|

|

市場調査レポート

商品コード

1795082

バッテリースワップ充電インフラ市場- 世界および地域別分析:車両タイプ別、サービスモデル別、バッテリータイプ別、スワップメカニズム別、地域別 - 分析と予測(2025年~2034年)Battery Swapping Charging Infrastructure Market - A Global and Regional Analysis: Focus on Vehicle Type, Service Model, Battery Type, Swap Mechanism, and Country Analysis - Analysis and Forecast, 2025-2034 |

||||||

カスタマイズ可能

|

|||||||

| バッテリースワップ充電インフラ市場- 世界および地域別分析:車両タイプ別、サービスモデル別、バッテリータイプ別、スワップメカニズム別、地域別 - 分析と予測(2025年~2034年) |

|

出版日: 2025年08月21日

発行: BIS Research

ページ情報: 英文 150 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

バッテリースワッピング充電インフラ市場は、電動モビリティと持続可能な都市交通へのシフトが加速する中で重要な役割を果たしています。

バッテリー技術、IoT、AI、クラウドコンピューティングの進歩により、電気自動車の普及が世界的に進むにつれ、高速でスケーラブルな、ユーザー中心のエネルギー補給ソリューションに対する需要がますます重要になっています。バッテリー交換インフラは、枯渇したバッテリーとフル充電されたバッテリーの迅速な交換を可能にすることで、長い充電時間や航続距離不安などの主要課題に対処し、車両のダウンタイムを大幅に削減し、全体的なユーザー体験を向上させます。

この業界は継続的な技術革新を特徴としており、大手企業はモジュール式バッテリー設計、自動スワッピング機構、統合型BaaS(Battery-as-a-Service)プラットフォームを開発しています。これらの技術的進歩には、リアルタイムのIoT接続、AIを活用したステーション管理、シームレスなバッテリー監視、スワップ・スケジューリング、支払い処理を容易にするモバイルアプリケーションが組み込まれています。スマートシティエコシステムや再生可能エネルギー・グリッドにバッテリー交換ステーションを統合することで、エネルギー貯蔵やグリッド・バランシング機能を実現し、運用効率と持続可能性をさらに高めることができます。これらすべてが、バッテリー交換充電インフラ市場の成長を促進すると予想されます。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2025年~2034年 |

| 2025年の評価 | 14億6,000万米ドル |

| 2034年の予測 | 227億2,000万米ドル |

| CAGR | 35.66% |

都市型車両、ラスト・マイル・デリバリー・サービス、商用電気自動車の拡大に伴い、柔軟で相互運用可能なバッテリー交換ソリューションの必要性が高まっています。この動向は、OEM、エネルギー・プロバイダー、政府間の標準化努力と戦略的パートナーシップを促進しています。バッテリースワッピング充電インフラ市場は、EVの大量導入をサポートし、総所有コストを削減し、世界中で弾力性のある電動モビリティインフラを育成するために不可欠な、AI対応、自動化、拡張可能なスワッピングネットワークに向けて進化しています。

バッテリースワッピング充電インフラ市場のライフサイクルステージ

バッテリースワッピング充電インフラ市場は現在、成長期と初期成熟期にあり、技術は技術成熟度レベル(TRLs)6~9まで進んでいます。焦点は、モジュール式バッテリー交換ステーションの拡張、AI主導の予知保全の統合、シームレスなユーザー体験のためのIoT対応リアルタイム・バッテリーおよびステーション監視の強化です。各社は、パイロット・プロジェクトや限定的な展開から本格的な商業展開へと移行しており、多様なEVモデル間の相互運用性、システムの信頼性、都市とフリートベースの両方の環境における迅速な交換速度を優先しています。

バッテリー交換インフラがより広範な電動モビリティ・エコシステムやスマートシティの枠組みに統合されるためには、EVメーカー、バッテリー・サプライヤー、インフラ開発者、政策立案者の協力が不可欠です。バッテリーの標準化、安全性、エネルギーグリッド統合に関する規制の枠組みは、バッテリースワッピング充電インフラ市場の普及を支援し、イノベーションを促進するために進化しています。

EVの普及拡大、都市部での車両利用拡大、迅速・便利・柔軟なエネルギー補給ソリューションに対する需要の高まりを背景に、商業展開が世界的に加速しています。こうした市場の需要拡大に対応するため、各社は自動化、AIを活用したステーション管理、再生可能エネルギーやスマートグリッドとの統合に重点を置いた研究開発に多額の投資を行っています。市場が成熟するにつれて、バッテリー交換インフラは持続可能な都市モビリティの重要な構成要素となり、航続距離不安を軽減し、総所有コストを削減し、世界中で電気自動車の全体的な体験を向上させます。

バッテリースワッピング充電インフラ市場のセグメンテーション:

セグメンテーション1:車両タイプ別

- 二輪車

- 三輪車

- 乗用車

- 商用車

セグメント2:サービスモデル別

- サブスクリプション制

- 従量課金制

セグメント3:バッテリータイプ別

- リチウムイオン電池

- 固体電池

- ウルトラキャパシタ

セグメント4:スワップメカニズム別

- 無人搬送車(AGV)ベース

- ロボットアームベース

セグメント5:地域別

- 北米- 米国、カナダ、メキシコ

- 欧州- ドイツ、フランス、イタリア、スペイン、英国、その他

- アジア太平洋- 中国、日本、韓国、インド、その他

- その他の地域- 南米、中東・アフリカ

需要- 促進要因と限界

バッテリースワップ充電インフラ市場の需要促進要因は以下の通りです。

- 電気自動車(EV)と自律走行車の成長

- バッテリー・アズ・ア・サービス(BaaS)モデルの採用

- 再生可能エネルギーおよびスマートグリッドとの統合

バッテリースワッピング充電インフラ市場は、以下の課題によっていくつかの抑制要因にも直面すると予想されます。

- 急速充電技術との競合

- 高い初期資本支出

- バッテリーのライフサイクル管理

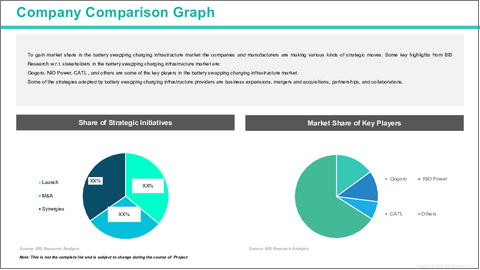

バッテリースワッピング充電インフラ市場の主要参入企業と競合の概要

バッテリースワッピング充電インフラ市場は、既存のバッテリーメーカー、EV市場情勢、革新的な技術を持つ新興企業の組み合わせにより、激しい競合情勢が形成されています。Gogoro、NIO Power、CATLなどの大手世界企業がこの分野をリードしており、EV充電のダウンタイムを大幅に削減し、ユーザーの利便性を向上させる、広範なバッテリー交換ネットワーク、モジュール式バッテリー設計、統合型BaaS(Battery-as-a-Service)プラットフォームを提供しています。技術面では、AmpleやSUN Mobilityといった企業が、都市部のフリート、ラストマイル・デリバリー、商用車向けにスケーラブルでモジュール式のスワッピング技術を進めており、北米やインドなどの新興市場での採用を促進しています。

Leo Motors、Battery Smart、Selex Motorsなど他の主要企業は、技術対応のスワッピングステーションや、電気二輪車や三輪車をターゲットにした費用対効果の高い従量課金モデルを提供することで、地域のイノベーションに注力し、都市部の通勤者のアクセシビリティを高めています。競争は、OEM、エネルギー供給会社、政府との戦略的パートナーシップによってさらに活性化し、エコシステムの統合とインフラ拡大に不可欠な政策支援が促進されます。研究開発への継続的な投資は、自動スワッピング機構、AIを活用したステーション管理、運用効率と相互運用性を高める標準化されたバッテリーパックなどのイノベーションを推進し、バッテリースワッピング充電インフラ市場の成長を促進しています。

各社が柔軟なビジネスモデル、迅速なバッテリー交換技術、広範なスワッピングネットワークで革新に努める中、市場は接続されたユーザー中心のEVエネルギー・エコシステムに向けて急速に進化しています。この進化は、航続距離不安への対応、総所有コストの削減、世界の電気自動車普及の加速に不可欠であり、バッテリー交換充電インフラ市場の成長を支えています。

バッテリースワッピング充電インフラ市場で確立されたいくつかの著名な名前は、次のとおりです:

- Ample

- Gogoro

- NIO Power

- Contemporary Amperex Technology Co. Limited

- SUN Mobility

- Battery Smart

- Selex Motors

- Spiro

- Oyika

- VoltUp

- Leo Motors

- Sunrack Energy

- Leap Motor

目次

エグゼクティブサマリー

第1章 市場:業界展望

- 動向:現状と将来への影響評価

- 市場力学の概要

- 市場促進要因

- 市場抑制要因

- 市場機会

- 規制および政策影響分析

- 特許分析

- 世界価格分析

第2章 バッテリー交換充電インフラ市場(車両タイプ別)

- 二輪車

- 三輪車

- 乗用車

- 商用車

第3章 バッテリー交換充電インフラ市場(サービスモデル別)

- サブスクリプション制

- 従量課金制

第4章 バッテリー交換充電インフラ市場(バッテリータイプ別)

- リチウムイオン電池

- 全固体電池

- ウルトラキャパシタ

第5章 バッテリー交換充電インフラ市場(スワップメカニズム別)

- 自動誘導車両(AGV)ベース

- ロボットアームベース

第6章 バッテリー交換充電インフラ市場(地域別)

- バッテリー交換充電インフラ市場(地域別)

- 北米

- 欧州

- アジア太平洋

- その他の地域

第7章 市場-競合ベンチマーキングと企業プロファイル

- 今後の見通し

- 地理的評価

- 企業プロファイル

- Ample

- Gogoro

- NIO Power

- Contemporary Amperex Technology Co. Limited

- SUN Mobility

- Battery Smart

- Selex Motors

- Spiro

- Oyika

- VoltUp

- Leo Motors

- Sunrack Energy

- Leap Motor

- その他の主要企業

第8章 調査手法

List of Figures

- Figure 1: Battery Swapping Charging Infrastructure Market (by Scenario), $Billion, 2025, 2028, and 2034

