|

|

市場調査レポート

商品コード

1735559

半導体フィルター市場- 世界および地域別分析:製品別、用途別、国別 - 分析と予測(2025年~2034年)Semiconductor Filter Market - A Global and Regional Analysis: Focus on Product, Application, and Country Analysis - Analysis and Forecast, 2025-2034 |

||||||

カスタマイズ可能

|

|||||||

| 半導体フィルター市場- 世界および地域別分析:製品別、用途別、国別 - 分析と予測(2025年~2034年) |

|

出版日: 2025年05月29日

発行: BIS Research

ページ情報: 英文 120 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

世界の半導体フィルター市場は、半導体製造プロセスで使用される気体や液体の純度と完全性を確保する上で極めて重要な役割を果たしています。

これらの特殊フィルターは、ウェットエッチング、フォトリソグラフィ、化学気相成長(CVD)、クリーンルーム環境など、微小な汚染物質でさえ半導体デバイスの性能と信頼性を損なう可能性がある用途において不可欠です。半導体製造工程がますます複雑化するにつれ、高性能なろ過ソリューションへの要求も高まっています。材料科学の革新やスマートろ過システムを含むフィルター技術の進歩は、現代の半導体製造の厳しい要件を満たすために不可欠です。業界では超クリーンな環境を維持することが重視されており、望ましいデバイス性能と歩留まりを達成するためには効果的なろ過が重要であることが強調されています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2025年~2034年 |

| 2025年の評価 | 19億8,000万米ドル |

| 2034年の予測 | 38億9,000万米ドル |

| CAGR | 7.79% |

世界の半導体フィルター市場は現在、ライフサイクルの成長段階にあります。この段階の特徴は、5G、人工知能(AI)、モノのインターネット(IoT)などの技術の進歩によって、高性能半導体デバイスの需要が増加していることです。メーカーは、半導体製造プロセスに不可欠な厳しい純度基準を満たすために、ろ過ソリューションの強化に注力しています。市場の主な参入企業は、半導体フィルターの革新と効率向上のための研究開発に投資しており、それによって業界の拡大を支え、半導体製造の進化するニーズに対応しています。

半導体フィルターの世界市場セグメンテーション:

セグメント1:用途別

- 半導体鋳造製造(電子半導体)

- メモリー製造(電子半導体)

- ソーラー半導体製造

- その他

半導体ファウンドリー製造(電子半導体)は、世界の半導体フィルター市場において顕著なアプリケーションセグメントの一つです。

セグメンテーション2:製品タイプ別

- フォトフィルター

- WETフィルター

- CMPフィルター

- ツールトップAMCフィルター

- ガスフィルター

世界の半導体フィルター市場は、フォトフィルターが牽引すると推定されます。

セグメンテーション3:地域別

- 北米- 米国、カナダ、メキシコ

- 欧州- ドイツ、フランス、イタリア、スペイン、英国、その他

- アジア太平洋地域- 中国、日本、韓国、インド、その他

- その他の地域- 南米、中東・アフリカ

世界の半導体フィルター市場では、北米が継続的な成長と主要メーカーの存在により、生産面で牽引役となると予想されます。

需要-促進要因と抑制要因

世界半導体フィルター市場の需要促進要因は以下の通り:

- 高性能半導体に対する需要の増加

- 先進的ソリューションの採用を必要とする製造プロセスの革新

世界の半導体フィルター市場は、以下の課題によっていくつかの制限にも直面すると予想される:

- 初期投資コストの高さ

- 複雑なろ過システム別メンテナンスと運用の課題

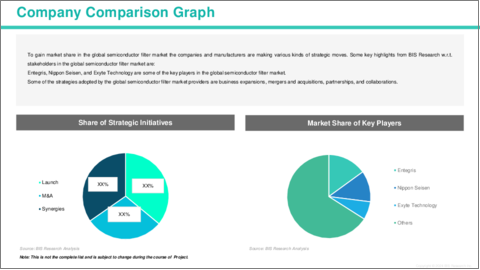

主要市場参入企業と競合情勢

世界の半導体フィルター市場は競合情勢が激しく、少数の主要企業が大きなシェアを占めています。 Entegris and Pall Corporationは、半導体液体フィルター市場のそれぞれ約28%と35%を占める傑出したリーダーです。その他の注目すべき企業には、Camfil、Nippon Seisen、Donaldson Companyなどがあり、それぞれが特殊なろ過ソリューションを通じて市場の多様性に貢献しています。これらの企業は、濾過効率を高め、半導体製造プロセスの厳しい要件を満たすことに焦点を当て、継続的な技術革新に取り組んでいます。研究開発への戦略的投資と新興国市場への進出は、競争優位性を維持するためのコミットメントを強調しています。市場の成長軌道は、半導体技術の進歩に牽引された高純度ろ過ソリューションの需要増加によってさらに支えられています。

