|

|

市場調査レポート

商品コード

1757392

自動車用センサーシグナルコンディショナー市場- 世界と地域別分析:出力タイプ別、用途別、地域別 - 分析と予測(2025年~2034年)Automotive Sensor Signal Conditioner Market - A Global and Regional Analysis: Focus on Output Type, Application, and Region - Analysis and Forecast, 2025-2034 |

||||||

カスタマイズ可能

|

|||||||

| 自動車用センサーシグナルコンディショナー市場- 世界と地域別分析:出力タイプ別、用途別、地域別 - 分析と予測(2025年~2034年) |

|

出版日: 2025年06月27日

発行: BIS Research

ページ情報: 英文 130 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

自動車用センサーシグナルコンディショナー市場は、広範な自動車エレクトロニクスのエコシステムにおいて重要な役割を担っており、さまざまな車両サブシステムにわたるセンサー出力の正確な解釈を可能にする、必要不可欠な信号増幅、フィルタリング、変換機能を提供しています。

これらのシグナルコンディショナーは、圧力センサ、温度センサ、加速度計、地磁気センサなどのセンサの性能に不可欠であり、ADAS(先進運転支援システム)、エンジン管理、排ガス制御の基盤となっています。自動車用センサーシグナルコンディショナー市場は、集積密度の向上、消費電力の削減、過酷な車載環境に対する堅牢性の強化など、半導体技術の継続的な進歩によって牽引されています。電気自動車(EV)やハイブリッド電気自動車(HEV)へのシフトは、複雑なセンサー・アレイに合わせた高度なシグナル・コンディショニング・ソリューションの需要をさらに加速しています。業界動向は、システムオンチップ(SoC)設計や多機能モジュールへの移行を示し、車載センサ・シグナルコンディショナー市場におけるシステムの信頼性を向上させ、全体的なコストを削減しています。

自動車用センサーシグナルコンディショナーの世界市場ライフサイクルステージ

| 主要市場統計 | |

|---|---|

| 予測期間 | 2025年~2034年 |

| 2025年の評価 | 25億5,000万米ドル |

| 2034年の予測 | 48億6,000万米ドル |

| CAGR | 7.43% |

現在、自動車用センサーシグナルコンディショナー市場は成熟段階にあり、乗用車や商用車への商用採用が広がっています。確立されたサプライチェーンとISOおよびSAE規制に沿った標準化努力に支えられ、技術的な準備態勢は整っています。

コア技術は安定していますが、現在進行中の段階的な技術革新は、小型化、スマート機能の統合、新しいセンサータイプへの適応に重点が置かれています。車載用センサーシグナルコンディショナー市場は、車両当たりのセンサー密度の向上と先進的な安全・性能機能の普及に後押しされ、2030年まで安定した成長が見込まれます。半導体メーカー、自動車OEM、研究機関の協力は、技術革新を推進し、センサ・コンディショニング回路内の電磁干渉(EMI)と熱管理に関連する課題に対処する上で引き続き重要です。

自動車用センサーシグナルコンディショナー市場のセグメンテーション:

セグメンテーション1:出力タイプ別

- アナログ出力

- デジタル出力

- ディスクリート出力

セグメンテーション2:用途別

- 燃料電池電気自動車

- バッテリー電気自動車

- プラグインハイブリッド電気自動車

セグメンテーション3:地域別

- 北米 - 米国、カナダ、メキシコ

- 欧州 - ドイツ、フランス、イタリア、スペイン、英国、その他

- アジア太平洋地域 - 中国、日本、韓国、インド、その他

- その他 - 南米、中東・アフリカ

アジア太平洋地域は、自動車製造基盤の拡大と先進センサー技術の採用増加により、自動車用センサーシグナルコンディショナー市場の重要な成長促進要因になると予測されます。

需要- 促進要因と限界

自動車用センサーシグナルコンディショナー市場の需要促進要因は以下の通りです:

- ADASと自律走行の成長

- 電気自動車とハイブリッド車の台頭

- 半導体技術の進歩

自動車用センサーシグナルコンディショナー市場は、以下の課題により、いくつかの制限にも直面すると予想されます:

- 高い統合コスト

- EMCとノイズの課題

自動車用センサーシグナルコンディショナー市場の主要企業と競合の概要

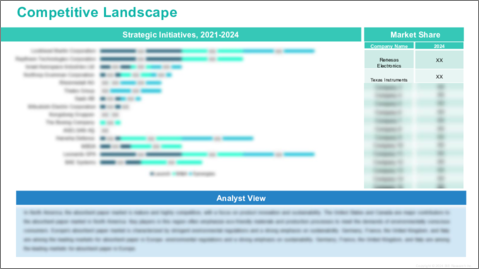

世界の自動車用センサーシグナルコンディショナー市場は、大手車載エレクトロニクスメーカーと革新的な半導体企業による激しい競争が特徴です。Renesas Electronics、Texas Instruments、Analog Devices、Rockwell Automation Inc.などの大手企業は、センサーの精度、信号処理、システム統合を強化する製品ポートフォリオを継続的に進化させることで、自動車用センサーシグナルコンディショナー市場を独占しています。これらの企業は、低ノイズアンプ、高精度アナログ回路、統合電源管理などの最先端技術を活用し、進化する車載センサー要件に対応しています。新興企業もまた、従来の内燃エンジン車と電動パワートレインの両方に対応するコスト効率と拡張性の高いソリューションを導入することで、自動車用センサーシグナルコンディショナー市場に貢献しています。センサーメーカー、OEM、Tier-1サプライヤー間のコラボレーションは、イノベーションを促進し、車両の安全性、性能、排ガス制御のための信頼性の高いセンサーデータを確保するシグナルコンディショニング技術の迅速な採用を促進する顕著な動向です。自動車用センサーシグナルコンディショナー市場が成長するにつれ、競争力学は、戦略的パートナーシップ、M&A、厳しい規制基準への対応と高度なカーエレクトロニクスに対する消費者需要の高まりに向けた継続的な研究開発投資によってますます形成されるようになっています。

当レポートでは、世界の自動車用センサーシグナルコンディショナー市場について調査し、市場の概要とともに、出力タイプ別、用途別、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場:業界展望

- 動向:現状と将来への影響評価

- 影響分析

- 市場力学の概要

- 市場促進要因

- 市場抑制要因

- 市場機会

- 規制および政策影響分析

- 地域別

- 特許分析

- スタートアップの情勢

- 投資情勢と研究開発動向

- 将来展望と市場ロードマップ

- バリューチェーン分析

- 世界価格分析

- 業界の魅力

第2章 世界の自動車用センサー信号コンディショナー市場(出力タイプ別)

- アナログ出力

- デジタル出力

- ディスクリート出力

第3章 世界の自動車用センサー信号コンディショナー市場(用途別)

- 燃料電池電気自動車

- バッテリー電気自動車

- プラグインハイブリッド電気自動車

第4章 世界の自動車用センサー信号コンディショナー市場(地域別)

- 世界の自動車用センサー信号コンディショナー市場(地域別)

- 北米

- 地域概要

- 市場成長促進要因

- 市場成長抑制要因

- 主要企業

- 出力タイプ

- 用途

- 北米(国別)

- 欧州

- 地域概要

- 市場成長促進要因

- 市場成長抑制要因

- 主要企業

- 出力タイプ

- 用途

- 欧州(国別)

- アジア太平洋

- 地域概要

- 市場成長促進要因

- 市場成長抑制要因

- 主要企業

- 出力タイプ

- 用途

- アジア太平洋(国別)

- その他の地域

- 地域概要

- 市場成長促進要因

- 市場成長抑制要因

- 主要企業

- 出力タイプ

- 用途

- その他の地域(地域別)

第5章 市場-競合ベンチマーキングと企業プロファイル

- 今後の見通し

- 地理的評価

- 企業プロファイル

- Renesas Electronics

- Texas Instruments

- Analog Devices, Inc.

