|

|

市場調査レポート

商品コード

1754870

カーボンフットプリント管理市場- 世界と地域の分析:コンポーネント別、展開モデル別、業界別、地域別 - 分析と予測(2025年~2034年)Carbon Footprint Management Market - A Global and Regional Analysis: Focus on Component, Deployment Model, Industry Vertical, and Regional Analysis - Analysis and Forecast, 2025-2034 |

||||||

カスタマイズ可能

|

|||||||

| カーボンフットプリント管理市場- 世界と地域の分析:コンポーネント別、展開モデル別、業界別、地域別 - 分析と予測(2025年~2034年) |

|

出版日: 2025年06月24日

発行: BIS Research

ページ情報: 英文 140 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

カーボンフットプリント管理市場は、より広範な持続可能性と環境管理のエコシステムの中で不可欠なセグメントを構成しています。

この市場内の技術は、AI、IoT対応モニタリング、データ透明性のためのブロックチェーン、クラウドベースの分析プラットフォームの改善によって進化し続けています。カーボンフットプリント管理ソリューションは、炭素排出量測定、規制遵守報告、サプライチェーンの炭素追跡、カーボンオフセット管理など、数多くの用途に展開されています。ソフトウェアの自動化と予測分析における最近の進歩は、排出削減の機会を特定し、持続可能性の目標をサポートする組織能力を強化しています。さらに、ESG(環境・社会・ガバナンス)フレームワークとの統合が進んでおり、カーボンフットプリント管理市場を投資家への報告や規制遵守のための戦略的イネーブラーとして位置付けています。同市場は、データ標準化の改善、運用コストの削減、製造業、運輸業、エネルギー業、小売業など幅広い業種のサポートを目的とした技術革新への継続的な投資によって利益を得ています。

世界のカーボンフットプリント管理市場のライフサイクルステージ

| 主要市場統計 | |

|---|---|

| 予測期間 | 2025年~2034年 |

| 2025年の評価 | 172億2,000万米ドル |

| 2034年の予測 | 1,125億6,000万米ドル |

| CAGR | 23.2% |

現在、カーボン・フットプリント管理市場は、厳しい環境規制、企業の環境説明責任の増大、技術革新に後押しされて力強い成長を遂げています。多くの炭素管理ソリューションは、北米、欧州、アジア太平洋の主要セクターで広く採用され、高度な成熟レベルに達しています。米国環境保護庁(EPA)の温室効果ガス報告プログラムや欧州連合(EU)の排出量取引制度などの規制要件を満たすため、政府も民間団体も次世代プラットフォームへの投資を進めています。ソフトウェアベンダー、コンサルティング会社、規制当局の協力体制は、相互運用性と標準化を推進し続けています。初期投資の高さやデータの複雑さといった課題は残りますが、AIやクラウド展開モデルの開発が進んでいるため、こうした障壁は軽減されています。カーボンフットプリント管理市場は、持続可能性の義務付けと透明性に対する市場の需要の拡大に後押しされ、今後10年間は安定した成長を維持すると予測されます。

カーボンフットプリント管理市場のセグメンテーション

セグメンテーション1:コンポーネント別

- ソフトウェア

- 炭素会計ソフトウェア

- カーボン分析プラットフォーム

- レポーティング・コンプライアンス・ソフトウェア

- その他

- サービス

- カーボンフットプリント算定・検証

- コンサルティング・サービス

- 再生可能エネルギー導入

- その他

セグメンテーション2:展開モデル別

- クラウドベース

- オンプレミス

セグメンテーション3:業界別

- 製造業

- 運輸・物流

- エネルギー・公益事業

- 住宅・商業ビル

- IT・通信

- 金融サービス

- その他

セグメンテーション4:地域別

- 北米- 米国、カナダ、メキシコ

- 欧州- ドイツ、フランス、イタリア、スペイン、英国、その他

- アジア太平洋- 中国、日本、韓国、インド、その他

- その他の地域- 南米、中東・アフリカ

需要- 促進要因と限界

カーボンフットプリント管理市場の需要促進要因は以下の通りです:

- 排出量報告に関する厳しい規制の義務化

- 企業の持続可能性とESGコンプライアンスの高まり

- AI、IoT、クラウドベースのリアルタイム炭素トラッキング

カーボンフットプリント管理市場は、以下の課題により、いくつかの制限にも直面すると予想されます:

- 高い導入コストと運用コスト

- データの正確性と標準化の課題

カーボンフットプリント管理市場の主要参入企業と競合の概要

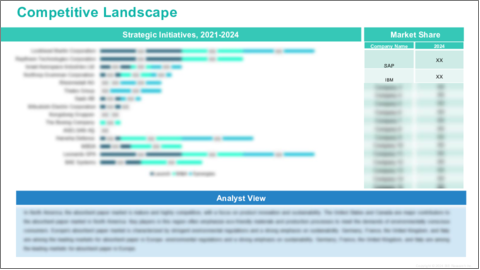

カーボンフットプリント管理市場は、大手テクノロジープロバイダーや持続可能性ソリューションの専門家によって形成されたダイナミックな競合環境を特徴としています。SAP、IBM、Schneider Electric、Salesforce Inc.、Enablonなどの著名な世界企業は、革新的なソフトウェアプラットフォームと包括的なコンサルティングサービスを通じて、カーボンフットプリント管理市場の提供を推進する上で大きな役割を果たしています。これらの主なプレーヤーは、統合された炭素会計ツール、リアルタイムの排出量追跡、分析、コンプライアンス報告ソリューションの開発を重視しています。既存企業と並んで、新興ベンダーもAI主導のデータ精度、サプライチェーン炭素管理、カーボンオフセット検証に焦点を当てたニッチなイノベーションに貢献しています。カーボンフットプリント管理市場の競争は、戦略的提携、規制遵守の義務付け、企業の持続可能性へのコミットメントの高まりによって促進されています。カーボンフットプリント管理市場の拡大に伴い、市場参入企業は、多様な産業要件や規制枠組みに対応する拡張性のある使いやすいソリューションを世界に提供することに注力しています。

当レポートでは、世界のカーボンフットプリント管理市場について調査し、市場の概要とともに、コンポーネント別、展開モデル別、業界別、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場:業界展望

- 動向:現状と将来への影響評価

- 市場力学の概要

- 規制と環境政策の影響

- 特許分析

- 技術分析

- カーボンフットプリント管理に関する基準

- 投資情勢と研究開発動向

- バリューチェーン分析

- 業界の魅力

第2章 世界のカーボンフットプリント管理市場(コンポーネント別)

- ソフトウェア

- 炭素会計ソフトウェア

- 炭素分析プラットフォーム

- レポートおよびコンプライアンスソフトウェア

- その他

- サービス

- カーボンフットプリントの計算と検証

- コンサルティングサービス

- 再生可能エネルギーの導入

- その他

第3章 世界のカーボンフットプリント管理市場(展開モデル別)

- クラウドベース

- オンプレミス

第4章 世界のカーボンフットプリント管理市場(業界別)

- 製造業

- 運輸・物流

- エネルギー・公益事業

- 住宅・商業ビル

- IT・通信

- 金融サービス

- その他

第5章 世界のカーボンフットプリント管理市場(地域別)

- 世界のカーボンフットプリント管理市場(地域別)

- 北米

- 欧州

- アジア太平洋

- その他の地域

第6章 市場-競合ベンチマーキングと企業プロファイル

- 今後の見通し

- 地理的評価

- 企業プロファイル

- SAP

- Salesforce, Inc.

- ENGIE Impact

- Schneider Electric

- IBM

- Isometrix

- Carbon Footprint

- Dakota Software

- Enviance

- ESP

- Accuvio

- Trinity Consultants

- Locus Technologies

- NativeEnergy

- Eco Track

- その他の主要企業

第7章 調査手法

List of Figures

- Figure 1: Carbon Footprint Management Market (by Scenario), $Billion, 2025, 2028, and 2034

- Figure 2: Carbon Footprint Management Market (by Region), $Billion, 2024, 2027, and 2034

- Figure 3: Carbon Footprint Management Market (by Component), $Billion, 2024, 2027, and 2034

