|

|

市場調査レポート

商品コード

1778600

大型衛星推進システム市場 - 世界および地域別分析:サブシステム別 、国別 - 分析と予測(2024年~2040年)Large Satellite Propulsion System Market - A Global and Regional Analysis: Focus on Subsystem and Country - Analysis and Forecast, 2024-2040 |

||||||

カスタマイズ可能

|

|||||||

| 大型衛星推進システム市場 - 世界および地域別分析:サブシステム別 、国別 - 分析と予測(2024年~2040年) |

|

出版日: 2025年07月30日

発行: BIS Research

ページ情報: 英文 162 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

大型衛星推進システム市場には、化学スラスター、電気スラスター、コールドガススラスター、ハイブリッドスラスターなど、幅広い宇宙推力技術が含まれ、いずれも重量級衛星の軌道投入、ステーション維持、終末操縦に不可欠なものです。

大型衛星推進システム市場は、高スループット通信衛星、高度地球観測プラットフォーム、拡大する航法コンステレーションの急増を支えることができる信頼性の高い高効率推進ソリューションの必要性によって牽引されてきました。高推力の電気ホール効果スラスター、グリーン推進薬化学エンジン、モジュール式ハイブリッド・ステージなどの推進力における革新は、スケーラブルでコスト効率が高く、持続可能な推進ソリューションに対する大型衛星運用者のニーズの高まりに応えています。大型衛星推進システム市場は競争が激しく、ボーイング、エアロジェット・ロケットダイン、エアバス、サフラン、ノースロップ・グラマンなどの主要企業が業界をリードしています。さらに、推進剤の効率、軌道上のデブリの軽減、ミッションの柔軟性を重視する傾向が強まっているため、買い手の優先順位が変化し、次世代の電気推進方式や再利用可能な推進方式への投資に拍車がかかっています。その結果、大型衛星推進システム市場は、急速な技術革新と最新の宇宙ミッションの性能要求の高まりに対応して絶えず進化し、非常にダイナミックな状態を維持しています。

市場導入

大型衛星推進システム市場には、化学スラスター、電気スラスター、コールドガスシステム、ハイブリッドエンジンなど、さまざまなサブシステムが含まれ、いずれも重量級宇宙船の信頼性の高い操縦とステーション維持に不可欠なものです。高スループットの通信、地球観測、航行能力への需要が高まるにつれ、効率的で信頼性の高い宇宙推進へのニーズが高まっています。高出力ホール効果スラスター、グリーン推進薬化学エンジン、モジュール式ハイブリッドステージなどの推進アーキテクチャの革新は、大型衛星に必要な軌道速度の変化をスケーラブルかつ確実に提供するため、脚光を浴びています。Boeing、Aerojet Rocketdyne、Airbus、Safran、Northrop Grummanなどの業界リーダーが市場を独占しており、競争力を維持するために技術ポートフォリオを継続的に進化させています。さらに、持続可能性とミッションのコスト効率への注目の高まりが、環境に優しい推進剤と高効率の電気推進システムへの投資を促進しています。大型衛星推進システム市場は、最新の宇宙ミッションの需要の高まりと、効率的な軌道操縦の必要性の高まりに対応するため、急速に進化しています。

産業への影響

大型衛星推進システム市場は産業界に大きな影響を与え、航空宇宙、エネルギー、先端製造業における経済活動と雇用を大幅に促進します。効率的な推力発生と軌道操縦ソリューションの需要は、推進技術の革新を促進し、エレクトロニクス、エネルギー貯蔵、通信などの産業に恩恵をもたらします。大型衛星が世界の接続と観測インフラにとってますます不可欠になるにつれて、高度な推進システムの必要性は高まり続け、燃料効率、モジュール式アーキテクチャ、インテリジェントなエンジン健康管理システムの開発につながっています。

さらに、大型衛星推進システム市場は、打上げサービス、軌道上サービス、宇宙状況認識などの関連分野の成長を支えています。これらの分野は効率的な推進能力に大きく依存しており、スラスターやサブシステムの進歩は、ミッションの信頼性を確保し、全体的な運用コストを削減する上で重要な役割を果たしています。持続可能性への注目の高まりは、グリーン推進剤と電気推進ソリューションへの投資を促し、打上げ活動の環境フットプリントを削減し、再使用可能な打上げ輸送体の採用を促しています。

さらに、推進剤の効率、性能、信頼性の最適化を重視する市場は、エネルギー供給会社、研究機関、航空宇宙会社など、業界を超えた協力関係を促進しています。このような協力関係は技術的進歩を促進し、衛星の全体的な寿命と回復力を向上させる。全体として、大型衛星推進システム市場は、技術革新、経済成長、および重要な世界の宇宙ベースのインフラの将来の重要な促進要因です。

市場セグメンテーション

セグメンテーション:サブシステム別

- 化学スラスター

- 推進剤タンク

- ポンプ

- 燃料・酸化剤バルブ

- 電気スラスター

- 推進剤タンク

- ポンプ

- コールドガススラスター

- ガス貯蔵タンク

- 推進チャンバー/ノズル

- ポンプ

- ハイブリッドスラスター

- 推進剤タンク

- 推進室/ノズル

- ポンプ

大型衛星推進システム市場を独占する化学スラスター(製品別)

大型衛星推進システム市場(製品別)は、化学スラスターが主に牽引しています。化学スラスター分野は2024年に20億5,120万米ドルと評価され、2033年には34億5,200万米ドルに達すると予測されています。このセグメントは、重量級通信、地球観測、国家安全保障宇宙船における高推力、高信頼性軌道上昇、ステーション維持ソリューションの需要増加により著しい成長を遂げています。化学スラスターは、電気システムだけでは対応できない即時の高インパルス操縦を実現することで、継続的なミッション能力を確保する上で重要な役割を果たしています。GEOや深宇宙プログラムの急速な拡大により、化学推進力の優位性はさらに強化されており、ミッションの長期化や軌道離脱の厳格化に対応するため、より高い推進剤容量が必要とされています。さらに、グリーン推進剤、添加剤製造エンジン部品、高度燃焼管理システムにおける技術革新がセグメントの成長を促進し、化学スラスターが進化する効率、持続可能性、コスト目標を満たすことを可能にしています。

