|

|

市場調査レポート

商品コード

1769473

欧州のデータセンター用配電ユニットと電源ユニット市場:用途別、製品別、国別 - 分析と予測(2025年~2035年)Europe Data Center Power Distribution Units and Power Supply Units Market: Focus on Application, Product, and Country - Analysis and Forecast, 2025-2035 |

||||||

カスタマイズ可能

|

|||||||

| 欧州のデータセンター用配電ユニットと電源ユニット市場:用途別、製品別、国別 - 分析と予測(2025年~2035年) |

|

出版日: 2025年07月14日

発行: BIS Research

ページ情報: 英文 92 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

欧州のデータセンター用配電ユニット(PDU)と電源ユニット(PSU)の市場規模は、2024年の24億5,570万米ドルから2035年には200億5,670万米ドルに達し、予測期間の2025年~2035年のCAGRは21.23%になると予測されています。

欧州のデータセンター用PDUとPSUは、信頼性が高く効果的なデータセンター運用を保証するために必要な幅広い配電・電源技術をカバーしています。増大するデータ作業負荷とデジタルインフラをサポートするため、堅牢でエネルギー効率の高い電源ソリューションに対するニーズの高まりが、市場の着実な成長を後押ししています。データセンターの電源管理は、インテリジェントPDU、モジュール型PSU、高度なリアルタイム監視システムなどの技術革新により、拡張性、持続可能性、経済性が高まっています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2025年~2035年 |

| 2025年の評価 | 29億2,420万米ドル |

| 2035年の予測 | 200億5,670万米ドル |

| CAGR | 21.23% |

Eaton、Vertiv、Schneider Electric、Delta Power Solutions、ABBが欧州市場のトップサプライヤーであり、次世代電力技術の供給を競っています。運用のアップタイム、二酸化炭素排出量の削減、エネルギー効率に対する関心の高まりは、消費者の行動を変化させ、インテリジェントで柔軟な電力インフラへの投資を促進しています。データセンター用PDUとPSUの市場開拓は、欧州がより環境に配慮した高密度のデジタル環境へ移行するにつれて、今後も発展し続けると予想されます。この動向は、規制の変更、技術的なブレークスルー、極めて信頼性が高く適応性の高い電源システムに対する需要によって促進されるとみられています。

欧州全域のデータセンター用配電ユニット(PDU)および電源ユニット(PSU)市場は、インテリジェントで拡張性が高く、エネルギー効率の高い電源インフラに対する需要の高まりにより、急速に拡大しています。クラウドコンピューティング、人工知能、モノのインターネット、エッジ展開により、データセンターの容量が地域全体で拡大する中、信頼性と適応性の高い配電は不可欠です。ハイパースケール施設とコロケーション施設の両方において、PDUとPSUは、一貫した電力供給、システムのアップタイム、運用の有効性を保証する重要な部品です。

インテリジェントPDUは、環境センシング、リモートコントロール、リアルタイムエネルギーモニタリングなどの機能により、ますます普及しています。これらの特徴により、プロアクティブな管理と電力使用の最適化が可能になります。その一方で、高密度ラックを実現し、エネルギーロスを削減するために、特にモジュール式でホットスワップ可能な設計の高効率PSUが使用されています。事業者は、EUの気候目標や規制の枠組みに従って低PUE(Power Usage Effectiveness)ソリューションを優先しており、持続可能性が市場の主要な促進要因となっています。

デジタルインフラへの旺盛な投資とグリーンデータセンターへの取り組みにより、ドイツ、オランダ、アイルランド、北欧などの国々が革新的な電源ソリューションの採用の先陣を切っています。欧州のPDUおよびPSU市場は、データセンターの継続的な拡大に伴い、徐々に拡大すると予想されます。この成長は、技術革新、統合、持続可能性と性能の重視によって特徴付けられます。

市場セグメンテーション

セグメンテーション1:用途別

- PSU

- ハイパースケールデータセンター

- コロケーションおよび小売データセンター

- 企業データセンター

- その他

- PDU

- ハイパースケールデータセンター

- コロケーションおよびリテールデータセンター

- エンタープライズ・データセンター

- その他

セグメンテーション2:製品別

- PDU配置

- 横型(1U/2U)

- 縦型(0U)

