|

|

市場調査レポート

商品コード

1726990

アジア太平洋の電気自動車バッテリー試験・検査・認証市場:車両タイプ別、ステージタイプ別、サービスタイプ別、推進力タイプ別、バッテリータイプ別、試験パラメータタイプ別、国別 - 分析と予測(2024年~2034年)Asia-Pacific Electric Vehicle Battery Testing, Inspection, and Certification Market: Focus on Vehicle Type, Stage Type, Service Type, Propulsion Type, Battery Type, Testing Parameter Type, and Country-Level Analysis - Analysis and Forecast, 2024-2034 |

||||||

カスタマイズ可能

|

|||||||

| アジア太平洋の電気自動車バッテリー試験・検査・認証市場:車両タイプ別、ステージタイプ別、サービスタイプ別、推進力タイプ別、バッテリータイプ別、試験パラメータタイプ別、国別 - 分析と予測(2024年~2034年) |

|

出版日: 2025年05月19日

発行: BIS Research

ページ情報: 英文 104 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

アジア太平洋の電気自動車バッテリー試験・検査・認証の市場規模は、2024年の20億3,000万米ドルから2034年には88億9,000万米ドルに達し、予測期間の2024年~2034年のCAGRは15.91%になると予測されています。

アジア太平洋諸国の強力な国内法、電気自動車の急速な普及、試験技術の継続的な進歩は、地域産業拡大の主要な促進要因です。EVバッテリーの安全性、信頼性、コンプライアンスは、徹底した試験、検査、認証サービスによって確認され、熱暴走、容量フェード、性能低下などの懸念も軽減されます。市場の拡大は、アジア太平洋の持続可能性目標と政府のインセンティブによってさらに加速されます。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2024年~2034年 |

| 2024年の評価 | 20億3,000万米ドル |

| 2034年の予測 | 88億9,000万米ドル |

| CAGR | 15.91% |

電気自動車(EV)用バッテリーの試験・検査・認証市場は、EV人気の高まりと安全規制の変化に対応するメーカー、サービスプロバイダー、地域の規制当局の動きによって、アジア太平洋で急成長しています。中国のGB/Tシリーズ、日本のJIS認証、ASEANの新興フレームワークなどの規格の下、市場は中国、日本、韓国、インドの主要な自動車およびバッテリー製造拠点によって支えられています。この市場には、セルレベルの分析、パックレベルの性能試験とライフサイクル試験、環境ストレススクリーニング、包括的な安全虐待プロトコル(熱暴走試験、過充電試験、短絡試験、破砕試験)が含まれます。

厳しい認証期限に間に合わせることを急ぐOEMやティア1サプライヤーのために、ギガファクトリーベースの社内ラボや専門的な受託試験ネットワークが拡張可能なキャパシティを提供する一方、ISO17025認定や各国のラボ認可が試験結果の一貫性と信頼性を保証します。スループット、精度、コスト効率は、高スループットの自動リグ、AI主導の診断、ローカル・デューティ・サイクルに校正されたデジタルツイン・シミュレーション、高度な熱量測定などの技術的進歩によって改善されています。現場据置型試験インフラへの投資は、セカンドライフ用途を支援する循環経済規制、政府のインセンティブ、国内電池生産を支援するグリーン資金プログラムによって推進されています。

大きな進展にもかかわらず、先進機器の高価なコスト、アジア太平洋諸国間で異なる規制環境、高度に熟練した技術者の不足、インフラストラクチャーの制限(電力安定性、冷却水、実験スペース)など、障害は依然として存在します。しかし、アジア太平洋地域の各国政府がバッテリー・サプライチェーンの回復力向上、より厳格な安全規則の施行、積極的なEV目標の設定を目指していることから、同産業は2030年まで2桁成長を続けると予想されます。