大型衛星推進システム市場の最近の動向

- 2025年3月14日、Ursa Majorは、戦術衛星バス用の完全に統合されたGEOクラスの推進パッケージを供給する約1,000万米ドルから1,500万米ドルの契約を獲得しました。

- 2023年6月23日、 Terran OrbitalとSafranは、サフランの地球低軌道衛星用ホール効果プラズマスラスターPPSX00を中心とした先進的な電気推進装置の米国での生産を評価するためのパートナーシップを結びました。このベンチャーは、軌道上昇、ステーション維持、軌道移動のための、より軽量で効率的なシステムをターゲットとしており、従来の化学エンジンに比べて大幅な質量削減を実現します。

- 2022年7月26日、Thales Alenia Spaceは、イタリアの新興企業MIPRONSと提携し、水を動力源とする衛星推進システムを開発しました。MIPRONS独自の電解プロセスを活用したこの技術は、水を水素と酸素に分解し、エンジンの燃焼室でそれらを再結合させることで、従来の推進剤に代わる、より環境に優しく、コスト効率の高い代替手段を提供します。

- 2023年7月12日、イスラエルの電気推進新興企業であるSpace Plasmaticsは、化学燃焼に頼る代わりにイオン化したガスを加速させる革新的なシステムであるプラズマ・スラスターを正式に発表しました。同社はすでに2023年6月にイスラエル航空宇宙産業とパートナーシップ契約を締結しており、IAIの大型衛星プラットフォームにこのスラスターを統合することで、大型衛星推進におけるIAIの競争力を強化しています。

製品/イノベーション戦略:製品タイプは、読者が世界的に利用可能なさまざまなタイプの製品を理解するのに役立ちます。さらに、推進サブシステムに基づく製品別に大型衛星推進システム市場の詳細な理解を読者に提供します。

成長/マーケティング戦略大型衛星推進システム市場では、事業拡大、提携、協力、合弁など、市場で事業を展開する主要企業による主要な開拓が見られます。各社にとって好ましい戦略は、大型衛星推進システム市場における地位を強化するためのシナジー活動です。

大型衛星推進システム市場は、世界の業界リーダー数社による激しい競争が特徴です。L3Harris Technologies, Inc.、Airbus、Safran、Boeing、Moog Inc.、Northrop Grummanなどの主要企業は、化学、電気、ハイブリッド推進ソリューションの包括的ポートフォリオを提供することで、この分野を支配しています。これらの企業は、衛星の運用寿命を延ばしながら性能とミッションの信頼性を高めることを目的とした、より高効率のスラスター・アーキテクチャー、次世代ターボポンプ、よりクリーンな推進剤化学物質を提供するための研究開発に多額の投資を行っています。

大型衛星推進システム市場は、継続的な技術進歩や、高効率電気スラスター、グリーン推進剤、太陽電気推進アーキテクチャを導入する新規事業者の参入によってさらに形成されています。このようなダイナミックな環境により、大型衛星推進システム市場は高い競争力を維持し、効率性、拡張性、持続可能性に対するオペレーターの要求の進化に対応しながら、衛星のバリューチェーン全体で継続的な技術革新を推進しています。

この市場で確立された著名な企業は以下の通りです:

- Boeing

- L3Harris Technologies, Inc.

- Airbus

- Safran

- QinetiQ

- Nammo AS

- IHI Corporation

- ISRO

- Lanzhou Institute of Physics

- OKB Fakel

- Rafael Advanced Defense System Ltd.

- Keldysh Research Center

- Moog Inc.

- Northrop Grumman

- OHB SE

当レポートでは、世界の大型衛星推進システム市場について調査し、市場の概要とともに、サブシステム別 、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 製品

- 市場概要

- スラスタータイプごとのポンプ性能の分析

- スラスターポンプの新興技術と革新

- スラスターポンプエコシステムにおける戦略的パートナーシップとコラボレーション

- 世界の大型衛星推進システム市場(サブシステム別)

- 大型衛星推進システム市場の需要分析(サブシステム別)、価値および数量データ

- 化学スラスター

- 電動スラスター

- コールドガススラスター

- ハイブリッドスラスター

第2章 地域

- 世界の大型衛星推進システム市場(地域別)

- 北米

- 欧州

- アジア太平洋

- その他の地域

第3章 スラスターと規制分析

- スラスターの分析(用途別)

- ハイブリッドスラスター

- コールドガススラスター

- 化学スラスター(高温ガスおよび温ガス)

- 電動スラスター

- アナリストの視点

- 規制分析(国別)

- 米国

- 英国

- フランス

- ドイツ

- インド

- 中国

- ロシア

第4章 重要な顧客情報

第5章 成長の機会と提言

- 成長の機会

- 次世代スラスターポンプのための材料科学の進歩

- AI駆動型予知保全と効率最適化の統合

- 新興宇宙および商業ベンチャーにおける市場需要の拡大

- 宇宙用途向け持続可能で環境に優しいポンプソリューション

- 大型衛星軌道遷移・マヌーバ用太陽電気推進システムの開発

- 宇宙ベースの情報収集・監視・偵察(ISR)ソリューションに対する需要の高まり

第6章 調査手法

List of Figures

- Figure 1: Key Players in the Large Satellite Propulsion System Market

- Figure 2: Data Triangulation

- Figure 3: Assumptions and Limitations

List of Tables

- Table 1: Market Segmentations for Large Satellite Propulsion System Market

- Table 2: Key Regulations for Large Satellite Propulsion System Market

- Table 3: Key Opportunities for Large Satellite Propulsion System Market

- Table 1: Comparative Summary of Pump Performance Parameters

- Table 4: Strategic Partnerships in Satellite Thruster/Pump Ecosystem (2022-2025)

- Table 5: Global Large Satellite Propulsion System Market (by Subsystem), $Million, 2024-2040

- Table 6: Global Large Satellite Propulsion System Market (by Subsystem), Units, 2024-2040

- Table 7: Global Large Satellite Propulsion System Market (by Chemical Thruster), $Million, 2024-2040

- Table 8: Global Large Satellite Propulsion System Market (by Chemical Thruster), Units, 2024-2040

- Table 9: Global Large Satellite Propulsion System Market (by Electric Thruster), $Million, 2024-2040

- Table 10: Global Large Satellite Propulsion System Market (by Electric Thruster), Units, 2024-2040

- Table 11: Global Large Satellite Propulsion System Market (by Cold Gas Thruster), $Million, 2024-2040

