|

|

市場調査レポート

商品コード

1800744

欧州のナトリウムイオン電池市場:用途別、製品タイプ別、フォームファクター別、システム/パックレベル電圧別、地域別 - 分析と予測(2025年~2035年)Europe Sodium-Ion Battery Market: Focus on Application, Product, and Country - Analysis and Forecast, 2025-2035 |

||||||

カスタマイズ可能

|

|||||||

| 欧州のナトリウムイオン電池市場:用途別、製品タイプ別、フォームファクター別、システム/パックレベル電圧別、地域別 - 分析と予測(2025年~2035年) |

|

出版日: 2025年08月30日

発行: BIS Research

ページ情報: 英文 99 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

欧州のナトリウムイオン電池の市場規模は、2024年の5,060万米ドルから2035年には14億9,040万米ドルに達し、予測期間の2025年~2035年のCAGRは38.24%になると予測されています。

欧州におけるナトリウムイオン電池の採用は、同地域が持続可能性、エネルギー安全保障を重視し、輸入リチウムやコバルトへの依存度を減らしていることが背景にあります。ナトリウムは豊富でコスト効率が高いため、これらの電池はグリッド規模の蓄電、再生可能エネルギー統合、手頃な価格のモビリティ用途に適しており、欧州のクリーンエネルギー移行目標に合致しています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2025年~2035年 |

| 2025年の評価 | 5,850万米ドル |

| 2035年の予測 | 14億9,040万米ドル |

| CAGR | 38.24% |

市場イントロダクション

ナトリウムイオン電池市場は、安全で手ごろな価格の環境に優しいエネルギー貯蔵オプションに対する需要の高まりにより、従来のリチウムイオン技術に代わる最も有望な選択肢のひとつになりつつあります。リチウムとは対照的に、ナトリウムは広く入手可能で、地理的に多様で、価格も手ごろであるため、不可欠で頻繁に輸入される原材料への依存度を下げる上で望ましい代替品となっています。このような利点から、ナトリウムイオン電池は、世界・サプライ・チェーンにおける価格安定とエネルギー安全保障のための重要なソリューションとして位置づけられています。

ナトリウムイオン電池は、グリッド規模のエネルギー貯蔵、再生可能エネルギーの統合、Eバイクや二輪車のような低コストのモビリティ・オプションなど、高エネルギー密度がそれほど重要でない用途に普及しています。正極材料、電解質、セル設計における最近の進歩は、その性能を向上させ、より長いサイクル寿命とより優れた効率を可能にし、リチウムイオン電池との商業的競合に近づいています。

政府と民間企業は、商業化を加速するため、研究、パイロット・スケール生産、産業パートナーシップへの投資を増やしています。エネルギー密度の低下や大規模製造能力の限界といった課題は残るもの、継続的な技術革新と支援的な政策枠組みが市場成長を促進すると予想されます。その結果、ナトリウムイオン電池市場は急速に進化し、クリーンエネルギー貯蔵と持続可能な電化に新たな機会を提供しています。

市場セグメンテーション

セグメンテーション1:用途別

- 自動車

- エレクトロニクス

- 大規模据置型エネルギー貯蔵

- 産業用

- その他

セグメント2:製品タイプ別

- 非水系ナトリウムイオン電池

- 水系ナトリウムイオン電池

- 固体ナトリウムイオン電池

セグメント3:フォームファクター別

- 角型

- 円筒形

- パウチ

セグメント4:システム/パックレベル電圧別

- 低電圧システム(12V-60V)

- 中電圧システム(60V~300V)

- 高電圧システム(300V以上)

