|

|

市場調査レポート

商品コード

1778599

月着陸船推進システム市場 - 世界および地域別分析:サブシステムと国別 - 分析と予測(2025年~2040年)Lunar Lander Propulsion System Market - A Global and Regional Analysis: Focus on Subsystem and Country Analysis - Analysis and Forecast, 2025-2040 |

||||||

カスタマイズ可能

|

|||||||

| 月着陸船推進システム市場 - 世界および地域別分析:サブシステムと国別 - 分析と予測(2025年~2040年) |

|

出版日: 2025年07月30日

発行: BIS Research

ページ情報: 英文 115 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

月着陸船推進システム市場には、化学スラスター、電気推進、ハイブリッドシステムなど、さまざまな推進技術が含まれ、これらは正確な月面着陸と操縦操作に不可欠です。

この市場を牽引しているのは、今後の月探査ミッションと人類が月面で持続的に活動するための、効率的で信頼性の高い推進システムに対する需要の高まりです。高度な燃料配合や軽量推進コンポーネントなどの推進技術の革新は、より高い性能とより長いミッション期間に対するニーズの高まりに対応するものです。月着陸船推進システム市場は競争が激しく、L3Harris Technologies、Northrop Grumman、Moog Inc.、Lockheed Martinなどの主要企業が技術進歩をリードしています。さらに、月探査計画を加速させるための宇宙機関や民間企業からの投資が増加しており、市場力学に影響を与えています。その結果、月着陸船推進システム市場は、月ミッションに関連する技術的課題に対応するために急速な発展を続けています。

市場のイントロダクション

月着陸船推進システム市場は、安全かつ正確な月着陸と月面作業を可能にする上で重要な役割を果たしています。月探査への関心の高まりと、月面で持続可能な有人存在を確立するという目標に伴い、市場は大幅な成長を遂げています。化学スラスターや電気推進システムなどの先進推進技術は、効率性、信頼性、ミッションの柔軟性を向上させるために採用が進んでいます。これらの技術革新は燃料消費の最適化と操縦性の向上に役立ち、月着陸船推進システム市場の拡大を後押ししています。さらに、政府の宇宙機関や非公開会社による月面ミッションへの投資の拡大も市場開拓に貢献しています。その結果、主な利害関係者は、複雑な月ミッションをサポートし、確実に成功させるための堅牢な推進ソリューションの開発に注力しています。

産業への影響

月着陸船推進システム市場は、月探査ミッションに不可欠な信頼性が高く効率的な推進技術に対する需要の高まりに後押しされ、着実な成長を遂げています。月着陸船推進システムは、月面での正確な着陸、操縦、安全な運用を保証します。化学スラスター、電気推進、ハイブリッドシステムなどの推進技術の革新により、市場は急速に進歩しています。これらの技術進歩により、従来の推進方法と比較して、燃料効率の改善、推力重量比の向上、ミッションの柔軟性の強化が可能になります。

さらに、政府宇宙機関や非公開航空宇宙会社からの投資が増加しており、月着陸船推進システムソリューションの開発と採用が世界中で加速しています。月ミッションの頻度と複雑さが増すにつれて、月着陸船推進システム市場は大きく成長し、宇宙探査と関連産業の進歩を促進すると予想されます。

市場セグメンテーション

セグメンテーション1:サブシステム別

- 化学スラスター

- 推進剤タンク

- ポンプ

- 燃料酸化装置とバルブ

- 電気スラスター

- 推進剤タンク

- ポンプ

- コールドガススラスター

- ガス/貯蔵タンク

- ポンプ

- 推進チャンバー/ノズル

- ハイブリッドスラスター

- 推進剤タンク

- ポンプ

- 推進チャンバー/ノズル

月着陸船推進システム市場を独占する化学スラスター(サブシステム別)

