|

|

市場調査レポート

商品コード

1757393

ホワイトバイオテクノロジー市場 - 世界および地域別分析:用途別、製品別、国別 - 分析と予測(2025年~2034年)White Biotechnology Market - A Global and Regional Analysis: Focus on Application, Product, and Country Analysis - Analysis and Forecast, 2025-2034 |

||||||

カスタマイズ可能

|

|||||||

| ホワイトバイオテクノロジー市場 - 世界および地域別分析:用途別、製品別、国別 - 分析と予測(2025年~2034年) |

|

出版日: 2025年06月27日

発行: BIS Research

ページ情報: 英文 120 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

産業バイオテクノロジーとしても知られるホワイトバイオテクノロジーは、生きた細胞、酵素、発酵プロセスを活用して、バイオベースの化学物質、材料、エネルギーキャリアを生産します。

主な用途分野には、バイオ燃料(先進バイオディーゼルやバイオエタノールなど)、生化学(有機酸、溶剤)、工業用酵素(洗剤、繊維製品、食品加工用)、バイオ材料(バイオポリマー、バイオプラスチック)、バイオレメディエーションや再生可能原料の価値化などの新興分野があります。合成生物学、代謝工学、タンパク質工学の技術的進歩は、より効率的な菌株開発、高収率、プロセスコストの削減を可能にしています。同時に、バイオプロセス最適化のための機械学習、ハイスループットスクリーニング、スケーラブルな連続フロー発酵といったデジタルツールが、新たなバイオ製品の市場投入までの時間を早めています。このような生物学とデジタル化の融合が、ニッチな特殊用途から大規模な産業利用へとホワイト・バイオテクノロジー市場の変貌を促しています。

ホワイトバイオテクノロジー市場のライフサイクルステージ

| 主要市場統計 | |

|---|---|

| 予測期間 | 2025年~2034年 |

| 2025年の評価 | 3,375億6,000万米ドル |

| 2034年の予測 | 6,729億2,000万米ドル |

| CAGR | 7.97% |

ホワイトバイオテクノロジー市場は、堅調な研究開発投資、急速な技術の商業化、既存の化学業界の既存企業と機敏なバイオテクノロジー新興企業の基盤の拡大を特徴とする成長段階にあります。NovozymesやDuPontのような酵素メーカーからバイオベース材料のパイオニアまで、多様なセグメントにイノベーションが分散しているため、市場の集中度はまだ緩やかで、新規参入の余地は十分にあります。プロセスの効率化が進み、バイオベース製品に関する規制の枠組みが成熟するにつれ、業界は今後10年間で統合と成熟へと移行し、大規模な戦略的提携や合併によって競合情勢が形成される可能性が高いです。

ホワイトバイオテクノロジー市場のセグメンテーション

セグメンテーション1:用途別

- バイオエネルギー

- 食品・飼料添加物

- 医薬品原料

- パーソナルケアと家庭用品

- その他

バイオエネルギーは、世界のホワイトバイオテクノロジー市場における顕著な用途分野の一つです。

セグメンテーション2:製品タイプ別

- 生化学

- バイオ燃料

- バイオ材料

- バイオ製品

世界のホワイトバイオテクノロジー市場は、製品タイプ別では生化学セグメントが牽引すると推定されます。

セグメンテーション3:地域別

- 北米 - 米国、カナダ、メキシコ

- 欧州 - ドイツ、フランス、イタリア、スペイン、英国、その他

- アジア太平洋 - 中国、日本、韓国、インド、その他

- その他 - 南米、中東・アフリカ

ホワイトバイオテクノロジー市場では、再生可能資源への需要の高まりと政府イニシアティブにより、北米が生産面で牽引力を増すと予想されます。

需要- 促進要因と限界

以下は、世界のホワイトバイオテクノロジー市場の需要促進要因です:

- 再生可能資源に向けた需要の増加

世界のホワイトバイオテクノロジー市場は、以下の課題によっていくつかの限界にも直面すると予想されます:

