|

|

市場調査レポート

商品コード

1747198

フロントガラス用ワイパーブレード市場- 世界および地域別分析:用途別、製品別、国別 - 分析と予測(2025年~2034年)Windshield Wiper Blades Market - A Global and Regional Analysis: Focus on Application, Product, and Country Analysis - Analysis and Forecast, 2025-2034 |

||||||

カスタマイズ可能

|

|||||||

| フロントガラス用ワイパーブレード市場- 世界および地域別分析:用途別、製品別、国別 - 分析と予測(2025年~2034年) |

|

出版日: 2025年06月13日

発行: BIS Research

ページ情報: 英文 120 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

この業界は、自動車のグレージングから降水や汚染物質を除去するブレードアセンブリのエンジニアリング、生産、流通を網羅し、乗用車、小型トラック、大型用途に展開しています。

過去10年間の技術進化により、市場は従来のブラケット付きスチールフレームブレードから、湾曲したフロントガラスの形状により適合し、高速走行時の空気力学的リフトに耐える薄型ビームやハイブリッド設計に移行しました。同時に、材料科学の進歩により、紫外線やオゾンに強いシリコンゴム、グラファイトを強化したスキージエレメント、耐用年数を延ばし拭き取り透明度を向上させる疎水性コーティングが導入されています。センサーとアクチュエーターの統合による自動雨天対応動作は、プレミアムセグメントや電気自動車/自律走行車プラットフォームにおける付加価値として台頭しています。

フロントガラス用ワイパーブレード市場のライフサイクルステージ

| 主要市場統計 | |

|---|---|

| 予測期間 | 2025年~2034年 |

| 2025年の評価 | 77億1,000万米ドル |

| 2034年の予測 | 106億2,000万米ドル |

| CAGR | 3.62% |

フロントガラス用ワイパーブレード市場は持続的な成長局面にあり、世界の自動車保有台数の増加と後付け志向のアフターマーケットによる安定した需要が特徴です。アジア太平洋とラテンアメリカにおける地域的なアフターマーケットの拡大が数量成長の原動力となる一方、メーカー各社はヒーター付きブレード、スマートセンサー統合、先進複合材料など差別化された製品を追求するため、技術革新サイクルが加速しています。中核となるビームブレードの設計が成熟し、先進国市場で普及が飽和状態に達するにつれ、業界は徐々に統合と垂直統合へと移行しています。新興経済諸国は、アフターマーケットの収益源を獲得し、規模の経済を達成するために、ニッチ技術企業やアフターマーケット販売代理店を買収しています。

フロントガラス用ワイパーブレード市場のセグメンテーション

セグメンテーション1:用途別

- 乗用車

- 小型商用車

- 大型商用車

乗用車は、世界のフロントガラス用ワイパーブレード市場において顕著な用途別セグメントの1つです。

セグメンテーション2:タイプ別

- ボーンレスワイパーブレード

- ボーンワイパーブレード

世界のフロントガラス用ワイパーブレード市場は、タイプ別ではボーンレスワイパーブレードセグメントが牽引すると推定されます。

セグメンテーション3:地域別

- 北米- 米国、カナダ、メキシコ

- 欧州- ドイツ、フランス、イタリア、スペイン、英国、その他

- アジア太平洋地域- 中国、日本、韓国、インド、その他

- その他の地域- 南米と中東とアフリカ

フロントガラス用ワイパーブレード市場では、自動車保有台数が多く、安全規制が厳しく、アフターマーケットのインフラが発達しているという特徴を持つ成熟した自動車産業である北米が、生産面で牽引役になると予想されます。

需要- 促進要因と抑制要因

世界のフロントガラス用ワイパーブレード市場における需要促進要因は以下の通りです:

- ADAS(先進運転支援システム)の統合

世界のフロントガラス用ワイパーブレード市場は、以下の課題によっていくつかの限界にも直面すると予想されます:

- ゴムとシリコーンの原材料コストの変動

フロントガラス用ワイパーブレード市場の主要企業と競合の要約

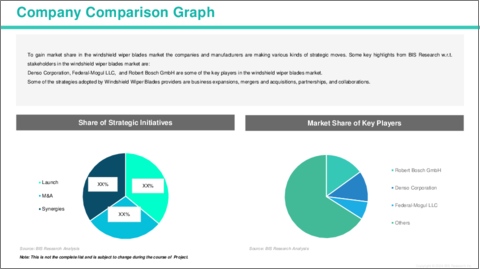

世界のフロントガラス用ワイパーブレード市場は、Robert Bosch GmbH、DENSO Corporation、Valeo SAを筆頭とする専門部品メーカーや自動車部品サプライヤーが集中しており、OEMおよびアフターマーケット市場で40%以上のシェアを占めています。その他の有力な競合企業には、Trico Products、Federal-Mogul Motorparts (Anco)、PPG Industries、Continental AGなどがあり、それぞれが独自の材料技術、独占的OEMパートナーシップ、広範な販売網を活用して戦略的地位を確保しています。競争力は、統合型レインセンシングビームブレードやヒーター付き氷融解設計などの積極的な製品革新や、地域的なフットプリントの拡大やアフターマーケットへの浸透を強化することを目的とした合併、戦略的提携、的を絞った垂直統合による継続的な統合によって、さらに激化しています。

当レポートでは、世界のフロントガラス用ワイパーブレード市場について調査し、市場の概要とともに、用途別、製品別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場:業界展望

- 動向:現状と将来への影響評価

- ステークホルダー分析

- 市場力学の概要

- 投資情勢と研究開発動向

- サプライチェーン分析

- 将来展望と市場ロードマップ

第2章 ワイパーブレード市場(用途別)

- 用途のセグメンテーション

- 用途のサマリー

- ワイパーブレード市場(用途別)

- 乗用車

- 小型商用車

- 大型商用車

第3章 ワイパーブレード市場(製品別)

- 製品のセグメンテーション

- 製品のサマリー

- ワイパーブレード市場(タイプ別)

- ボーンレスワイパーブレード

- ボーンワイパーブレード

- ワイパーブレード市場(販売チャネル別)

- アフターマーケット

- オリジナル機器メーカー(OEM)

第4章 ワイパーブレード市場(地域別)

- ワイパーブレード市場(地域別)

- 北米

- 欧州

- アジア太平洋

- その他の地域

第5章 市場-競合ベンチマーキングと企業プロファイル

- 今後の見通し

- 地理的評価

- 企業プロファイル

- Denso Corporation

- Federal-Mogul LLC

- HELLA GmbH & Co. KGaA

- Mitsuba Corporation

- PIAA Corporation

- Robert Bosch GmbH

- The Goodyear Tire & Rubber Company

- Trico Products Corporation

- Valeo SA

- WEXCO Industries Inc

- その他の主要企業

第6章 調査手法

List of Figures

- Figure 1: Windshield Wiper Blades Market (by Scenario), $Billion, 2025, 2028, and 2034

- Figure 2: Windshield Wiper Blades Market (by Region), $Billion, 2024, 2027, and 2034

- Figure 3: Windshield Wiper Blades Market (by Application), $Billion, 2024, 2027, and 2034

- Figure 4: Windshield Wiper Blades Market (by Product), $Billion, 2024, 2027, and 2034

- Figure 5: Competitive Landscape Snapshot

- Figure 6: Supply Chain Analysis

- Figure 7: Value Chain Analysis

- Figure 8: Patent Analysis (by Country), January 2021-April 2025

- Figure 9: Patent Analysis (by Company), January 2021-April 2025

- Figure 10: Impact Analysis of Market Navigating Factors, 2024-2034

- Figure 11: U.S. Windshield Wiper Blades Market, $Billion, 2024-2034

- Figure 12: Canada Windshield Wiper Blades Market, $Billion, 2024-2034

- Figure 13: Mexico Windshield Wiper Blades Market, $Billion, 2024-2034

- Figure 14: Germany Windshield Wiper Blades Market, $Billion, 2024-2034

- Figure 15: France Windshield Wiper Blades Market, $Billion, 2024-2034

- Figure 16: Italy Windshield Wiper Blades Market, $Billion, 2024-2034

- Figure 17: Spain Windshield Wiper Blades Market, $Billion, 2024-2034

- Figure 18: U.K. Windshield Wiper Blades Market, $Billion, 2024-2034

- Figure 19: Rest-of-Europe Windshield Wiper Blades Market, $Billion, 2024-2034

- Figure 20: China Windshield Wiper Blades Market, $Billion, 2024-2034

- Figure 21: Japan Windshield Wiper Blades Market, $Billion, 2024-2034

- Figure 22: India Windshield Wiper Blades Market, $Billion, 2024-2034

- Figure 23: South Korea Windshield Wiper Blades Market, $Billion, 2024-2034

- Figure 24: Rest-of-Asia-Pacific Windshield Wiper Blades Market, $Billion, 2024-2034