- Figure 2: Battery Swapping Charging Infrastructure Market (by Region), $Billion, 2024, 2027, and 2034

- Figure 3: Battery Swapping Charging Infrastructure Market (by Vehicle Type), $Billion, 2024, 2027, and 2034

- Figure 4: Battery Swapping Charging Infrastructure Market (by Service Model), $Billion, 2024, 2027, and 2034

- Figure 5: Battery Swapping Charging Infrastructure Market (by Battery Type), $Billion, 2024, 2027, and 2034

- Figure 6: Battery Swapping Charging Infrastructure Market (by Swap Mechanism), $Billion, 2024, 2027, and 2034

- Figure 7: Competitive Landscape Snapshot

- Figure 8: Supply Chain Analysis

- Figure 9: Value Chain Analysis

- Figure 10: Patent Analysis (by Country), January 2021-April 2025

- Figure 11: Patent Analysis (by Company), January 2021-April 2025

- Figure 12: Impact Analysis of Market Navigating Factors, 2024-2034

- Figure 13: U.S. Battery Swapping Charging Infrastructure Market, $Billion, 2024-2034

- Figure 14: Canada Battery Swapping Charging Infrastructure Market, $Billion, 2024-2034

- Figure 15: Mexico Battery Swapping Charging Infrastructure Market, $Billion, 2024-2034

- Figure 16: Germany Battery Swapping Charging Infrastructure Market, $Billion, 2024-2034

- Figure 17: France Battery Swapping Charging Infrastructure Market, $Billion, 2024-2034

- Figure 18: Italy Battery Swapping Charging Infrastructure Market, $Billion, 2024-2034

- Figure 19: Spain Battery Swapping Charging Infrastructure Market, $Billion, 2024-2034

- Figure 20: U.K. Battery Swapping Charging Infrastructure Market, $Billion, 2024-2034

- Figure 21: Rest-of-Europe Battery Swapping Charging Infrastructure Market, $Billion, 2024-2034

- Figure 22: China Battery Swapping Charging Infrastructure Market, $Billion, 2024-2034

- Figure 23: Japan Battery Swapping Charging Infrastructure Market, $Billion, 2024-2034

- Figure 24: India Battery Swapping Charging Infrastructure Market, $Billion, 2024-2034

- Figure 25: South Korea Battery Swapping Charging Infrastructure Market, $Billion, 2024-2034

- Figure 26: Rest-of-Asia-Pacific Battery Swapping Charging Infrastructure Market, $Billion, 2024-2034

- Figure 27: South America Battery Swapping Charging Infrastructure Market, $Billion, 2024-2034

- Figure 28: Middle East and Africa Battery Swapping Charging Infrastructure Market, $Billion, 2024-2034

- Figure 29: Strategic Initiatives (by Company), 2021-2025

- Figure 30: Share of Strategic Initiatives, 2021-2025

- Figure 31: Data Triangulation

- Figure 32: Top-Down and Bottom-Up Approach

- Figure 33: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Opportunities across Region

- Table 3: Trends Overview

- Table 4: Battery Swapping Charging Infrastructure Market (by Region), $Billion, 2024-2034

- Table 5: North America Battery Swapping Charging Infrastructure Market (by Vehicle Type), $Billion, 2024-2034

- Table 6: North America Battery Swapping Charging Infrastructure Market (by Service Model), $Billion, 2024-2034

- Table 7: North America Battery Swapping Charging Infrastructure Market (by Battery Type), $Billion, 2024-2034

- Table 8: North America Battery Swapping Charging Infrastructure Market (by Swap Mechanism), $Billion, 2024-2034

- Table 9: U.S. Battery Swapping Charging Infrastructure Market (by Vehicle Type), $Billion, 2024-2034

- Table 10: U.S. Battery Swapping Charging Infrastructure Market (by Service Model), $Billion, 2024-2034

- Table 11: U.S. Battery Swapping Charging Infrastructure Market (by Battery Type), $Billion, 2024-2034

- Table 12: U.S. Battery Swapping Charging Infrastructure Market (by Swap Mechanism), $Billion, 2024-2034

- Table 13: Canada Battery Swapping Charging Infrastructure Market (by Vehicle Type), $Billion, 2024-2034

- Table 14: Canada Battery Swapping Charging Infrastructure Market (by Service Model), $Billion, 2024-2034

- Table 15: Canada Battery Swapping Charging Infrastructure Market (by Battery Type), $Billion, 2024-2034

- Table 16: Canada Battery Swapping Charging Infrastructure Market (by Swap Mechanism), $Billion, 2024-2034

- Table 17: Mexico Battery Swapping Charging Infrastructure Market (by Vehicle Type), $Billion, 2024-2034

- Table 18: Mexico Battery Swapping Charging Infrastructure Market (by Service Model), $Billion, 2024-2034

- Table 19: Mexico Battery Swapping Charging Infrastructure Market (by Battery Type), $Billion, 2024-2034

- Table 20: Mexico Battery Swapping Charging Infrastructure Market (by Swap Mechanism), $Billion, 2024-2034

- Table 21: Europe Battery Swapping Charging Infrastructure Market (by Vehicle Type), $Billion, 2024-2034