- Figure 4: Carbon Footprint Management Market (by Deployment Model), $Billion, 2024, 2027, and 2034

- Figure 5: Carbon Footprint Management Market (by Industry Vertical), $Billion, 2024, 2027, and 2034

- Figure 6: Competitive Landscape Snapshot

- Figure 7: Supply Chain Analysis

- Figure 8: Value Chain Analysis

- Figure 9: Patent Analysis (by Country), January 2021-April 2025

- Figure 10: Patent Analysis (by Company), January 2021-April 2025

- Figure 11: Impact Analysis of Market Navigating Factors, 2024-2034

- Figure 12: U.S. Carbon Footprint Management Market, $Billion, 2024-2034

- Figure 13: Canada Carbon Footprint Management Market, $Billion, 2024-2034

- Figure 14: Mexico Carbon Footprint Management Market, $Billion, 2024-2034

- Figure 15: Germany Carbon Footprint Management Market, $Billion, 2024-2034

- Figure 16: France Carbon Footprint Management Market, $Billion, 2024-2034

- Figure 17: Italy Carbon Footprint Management Market, $Billion, 2024-2034

- Figure 18: Spain Carbon Footprint Management Market, $Billion, 2024-2034

- Figure 19: U.K. Carbon Footprint Management Market, $Billion, 2024-2034

- Figure 20: Rest-of-Europe Carbon Footprint Management Market, $Billion, 2024-2034

- Figure 21: China Carbon Footprint Management Market, $Billion, 2024-2034

- Figure 22: Japan Carbon Footprint Management Market, $Billion, 2024-2034

- Figure 23: India Carbon Footprint Management Market, $Billion, 2024-2034

- Figure 24: South Korea Carbon Footprint Management Market, $Billion, 2024-2034

- Figure 25: Rest-of-Asia-Pacific Carbon Footprint Management Market, $Billion, 2024-2034

- Figure 26: South America Carbon Footprint Management Market, $Billion, 2024-2034

- Figure 27: Middle East and Africa Carbon Footprint Management Market, $Billion, 2024-2034

- Figure 28: Strategic Initiatives (by Company), 2021-2025

- Figure 29: Share of Strategic Initiatives, 2021-2025

- Figure 30: Data Triangulation

- Figure 31: Top-Down and Bottom-Up Approach

- Figure 32: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Opportunities across Region

- Table 3: Trends Overview

- Table 4: Carbon Footprint Management Market (by Region), $Billion, 2024-2034

- Table 5: North America Carbon Footprint Management Market (by Component), $Billion, 2024-2034

- Table 6: North America Carbon Footprint Management Market (by Deployment Model), $Billion, 2024-2034

- Table 7: North America Carbon Footprint Management Market (by Industry Vertical), $Billion, 2024-2034

- Table 8: U.S. Carbon Footprint Management Market (by Component), $Billion, 2024-2034

- Table 9: U.S. Carbon Footprint Management Market (by Deployment Model), $Billion, 2024-2034

- Table 10: U.S. Carbon Footprint Management Market (by Industry Vertical), $Billion, 2024-2034

- Table 11: Canada Carbon Footprint Management Market (by Component), $Billion, 2024-2034

- Table 12: Canada Carbon Footprint Management Market (by Deployment Model), $Billion, 2024-2034

- Table 13: Canada Carbon Footprint Management Market (by Industry Vertical), $Billion, 2024-2034

- Table 14: Mexico Carbon Footprint Management Market (by Component), $Billion, 2024-2034

- Table 15: Mexico Carbon Footprint Management Market (by Deployment Model), $Billion, 2024-2034

- Table 16: Mexico Carbon Footprint Management Market (by Industry Vertical), $Billion, 2024-2034

- Table 17: Europe Carbon Footprint Management Market (by Component), $Billion, 2024-2034

- Table 18: Europe Carbon Footprint Management Market (by Deployment Model), $Billion, 2024-2034

- Table 19: Europe Carbon Footprint Management Market (by Industry Vertical), $Billion, 2024-2034

- Table 20: Germany Carbon Footprint Management Market (by Component), $Billion, 2024-2034