セグメント5:地域別

- 欧州

欧州ナトリウムイオン電池市場動向と促進要因・課題

動向

- エネルギー貯蔵と電化における欧州のイニシアティブにより、リチウムイオンに代わるナトリウムイオン技術への研究開発投資が増加。

- 再生可能エネルギーの統合と送電網の安定性をサポートするための据置型エネルギー貯蔵システム(ESS)の採用が増加。

- 欧州の新興企業別ナトリウムイオン電池の早期商業化と世界企業との提携。

- 欧州、特に英国、フランス、ドイツにおけるパイロット生産施設の拡大。

- リチウムやコバルトに比べて持続可能で低コストかつ無害な原材料への注目。

- 低コストの電動モビリティ用途(e-bike、スクーター、小型EV)でのナトリウムイオンへの関心の高まり。

促進要因

- 豊富で地理的に多様なナトリウム資源により、輸入リチウムとコバルトへの依存度が低下。

- クリーンエネルギー、脱炭素化、エネルギー自給を推進するEUの強力な政策。

- 断続的な再生可能エネルギーとのバランスをとるためのグリッド規模の蓄電ソリューションに対する需要の高まり。

- リチウムイオンに比べ、生産コストと原料入手における優位性。

- EUのHorizonプログラムおよび各国の資金援助別、電池イノベーション・エコシステムへの投資の拡大。

課題

- リチウムイオンに比べてエネルギー密度が低いため、高性能EVへの採用が制限されます。

- コスト競争力を実現するためには、製造能力を拡大する必要があります。

- ナトリウムイオンの大規模サプライチェーンとリサイクルインフラが確立されていない状況。

- すでに商業化されている先進リチウムイオン化学物質(LFP、固体)との競合。

- サイクル寿命、極端な温度下での性能、安全性検証における技術的障壁。

- ナトリウムイオンはまだ初期の商業化段階であるため、商業的導入スケジュールの不確実性。

製品/イノベーション戦略:当レポートは、欧州のナトリウムイオン電池市場を製品タイプ、フォームファクター、システム/パックレベル電圧別に詳細に分析しています。非水系、水系、固体ナトリウムイオン電池など様々な電池タイプを網羅し、進化する化学的性質や技術的優位性についての洞察を提供しています。さらに、角型、円筒型、パウチ型といったフォームファクターの区分は、利害関係者がアプリケーション固有の要件に基づく設計動向を理解するのに役立ちます。電圧レベル分析(低電圧、中電圧、高電圧システム)は、多様な使用事例に対応するエネルギー貯蔵ソリューションを開発する企業にとって、さらに詳細な情報を提供します。当レポートは、製品チームがイノベーションの機会を特定し、性能、統合、コスト効率の要求を満たすために戦略を適応させるのに役立ちます。

成長/マーケティング戦略:欧州のナトリウムイオン電池市場は急速に進化しており、主要企業は生産能力の拡大、戦略的提携、試験的展開に取り組み、市場での地位を強化しています。当レポートは、こうした開発を追跡し、自動車、エレクトロニクス、大規模据置型エネルギー貯蔵、産業用などのアプリケーション分野で、主要企業がどのように参入または拡大しているかについての洞察を提供します。当レポートは、マーケティングチームが高成長分野を特定し、価値提案をエンドユーザーの期待に合致させ、地域力学と技術的準備に基づき的を絞った市場参入戦略を策定する際の支援となります。

競合戦略:徹底的な競合情勢を提供し、製品提供、技術革新のパイプライン、パートナーシップ、事業拡大計画に基づいて主要プレーヤーをプロファイリングしています。競合ベンチマーキングにより、読者は製品タイプや応用分野における各社の位置付けを評価することができます。

目次

エグゼクティブサマリー

第1章 市場:業界展望

- 市場力学

- 動向

- グリッドスケールエネルギー貯蔵プロジェクトの拡大

- 高エネルギーナトリウムイオン電池の産業化

- 規制機関/認証機関

- 政府プログラム

- 調査機関・大学別プログラム

- バリューチェーン分析

- ステークホルダー分析

- 市場力学

- スタートアップの情勢

- 特許分析

- コスト分析

- ナトリウムイオン電池リサイクルエコシステム

第2章 地域

- 地域サマリー

- 欧州

- 地域概要

- 市場成長促進要因

- 市場成長抑制要因

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- その他

第3章 市場-競合ベンチマーキングと企業プロファイル

- Faradion (Reliance Industries Ltd)

- AMTE Power plc(AGM Batteries Limited)

- TIAMAT

- Altris AB

第4章 調査手法

List of Figures

- Figure 1: Europe Sodium-Ion Battery Market (by Scenario), Million, 2024, 2028, and 2034