- 初期投資コストの高さ

ホワイトバイオテクノロジー市場の主要企業と競合情勢

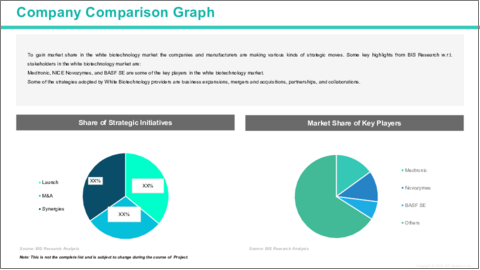

ホワイトバイオテクノロジー市場の競合情勢は、バイオテクノロジーに特化したイノベーターの波とともに、既存の化学・ライフサイエンス企業によって支配される多様性を特徴としています。Novozymes A/S、DuPont de Nemours、BASF SE、Evonik Industries AGなどの主要企業は、広範な研究開発能力と世界な生産ネットワークを活用して、工業用酵素、バイオベースポリマー、特殊バイオケミカルを大規模に供給しています。同時に、Amyris Inc.、Genomatica Inc.、Codexis Inc.、Ginkgo Bioworksなど、機敏なピュアプレイ・バイオテクノロジー企業は、高度な代謝工学、独自の菌株開発プラットフォーム、デジタル・バイオプロセス最適化ツールによって差別化を図り、市場投入までの時間を短縮し、単価を下げています。Archer Daniels Midland、Cargill Incorporated、Corbion N.V. 、Lonza Group Ltd.などの中堅企業は、原料統合と循環型経済ソリューションで競争しており、活発なM&A環境と化学大手とバイオベンチャーを結ぶ戦略的パートナーシップは、市場シェアの再編成、統合の推進、次世代技術移転の促進を続けています。

当レポートでは、世界のホワイトバイオテクノロジー市場について調査し、市場の概要とともに、用途別、製品別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場:業界展望

- 動向:現状と将来への影響評価

- ステークホルダー分析

- 使用事例

- エンドユーザーと購入基準

- 市場力学の概要

- 市場促進要因

- 市場抑制要因

- 市場機会

- 投資情勢と研究開発動向

- 将来展望と市場ロードマップ

第2章 ホワイトバイオテクノロジー市場(用途別)

- 用途のセグメンテーション

- 用途のサマリー

- ホワイトバイオテクノロジー市場(用途別)

- バイオエネルギー

- 食品・飼料添加物

- 医薬品原料

- パーソナルケア製品と家庭用品

- その他

第3章 ホワイトバイオテクノロジー市場(製品別)

- 製品のセグメンテーション

- 製品のサマリー

- ホワイトバイオテクノロジー市場(製品タイプ別)

- 生化学

- バイオ燃料

- 生体材料

- バイオ製品

第4章 ホワイトバイオテクノロジー市場(地域別)

- ホワイトバイオテクノロジー市場(地域別)

- 北米

- 地域概要

- 市場成長促進要因

- 市場成長抑制要因

- 主要企業

- 用途

- 製品

- 北米(国別)

- 欧州

- 地域概要

- 市場成長促進要因

- 市場成長抑制要因

- 主要企業

- 用途

- 製品

- 欧州(国別)

- アジア太平洋

- 地域概要

- 市場成長促進要因

- 市場成長抑制要因

- 主要企業

- 用途

- 製品

- アジア太平洋(国別)

- その他の地域

- 地域概要

- 市場成長促進要因

- 市場成長抑制要因

- 主要企業

- 用途

- 製品

- その他の地域(地域別)

第5章 市場-競合ベンチマーキングと企業プロファイル

- 今後の見通し

- 地理的評価

- 企業プロファイル

- Medtronic

- Novozymes

- BASF SE

- DuPont

- Cargill, Inc.

- Royal DSM N.V.

- Archer Daniles Midland Company

- BioAmber Inc.

- Lesaffre

- Corbion N.V.

- Evonik Industries AG

- Genomatica, Inc

- Ginkgo Bioworks

- Amyris Inc.