- Table 21: Germany Carbon Footprint Management Market (by Deployment Model), $Billion, 2024-2034

- Table 22: Germany Carbon Footprint Management Market (by Industry Vertical), $Billion, 2024-2034

- Table 23: France Carbon Footprint Management Market (by Component), $Billion, 2024-2034

- Table 24: France Carbon Footprint Management Market (by Deployment Model), $Billion, 2024-2034

- Table 25: France Carbon Footprint Management Market (by Industry Vertical), $Billion, 2024-2034

- Table 26: Italy Carbon Footprint Management Market (by Component), $Billion, 2024-2034

- Table 27: Italy Carbon Footprint Management Market (by Deployment Model), $Billion, 2024-2034

- Table 28: Italy Carbon Footprint Management Market (by Industry Vertical), $Billion, 2024-2034

- Table 29: Spain Carbon Footprint Management Market (by Component), $Billion, 2024-2034

- Table 30: Spain Carbon Footprint Management Market (by Deployment Model), $Billion, 2024-2034

- Table 31: Spain Carbon Footprint Management Market (by Industry Vertical), $Billion, 2024-2034

- Table 32: U.K. Carbon Footprint Management Market (by Component), $Billion, 2024-2034

- Table 33: U.K. Carbon Footprint Management Market (by Deployment Model), $Billion, 2024-2034

- Table 34: U.K. Carbon Footprint Management Market (by Industry Vertical), $Billion, 2024-2034

- Table 35: Rest-of-Europe Carbon Footprint Management Market (by Component), $Billion, 2024-2034

- Table 36: Rest-of-Europe Carbon Footprint Management Market (by Deployment Model), $Billion, 2024-2034

- Table 37: Rest-of-Europe Carbon Footprint Management Market (by Industry Vertical), $Billion, 2024-2034

- Table 38: China Carbon Footprint Management Market (by Component), $Billion, 2024-2034

- Table 39: China Carbon Footprint Management Market (by Deployment Model), $Billion, 2024-2034

- Table 40: China Carbon Footprint Management Market (by Industry Vertical), $Billion, 2024-2034

- Table 41: Japan Carbon Footprint Management Market (by Component), $Billion, 2024-2034

- Table 42: Japan Carbon Footprint Management Market (by Deployment Model), $Billion, 2024-2034

- Table 43: Japan Carbon Footprint Management Market (by Industry Vertical), $Billion, 2024-2034

- Table 44: India Carbon Footprint Management Market (by Component), $Billion, 2024-2034

- Table 45: India Carbon Footprint Management Market (by Deployment Model), $Billion, 2024-2034

- Table 46: India Carbon Footprint Management Market (by Industry Vertical), $Billion, 2024-2034

- Table 47: South Korea Carbon Footprint Management Market (by Component), $Billion, 2024-2034

- Table 48: South Korea Carbon Footprint Management Market (by Deployment Model), $Billion, 2024-2034

- Table 49: South Korea Carbon Footprint Management Market (by Industry Vertical), $Billion, 2024-2034

- Table 50: Rest-of-Asia-Pacific Carbon Footprint Management Market (by Component), $Billion, 2024-2034

- Table 51: Rest-of-Asia-Pacific Carbon Footprint Management Market (by Deployment Model), $Billion, 2024-2034

- Table 52: Rest-of-Asia-Pacific Carbon Footprint Management Market (by Industry Vertical), $Billion, 2024-2034

- Table 53: Rest-of-the-World Carbon Footprint Management Market (by Component), $Billion, 2024-2034

- Table 54: Rest-of-the-World Carbon Footprint Management Market (by Deployment Model), $Billion, 2024-2034

- Table 55: Rest-of-the-World Carbon Footprint Management Market (by Industry Vertical), $Billion, 2024-2034

- Table 56: South America Carbon Footprint Management Market (by Component), $Billion, 2024-2034

- Table 57: South America Carbon Footprint Management Market (by Deployment Model), $Billion, 2024-2034

- Table 58: South America Carbon Footprint Management Market (by Industry Vertical), $Billion, 2024-2034

- Table 59: Middle East and Africa Carbon Footprint Management Market (by Component), $Billion, 2024-2034