当レポートでは、世界の半導体フィルター市場について調査し、市場の概要とともに、製品別、用途別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場:業界見通し

- 動向:現状と将来への影響評価

- ステークホルダー分析

- 市場力学の概要

- 市場促進要因

- 市場抑制要因

- 市場機会

- 規制および政策影響分析

- 特許分析

- スタートアップの情勢

- 総アドレス可能市場

- 投資情勢と研究開発動向

- 将来展望と市場ロードマップ

- サプライチェーン分析

- バリューチェーン分析

- 世界価格分析

- 業界の魅力

第2章 世界の半導体フィルター市場(用途別)

- 用途のセグメンテーション

- 用途のサマリー

- 世界の半導体フィルター市場(用途別)

- 半導体ファウンドリ製造(電子半導体)

- メモリ製造(電子半導体)

- 太陽光発電半導体製造

- その他

第3章 世界の半導体フィルター市場(製品別)

- 製品のセグメンテーション

- 製品のサマリー

- 世界の半導体フィルター市場(製品タイプ別)

- 写真フィルター

- ウェットフィルター

- CMPフィルター

- ツールトップAMCフィルター

- ガスフィルター

第4章 世界の半導体フィルター市場(地域別)

- 半導体フィルター市場(地域別)

- 北米

- 欧州

- アジア太平洋

- その他の地域

第5章 市場-競合ベンチマーキングと企業プロファイル

- 今後の見通し

- 地理的評価

- 企業プロファイル

- Entegris

- Nippon Seisen

- Exyte Technology

- Camfil

- Ecopro

- Danaher Corporation (Pall Corporation)

- Yesiang Enterprise Co., Ltd.

- 3M

- Parker Hannifin Corporation

- Donaldson Company, Inc.

- その他の主要企業

第6章 調査手法

List of Figures

- Figure 1: Semiconductor Filter Market (by Scenario), $Billion, 2025, 2028, and 2034

- Figure 2: Semiconductor Filter Market (by Region), $Billion, 2024, 2027, and 2034

- Figure 3: Semiconductor Filter Market (by Application), $Billion, 2024, 2027, and 2034

- Figure 4: Semiconductor Filter Market (by Product), $Billion, 2024, 2027, and 2034

- Figure 5: Competitive Landscape Snapshot

- Figure 6: Supply Chain Analysis

- Figure 7: Value Chain Analysis

- Figure 8: Patent Analysis (by Country), January 2021-April 2025

- Figure 9: Patent Analysis (by Company), January 2021-April 2025

- Figure 10: Impact Analysis of Market Navigating Factors, 2024-2034

- Figure 11: U.S. Semiconductor Filter Market, $Billion, 2024-2034

- Figure 12: Canada Semiconductor Filter Market, $Billion, 2024-2034

- Figure 13: Mexico Semiconductor Filter Market, $Billion, 2024-2034

- Figure 14: Germany Semiconductor Filter Market, $Billion, 2024-2034

- Figure 15: France Semiconductor Filter Market, $Billion, 2024-2034

- Figure 16: Italy Semiconductor Filter Market, $Billion, 2024-2034

- Figure 17: Spain Semiconductor Filter Market, $Billion, 2024-2034

- Figure 18: U.K. Semiconductor Filter Market, $Billion, 2024-2034

- Figure 19: Rest-of-Europe Semiconductor Filter Market, $Billion, 2024-2034

- Figure 20: China Semiconductor Filter Market, $Billion, 2024-2034

- Figure 21: Japan Semiconductor Filter Market, $Billion, 2024-2034

- Figure 22: India Semiconductor Filter Market, $Billion, 2024-2034

- Figure 23: South Korea Semiconductor Filter Market, $Billion, 2024-2034

- Figure 24: Rest-of-Asia-Pacific Semiconductor Filter Market, $Billion, 2024-2034