- Pepperl+Fuchs

- Calex Manufacturing Co., Inc.

- Acromag Inc.

- Omega Engineering

- ABB

- Moore Industries-International Inc.

- Turck Inc.

- Rockwell Automation Inc.

- Yokogawa Electric Corporation

- S. Himmelstein and Company

- Schneider Electric

- TE Connectivity Ltd.

- その他の主要企業

第6章 調査手法

List of Figures

- Figure 1: Automotive Sensor Signal Conditioner Market (by Scenario), $Billion, 2025, 2028, and 2034

- Figure 2: Automotive Sensor Signal Conditioner Market (by Region), $Billion, 2024, 2027, and 2034

- Figure 3: Automotive Sensor Signal Conditioner Market (by Output Type), $Billion, 2024, 2027, and 2034

- Figure 4: Automotive Sensor Signal Conditioner Market (by Application), $Billion, 2024, 2027, and 2034

- Figure 5: Competitive Landscape Snapshot

- Figure 6: Supply Chain Analysis

- Figure 7: Value Chain Analysis

- Figure 8: Patent Analysis (by Country), January 2021-April 2025

- Figure 9: Patent Analysis (by Company), January 2021-April 2025

- Figure 10: Impact Analysis of Market Navigating Factors, 2024-2034

- Figure 11: U.S. Automotive Sensor Signal Conditioner Market, $Billion, 2024-2034

- Figure 12: Canada Automotive Sensor Signal Conditioner Market, $Billion, 2024-2034

- Figure 13: Mexico Automotive Sensor Signal Conditioner Market, $Billion, 2024-2034

- Figure 14: Germany Automotive Sensor Signal Conditioner Market, $Billion, 2024-2034

- Figure 15: France Automotive Sensor Signal Conditioner Market, $Billion, 2024-2034

- Figure 16: Italy Automotive Sensor Signal Conditioner Market, $Billion, 2024-2034

- Figure 17: Spain Automotive Sensor Signal Conditioner Market, $Billion, 2024-2034

- Figure 18: U.K. Automotive Sensor Signal Conditioner Market, $Billion, 2024-2034

- Figure 19: Rest-of-Europe Automotive Sensor Signal Conditioner Market, $Billion, 2024-2034

- Figure 20: China Automotive Sensor Signal Conditioner Market, $Billion, 2024-2034

- Figure 21: Japan Automotive Sensor Signal Conditioner Market, $Billion, 2024-2034

- Figure 22: India Automotive Sensor Signal Conditioner Market, $Billion, 2024-2034

- Figure 23: South Korea Automotive Sensor Signal Conditioner Market, $Billion, 2024-2034

- Figure 24: Rest-of-Asia-Pacific Automotive Sensor Signal Conditioner Market, $Billion, 2024-2034

- Figure 25: South America Automotive Sensor Signal Conditioner Market, $Billion, 2024-2034

- Figure 26: Middle East and Africa Automotive Sensor Signal Conditioner Market, $Billion, 2024-2034

- Figure 27: Strategic Initiatives (by Company), 2021-2025

- Figure 28: Share of Strategic Initiatives, 2021-2025

- Figure 29: Data Triangulation

- Figure 30: Top-Down and Bottom-Up Approach

- Figure 31: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Opportunities across Region

- Table 3: Trends Overview

- Table 4: Automotive Sensor Signal Conditioner Market Pricing Forecast, 2024-2034

- Table 5: Automotive Sensor Signal Conditioner Market (by Region), $Billion, 2024-2034

- Table 6: North America Automotive Sensor Signal Conditioner Market (by Output Type), $Billion, 2024-2034

- Table 7: North America Automotive Sensor Signal Conditioner Market (by Application), $Billion, 2024-2034