- Table 60: Middle East and Africa Carbon Footprint Management Market (by Deployment Model), $Billion, 2024-2034

- Table 61: Middle East and Africa Carbon Footprint Management Market (by Industry Vertical), $Billion, 2024-2034

- Table 62: Market Share

Carbon Footprint Management Market Industry and Technology Overview

The carbon footprint management market constitutes an essential segment within the broader sustainability and environmental management ecosystem. Technologies within this market continue to evolve with improvements in AI, IoT-enabled monitoring, blockchain for data transparency, and cloud-based analytics platforms. Carbon footprint management solutions are deployed across numerous applications, including carbon emission measurement, regulatory compliance reporting, supply chain carbon tracking, and carbon offset management. Recent advancements in software automation and predictive analytics enhance organizational capabilities to identify emission reduction opportunities and support sustainability goals. Furthermore, integration with ESG (Environmental, Social, and Governance) frameworks is increasing, positioning the carbon footprint management market as a strategic enabler for investor reporting and regulatory adherence. The market benefits from ongoing investments in innovation aimed at improving data standardization, reducing operational costs, and supporting a wide range of industries such as manufacturing, transportation, energy, and retail.

Global Carbon Footprint Management Market Lifecycle Stage

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2025 - 2034 |

| 2025 Evaluation | $17.22 Billion |

| 2034 Forecast | $112.56 Billion |

| CAGR | 23.2% |

Currently, the carbon footprint management market is experiencing robust growth fueled by stringent environmental regulations, increasing corporate environmental accountability, and technological innovation. Many carbon management solutions have reached advanced maturity levels with widespread adoption in key sectors across North America, Europe, and Asia-Pacific. Governments and private organizations alike are investing in next-generation platforms to meet regulatory requirements such as the U.S. EPA's greenhouse gas reporting program and the European Union's Emissions Trading Scheme. Collaborative efforts among software vendors, consulting firms, and regulatory bodies continue to drive interoperability and standardization. Challenges such as high initial investment and data complexity remain, but ongoing developments in AI and cloud deployment models reduce these barriers. The carbon footprint management market is projected to maintain steady growth over the next decade, propelled by expanding sustainability mandates and market demand for transparency.

Carbon Footprint Management Market Segmentation:

Segmentation 1: by Component

- Softwares

- Carbon Accounting Software

- Carbon Analytics Platforms

- Reporting and Compliance Software

- Others

- Services

- Carbon Footprint Calculation and Verification

- Consulting Services

- Renewable Energy Implementation

- Others

Segmentation 2: by Deployment Model

- Cloud-based

- On-Premises

Segmentation 3: by Industry Vertical

- Manufacturing

- Transportation and Logistics

- Energy and Utilities

- Residential and Commercial Buildings

- IT and Telecom

- Financial Services

- Others

Segmentation 4: by Region

- North America - U.S., Canada, and Mexico

- Europe - Germany, France, Italy, Spain, U.K., and Rest-of-Europe

- Asia-Pacific - China, Japan, South Korea, India, and Rest-of-Asia-Pacific

- Rest-of-the-World - South America and Middle East and Africa

Demand - Drivers and Limitations

The following are the demand drivers for the carbon footprint management market:

- Stringent regulatory mandates for emission reporting

- Rising corporate sustainability and ESG compliance

- AI, IoT, and cloud-based real-time carbon tracking

The carbon footprint management market is expected to face some limitations as well due to the following challenges:

- High implementation and operational costs

- Data accuracy and standardization challenges

Carbon Footprint Management Market Key Players and Competition Synopsis

The carbon footprint management market features a dynamic and competitive environment shaped by leading technology providers and sustainability solution specialists. Prominent global companies such as SAP, IBM, Schneider Electric, Salesforce Inc., and Enablon are instrumental in advancing carbon footprint management market offerings through innovative software platforms and comprehensive consulting services. These key players emphasize the development of integrated carbon accounting tools, real-time emission tracking, analytics, and compliance reporting solutions. Alongside established corporations, emerging vendors contribute niche innovations focusing on AI-driven data accuracy, supply chain carbon management, and carbon offset verification. Competition within the carbon footprint management market is driven by strategic collaborations, regulatory compliance mandates, and rising corporate sustainability commitments. As the carbon footprint management market expands, participants are concentrating on delivering scalable, user-friendly solutions that address diverse industry requirements and regulatory frameworks globally.