- Figure 25: South America Windshield Wiper Blades Market, $Billion, 2024-2034

- Figure 26: Middle East and Africa Windshield Wiper Blades Market, $Billion, 2024-2034

- Figure 27: Strategic Initiatives (by Company), 2021-2025

- Figure 28: Share of Strategic Initiatives, 2021-2025

- Figure 29: Data Triangulation

- Figure 30: Top-Down and Bottom-Up Approach

- Figure 31: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Opportunities across Region

- Table 3: Trends Overview

- Table 4: Windshield Wiper Blades Market Pricing Forecast, 2024-2034

- Table 5: Application Summary (by Application)

- Table 6: Product Summary (by Product)

- Table 7: Windshield Wiper Blades Market (by Region), $Billion, 2024-2034

- Table 8: North America Windshield Wiper Blades Market (by Application), $Billion, 2024-2034

- Table 9: North America Windshield Wiper Blades Market (by Product), $Billion, 2024-2034

- Table 10: U.S. Windshield Wiper Blades Market (by Application), $Billion, 2024-2034

- Table 11: U.S. Windshield Wiper Blades Market (by Product), $Billion, 2024-2034

- Table 12: Canada Windshield Wiper Blades Market (by Application), $Billion, 2024-2034

- Table 13: Canada Windshield Wiper Blades Market (by Product), $Billion, 2024-2034

- Table 14: Mexico Windshield Wiper Blades Market (by Application), $Billion, 2024-2034

- Table 15: Mexico Windshield Wiper Blades Market (by Product), $Billion, 2024-2034

- Table 16: Europe Windshield Wiper Blades Market (by Application), $Billion, 2024-2034

- Table 17: Europe Windshield Wiper Blades Market (by Product), $Billion, 2024-2034

- Table 18: Germany Windshield Wiper Blades Market (by Application), $Billion, 2024-2034

- Table 19: Germany Windshield Wiper Blades Market (by Product), $Billion, 2024-2034

- Table 20: France Windshield Wiper Blades Market (by Application), $Billion, 2024-2034

- Table 21: France Windshield Wiper Blades Market (by Product), $Billion, 2024-2034

- Table 22: Italy Windshield Wiper Blades Market (by Application), $Billion, 2024-2034

- Table 23: Italy Windshield Wiper Blades Market (by Product), $Billion, 2024-2034

- Table 24: Spain Windshield Wiper Blades Market (by Application), $Billion, 2024-2034

- Table 25: Spain Windshield Wiper Blades Market (by Product), $Billion, 2024-2034

- Table 26: U.K. Windshield Wiper Blades Market (by Application), $Billion, 2024-2034

- Table 27: U.K. Windshield Wiper Blades Market (by Product), $Billion, 2024-2034

- Table 28: Rest-of-Europe Windshield Wiper Blades Market (by Application), $Billion, 2024-2034

- Table 29: Rest-of-Europe Windshield Wiper Blades Market (by Product), $Billion, 2024-2034

- Table 30: Asia-Pacific Windshield Wiper Blades Market (by Application), $Billion, 2024-2034

- Table 31: Asia-Pacific Windshield Wiper Blades Market (by Product), $Billion, 2024-2034

- Table 32: China Windshield Wiper Blades Market (by Application), $Billion, 2024-2034

- Table 33: China Windshield Wiper Blades Market (by Product), $Billion, 2024-2034

- Table 34: Japan Windshield Wiper Blades Market (by Application), $Billion, 2024-2034

- Table 35: Japan Windshield Wiper Blades Market (by Product), $Billion, 2024-2034

- Table 36: India Windshield Wiper Blades Market (by Application), $Billion, 2024-2034

- Table 37: India Windshield Wiper Blades Market (by Product), $Billion, 2024-2034

- Table 38: South Korea Windshield Wiper Blades Market (by Application), $Billion, 2024-2034

- Table 39: South Korea Windshield Wiper Blades Market (by Product), $Billion, 2024-2034

- Table 40: Rest-of-Asia-Pacific Windshield Wiper Blades Market (by Application), $Billion, 2024-2034

- Table 41: Rest-of-Asia-Pacific Windshield Wiper Blades Market (by Product), $Billion, 2024-2034