動向

- 型式承認プロセスを合理化するための地域規格の調和(中国GB/T、日本JIS、ASEAN)。

- AIを活用した診断、デジタルツインシミュレーション、高スループット自動試験装置の採用。

- より迅速なターンアラウンドのための、オンサイトのギガファクトリーラボラトリーおよび専門家別受託試験ネットワークの拡大。

- 次世代化学物質のための高度熱量測定とリアルタイム熱暴走モニタリングの統合。

促進要因

- 中国、インド、日本、東南アジアにおけるEV販売の爆発的拡大。

- 政府のインセンティブ、グリーン資金制度、国内電池義務化により、現地ラボへの投資が活発化。

- 認証スケジュールのリスクを軽減し、国境を越えた物流コストを削減するためのOEMやティア1サプライヤーの戦略。

- 健全性評価と再利用認証を必要とするセカンドライフバッテリー用途の出現。

課題

- 最先端機器と施設建設のための高額な資本支出。

- 細分化された地域規制と進化する規格が、市場横断的なコンプライアンスを複雑にする。

- バッテリー試験プロトコルを専門とする熟練エンジニアや技術者の数が限られている。

- インフラの制約-主要拠点における電力安定性、冷却水供給、ラボスペースの不足。

当レポートは、アジア太平洋のEVバッテリー試験・検査・認証市場に関する貴重な洞察を提供し、戦略的意思決定と市場予測に必要な知識を企業に提供します。当レポートは、新興技術、規制の変化、競合のダイナミクスを包括的に分析し、企業が成長機会を特定し、進化する業界のニーズに合わせて製品を提供できるよう支援します。さらに、主要な市場参入企業、その戦略、ビジネスモデルを詳細に調査し、競合情勢の中で企業が優位に立つことを可能にします。規制とコンプライアンスに関する洞察もカバーしており、国際的な試験規格、安全規制、持続可能性への取り組みについて詳細な評価を行い、市場への対応を確実なものにしています。さらに、地域別およびセグメント別の分析により、さまざまな市場の成長パターン、課題、機会を明らかにし、的を絞った市場参入・拡大戦略をサポートします。本レポートの調査結果を活用することで、企業はイノベーションを推進し、業務効率を向上させ、進化するEVバッテリー試験および認証情勢において競合優位性を確保することができます。

当レポートでは、アジア太平洋の電気自動車バッテリー試験・検査・認証市場について調査し、市場の概要とともに、車両タイプ別、ステージタイプ別、サービスタイプ別、推進力タイプ別、バッテリータイプ別、試験パラメータタイプ別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場:業界展望

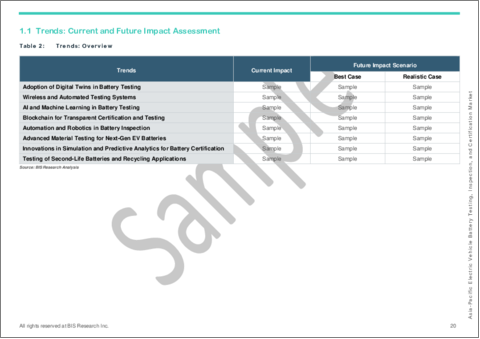

- 動向:現状と将来への影響評価

- バッテリー試験におけるデジタルツインの導入

- ワイヤレスおよび自動テストシステム

- バッテリー試験におけるAIと機械学習

- 透明な認証とテストのためのブロックチェーン

- バッテリー検査における自動化とロボット工学

- 次世代EVバッテリー向け先進材料試験

- バッテリー認証のためのシミュレーションと予測分析におけるイノベーション

- 再利用バッテリーのテストとリサイクルアプリケーション

- サプライチェーンの概要

- 研究開発レビュー

- 規制状況

- サービス概要

- 試験

- 検査

- 認証

- COVID-19による業界への影響

- 市場力学の概要

第2章 地域

- 地域のサマリー

- アジア太平洋

- 地域概要

- 市場成長促進要因

- 市場成長抑制要因

- 中国

- 日本

- 韓国

- インド

- その他

第3章 市場- 競争環境と企業プロファイル

- 今後の見通し

- 地理的評価

- 競合情勢

- 企業プロファイル

- The Hong Kong Standards and Testing Centre Limited

- ATIC (Guangzhou) Co., Ltd.