Some prominent names established in the carbon footprint management market are:

- SAP

- Salesforce, Inc.

- ENGIE Impact

- Schneider Electric

- IBM

- Isometrix

- Carbon Footprint

- Dakota Software

- Enviance

- ESP

- Accuvio

- Trinity Consultants

- Locus Technologies

- NativeEnergy

- Eco Track

Companies that are not a part of the previously mentioned pool have been well represented across different sections of the report (wherever applicable).

Table of Contents

Executive Summary

Scope and Definition

Market/Product Definition

Key Questions Answered

Analysis and Forecast Note

1. Markets: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.2 Market Dynamics Overview

- 1.2.1 Market Drivers

- 1.2.2 Market Restraints

- 1.2.3 Market Opportunities

- 1.3 Impact of Regulatory and Environmental Policies

- 1.4 Patent Analysis

- 1.4.1 By Year

- 1.4.2 By Region

- 1.5 Technology Analysis

- 1.6 Standards Related to Carbon Footprint Management

- 1.7 Investment Landscape and R&D Trends

- 1.8 Value Chain Analysis

- 1.9 Industry Attractiveness

2. Global Carbon Footprint Management Market (by Component)

- 2.1 Software

- 2.1.1 Carbon Accounting Software

- 2.1.2 Carbon Analytics Platforms

- 2.1.3 Reporting and Compliance Software

- 2.1.4 Others

- 2.2 Services

- 2.2.1 Carbon Footprint Calculation and Verification

- 2.2.2 Consulting Services

- 2.2.3 Renewable Energy Implementation

- 2.2.4 Others

3. Global Carbon Footprint Management Market (by Deployment Model)

- 3.1 Cloud-based

- 3.2 On-Premises

4. Global Carbon Footprint Management Market (by Industry Verticals)

- 4.1 Manufacturing

- 4.2 Transportation and Logistics

- 4.3 Energy and Utilities

- 4.4 Residential and Commercial Buildings

- 4.5 IT and Telecom

- 4.6 Financial Services

- 4.7 Others

5. Global Carbon Footprint Management Market (by Region)

- 5.1 Global Carbon Footprint Management Market (by Region)

- 5.2 North America

- 5.2.1 Regional Overview

- 5.2.2 Driving Factors for Market Growth

- 5.2.3 Factors Challenging the Market

- 5.2.4 Key Companies

- 5.2.5 Components

- 5.2.6 Deployment Model

- 5.2.7 Industry Vertical

- 5.2.8 North America (by Country)

- 5.2.8.1 U.S.

- 5.2.8.1.1 Market by Component

- 5.2.8.1.2 Market by Deployment Model

- 5.2.8.1.3 Market by Industry Vertical

- 5.2.8.2 Canada

- 5.2.8.2.1 Market by Component

- 5.2.8.2.2 Market by Deployment Model

- 5.2.8.2.3 Market by Industry Vertical

- 5.2.8.3 Mexico

- 5.2.8.3.1 Market by Component

- 5.2.8.3.2 Market by Deployment Model

- 5.2.8.3.3 Market by Industry Vertical

- 5.2.8.1 U.S.

- 5.3 Europe

- 5.3.1 Regional Overview

- 5.3.2 Driving Factors for Market Growth

- 5.3.3 Factors Challenging the Market

- 5.3.4 Key Companies

- 5.3.5 Components

- 5.3.6 Deployment Model

- 5.3.7 Industry Vertical

- 5.3.8 Europe (by Country)

- 5.3.8.1 Germany

- 5.3.8.1.1 Market by Component

- 5.3.8.1.2 Market by Deployment Model

- 5.3.8.1.3 Market by Industry Vertical

- 5.3.8.2 France

- 5.3.8.2.1 Market by Component

- 5.3.8.2.2 Market by Deployment Model

- 5.3.8.2.3 Market by Industry Vertical

- 5.3.8.3 Italy

- 5.3.8.3.1 Market by Component

- 5.3.8.3.2 Market by Deployment Model

- 5.3.8.3.3 Market by Industry Vertical

- 5.3.8.4 Spain

- 5.3.8.4.1 Market by Component

- 5.3.8.4.2 Market by Deployment Model

- 5.3.8.4.3 Market by Industry Vertical

- 5.3.8.5 U.K.