- PDUタイプ

- インテリジェントPDU

- ベーシックPDU

- PSUタイプ

- AC-DC

- DC-DC

セグメンテーション3:電源アーキテクチャ別

- 12 V DCラックレベルPSUアーキテクチャ

- 48 V DCラックレベルPSUアーキテクチャ

- 400V+-DCラック電源アーキテクチャ

セグメンテーション4:国別

- ドイツ

- フランス

- 英国

- イタリア

- オランダ

- アイルランド

- その他

欧州のデータセンター用PDUとPSU市場の市場動向と促進要因・課題

市場動向

- リアルタイム監視、リモート管理、環境センシング機能を備えたインテリジェントPDUの採用増加

- 高密度エッジコンピューティングおよびHPCワークロードに特化した電源ソリューションの開発

- 変換ロスを低減するため、ラックレベルでの直接DC配電へのシフトが加速

- 柔軟かつ迅速なデータセンター展開をサポートする、モジュール式で拡張可能なPSUへの需要

- 予測的エネルギー最適化のためのAIとソフトウェア定義電源管理の統合

市場促進要因

- AI、クラウドコンピューティング、ビッグデータの成長別ラック電力密度の上昇

- エネルギー効率と持続可能性に関する規制別高効率電源ソリューションの採用促進

- コンパクトで効率的な電力供給システムを必要とするモジュール型データセンターとエッジデータセンターの欧州全域への拡大

- ミッションクリティカルな環境におけるリアルタイムの電力可視性とフェイルオーバー耐性のニーズの高まり

- EUの気候目標や二酸化炭素削減目標に沿ったグリーンデータセンターへの注目の高まり

市場の課題

- 中小規模の事業者にとっての高度でインテリジェントなPDU/PSUの初期コストの高さ

- レガシーインフラを次世代電源システムでレトロフィットする際の統合の難しさ

- 安全、環境、サイバーセキュリティに関するさまざまな基準を含む、規制遵守の複雑さ

- サプライチェーンの混乱と急速な技術の入れ替わり別調達リスクとライフサイクルリスクの増大

成長/マーケティング戦略:欧州のデータセンター用PDUおよびPSU市場では、データセンター用PDUおよびPSU市場で事業を展開する主要企業による事業拡大、提携、協業、合弁などの大規模な市場開拓が見られます。欧州のデータセンター用PDUおよびPSU市場における地位を強化するため、各社は相乗効果を狙った戦略をとっています。

競合戦略:欧州のデータセンター用PDUおよびPSU市場の主要企業について分析し、データセンター用PDUおよびPSU製品のプロファイルをまとめました。さらに、欧州のデータセンター用PDUおよびPSU市場で事業を展開する企業の詳細な競合ベンチマーキングを実施し、企業が互いにどのように競争しているかを読者が理解できるようにし、明確なデータセンター用PDUおよびPSU市場情勢を提示しています。さらに、提携、合意、協力などの包括的な競合戦略は、欧州のデータセンター用PDUおよびPSU市場における未開拓の収益ポケットを理解する上で読者を支援します。

主要市場参入企業と競合の要約

目次

エグゼクティブサマリー

第1章 市場

- 動向:現状と将来への影響評価

- 研究開発レビュー

- ステークホルダー分析

- 市場力学の概要

第2章 地域

- 地域サマリー

- 欧州

- 地域概要

- 市場成長促進要因

- 市場成長抑制要因

- 市場(用途別)

- 市場(製品別)

- ドイツ

- フランス

- 英国

- イタリア

- オランダ

- アイルランド

- その他

第3章 市場-競合ベンチマーキングと企業プロファイル

- 今後の見通し

- 地理的評価

- Eaton

- Schneider Electric

- Legrand

- Siemens

- Rittal Pvt. Ltd.

第4章 調査手法

List of Figures

- Figure 1: Europe Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market Scenarios, 2024, 2029, 2035

- Figure 2: Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market (by Region), $Million, 2024, 2029, and 2035

- Figure 3: Europe Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market (by rPDUs by Data Center Type), $Million, 2024, 2029, and 2035

- Figure 4: Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market (by PSUs by Data Center Type), $Million, 2024, 2029, and 2035

- Figure 5: Europe Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market (by PDUs by Placement), $Million, 2024, 2029, and 2035

- Figure 6: Europe Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market (by PDUs by Type), $Million, 2024, 2029, and 2035