- Table 42: Rest-of-the-World Windshield Wiper Blades Market (by Application), $Billion, 2024-2034

- Table 43: Rest-of-the-World Windshield Wiper Blades Market (by Product), $Billion, 2024-2034

- Table 44: South America Windshield Wiper Blades Market (by Application), $Billion, 2024-2034

- Table 45: South America Windshield Wiper Blades Market (by Product), $Billion, 2024-2034

- Table 46: Middle East and Africa Windshield Wiper Blades Market (by Application), $Billion, 2024-2034

- Table 47: Middle East and Africa Windshield Wiper Blades Market (by Product), $Billion, 2024-2034

- Table 48: Market Share

Global Windshield Wiper Blades Market: Industry Overview

The industry encompasses the engineering, production and distribution of blade assemblies that clear precipitation and contaminants from automotive glazing, with deployment across passenger vehicles, light trucks and heavy-duty applications. Technology evolution over the past decade has shifted the market from traditional bracketed steel-frame blades to low-profile beam and hybrid designs that better conform to curved windshield geometries and withstand aerodynamic lifts at high speeds. Concurrently, material science advances have introduced UV- and ozone-resistant silicone rubbers, graphite-enhanced squeegee elements and hydrophobic coatings that prolong service life and improve wipe clarity. The integration of sensors and actuators for automatic, rain-responsive operation is emerging as a value-add in premium segments and electric/autonomous vehicle platforms.

Windshield Wiper Blades Market Lifecycle Stage

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2025 - 2034 |

| 2025 Evaluation | $7.71 Billion |

| 2034 Forecast | $10.62 Billion |

| CAGR | 3.62% |

The windshield wiper blades market is in a sustained growth phase, characterized by steady demand from increasing global vehicle parc and the retrofit-oriented aftermarket. Innovation cycles are accelerating as manufacturers pursue differentiated offerings-such as heated blades, smart-sensor integration and advanced composite materials-while regional aftermarket expansion in Asia-Pacific and Latin America drives volume growth. As core beam-blade designs mature and penetration reaches saturation in developed markets, the industry is gradually shifting toward consolidation and vertical integration, with leading players acquiring niche technology firms and aftermarket distributors to capture aftermarket revenue streams and achieve economies of scale.

Windshield Wiper Blades Market Segmentation:

Segmentation 1: by Application

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

Passenger cars is one of the prominent application segments in the global windshield wiper blades market.

Segmentation 2: by Type

- Boneless Wiper Blades

- Bone Wiper Blades

The global windshield wiper blades market is estimated to be led by the boneless wiper blades segment in terms of type.

Segmentation 3: by Region

- North America - U.S., Canada, and Mexico

- Europe - Germany, France, Italy, Spain, U.K., and Rest-of-Europe

- Asia-Pacific - China, Japan, South Korea, India, and Rest-of-Asia-Pacific

- Rest-of-the-World - South America and Middle East and Africa

In the windshield wiper blades market, North America is anticipated to gain traction in terms of production,given the mature automotive industry characterized by high vehicle ownership, stringent safety regulations and a well-developed aftermarket infrastructure.

Demand - Drivers and Limitations

The following are the demand drivers for the global windshield wiper blades market:

- Integration of Advanced Driver-Assistance Systems (ADAS)

The global windshield wiper blades market is expected to face some limitations as well due to the following challenges:

- Volatility in Raw-Material Costs for Rubber and Silicone

Windshield Wiper Blades Market Key Players and Competition Synopsis

The global windshield wiper blades market is dominated by a concentrated group of specialized component manufacturers and automotive suppliers, led by Robert Bosch GmbH, DENSO Corporation and Valeo SA, which collectively hold over 40 percent of OEM and aftermarket share. Other prominent competitors include Trico Products, Federal-Mogul Motorparts (Anco), PPG Industries and Continental AG, each leveraging proprietary materials technology, exclusive OEM partnerships and broad distribution networks to secure strategic positioning. Competitive dynamics are further intensified by aggressive product innovations-such as integrated rain-sensing beam blades and heated, ice-mitigating designs-and by ongoing consolidation through mergers, strategic alliances and targeted vertical integration aimed at expanding regional footprints and bolstering aftermarket penetration.

Some prominent names established in the windshield wiper blades market are:

- Denso Corporation

- Federal-Mogul LLC

- HELLA GmbH & Co. KGaA

- Mitsuba Corporation

- PIAA Corporation

- Robert Bosch GmbH

- The Goodyear Tire & Rubber Company

- Trico Products Corporation

- Valeo SA

- WEXCO Industries Inc.