月着陸船推進システム市場(サブシステム別)は、化学スラスターが主に牽引しています。化学スラスター分野は2024年に6,150万米ドルと評価され、着実な成長を反映して2040年には7,150万米ドルに達すると予測されています。この分野が強いのは、正確な月面着陸と操縦に必要な信頼性の高い高推力の推進力を提供する上で、化学スラスターが重要な役割を果たしているためです。さらに、月探査プログラムへの投資の増加、月ミッションに対する厳しい性能要件、月着陸船専用に設計された化学推進技術の継続的な進歩が、このセグメントの拡大に寄与しています。これらの要因が相まって、予測期間中に化学スラスターが月着陸船推進システム市場を独占すると予想される理由が浮き彫りになっています。

セグメンテーション2:地域別

- 北米

- 欧州

- アジア太平洋

- その他の地域

月着陸船推進システム市場の最近の動向

- ITARの制限により、欧州やインドなどの地域は月着陸船推進システムの固有技術に投資するようになり、2040年までにはより多様なサプライヤー基盤が育成されます。

- 2020年代には、月着陸船推進システム市場における化学スラスターのルネサンスが到来し、数十年にわたる飛行の伝統と、精度と安全性の要件を満たすための最新の技術革新が統合されます。

- 2024年、米国国務省と商務省は輸出管理規則を更新し、同盟国との協力のためのライセンス供与を緩和しましたが、これはSpaceX、Blue Origin、Astroboticなどの企業に影響を及ぼし、月着陸船推進システムの開発中にコンプライアンスを確保する必要があります。

- 米国の規制の慎重な緩和は、産業の成長とArtemisの国際的パートナーシップを支援することを目的としていますが、一方で推進技術の中核は国家安全保障のために厳重に管理されています。

- 2019年にNASAから資金提供を受け、2024年に打ち上げられるアストロボティックのペレグリン・ミッション1は、Artemis初の商業月ペイロード・サービス(CLPS)提供で、フロンティア・エアロスペース社の667Nのメインスラスター5基を使用し、精密着陸能力を実証します。

- 2022年12月には、日本のISPACEが、月周回軌道への投入と制御された降下に搭載されたエンジンを利用して、米国のラシッド探査機を月着陸船「はくと-R」に搭載して月への輸送に成功し、月着陸船推進システム市場における商業月輸送の進歩を浮き彫りにしました。

製品/イノベーション戦略:製品タイプは、読者が世界的に利用可能なさまざまなタイプのサービスを理解するのに役立ちます。さらに、サブシステムに基づく製品別の月着陸船推進システム市場の詳細な理解を読者に提供します。

成長/マーケティング戦略月着陸船推進システム市場では、事業拡大、提携、協力、合弁事業など、市場で事業を展開する主要企業による主要な開拓が見られます。各社に好まれる戦略は、月着陸船推進システム市場における地位を強化するための相乗的な活動です。

月着陸船推進システム市場は、技術革新と市場成長を牽引する著名企業の存在によって特徴付けられています。L3Harris Technologies, Inc.、Northrop Grumman、Moog Inc.、Lockheed Martinなどの大手企業は、月着陸船の用途に合わせた高度な推進ソリューションを提供しています。これらの主要企業は、月探査ミッションをサポートするために推進効率、信頼性、安全性を高めることに注力しています。月着陸船推進システム市場の競合は激しく、各社は最先端の推進技術を提供するために研究開発に多額の投資を行っています。市場力学は、推進装置の設計と材料の継続的な改善によってさらに形成され、課題である月環境での性能向上を可能にしています。月探査の需要が高まるにつれ、非公開会社は宇宙機関や民間企業との契約を確保するため、そのポートフォリオを拡大し、世界の活動を展開しています。推進技術の継続的な進歩により、月面着陸船推進システム市場における競争が激化し、技術革新が促進されると予想されます。

この市場に設立された著名な企業には以下の通りです:

- Ariane Group

- SpaceX

- Blue Origin

- Dynetics (Leidos)

- Lockheed Martin

- Northrop Grumman

- Astrobotic

- Intuitive Machines

- Firefly Aerospace

- Draper Laboratory

- ISPACE, Inc.