- Table 8: U.S. Automotive Sensor Signal Conditioner Market (by Output Type), $Billion, 2024-2034

- Table 9: U.S. Automotive Sensor Signal Conditioner Market (by Application), $Billion, 2024-2034

- Table 10: Canada Automotive Sensor Signal Conditioner Market (by Output Type), $Billion, 2024-2034

- Table 11: Canada Automotive Sensor Signal Conditioner Market (by Application), $Billion, 2024-2034

- Table 12: Mexico Automotive Sensor Signal Conditioner Market (by Output Type), $Billion, 2024-2034

- Table 13: Mexico Automotive Sensor Signal Conditioner Market (by Application), $Billion, 2024-2034

- Table 14: Europe Automotive Sensor Signal Conditioner Market (by Output Type), $Billion, 2024-2034

- Table 15: Europe Automotive Sensor Signal Conditioner Market (by Application), $Billion, 2024-2034

- Table 16: Germany Automotive Sensor Signal Conditioner Market (by Output Type), $Billion, 2024-2034

- Table 17: Germany Automotive Sensor Signal Conditioner Market (by Application), $Billion, 2024-2034

- Table 18: France Automotive Sensor Signal Conditioner Market (by Output Type), $Billion, 2024-2034

- Table 19: France Automotive Sensor Signal Conditioner Market (by Application), $Billion, 2024-2034

- Table 20: Italy Automotive Sensor Signal Conditioner Market (by Output Type), $Billion, 2024-2034

- Table 21: Italy Automotive Sensor Signal Conditioner Market (by Application), $Billion, 2024-2034

- Table 22: Spain Automotive Sensor Signal Conditioner Market (by Output Type), $Billion, 2024-2034

- Table 23: Spain Automotive Sensor Signal Conditioner Market (by Application), $Billion, 2024-2034

- Table 24: U.K. Automotive Sensor Signal Conditioner Market (by Output Type), $Billion, 2024-2034

- Table 25: U.K. Automotive Sensor Signal Conditioner Market (by Application), $Billion, 2024-2034

- Table 26: Rest-of-Europe Automotive Sensor Signal Conditioner Market (by Output Type), $Billion, 2024-2034

- Table 27: Rest-of-Europe Automotive Sensor Signal Conditioner Market (by Application), $Billion, 2024-2034

- Table 28: China Automotive Sensor Signal Conditioner Market (by Output Type), $Billion, 2024-2034

- Table 29: China Automotive Sensor Signal Conditioner Market (by Application), $Billion, 2024-2034

- Table 30: Japan Automotive Sensor Signal Conditioner Market (by Output Type), $Billion, 2024-2034

- Table 31: Japan Automotive Sensor Signal Conditioner Market (by Application), $Billion, 2024-2034

- Table 32: India Automotive Sensor Signal Conditioner Market (by Output Type), $Billion, 2024-2034

- Table 33: India Automotive Sensor Signal Conditioner Market (by Application), $Billion, 2024-2034

- Table 34: South Korea Automotive Sensor Signal Conditioner Market (by Output Type), $Billion, 2024-2034

- Table 35: South Korea Automotive Sensor Signal Conditioner Market (by Application), $Billion, 2024-2034

- Table 36: Rest-of-Asia-Pacific Automotive Sensor Signal Conditioner Market (by Output Type), $Billion, 2024-2034

- Table 37: Rest-of-Asia-Pacific Automotive Sensor Signal Conditioner Market (by Application), $Billion, 2024-2034

- Table 38: Rest-of-the-World Automotive Sensor Signal Conditioner Market (by Output Type), $Billion, 2024-2034

- Table 39: Rest-of-the-World Automotive Sensor Signal Conditioner Market (by Application), $Billion, 2024-2034

- Table 40: South America Automotive Sensor Signal Conditioner Market (by Output Type), $Billion, 2024-2034