- Table 12: Global Large Satellite Propulsion System Market (by Cold Gas Thruster), Units, 2024-2040

- Table 13: Global Large Satellite Propulsion System Market (by Hybrid Thruster), $Million, 2024-2040

- Table 14: Global Large Satellite Propulsion System Market (by Hybrid Thruster), Units, 2024-2040

- Table 15: Global Large Satellite Propulsion System Market (by Region), $Million, 2024-2040

- Table 16: Global Large Satellite Propulsion System Market (by Region), Units, 2024-2040

- Table 17: North America Large Satellite Propulsion System Market (by Subsystem), $Million, 2024-2040

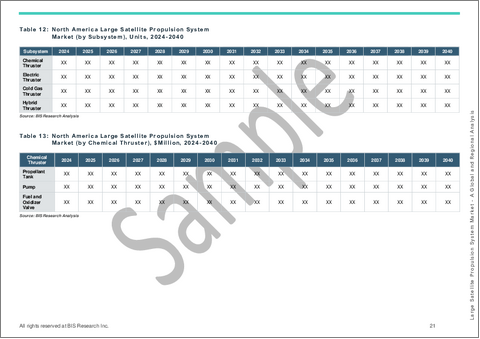

- Table 18: North America Large Satellite Propulsion System Market (by Subsystem), Units, 2024-2040

- Table 19: North America Large Satellite Propulsion System Market (by Chemical Thruster), $Million, 2024-2040

- Table 20: North America Large Satellite Propulsion System Market (by Chemical Thruster), Units, 2024-2040

- Table 21: North America Large Satellite Propulsion System Market (by Electric Thruster), $Million, 2024-2040

- Table 22: North America Large Satellite Propulsion System Market (by Electric Thruster), Units, 2024-2040

- Table 23: North America Large Satellite Propulsion System Market (by Cold Gas Thruster), $Million, 2024-2040

- Table 24: North America Large Satellite Propulsion System Market (by Cold Gas Thruster), Units, 2024-2040

- Table 25: North America Large Satellite Propulsion System Market (by Hybrid Thruster), $Million, 2024-2040

- Table 26: North America Large Satellite Propulsion System Market (by Hybrid Thruster), Units, 2024-2040

- Table 27: U.S. Large Satellite Propulsion System Market (by Subsystem), $Million, 2024-2040

- Table 28: U.S. Large Satellite Propulsion System Market (by Subsystem), Units, 2024-2040

- Table 29: U.S. Large Satellite Propulsion System Market (by Chemical Thruster), $Million, 2024-2040

- Table 30: U.S. Large Satellite Propulsion System Market (by Chemical Thruster), Units, 2024-2040

- Table 31: U.S. Large Satellite Propulsion System Market (by Electric Thruster), $Million, 2024-2040

- Table 32: U.S. Large Satellite Propulsion System Market (by Electric Thruster), Units, 2024-2040

- Table 33: U.S. Large Satellite Propulsion System Market (by Cold Gas Thruster), $Million, 2024-2040

- Table 34: U.S. Large Satellite Propulsion System Market (by Cold Gas Thruster), Units, 2024-2040

- Table 35: U.S. Large Satellite Propulsion System Market (by Hybrid Thruster), $Million, 2024-2040

- Table 36: U.S. Large Satellite Propulsion System Market (by Hybrid Thruster), Units, 2024-2040

- Table 37: Canada Large Satellite Propulsion System Market (by Subsystem), $Million, 2024-2040

- Table 38: Canada Large Satellite Propulsion System Market (by Subsystem), Units, 2024-2040

- Table 39: Canada Large Satellite Propulsion System Market (by Chemical Thruster), $Million, 2024-2040

- Table 40: Canada Large Satellite Propulsion System Market (by Chemical Thruster), Units, 2024-2040

- Table 41: Canada Large Satellite Propulsion System Market (by Electric Thruster), $Million, 2024-2040

- Table 42: Canada Large Satellite Propulsion System Market (by Electric Thruster), Units, 2024-2040

- Table 43: Canada Large Satellite Propulsion System Market (by Cold Gas Thruster), $Million, 2024-2040

- Table 44: Canada Large Satellite Propulsion System Market (by Cold Gas Thruster), Units, 2024-2040

- Table 45: Canada Large Satellite Propulsion System Market (by Hybrid Thruster), $Million, 2024-2040

- Table 46: Canada Large Satellite Propulsion System Market (by Hybrid Thruster), Units, 2024-2040

- Table 47: Europe Large Satellite Propulsion System Market (by Subsystem), $Million, 2024-2040

- Table 48: Europe Large Satellite Propulsion System Market (by Subsystem), Units, 2024-2040

- Table 49: Europe Large Satellite Propulsion System Market (by Chemical Thruster), $Million, 2024-2040

- Table 50: Europe Large Satellite Propulsion System Market (by Chemical Thruster), Units, 2024-2040

- Table 51: Europe Large Satellite Propulsion System Market (by Electric Thruster), $Million, 2024-2040

- Table 52: Europe Large Satellite Propulsion System Market (by Electric Thruster), Units, 2024-2040

- Table 53: Europe Large Satellite Propulsion System Market (by Cold Gas Thruster), $Million, 2024-2040

- Table 54: Europe Large Satellite Propulsion System Market (by Cold Gas Thruster), Units, 2024-2040

- Table 55: Europe Large Satellite Propulsion System Market (by Hybrid Thruster), $Million, 2024-2040

- Table 56: Europe Large Satellite Propulsion System Market (by Hybrid Thruster), Units, 2024-2040

- Table 57: France Large Satellite Propulsion System Market (by Subsystem), $Million, 2024-2040

- Table 58: France Large Satellite Propulsion System Market (by Subsystem), Units, 2024-2040

- Table 59: France Large Satellite Propulsion System Market (by Chemical Thruster), $Million, 2024-2040

- Table 60: France Large Satellite Propulsion System Market (by Chemical Thruster), Units, 2024-2040

- Table 61: France Large Satellite Propulsion System Market (by Electric Thruster), $Million, 2024-2040

- Table 62: France Large Satellite Propulsion System Market (by Electric Thruster), Units, 2024-2040

- Table 63: France Large Satellite Propulsion System Market (by Cold Gas Thruster), $Million, 2024-2040

- Table 64: France Large Satellite Propulsion System Market (by Cold Gas Thruster), Units, 2024-2040