- Table 22: Europe Battery Swapping Charging Infrastructure Market (by Service Model), $Billion, 2024-2034

- Table 23: Europe Battery Swapping Charging Infrastructure Market (by Battery Type), $Billion, 2024-2034

- Table 24: Europe Battery Swapping Charging Infrastructure Market (by Swap Mechanism), $Billion, 2024-2034

- Table 25: Germany Battery Swapping Charging Infrastructure Market (by Vehicle Type), $Billion, 2024-2034

- Table 26: Germany Battery Swapping Charging Infrastructure Market (by Service Model), $Billion, 2024-2034

- Table 27: Germany Battery Swapping Charging Infrastructure Market (by Battery Type), $Billion, 2024-2034

- Table 28: Germany Battery Swapping Charging Infrastructure Market (by Swap Mechanism), $Billion, 2024-2034

- Table 29: France Battery Swapping Charging Infrastructure Market (by Vehicle Type), $Billion, 2024-2034

- Table 30: France Battery Swapping Charging Infrastructure Market (by Service Model), $Billion, 2024-2034

- Table 31: France Battery Swapping Charging Infrastructure Market (by Battery Type), $Billion, 2024-2034

- Table 32: France Battery Swapping Charging Infrastructure Market (by Swap Mechanism), $Billion, 2024-2034

- Table 33: Italy Battery Swapping Charging Infrastructure Market (by Vehicle Type), $Billion, 2024-2034

- Table 34: Italy Battery Swapping Charging Infrastructure Market (by Service Model), $Billion, 2024-2034

- Table 35: Italy Battery Swapping Charging Infrastructure Market (by Battery Type), $Billion, 2024-2034

- Table 36: Italy Battery Swapping Charging Infrastructure Market (by Swap Mechanism), $Billion, 2024-2034

- Table 37: Spain Battery Swapping Charging Infrastructure Market (by Vehicle Type), $Billion, 2024-2034

- Table 38: Spain Battery Swapping Charging Infrastructure Market (by Service Model), $Billion, 2024-2034

- Table 39: Spain Battery Swapping Charging Infrastructure Market (by Battery Type), $Billion, 2024-2034

- Table 40: Spain Battery Swapping Charging Infrastructure Market (by Swap Mechanism), $Billion, 2024-2034

- Table 41: U.K. Battery Swapping Charging Infrastructure Market (by Vehicle Type), $Billion, 2024-2034

- Table 42: U.K. Battery Swapping Charging Infrastructure Market (by Service Model), $Billion, 2024-2034

- Table 43: U.K. Battery Swapping Charging Infrastructure Market (by Battery Type), $Billion, 2024-2034

- Table 44: U.K. Battery Swapping Charging Infrastructure Market (by Swap Mechanism), $Billion, 2024-2034

- Table 45: Rest-of-Europe Battery Swapping Charging Infrastructure Market (by Vehicle Type), $Billion, 2024-2034

- Table 46: Rest-of-Europe Battery Swapping Charging Infrastructure Market (by Service Model), $Billion, 2024-2034

- Table 47: Rest-of-Europe Battery Swapping Charging Infrastructure Market (by Battery Type), $Billion, 2024-2034

- Table 48: Rest-of-Europe Battery Swapping Charging Infrastructure Market (by Swap Mechanism), $Billion, 2024-2034

- Table 49: China Battery Swapping Charging Infrastructure Market (by Vehicle Type), $Billion, 2024-2034

- Table 50: China Battery Swapping Charging Infrastructure Market (by Service Model), $Billion, 2024-2034

- Table 51: China Battery Swapping Charging Infrastructure Market (by Battery Type), $Billion, 2024-2034

- Table 52: China Battery Swapping Charging Infrastructure Market (by Swap Mechanism), $Billion, 2024-2034

- Table 53: Japan Battery Swapping Charging Infrastructure Market (by Vehicle Type), $Billion, 2024-2034

- Table 54: Japan Battery Swapping Charging Infrastructure Market (by Service Model), $Billion, 2024-2034

- Table 55: Japan Battery Swapping Charging Infrastructure Market (by Battery Type), $Billion, 2024-2034

- Table 56: Japan Battery Swapping Charging Infrastructure Market (by Swap Mechanism), $Billion, 2024-2034

- Table 57: India Battery Swapping Charging Infrastructure Market (by Vehicle Type), $Billion, 2024-2034

- Table 58: India Battery Swapping Charging Infrastructure Market (by Service Model), $Billion, 2024-2034

- Table 59: India Battery Swapping Charging Infrastructure Market (by Battery Type), $Billion, 2024-2034

- Table 60: India Battery Swapping Charging Infrastructure Market (by Swap Mechanism), $Billion, 2024-2034

- Table 61: South Korea Battery Swapping Charging Infrastructure Market (by Vehicle Type), $Billion, 2024-2034

- Table 62: South Korea Battery Swapping Charging Infrastructure Market (by Service Model), $Billion, 2024-2034

- Table 63: South Korea Battery Swapping Charging Infrastructure Market (by Battery Type), $Billion, 2024-2034

- Table 64: South Korea Battery Swapping Charging Infrastructure Market (by Swap Mechanism), $Billion, 2024-2034