- TerraVia Holdings, Inc

- その他の主要企業

第6章 調査手法

List of Figures

- Figure 1: White Biotechnology Market (by Scenario), $Billion, 2025, 2028, and 2034

- Figure 2: White Biotechnology Market (by Region), $Billion, 2024, 2027, and 2034

- Figure 3: White Biotechnology Market (by Application), $Billion, 2024, 2027, and 2034

- Figure 4: White Biotechnology Market (by Product), $Billion, 2024, 2027, and 2034

- Figure 5: Competitive Landscape Snapshot

- Figure 6: Supply Chain Analysis

- Figure 7: Value Chain Analysis

- Figure 8: Impact Analysis of Market Navigating Factors, 2024-2034

- Figure 9: U.S. White Biotechnology Market, $Billion, 2024-2034

- Figure 10: Canada White Biotechnology Market, $Billion, 2024-2034

- Figure 11: Germany White Biotechnology Market, $Billion, 2024-2034

- Figure 12: France White Biotechnology Market, $Billion, 2024-2034

- Figure 13: Italy White Biotechnology Market, $Billion, 2024-2034

- Figure 14: Spain White Biotechnology Market, $Billion, 2024-2034

- Figure 15: U.K. White Biotechnology Market, $Billion, 2024-2034

- Figure 16: Rest-of-Europe White Biotechnology Market, $Billion, 2024-2034

- Figure 17: China White Biotechnology Market, $Billion, 2024-2034

- Figure 18: Japan White Biotechnology Market, $Billion, 2024-2034

- Figure 19: India White Biotechnology Market, $Billion, 2024-2034

- Figure 20: South Korea White Biotechnology Market, $Billion, 2024-2034

- Figure 21: Rest-of-Asia-Pacific White Biotechnology Market, $Billion, 2024-2034

- Figure 22: South America White Biotechnology Market, $Billion, 2024-2034

- Figure 23: Middle East and Africa White Biotechnology Market, $Billion, 2024-2034

- Figure 24: Strategic Initiatives (by Company), 2021-2025

- Figure 25: Share of Strategic Initiatives, 2021-2025

- Figure 26: Data Triangulation

- Figure 27: Top-Down and Bottom-Up Approach

- Figure 28: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Opportunities across Region

- Table 3: Trends Overview

- Table 4: Application Summary (by Application)

- Table 5: Product Summary (by Product)

- Table 6: White Biotechnology Market (by Region), $Billion, 2024-2034

- Table 7: North America White Biotechnology Market (by Application), $Billion, 2024-2034

- Table 8: North America White Biotechnology Market (by Product), $Billion, 2024-2034

- Table 9: U.S. White Biotechnology Market (by Application), $Billion, 2024-2034

- Table 10: U.S. White Biotechnology Market (by Product), $Billion, 2024-2034

- Table 11: Canada White Biotechnology Market (by Application), $Billion, 2024-2034

- Table 12: Canada White Biotechnology Market (by Product), $Billion, 2024-2034

- Table 13: Europe White Biotechnology Market (by Application), $Billion, 2024-2034

- Table 14: Europe White Biotechnology Market (by Product), $Billion, 2024-2034

- Table 15: Germany White Biotechnology Market (by Application), $Billion, 2024-2034

- Table 16: Germany White Biotechnology Market (by Product), $Billion, 2024-2034

- Table 17: France White Biotechnology Market (by Application), $Billion, 2024-2034

- Table 18: France White Biotechnology Market (by Product), $Billion, 2024-2034

- Table 19: Italy White Biotechnology Market (by Application), $Billion, 2024-2034

- Table 20: Italy White Biotechnology Market (by Product), $Billion, 2024-2034

- Table 21: Spain White Biotechnology Market (by Application), $Billion, 2024-2034

- Table 22: Spain White Biotechnology Market (by Product), $Billion, 2024-2034

- Table 23: U.K. White Biotechnology Market (by Application), $Billion, 2024-2034

- Table 24: U.K. White Biotechnology Market (by Product), $Billion, 2024-2034

- Table 25: Rest-of-Europe White Biotechnology Market (by Application), $Billion, 2024-2034