- Table 65: France Large Satellite Propulsion System Market (by Hybrid Thruster), $Million, 2024-2040

- Table 66: France Large Satellite Propulsion System Market (by Hybrid Thruster), Units, 2024-2040

- Table 67: Germany Large Satellite Propulsion System Market (by Subsystem), $Million, 2024-2040

- Table 68: Germany Large Satellite Propulsion System Market (by Subsystem), Units, 2024-2040

- Table 69: Germany Large Satellite Propulsion System Market (by Chemical Thruster), $Million, 2024-2040

- Table 70: Germany Large Satellite Propulsion System Market (by Chemical Thruster), Units, 2024-2040

- Table 71: Germany Large Satellite Propulsion System Market (by Electric Thruster), $Million, 2024-2040

- Table 72: Germany Large Satellite Propulsion System Market (by Electric Thruster), Units, 2024-2040

- Table 73: Germany Large Satellite Propulsion System Market (by Cold Gas Thruster), $Million, 2024-2040

- Table 74: Germany Large Satellite Propulsion System Market (by Cold Gas Thruster), Units, 2024-2040

- Table 75: Germany Large Satellite Propulsion System Market (by Hybrid Thruster), $Million, 2024-2040

- Table 76: Germany Large Satellite Propulsion System Market (by Hybrid Thruster), Units, 2024-2040

- Table 77: U.K. Large Satellite Propulsion System Market (by Subsystem), $Million, 2024-2040

- Table 78: U.K. Large Satellite Propulsion System Market (by Subsystem), Units, 2024-2040

- Table 79: U.K. Large Satellite Propulsion System Market (by Chemical Thruster), $Million, 2024-2040

- Table 80: U.K. Large Satellite Propulsion System Market (by Chemical Thruster), Units, 2024-2040

- Table 81: U.K. Large Satellite Propulsion System Market (by Electric Thruster), $Million, 2024-2040

- Table 82: U.K. Large Satellite Propulsion System Market (by Electric Thruster), Units, 2024-2040

- Table 83: U.K. Large Satellite Propulsion System Market (by Cold Gas Thruster), $Million, 2024-2040

- Table 84: U.K. Large Satellite Propulsion System Market (by Cold Gas Thruster), Units, 2024-2040

- Table 85: U.K. Large Satellite Propulsion System Market (by Hybrid Thruster), $Million, 2024-2040

- Table 86: U.K. Large Satellite Propulsion System Market (by Hybrid Thruster), Units, 2024-2040

- Table 87: Rest-of-Europe Large Satellite Propulsion System Market (by Subsystem), $Million, 2024-2040

- Table 88: Rest-of-Europe Large Satellite Propulsion System Market (by Subsystem), Units, 2024-2040

- Table 89: Rest-of-Europe Large Satellite Propulsion System Market (by Chemical Thruster), $Million, 2024-2040

- Table 90: Rest-of-Europe Large Satellite Propulsion System Market (by Chemical Thruster), Units, 2024-2040

- Table 91: Rest-of-Europe Large Satellite Propulsion System Market (by Electric Thruster), $Million, 2024-2040

- Table 92: Rest-of-Europe Large Satellite Propulsion System Market (by Electric Thruster), Units, 2024-2040

- Table 93: Rest-of-Europe Large Satellite Propulsion System Market (by Cold Gas Thruster), $Million, 2024-2040

- Table 94: Rest-of-Europe Large Satellite Propulsion System Market (by Cold Gas Thruster), Units, 2024-2040

- Table 95: Rest-of-Europe Large Satellite Propulsion System Market (by Hybrid Thruster), $Million, 2024-2040

- Table 96: Rest-of-Europe Large Satellite Propulsion System Market (by Hybrid Thruster), Units, 2024-2040

- Table 97: Asia-Pacific Large Satellite Propulsion System Market (by Subsystem), $Million, 2024-2040

- Table 98: Asia-Pacific Large Satellite Propulsion System Market (by Subsystem), Units, 2024-2040

- Table 99: Asia-Pacific Large Satellite Propulsion System Market (by Chemical Thruster), $Million, 2024-2040

- Table 100: Asia-Pacific Large Satellite Propulsion System Market (by Chemical Thruster), Units, 2024-2040

- Table 101: Asia-Pacific Large Satellite Propulsion System Market (by Electric Thruster), $Million, 2024-2040

- Table 102: Asia-Pacific Large Satellite Propulsion System Market (by Electric Thruster), Units, 2024-2040

- Table 103: Asia-Pacific Large Satellite Propulsion System Market (by Cold Gas Thruster), $Million, 2024-2040

- Table 104: Asia-Pacific Large Satellite Propulsion System Market (by Cold Gas Thruster), Units, 2024-2040

- Table 105: Asia-Pacific Large Satellite Propulsion System Market (by Hybrid Thruster), $Million, 2024-2040

- Table 106: Asia-Pacific Large Satellite Propulsion System Market (by Hybrid Thruster), Units, 2024-2040

- Table 107: China Large Satellite Propulsion System Market (by Subsystem), $Million, 2024-2040

- Table 108: China Large Satellite Propulsion System Market (by Subsystem), Units, 2024-2040

- Table 109: China Large Satellite Propulsion System Market (by Chemical Thruster), $Million, 2024-2040

- Table 110: China Large Satellite Propulsion System Market (by Chemical Thruster), Units, 2024-2040

- Table 111: China Large Satellite Propulsion System Market (by Electric Thruster), $Million, 2024-2040

- Table 112: China Large Satellite Propulsion System Market (by Electric Thruster), Units, 2024-2040

- Table 113: China Large Satellite Propulsion System Market (by Cold Gas Thruster), $Million, 2024-2040

- Table 114: China Large Satellite Propulsion System Market (by Cold Gas Thruster), Units, 2024-2040

- Table 115: China Large Satellite Propulsion System Market (by Hybrid Thruster), $Million, 2024-2040

- Table 116: China Large Satellite Propulsion System Market (by Hybrid Thruster), Units, 2024-2040

- Table 117: India Large Satellite Propulsion System Market (by Subsystem), $Million, 2024-2040

- Table 118: India Large Satellite Propulsion System Market (by Subsystem), Units, 2024-2040

- Table 119: India Large Satellite Propulsion System Market (by Chemical Thruster), $Million, 2024-2040