- 5.3.8.5.1 Market by Component

- 5.3.8.5.2 Market by Deployment Model

- 5.3.8.5.3 Market by Industry Vertical

- 5.3.8.6 Rest-of-Europe

- 5.3.8.6.1 Market by Component

- 5.3.8.6.2 Market by Deployment Model

- 5.3.8.6.3 Market by Industry Vertical

- 5.3.8.1 Germany

- 5.4 Asia-Pacific

- 5.4.1 Regional Overview

- 5.4.2 Driving Factors for Market Growth

- 5.4.3 Factors Challenging the Market

- 5.4.4 Key Companies

- 5.4.5 Components

- 5.4.6 Deployment Model

- 5.4.7 Industry Vertical

- 5.4.8 Asia-Pacific (by Country)

- 5.4.8.1 China

- 5.4.8.1.1 Market by Component

- 5.4.8.1.2 Market by Deployment Model

- 5.4.8.1.3 Market by Industry Vertical

- 5.4.8.2 Japan

- 5.4.8.2.1 Market by Component

- 5.4.8.2.2 Market by Deployment Model

- 5.4.8.2.3 Market by Industry Vertical

- 5.4.8.3 India

- 5.4.8.3.1 Market by Component

- 5.4.8.3.2 Market by Deployment Model

- 5.4.8.3.3 Market by Industry Vertical

- 5.4.8.4 South Korea

- 5.4.8.4.1 Market by Component

- 5.4.8.4.2 Market by Deployment Model

- 5.4.8.4.3 Market by Industry Vertical

- 5.4.8.5 Rest-of-Asia-Pacific

- 5.4.8.5.1 Market by Component

- 5.4.8.5.2 Market by Deployment Model

- 5.4.8.5.3 Market by Industry Vertical

- 5.4.8.1 China

- 5.5 Rest-of-the-World

- 5.5.1 Regional Overview

- 5.5.2 Driving Factors for Market Growth

- 5.5.3 Factors Challenging the Market

- 5.5.4 Key Companies

- 5.5.5 Components

- 5.5.6 Deployment Model

- 5.5.7 Industry Vertical

- 5.5.8 Rest-of-the-World (by Region)

- 5.5.8.1 South America

- 5.5.8.1.1 Market by Component

- 5.5.8.1.2 Market by Deployment Model

- 5.5.8.1.3 Market by Industry Vertical

- 5.5.8.2 Middle East and Africa

- 5.5.8.2.1 Market by Component

- 5.5.8.2.2 Market by Deployment Model

- 5.5.8.2.3 Market by Industry Vertical

- 5.5.8.1 South America

6. Markets - Competitive Benchmarking & Company Profiles

- 6.1 Next Frontiers

- 6.2 Geographic Assessment

- 6.3 Company Profiles

- 6.3.1 SAP

- 6.3.1.1 Overview

- 6.3.1.2 Top Products/Product Portfolio

- 6.3.1.3 Top Competitors

- 6.3.1.4 Target Customers

- 6.3.1.5 Key Personnel

- 6.3.1.6 Analyst View

- 6.3.1.7 Market Share

- 6.3.2 Salesforce, Inc.