- Table 65: Rest-of-Asia-Pacific Battery Swapping Charging Infrastructure Market (by Vehicle Type), $Billion, 2024-2034

- Table 66: Rest-of-Asia-Pacific Battery Swapping Charging Infrastructure Market (by Service Model), $Billion, 2024-2034

- Table 67: Rest-of-Asia-Pacific Battery Swapping Charging Infrastructure Market (by Battery Type), $Billion, 2024-2034

- Table 68: Rest-of-Asia-Pacific Battery Swapping Charging Infrastructure Market (by Swap Mechanism), $Billion, 2024-2034

- Table 69: Rest-of-the-World Battery Swapping Charging Infrastructure Market (by Vehicle Type), $Billion, 2024-2034

- Table 70: Rest-of-the-World Battery Swapping Charging Infrastructure Market (by Service Model), $Billion, 2024-2034

- Table 71: Rest-of-the-World Battery Swapping Charging Infrastructure Market (by Battery Type), $Billion, 2024-2034

- Table 72: Rest-of-the-World Battery Swapping Charging Infrastructure Market (by Swap Mechanism), $Billion, 2024-2034

- Table 73: South America Battery Swapping Charging Infrastructure Market (by Vehicle Type), $Billion, 2024-2034

- Table 74: South America Battery Swapping Charging Infrastructure Market (by Service Model), $Billion, 2024-2034

- Table 75: South America Battery Swapping Charging Infrastructure Market (by Battery Type), $Billion, 2024-2034

- Table 76: South America Battery Swapping Charging Infrastructure Market (by Swap Mechanism), $Billion, 2024-2034

- Table 77: Middle East and Africa Battery Swapping Charging Infrastructure Market (by Vehicle Type), $Billion, 2024-2034

- Table 78: Middle East and Africa Battery Swapping Charging Infrastructure Market (by Service Model), $Billion, 2024-2034

- Table 79: Middle East and Africa Battery Swapping Charging Infrastructure Market (by Battery Type), $Billion, 2024-2034

- Table 80: Middle East and Africa Battery Swapping Charging Infrastructure Market (by Swap Mechanism), $Billion, 2024-2034

- Table 81: Market Share

Battery Swapping Charging Infrastructure Market: Industry Overview

The battery swapping charging infrastructure market plays a critical role in the accelerating shift toward electric mobility and sustainable urban transportation. As electric vehicle adoption rises globally, driven by advancements in battery technology, IoT, AI, and cloud computing, the demand for fast, scalable, and user-centric energy replenishment solutions is becoming increasingly vital. Battery swapping infrastructure addresses key challenges such as long charging times and range anxiety by enabling rapid exchange of depleted batteries with fully charged ones, significantly reducing vehicle downtime and improving overall user experience.

The industry is characterized by continuous innovation, with leading players developing modular battery designs, automated swapping mechanisms, and integrated Battery-as-a-Service (BaaS) platforms. These technological advancements incorporate real-time IoT connectivity, AI-powered station management, and mobile applications that facilitate seamless battery monitoring, swap scheduling, and payment processing. The integration of battery swapping stations within smart city ecosystems and renewable energy grids further enhances operational efficiency and sustainability by enabling energy storage and grid balancing functionalities. All these expected to drive the battery swapping charging infrastructure market growth.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2025 - 2034 |

| 2025 Evaluation | $1.46 Billion |

| 2034 Forecast | $22.72 Billion |

| CAGR | 35.66% |

With the expansion of urban fleets, last-mile delivery services, and commercial electric vehicles, the need for flexible and interoperable battery swapping solutions is growing. This trend is driving standardization efforts and strategic partnerships among OEMs, energy providers, and governments. The battery swapping charging infrastructure market is evolving towards AI-enabled, automated, and scalable swapping networks that are essential for supporting mass EV adoption, reducing total cost of ownership, and fostering a resilient electric mobility infrastructure worldwide.

Battery Swapping Charging Infrastructure Market Lifecycle Stage

The battery swapping charging infrastructure market is currently in the growth and early maturity phase, with technologies advancing through Technology Readiness Levels (TRLs) 6-9. The focus is on scaling modular battery swapping stations, integrating AI-driven predictive maintenance, and enhancing IoT-enabled real-time battery and station monitoring for seamless user experiences. Companies are transitioning from pilot projects and limited deployments to full-scale commercial rollouts, prioritizing interoperability across diverse EV models, system reliability, and rapid swapping speeds in both urban and fleet-based environments.

Collaborations between EV manufacturers, battery suppliers, infrastructure developers, and policymakers are essential as battery swapping infrastructure is integrated into broader electric mobility ecosystems and smart city frameworks. Regulatory frameworks around battery standardization, safety, and energy grid integration are evolving to support widespread adoption and facilitate innovation in battery swapping charging infrastructure market.

Commercial deployment is accelerating globally, driven by increasing EV penetration, expanding urban fleets, and rising demand for fast, convenient, and flexible energy replenishment solutions. As companies scale operations to meet these growing market demands, significant investments are being directed toward R&D efforts focusing on automation, AI-powered station management, and integration with renewable energy sources and smart grids. As the market matures, battery swapping infrastructure is set to become a critical component of sustainable urban mobility, reducing range anxiety, lowering total cost of ownership, and enhancing the overall electric vehicle experience worldwide.