- Figure 25: South America Semiconductor Filter Market, $Billion, 2024-2034

- Figure 26: Middle East and Africa Semiconductor Filter Market, $Billion, 2024-2034

- Figure 27: Strategic Initiatives (by Company), 2021-2025

- Figure 28: Share of Strategic Initiatives, 2021-2025

- Figure 29: Data Triangulation

- Figure 30: Top-Down and Bottom-Up Approach

- Figure 31: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Opportunities across Region

- Table 3: Trends Overview

- Table 4: Semiconductor Filter Market Pricing Forecast, 2024-2034

- Table 5: Application Summary (by Application)

- Table 6: Product Summary (by Product)

- Table 7: Semiconductor Filter Market (by Region), $Billion, 2024-2034

- Table 8: North America Semiconductor Filter Market (by Application), $Billion, 2024-2034

- Table 9: North America Semiconductor Filter Market (by Product), $Billion, 2024-2034

- Table 10: U.S. Semiconductor Filter Market (by Application), $Billion, 2024-2034

- Table 11: U.S. Semiconductor Filter Market (by Product), $Billion, 2024-2034

- Table 12: Canada Semiconductor Filter Market (by Application), $Billion, 2024-2034

- Table 13: Canada Semiconductor Filter Market (by Product), $Billion, 2024-2034

- Table 14: Mexico Semiconductor Filter Market (by Application), $Billion, 2024-2034

- Table 15: Mexico Semiconductor Filter Market (by Product), $Billion, 2024-2034

- Table 16: Europe Semiconductor Filter Market (by Application), $Billion, 2024-2034

- Table 17: Europe Semiconductor Filter Market (by Product), $Billion, 2024-2034

- Table 18: Germany Semiconductor Filter Market (by Application), $Billion, 2024-2034

- Table 19: Germany Semiconductor Filter Market (by Product), $Billion, 2024-2034

- Table 20: France Semiconductor Filter Market (by Application), $Billion, 2024-2034

- Table 21: France Semiconductor Filter Market (by Product), $Billion, 2024-2034

- Table 22: Italy Semiconductor Filter Market (by Application), $Billion, 2024-2034

- Table 23: Italy Semiconductor Filter Market (by Product), $Billion, 2024-2034

- Table 24: Spain Semiconductor Filter Market (by Application), $Billion, 2024-2034

- Table 25: Spain Semiconductor Filter Market (by Product), $Billion, 2024-2034

- Table 26: U.K. Semiconductor Filter Market (by Application), $Billion, 2024-2034

- Table 27: U.K. Semiconductor Filter Market (by Product), $Billion, 2024-2034

- Table 28: Rest-of-Europe Semiconductor Filter Market (by Application), $Billion, 2024-2034

- Table 29: Rest-of-Europe Semiconductor Filter Market (by Product), $Billion, 2024-2034

- Table 30: Asia-Pacific Semiconductor Filter Market (by Application), $Billion, 2024-2034

- Table 31: Asia-Pacific Semiconductor Filter Market (by Product), $Billion, 2024-2034

- Table 32: China Semiconductor Filter Market (by Application), $Billion, 2024-2034

- Table 33: China Semiconductor Filter Market (by Product), $Billion, 2024-2034

- Table 34: Japan Semiconductor Filter Market (by Application), $Billion, 2024-2034

- Table 35: Japan Semiconductor Filter Market (by Product), $Billion, 2024-2034

- Table 36: India Semiconductor Filter Market (by Application), $Billion, 2024-2034

- Table 37: India Semiconductor Filter Market (by Product), $Billion, 2024-2034

- Table 38: South Korea Semiconductor Filter Market (by Application), $Billion, 2024-2034

- Table 39: South Korea Semiconductor Filter Market (by Product), $Billion, 2024-2034

- Table 40: Rest-of-Asia-Pacific Semiconductor Filter Market (by Application), $Billion, 2024-2034

- Table 41: Rest-of-Asia-Pacific Semiconductor Filter Market (by Product), $Billion, 2024-2034

- Table 42: Rest-of-the-World Semiconductor Filter Market (by Application), $Billion, 2024-2034

- Table 43: Rest-of-the-World Semiconductor Filter Market (by Product), $Billion, 2024-2034

- Table 44: South America Semiconductor Filter Market (by Application), $Billion, 2024-2034

- Table 45: South America Semiconductor Filter Market (by Product), $Billion, 2024-2034