第4章 調査手法

List of Figures

- Figure 1: Electric Vehicle Battery Testing, Inspection, and Certification Market (by Region), $Million, 2024, 2027, and 2034

- Figure 2: Asia-Pacific Electric Vehicle Battery Testing, Inspection, and Certification Market (by Vehicle Type), $Million, 2024, 2027, and 2034

- Figure 3: Asia-Pacific Electric Vehicle Battery Testing, Inspection, and Certification Market (by Stage), $Million, 2024, 2027, and 2034

- Figure 4: Asia-Pacific Electric Vehicle Battery Testing, Inspection, and Certification Market (by Propulsion Type), $Million, 2024, 2027, and 2034

- Figure 5: Asia-Pacific Electric Vehicle Battery Testing, Inspection, and Certification Market (by Battery Type), $Million, 2024, 2027, and 2034

- Figure 6: Asia-Pacific Electric Vehicle Battery Testing, Inspection, and Certification Market (by Lithium-Ion), $Million, 2024, 2027, and 2034

- Figure 7: Asia-Pacific Electric Vehicle Battery Testing, Inspection, and Certification Market (by Service Type), $Million, 2024, 2027, and 2034

- Figure 8: Asia-Pacific Electric Vehicle Battery Testing, Inspection, and Certification Market (by Testing Parameter Type), $Million, 2024, 2027, and 2034

- Figure 9: Asia-Pacific Electric Vehicle Battery Testing, Inspection, and Certification Market (by Sourcing Type), $Million, 2024, 2027, and 2034

- Figure 10: Key Events

- Figure 11: Benefits of Digital Twin Technology in EV Battery Testing, Inspection, and Certification

- Figure 12: Key Characteristics of Wireless/Automated Battery Test Systems

- Figure 13: Edge vs. Deep Learning in EV Battery Testing

- Figure 14: Blockchain Requirements for EV Battery Testing and Swapping Transparency

- Figure 15: Automation and Robotics Use Cases in EV Battery Inspection

- Figure 16: Few Advanced Materials Enhancing EV Battery Performance and Sustainability

- Figure 17: Key Advantages of Simulation and Predictive Analytics in EV Battery Testing and Certification

- Figure 18: EV Battery Lifecycle: Testing and Applications for Second Life and Recycling

- Figure 19: Supply Chain Overview

- Figure 20: End-Use Industries Overview

- Figure 21: Value Chain Overview

- Figure 22: Cost for Electric Vehicle Battery Testing, Inspection, and Certification, $/Unit Vehicle, 2023-2034

- Figure 23: Patent Filed (by Country), January 2021-October 2024

- Figure 24: Patent Filed (by Company), January 2021-October 2024

- Figure 25: Impact Analysis of Electric Vehicle Battery Testing, Inspection, and Certification Market Navigating Factors, 2024-2034

- Figure 26: Electric Car Sales, Million Units, 2022-2024

- Figure 27: China Electric Vehicle Battery Testing, Inspection, and Certification Market, $Million, 2023-2034

- Figure 28: Japan Electric Vehicle Battery Testing, Inspection, and Certification Market, $Million, 2023-2034

- Figure 29: South Korea Electric Vehicle Battery Testing, Inspection, and Certification Market, $Million, 2023-2034

- Figure 30: India Electric Vehicle Battery Testing, Inspection, and Certification Market, $Million, 2023-2034

- Figure 31: Rest-of-Asia-Pacific Electric Vehicle Battery Testing, Inspection, and Certification Market, $Million, 2023-2034

- Figure 32: Strategic Initiatives, January 2020-September 2024

- Figure 33: Share of Strategic Initiatives, January 2020-September 2024

- Figure 34: Data Triangulation

- Figure 35: Top-Down and Bottom-Up Approach

- Figure 36: Assumptions and Limitations

List of Tables

- Table 1: Opportunities Across Regions

- Table 2: Trends: Overview

- Table 3: Regulatory Landscape

- Table 4: Electric Vehicle Battery Testing, Inspection, and Certification Market (by Region), $Million, 2023-2034

- Table 5: Asia-Pacific Electric Vehicle Battery Testing, Inspection, and Certification Market (by Vehicle Type), $Million, 2023-2034

- Table 6: Asia-Pacific Electric Vehicle Battery Testing, Inspection, and Certification Market (by Stage), $Million, 2023-2034

- Table 7: Asia-Pacific Electric Vehicle Battery Testing, Inspection, and Certification Market (by Propulsion Type), $Million, 2023-2034

- Table 8: Asia-Pacific Electric Vehicle Battery Testing, Inspection, and Certification Market (by Battery Type), $Million, 2023-2034