- Table 120: India Large Satellite Propulsion System Market (by Chemical Thruster), Units, 2024-2040

- Table 121: India Large Satellite Propulsion System Market (by Electric Thruster), $Million, 2024-2040

- Table 122: India Large Satellite Propulsion System Market (by Electric Thruster), Units, 2024-2040

- Table 123: India Large Satellite Propulsion System Market (by Cold Gas Thruster), $Million, 2024-2040

- Table 124: India Large Satellite Propulsion System Market (by Cold Gas Thruster), Units, 2024-2040

- Table 125: India Large Satellite Propulsion System Market (by Hybrid Thruster), $Million, 2024-2040

- Table 126: India Large Satellite Propulsion System Market (by Hybrid Thruster), Units, 2024-2040

- Table 127: Japan Large Satellite Propulsion System Market (by Subsystem), $Million, 2024-2040

- Table 128: Japan Large Satellite Propulsion System Market (by Subsystem), Units, 2024-2040

- Table 129: Japan Large Satellite Propulsion System Market (by Chemical Thruster), $Million, 2024-2040

- Table 130: Japan Large Satellite Propulsion System Market (by Chemical Thruster), Units, 2024-2040

- Table 131: Japan Large Satellite Propulsion System Market (by Electric Thruster), $Million, 2024-2040

- Table 132: Japan Large Satellite Propulsion System Market (by Electric Thruster), Units, 2024-2040

- Table 133: Japan Large Satellite Propulsion System Market (by Cold Gas Thruster), $Million, 2024-2040

- Table 134: Japan Large Satellite Propulsion System Market (by Cold Gas Thruster), Units, 2024-2040

- Table 135: Japan Large Satellite Propulsion System Market (by Hybrid Thruster), $Million, 2024-2040

- Table 136: Japan Large Satellite Propulsion System Market (by Hybrid Thruster), Units, 2024-2040

- Table 137: Rest-of-Asia-Pacific Large Satellite Propulsion System Market (by Subsystem), $Million, 2024-2040

- Table 138: Rest-of-Asia-Pacific Large Satellite Propulsion System Market (by Subsystem), Units, 2024-2040

- Table 139: Rest-of-Asia-Pacific Large Satellite Propulsion System Market (by Chemical Thruster), $Million, 2024-2040

- Table 140: Rest-of-Asia-Pacific Large Satellite Propulsion System Market (by Chemical Thruster), Units, 2024-2040

- Table 141: Rest-of-Asia-Pacific Large Satellite Propulsion System Market (by Electric Thruster), $Million, 2024-2040

- Table 142: Rest-of-Asia-Pacific Large Satellite Propulsion System Market (by Electric Thruster), Units, 2024-2040

- Table 143: Rest-of-Asia-Pacific Large Satellite Propulsion System Market (by Cold Gas Thruster), $Million, 2024-2040

- Table 144: Rest-of-Asia-Pacific Large Satellite Propulsion System Market (by Cold Gas Thruster), Units, 2024-2040

- Table 145: Rest-of-Asia-Pacific Large Satellite Propulsion System Market (by Hybrid Thruster), $Million, 2024-2040

- Table 146: Rest-of-Asia-Pacific Large Satellite Propulsion System Market (by Hybrid Thruster), Units, 2024-2040

- Table 147: Rest-of-the-World Large Satellite Propulsion System Market (by Subsystem), $Million, 2024-2040

- Table 148: Rest-of-the-World Large Satellite Propulsion System Market (by Subsystem), Units, 2024-2040

- Table 149: Rest-of-the-World Large Satellite Propulsion System Market (by Chemical Thruster), $Million, 2024-2040

- Table 150: Rest-of-the-World Large Satellite Propulsion System Market (by Chemical Thruster), Units, 2024-2040

- Table 151: Rest-of-the-World Large Satellite Propulsion System Market (by Electric Thruster), $Million, 2024-2040

- Table 152: Rest-of-the-World Large Satellite Propulsion System Market (by Electric Thruster), Units, 2024-2040

- Table 153: Rest-of-the-World Large Satellite Propulsion System Market (by Cold Gas Thruster), $Million, 2024-2040

- Table 154: Rest-of-the-World Large Satellite Propulsion System Market (by Cold Gas Thruster), Units, 2024-2040

- Table 155: Rest-of-the-World Large Satellite Propulsion System Market (by Hybrid Thruster), $Million, 2024-2040

- Table 156: Rest-of-the-World Large Satellite Propulsion System Market (by Hybrid Thruster), Units, 2024-2040

- Table 157: Middle East and Africa Large Satellite Propulsion System Market (by Subsystem), $Million, 2024-2040

- Table 158: Middle East and Africa Large Satellite Propulsion System Market (by Subsystem), Units, 2024-2040

- Table 159: Middle East and Africa Large Satellite Propulsion System Market (by Chemical Thruster), $Million, 2024-2040

- Table 160: Middle East and Africa Large Satellite Propulsion System Market (by Chemical Thruster), Units, 2024-2040

- Table 161: Middle East and Africa Large Satellite Propulsion System Market (by Electric Thruster), $Million, 2024-2040

- Table 162: Middle East and Africa Large Satellite Propulsion System Market (by Electric Thruster), Units, 2024-2040

- Table 163: Middle East and Africa Large Satellite Propulsion System Market (by Cold Gas Thruster), $Million, 2024-2040

- Table 164: Middle East and Africa Large Satellite Propulsion System Market (by Cold Gas Thruster), Units, 2024-2040

- Table 165: Middle East and Africa Large Satellite Propulsion System Market (by Hybrid Thruster), $Million, 2024-2040

- Table 166: Middle East and Africa Large Satellite Propulsion System Market (by Hybrid Thruster), Units, 2024-2040

- Table 167: Latin America Large Satellite Propulsion System Market (by Subsystem), $Million, 2024-2040

- Table 168: Latin America Large Satellite Propulsion System Market (by Subsystem), Units, 2024-2040

- Table 169: Latin America Large Satellite Propulsion System Market (by Chemical Thruster), $Million, 2024-2040

- Table 170: Latin America Large Satellite Propulsion System Market (by Chemical Thruster), Units, 2024-2040

- Table 171: Latin America Large Satellite Propulsion System Market (by Electric Thruster), $Million, 2024-2040

- Table 172: Latin America Large Satellite Propulsion System Market (by Electric Thruster), Units, 2024-2040

- Table 173: Latin America Large Satellite Propulsion System Market (by Cold Gas Thruster), $Million, 2024-2040

- Table 174: Latin America Large Satellite Propulsion System Market (by Cold Gas Thruster), Units, 2024-2040

- Table 175: Latin America Large Satellite Propulsion System Market (by Hybrid Thruster), $Million, 2024-2040

- Table 176: Latin America Large Satellite Propulsion System Market (by Hybrid Thruster), Units, 2024-2040

- Table 177: Companies Manufacturing Hybrid Thrusters

- Table 178: Companies Manufacturing Cold Gas Thrusters

- Table 179: Companies Manufacturing Chemical Thrusters

- Table 180: Companies Manufacturing Electric Thrusters

- Table 181: List of Companies and their Key Customers for Thrusters

This report can be delivered within 1 working day.

