|

|

市場調査レポート

商品コード

1732575

新興メモリおよびストレージ技術の世界市場:用途・技術・ウエハサイズ・地域/国別の分析・予測 (2025-2034年)Emerging Memory and Storage Technology Market - A Global and Regional Analysis: Focus on Application, Technology, Wafer Size, and Country Analysis - Analysis and Forecast, 2025-2034 |

||||||

カスタマイズ可能

|

|||||||

| 新興メモリおよびストレージ技術の世界市場:用途・技術・ウエハサイズ・地域/国別の分析・予測 (2025-2034年) |

|

出版日: 2025年05月26日

発行: BIS Research

ページ情報: 英文 120 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

新興メモリおよびストレージ技術産業は大きな転換期を迎えており、主要な半導体ファウンドリー、材料サプライヤー、システムインテグレーターが連携して、DRAMやNANDフラッシュの遅延・耐久性・エネルギー効率の課題を克服する不揮発性メモリの商用化を進めています。

過去2年間で、相変化メモリ (PCM)、抵抗変化メモリ (ReRAM)、スピントランスファートルクMRAM (STT-MRAM) が、ラボでの実証段階から22nm未満のプロセスノードでのパイロットラインに進み、3D積層技術や先端パターニング技術を活用して、競争力のある記憶密度や100ナノ秒未満のアクセス速度を実現しています。TSMC、Samsung Foundry、Micron、Intel、専門IPプロバイダーを中心とするコンソーシアムは、カルコゲナイド、金属酸化物、磁気トンネル接合材料向けの成膜装置やプロセスフローの最適化を共同開発しており、量産化に向けた歩留まりの向上が加速しています。年間50億ドルを超える研究開発投資と、ハイパースケールデータセンター、エンタープライズストレージ、自動車制御ユニット向けのモジュールとしての初期出荷により、業界は実験的検証段階から本格商業展開への転換点にあります。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2025-2034年 |

| 2025年評価 | 72億5,000万米ドル |

| 2034年予測 | 183億4,000万米ドル |

| CAGR | 10.86% |

現在、市場はライフサイクルの初期成長段階に位置しています。大学や国立研究機関による数年にわたる導入期間を経て、主要なメモリ技術は初期生産の段階へと突入しました。第一世代のPCMおよびMRAMモジュールは、現在、特定の高性能およびエッジコンピューティング用途において認証されています。採用は依然として、ハイパースケールクラウド事業者、AIアクセラレータのOEM、防衛請負業者といった初期採用者の間に集中していますが、自動車および産業用IoTにおける最近の設計採用は、対応可能な市場の拡大を示しています。今後2~3年の間に、製造の拡大、欠陥率の低下、インターフェース規格の確立が進むにつれ、新興メモリ市場は成長段階へと移行する見込みです。この段階では、ビット当たりコストの効率性と、より広範なシステム統合が、主流市場での採用を促進する見通しです。

市場の分類:

セグメンテーション1:用途別

- CE製品

- エンタープライズストレージ

- 自動車・輸送機器

- 軍事・航空宇宙

- 工業

- 通信

- エネルギー・電力

- ヘルスケア

- その他

セグメンテーション2:技術別

- 不揮発性メモリ

- 抵抗変化メモリ (RRAM)

- 相変化メモリ (PCM)

- 磁気抵抗RAM (MRAM)

- 3D XPoint

- ナノRAM (NRAM)

- その他

- 揮発性メモリ

- ハイブリッドメモリキューブ (HMC)

- 高帯域幅メモリ (HBM)

セグメンテーション3:地域別

- 北米:米国、カナダ、メキシコ

- 欧州:ドイツ、フランス、イタリア、スペイン、英国、その他

- アジア太平洋地域:中国、日本、韓国、インド、その他

- その他:南米、中東・アフリカ

当レポートでは、世界の新興メモリおよびストレージ技術の市場を調査し、主要動向、市場影響因子の分析、法規制環境、技術・特許の動向、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