- Table 26: Rest-of-Europe White Biotechnology Market (by Product), $Billion, 2024-2034

- Table 27: Asia-Pacific White Biotechnology Market (by Application), $Billion, 2024-2034

- Table 28: Asia-Pacific White Biotechnology Market (by Product), $Billion, 2024-2034

- Table 29: China White Biotechnology Market (by Application), $Billion, 2024-2034

- Table 30: China White Biotechnology Market (by Product), $Billion, 2024-2034

- Table 31: Japan White Biotechnology Market (by Application), $Billion, 2024-2034

- Table 32: Japan White Biotechnology Market (by Product), $Billion, 2024-2034

- Table 33: India White Biotechnology Market (by Application), $Billion, 2024-2034

- Table 34: India White Biotechnology Market (by Product), $Billion, 2024-2034

- Table 35: South Korea White Biotechnology Market (by Application), $Billion, 2024-2034

- Table 36: South Korea White Biotechnology Market (by Product), $Billion, 2024-2034

- Table 37: Rest-of-Asia-Pacific White Biotechnology Market (by Application), $Billion, 2024-2034

- Table 38: Rest-of-Asia-Pacific White Biotechnology Market (by Product), $Billion, 2024-2034

- Table 39: Rest-of-the-World White Biotechnology Market (by Application), $Billion, 2024-2034

- Table 40: Rest-of-the-World White Biotechnology Market (by Product), $Billion, 2024-2034

- Table 41: South America White Biotechnology Market (by Application), $Billion, 2024-2034

- Table 42: South America White Biotechnology Market (by Product), $Billion, 2024-2034

- Table 43: Middle East and Africa White Biotechnology Market (by Application), $Billion, 2024-2034

- Table 44: Middle East and Africa White Biotechnology Market (by Product), $Billion, 2024-2034

- Table 45: Market Share

Global White Biotechnology Market: Industry Overview

White biotechnology also known as industrial biotechnology leverages living cells, enzymes and fermentation processes to produce bio-based chemicals, materials and energy carriers. Core application areas include biofuels (e.g., advanced biodiesel and bioethanol), biochemicals (organic acids, solvents), industrial enzymes (for detergents, textiles, food processing), biomaterials (biopolymers, bioplastics) and emerging fields such as bioremediation and renewable feedstock valorization. Technological advances in synthetic biology, metabolic engineering and protein engineering are enabling more efficient strain development, higher yields and reduced process costs. Concurrently, digital tools-machine learning for bioprocess optimization, high-throughput screening and scalable continuous-flow fermentation-are accelerating time-to-market for new bioproducts. This convergence of biology and digitalization is driving white biotechnology market's transformation from niche specialty applications toward large-scale industrial adoption.

White Biotechnology Market Lifecycle Stage

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2025 - 2034 |

| 2025 Evaluation | $337.56 Billion |

| 2034 Forecast | $672.92 Billion |

| CAGR | 7.97% |

The white biotechnology market is firmly in its growth phase, characterized by robust R&D investment, rapid technology commercialization and an expanding base of both established chemical-industry incumbents and agile biotech startups. Market concentration remains moderate, with innovation dispersed across diverse segments-from enzyme producers like Novozymes and DuPont to bio-based materials pioneers-indicating ample room for new entrants. As process efficiencies improve and regulatory frameworks for bio-based products mature, the industry is poised to transition toward consolidation and maturation over the next decade, with large strategic partnerships and mergers likely to shape the competitive landscape.

White Biotechnology Market Segmentation:

Segmentation 1: by Application

- Bioenergy

- Food and Feed Additives

- Pharmaceutical Ingredients

- Personal Care and Household Products

- Others

Bioenergy is one of the prominent application segments in the global white biotechnology market.

Segmentation 2: by Product Type

- Biochemical

- Biofuel

- Biomaterial

- Bioproduct

The global white biotechnology market is estimated to be led by the biochemical segment in terms of product type.