- Table 46: Middle East and Africa Semiconductor Filter Market (by Application), $Billion, 2024-2034

- Table 47: Middle East and Africa Semiconductor Filter Market (by Product), $Billion, 2024-2034

- Table 48: Market Share

Global Semiconductor Filter Market: Industry Overview

The global semiconductor filter market plays a pivotal role in ensuring the purity and integrity of gases and liquids used in semiconductor manufacturing processes. These specialized filters are essential in applications such as wet etching, photolithography, chemical vapor deposition (CVD), and cleanroom environments, where even minute contaminants can compromise the performance and reliability of semiconductor devices. As semiconductor manufacturing processes become increasingly complex, the demand for high-performance filtration solutions intensifies. Advancements in filter technologies, including innovations in material science and smart filtration systems, are crucial to meet the stringent requirements of modern semiconductor fabrication. The industry's emphasis on maintaining ultra-clean environments underscores the importance of effective filtration in achieving desired device performance and yield.

Market Lifecycle Stage

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2025 - 2034 |

| 2025 Evaluation | $1.98 Billion |

| 2034 Forecast | $3.89 Billion |

| CAGR | 7.79% |

The global semiconductor filter market is currently in the growth phase of its lifecycle. This phase is characterized by increasing demand for high-performance semiconductor devices, driven by advancements in technologies such as 5G, artificial intelligence (AI), and the Internet of Things (IoT). Manufacturers are focusing on enhancing filtration solutions to meet stringent purity standards essential for semiconductor fabrication processes. Key players in the market are investing in research and development to innovate and improve the efficiency of semiconductor filters, thereby supporting the industry's expansion and addressing the evolving needs of semiconductor manufacturing.

Global Semiconductor Filter Market Segmentation:

Segmentation 1: by Application

- Semiconductor Foundry Manufacturing (Electronic Semiconductor)

- Memory Manufacturing (Electronic Semiconductor)

- Solar Semiconductor Manufacturing

- Others

Semiconductor foundry manufacturing (electronic semiconductor) is one of the prominent application segments in the global semiconductor filter market.

Segmentation 2: by Product Type

- Photo Filter

- WET Filter

- CMP Filter

- Tool Top AMC Filter

- Gas Filter

The global semiconductor filter market is estimated to be led by photo filter.

Segmentation 3: by Region

- North America - U.S., Canada, and Mexico

- Europe - Germany, France, Italy, Spain, U.K., and Rest-of-Europe

- Asia-Pacific - China, Japan, South Korea, India, and Rest-of-Asia-Pacific

- Rest-of-the-World - South America and Middle East and Africa

In the global semiconductor filter market, North America is anticipated to gain traction in terms of production, owing to the continuous growth and the presence of key manufacturers in the region.

Demand - Drivers and Limitations

The following are the demand drivers for the global semiconductor filter market:

- Increasing Demand for High-Performance Semiconductors

- Innovations in Manufacturing Processes necessitating Adoption of Advanced Solutions

The global semiconductor filter market is expected to face some limitations as well due to the following challenges:

- High Initial Investment Costs

- Complexity of Filtration Systems Challenging Maintenance and Operation

Key Market Players and Competition Synopsis

The global semiconductor filter market is characterized by a concentrated competitive landscape, with a few key players commanding a significant share. Entegris and Pall Corporation are prominent leaders, holding approximately 28% and 35% of the semiconductor liquid filter market respectively. Other notable companies include Camfil, Nippon Seisen, and Donaldson Company, each contributing to the market's diversity through specialized filtration solutions. These companies engage in continuous innovation, focusing on enhancing filtration efficiency and meeting the stringent requirements of semiconductor manufacturing processes. Their strategic investments in research and development, along with expansions into emerging markets, underscore their commitment to maintaining competitive advantages. The market's growth trajectory is further supported by the increasing demand for high-purity filtration solutions driven by advancements in semiconductor technologies.

Some of the prominent established names in global semiconductor filter market are:

- Entegris

- Nippon Seisen

- Exyte Technology

- Camfil

- Ecopro

- Danaher Corporation (Pall Corporation)

- Yesiang Enterprise Co., Ltd.

- 3M

- Parker Hannifin Corporation

- Donaldson Company, Inc.

Companies that are not a part of the previously mentioned pool have been well represented across different sections of the report (wherever applicable).