エグゼクティブサマリー

第1章 市場:業界展望

- 動向:現状と将来への影響評価

- ステークホルダー分析

- 使用事例

- エンドユーザーと購入基準

- 市場力学の概要

- 市場促進要因

- 市場抑制要因

- 市場機会

- 規制および政策の影響分析

- 特許分析

- スタートアップの情勢

- 投資情勢と研究開発動向

- 将来展望と市場ロードマップ

- バリューチェーン分析

- 世界価格分析

- 業界の魅力

第2章 新興メモリおよびストレージ技術市場:用途別

- セグメンテーション

- サマリー

- 用途別市場

- CE製品

- エンタープライズストレージ

- 自動車・輸送

- 軍事・航空宇宙

- 産業

- 通信

- エネルギー・電力

- ヘルスケア

- その他

第3章 新興メモリおよびストレージ技術市場:製品別

- 製品セグメンテーション

- 製品サマリー

- 技術別市場

- 不揮発性メモリ

- 揮発性メモリ

- ウエハサイズ別市場

- 200mm

- 300mm

第4章 新興メモリおよびストレージ技術市場:地域別

- 地域別市場

- 北米

- 地域概要

- 市場成長の原動力

- 市場課題

- 用途

- 製品

- 北米 (国別)

- 欧州

- 地域概要

- 市場成長の原動力

- 市場課題

- 用途

- 製品

- 欧州 (国別)

- アジア太平洋

- 地域概要

- 市場成長の原動力

- 市場課題

- 用途

- 製品

- アジア太平洋 (国別)

- その他の地域

- 地域概要

- 市場成長の原動力

- 市場課題

- 用途

- 製品

- その他の地域 (地域別)

第5章 市場:競合ベンチマーキングと企業プロファイル

- 次のフロンティア

- 地理的評価

- 企業プロファイル

- SAMSUNG

- CrossBar Inc

- 4DS Memory

- RAMXEED

- GlobalFoundries

- TSMC

- IDTechEx

- Micron

- SK Hynix

- Weebit Nano

- その他の主要企業

第6章 調査手法

List of Figures

- Figure 1: Emerging Memory and Storage Technology Market (by Scenario), $Billion, 2025, 2028, and 2034

- Figure 2: Emerging Memory and Storage Technology Market (by Region), $Billion, 2024, 2027, and 2034

- Figure 3: Emerging Memory and Storage Technology Market (by Application), $Billion, 2024, 2027, and 2034

- Figure 4: Emerging Memory and Storage Technology Market (by Product), $Billion, 2024, 2027, and 2034

- Figure 5: Competitive Landscape Snapshot

- Figure 6: Supply Chain Analysis

- Figure 7: Value Chain Analysis

- Figure 8: Patent Analysis (by Country), January 2021-April 2025

- Figure 9: Patent Analysis (by Company), January 2021-April 2025

- Figure 10: Impact Analysis of Market Navigating Factors, 2024-2034

- Figure 11: U.S. Emerging Memory and Storage Technology Market, $Billion, 2024-2034

- Figure 12: Canada Emerging Memory and Storage Technology Market, $Billion, 2024-2034

- Figure 13: Mexico Emerging Memory and Storage Technology Market, $Billion, 2024-2034

- Figure 14: Germany Emerging Memory and Storage Technology Market, $Billion, 2024-2034

- Figure 15: France Emerging Memory and Storage Technology Market, $Billion, 2024-2034

- Figure 16: Italy Emerging Memory and Storage Technology Market, $Billion, 2024-2034

- Figure 17: Spain Emerging Memory and Storage Technology Market, $Billion, 2024-2034

- Figure 18: U.K. Emerging Memory and Storage Technology Market, $Billion, 2024-2034

- Figure 19: Rest-of-Europe Emerging Memory and Storage Technology Market, $Billion, 2024-2034

- Figure 20: China Emerging Memory and Storage Technology Market, $Billion, 2024-2034

- Figure 21: Japan Emerging Memory and Storage Technology Market, $Billion, 2024-2034

- Figure 22: India Emerging Memory and Storage Technology Market, $Billion, 2024-2034

- Figure 23: South Korea Emerging Memory and Storage Technology Market, $Billion, 2024-2034