Segmentation 3: by Region

- North America - U.S., Canada, and Mexico

- Europe - Germany, France, Italy, Spain, U.K., and Rest-of-Europe

- Asia-Pacific - China, Japan, South Korea, India, and Rest-of-Asia-Pacific

- Rest-of-the-World - South America and Middle East and Africa

In the white biotechnology market, North America is anticipated to gain traction in terms of production, with increasing demand towards renewable resources and govement initiatives.

Demand - Drivers and Limitations

The following are the demand drivers for the global white biotechnology market:

- Increasing Demand Towards Renewable Resources

The global white biotechnology market is expected to face some limitations as well due to the following challenges:

- High Initial Investment Costs

White Biotechnology Market Key Players and Competition Synopsis

The white biotechnology market sector is characterized by a diverse competitive landscape dominated by established chemical and life-sciences firms alongside a wave of specialized biotech innovators. Leading companies-such as Novozymes A/S, DuPont de Nemours, BASF SE, Evonik Industries AG-leverage extensive R&D capabilities and global production networks to supply industrial enzymes, bio-based polymers and specialty biochemicals at scale. At the same time, agile pure-play biotechnology companies-Amyris Inc., Genomatica Inc., Codexis Inc. and Ginkgo Bioworks-are differentiating themselves through advanced metabolic engineering, proprietary strain-development platforms and digital bioprocess optimization tools that accelerate time-to-market and reduce unit costs. Mid-tier players including Archer Daniels Midland, Cargill Incorporated, Corbion N.V. and Lonza Group Ltd. compete on feedstock integration and circular-economy solutions, while an active M&A environment and strategic partnerships-linking chemical giants with biotech startups-continue to reshape market share, drive consolidation and foster next-generation technology transfer.

Some prominent names established in the white biotechnology market are:

- Medtronic

- Novozymes

- BASF SE

- DuPont

- Cargill, Inc.

- Royal DSM N.V.

- Archer Daniles Midland Company

- BioAmber Inc.

- Lesaffre

- Corbion N.V.

- Evonik Industries AG

- Genomatica, Inc

- Ginkgo Bioworks

- Amyris Inc.

- TerraVia Holdings, Inc

Companies that are not a part of the previously mentioned pool have been well represented across different sections of the report (wherever applicable).

Table of Contents

Executive Summary

Scope and Definition

Market/Product Definition

Key Questions Answered

Analysis and Forecast Note

1. Markets: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.2 Stakeholder Analysis

- 1.2.1 Use Case

- 1.2.2 End User and Buying Criteria

- 1.3 Market Dynamics Overview

- 1.3.1 Market Drivers

- 1.3.2 Market Restraints

- 1.3.3 Market Opportunities

- 1.4 Investment Landscape and R&D Trends

- 1.5 Future Outlook and Market Roadmap

2. White Biotechnology Market (by Application)

- 2.1 Application Segmentation

- 2.2 Application Summary

- 2.3 White Biotechnology Market (by Application)

- 2.3.1 Bioenergy

- 2.3.2 Food and Feed Additives

- 2.3.3 Pharmaceutical Ingredients

- 2.3.4 Personal Care and Household Products

- 2.3.5 Others

3. White Biotechnology Market (by Product)

- 3.1 Product Segmentation

- 3.2 Product Summary

- 3.3 White Biotechnology Market (by Product Type)

- 3.3.1 Biochemical

- 3.3.2 Biofuel

- 3.3.3 Biomaterial

- 3.3.4 Bioproduct

4. White Biotechnology Market (by Region)

- 4.1 White Biotechnology Market (by Region)

- 4.2 North America

- 4.2.1 Regional Overview

- 4.2.2 Driving Factors for Market Growth

- 4.2.3 Factors Challenging the Market

- 4.2.4 Key Companies

- 4.2.5 Application

- 4.2.6 Product

- 4.2.7 North America (by Country)

- 4.2.7.1 U.S.

- 4.2.7.1.1 Market by Application

- 4.2.7.1.2 Market by Product

- 4.2.7.2 Canada

- 4.2.7.2.1 Market by Application

- 4.2.7.2.2 Market by Product

- 4.2.7.1 U.S.