Companies that are not a part of the previously mentioned pool have been well represented across different sections of the report (wherever applicable).

Table of Contents

Executive Summary

Scope and Definition

Market/Product Definition

Key Questions Answered

Analysis and Forecast Note

1. Markets: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.2 Stakeholder Analysis

- 1.2.1 Use Case

- 1.2.2 End User and Buying Criteria

- 1.3 Market Dynamics Overview

- 1.3.1 Market Drivers

- 1.3.2 Market Restraints

- 1.3.3 Market Opportunities

- 1.4 Investment Landscape and R&D Trends

- 1.5 Supply Chain Analysis

- 1.6 Future Outlook and Market Roadmap

2. Windshield Wiper Blades Market (by Application)

- 2.1 Application Segmentation

- 2.2 Application Summary

- 2.3 Windshield Wiper Blades Market (by Application)

- 2.3.1 Passenger Cars

- 2.3.2 Light Commercial Vehicles

- 2.3.3 Heavy Commercial Vehicles

3. Windshield Wiper Blades Market (by Product)

- 3.1 Product Segmentation

- 3.2 Product Summary

- 3.3 Windshield Wiper Blades Market (by Type)

- 3.3.1 Boneless Wiper Blades

- 3.3.2 Bone Wiper Blades

- 3.4 Windshield Wiper Blades Market (by Sales Channel)

- 3.4.1 Aftermarket

- 3.4.2 Original Equipment Manufacturers (OEMs)

4. Windshield Wiper Blades Market (by Region)

- 4.1 Windshield Wiper Blades Market (by Region)

- 4.2 North America

- 4.2.1 Regional Overview

- 4.2.2 Driving Factors for Market Growth

- 4.2.3 Factors Challenging the Market

- 4.2.4 Key Companies

- 4.2.5 Application

- 4.2.6 Product

- 4.2.7 North America (by Country)

- 4.2.7.1 U.S.

- 4.2.7.1.1 Market by Application

- 4.2.7.1.2 Market by Product

- 4.2.7.2 Canada

- 4.2.7.2.1 Market by Application

- 4.2.7.2.2 Market by Product

- 4.2.7.3 Mexico

- 4.2.7.3.1 Market by Application

- 4.2.7.3.2 Market by Product

- 4.2.7.1 U.S.

- 4.3 Europe

- 4.3.1 Regional Overview

- 4.3.2 Driving Factors for Market Growth

- 4.3.3 Factors Challenging the Market

- 4.3.4 Key Companies

- 4.3.5 Application

- 4.3.6 Product

- 4.3.7 Europe (by Country)

- 4.3.7.1 Germany

- 4.3.7.1.1 Market by Application

- 4.3.7.1.2 Market by Product

- 4.3.7.2 France

- 4.3.7.2.1 Market by Application

- 4.3.7.2.2 Market by Product

- 4.3.7.3 Italy

- 4.3.7.3.1 Market by Application

- 4.3.7.3.2 Market by Product

- 4.3.7.4 Spain

- 4.3.7.4.1 Market by Application

- 4.3.7.4.2 Market by Product

- 4.3.7.5 U.K.

- 4.3.7.5.1 Market by Application

- 4.3.7.5.2 Market by Product

- 4.3.7.6 Rest-of-Europe

- 4.3.7.6.1 Market by Application

- 4.3.7.6.2 Market by Product

- 4.3.7.1 Germany

- 4.4 Asia-Pacific

- 4.4.1 Regional Overview

- 4.4.2 Driving Factors for Market Growth

- 4.4.3 Factors Challenging the Market

- 4.4.4 Key Companies

- 4.4.5 Application

- 4.4.6 Product

- 4.4.7 Asia-Pacific (by Country)

- 4.4.7.1 China

- 4.4.7.1.1 Market by Application

- 4.4.7.1.2 Market by Product

- 4.4.7.2 Japan

- 4.4.7.2.1 Market by Application

- 4.4.7.2.2 Market by Product

- 4.4.7.3 India

- 4.4.7.3.1 Market by Application

- 4.4.7.3.2 Market by Product

- 4.4.7.4 South Korea

- 4.4.7.4.1 Market by Application

- 4.4.7.4.2 Market by Product

- 4.4.7.5 Rest-of-Asia-Pacific

- 4.4.7.5.1 Market by Application

- 4.4.7.5.2 Market by Product

- 4.4.7.1 China

- 4.5 Rest-of-the-World

- 4.5.1 Regional Overview

- 4.5.2 Driving Factors for Market Growth

- 4.5.3 Factors Challenging the Market

- 4.5.4 Key Companies

- 4.5.5 Application

- 4.5.6 Product

- 4.5.7 Rest-of-the-World (by Region)