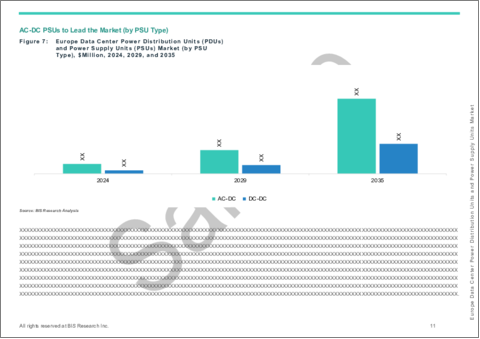

- Figure 7: Europe Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market (by PSU Type), $Million, 2024, 2029, and 2035

- Figure 8: Europe Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market (by PDUs Supply Architecture), $Million, 2024, 2029, and 2035

- Figure 9: Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market, Recent Developments

- Figure 10: Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market (by Country), January 2021-December 2024

- Figure 11: Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market (by Company), January 2021-December 2024

- Figure 12: Enhancing Power Management and Efficiency for Exponential-e's Data Center Operations

- Figure 13: Germany Data Center CAPEX for 2024

- Figure 14: Germany Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market, $Million, 2024-2035

- Figure 15: France Data Center CAPEX for 2024

- Figure 16: France Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market, $Million, 2024-2035

- Figure 17: U.K. Data Center CAPEX for 2024

- Figure 18: U.K. Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market, $Million, 2024-2035

- Figure 19: Italy Data Center CAPEX for 2024

- Figure 20: Italy Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market, $Million, 2024-2035

- Figure 21: Netherlands Data Center CAPEX for 2024

- Figure 22: Netherlands Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market, $Million, 2024-2035

- Figure 23: Ireland Data Center CAPEX for 2024

- Figure 24: Ireland Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market, $Million, 2024-2035

- Figure 25: Rest-of-Europe Data Center CAPEX for 2024

- Figure 26: Rest-of-Europe Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market, $Million, 2024-2035

- Figure 27: Data Triangulation

- Figure 28: Top-Down and Bottom-Up Approach

- Figure 29: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Opportunities across Regions

- Table 3: Impact Analysis of Market Navigating Factors, 2024-2033

- Table 4: Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market (by Region), $Million, 2024-2035

- Table 5: Europe Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market (by Application), $Million, 2024-2035

- Table 6: Europe Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market (by Power Distribution Units (PDUs) by Placement), $Million, 2024-2035

- Table 7: Europe Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market (by Power Distribution Units (PDUs) by Type), $Million, 2024-2035

- Table 8: Europe Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market (by Power Supply Units (PSUs)), $Million, 2024-2035

- Table 9: Europe Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market (by Power Supply Units (PSUs) by Supply Architecture), $Million, 2024-2035

- Table 10: Germany Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market (by Application), $Million, 2024-2035

- Table 11: Germany Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market (by Power Distribution Units (PDUs) by Placement), $Million, 2024-2035

- Table 12: Germany Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market (by Power Distribution Units (PDUs) by Type), $Million, 2024-2035

- Table 13: Germany Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market (by Power Supply Units (PSUs)), $Million, 2024-2035

- Table 14: Germany Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market (by Power Supply Units (PSUs) by Supply Architecture), $Million, 2024-2035

- Table 15: France Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market (by Application), $Million, 2024-2035

- Table 16: France Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market (by Power Distribution Units (PDUs) by Placement), $Million, 2024-2035

- Table 17: France Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market (by Power Distribution Units (PDUs) by Type), $Million, 2024-2035

- Table 18: France Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market (by Power Supply Units (PSUs)), $Million, 2024-2035

- Table 19: France Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market (by Power Supply Units (PSUs) by Supply Architecture), $Million, 2024-2035

- Table 20: U.K. Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market (by Application), $Million, 2024-2035

- Table 21: U.K. Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market (by Power Distribution Units (PDUs) by Placement), $Million, 2024-2035

- Table 22: U.K. Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market (by Power Distribution Units (PDUs) by Type), $Million, 2024-2035

- Table 23: U.K. Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market (by Power Supply Units (PSUs)), $Million, 2024-2035

- Table 24: U.K. Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market (by Power Supply Units (PSUs) by Supply Architecture), $Million, 2024-2035

- Table 25: Italy Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market (by Application), $Million, 2024-2035

- Table 26: Italy Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market (by Power Distribution Units (PDUs) by Placement), $Million, 2024-2035