- 4.3 Europe

- 4.3.1 Regional Overview

- 4.3.2 Driving Factors for Market Growth

- 4.3.3 Factors Challenging the Market

- 4.3.4 Key Companies

- 4.3.5 Application

- 4.3.6 Product

- 4.3.7 Europe (by Country)

- 4.3.7.1 Germany

- 4.3.7.1.1 Market by Application

- 4.3.7.1.2 Market by Product

- 4.3.7.2 France

- 4.3.7.2.1 Market by Application

- 4.3.7.2.2 Market by Product

- 4.3.7.3 Italy

- 4.3.7.3.1 Market by Application

- 4.3.7.3.2 Market by Product

- 4.3.7.4 Spain

- 4.3.7.4.1 Market by Application

- 4.3.7.4.2 Market by Product

- 4.3.7.5 U.K.

- 4.3.7.5.1 Market by Application

- 4.3.7.5.2 Market by Product

- 4.3.7.6 Rest-of-Europe

- 4.3.7.6.1 Market by Application

- 4.3.7.6.2 Market by Product

- 4.3.7.1 Germany

- 4.4 Asia-Pacific

- 4.4.1 Regional Overview

- 4.4.2 Driving Factors for Market Growth

- 4.4.3 Factors Challenging the Market

- 4.4.4 Key Companies

- 4.4.5 Application

- 4.4.6 Product

- 4.4.7 Asia-Pacific (by Country)

- 4.4.7.1 China

- 4.4.7.1.1 Market by Application

- 4.4.7.1.2 Market by Product

- 4.4.7.2 Japan

- 4.4.7.2.1 Market by Application

- 4.4.7.2.2 Market by Product

- 4.4.7.3 India

- 4.4.7.3.1 Market by Application

- 4.4.7.3.2 Market by Product

- 4.4.7.4 South Korea

- 4.4.7.4.1 Market by Application

- 4.4.7.4.2 Market by Product

- 4.4.7.5 Rest-of-Asia-Pacific

- 4.4.7.5.1 Market by Application

- 4.4.7.5.2 Market by Product

- 4.4.7.1 China

- 4.5 Rest-of-the-World

- 4.5.1 Regional Overview

- 4.5.2 Driving Factors for Market Growth

- 4.5.3 Factors Challenging the Market

- 4.5.4 Key Companies

- 4.5.5 Application

- 4.5.6 Product

- 4.5.7 Rest-of-the-World (by Region)

- 4.5.7.1 South America

- 4.5.7.1.1 Market by Application

- 4.5.7.1.2 Market by Product

- 4.5.7.2 Middle East and Africa

- 4.5.7.2.1 Market by Application

- 4.5.7.2.2 Market by Product

- 4.5.7.1 South America

5. Markets - Competitive Benchmarking & Company Profiles

- 5.1 Next Frontiers

- 5.2 Geographic Assessment

- 5.3 Company Profiles

- 5.3.1 Medtronic

- 5.3.1.1 Overview

- 5.3.1.2 Top Products/Product Portfolio

- 5.3.1.3 Top Competitors

- 5.3.1.4 Target Customers

- 5.3.1.5 Key Personnel

- 5.3.1.6 Analyst View

- 5.3.1.7 Market Share

- 5.3.2 Novozymes

- 5.3.2.1 Overview

- 5.3.2.2 Top Products/Product Portfolio

- 5.3.2.3 Top Competitors

- 5.3.2.4 Target Customers

- 5.3.2.5 Key Personnel

- 5.3.2.6 Analyst View

- 5.3.2.7 Market Share

- 5.3.3 BASF SE

- 5.3.3.1 Overview

- 5.3.3.2 Top Products/Product Portfolio

- 5.3.3.3 Top Competitors

- 5.3.3.4 Target Customers

- 5.3.3.5 Key Personnel

- 5.3.3.6 Analyst View

- 5.3.3.7 Market Share

- 5.3.4 DuPont

- 5.3.4.1 Overview

- 5.3.4.2 Top Products/Product Portfolio

- 5.3.4.3 Top Competitors

- 5.3.4.4 Target Customers

- 5.3.4.5 Key Personnel

- 5.3.4.6 Analyst View

- 5.3.4.7 Market Share

- 5.3.5 Cargill, Inc.