Introduction of Large Satellite Propulsion System Market

The large satellite propulsion system market encompasses a broad spectrum of in-space thrust technologies, including chemical, electric, cold-gas, and hybrid thrusters, all of which are essential for orbit insertion, station-keeping, and end-of-life maneuvers of heavyweight satellites. The large satellite propulsion system market has been driven by the need for reliable, high-efficiency propulsion solutions that can support the surge in high-throughput communications satellites, advanced Earth-observation platforms, and expanding navigation constellations, each requiring precise orbit-raising and extended station-keeping capabilities. Innovations in propulsion, such as high-thrust electric Hall-effect thrusters, green-propellant chemical engines, and modular hybrid stages, are responding to the rising need among large satellite operators for scalable, cost-efficient, and sustainable propulsion solutions. The large satellite propulsion system market is highly competitive, with key players such as Boeing, Aerojet Rocketdyne, Airbus, Safran, and Northrop Grumman leading the industry. Additionally, heightened emphasis on propellant efficiency, orbital-debris mitigation, and mission flexibility is reshaping buyer priorities, spurring investment in next-generation electric and reusable propulsion architectures. Consequently, the large satellite propulsion system market remains highly dynamic, continually evolving in response to rapid technological innovation and the escalating performance demands of modern space missions.

Market Introduction

The large satellite propulsion system market encompasses a variety of subsystems, including chemical thrusters, electric thrusters, cold gas systems, and hybrid engines, all critical for ensuring reliable maneuvering and station keeping of heavyweight spacecraft. As demand for high throughput communications, Earth observation, and navigation capacity grows, the need for efficient and dependable space propulsion rises. Innovations in propulsion architectures, such as high-power Hall-effect thrusters, green propellant chemical engines, and modular hybrid stages, are gaining prominence because they deliver scalable and reliable required change in orbital velocity for large satellites. Industry leaders such as Boeing, Aerojet Rocketdyne, Airbus, Safran, and Northrop Grumman dominate the market, continually advancing their technology portfolios to remain competitive. Moreover, an increasing focus on sustainability and mission cost efficiency is driving investment in eco-friendly propellants and high-efficiency electric propulsion systems. The large satellite propulsion system market is evolving rapidly to meet the rising demands of modern space missions and the growing need for efficient orbital maneuvering.

Industrial Impact

The large satellite propulsion system market has a significant industrial impact, driving substantial economic activity and employment within the aerospace, energy, and advanced manufacturing sectors. The demand for efficient thrust generation and orbital maneuvering solutions fosters innovation in propulsion technologies, benefiting industries such as electronics, energy storage, and telecommunications. As large satellites become increasingly vital for global connectivity and observation infrastructure, the need for advanced propulsion systems continues to grow, leading to developments in fuel efficiency, modular architectures, and intelligent engine-health management systems.

Additionally, the large satellite propulsion system market supports the growth of related sectors, including launch services, on-orbit servicing, and space situational awareness. These sectors rely heavily on efficient propulsion capability, where advancements in thrusters and subsystems play a crucial role in ensuring mission reliability and reducing overall operational costs. The increasing focus on sustainability has been prompting investments in green propellants and electric propulsion solutions, reducing the environmental footprint of launch activities and encouraging the adoption of reusable launch vehicles.

Moreover, the market's emphasis on optimizing propulsion efficiency, performance, and reliability drives collaborations across industries, including energy providers, research institutions, and aerospace companies. These collaborations enhance technological advancements, improving satellites' overall longevity and resilience. Overall, the large satellite propulsion system market is a key driver of technological innovation, economic growth, and the future of critical global space-based infrastructure.

Market Segmentation:

Segmentation: By Subsystem

- Chemical Thruster

- Propellant Tank

- Pump

- Fuel and Oxidizer Valve

- Electric Thruster

- Propellant Tank

- Pump

- Cold Gas Thruster

- Gas Storage Tank

- Propulsion Chamber/Nozzle

- Pump

- Hybrid Thruster

- Propellant Tank

- Propulsion Chamber/Nozzle

- Pump

Chemical Thrusters to Dominate the Large Satellite Propulsion System Market (by Product)

The large satellite propulsion system market, by product, is predominantly driven by chemical thrusters. The chemical thrusters segment was valued at $2,051.2 million in 2024 and is projected to reach $3,452.0 million by 2033. This segment has been experiencing remarkable growth due to increasing demand for high-thrust, reliable orbit-raising, and station-keeping solutions in heavyweight communications, Earth-observation, and national security spacecraft. Chemical thrusters play a crucial role in ensuring continuous mission capability by delivering immediate, high-impulse maneuvers that electric systems alone cannot match. The dominance of chemical propulsion has been further reinforced by the rapid expansion of GEO and deep-space programs, which require higher propellant capacities to accommodate extended mission durations and stricter end-of-life de-orbit mandates. Additionally, innovations in green propellants, additive-manufactured engine components, and advanced combustion management systems have driven segment growth, enabling chemical thrusters to meet evolving efficiency, sustainability, and cost targets.

Recent Developments in the Large Satellite Propulsion System Market

- On March 14, 2025, Ursa Major secured approximately $10.0 to $15.0 million contract to supply fully integrated GEO-class propulsion packages for tactical satellite buses, boosting on-orbit maneuverability, collision-avoidance capability, and controlled de-orbit to meet the demand for more agile, responsive space operations.

- On June 23, 2023, Terran Orbital and Safran formed a partnership to assess U.S. production of advanced electric propulsion centered on Safran's PPSX00 Hall-effect plasma thruster for low-Earth-orbit satellites. The venture targets lighter, more efficient systems for orbit raising, station-keeping, and orbital transfers, delivering significant mass savings over conventional chemical engines.