- Figure 2: Europe Sodium-Ion Battery Market, 2024-2035

- Figure 3: Market Snapshot, 2024

- Figure 4: Sodium-Ion Battery Market, $Million, 2024 and 2035

- Figure 5: Europe Sodium-Ion Battery Market (by Application), $Million, 2024, 2028, and 2035

- Figure 6: Europe Sodium-Ion Battery Market (by Application), MWh, 2024, 2028, and 2035

- Figure 7: Europe Sodium-Ion Battery Market (by Type), $Million, 2024, 2028, and 2035

- Figure 8: Europe Sodium-Ion Battery Market (by Type), MWh, 2024, 2028, and 2035

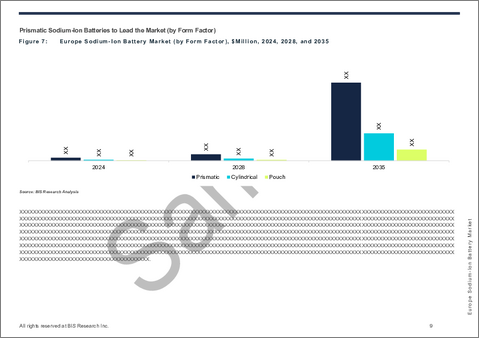

- Figure 9: Europe Sodium-Ion Battery Market (by Form Factor), $Million, 2024, 2028, and 2035

- Figure 10: Europe Sodium-Ion Battery Market (by Form Factor), MWh, 2024, 2028, and 2035

- Figure 11: Europe Sodium-Ion Battery Market (by System/Pack-Level Voltage), $Million, 2024, 2028, and 2035

- Figure 12: Europe Sodium-Ion Battery Market (by System/Pack-Level Voltage), MWh, 2024, 2028, and 2035

- Figure 13: Sodium-Ion Battery Market Segmentation

- Figure 14: Factors Influencing Sodium-Ion Battery Commercialization

- Figure 15: Projected Europe Stationary Battery Storage Capacity (by Scenario), 2020-2050

- Figure 16: Patent Analysis (by Year and Country), January 2020-May2025

- Figure 17: Sodium-Ion Battery: Cost Breakdown (by Component), 2024

- Figure 18: Sodium-Ion Battery: Battery Pack Energy Price (by Configuration), 2024

- Figure 19: Sodium-Ion Battery Recycling Ecosystem

- Figure 20: Germany Sodium-Ion Battery Market, $Million, 2024-2035

- Figure 21: France Sodium-Ion Battery Market, $Million, 2024-2035

- Figure 22: U.K. Sodium-Ion Battery Market, $Million, 2024-2035

- Figure 23: Italy Sodium-Ion Battery Market, $Million, 2024-2035

- Figure 24: Spain Sodium-Ion Battery Market, $Million, 2024-2035

- Figure 25: Rest-of-Europe Sodium-Ion Battery Market, $Million, 2024-2035

- Figure 26: Strategic Initiatives, January 2020-May 2025

- Figure 27: Data Triangulation

- Figure 28: Top-Down and Bottom-Up Approach

- Figure 29: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Competitive Landscape Snapshot

- Table 3: Large Scale Grid Storage Deployments

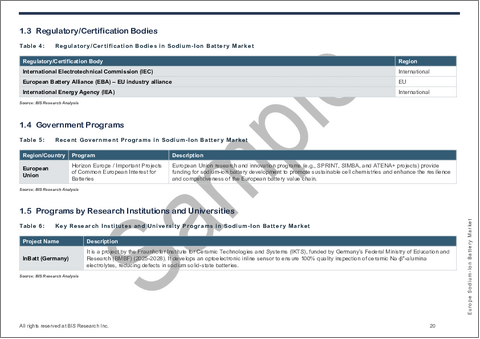

- Table 4: Regulatory/Certification Bodies in Sodium-Ion Battery Market

- Table 5: Recent Government Programs in Sodium-Ion Battery Market

- Table 6: Key Research Institutes and University Programs in Sodium-Ion Battery Market