- Table 27: Italy Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market (by Power Distribution Units (PDUs) by Type), $Million, 2024-2035

- Table 28: Italy Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market (by Power Supply Units (PSUs)), $Million, 2024-2035

- Table 29: Italy Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market (by Power Supply Units (PSUs) by Supply Architecture), $Million, 2024-2035

- Table 30: Netherlands Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market (by Application), $Million, 2024-2035

- Table 31: Netherlands Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market (by Power Distribution Units (PDUs) by Placement), $Million, 2024-2035

- Table 32: Netherlands Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market (by Power Distribution Units (PDUs) by Type), $Million, 2024-2035

- Table 33: Netherlands Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market (by Power Supply Units (PSUs)), $Million, 2024-2035

- Table 34: Netherlands Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market (by Power Supply Units (PSUs) by Supply Architecture), $Million, 2024-2035

- Table 35: Ireland Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market (by Application), $Million, 2024-2035

- Table 36: Ireland Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market (by Power Distribution Units (PDUs) by Placement), $Million, 2024-2035

- Table 37: Ireland Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market (by Power Distribution Units (PDUs) by Type), $Million, 2024-2035

- Table 38: Ireland Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market (by Power Supply Units (PSUs)), $Million, 2024-2035

- Table 39: Ireland Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market (by Power Supply Units (PSUs) by Supply Architecture), $Million, 2024-2035

- Table 40: Rest-of-Europe Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market (by Application), $Million, 2024-2035

- Table 41: Rest-of-Europe Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market (by Power Distribution Units (PDUs) by Placement), $Million, 2024-2035

- Table 42: Rest-of-Europe Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market (by Power Distribution Units (PDUs) by Type), $Million, 2024-2035

- Table 43: Rest-of-Europe Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market (by Power Supply Units (PSUs)), $Million, 2024-2035

- Table 44: Rest-of-Europe Data Center Power Distribution Units (PDUs) and Power Supply Units (PSUs) Market (by Power Supply Units (PSUs) by Supply Architecture), $Million, 2024-2035

- Table 45: Market Share, Data Center PDUs, 2024

This report can be delivered in 2 working days.

Introduction to Europe Data Center Power Distribution Units and Power Supply Units Market

The Europe data center PDUs and PSUs market is projected to reach $20,056.7 million by 2035 from $2,455.7 million in 2024, growing at a CAGR of 21.23% during the forecast period 2025-2035. Data centre PDUs and PSUs in Europe cover a wide range of power distribution and supply technologies that are necessary to guarantee dependable and effective data centre operations. The growing need for robust and energy-efficient power solutions to support increased data workloads and digital infrastructure is driving the market's steady growth. Power management in data centres is becoming more scalable, sustainable, and economical thanks to innovations like intelligent PDUs, modular PSUs, and sophisticated real-time monitoring systems.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2025 - 2035 |

| 2025 Evaluation | $2,924.2 Million |

| 2035 Forecast | $20,056.7 Million |

| CAGR | 21.23% |

Eaton, Vertiv, Schneider Electric, Delta Power Solutions, and ABB are among the top suppliers in the European market, and they are all vying to supply next-generation power technology. Growing concerns about operational uptime, carbon footprint reduction, and energy efficiency are changing consumer behaviour and driving more investment in intelligent and flexible power infrastructure. The market for data centre PDUs and PSUs is expected to continue to develop as Europe moves towards greener, high-density digital environments. This trend will be fuelled by changes in regulations, technical breakthroughs, and the demand for extremely dependable and adaptable power systems.

Market Introduction

The market for power distribution units (PDUs) and power supply units (PSUs) in data centres across Europe is expanding quickly due to rising demand for intelligent, scalable, and energy-efficient power infrastructure. Reliable and adaptable power distribution is essential as data centre capacity grows throughout the region due to cloud computing, artificial intelligence, the Internet of Things, and edge deployments. In both hyperscale and colocation facilities, PDUs and PSUs are crucial parts that guarantee consistent power delivery, system uptime, and operational effectiveness.

Intelligent PDUs are becoming more and more popular because of their capabilities, which include environmental sensing, remote control, and real-time energy monitoring. These characteristics allow for proactive management and power usage optimisation. In the meanwhile, high-efficiency PSUs are being used to enable high-density racks and cut down on energy loss, especially those with modular and hot-swappable designs. Operators prioritise low-PUE (Power Usage Effectiveness) solutions in accordance with EU climate targets and regulatory frameworks, making sustainability a major market driver.