- On July 26, 2022, Thales Alenia Space partnered with Italian startup MIPRONS to create a water-powered satellite propulsion system. Leveraging MIPRONS' proprietary electrolysis process, the technology splits water into hydrogen and oxygen, then recombines them in the engine's combustion chamber, providing a greener and more cost-effective alternative to traditional propellants.

- On July 12, 2023, Space Plasmatics, the Israeli electric-propulsion start-up, formally unveiled its plasma thrusters, an innovative system that accelerates ionized gas instead of relying on chemical combustion. The company had already signed a partnership agreement with Israel Aerospace Industries in June 2023 to integrate these thrusters into IAI's heavy-satellite platforms, a move that strengthens IAI's competitive position in large-satellite propulsion.

How can this report add value to an organization?

Product/Innovation Strategy: The product segment helps the reader understand the different types of products available globally. Moreover, the study provides the reader with a detailed understanding of the large satellite propulsion system market by products based on propulsion subsystems.

Growth/Marketing Strategy: The large satellite propulsion system market has seen major development by key players operating in the market, such as business expansion, partnership, collaboration, and joint venture. The favored strategy for the companies has been synergistic activities to strengthen their position in the large satellite propulsion system market.

Methodology: The research methodology design adopted for this specific study includes a mix of data collected from primary and secondary data sources. Both primary resources (key players, market leaders, and in-house experts) and secondary research (a host of paid and unpaid databases), along with analytical tools, have been employed to build the predictive and forecast models.

Data and validation have been taken into consideration from both primary sources as well as secondary sources.

Key Considerations and Assumptions in Market Engineering and Validation

- Detailed secondary research has been done to ensure maximum coverage of manufacturers/suppliers operational in a country.

- To a certain extent, exact revenue information has been extracted for each company from secondary sources and databases. Revenues specific to product/service/technology were then estimated based on fact-based proxy indicators as well as primary inputs.

- The average selling price (ASP) has been calculated using the weighted average method based on the classification.

- The currency conversion rate has been taken from the historical exchange rate of Oanda and/or other relevant websites.

- Any economic downturn in the future has not been taken into consideration for the market estimation and forecast.

- The base currency considered for the market analysis is US$. Currencies other than the US$ have been converted to the US$ for all statistical calculations, considering the average conversion rate for that particular year.

- The term "product" in this document may refer to "subsystem" or "thruster" as and where relevant.

Primary Research

The primary sources involve large satellite propulsion system industry experts, including large satellite propulsion system product providers. Respondents such as CEOs, vice presidents, marketing directors, and technology and innovation directors have been interviewed to obtain and verify both qualitative and quantitative aspects of this research study.

Secondary Research

This study involves the usage of extensive secondary research, company websites, directories, and annual reports. It also makes use of databases, such as Businessweek and others, to collect effective and useful information for a market-oriented, technical, commercial, and extensive study of the global market. In addition to the data sources, the study has been undertaken with the help of other data sources and websites.

Secondary research was done to obtain critical information about the industry's value chain, the market's monetary chain, revenue models, the total pool of key players, and the current and potential use cases and applications.

Key Market Players and Competition Synopsis

The large satellite propulsion system market has been characterized by intense competition among several global industry leaders. Major companies such as L3Harris Technologies, Inc., Airbus, Safran, Boeing, Moog Inc., and Northrop Grumman dominate this space by offering a comprehensive portfolio of chemical, electric, and hybrid propulsion solutions. These firms invest heavily in research and development to deliver higher-efficiency thruster architectures, next-generation turbopumps, and cleaner propellant chemistries aimed at boosting performance and mission reliability while prolonging satellite operational life.

The large satellite propulsion system market has been further shaped by ongoing technological advances and the entrance of new players, introducing high-efficiency electric thrusters, green propellants, and solar-electric propulsion architectures. This dynamic environment keeps the large satellite propulsion system market highly competitive and responsive to evolving operator requirements for efficiency, scalability, and sustainability while driving continuous innovation across the satellite value chain.

Some prominent names established in this market are:

- Boeing

- L3Harris Technologies, Inc.

- Airbus

- Safran

- QinetiQ

- Nammo AS

- IHI Corporation

- ISRO

- Lanzhou Institute of Physics

- OKB Fakel

- Rafael Advanced Defense System Ltd.

- Keldysh Research Center

- Moog Inc.

- Northrop Grumman

- OHB SE

Table of Contents

Executive Summary

Market/Product Definition

1 Product

- 1.1 Market Overview

- 1.1.1 Analysis of Pump Performance across Thruster Types

- 1.1.2 Emerging Technologies and Innovations in Thruster Pumps

- 1.1.2.1 3D-Printed Pump Components and Advanced Materials

- 1.1.2.2 AI and IoT-Driven Predictive Maintenance

- 1.1.2.3 Sustainability and Energy-Efficiency in Pump Design

- 1.1.3 Strategic Partnerships and Collaborations in the Thruster Pump Ecosystem

- 1.2 Global Large Satellite Propulsion System Market (by Subsystem)

- 1.2.1 Demand Analysis of Large Satellite Propulsion System Market (by Subsystem), Value and Volume Data

- 1.2.2 Chemical Thruster

- 1.2.2.1 Propellant Tank

- 1.2.2.2 Pump

- 1.2.2.3 Fuel and Oxidizer Valve

- 1.2.3 Electric Thruster

- 1.2.3.1 Propellant Tank

- 1.2.3.2 Pump

- 1.2.4 Cold Gas Thrusters

- 1.2.4.1 Gas Storage Tank

- 1.2.4.2 Propulsion Chamber/Nozzle

- 1.2.4.3 Pump

- 1.2.5 Hybrid Thruster

- 1.2.5.1 Propellant Tank

- 1.2.5.2 Propulsion Chamber/Nozzle

- 1.2.5.3 Pump

2 Regions

- 2.1 Global Large Satellite Propulsion System Market (by Region)

- 2.1.1 North America

- 2.1.1.1 North America Large Satellite Propulsion System Market (by Subsystem)

- 2.1.1.2 North America (by Country)

- 2.1.1.2.1 U.S.