- Figure 24: Rest-of-Asia-Pacific Emerging Memory and Storage Technology Market, $Billion, 2024-2034

- Figure 25: South America Emerging Memory and Storage Technology Market, $Billion, 2024-2034

- Figure 26: Middle East and Africa Emerging Memory and Storage Technology Market, $Billion, 2024-2034

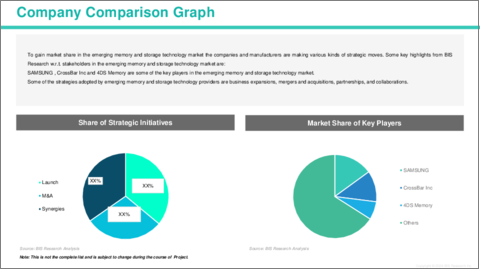

- Figure 27: Strategic Initiatives (by Company), 2021-2025

- Figure 28: Share of Strategic Initiatives, 2021-2025

- Figure 29: Data Triangulation

- Figure 30: Top-Down and Bottom-Up Approach

- Figure 31: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Opportunities across Region

- Table 3: Trends Overview

- Table 4: Emerging Memory and Storage Technology Market Pricing Forecast, 2024-2034

- Table 5: Application Summary (by Application)

- Table 6: Product Summary (by Product)

- Table 7: Emerging Memory and Storage Technology Market (by Region), $Billion, 2024-2034

- Table 8: North America Emerging Memory and Storage Technology Market (by Application), $Billion, 2024-2034

- Table 9: North America Emerging Memory and Storage Technology Market (by Product), $Billion, 2024-2034

- Table 10: U.S. Emerging Memory and Storage Technology Market (by Application), $Billion, 2024-2034

- Table 11: U.S. Emerging Memory and Storage Technology Market (by Product), $Billion, 2024-2034

- Table 12: Canada Emerging Memory and Storage Technology Market (by Application), $Billion, 2024-2034

- Table 13: Canada Emerging Memory and Storage Technology Market (by Product), $Billion, 2024-2034

- Table 14: Mexico Emerging Memory and Storage Technology Market (by Application), $Billion, 2024-2034

- Table 15: Mexico Emerging Memory and Storage Technology Market (by Product), $Billion, 2024-2034

- Table 16: Europe Emerging Memory and Storage Technology Market (by Application), $Billion, 2024-2034

- Table 17: Europe Emerging Memory and Storage Technology Market (by Product), $Billion, 2024-2034

- Table 18: Germany Emerging Memory and Storage Technology Market (by Application), $Billion, 2024-2034

- Table 19: Germany Emerging Memory and Storage Technology Market (by Product), $Billion, 2024-2034

- Table 20: France Emerging Memory and Storage Technology Market (by Application), $Billion, 2024-2034

- Table 21: France Emerging Memory and Storage Technology Market (by Product), $Billion, 2024-2034

- Table 22: Italy Emerging Memory and Storage Technology Market (by Application), $Billion, 2024-2034

- Table 23: Italy Emerging Memory and Storage Technology Market (by Product), $Billion, 2024-2034

- Table 24: Spain Emerging Memory and Storage Technology Market (by Application), $Billion, 2024-2034

- Table 25: Spain Emerging Memory and Storage Technology Market (by Product), $Billion, 2024-2034

- Table 26: U.K. Emerging Memory and Storage Technology Market (by Application), $Billion, 2024-2034

- Table 27: U.K. Emerging Memory and Storage Technology Market (by Product), $Billion, 2024-2034

- Table 28: Rest-of-Europe Emerging Memory and Storage Technology Market (by Application), $Billion, 2024-2034

- Table 29: Rest-of-Europe Emerging Memory and Storage Technology Market (by Product), $Billion, 2024-2034

- Table 30: Asia-Pacific Emerging Memory and Storage Technology Market (by Application), $Billion, 2024-2034

- Table 31: Asia-Pacific Emerging Memory and Storage Technology Market (by Product), $Billion, 2024-2034

- Table 32: China Emerging Memory and Storage Technology Market (by Application), $Billion, 2024-2034