Table of Contents

Executive Summary

Scope and Definition

Market/Product Definition

Key Questions Answered

Analysis and Forecast Note

1. Markets: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.2 Stakeholder Analysis

- 1.2.1 Use Case

- 1.2.2 End User and Buying Criteria

- 1.3 Market Dynamics Overview

- 1.3.1 Market Drivers

- 1.3.2 Market Restraints

- 1.3.3 Market Opportunities

- 1.4 Regulatory & Policy Impact Analysis

- 1.5 Patent Analysis

- 1.6 Start-Up Landscape

- 1.7 Total Addressable Market

- 1.8 Investment Landscape and R&D Trends

- 1.9 Future Outlook and Market Roadmap

- 1.10 Supply Chain Analysis

- 1.11 Value Chain Analysis

- 1.12 Global Pricing Analysis

- 1.13 Industry Attractiveness

2. Global Semiconductor Filter Market (by Application)

- 2.1 Application Segmentation

- 2.2 Application Summary

- 2.3 Global Semiconductor Filter Market (by Application)

- 2.3.1 Semiconductor Foundry Manufacturing (Electronic Semiconductor)

- 2.3.2 Memory Manufacturing (Electronic Semiconductor)

- 2.3.3 Solar Semiconductor Manufacturing

- 2.3.4 Others

3. Global Semiconductor Filter Market (by Product)

- 3.1 Product Segmentation

- 3.2 Product Summary

- 3.3 Global Semiconductor Filter Market (by Product Type)

- 3.3.1 Photo Filter

- 3.3.2 WET Filter

- 3.3.3 CMP Filter

- 3.3.4 Tool Top AMC Filter

- 3.3.5 Gas Filter

4. Global Semiconductor Filter Market (by Region)

- 4.1 Semiconductor Filter Market (by Region)

- 4.2 North America

- 4.2.1 Regional Overview

- 4.2.2 Driving Factors for Market Growth

- 4.2.3 Factors Challenging the Market

- 4.2.4 Application

- 4.2.5 Product

- 4.2.6 North America (by Country)

- 4.2.6.1 U.S.

- 4.2.6.1.1 Market by Application

- 4.2.6.1.2 Market by Product

- 4.2.6.2 Canada

- 4.2.6.2.1 Market by Application

- 4.2.6.2.2 Market by Product

- 4.2.6.3 Mexico

- 4.2.6.3.1 Market by Application

- 4.2.6.3.2 Market by Product

- 4.2.6.1 U.S.

- 4.3 Europe

- 4.3.1 Regional Overview

- 4.3.2 Driving Factors for Market Growth

- 4.3.3 Factors Challenging the Market

- 4.3.4 Application

- 4.3.5 Product

- 4.3.6 Europe (by Country)

- 4.3.6.1 Germany

- 4.3.6.1.1 Market by Application

- 4.3.6.1.2 Market by Product

- 4.3.6.2 France

- 4.3.6.2.1 Market by Application

- 4.3.6.2.2 Market by Product

- 4.3.6.3 Italy

- 4.3.6.3.1 Market by Application

- 4.3.6.3.2 Market by Product

- 4.3.6.4 Spain

- 4.3.6.4.1 Market by Application

- 4.3.6.4.2 Market by Product

- 4.3.6.5 U.K.

- 4.3.6.5.1 Market by Application

- 4.3.6.5.2 Market by Product

- 4.3.6.6 Rest-of-Europe

- 4.3.6.6.1 Market by Application

- 4.3.6.6.2 Market by Product

- 4.3.6.1 Germany

- 4.4 Asia-Pacific

- 4.4.1 Regional Overview

- 4.4.2 Driving Factors for Market Growth

- 4.4.3 Factors Challenging the Market

- 4.4.4 Application

- 4.4.5 Product

- 4.4.6 Asia-Pacific (by Country)

- 4.4.6.1 China

- 4.4.6.1.1 Market by Application

- 4.4.6.1.2 Market by Product

- 4.4.6.2 Japan

- 4.4.6.2.1 Market by Application

- 4.4.6.2.2 Market by Product

- 4.4.6.3 India

- 4.4.6.3.1 Market by Application

- 4.4.6.3.2 Market by Product

- 4.4.6.4 South Korea

- 4.4.6.4.1 Market by Application

- 4.4.6.4.2 Market by Product

- 4.4.6.5 Rest-of-Asia-Pacific

- 4.4.6.5.1 Market by Application

- 4.4.6.5.2 Market by Product

- 4.4.6.1 China

- 4.5 Rest-of-the-World

- 4.5.1 Regional Overview

- 4.5.2 Driving Factors for Market Growth

- 4.5.3 Factors Challenging the Market

- 4.5.4 Application

- 4.5.5 Product

- 4.5.6 Rest-of-the-World (by Region)