- 4.5.7.1 South America

- 4.5.7.1.1 Market by Application

- 4.5.7.1.2 Market by Product

- 4.5.7.2 Middle East and Africa

- 4.5.7.2.1 Market by Application

- 4.5.7.2.2 Market by Product

- 4.5.7.1 South America

5. Markets - Competitive Benchmarking & Company Profiles

- 5.1 Next Frontiers

- 5.2 Geographic Assessment

- 5.3 Company Profiles

- 5.3.1 Denso Corporation

- 5.3.1.1 Overview

- 5.3.1.2 Top Products/Product Portfolio

- 5.3.1.3 Top Competitors

- 5.3.1.4 Target Customers

- 5.3.1.5 Key Personnel

- 5.3.1.6 Analyst View

- 5.3.1.7 Market Share

- 5.3.2 Federal-Mogul LLC

- 5.3.2.1 Overview

- 5.3.2.2 Top Products/Product Portfolio

- 5.3.2.3 Top Competitors

- 5.3.2.4 Target Customers

- 5.3.2.5 Key Personnel

- 5.3.2.6 Analyst View

- 5.3.2.7 Market Share

- 5.3.3 HELLA GmbH & Co. KGaA

- 5.3.3.1 Overview

- 5.3.3.2 Top Products/Product Portfolio

- 5.3.3.3 Top Competitors

- 5.3.3.4 Target Customers

- 5.3.3.5 Key Personnel

- 5.3.3.6 Analyst View

- 5.3.3.7 Market Share

- 5.3.4 Mitsuba Corporation

- 5.3.4.1 Overview

- 5.3.4.2 Top Products/Product Portfolio

- 5.3.4.3 Top Competitors

- 5.3.4.4 Target Customers

- 5.3.4.5 Key Personnel

- 5.3.4.6 Analyst View

- 5.3.4.7 Market Share

- 5.3.5 PIAA Corporation

- 5.3.5.1 Overview

- 5.3.5.2 Top Products/Product Portfolio

- 5.3.5.3 Top Competitors

- 5.3.5.4 Target Customers

- 5.3.5.5 Key Personnel

- 5.3.5.6 Analyst View

- 5.3.5.7 Market Share

- 5.3.6 Robert Bosch GmbH

- 5.3.6.1 Overview

- 5.3.6.2 Top Products/Product Portfolio

- 5.3.6.3 Top Competitors

- 5.3.6.4 Target Customers

- 5.3.6.5 Key Personnel

- 5.3.6.6 Analyst View

- 5.3.6.7 Market Share

- 5.3.7 The Goodyear Tire & Rubber Company

- 5.3.7.1 Overview

- 5.3.7.2 Top Products/Product Portfolio

- 5.3.7.3 Top Competitors

- 5.3.7.4 Target Customers

- 5.3.7.5 Key Personnel

- 5.3.7.6 Analyst View

- 5.3.7.7 Market Share

- 5.3.8 Trico Products Corporation

- 5.3.8.1 Overview

- 5.3.8.2 Top Products/Product Portfolio

- 5.3.8.3 Top Competitors

- 5.3.8.4 Target Customers

- 5.3.8.5 Key Personnel

- 5.3.8.6 Analyst View

- 5.3.8.7 Market Share

- 5.3.9 Valeo SA

- 5.3.9.1 Overview

- 5.3.9.2 Top Products/Product Portfolio

- 5.3.9.3 Top Competitors

- 5.3.9.4 Target Customers

- 5.3.9.5 Key Personnel

- 5.3.9.6 Analyst View

- 5.3.9.7 Market Share

- 5.3.10 WEXCO Industries Inc.

- 5.3.10.1 Overview

- 5.3.10.2 Top Products/Product Portfolio

- 5.3.10.3 Top Competitors

- 5.3.10.4 Target Customers

- 5.3.10.5 Key Personnel

- 5.3.10.6 Analyst View

- 5.3.10.7 Market Share

- 5.3.1 Denso Corporation

- 5.4 Other Key Companies