- Table 7: Stakeholder Analysis in Sodium-Ion Battery Market

- Table 8: Key Fundings in Sodium-Ion Battery Market

- Table 9: Start-Ups and Investment Landscape

- Table 10: Sodium-Ion Battery Market (by Region), $/MWh, 2024-2035

- Table 11: Sodium-Ion Recycling Status (by Country)

- Table 12: Sodium-Ion Battery Market (by Region), $Million, 2024-2035

- Table 13: Sodium-Ion Battery Market (by Region), MWh, 2024-2035

- Table 14: Europe Sodium-Ion Battery Market (by Application), $Million, 2024-2035

- Table 15: Europe Sodium-Ion Battery Market (by Application), MWh, 2024-2035

- Table 16: Europe Sodium-Ion Battery Market (by Type), $Million, 2024-2035

- Table 17: Europe Sodium-Ion Battery Market (by Type), MWh, 2024-2035

- Table 18: Europe Sodium-Ion Battery Market (by Form Factor), $Million, 2024-2035

- Table 19: Europe Sodium-Ion Battery Market (by Form Factor), MWh, 2024-2035

- Table 20: Europe Sodium-Ion Battery Market (by System/Pack-Level Voltage), $Million, 2024-2035

- Table 21: Europe Sodium-Ion Battery Market (by System/Pack-Level Voltage), MWh, 2024-2035

- Table 22: Germany Sodium-Ion Battery Market (by Application), $Million, 2024-2035

- Table 23: Germany Sodium-Ion Battery Market (by Application), MWh, 2024-2035

- Table 24: Germany Sodium-Ion Battery Market (by Type), $Million, 2024-2035

- Table 25: Germany Sodium-Ion Battery Market (by Type), MWh, 2024-2035

- Table 26: Germany Sodium-Ion Battery Market (by Form Factor), $Million, 2024-2035

- Table 27: Germany Sodium-Ion Battery Market (by Form Factor), MWh, 2024-2035

- Table 28: Germany Sodium-Ion Battery Market (by System/Pack-Level Voltage), $Million, 2024-2035

- Table 29: Germany Sodium-Ion Battery Market (by System/Pack-Level Voltage), MWh, 2024-2035

- Table 30: France Sodium-Ion Battery Market (by Application), $Million, 2024-2035

- Table 31: France Sodium-Ion Battery Market (by Application), MWh, 2024-2035

- Table 32: France Sodium-Ion Battery Market (by Type), $Million, 2024-2035

- Table 33: France Sodium-Ion Battery Market (by Type), MWh, 2024-2035

- Table 34: France Sodium-Ion Battery Market (by Form Factor), $Million, 2024-2035

- Table 35: France Sodium-Ion Battery Market (by Form Factor), MWh, 2024-2035

- Table 36: France Sodium-Ion Battery Market (by System/Pack-Level Voltage), $Million, 2024-2035

- Table 37: France Sodium-Ion Battery Market (by System/Pack-Level Voltage), MWh, 2024-2035

- Table 38: U.K. Sodium-Ion Battery Market (by Application), $Million, 2024-2035

- Table 39: U.K. Sodium-Ion Battery Market (by Application), MWh, 2024-2035

- Table 40: U.K. Sodium-Ion Battery Market (by Type), $Million, 2024-2035

- Table 41: U.K. Sodium-Ion Battery Market (by Type), MWh, 2024-2035

- Table 42: U.K. Sodium-Ion Battery Market (by Form Factor), $Million, 2024-2035

- Table 43: U.K. Sodium-Ion Battery Market (by Form Factor), MWh, 2024-2035

- Table 44: U.K. Sodium-Ion Battery Market (by System/Pack-Level Voltage), $Million, 2024-2035

- Table 45: U.K. Sodium-Ion Battery Market (by System/Pack-Level Voltage), MWh, 2024-2035

- Table 46: Italy Sodium-Ion Battery Market (by Application), $Million, 2024-2035

- Table 47: Italy Sodium-Ion Battery Market (by Application), MWh, 2024-2035

- Table 48: Italy Sodium-Ion Battery Market (by Type), $Million, 2024-2035

- Table 49: Italy Sodium-Ion Battery Market (by Type), MWh, 2024-2035

- Table 50: Italy Sodium-Ion Battery Market (by Form Factor), $Million, 2024-2035