- 4.5.6.1 South America

- 4.5.6.1.1 Market by Application

- 4.5.6.1.2 Market by Product

- 4.5.6.2 Middle East and Africa

- 4.5.6.2.1 Market by Application

- 4.5.6.2.2 Market by Product

- 4.5.6.1 South America

5. Markets - Competitive Benchmarking & Company Profiles

- 5.1 Next Frontiers

- 5.2 Geographic Assessment

- 5.3 Company Profiles

- 5.3.1 Entegris

- 5.3.1.1 Overview

- 5.3.1.2 Top Products/Product Portfolio

- 5.3.1.3 Top Competitors

- 5.3.1.4 Target Customers

- 5.3.1.5 Key Personnel

- 5.3.1.6 Analyst View

- 5.3.1.7 Market Share

- 5.3.2 Nippon Seisen

- 5.3.2.1 Overview

- 5.3.2.2 Top Products/Product Portfolio

- 5.3.2.3 Top Competitors

- 5.3.2.4 Target Customers

- 5.3.2.5 Key Personnel

- 5.3.2.6 Analyst View

- 5.3.2.7 Market Share

- 5.3.3 Exyte Technology

- 5.3.3.1 Overview

- 5.3.3.2 Top Products/Product Portfolio

- 5.3.3.3 Top Competitors

- 5.3.3.4 Target Customers

- 5.3.3.5 Key Personnel

- 5.3.3.6 Analyst View

- 5.3.3.7 Market Share

- 5.3.4 Camfil

- 5.3.4.1 Overview

- 5.3.4.2 Top Products/Product Portfolio

- 5.3.4.3 Top Competitors

- 5.3.4.4 Target Customers

- 5.3.4.5 Key Personnel

- 5.3.4.6 Analyst View

- 5.3.4.7 Market Share

- 5.3.5 Ecopro

- 5.3.5.1 Overview

- 5.3.5.2 Top Products/Product Portfolio

- 5.3.5.3 Top Competitors

- 5.3.5.4 Target Customers

- 5.3.5.5 Key Personnel

- 5.3.5.6 Analyst View

- 5.3.5.7 Market Share

- 5.3.6 Danaher Corporation (Pall Corporation)

- 5.3.6.1 Overview

- 5.3.6.2 Top Products/Product Portfolio

- 5.3.6.3 Top Competitors

- 5.3.6.4 Target Customers

- 5.3.6.5 Key Personnel

- 5.3.6.6 Analyst View

- 5.3.6.7 Market Share

- 5.3.7 Yesiang Enterprise Co., Ltd.

- 5.3.7.1 Overview

- 5.3.7.2 Top Products/Product Portfolio

- 5.3.7.3 Top Competitors

- 5.3.7.4 Target Customers

- 5.3.7.5 Key Personnel

- 5.3.7.6 Analyst View

- 5.3.7.7 Market Share

- 5.3.8 3M

- 5.3.8.1 Overview

- 5.3.8.2 Top Products/Product Portfolio

- 5.3.8.3 Top Competitors

- 5.3.8.4 Target Customers

- 5.3.8.5 Key Personnel

- 5.3.8.6 Analyst View

- 5.3.8.7 Market Share

- 5.3.9 Parker Hannifin Corporation

- 5.3.9.1 Overview

- 5.3.9.2 Top Products/Product Portfolio

- 5.3.9.3 Top Competitors

- 5.3.9.4 Target Customers

- 5.3.9.5 Key Personnel

- 5.3.9.6 Analyst View

- 5.3.9.7 Market Share

- 5.3.10 Donaldson Company, Inc.

- 5.3.10.1 Overview

- 5.3.10.2 Top Products/Product Portfolio

- 5.3.10.3 Top Competitors

- 5.3.10.4 Target Customers

- 5.3.10.5 Key Personnel

- 5.3.10.6 Analyst View

- 5.3.10.7 Market Share

- 5.3.1 Entegris

- 5.4 Other Key Companies