- Frontier Aerospace

- Agile Space Industries

- Thales Alenia Space

- Godrej Aerospace

- IAI

- CASC / AAPT

- Sierra Space

- Aerojet Rocketdyne

- IHI Aerospace

- Bradford ECAPS

- Moog

- VACCO Industries

当レポートでは、世界の月着陸船推進システム市場について調査し、市場の概要とともに、サブシステムと国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 製品

- 市場概要

- 月面着陸船用スラスターポンプエコシステムにおける戦略的パートナーシップと協力

- 世界の月着陸船推進システム市場(サブシステム別)

- 月着陸船推進システム市場の需要分析(サブシステム別)、価値と数量データ

- 化学スラスター

- 電動スラスター

- コールドガススラスター

- ハイブリッドスラスター

第2章 地域

- 世界の月着陸船推進システム市場(地域別)

- 北米

- 欧州

- アジア太平洋

- その他の地域

第3章 スラスターと規制分析

- スラスターの分析(用途別)

- ハイブリッドスラスター

- コールドガススラスター

- 化学スラスター(高温ガスおよび温ガス)

- 電動スラスター

- アナリストの視点

- 規制分析(国別)

- 米国

- 英国

- フランス

- ドイツ

- インド

- 中国

- ロシア

第4章 重要な顧客情報

第5章 成長の機会と提言

- 成長の機会

- 次世代月着陸船スラスターポンプのための材料科学の進歩

- AI駆動型予知保全と効率最適化の統合

- 新興の月面および商業宇宙ベンチャーにおける市場需要の拡大

- 月面用途向けの持続可能で環境に優しいポンプソリューション

- 月面着陸船のための太陽電気推進統合の開発

- 月面探査と現地資源利用(ISRU)の需要増加

第6章 調査手法

List of Figures

- Figure 1: Key Players in the Lunar Lander Propulsion System Market

- Figure 2: Data Triangulation

- Figure 3: Assumptions and Limitations

List of Tables

- Table 1: Market Segmentations for Lunar Lander Propulsion System Market

- Table 2: Key Opportunities within Lunar Lander Propulsion System Market

- Table 3: Strategic Partnerships and Collaborations in the Thruster Pump Ecosystem for Lunar Landers (2020-2025)

- Table 4: Global Lunar Lander Propulsion System Market (by Subsystem), $Million, 2024-2040

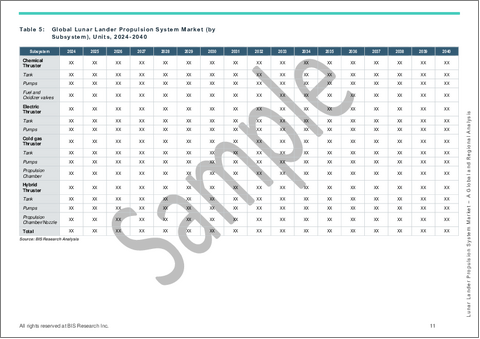

- Table 5: Global Lunar Lander Propulsion System Market (by Subsystem), Units, 2024-2040

- Table 6: Global Lunar Lander Propulsion System Market (by Region), $Million, 2024-2040

- Table 7: Global Lunar Lander Propulsion System Market (by Region), Units, 2024-2040

- Table 8: North America Lunar Lander Propulsion System Market (by Subsystem), $Million, 2024-2040

- Table 9: North America Lunar Lander Propulsion System Market (by Subsystem), Units, 2024-2040

- Table 10: U.S. Lunar Lander Propulsion System Market (by Subsystem), $Million, 2024-2040