- Table 51: Italy Sodium-Ion Battery Market (by Form Factor), MWh, 2024-2035

- Table 52: Italy Sodium-Ion Battery Market (by System/Pack-Level Voltage), $Million, 2024-2035

- Table 53: Italy Sodium-Ion Battery Market (by System/Pack-Level Voltage), MWh, 2024-2035

- Table 54: Spain Sodium-Ion Battery Market (by Application), $Million, 2024-2035

- Table 55: Spain Sodium-Ion Battery Market (by Application), MWh, 2024-2035

- Table 56: Spain Sodium-Ion Battery Market (by Type), $Million, 2024-2035

- Table 57: Spain Sodium-Ion Battery Market (by Type), MWh, 2024-2035

- Table 58: Spain Sodium-Ion Battery Market (by Form Factor), $Million, 2024-2035

- Table 59: Spain Sodium-Ion Battery Market (by Form Factor), MWh, 2024-2035

- Table 60: Spain Sodium-Ion Battery Market (by System/Pack-Level Voltage), $Million, 2024-2035

- Table 61: Spain Sodium-Ion Battery Market (by System/Pack-Level Voltage), MWh, 2024-2035

- Table 62: Rest-of-the-Europe Sodium-Ion Battery Market (by Application), $Million, 2024-2035

- Table 63: Rest-of-the-Europe Sodium-Ion Battery Market (by Application), MWh, 2024-2035

- Table 64: Rest-of-the-Europe Sodium-Ion Battery Market (by Type), $Million, 2024-2035

- Table 65: Rest-of-the-Europe Sodium-Ion Battery Market (by Type), MWh, 2024-2035

- Table 66: Rest-of-the-Europe Sodium-Ion Battery Market (by Form Factor), $Million, 2024-2035

- Table 67: Rest-of-the-Europe Sodium-Ion Battery Market (by Form Factor), MWh, 2024-2035

- Table 68: Rest-of-the-Europe Sodium-Ion Battery Market (by System/Pack-Level Voltage), $Million, 2024-2035

- Table 69: Rest-of-the-Europe Sodium-Ion Battery Market (by System/Pack-Level Voltage), MWh, 2024-2035

This report can be delivered in 2 working days.

Introduction to Europe Sodium-Ion Battery Market

The Europe sodium-ion battery market is projected to reach $1,490.4 million by 2035 from $50.6 million in 2024, growing at a CAGR of 38.24% during the forecast period 2025-2035. The adoption of sodium-ion batteries in Europe is driven by the region's emphasis on sustainability, energy security, and reduced reliance on imported lithium and cobalt. With sodium being abundant and cost-effective, these batteries are well-suited for grid-scale storage, renewable energy integration, and affordable mobility applications, aligning with Europe's clean energy transition goals.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2025 - 2035 |

| 2025 Evaluation | $58.5 Million |

| 2035 Forecast | $1,490.4 Million |

| CAGR | 38.24% |

Market Introduction

The market for sodium-ion batteries is becoming one of the most promising substitutes for traditional lithium-ion technology due to the increasing demand for safe, affordable, and environmentally friendly energy storage options. In contrast to lithium, sodium is widely accessible, geographically diversified, and reasonably priced, which makes it a desirable alternative for lowering reliance on essential and frequently imported raw materials. Because of this benefit, sodium-ion batteries are positioned as a crucial solution for price stability and energy security in global supply chains.

Sodium-ion batteries are becoming more popular for uses where high energy density is not as important, like grid-scale energy storage, renewable energy integration, and low-cost mobility options like e-bikes and two-wheelers. Recent advancements in cathode materials, electrolytes, and cell designs are improving their performance, enabling longer cycle life and better efficiency, bringing them closer to commercial competitiveness with lithium-ion batteries.

Governments and private sector players are increasingly investing in research, pilot-scale production, and industrial partnerships to accelerate commercialization. While challenges such as lower energy density and limited large-scale manufacturing capacity remain, ongoing innovation and supportive policy frameworks are expected to drive market growth. As a result, the sodium-ion battery market is evolving rapidly, offering new opportunities for clean energy storage and sustainable electrification.