Battery Swapping Charging Infrastructure Market Segmentation:

Segmentation 1: by Vehicle Type

- Two-Wheelers

- Three-Wheelers

- Passenger Vehicles

- Commercial Vehicles

Segmentation 2: by Service Model

- Subscription-Based

- Pay-Per-Use

Segmentation 3: by Battery Type

- Lithium-Ion Batteries

- Solid-State Batteries

- Ultracapacitors

Segmentation 4: by Swap Mechanism

- Automated Guided Vehicle (AGV)-Based

- Robotic Arm-Based

Segmentation 5: by Region

- North America - U.S., Canada, and Mexico

- Europe - Germany, France, Italy, Spain, U.K., and Rest-of-Europe

- Asia-Pacific - China, Japan, South Korea, India, and Rest-of-Asia-Pacific

- Rest-of-the-World - South America and Middle East and Africa

Demand - Drivers and Limitations

The following are the demand drivers for the battery swapping charging infrastructure market:

- Growth of Electric Vehicles (EVs) and Autonomous Vehicles

- Adoption battery-as-a-Service (BaaS) Model

- Integration with Renewable Energy and Smart Grids

The battery swapping charging infrastructure market is expected to face some limitations as well due to the following challenges:

- Competition from Fast Charging Technologies

- High Initial Capital Expenditure

- Battery Lifecycle Management

Battery Swapping Charging Infrastructure Market Key Players and Competition Synopsis

The battery swapping charging infrastructure market presents a highly competitive landscape fuelled by a combination of established battery manufacturers, EV OEMs, and innovative technology startups. Leading global players such as Gogoro, NIO Power, and CATL dominate the sector, offering expansive battery swapping networks, modular battery designs, and integrated Battery-as-a-Service (BaaS) platforms that significantly reduce EV charging downtime and improve user convenience. On the technology front, companies like Ample and SUN Mobility are advancing scalable and modular swapping technologies tailored for urban fleets, last-mile delivery, and commercial vehicles, driving adoption in North America and emerging markets like India.

Other key players, including Leo Motors, Battery Smart, and Selex Motors, focus on regional innovations by providing tech-enabled swapping stations and cost-effective pay-per-use models targeting electric two-wheelers and three-wheelers, enhancing accessibility for urban commuters. Competition is further fuelled by strategic partnerships with OEMs, energy providers, and governments, fostering ecosystem integration and policy support critical for infrastructure expansion. Continuous investment in R&D is driving innovations such as automated swapping mechanisms, AI-powered station management, and standardized battery packs that enhance operational efficiency and interoperability, thereby driving the battery swapping charging infrastructure market growth.

As each player strives to innovate with flexible business models, rapid battery replacement technologies, and extensive swapping networks, the market is rapidly evolving toward a connected, user-centric EV energy ecosystem. This evolution is essential to addressing range anxiety, reducing total cost of ownership, and accelerating electric vehicle adoption globally, thereby supporting growth of the battery swapping charging infrastructure market.

Some prominent names established in the Battery Swapping Charging Infrastructure Market are:

- Ample

- Gogoro

- NIO Power

- Contemporary Amperex Technology Co. Limited

- SUN Mobility

- Battery Smart

- Selex Motors

- Spiro

- Oyika

- VoltUp

- Leo Motors

- Sunrack Energy

- Leap Motor

Companies that are not a part of the previously mentioned pool have been well represented across different sections of the battery swapping charging infrastructure market report (wherever applicable).

Table of Contents

Executive Summary

Scope and Definition

Market/Product Definition

Key Questions Answered

Analysis and Forecast Note

1. Markets: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.2 Market Dynamics Overview

- 1.2.1 Market Drivers

- 1.2.2 Market Restraints

- 1.2.3 Market Opportunities

- 1.3 Regulatory & Policy Impact Analysis

- 1.4 Patent Analysis

- 1.5 Global Pricing Analysis

2. Battery Swapping Charging Infrastructure Market (by Vehicle Type)

- 2.1 Two-Wheelers

- 2.2 Three-Wheelers

- 2.3 Passenger Vehicles

- 2.4 Commercial Vehicles

3. Battery Swapping Charging Infrastructure Market (by Service Model)

- 3.1 Subscription-Based

- 3.2 Pay-Per-Use

4. Battery Swapping Charging Infrastructure Market (by Battery Type)

- 4.1 Lithium-Ion Batteries

- 4.2 Solid-State Batteries

- 4.3 Ultracapacitors

5. Battery Swapping Charging Infrastructure Market (by Swap Mechanism)

- 5.1 Automated Guided Vehicle (AGV)-Based

- 5.2 Robotic Arm-Based

6. Battery Swapping Charging Infrastructure Market (by Region)

- 6.1 Battery Swapping Charging Infrastructure Market (by Region)

- 6.2 North America

- 6.2.1 Regional Overview

- 6.2.2 Driving Factors for Market Growth

- 6.2.3 Factors Challenging the Market

- 6.2.4 Key Companies

- 6.2.5 Vehicle Type

- 6.2.6 Service Model

- 6.2.7 Battery Type

- 6.2.8 Swap Mechanism

- 6.2.9 North America (by Country)

- 6.2.9.1 U.S.