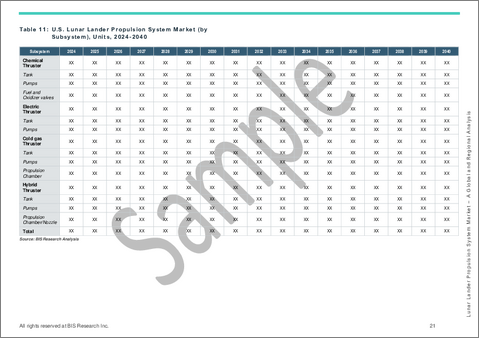

- Table 11: U.S. Lunar Lander Propulsion System Market (by Subsystem), Units, 2024-2040

- Table 12: Europe Lunar Lander Propulsion System Market (by Subsystem), $Million, 2024-2040

- Table 13: Europe Lunar Lander Propulsion System Market (by Subsystem), Units, 2024-2040

- Table 14: Rest-of-Europe Lunar Lander Propulsion System Market (by Subsystem), $Million, 2024-2040

- Table 15: Rest-of-Europe Lunar Lander Propulsion System Market (by Subsystem), Units, 2024-2040

- Table 16: Asia-Pacific Lunar Lander Propulsion System Market (by Subsystem), $Million, 2024-2040

- Table 17: Asia-Pacific Lunar Lander Propulsion System Market (by Subsystem), Units, 2024-2040

- Table 18: China Lunar Lander Propulsion System Market (by Subsystem), $Million, 2024-2040

- Table 19: China Lunar Lander Propulsion System Market (by Subsystem), Units, 2024-2040

- Table 20: India Lunar Lander Propulsion System Market (by Subsystem), $Million, 2024-2040

- Table 21: India Lunar Lander Propulsion System Market (by Subsystem), Units, 2024-2040

- Table 22: Japan Lunar Lander Propulsion System Market (by Subsystem), $Million, 2024-2040

- Table 23: Japan Lunar Lander Propulsion System Market (by Subsystem), Units, 2024-2040

- Table 24: Rest-of-Asia-Pacific Lunar Lander Propulsion System Market (by Subsystem), $Million, 2024-2040

- Table 25: Rest-of-Asia-Pacific Lunar Lander Propulsion System Market (by Subsystem), Units, 2024-2040

- Table 26: Rest-of-the-World Lunar Lander Propulsion System Market (by Subsystem), $Million, 2024-2040

- Table 27: Rest-of-the-World Lunar Lander Propulsion System Market (by Subsystem), Units, 2024-2040

- Table 28: Middle East and Africa Lunar Lander Propulsion System Market (by Subsystem), $Million, 2024-2040

- Table 29: Middle East and Africa Lunar Lander Propulsion System Market (by Subsystem), Units, 2024-2040

- Table 30: Key Chemical Propulsion Developments for Lunar Landers, 2020-2025

- Table 31: Key Chemical Thrusters Enabling Precision Lunar Landing

- Table 32: Key Chemical Thrusters in Touchdown and Ascent Phases

- Table 33: Key Roll Control Thrusters in Lunar Ascent Systems

- Table 34: List of Companies and their Key Customers

This report can be delivered within 1 working day.

Introduction of Lunar Lander Propulsion System Market

The lunar lander propulsion system market encompasses a variety of propulsion technologies, including chemical thrusters, electric propulsion, and hybrid systems, which are crucial for precise lunar landing and maneuvering operations. This market has been driven by the increasing demand for efficient and reliable propulsion systems to support upcoming lunar exploration missions and sustained human presence on the Moon. Innovations in propulsion technologies, such as advanced fuel formulations and lightweight propulsion components, address the growing need for higher performance and longer mission durations. The lunar lander propulsion system market is competitive, with key players such as L3Harris Technologies, Northrop Grumman, Moog Inc., and Lockheed Martin leading technological advancements. Furthermore, rising investments from space agencies and private enterprises to accelerate lunar exploration programs influence market dynamics. Consequently, the lunar lander propulsion system market continues to develop rapidly to meet the technical challenges associated with lunar missions.