Market Segmentation

Segmentation 1: by Application

- Automotive

- Electronics

- Large Scale Stationary Energy Storage

- Industrial

- Others

Segmentation 2: by Product Type

- Non-Aqueous Sodium-Ion Batteries

- Aqueous Sodium-Ion Batteries

- Solid State Sodium-Ion Batteries

Segmentation 3: by Form Factor

- Prismatic

- Cylindrical

- Pouch

Segmentation 4: by System/Pack-Level Voltage

- Low Voltage System (12V-60V)

- Medium Voltage System (60V-300V)

- High Voltage System (>300V)

Segmentation 5: by Region

- Europe

Europe Sodium-Ion Battery Market Trends, Drivers and Challenges

Trends

- Growing R&D investment in sodium-ion technology as an alternative to lithium-ion, driven by European initiatives in energy storage and electrification.

- Increasing adoption for stationary energy storage systems (ESS) to support renewable integration and grid stability.

- Early commercialization of sodium-ion batteries by European startups and partnerships with global players.

- Expansion of pilot production facilities in Europe, particularly in the UK, France, and Germany.

- Focus on sustainable, low-cost, and non-toxic raw materials compared to lithium and cobalt.

- Rising interest in sodium-ion for low-cost electric mobility applications (e-bikes, scooters, small EVs).

Drivers

- Abundant and geographically diverse sodium resources, reducing reliance on imported lithium and cobalt.

- Strong EU policies promoting clean energy, decarbonization, and energy independence.

- Increasing demand for grid-scale storage solutions to balance intermittent renewable energy.

- Cost advantages in production and raw material availability compared to lithium-ion.

- Growing investment in battery innovation ecosystems, supported by EU Horizon programs and national funding.

Challenges

- Lower energy density compared to lithium-ion, limiting adoption in high-performance EVs.

- Need for scaling up manufacturing capacity to achieve cost competitiveness.

- Lack of established large-scale supply chains and recycling infrastructure for sodium-ion.

- Competition from advanced lithium-ion chemistries (LFP, solid-state) that are already commercialized.

- Technical barriers in cycle life, performance under extreme temperatures, and safety validation.

- Uncertainty in commercial adoption timelines, as sodium-ion is still in early commercialization stage.

How can this report add value to an organization?

Product/Innovation Strategy: This report provides a detailed analysis of the Europe sodium-ion battery market segmented by product type, form factor, and system/pack-level voltage. It covers various battery types, including non-aqueous, aqueous, and solid-state sodium-ion batteries, offering insights into their evolving chemistries and technical advantages. Additionally, the form factor segmentation, i.e., prismatic, cylindrical, and pouch, helps stakeholders understand design trends based on application-specific requirements. The voltage-level analysis (low, medium, and high voltage systems) adds further granularity for organizations developing energy storage solutions across diverse use cases. The report helps product teams identify innovation opportunities and adapt their strategies to meet performance, integration, and cost-efficiency demands.

Growth/Marketing Strategy: The Europe sodium-ion battery market has been rapidly evolving, with major players engaging in capacity expansion, strategic alliances, and pilot deployments to strengthen their market position. This report tracks those developments and provides insights into how key companies are entering or expanding in application segments such as automotive, electronics, large-scale stationary energy storage, industrial use, and others. It supports marketing teams in identifying high-growth sectors, aligning value propositions with end-user expectations, and crafting targeted go-to-market strategies based on regional dynamics and technological readiness.

Competitive Strategy: A thorough competitive landscape is provided, profiling leading players based on their product offerings, innovation pipelines, partnerships, and expansion plans. Competitive benchmarking enables readers to evaluate how companies are positioned across product types and application areas.