- Table 9: Asia-Pacific Electric Vehicle Battery Testing, Inspection, and Certification Market (by Service Type), $Million, 2023-2034

- Table 10: Asia-Pacific Electric Vehicle Battery Testing, Inspection, and Certification Market (by Testing Parameter Type), $Million, 2023-2034

- Table 11: Asia-Pacific Electric Vehicle Battery Testing, Inspection, and Certification Market (by Sourcing Type), $Million, 2023-2034

- Table 12: China Electric Vehicle Battery Testing, Inspection, and Certification Market (by Vehicle Type), $Million, 2023-2034

- Table 13: China Electric Vehicle Battery Testing, Inspection, and Certification Market (by Stage), $Million, 2023-2034

- Table 14: China Electric Vehicle Battery Testing, Inspection, and Certification Market (by Propulsion Type), $Million, 2023-2034

- Table 15: China Electric Vehicle Battery Testing, Inspection, and Certification Market (by Battery Type), $Million, 2023-2034

- Table 16: China Electric Vehicle Battery Testing, Inspection, and Certification Market (by Service Type), $Million, 2023-2034

- Table 17: China Electric Vehicle Battery Testing, Inspection, and Certification Market (by Testing Parameter Type), $Million, 2023-2034

- Table 18: China Electric Vehicle Battery Testing, Inspection, and Certification Market (by Sourcing Type), $Million, 2023-2034

- Table 19: Japan Electric Vehicle Battery Testing, Inspection, and Certification Market (by Vehicle Type), $Million, 2023-2034

- Table 20: Japan Electric Vehicle Battery Testing, Inspection, and Certification Market (by Stage), $Million, 2023-2034

- Table 21: Japan Electric Vehicle Battery Testing, Inspection, and Certification Market (by Propulsion Type), $Million, 2023-2034

- Table 22: Japan Electric Vehicle Battery Testing, Inspection, and Certification Market (by Battery Type), $Million, 2023-2034

- Table 23: Japan Electric Vehicle Battery Testing, Inspection, and Certification Market (by Service Type), $Million, 2023-2034

- Table 24: Japan Electric Vehicle Battery Testing, Inspection, and Certification Market (by Testing Parameter Type), $Million, 2023-2034

- Table 25: Japan Electric Vehicle Battery Testing, Inspection, and Certification Market (by Sourcing Type), $Million, 2023-2034

- Table 26: South Korea Electric Vehicle Battery Testing, Inspection, and Certification Market (by Vehicle Type), $Million, 2023-2034

- Table 27: South Korea Electric Vehicle Battery Testing, Inspection, and Certification Market (by Stage), $Million, 2023-2034

- Table 28: South Korea Electric Vehicle Battery Testing, Inspection, and Certification Market (by Propulsion Type), $Million, 2023-2034

- Table 29: South Korea Electric Vehicle Battery Testing, Inspection, and Certification Market (by Battery Type), $Million, 2023-2034

- Table 30: South Korea Electric Vehicle Battery Testing, Inspection, and Certification Market (by Service Type), $Million, 2023-2034

- Table 31: South Korea Electric Vehicle Battery Testing, Inspection, and Certification Market (by Testing Parameter Type), $Million, 2023-2034

- Table 32: South Korea Electric Vehicle Battery Testing, Inspection, and Certification Market (by Sourcing Type), $Million, 2023-2034

- Table 33: India Electric Vehicle Battery Testing, Inspection, and Certification Market (by Vehicle Type), $Million, 2023-2034

- Table 34: India Electric Vehicle Battery Testing, Inspection, and Certification Market (by Stage), $Million, 2023-2034

- Table 35: India Electric Vehicle Battery Testing, Inspection, and Certification Market (by Propulsion Type), $Million, 2023-2034

- Table 36: India Electric Vehicle Battery Testing, Inspection, and Certification Market (by Battery Type), $Million, 2023-2034

- Table 37: India Electric Vehicle Battery Testing, Inspection, and Certification Market (by Service Type), $Million, 2023-2034

- Table 38: India Electric Vehicle Battery Testing, Inspection, and Certification Market (by Testing Parameter Type), $Million, 2023-2034

- Table 39: India Electric Vehicle Battery Testing, Inspection, and Certification Market (by Sourcing Type), $Million, 2023-2034