Market Introduction

The lunar lander propulsion system market plays a vital role in enabling safe and precise lunar landing and surface operations. With the increasing interest in lunar exploration and the goal of establishing a sustainable human presence on the Moon, the market has experienced substantial growth. Advanced propulsion technologies, including chemical thrusters and electric propulsion systems, are being increasingly adopted to improve efficiency, reliability, and mission flexibility. These innovations help optimize fuel consumption and enhance maneuverability, driving the expansion of the lunar lander propulsion system market. Furthermore, growing investments by government space agencies and private companies in lunar missions contribute to market development. As a result, key stakeholders have been focusing on developing robust propulsion solutions to support complex lunar missions and ensure mission success.

Industrial Impact

The lunar lander propulsion system market has been experiencing steady growth driven by the rising demand for reliable and efficient propulsion technologies critical to lunar exploration missions. Lunar lander propulsion systems ensure precise landing, maneuvering, and safe operations on the lunar surface. The market is advancing rapidly due to innovations in propulsion technologies such as chemical thrusters, electric propulsion, and hybrid systems. These technological advancements enable improved fuel efficiency, higher thrust-to-weight ratios, and enhanced mission flexibility compared to conventional propulsion methods.

Additionally, increasing investments from government space agencies and private aerospace companies accelerate the development and adoption of lunar lander propulsion system solutions worldwide. As lunar missions become more frequent and complex, the lunar lander propulsion system market is expected to grow substantially, driving progress in space exploration and related industries.

Market Segmentation:

Segmentation 1: By Subsystem

- Chemical Thruster

- Propellant Tank

- Pump

- Fuel Oxidizer and Valve

- Electric Thruster

- Propellant Tank

- Pump

- Cold gas Thruster

- Gas/Storage Tank

- Pump

- Propulsion Chamber/Nozzle

- Hybrid Thruster

- Propellant Tank

- Pump

- Propulsion Chamber/Nozzle

Chemical Thruster to Dominate the Lunar Lander Propulsion System Market (by Subsystem)

The lunar lander propulsion system market, by subsystem, is predominantly driven by chemical thrusters. The chemical thrusters segment was valued at $61.5 million in 2024 and is projected to reach $71.5 million by 2040, reflecting steady growth. This segment's strong position is due to the critical role that chemical thrusters play in providing reliable and high-thrust propulsion necessary for precise lunar landing and maneuvering. Furthermore, increasing investments in lunar exploration programs, stringent performance requirements for lunar missions, and continuous advancements in chemical propulsion technology specifically designed for lunar landers contribute to the expansion of this segment. These factors combined highlight why chemical thrusters are expected to dominate the lunar lander propulsion system market over the forecast period.

Segmentation 2 : by Region

- North America

- Europe

- Asia-Pacific

- Rest-of-the-World

Recent Developments in the Lunar Lander Propulsion System Market

- ITAR restrictions have prompted regions such as Europe and India to invest in indigenous lunar lander propulsion system technologies, fostering a more diverse supplier base by 2040.

- The 2020s mark a renaissance for chemical thrusters in the lunar lander propulsion system market, integrating decades of flight heritage with modern innovations to meet precision and safety requirements.

- In 2024, the U.S. State and Commerce Departments updated export control rules to ease licensing for allied cooperation, affecting companies such as SpaceX, Blue Origin, and Astrobotic, which must ensure compliance while developing lunar lander propulsion systems.

- The cautious relaxation of U.S. regulations aims to support industry growth and Artemis international partnerships while core propulsion technologies remain tightly controlled for national security.

- Astrobotic's Peregrine Mission 1, funded by NASA in 2019 and launched in 2024, is the first Artemis Commercial Lunar Payload Services (CLPS) delivery, using five 667 N main thrusters from Frontier Aerospace to demonstrate precision landing capabilities.

- In December 2022, Japan's ISPACE successfully delivered the U.A.E.'s Rashid rover to the Moon aboard the Hakuto-R lander, utilizing its onboard engines for lunar orbit insertion and controlled descent, highlighting commercial lunar delivery advances in the lunar lander propulsion system market.

How can this report add value to an organization?