- 6.2.9.1.1 Market by Vehicle Type

- 6.2.9.1.2 Market by Service Model

- 6.2.9.1.3 Market by Battery Type

- 6.2.9.1.4 Market by Swap Mechanism

- 6.2.9.2 Canada

- 6.2.9.2.1 Market by Vehicle Type

- 6.2.9.2.2 Market by Service Model

- 6.2.9.2.3 Market by Battery Type

- 6.2.9.2.4 Market by Swap Mechanism

- 6.2.9.3 Mexico

- 6.2.9.3.1 Market by Vehicle Type

- 6.2.9.3.2 Market by Service Model

- 6.2.9.3.3 Market by Battery Type

- 6.2.9.3.4 Market by Swap Mechanism

- 6.2.9.1 U.S.

- 6.3 Europe

- 6.3.1 Regional Overview

- 6.3.2 Driving Factors for Market Growth

- 6.3.3 Factors Challenging the Market

- 6.3.4 Key Companies

- 6.3.5 Vehicle Type

- 6.3.6 Service Model

- 6.3.7 Battery Type

- 6.3.8 Swap Mechanism

- 6.3.9 Europe (by Country)

- 6.3.9.1 Germany

- 6.3.9.1.1 Market by Vehicle Type

- 6.3.9.1.2 Market by Service Model

- 6.3.9.1.3 Market by Battery Type

- 6.3.9.1.4 Market by Swap Mechanism

- 6.3.9.2 France

- 6.3.9.2.1 Market by Vehicle Type

- 6.3.9.2.2 Market by Service Model

- 6.3.9.2.3 Market by Battery Type

- 6.3.9.2.4 Market by Swap Mechanism

- 6.3.9.3 Italy

- 6.3.9.3.1 Market by Vehicle Type

- 6.3.9.3.2 Market by Service Model

- 6.3.9.3.3 Market by Battery Type

- 6.3.9.3.4 Market by Swap Mechanism

- 6.3.9.4 Spain

- 6.3.9.4.1 Market by Vehicle Type

- 6.3.9.4.2 Market by Service Model

- 6.3.9.4.3 Market by Battery Type

- 6.3.9.4.4 Market by Swap Mechanism

- 6.3.9.5 U.K.

- 6.3.9.5.1 Market by Vehicle Type

- 6.3.9.5.2 Market by Service Model

- 6.3.9.5.3 Market by Battery Type

- 6.3.9.5.4 Market by Swap Mechanism

- 6.3.9.6 Rest-of-Europe

- 6.3.9.6.1 Market by Vehicle Type

- 6.3.9.6.2 Market by Service Model

- 6.3.9.6.3 Market by Battery Type

- 6.3.9.6.4 Market by Swap Mechanism

- 6.3.9.1 Germany

- 6.4 Asia-Pacific

- 6.4.1 Regional Overview

- 6.4.2 Driving Factors for Market Growth

- 6.4.3 Factors Challenging the Market

- 6.4.4 Key Companies

- 6.4.5 Vehicle Type

- 6.4.6 Service Model

- 6.4.7 Battery Type

- 6.4.8 Swap Mechanism

- 6.4.9 Asia-Pacific (by Country)

- 6.4.9.1 China

- 6.4.9.1.1 Market by Vehicle Type

- 6.4.9.1.2 Market by Service Model

- 6.4.9.1.3 Market by Battery Type

- 6.4.9.1.4 Market by Swap Mechanism

- 6.4.9.2 Japan

- 6.4.9.2.1 Market by Vehicle Type

- 6.4.9.2.2 Market by Service Model

- 6.4.9.2.3 Market by Battery Type

- 6.4.9.2.4 Market by Swap Mechanism

- 6.4.9.3 India

- 6.4.9.3.1 Market by Vehicle Type

- 6.4.9.3.2 Market by Service Model

- 6.4.9.3.3 Market by Battery Type

- 6.4.9.3.4 Market by Swap Mechanism

- 6.4.9.4 South Korea

- 6.4.9.4.1 Market by Vehicle Type

- 6.4.9.4.2 Market by Service Model

- 6.4.9.4.3 Market by Battery Type

- 6.4.9.4.4 Market by Swap Mechanism

- 6.4.9.5 Rest-of-Asia-Pacific

- 6.4.9.5.1 Market by Vehicle Type

- 6.4.9.5.2 Market by Service Model

- 6.4.9.5.3 Market by Battery Type

- 6.4.9.5.4 Market by Swap Mechanism

- 6.4.9.1 China

- 6.5 Rest-of-the-World

- 6.5.1 Regional Overview

- 6.5.2 Driving Factors for Market Growth

- 6.5.3 Factors Challenging the Market

- 6.5.4 Key Companies

- 6.5.5 Vehicle Type

- 6.5.6 Service Model

- 6.5.7 Battery Type

- 6.5.8 Swap Mechanism

- 6.5.9 Rest-of-the-World (by Region)