- Table 40: Rest-of-Asia-Pacific Electric Vehicle Battery Testing, Inspection, and Certification Market (by Vehicle Type), $Million, 2023-2034

- Table 41: Rest-of-Asia-Pacific Electric Vehicle Battery Testing, Inspection, and Certification Market (by Stage), $Million, 2023-2034

- Table 42: Rest-of-Asia-Pacific Electric Vehicle Battery Testing, Inspection, and Certification Market (by Propulsion Type), $Million, 2023-2034

- Table 43: Rest-of-Asia-Pacific Electric Vehicle Battery Testing, Inspection, and Certification Market (by Battery Type), $Million, 2023-2034

- Table 44: Rest-of-Asia-Pacific Electric Vehicle Battery Testing, Inspection, and Certification Market (by Service Type), $Million, 2023-2034

- Table 45: Rest-of-Asia-Pacific Electric Vehicle Battery Testing, Inspection, and Certification Market (by Testing Parameter Type), $Million, 2023-2034

- Table 46: Rest-of-Asia-Pacific Electric Vehicle Battery Testing, Inspection, and Certification Market (by Sourcing Type), $Million, 2023-2034

- Table 47: Market Share Range, 2023

Introduction to Asia-Pacific Electric Vehicle Battery Testing, Inspection, and Certification Market

The Asia-Pacific EV battery testing, inspection, and certification market is projected to reach $8.89 billion by 2034 from $2.03 billion in 2024, growing at a CAGR of 15.91% during the forecast period 2024-2034. Strong national laws in APAC countries, the rapid use of electric vehicles, and ongoing advancements in testing technologies are major drivers of regional industry expansion. EV battery safety, dependability, and compliance are confirmed by thorough testing, inspection, and certification services, which also reduce concerns like thermal runaway, capacity fade, and performance loss. Market expansion is further accelerated by APAC's sustainability goals and government incentives.

Market Introduction

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2024 - 2034 |

| 2024 Evaluation | $2.03 Billion |

| 2034 Forecast | $8.89 Billion |

| CAGR | 15.91% |

The market for electric vehicle (EV) battery testing, inspection, and certification is growing quickly in Asia-Pacific as manufacturers, service providers, and regional regulators react to the growing popularity of EVs and changing safety regulations. Under standards like China's GB/T series, Japan's JIS certifications, and emerging ASEAN frameworks, the market is anchored by major automotive and battery manufacturing hubs in China, Japan, South Korea, and India. It includes cell-level analyses, pack-level performance and lifecycle testing, environmental stress screening, and comprehensive safety-abuse protocols-thermal-runaway, overcharge, short-circuit, and crush tests.

For OEMs and Tier 1 suppliers rushing to meet strict certification deadlines, gigafactory-based in-house laboratories and specialised contract-testing networks offer scalable capacity, while ISO 17025 accreditation and national laboratory authorisations guarantee consistency and credibility in test results. Throughput, accuracy, and cost efficiency have been improved by technological advancements such as high-throughput automated rigs, AI-driven diagnostics, digital-twin simulations calibrated to local duty cycles, and sophisticated calorimetry. Investments in on-site stationary testing infrastructure are being driven by circular economy regulations that support second-life applications, government incentives, and green funding programs that support domestic battery production.

Despite significant progress, obstacles still exist, including the expensive cost of advanced equipment, the disparate regulatory environments across APAC nations, the scarcity of highly skilled technical personnel, and infrastructure limitations (power stability, cooling water, and lab space). However, the industry is expected to continue growing at double-digit rates through 2030 as governments in the Asia-Pacific region aim to improve battery supply chain resilience, enforce stricter safety rules, and set aggressive EV targets.

Market Segmentation

Segmentation 1: By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

Segmentation 2: By Stage Type

- Pre-Production Testing

- Post-Production Testing

Segmentation 3: By Battery Type

- Lithium-Ion

- Lead Acid

- Others

Segmentation 4: By Service Type

- Testing

- Inspection

- Certification

Segmentation 5: By Sourcing Type

- In-House

- Outsourced

Segmentation 6: By Propulsion Type

- Battery Electric Vehicles (BEVs)

- Plug-In Hybrid Electric Vehicles (PHEVs)

- Hybrid Electric Vehicles (HEVs)

Segmentation 7: By Testing Parameter Type

- Electrical Testing

- Mechanical Testing

- Thermal Testing

- Electromagnetic Compatibility (EMC) Testing

- Chemical Testing

- Others

Segmentation 8: By Region

- Asia-Pacific: China, Japan, India, South Korea, and Rest-of-Asia-Pacific

APAC Electric Vehicle Battery Testing, Inspection, and Certification Market Trends, Drivers and Challenges

Trends

- Harmonization of regional standards (China GB/T, Japan JIS, ASEAN) to streamline type-approval processes.