Table of Contents

Executive Summary

Scope and Definition

1 Market: Industry Outlook

- 1.1 Market Dynamics

- 1.1.1 Trends, Drivers, Challenges, and Opportunities: Current and Future Impact Assessment

- 1.2 Trends

- 1.2.1 Expansion of Grid-Scale Energy Storage Projects

- 1.2.2 Industrializing High-Energy Sodium-Ion Batteries

- 1.3 Regulatory/Certification Bodies

- 1.4 Government Programs

- 1.5 Programs by Research Institutions and Universities

- 1.6 Value Chain Analysis

- 1.7 Stakeholder Analysis

- 1.8 Market Dynamics

- 1.8.1 Market Drivers

- 1.8.1.1 Push for Lithium Diversification and Supply Security

- 1.8.1.2 Government Policy and Funding Support

- 1.8.1.3 Rising Momentum for Sodium-Ion Battery Commercialization

- 1.8.2 Market Challenges

- 1.8.2.1 Lower Energy Density and Cycle Life Limitations

- 1.8.2.2 Scaling Challenges and Cost Realities in Sodium-Ion Battery Commercialization

- 1.8.3 Business Strategies

- 1.8.3.1 Product Developments

- 1.8.3.2 Market Developments

- 1.8.4 Corporate Strategies

- 1.8.4.1 Partnerships and Joint Ventures

- 1.8.5 Market Opportunities

- 1.8.5.1 Hybrid Grid Energy Storage Systems

- 1.8.5.2 Growth Potential for Sodium-Ion Technology in Affordable Electric Mobility

- 1.8.1 Market Drivers

- 1.9 Start-Ups Landscape

- 1.9.1 Key Start-Ups in the Ecosystem

- 1.1 Patent Analysis

- 1.10.1 Patent Filing Trend (by Number of Patents, by Year and by Country)

- 1.11 Cost Analysis

- 1.11.1 Cost Breakdown (by Component)

- 1.11.2 Battery Pack Energy Price (by Configuration)

- 1.11.3 Average Pricing Analysis: Global and Regional Level, Sodium-Ion Battery

- 1.12 Sodium-Ion Battery Recycling Ecosystem

2 Region

- 2.1 Regional Summary

- 2.2 Europe

- 2.2.1 Regional Overview

- 2.2.2 Driving Factors for Market Growth

- 2.2.3 Factors Challenging the Market

- 2.2.3.1 Application

- 2.2.3.2 Product

- 2.2.4 Germany

- 2.2.4.1 Application

- 2.2.4.2 Product

- 2.2.5 France

- 2.2.5.1 Application

- 2.2.5.2 Product

- 2.2.6 U.K.

- 2.2.6.1 Application

- 2.2.6.2 Product

- 2.2.7 Italy

- 2.2.7.1 Application

- 2.2.7.2 Product

- 2.2.8 Spain

- 2.2.8.1 Application

- 2.2.8.2 Product

- 2.2.9 Rest-of-Europe

- 2.2.9.1 Application

- 2.2.9.2 Product

3 Markets - Competitive Benchmarking & Company Profiles

- 3.1 Faradion (Reliance Industries Ltd)

- 3.1.1 Overview

- 3.1.2 Top Products/Product Portfolio

- 3.1.3 Top Competitors

- 3.1.4 Target Customers

- 3.1.5 Key Personal

- 3.1.6 Analyst View

- 3.1.7 Market Share, 2024

- 3.2 AMTE Power plc (AGM Batteries Limited)

- 3.2.1 Overview

- 3.2.2 Top Products/Product Portfolio

- 3.2.3 Top Competitors

- 3.2.4 Target Customers

- 3.2.5 Key Personal

- 3.2.6 Analyst View

- 3.2.7 Market Share, 2024

- 3.3 TIAMAT

- 3.3.1 Overview

- 3.3.2 Top Products/Product Portfolio

- 3.3.3 Top Competitors

- 3.3.4 Target Customers

- 3.3.5 Key Personal

- 3.3.6 Analyst View

- 3.3.7 Market Share, 2024

- 3.4 Altris AB

- 3.4.1 Overview

- 3.4.2 Top Products/Product Portfolio

- 3.4.3 Top Competitors

- 3.4.4 Target Customers

- 3.4.5 Key Personal

- 3.4.6 Analyst View

- 3.4.7 Market Share, 2024

4 Research Methodology

- 4.1 Data Sources

- 4.1.1 Primary Data Sources

- 4.1.2 Secondary Data Sources

- 4.1.3 Data Triangulation

- 4.2 Market Estimation and Forecast