- Table 41: South America Automotive Sensor Signal Conditioner Market (by Application), $Billion, 2024-2034

- Table 42: Middle East and Africa Automotive Sensor Signal Conditioner Market (by Output Type), $Billion, 2024-2034

- Table 43: Middle East and Africa Automotive Sensor Signal Conditioner Market (by Application), $Billion, 2024-2034

- Table 44: Market Share

Automotive Sensor Signal Conditioner Market Industry and Technology Overview

The automotive sensor signal conditioner market plays a critical role in the broader automotive electronics ecosystem, providing essential signal amplification, filtering, and conversion functions that enable accurate interpretation of sensor outputs across various vehicle subsystems. These signal conditioners are integral to the performance of sensors such as pressure sensors, temperature sensors, accelerometers, and magnetometers, which are foundational to advanced driver-assistance systems (ADAS), engine management, and emission control. The automotive sensor signal conditioner market is driven by ongoing advancements in semiconductor technology, including increased integration density, reduced power consumption, and enhanced robustness against harsh automotive environments. The shift towards electric vehicles (EVs) and hybrid electric vehicles (HEVs) further accelerates demand for sophisticated signal conditioning solutions tailored to complex sensor arrays. Industry trends indicate a move towards system-on-chip (SoC) designs and multifunctional modules, improving system reliability and reducing overall costs in the automotive sensor signal conditioner market.

Global Automotive Sensor Signal Conditioner Market Lifecycle Stage

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2025 - 2034 |

| 2025 Evaluation | $2.55 Billion |

| 2034 Forecast | $4.86 Billion |

| CAGR | 7.43% |

Currently, the automotive sensor signal conditioner market is in a mature phase of development, with widespread commercial adoption across passenger and commercial vehicles. Technology readiness is high, supported by established supply chains and standardization efforts aligned with ISO and SAE regulations.

While the core technology is stable, ongoing incremental innovation is focused on miniaturization, integration of smart features, and adaptation to emerging sensor types. The automotive sensor signal conditioner market is expected to experience steady growth through 2030, propelled by increasing sensor density per vehicle and the proliferation of advanced safety and performance features. Collaborations between semiconductor manufacturers, automotive OEMs, and research institutes remain critical in driving innovation and addressing challenges related to electromagnetic interference (EMI) and thermal management within sensor conditioning circuits.

Automotive Sensor Signal Conditioner Market Segmentation:

Segmentation 1: by Output Type

- Analog Output

- Digital Output

- Discrete Output

Segmentation 2: by Application

- Fuel-Cell Electric Vehicles

- Battery Electric Vehicles

- Plug-In Hybrid Electric Vehicles

Segmentation 3: by Region

- North America - U.S., Canada, and Mexico

- Europe - Germany, France, Italy, Spain, U.K., and Rest-of-Europe

- Asia-Pacific - China, Japan, South Korea, India, and Rest-of-Asia-Pacific

- Rest-of-the-World - South America and Middle East and Africa

Asia-Pacific is anticipated to be a significant growth driver for the automotive sensor signal conditioner market due to expanding automotive manufacturing bases and increasing adoption of advanced sensor technologies.

Demand - Drivers and Limitations

The following are the demand drivers for the automotive sensor signal conditioner market:

- Growth of ADAS and autonomous driving

- Rise of electric and hybrid vehicles

- Advances in semiconductor tech

The automotive sensor signal conditioner market is expected to face some limitations as well due to the following challenges:

- High integration costs

- EMC and noise challenges

Automotive Sensor Signal Conditioner Market Key Players and Competition Synopsis

The global automotive sensor signal conditioner market is characterized by intense competition among leading automotive electronics manufacturers and innovative semiconductor firms. Major players such as Renesas Electronics , Texas Instruments, Analog Devices, and Rockwell Automation Inc. dominate the automotive sensor signal conditioner market by continuously advancing product portfolios that enhance sensor accuracy, signal processing, and system integration. These companies are leveraging cutting-edge technologies including low-noise amplifiers, precision analog circuits, and integrated power management to meet evolving automotive sensor requirements. Emerging players are also contributing to the automotive sensor signal conditioner market by introducing cost-efficient and scalable solutions for both traditional internal combustion engine vehicles and electrified powertrains. Collaboration between sensor manufacturers, OEMs, and Tier-1 suppliers is a prominent trend, driving innovation and fostering quicker adoption of signal conditioning technologies that ensure reliable sensor data for vehicle safety, performance, and emissions control. As the automotive sensor signal conditioner market grows, competitive dynamics are increasingly shaped by strategic partnerships, mergers and acquisitions, and continuous R&D investments aimed at addressing stringent regulatory standards and rising consumer demand for advanced vehicle electronics.

Some prominent names established in the automotive sensor signal conditioner market are:

- Renesas Electronics

- Texas Instruments

- Analog Devices, Inc.

- Pepperl+Fuchs

- Calex Manufacturing Co., Inc.

- Acromag Inc.

- Omega Engineering

- ABB

- Moore Industries-International Inc.

- Turck Inc.

- Rockwell Automation Inc.

- Yokogawa Electric Corporation

- S. Himmelstein and Company

- Schneider Electric

- TE Connectivity Ltd.

Companies that are not a part of the previously mentioned pool have been well represented across different sections of the report (wherever applicable).

Table of Contents

Executive Summary

Scope and Definition

Market/Product Definition

Key Questions Answered

Analysis and Forecast Note

1. Markets: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.1.1 Impact Analysis

- 1.2 Market Dynamics Overview

- 1.2.1 Market Drivers

- 1.2.2 Market Restraints

- 1.2.3 Market Opportunities

- 1.3 Regulatory & Policy Impact Analysis

- 1.3.1 By Region

- 1.4 Patent Analysis

- 1.4.1 By Year

- 1.4.2 By Region

- 1.5 Start-Up Landscape

- 1.6 Investment Landscape and R&D Trends

- 1.7 Future Outlook and Market Roadmap

- 1.8 Value Chain Analysis

- 1.9 Global Pricing Analysis

- 1.10 Industry Attractiveness

2. Global Automotive Sensor Signal Conditioner Market (by Output Type)

- 2.1 Analog Output

- 2.2 Digital Output

- 2.3 Discrete Output

3. Global Automotive Sensor Signal Conditioner Market (by Application)

- 3.1 Fuel-Cell Electric Vehicles

- 3.2 Battery Electric Vehicles

- 3.3 Plug-In Hybrid Electric Vehicles

4. Global Automotive Sensor Signal Conditioner Market (by Region)

- 4.1 Global Automotive Sensor Signal Conditioner Market (by Region)

- 4.2 North America

- 4.2.1 Regional Overview

- 4.2.2 Driving Factors for Market Growth

- 4.2.3 Factors Challenging the Market

- 4.2.4 Key Companies

- 4.2.5 Output Type

- 4.2.6 Application

- 4.2.7 North America (by Country)

- 4.2.7.1 U.S.

- 4.2.7.1.1 Market by Output Type

- 4.2.7.1.2 Market by Application

- 4.2.7.2 Canada

- 4.2.7.2.1 Market by Output Type

- 4.2.7.2.2 Market by Application

- 4.2.7.3 Mexico

- 4.2.7.3.1 Market by Output Type

- 4.2.7.3.2 Market by Application

- 4.2.7.1 U.S.

- 4.3 Europe

- 4.3.1 Regional Overview

- 4.3.2 Driving Factors for Market Growth

- 4.3.3 Factors Challenging the Market

- 4.3.4 Key Companies

- 4.3.5 Output Type

- 4.3.6 Application

- 4.3.7 Europe (by Country)

- 4.3.7.1 Germany

- 4.3.7.1.1 Market by Output Type

- 4.3.7.1.2 Market by Application

- 4.3.7.2 France

- 4.3.7.2.1 Market by Output Type

- 4.3.7.2.2 Market by Application

- 4.3.7.3 Italy

- 4.3.7.3.1 Market by Output Type

- 4.3.7.3.2 Market by Application

- 4.3.7.4 Spain

- 4.3.7.4.1 Market by Output Type

- 4.3.7.4.2 Market by Application

- 4.3.7.5 U.K.