With the help of robust investments in digital infrastructure and green data centre efforts, nations like Germany, the Netherlands, Ireland, and the Nordics are spearheading the adoption of innovative power solutions. The market for PDUs and PSUs in Europe is anticipated to expand gradually as data centres continue to expand. This growth will be marked by innovation, integration, and a strong emphasis on sustainability and performance.

Market Segmentation

Segmentation 1: by Application

- By PSUs

- Hyperscale Data Centers

- Colocation and Retail Data Centers

- Enterprise Data Centers

- Others

- PDUs

- Hyperscale Data Centers

- Colocation Data Center and Retail Data Centers

- Enterprise Data Centers

- Others

Segmentation 2: by Product

- By PDU Placement

- Horizontal (1U/2U)

- Vertical (0U)

- By PDU Type

- Intelligent PDUs

- Basic PDUs

- By PSU Type

- AC-DC

- DC-DC

Segmentation 3: by Supply Architecture

- 12 V DC Rack-Level PSU Architecture

- 48 V DC Rack-Level PSU Architecture

- 400V +- DC Rack Power Architecture

Segmentation 4: by Country

- Germany

- France

- U.K.

- Italy

- Netherlands

- Ireland

- Rest-of-Europe

Market trends, Drivers and Challenges of Europe Data Center PDUs and PSUs Market

Market Trends

- Increasing adoption of intelligent PDUs with real-time monitoring, remote management, and environmental sensing

- Development of specialized power solutions for high-density edge computing and HPC workloads

- Growing shift toward direct-DC power distribution at the rack level to reduce conversion losses

- Demand for modular, scalable PSUs that support flexible, rapid data center deployment

- Integration of AI and software-defined power management for predictive energy optimization

Market Drivers

- Rising rack power densities due to AI, cloud computing, and big data growth

- Energy efficiency and sustainability regulations pushing the adoption of high-efficiency power solutions

- Expansion of modular and edge data centers across Europe, requiring compact, efficient power delivery systems

- Growing need for real-time power visibility and failover resilience in mission-critical environments

- Increasing focus on green data centers aligned with EU climate targets and carbon reduction goals

Market Challenges

- High initial costs of advanced and intelligent PDUs/PSUs for small and mid-sized operators

- Integration difficulties when retrofitting legacy infrastructure with next-gen power systems

- Regulatory compliance complexity, including varying standards for safety, environment, and cybersecurity

- Supply chain disruptions and rapid technology turnover increasing procurement and lifecycle risks

How can this report add value to an organization?

Growth/Marketing Strategy: The Europe data center PDUs and PSUs market has seen major development by key players operating in the data center PDUs and PSUs market, such as business expansion, partnership, collaboration, and joint venture. The favored strategy for the companies has been synergistic activities to strengthen their position in the Europe data center PDUs and PSUs market.

Competitive Strategy: Key players in the Europe data center PDUs and PSUs market have been analyzed and profiled in the study of data center PDUs and PSUs products. Moreover, a detailed competitive benchmarking of the players operating in the Europe data center PDUs and PSUs market has been done to help the reader understand how players stack against each other, presenting a clear data center PDUs and PSUs market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the Europe data center PDUs and PSUs market.

Key Market Players and Competition Synopsis

Some prominent names established in the Europe data center PDUs and PSUs market are:

- Eaton

- Schneider Electric

- Legrand

- Siemens

- Rittal Pvt. Ltd.

Table of Contents

Executive Summary

Scope and Definition

1 Markets

- 1.1 Trends: Current and Future Impact Assessment

- 1.1.1 Data Center Trends: Current and Future

- 1.1.1.1 Retrofitting and Brownfield Projects

- 1.1.1.2 Green Field Projects and New Installations

- 1.1.2 Data Center Power Consumption Scenario

- 1.1.3 Impact of United Nations Intergovernmental Panel on Climate Change on Data Center Market

- 1.1.4 Other Industrial Trends

- 1.1.4.1 HPC Cluster Developments

- 1.1.4.2 Blockchain Initiatives

- 1.1.4.3 Super Computing

- 1.1.4.4 5G and 6G Developments

- 1.1.4.5 Impact of Server/Rack Density

- 1.1.4.6 Power Distribution Trends (AC vs. DC Supply)