- 5.3.5.1 Overview

- 5.3.5.2 Top Products/Product Portfolio

- 5.3.5.3 Top Competitors

- 5.3.5.4 Target Customers

- 5.3.5.5 Key Personnel

- 5.3.5.6 Analyst View

- 5.3.5.7 Market Share

- 5.3.6 Royal DSM N.V.

- 5.3.6.1 Overview

- 5.3.6.2 Top Products/Product Portfolio

- 5.3.6.3 Top Competitors

- 5.3.6.4 Target Customers

- 5.3.6.5 Key Personnel

- 5.3.6.6 Analyst View

- 5.3.6.7 Market Share

- 5.3.7 Archer Daniles Midland Company

- 5.3.7.1 Overview

- 5.3.7.2 Top Products/Product Portfolio

- 5.3.7.3 Top Competitors

- 5.3.7.4 Target Customers

- 5.3.7.5 Key Personnel

- 5.3.7.6 Analyst View

- 5.3.7.7 Market Share

- 5.3.8 BioAmber Inc.

- 5.3.8.1 Overview

- 5.3.8.2 Top Products/Product Portfolio

- 5.3.8.3 Top Competitors

- 5.3.8.4 Target Customers

- 5.3.8.5 Key Personnel

- 5.3.8.6 Analyst View

- 5.3.8.7 Market Share

- 5.3.9 Lesaffre

- 5.3.9.1 Overview

- 5.3.9.2 Top Products/Product Portfolio

- 5.3.9.3 Top Competitors

- 5.3.9.4 Target Customers

- 5.3.9.5 Key Personnel

- 5.3.9.6 Analyst View

- 5.3.9.7 Market Share

- 5.3.10 Corbion N.V.

- 5.3.10.1 Overview

- 5.3.10.2 Top Products/Product Portfolio

- 5.3.10.3 Top Competitors

- 5.3.10.4 Target Customers

- 5.3.10.5 Key Personnel

- 5.3.10.6 Analyst View

- 5.3.10.7 Market Share

- 5.3.11 Evonik Industries AG

- 5.3.11.1 Overview

- 5.3.11.2 Top Products/Product Portfolio

- 5.3.11.3 Top Competitors

- 5.3.11.4 Target Customers

- 5.3.11.5 Key Personnel

- 5.3.11.6 Analyst View

- 5.3.11.7 Market Share

- 5.3.12 Genomatica, Inc

- 5.3.12.1 Overview

- 5.3.12.2 Top Products/Product Portfolio

- 5.3.12.3 Top Competitors

- 5.3.12.4 Target Customers

- 5.3.12.5 Key Personnel

- 5.3.12.6 Analyst View

- 5.3.12.7 Market Share

- 5.3.13 Ginkgo Bioworks

- 5.3.13.1 Overview

- 5.3.13.2 Top Products/Product Portfolio

- 5.3.13.3 Top Competitors

- 5.3.13.4 Target Customers

- 5.3.13.5 Key Personnel

- 5.3.13.6 Analyst View

- 5.3.13.7 Market Share

- 5.3.14 Amyris Inc.

- 5.3.14.1 Overview

- 5.3.14.2 Top Products/Product Portfolio

- 5.3.14.3 Top Competitors

- 5.3.14.4 Target Customers

- 5.3.14.5 Key Personnel

- 5.3.14.6 Analyst View

- 5.3.14.7 Market Share

- 5.3.15 TerraVia Holdings, Inc

- 5.3.15.1 Overview

- 5.3.15.2 Top Products/Product Portfolio

- 5.3.15.3 Top Competitors

- 5.3.15.4 Target Customers

- 5.3.15.5 Key Personnel

- 5.3.15.6 Analyst View

- 5.3.15.7 Market Share

- 5.3.1 Medtronic

- 5.4 Other Key Companies