- 4.3.7.5.1 Market by Output Type

- 4.3.7.5.2 Market by Application

- 4.3.7.6 Rest-of-Europe

- 4.3.7.6.1 Market by Output Type

- 4.3.7.6.2 Market by Application

- 4.3.7.1 Germany

- 4.4 Asia-Pacific

- 4.4.1 Regional Overview

- 4.4.2 Driving Factors for Market Growth

- 4.4.3 Factors Challenging the Market

- 4.4.4 Key Companies

- 4.4.5 Output Type

- 4.4.6 Application

- 4.4.7 Asia-Pacific (by Country)

- 4.4.7.1 China

- 4.4.7.1.1 Market by Output Type

- 4.4.7.1.2 Market by Application

- 4.4.7.2 Japan

- 4.4.7.2.1 Market by Output Type

- 4.4.7.2.2 Market by Application

- 4.4.7.3 India

- 4.4.7.3.1 Market by Output Type

- 4.4.7.3.2 Market by Application

- 4.4.7.4 South Korea

- 4.4.7.4.1 Market by Output Type

- 4.4.7.4.2 Market by Application

- 4.4.7.5 Rest-of-Asia-Pacific

- 4.4.7.5.1 Market by Output Type

- 4.4.7.5.2 Market by Application

- 4.4.7.1 China

- 4.5 Rest-of-the-World

- 4.5.1 Regional Overview

- 4.5.2 Driving Factors for Market Growth

- 4.5.3 Factors Challenging the Market

- 4.5.4 Key Companies

- 4.5.5 Output Type

- 4.5.6 Application

- 4.5.7 Rest-of-the-World (by Region)

- 4.5.7.1 South America

- 4.5.7.1.1 Market by Output Type

- 4.5.7.1.2 Market by Application

- 4.5.7.2 Middle East and Africa

- 4.5.7.2.1 Market by Output Type

- 4.5.7.2.2 Market by Application

- 4.5.7.1 South America

5. Markets - Competitive Benchmarking & Company Profiles

- 5.1 Next Frontiers

- 5.2 Geographic Assessment

- 5.3 Company Profiles

- 5.3.1 Renesas Electronics

- 5.3.1.1 Overview

- 5.3.1.2 Top Products/Product Portfolio

- 5.3.1.3 Top Competitors

- 5.3.1.4 Target Customers

- 5.3.1.5 Key Personnel

- 5.3.1.6 Analyst View

- 5.3.1.7 Market Share

- 5.3.2 Texas Instruments

- 5.3.2.1 Overview

- 5.3.2.2 Top Products/Product Portfolio

- 5.3.2.3 Top Competitors

- 5.3.2.4 Target Customers

- 5.3.2.5 Key Personnel

- 5.3.2.6 Analyst View

- 5.3.2.7 Market Share

- 5.3.3 Analog Devices, Inc.

- 5.3.3.1 Overview

- 5.3.3.2 Top Products/Product Portfolio

- 5.3.3.3 Top Competitors

- 5.3.3.4 Target Customers

- 5.3.3.5 Key Personnel

- 5.3.3.6 Analyst View

- 5.3.3.7 Market Share

- 5.3.4 Pepperl+Fuchs

- 5.3.4.1 Overview

- 5.3.4.2 Top Products/Product Portfolio

- 5.3.4.3 Top Competitors

- 5.3.4.4 Target Customers

- 5.3.4.5 Key Personnel

- 5.3.4.6 Analyst View

- 5.3.4.7 Market Share

- 5.3.5 Calex Manufacturing Co., Inc.