- 2.1.1.2.1.1 U.S. Large Satellite Propulsion System Market (by Subsystem)

- 2.1.1.2.2 Canada

- 2.1.1.2.2.1 Canada Large Satellite Propulsion System Market (by Subsystem)

- 2.1.1.2.1 U.S.

- 2.1.2 Europe

- 2.1.2.1 Europe Large Satellite Propulsion System Market (by Subsystem)

- 2.1.2.2 Europe (by Country)

- 2.1.2.2.1 France

- 2.1.2.2.1.1 France Large Satellite Propulsion System Market (by Subsystem)

- 2.1.2.2.2 Germany

- 2.1.2.2.2.1 Germany Large Satellite Propulsion System Market (by Subsystem)

- 2.1.2.2.3 U.K.

- 2.1.2.2.3.1 U.K. Large Satellite Propulsion System Market (by Subsystem)

- 2.1.2.2.4 Rest-of-Europe

- 2.1.2.2.4.1 Rest-of-Europe Large Satellite Propulsion System Market (by Subsystem)

- 2.1.2.2.1 France

- 2.1.3 Asia-Pacific

- 2.1.3.1 Asia-Pacific Large Satellite Propulsion System Market (by Subsystem)

- 2.1.3.2 Asia-Pacific (by Country)

- 2.1.3.2.1 China

- 2.1.3.2.1.1 China Large Satellite Propulsion System Market (by Subsystem)

- 2.1.3.2.2 India

- 2.1.3.2.2.1 India Large Satellite Propulsion System Market (by Subsystem)

- 2.1.3.2.3 Japan

- 2.1.3.2.3.1 Japan Large Satellite Propulsion System Market (by Subsystem)

- 2.1.3.2.4 Rest-of-Asia-Pacific

- 2.1.3.2.4.1 Rest-of-Asia-Pacific Large Satellite Propulsion System Market (by Subsystem)

- 2.1.3.2.1 China

- 2.1.4 Rest-of-the-World

- 2.1.4.1 Rest-of-the-World Large Satellite Propulsion System Market (by Subsystem)

- 2.1.4.2 Rest-of-the-World (by Region)

- 2.1.4.2.1 Middle East and Africa

- 2.1.4.2.1.1 Middle East and Africa Large Satellite Propulsion System Market (by Subsystem)

- 2.1.4.2.2 Latin America

- 2.1.4.2.2.1 Latin America Large Satellite Propulsion System Market (by Subsystem)

- 2.1.4.2.1 Middle East and Africa

- 2.1.1 North America

3 Thruster and Regulatory Analysis

- 3.1 Analysis of Thrusters (by Application)

- 3.1.1 Hybrid Thruster

- 3.1.1.1 Maneuvering and Attitude Control

- 3.1.1.2 End-of-Life Deorbiting

- 3.1.1.3 Orbit Transfer

- 3.1.1.4 Docking

- 3.1.1.5 Station Keeping (Impulse Bits)

- 3.1.1.6 In-Orbit Transportation

- 3.1.2 Cold Gas Thruster

- 3.1.2.1 Maneuvering and Attitude Control of Satellites

- 3.1.2.2 Astronaut Maneuvering (Spacewalk)

- 3.1.2.3 End-of-Life Deorbiting

- 3.1.2.4 Reaction Wheel Unloading

- 3.1.2.5 Orbit Transfer

- 3.1.2.6 Launch Vehicle Roll Control

- 3.1.3 Chemical Thruster (Hot and Warm Gas)

- 3.1.3.1 Maneuvering and Attitude Control

- 3.1.3.2 Landing Control for Interplanetary Landers

- 3.1.3.3 Launch Vehicle Roll Control

- 3.1.4 Electric Thruster

- 3.1.4.1 Maneuvering and Orientation Control

- 3.1.4.2 Primary Propulsion for Deep Space Missions

- 3.1.4.3 Attitude Control for Microsatellites

- 3.1.4.4 Station Keeping (Impulse Bits)

- 3.1.5 Analyst Perspective

- 3.1.1 Hybrid Thruster

- 3.2 Regulatory Analysis (by Country)

- 3.2.1 U.S.

- 3.2.1.1 International Traffic in Arms Regulations (ITAR)

- 3.2.1.2 U.S. Munitions List (USML) Category XV(e)(12)

- 3.2.1.3 Export Control Classification Number (ECCN) 9A515

- 3.2.2 U.K.

- 3.2.2.1 The Space Industry Regulations 2021

- 3.2.2.2 European Space Agency (ESA) Industrial Policy Committee

- 3.2.2.3 European Cooperation for Space Standardization/Slovenian Institute for Standardization (SIST)

- 3.2.2.3.1 SIST EN 16603-35:2014

- 3.2.2.3.2 ECSS-E-ST-35-06

- 3.2.3 France

- 3.2.3.1 Centre National D'Etudes Spatiales (CNES)

- 3.2.4 Germany

- 3.2.4.1 Germany Federal Office of Economics and Export Control (BAFA)

- 3.2.4.1.1 Regulation (EU) 2021/821 - Dual-Use Export Controls

- 3.2.4.1 Germany Federal Office of Economics and Export Control (BAFA)

- 3.2.5 India

- 3.2.5.1 Indian Space Policy 2023

- 3.2.6 China

- 3.2.6.1 China Space Standard System

- 3.2.7 Russia

- 3.2.7.1 Russian Federation Federal Law

- 3.2.7.1.1 GOST R 52925-2018

- 3.2.7.1 Russian Federation Federal Law

- 3.2.1 U.S.

4 Key Customer Information

- 4.1 Key Customer Information

5 Growth Opportunities and Recommendations

- 5.1 Growth Opportunities

- 5.1.1 Advancements in Material Science for Next-Generation Thruster Pumps

- 5.1.2 Integration of AI-Driven Predictive Maintenance and Efficiency Optimization

- 5.1.3 Expanding Market Demand in Emerging Space and Commercial Ventures

- 5.1.4 Sustainable and Eco-Friendly Pump Solutions for Space Applications

- 5.1.5 Development of Solar Electric Propulsion System for Large Satellite Orbital Transfer and Maneuver

- 5.1.6 Growing Demand for Space-Based Intelligence, Surveillance, and Reconnaissance (ISR) Solutions

6 Research Methodology

- 6.1 Data Sources

- 6.1.1 Primary Data Sources

- 6.1.2 Secondary Data Sources

- 6.2 Data Triangulation