- Table 33: China Emerging Memory and Storage Technology Market (by Product), $Billion, 2024-2034

- Table 34: Japan Emerging Memory and Storage Technology Market (by Application), $Billion, 2024-2034

- Table 35: Japan Emerging Memory and Storage Technology Market (by Product), $Billion, 2024-2034

- Table 36: India Emerging Memory and Storage Technology Market (by Application), $Billion, 2024-2034

- Table 37: India Emerging Memory and Storage Technology Market (by Product), $Billion, 2024-2034

- Table 38: South Korea Emerging Memory and Storage Technology Market (by Application), $Billion, 2024-2034

- Table 39: South Korea Emerging Memory and Storage Technology Market (by Product), $Billion, 2024-2034

- Table 40: Rest-of-Asia-Pacific Emerging Memory and Storage Technology Market (by Application), $Billion, 2024-2034

- Table 41: Rest-of-Asia-Pacific Emerging Memory and Storage Technology Market (by Product), $Billion, 2024-2034

- Table 42: Rest-of-the-World Emerging Memory and Storage Technology Market (by Application), $Billion, 2024-2034

- Table 43: Rest-of-the-World Emerging Memory and Storage Technology Market (by Product), $Billion, 2024-2034

- Table 44: South America Emerging Memory and Storage Technology Market (by Application), $Billion, 2024-2034

- Table 45: South America Emerging Memory and Storage Technology Market (by Product), $Billion, 2024-2034

- Table 46: Middle East and Africa Emerging Memory and Storage Technology Market (by Application), $Billion, 2024-2034

- Table 47: Middle East and Africa Emerging Memory and Storage Technology Market (by Product), $Billion, 2024-2034

- Table 48: Market Share

Global Emerging Memory and Storage Technology Market: Industry Overview

The global emerging memory and storage technology industry is undergoing a transformative shift as leading semiconductor foundries, material suppliers, and system integrators converge to commercialize non-volatile solutions that overcome the latency, endurance, and energy inefficiencies of DRAM and NAND flash. Over the past two years, Phase Change Memory, Resistive RAM, and Spin-Transfer Torque MRAM have progressed from lab demonstrations to pilot-line incorporation at sub-22 nm process nodes, leveraging 3D stacking and advanced patterning techniques to achieve competitive densities and sub-100 ns access times. Key consortia-anchored by TSMC, Samsung Foundry, Micron, Intel, and specialist IP providers-are co-developing optimized deposition equipment and process flows for chalcogenide, metal-oxide, and magnetic tunnel junction materials, accelerating yield maturation. With R&D investments exceeding USD 5 billion annually and early revenue shipments for discrete and embedded modules in hyperscale data centers, enterprise storage arrays, and automotive control units, the industry is at an inflection point between experimental validation and full commercial rollout.

Emerging Memory and Storage Technology Market Lifecycle Stage

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2025 - 2034 |

| 2025 Evaluation | $7.25 Billion |

| 2034 Forecast | $18.34 Billion |

| CAGR | 10.86% |

The market today resides in the early growth phase of its lifecycle. After a multi-year introduction period defined by university and national-lab research, key memory technologies have crossed the threshold into initial production, with first-generation PCM and MRAM modules now qualified in select high-performance and edge computing applications. Adoption remains concentrated among early adopters-hyperscale cloud operators, AI accelerator OEMs, and defense contractors-but recent design wins in automotive and industrial IoT signal a widening addressable base. As manufacturing scales, defect rates fall, and interface standards solidify over the next two to three years, the emerging memory market is poised to transition into the growth phase, where per-bit cost efficiencies and broader system integration will drive mainstream uptake.

Emerging Memory and Storage Technology Market Segmentation:

Segmentation 1: by Application

- Consumer Electronics

- Enterprise Storage

- Automotive and Transportation

- Military and Aerospace

- Industrial

- Telecommunications

- Energy and Power

- Healthcare

- Others

Consumer electronics is one of the prominent application segments in the global emerging memory and storage technology market.