Product/Innovation Strategy: The product segment helps the reader understand the different types of services available globally. Moreover, the study provides the reader with a detailed understanding of the lunar lander propulsion system market by products based on subsystems.

Growth/Marketing Strategy: The lunar lander propulsion system market has seen major development by key players operating in the market, such as business expansion, partnership, collaboration, and joint venture. The favored strategy for the companies has been synergistic activities to strengthen their position in the lunar lander propulsion system market.

Methodology: The research methodology design adopted for this specific study includes a mix of data collected from primary and secondary data sources. Both primary resources (key players, market leaders, and in-house experts) and secondary research (a host of paid and unpaid databases), along with analytical tools, have been employed to build the predictive and forecast models.

Data and validation have been taken into consideration from both primary sources as well as secondary sources.

Key Considerations and Assumptions in Market Engineering and Validation

- Detailed secondary research has been done to ensure maximum coverage of manufacturers/suppliers operational in a country.

- To a certain extent, exact revenue information has been extracted for each company from secondary sources and databases. Revenues specific to product/service/technology were then estimated based on fact-based proxy indicators as well as primary inputs.

- The average selling price (ASP) has been calculated using the weighted average method based on the classification.

- The currency conversion rate has been taken from the historical exchange rate of Oanda and/or other relevant websites.

- Any economic downturn in the future has not been taken into consideration for the market estimation and forecast.

- The base currency considered for the market analysis is US$. Considering the average conversion rate for that particular year, currencies other than the US$ have been converted to the US$ for all statistical calculations.

- The term "product" in this document may refer to "service" or "technology" as and where relevant.

- The term "manufacturers/suppliers" may refer to "service providers" or "technology providers" as and where relevant.

Primary Research

The primary sources involve industry experts from the lunar lander propulsion system industry, including lunar lander propulsion system product providers. Respondents such as CEOs, vice presidents, marketing directors, and technology and innovation directors have been interviewed to obtain and verify both qualitative and quantitative aspects of this research study.

Secondary Research

This study involves the usage of extensive secondary research, company websites, directories, and annual reports. It also makes use of databases, such as Businessweek and others, to collect effective and useful information for a market-oriented, technical, commercial, and extensive study of the global market. In addition to the data sources, the study has been undertaken with the help of other data sources and websites.

Secondary research was done to obtain critical information about the industry's value chain, the market's monetary chain, revenue models, the total pool of key players, and the current and potential use cases and applications.

Key Market Players and Competition Synopsis

The lunar lander propulsion system market has been characterized by the presence of prominent companies driving technological innovation and market growth. Leading firms such as L3Harris Technologies, Inc., Northrop Grumman, Moog Inc., and Lockheed Martin offer advanced propulsion solutions tailored for lunar lander applications. These key players focus on enhancing propulsion efficiency, reliability, and safety to support lunar exploration missions. The competition in the lunar lander propulsion system market is robust, with companies investing substantially in research and development to deliver cutting-edge propulsion technologies. The market dynamics have been further shaped by continuous improvements in propulsion design and materials, enabling better performance in the challenging lunar environment. As the demand for lunar missions increases, companies are expanding their portfolios and global outreach to secure contracts with space agencies and private enterprises. The ongoing advancements in propulsion technologies are expected to intensify competition and foster innovation in the lunar lander propulsion system market.

Some prominent names established in this market are:

- Ariane Group

- SpaceX

- Blue Origin

- Dynetics (Leidos)

- Lockheed Martin

- Northrop Grumman

- Astrobotic

- Intuitive Machines

- Firefly Aerospace

- Draper Laboratory

- ISPACE, Inc.