- 6.3.2.1 Overview

- 6.3.2.2 Top Products/Product Portfolio

- 6.3.2.3 Top Competitors

- 6.3.2.4 Target Customers

- 6.3.2.5 Key Personnel

- 6.3.2.6 Analyst View

- 6.3.2.7 Market Share

- 6.3.3 ENGIE Impact

- 6.3.3.1 Overview

- 6.3.3.2 Top Products/Product Portfolio

- 6.3.3.3 Top Competitors

- 6.3.3.4 Target Customers

- 6.3.3.5 Key Personnel

- 6.3.3.6 Analyst View

- 6.3.3.7 Market Share

- 6.3.4 Schneider Electric

- 6.3.4.1 Overview

- 6.3.4.2 Top Products/Product Portfolio

- 6.3.4.3 Top Competitors

- 6.3.4.4 Target Customers

- 6.3.4.5 Key Personnel

- 6.3.4.6 Analyst View

- 6.3.4.7 Market Share

- 6.3.5 IBM

- 6.3.5.1 Overview

- 6.3.5.2 Top Products/Product Portfolio

- 6.3.5.3 Top Competitors

- 6.3.5.4 Target Customers

- 6.3.5.5 Key Personnel

- 6.3.5.6 Analyst View

- 6.3.5.7 Market Share

- 6.3.6 Isometrix

- 6.3.6.1 Overview

- 6.3.6.2 Top Products/Product Portfolio

- 6.3.6.3 Top Competitors

- 6.3.6.4 Target Customers

- 6.3.6.5 Key Personnel

- 6.3.6.6 Analyst View

- 6.3.6.7 Market Share

- 6.3.7 Carbon Footprint

- 6.3.7.1 Overview

- 6.3.7.2 Top Products/Product Portfolio

- 6.3.7.3 Top Competitors

- 6.3.7.4 Target Customers

- 6.3.7.5 Key Personnel

- 6.3.7.6 Analyst View

- 6.3.7.7 Market Share

- 6.3.8 Dakota Software

- 6.3.8.1 Overview

- 6.3.8.2 Top Products/Product Portfolio

- 6.3.8.3 Top Competitors

- 6.3.8.4 Target Customers

- 6.3.8.5 Key Personnel

- 6.3.8.6 Analyst View

- 6.3.8.7 Market Share

- 6.3.9 Enviance

- 6.3.9.1 Overview

- 6.3.9.2 Top Products/Product Portfolio

- 6.3.9.3 Top Competitors

- 6.3.9.4 Target Customers

- 6.3.9.5 Key Personnel

- 6.3.9.6 Analyst View

- 6.3.9.7 Market Share

- 6.3.10 ESP

- 6.3.10.1 Overview

- 6.3.10.2 Top Products/Product Portfolio

- 6.3.10.3 Top Competitors

- 6.3.10.4 Target Customers

- 6.3.10.5 Key Personnel

- 6.3.10.6 Analyst View

- 6.3.10.7 Market Share

- 6.3.11 Accuvio

- 6.3.11.1 Overview

- 6.3.11.2 Top Products/Product Portfolio

- 6.3.11.3 Top Competitors

- 6.3.11.4 Target Customers

- 6.3.11.5 Key Personnel

- 6.3.11.6 Analyst View

- 6.3.11.7 Market Share

- 6.3.12 Trinity Consultants

- 6.3.12.1 Overview

- 6.3.12.2 Top Products/Product Portfolio

- 6.3.12.3 Top Competitors

- 6.3.12.4 Target Customers

- 6.3.12.5 Key Personnel

- 6.3.12.6 Analyst View

- 6.3.12.7 Market Share

- 6.3.13 Locus Technologies

- 6.3.13.1 Overview

- 6.3.13.2 Top Products/Product Portfolio

- 6.3.13.3 Top Competitors

- 6.3.13.4 Target Customers

- 6.3.13.5 Key Personnel

- 6.3.13.6 Analyst View

- 6.3.13.7 Market Share

- 6.3.14 NativeEnergy

- 6.3.14.1 Overview

- 6.3.14.2 Top Products/Product Portfolio

- 6.3.14.3 Top Competitors

- 6.3.14.4 Target Customers

- 6.3.14.5 Key Personnel

- 6.3.14.6 Analyst View

- 6.3.14.7 Market Share

- 6.3.15 Eco Track

- 6.3.15.1 Overview

- 6.3.15.2 Top Products/Product Portfolio

- 6.3.15.3 Top Competitors

- 6.3.15.4 Target Customers

- 6.3.15.5 Key Personnel

- 6.3.15.6 Analyst View

- 6.3.15.7 Market Share

- 6.3.1 SAP

- 6.4 Other Key Companies