Segmentation 2: by Technology

- Non Volatile Memory

- Resistive RAM (RRAM)

- Phase-Change Memory (PCM)

- Magnetoresistive RAM (MRAM)

- 3D XPoint

- Nano RAM (NRAM)

- Others

- Volatile Memory

- Hybrid Memory Cube (HMC)

- High Bandwidth Memory (HBM)

The global emerging memory and storage technology market is estimated to be led by the non volatile memory segment in terms of technology.

Segmentation 3: by Region

- North America - U.S., Canada, and Mexico

- Europe - Germany, France, Italy, Spain, U.K., and Rest-of-Europe

- Asia-Pacific - China, Japan, South Korea, India, and Rest-of-Asia-Pacific

- Rest-of-the-World - South America and Middle East and Africa

In the emerging memory and storage technology market, Asia-Pacific is anticipated to gain traction in terms of production, with increasing infrastructure demand and govement initiatives.

Demand - Drivers and Limitations

The following are the demand drivers for the global emerging memory and storage technology market:

- Increasing Demand For Memory Devices That Provide Fast Access and Consume Minimal Power

- Explosion of AI/ML and High-Performance Computing Workloads

The global emerging memory and storage technology market is expected to face some limitations as well due to the following challenges:

- High Manufacturing Cost of Next-Generation Memories

- Integration Complexity with Legacy Architectures

Emerging Memory and Storage Technology Market Key Players and Competition Synopsis

The competitive landscape of the emerging memory and storage technology market is anchored by established semiconductor giants-Micron Technology, Samsung Electronics, Intel, SK Hynix, and Western Digital-each leveraging extensive IP portfolios, proprietary process nodes, and integrated supply chains to advance Phase Change Memory (PCM), Resistive RAM (ReRAM), and Spin-Transfer Torque MRAM (STT-MRAM) offerings. Micron is rapidly maturing its PCM pilot lines toward commercial qualification, while Intel continues to refine its embedded ReRAM solutions in collaboration with leading foundries. Samsung has already deployed STT-MRAM in mobile and enterprise platforms since 2023, complemented by Everspin's niche, discrete MRAM modules for high-reliability applications. Simultaneously, agile innovators such as Crossbar and Applied Materials are pushing novel materials and deposition techniques, compelling incumbents to accelerate yield improvements and cost reductions. Strategic partnerships for 3D stacking, cross-licensing agreements, and targeted acquisitions further intensify competition, shaping a market where technological differentiation and ecosystem alliances will determine the next wave of leadership.

Some prominent names established in the emerging memory and storage technology market are:

- SAMSUNG

- CrossBar Inc

- 4DS Memory

- RAMXEED

- GlobalFoundries

- TSMC

- IDTechEx

- Micron

- SK Hynix

- Weebit Nano

Companies that are not a part of the previously mentioned pool have been well represented across different sections of the report (wherever applicable).

Table of Contents

Executive Summary

Scope and Definition

Market/Product Definition

Key Questions Answered

Analysis and Forecast Note

1. Markets: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.2 Stakeholder Analysis

- 1.2.1 Use Case

- 1.2.2 End User and Buying Criteria

- 1.3 Market Dynamics Overview

- 1.3.1 Market Drivers

- 1.3.2 Market Restraints

- 1.3.3 Market Opportunities

- 1.4 Regulatory & Policy Impact Analysis

- 1.5 Patent Analysis

- 1.6 Start-Up Landscape

- 1.7 Investment Landscape and R&D Trends

- 1.8 Future Outlook and Market Roadmap

- 1.9 Value Chain Analysis

- 1.10 Global Pricing Analysis

- 1.11 Industry Attractiveness

2. Emerging Memory and Storage Technology Market (by Application)

- 2.1 Application Segmentation

- 2.2 Application Summary

- 2.3 Emerging Memory and Storage Technology Market (by Application)