- Frontier Aerospace

- Agile Space Industries

- Thales Alenia Space

- Godrej Aerospace

- IAI

- CASC / AAPT

- Sierra Space

- Aerojet Rocketdyne

- IHI Aerospace

- Bradford ECAPS

- Moog

- VACCO Industries

Table of Contents

Executive Summary

Scope and Definition

1 Products

- 1.1 Market Overview

- 1.1.1 Strategic Partnerships and Collaborations in the Thruster Pump Ecosystem for Lunar Landers

- 1.2 Global Lunar Lander Propulsion System Market (by Subsystem)

- 1.2.1 Demand Analysis of Lunar Lander Propulsion System Market (by Subsystem), Value and Volume Data

- 1.2.2 Chemical Thruster

- 1.2.2.1 Propellant Tank

- 1.2.2.2 Pump

- 1.2.2.3 Fuel and Oxidizer Valve

- 1.2.3 Electric Thruster

- 1.2.3.1 Propellant Tank

- 1.2.3.2 Pump

- 1.2.4 Cold Gas Thrusters

- 1.2.4.1 Gas Storage Tank

- 1.2.4.2 Propulsion Chamber/Nozzle

- 1.2.4.3 Pump

- 1.2.5 Hybrid Thruster

- 1.2.5.1 Propellant Tank

- 1.2.5.2 Propulsion Chamber/Nozzle

- 1.2.5.3 Pump

2 Region

- 2.1 Global Lunar Lander Propulsion System Market (by Region)

- 2.1.1 North America

- 2.1.1.1 North America Lunar Lander Propulsion System Market (by Subsystem)

- 2.1.1.2 North America (by Country)

- 2.1.1.2.1 U.S.

- 2.1.1.2.1.1 Key Players and Subsystem Suppliers in the U.S.

- 2.1.1.2.1.2 U.S. Lunar Lander Propulsion System Market (by Subsystem)

- 2.1.1.2.2 Canada

- 2.1.1.2.2.1 Key Players and Subsystem Suppliers in Canada

- 2.1.1.2.1 U.S.

- 2.1.2 Europe

- 2.1.2.1 Europe Lunar Lander Propulsion System Market (by Subsystem)

- 2.1.2.2 Europe (by Country)

- 2.1.2.2.1 France

- 2.1.2.2.1.1 Key Players and Subsystem Suppliers in France

- 2.1.2.2.2 Germany

- 2.1.2.2.2.1 Key Players and Subsystem Suppliers in Germany

- 2.1.2.2.3 U.K.

- 2.1.2.2.3.1 Key Players and Subsystem Suppliers in the U.K.

- 2.1.2.2.4 Rest-of-Europe

- 2.1.2.2.4.1 Rest-of-Europe Lunar Lander Propulsion System Market (by Subsystem)

- 2.1.2.2.1 France

- 2.1.3 Asia-Pacific

- 2.1.3.1 Asia-Pacific Lunar Lander Propulsion System Market (by Subsystem)

- 2.1.3.2 Asia-Pacific (by Country)

- 2.1.3.2.1 China

- 2.1.3.2.1.1 Key Players and Subsystem Suppliers in China

- 2.1.3.2.1.2 China Lunar Lander Propulsion System Market (by Subsystem)

- 2.1.3.2.2 India

- 2.1.3.2.2.1 Key Players and Subsystem Suppliers in India

- 2.1.3.2.2.2 India Lunar Lander Propulsion System Market (by Subsystem)

- 2.1.3.2.3 Japan

- 2.1.3.2.3.1 Key Players and Subsystem Suppliers in Japan

- 2.1.3.2.3.2 Japan Lunar Lander Propulsion System Market (by Subsystem)

- 2.1.3.2.4 Rest-of-Asia-Pacific

- 2.1.3.2.4.1 Key Players and Subsystem Suppliers in Rest-of-Asia-Pacific

- 2.1.3.2.4.2 Rest-of-Asia-Pacific Lunar Lander Propulsion System Market (by Subsystem)

- 2.1.3.2.1 China

- 2.1.4 Rest-of-the-World

- 2.1.4.1 Rest-of-the-World Lunar Lander Propulsion System Market (by Subsystem)

- 2.1.4.2 Rest-of-the-World (by Region)