- 1.1.1 Data Center Trends: Current and Future

- 1.2 Research and Development Review

- 1.2.1 Patent Filing Trend (by Country, Company)

- 1.3 Stakeholder Analysis

- 1.3.1 Use Case

- 1.3.2 End User and Buying Criteria

- 1.4 Market Dynamics Overview

- 1.4.1 Market Drivers

- 1.4.1.1 Increasing Data Center Demand

- 1.4.1.2 Growing Need for Efficient Power Management

- 1.4.2 Market Restraints

- 1.4.2.1 High Initial Investment Costs and Customization Costs for Specific Applications

- 1.4.3 Market Opportunities

- 1.4.3.1 Growing Demand for Renewable Energy Solutions

- 1.4.3.2 Demand for Smart and Intelligent PDUs

- 1.4.1 Market Drivers

2 Regions

- 2.1 Regional Summary

- 2.2 Europe

- 2.2.1 Regional Overview

- 2.2.2 Driving Factors for Market Growth

- 2.2.3 Factors Challenging the Market

- 2.2.4 Market (by Application)

- 2.2.5 Market (by Product)

- 2.2.6 Germany

- 2.2.6.1 Data Center Trends and CAPEX

- 2.2.6.2 Market (by Application)

- 2.2.6.3 Market (by Product)

- 2.2.7 France

- 2.2.7.1 Data Center Trends and CAPEX in France

- 2.2.7.2 Market (by Application)

- 2.2.7.3 Market (by Product)

- 2.2.8 U.K.

- 2.2.8.1 Data Center Trends and CAPEX in U.K.

- 2.2.8.2 Market (by Application)

- 2.2.8.3 Market (by Product)

- 2.2.9 Italy

- 2.2.9.1 Data Center Trends and CAPEX in Italy

- 2.2.9.2 Market (by Application)

- 2.2.9.3 Market (by Product)

- 2.2.10 Netherlands

- 2.2.10.1 Data Center Trends and CAPEX in Netherlands

- 2.2.10.2 Market (by Application)

- 2.2.10.3 Market (by Product)

- 2.2.11 Ireland

- 2.2.11.1 Data Center Trends and CAPEX in Ireland

- 2.2.11.2 Market (by Application)

- 2.2.11.3 Market (by Product)

- 2.2.12 Rest-of-Europe

- 2.2.12.1 Data Center Trends and CAPEX in Rest-of-Europe

- 2.2.12.2 Market (by Application)

- 2.2.12.3 Market (by Product)

3 Markets - Competitive Benchmarking & Company Profiles

- 3.1 Next Frontiers

- 3.2 Geographic Assessment

- 3.2.1 Eaton

- 3.2.1.1 Overview

- 3.2.1.2 Top Products/Product Portfolio

- 3.2.1.3 Top Competitors

- 3.2.1.4 Target Customers

- 3.2.1.5 Key Personnel

- 3.2.1.6 Analyst View

- 3.2.2 Schneider Electric

- 3.2.2.1 Overview

- 3.2.2.2 Top Products/Product Portfolio

- 3.2.2.3 Top Competitors

- 3.2.2.4 Target Customers

- 3.2.2.5 Key Personnel

- 3.2.2.6 Analyst View

- 3.2.3 Legrand

- 3.2.3.1 Overview

- 3.2.3.2 Top Products/Product Portfolio

- 3.2.3.3 Top Competitors

- 3.2.3.4 Target Customers

- 3.2.3.5 Key Personnel

- 3.2.3.6 Analyst View

- 3.2.4 Siemens

- 3.2.4.1 Overview

- 3.2.4.2 Top Products/Product Portfolio

- 3.2.4.3 Top Competitors

- 3.2.4.4 Target Customers

- 3.2.4.5 Key Personnel

- 3.2.4.6 Analyst View

- 3.2.5 Rittal Pvt. Ltd.

- 3.2.5.1 Overview

- 3.2.5.2 Top Products/Product Portfolio

- 3.2.5.3 Top Competitors

- 3.2.5.4 Target Customers

- 3.2.5.5 Key Personnel

- 3.2.5.6 Analyst View

- 3.2.1 Eaton

4 Research Methodology

- 4.1 Data Sources

- 4.1.1 Primary Data Sources

- 4.1.2 Secondary Data Sources

- 4.1.3 Data Triangulation

- 4.2 Market Estimation and Forecast