- 2.3.1 Consumer Electronics

- 2.3.2 Enterprise Storage

- 2.3.3 Automotive and Transportation

- 2.3.4 Military and Aerospace

- 2.3.5 Industrial

- 2.3.6 Telecommunications

- 2.3.7 Energy and Power

- 2.3.8 Healthcare

- 2.3.9 Others

3. Emerging Memory and Storage Technology Market (by Product)

- 3.1 Product Segmentation

- 3.2 Product Summary

- 3.3 Emerging Memory and Storage Technology Market (by Technology)

- 3.3.1 Non Volatile Memory

- 3.3.1.1 Resistive RAM (RRAM)

- 3.3.1.2 Phase-Change Memory (PCM)

- 3.3.1.3 Magnetoresistive RAM (MRAM)

- 3.3.1.4 Ferroelectric RAM (FeRAM)

- 3.3.1.5 3D XPOINT

- 3.3.1.6 Nano RAM (NRAM)

- 3.3.1.7 Others

- 3.3.2 Volatile Memory

- 3.3.2.1 Hyrid Memory Cube (HMC)

- 3.3.2.2 High Bandwidth Memory (HBM)

- 3.3.1 Non Volatile Memory

- 3.4 Emerging Memory and Storage Technology Market (by Wafer Size)

- 3.4.1 200mm

- 3.4.2 300mm

4. Emerging Memory and Storage Technology Market (by Region)

- 4.1 Emerging Memory and Storage Technology Market (by Region)

- 4.2 North America

- 4.2.1 Regional Overview

- 4.2.2 Driving Factors for Market Growth

- 4.2.3 Factors Challenging the Market

- 4.2.4 Application

- 4.2.5 Product

- 4.2.6 North America (by Country)

- 4.2.6.1 U.S.

- 4.2.6.1.1 Market by Application

- 4.2.6.1.2 Market by Product

- 4.2.6.2 Canada

- 4.2.6.2.1 Market by Application

- 4.2.6.2.2 Market by Product

- 4.2.6.3 Mexico

- 4.2.6.3.1 Market by Application

- 4.2.6.3.2 Market by Product

- 4.2.6.1 U.S.

- 4.3 Europe

- 4.3.1 Regional Overview

- 4.3.2 Driving Factors for Market Growth

- 4.3.3 Factors Challenging the Market

- 4.3.4 Application

- 4.3.5 Product

- 4.3.6 Europe (by Country)

- 4.3.6.1 Germany

- 4.3.6.1.1 Market by Application

- 4.3.6.1.2 Market by Product

- 4.3.6.2 France

- 4.3.6.2.1 Market by Application

- 4.3.6.2.2 Market by Product

- 4.3.6.3 Italy

- 4.3.6.3.1 Market by Application

- 4.3.6.3.2 Market by Product

- 4.3.6.4 Spain

- 4.3.6.4.1 Market by Application

- 4.3.6.4.2 Market by Product

- 4.3.6.5 U.K.

- 4.3.6.5.1 Market by Application

- 4.3.6.5.2 Market by Product

- 4.3.6.6 Rest-of-Europe

- 4.3.6.6.1 Market by Application

- 4.3.6.6.2 Market by Product

- 4.3.6.1 Germany

- 4.4 Asia-Pacific

- 4.4.1 Regional Overview

- 4.4.2 Driving Factors for Market Growth

- 4.4.3 Factors Challenging the Market

- 4.4.4 Application

- 4.4.5 Product

- 4.4.6 Asia-Pacific (by Country)

- 4.4.6.1 China

- 4.4.6.1.1 Market by Application

- 4.4.6.1.2 Market by Product

- 4.4.6.2 Japan

- 4.4.6.2.1 Market by Application

- 4.4.6.2.2 Market by Product

- 4.4.6.3 India

- 4.4.6.3.1 Market by Application

- 4.4.6.3.2 Market by Product

- 4.4.6.4 South Korea

- 4.4.6.4.1 Market by Application

- 4.4.6.4.2 Market by Product

- 4.4.6.5 Rest-of-Asia-Pacific

- 4.4.6.5.1 Market by Application

- 4.4.6.5.2 Market by Product

- 4.4.6.1 China

- 4.5 Rest-of-the-World

- 4.5.1 Regional Overview

- 4.5.2 Driving Factors for Market Growth

- 4.5.3 Factors Challenging the Market

- 4.5.4 Application

- 4.5.5 Product

- 4.5.6 Rest-of-the-World (by Region)

