3.8 Spain

- 4.3.8.1 Application

- 4.3.8.2 Product

- 4.3.9 The Netherlands

- 4.3.9.1 Application

- 4.3.9.2 Product

- 4.3.10 Denmark

- 4.3.10.1 Application

- 4.3.10.2 Product

- 4.3.11 Rest-of-Europe

- 4.3.11.1 Application

- 4.3.11.2 Product

- 4.4 Asia-Pacific

- 4.4.1 Regional Overview

- 4.4.2 Driving Factors for Market Growth

- 4.4.3 Factors Challenging the Market

- 4.4.3.1 Application

- 4.4.3.2 Product

- 4.4.4 China

- 4.4.4.1 Application

- 4.4.4.2 Product

- 4.4.5 Japan

- 4.4.5.1 Application

- 4.4.5.2 Product

- 4.4.6 India

- 4.4.6.1 Application

- 4.4.6.2 Product

- 4.4.7 Indonesia

- 4.4.7.1 Application

- 4.4.7.2 Product

- 4.4.8 Australia

- 4.4.8.1 Application

- 4.4.8.2 Product

- 4.4.9 Vietnam

- 4.4.9.1 Application

- 4.4.9.2 Product

- 4.4.10 Malaysia

- 4.4.10.1 Application

- 4.4.10.2 Product

- 4.4.11 Rest-of-Asia-Pacific

- 4.4.11.1 Application

- 4.4.11.2 Product

- 4.5 Rest-of-the-World

- 4.5.1 Regional Overview

- 4.5.2 Driving Factors for Market Growth

- 4.5.3 Factors Challenging the Market

- 4.5.3.1 Application

- 4.5.3.2 Product

- 4.5.4 South America

- 4.5.4.1 Application

- 4.5.4.2 Product

- 4.5.5 Middle East and Africa

- 4.5.5.1 Application

- 4.5.5.2 Product

5 Markets - Competitive Benchmarking & Company Profiles

- 5.1 Deere & Company

- 5.1.1 Overview

- 5.1.2 Top Products/Product Portfolio

- 5.1.3 Top Competitors

- 5.1.4 Target Customers

- 5.1.5 Key Personal

- 5.1.6 Analyst View

- 5.1.7 Market Share, 2024

- 5.2 Kinze Manufacturing

- 5.2.1 Overview

- 5.2.2 Top Products/Product Portfolio

- 5.2.3 Top Competitors

- 5.2.4 Target Customers

- 5.2.5 Key Personal

- 5.2.6 Analyst View

- 5.2.7 Market Share, 2024

- 5.3 AGCO Corporation

- 5.3.1 Overview

- 5.3.2 Top Products/Product Portfolio

- 5.3.3 Top Competitors

- 5.3.4 Target Customers

- 5.3.5 Key Personal

- 5.3.6 Analyst View

- 5.3.7 Market Share, 2024

- 5.4 CNH Industrial N.V.

- 5.4.1 Overview

- 5.4.2 Top Products/Product Portfolio

- 5.4.3 Top Competitors

- 5.4.4 Target Customers

- 5.4.5 Key Personal

- 5.4.6 Analyst View

- 5.4.7 Market Share, 2024

- 5.5 Vaderstad Group

- 5.5.1 Overview

- 5.5.2 Top Products/Product Portfolio

- 5.5.3 Top Competitors

- 5.5.4 Target Customers

- 5.5.5 Key Personal

- 5.5.6 Analyst View

- 5.5.7 Market Share, 2024

- 5.6 HORSCH Maschinen GmbH

- 5.6.1 Overview

- 5.6.2 Top Products/Product Portfolio

- 5.6.3 Top Competitors

- 5.6.4 Target Customers

- 5.6.5 Key Personal

- 5.6.6 Analyst View

- 5.6.7 Market Share, 2024

- 5.7 Great Plains Manufacturing

- 5.7.1 Overview

- 5.7.2 Top Products/Product Portfolio

- 5.7.3 Top Competitors

- 5.7.4 Target Customers

- 5.7.5 Key Personal

- 5.7.6 Analyst View

- 5.7.7 Market Share, 2024

- 5.8 KUHN SAS

- 5.8.1 Overview

- 5.8.2 Top Products/Product Portfolio

- 5.8.3 Top Competitors

- 5.8.4 Target Customers

- 5.8.5 Key Personal

- 5.8.6 Analyst View

- 5.8.7 Market Share, 2024

- 5.9 Maschio Gaspardo S.p.A.

- 5.9.1 Overview

- 5.9.2 Top Products/Product Portfolio

- 5.9.3 Top Competitors

- 5.9.4 Target Customers

- 5.9.5 Key Personal

- 5.9.6 Analyst View

- 5.9.7 Market Share, 2024

- 5.1 Ag Leader Technology

- 5.10.1 Overview

- 5.10.2 Top Products/Product Portfolio

- 5.10.3 Top Competitors

- 5.10.4 Target Customers

- 5.10.5 Key Personal

- 5.10.6 Analyst View

- 5.10.7 Market Share, 2024

- 5.11 Hylio, Inc.

- 5.11.1 Overview

- 5.11.2 Top Products/Product Portfolio

- 5.11.3 Top Competitors

- 5.11.4 Target Customers

- 5.11.5 Key Personal

- 5.11.6 Analyst View

- 5.11.7 Market Share, 2024

- 5.12 Skyssed GmbH

- 5.12.1 Overview

- 5.12.2 Top Products/Product Portfolio

- 5.12.3 Top Competitors

- 5.12.4 Target Customers

- 5.12.5 Key Personal

- 5.12.6 Analyst View

- 5.12.7 Market Share, 2024

- 5.13 Yetter Manufacturing Co, Inc.

- 5.13.1 Overview

- 5.13.2 Top Products/Product Portfolio

- 5.13.3 Top Competitors

- 5.13.4 Target Customers

- 5.13.5 Key Personal

- 5.13.6 Analyst View

- 5.13.7 Market Share, 2024

- 5.14 Stara S/A

- 5.14.1 Overview

- 5.14.2 Top Products/Product Portfolio

- 5.14.3 Top Competitors

- 5.14.4 Target Customers

- 5.14.5 Key Personal

- 5.14.6 Analyst View

- 5.14.7 Market Share, 2024

- 5.15 Bourgault Industries Ltd.

- 5.15.1 Overview

- 5.15.2 Top Products/Product Portfolio

- 5.15.3 Top Competitors

- 5.15.4 Target Customers

- 5.15.5 Key Personal

- 5.15.6 Analyst View

- 5.15.7 Market Share, 224

6 Research Methodology

- 6.1 Data Sources

- 6.1.1 Primary Data Sources

- 6.1.2 Secondary Data Sources

- 6.1.3 Data Triangulation

- 6.2 Market Estimation and Forecast