- 6.5.9.1 South America

- 6.5.9.1.1 Market by Vehicle Type

- 6.5.9.1.2 Market by Service Model

- 6.5.9.1.3 Market by Battery Type

- 6.5.9.1.4 Market by Swap Mechanism

- 6.5.9.2 Middle East and Africa

- 6.5.9.2.1 Market by Vehicle Type

- 6.5.9.2.2 Market by Service Model

- 6.5.9.2.3 Market by Battery Type

- 6.5.9.2.4 Market by Swap Mechanism

- 6.5.9.1 South America

7. Markets - Competitive Benchmarking & Company Profiles

- 7.1 Next Frontiers

- 7.2 Geographic Assessment

- 7.3 Company Profiles

- 7.3.1 Ample

- 7.3.1.1 Overview

- 7.3.1.2 Top Products/Product Portfolio

- 7.3.1.3 Top Competitors

- 7.3.1.4 Target Customers

- 7.3.1.5 Key Personnel

- 7.3.1.6 Analyst View

- 7.3.1.7 Market Share

- 7.3.2 Gogoro

- 7.3.2.1 Overview

- 7.3.2.2 Top Products/Product Portfolio

- 7.3.2.3 Top Competitors

- 7.3.2.4 Target Customers

- 7.3.2.5 Key Personnel

- 7.3.2.6 Analyst View

- 7.3.2.7 Market Share

- 7.3.3 NIO Power

- 7.3.3.1 Overview

- 7.3.3.2 Top Products/Product Portfolio

- 7.3.3.3 Top Competitors

- 7.3.3.4 Target Customers

- 7.3.3.5 Key Personnel

- 7.3.3.6 Analyst View

- 7.3.3.7 Market Share

- 7.3.4 Contemporary Amperex Technology Co. Limited

- 7.3.4.1 Overview

- 7.3.4.2 Top Products/Product Portfolio

- 7.3.4.3 Top Competitors

- 7.3.4.4 Target Customers

- 7.3.4.5 Key Personnel

- 7.3.4.6 Analyst View

- 7.3.4.7 Market Share

- 7.3.5 SUN Mobility

- 7.3.5.1 Overview

- 7.3.5.2 Top Products/Product Portfolio

- 7.3.5.3 Top Competitors

- 7.3.5.4 Target Customers

- 7.3.5.5 Key Personnel

- 7.3.5.6 Analyst View

- 7.3.5.7 Market Share

- 7.3.6 Battery Smart

- 7.3.6.1 Overview

- 7.3.6.2 Top Products/Product Portfolio

- 7.3.6.3 Top Competitors

- 7.3.6.4 Target Customers

- 7.3.6.5 Key Personnel

- 7.3.6.6 Analyst View

- 7.3.6.7 Market Share

- 7.3.7 Selex Motors

- 7.3.7.1 Overview

- 7.3.7.2 Top Products/Product Portfolio

- 7.3.7.3 Top Competitors

- 7.3.7.4 Target Customers

- 7.3.7.5 Key Personnel

- 7.3.7.6 Analyst View

- 7.3.7.7 Market Share

- 7.3.8 Spiro

- 7.3.8.1 Overview

- 7.3.8.2 Top Products/Product Portfolio

- 7.3.8.3 Top Competitors

- 7.3.8.4 Target Customers

- 7.3.8.5 Key Personnel

- 7.3.8.6 Analyst View

- 7.3.8.7 Market Share

- 7.3.9 Oyika

- 7.3.9.1 Overview

- 7.3.9.2 Top Products/Product Portfolio

- 7.3.9.3 Top Competitors

- 7.3.9.4 Target Customers

- 7.3.9.5 Key Personnel

- 7.3.9.6 Analyst View

- 7.3.9.7 Market Share

- 7.3.10 VoltUp

- 7.3.10.1 Overview

- 7.3.10.2 Top Products/Product Portfolio

- 7.3.10.3 Top Competitors

- 7.3.10.4 Target Customers

- 7.3.10.5 Key Personnel

- 7.3.10.6 Analyst View

- 7.3.10.7 Market Share

- 7.3.10.8 Share

- 7.3.11 Leo Motors

- 7.3.11.1 Overview

- 7.3.11.2 Top Products/Product Portfolio

- 7.3.11.3 Top Competitors

- 7.3.11.4 Target Customers

- 7.3.11.5 Key Personnel

- 7.3.11.6 Analyst View

- 7.3.11.7 Market Share

- 7.3.11.8 Share

- 7.3.12 Sunrack Energy

- 7.3.12.1 Overview

- 7.3.12.2 Top Products/Product Portfolio

- 7.3.12.3 Top Competitors

- 7.3.12.4 Target Customers

- 7.3.12.5 Key Personnel

- 7.3.12.6 Analyst View

- 7.3.12.7 Market Share

- 7.3.13 Leap Motor

- 7.3.13.1 Overview

- 7.3.13.2 Top Products/Product Portfolio

- 7.3.13.3 Top Competitors

- 7.3.13.4 Target Customers

- 7.3.13.5 Key Personnel

- 7.3.13.6 Analyst View

- 7.3.13.7 Market Share

- 7.3.13.8 Share

- 7.3.1 Ample

- 7.4 Other Key Companies