- 4.5.6.1 South America

- 4.5.6.1.1 Market by Application

- 4.5.6.1.2 Market by Product

- 4.5.6.2 Middle East and Africa

- 4.5.6.2.1 Market by Application

- 4.5.6.2.2 Market by Product

- 4.5.6.1 South America

5. Markets - Competitive Benchmarking & Company Profiles

- 5.1 Next Frontiers

- 5.2 Geographic Assessment

- 5.3 Company Profiles

- 5.3.1 SAMSUNG

- 5.3.1.1 Overview

- 5.3.1.2 Top Products/Product Portfolio

- 5.3.1.3 Top Competitors

- 5.3.1.4 Target Customers

- 5.3.1.5 Key Personnel

- 5.3.1.6 Analyst View

- 5.3.1.7 Market Share

- 5.3.2 CrossBar Inc

- 5.3.2.1 Overview

- 5.3.2.2 Top Products/Product Portfolio

- 5.3.2.3 Top Competitors

- 5.3.2.4 Target Customers

- 5.3.2.5 Key Personnel

- 5.3.2.6 Analyst View

- 5.3.2.7 Market Share

- 5.3.3 4DS Memory

- 5.3.3.1 Overview

- 5.3.3.2 Top Products/Product Portfolio

- 5.3.3.3 Top Competitors

- 5.3.3.4 Target Customers

- 5.3.3.5 Key Personnel

- 5.3.3.6 Analyst View

- 5.3.3.7 Market Share

- 5.3.4 RAMXEED

- 5.3.4.1 Overview

- 5.3.4.2 Top Products/Product Portfolio

- 5.3.4.3 Top Competitors

- 5.3.4.4 Target Customers

- 5.3.4.5 Key Personnel

- 5.3.4.6 Analyst View

- 5.3.4.7 Market Share

- 5.3.5 GlobalFoundries

- 5.3.5.1 Overview

- 5.3.5.2 Top Products/Product Portfolio

- 5.3.5.3 Top Competitors

- 5.3.5.4 Target Customers

- 5.3.5.5 Key Personnel

- 5.3.5.6 Analyst View

- 5.3.5.7 Market Share

- 5.3.6 TSMC

- 5.3.6.1 Overview

- 5.3.6.2 Top Products/Product Portfolio

- 5.3.6.3 Top Competitors

- 5.3.6.4 Target Customers

- 5.3.6.5 Key Personnel

- 5.3.6.6 Analyst View

- 5.3.6.7 Market Share

- 5.3.7 IDTechEx

- 5.3.7.1 Overview

- 5.3.7.2 Top Products/Product Portfolio

- 5.3.7.3 Top Competitors

- 5.3.7.4 Target Customers

- 5.3.7.5 Key Personnel

- 5.3.7.6 Analyst View

- 5.3.7.7 Market Share

- 5.3.8 Micron

- 5.3.8.1 Overview

- 5.3.8.2 Top Products/Product Portfolio

- 5.3.8.3 Top Competitors

- 5.3.8.4 Target Customers

- 5.3.8.5 Key Personnel

- 5.3.8.6 Analyst View

- 5.3.8.7 Market Share

- 5.3.9 SK Hynix

- 5.3.9.1 Overview

- 5.3.9.2 Top Products/Product Portfolio

- 5.3.9.3 Top Competitors

- 5.3.9.4 Target Customers

- 5.3.9.5 Key Personnel

- 5.3.9.6 Analyst View

- 5.3.9.7 Market Share

- 5.3.10 Weebit Nano

- 5.3.10.1 Overview

- 5.3.10.2 Top Products/Product Portfolio

- 5.3.10.3 Top Competitors

- 5.3.10.4 Target Customers

- 5.3.10.5 Key Personnel

- 5.3.10.6 Analyst View

- 5.3.10.7 Market Share

- 5.3.10.8 Share

- 5.3.1 SAMSUNG

- 5.4 Other Key Companies