- 2.1.4.2.1 Middle East and Africa

- 2.1.4.2.1.1 Key Players and Subsystem Suppliers in the Middle East and Africa

- 2.1.4.2.1.2 Middle East and Africa Lunar Lander Propulsion System Market (by Subsystem)

- 2.1.4.2.2 Latin America

- 2.1.4.2.2.1 Key Players and Subsystem Suppliers in Latin America

- 2.1.4.2.1 Middle East and Africa

- 2.1.1 North America

3 Thruster and Regulatory Analysis

- 3.1 Analysis of Thrusters (by Application)

- 3.1.1 Hybrid Thruster

- 3.1.1.1 Maneuvering and Attitude Control (for Descent/Ascent)

- 3.1.1.2 End-of-Surface Operations and Soft-Landing

- 3.1.1.3 Orbit Transfer and Lunar Ascent

- 3.1.1.4 Docking and Landing Site Approach

- 3.1.1.5 Station Keeping and Hovering

- 3.1.2 Cold Gas Thruster

- 3.1.2.1 Maneuvering and Attitude Control of Lunar Landers

- 3.1.2.2 Emergency Abort and Thruster Reliability

- 3.1.3 Chemical Thruster (Hot and Warm Gas)

- 3.1.3.1 Maneuvering and Attitude Control for Precision Landing

- 3.1.3.2 Surface Touchdown and Ascent Control

- 3.1.3.3 Launch Vehicle Roll Control during Lunar Ascent

- 3.1.4 Electric Thruster

- 3.1.4.1 Primary Propulsion for Deep-Space Maneuvers

- 3.1.4.2 Attitude Control for Micro-Adjustment during Landing

- 3.1.4.3 Station Keeping and Post-Landing Operations

- 3.1.5 Analyst Perspective

- 3.1.1 Hybrid Thruster

- 3.2 Regulatory Analysis (by Country)

- 3.2.1 U.S.

- 3.2.1.1 International Traffic in Arms Regulations (ITAR)

- 3.2.1.2 U.S. Munitions List (USML) Category XV(e)(12)

- 3.2.1.3 Export Control Classification Number (ECCN) 9A515

- 3.2.2 U.K.

- 3.2.2.1 The Space Industry Regulations 2021

- 3.2.2.2 European Space Agency (ESA) Industrial Policy Committee

- 3.2.2.3 European Cooperation for Space Standardization/Slovenian Institute for Standardization (SIST)

- 3.2.3 France

- 3.2.3.1 Centre National D'Etudes Spatiales (CNES)

- 3.2.4 Germany

- 3.2.4.1 Germany Federal Office of Economics and Export Control (BAFA)

- 3.2.4.1.1 Regulation (EU) 2021/821 - Dual-Use Export Controls

- 3.2.4.1 Germany Federal Office of Economics and Export Control (BAFA)

- 3.2.5 India

- 3.2.5.1 Indian Space Policy 2023

- 3.2.6 China

- 3.2.6.1 China Space Standard System

- 3.2.7 Russia

- 3.2.7.1 The Russian Federation Federal Law

- 3.2.1 U.S.

4 Key Customer Information

- 4.1 Key Customer Information

5 Growth Opportunities and Recommendations

- 5.1 Growth Opportunities

- 5.1.1 Advancements in Material Science for Next-Generation Lunar Lander Thruster Pumps

- 5.1.2 Integration of AI-Driven Predictive Maintenance and Efficiency Optimization

- 5.1.3 Expanding Market Demand in Emerging Lunar and Commercial Space Ventures

- 5.1.4 Sustainable and Eco-Friendly Pump Solutions for Lunar Applications

- 5.1.5 Development of Solar-Electric Propulsion Integration for Lunar Landers

- 5.1.6 Growing Demand for Lunar Surface Exploration and In-Situ Resource Utilization (ISRU)

6 Research Methodology

- 6.1 Data Sources

- 6.1.1 Primary Data Sources

- 6.1.2 Secondary Data Sources

- 6.2 Data Triangulation