- 5.3.5.1 Overview

- 5.3.5.2 Top Products/Product Portfolio

- 5.3.5.3 Top Competitors

- 5.3.5.4 Target Customers

- 5.3.5.5 Key Personnel

- 5.3.5.6 Analyst View

- 5.3.5.7 Market Share

- 5.3.6 Acromag Inc.

- 5.3.6.1 Overview

- 5.3.6.2 Top Products/Product Portfolio

- 5.3.6.3 Top Competitors

- 5.3.6.4 Target Customers

- 5.3.6.5 Key Personnel

- 5.3.6.6 Analyst View

- 5.3.6.7 Market Share

- 5.3.7 Omega Engineering

- 5.3.7.1 Overview

- 5.3.7.2 Top Products/Product Portfolio

- 5.3.7.3 Top Competitors

- 5.3.7.4 Target Customers

- 5.3.7.5 Key Personnel

- 5.3.7.6 Analyst View

- 5.3.7.7 Market Share

- 5.3.8 ABB

- 5.3.8.1 Overview

- 5.3.8.2 Top Products/Product Portfolio

- 5.3.8.3 Top Competitors

- 5.3.8.4 Target Customers

- 5.3.8.5 Key Personnel

- 5.3.8.6 Analyst View

- 5.3.8.7 Market Share

- 5.3.9 Moore Industries-International Inc.

- 5.3.9.1 Overview

- 5.3.9.2 Top Products/Product Portfolio

- 5.3.9.3 Top Competitors

- 5.3.9.4 Target Customers

- 5.3.9.5 Key Personnel

- 5.3.9.6 Analyst View

- 5.3.9.7 Market Share

- 5.3.10 Turck Inc.

- 5.3.10.1 Overview

- 5.3.10.2 Top Products/Product Portfolio

- 5.3.10.3 Top Competitors

- 5.3.10.4 Target Customers

- 5.3.10.5 Key Personnel

- 5.3.10.6 Analyst View

- 5.3.10.7 Market Share

- 5.3.11 Rockwell Automation Inc.

- 5.3.11.1 Overview

- 5.3.11.2 Top Products/Product Portfolio

- 5.3.11.3 Top Competitors

- 5.3.11.4 Target Customers

- 5.3.11.5 Key Personnel

- 5.3.11.6 Analyst View

- 5.3.11.7 Market Share

- 5.3.12 Yokogawa Electric Corporation

- 5.3.12.1 Overview

- 5.3.12.2 Top Products/Product Portfolio

- 5.3.12.3 Top Competitors

- 5.3.12.4 Target Customers

- 5.3.12.5 Key Personnel

- 5.3.12.6 Analyst View

- 5.3.12.7 Market Share

- 5.3.13 S. Himmelstein and Company

- 5.3.13.1 Overview

- 5.3.13.2 Top Products/Product Portfolio

- 5.3.13.3 Top Competitors

- 5.3.13.4 Target Customers

- 5.3.13.5 Key Personnel

- 5.3.13.6 Analyst View

- 5.3.13.7 Market Share

- 5.3.14 Schneider Electric

- 5.3.14.1 Overview

- 5.3.14.2 Top Products/Product Portfolio

- 5.3.14.3 Top Competitors

- 5.3.14.4 Target Customers

- 5.3.14.5 Key Personnel

- 5.3.14.6 Analyst View

- 5.3.14.7 Market Share

- 5.3.15 TE Connectivity Ltd.

- 5.3.15.1 Overview

- 5.3.15.2 Top Products/Product Portfolio

- 5.3.15.3 Top Competitors

- 5.3.15.4 Target Customers

- 5.3.15.5 Key Personnel

- 5.3.15.6 Analyst View

- 5.3.15.7 Market Share

- 5.3.15.8 Share

- 5.3.1 Renesas Electronics

- 5.4 Other Key Companies