- Adoption of AI-enhanced diagnostics, digital-twin simulations and high-throughput automated testing rigs.

- Expansion of on-site gigafactory laboratories and specialist contract-testing networks for faster turnaround.

- Integration of advanced calorimetry and real-time thermal-runaway monitoring for next-gen chemistries.

Drivers

- Explosive growth in EV sales across China, India, Japan and Southeast Asia driving testing demand.

- Government incentives, green-funding schemes and domestic battery mandates bolstering local lab investments.

- OEM and Tier 1 supplier strategies to de-risk certification timelines and reduce cross-border logistics costs.

- Emergence of second-life battery applications requiring state-of-health assessments and repurposing certifications.

Challenges

- High capital expenditure for cutting-edge equipment and facility build-outs.

- Fragmented regional regulations and evolving standards complicating cross-market compliance.

- Limited pool of skilled engineers and technicians specialized in battery testing protocols.

- Infrastructure constraints-power stability, cooling water supply and lab space shortages in key hubs.

How can this report add value to an organization?

This report provides invaluable insights into the APAC EV battery testing, inspection, and certification market, equipping organizations with the knowledge needed for strategic decision-making and market forecasting. It comprehensively analyzes emerging technologies, regulatory shifts, and competitive dynamics, helping businesses identify growth opportunities and align their offerings with evolving industry needs. Additionally, the report provides an in-depth examination of key market players, their strategies, and business models, enabling organizations to stay ahead in a competitive landscape. Regulatory and compliance insights are also covered, offering a detailed assessment of international testing standards, safety regulations, and sustainability initiatives to ensure market readiness. Furthermore, regional and segmentation analyses shed light on growth patterns, challenges, and opportunities across different markets, supporting targeted market entry and expansion strategies. By leveraging the findings of this report, businesses can drive innovation, enhance operational efficiency, and secure a competitive advantage in the evolving EV battery testing and certification landscape.

Table of Contents

Executive Summary

Scope and Definition

1 Market: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.1.1 Adoption of Digital Twins in Battery Testing

- 1.1.2 Wireless and Automated Testing Systems

- 1.1.3 AI and Machine Learning in Battery Testing

- 1.1.4 Blockchain for Transparent Certification and Testing

- 1.1.5 Automation and Robotics in Battery Inspection

- 1.1.6 Advanced Material Testing for Next-Gen EV Batteries

- 1.1.7 Innovations in Simulation and Predictive Analytics for Battery Certification

- 1.1.8 Testing of Second-Life Batteries and Recycling Applications

- 1.2 Supply Chain Overview

- 1.2.1 Key Stakeholders

- 1.2.1.1 Raw Material Testing

- 1.2.1.2 Battery Manufacturing and Integration

- 1.2.1.3 Testing and Certification Service Providers

- 1.2.1.4 End-Use Industries

- 1.2.2 Value Chain Analysis

- 1.2.3 Pricing Forecast

- 1.2.1 Key Stakeholders

- 1.3 Research and Development Review

- 1.3.1 Patent Filing Trend (by Country and Company)

- 1.4 Regulatory Landscape

- 1.5 Services Overview

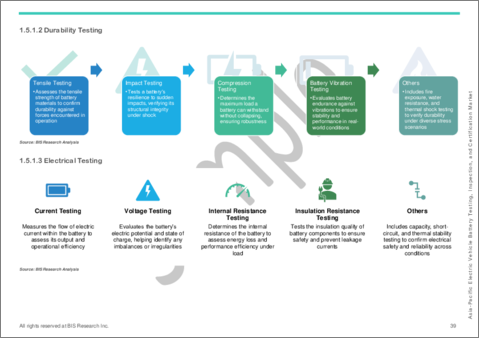

- 1.5.1 Testing

- 1.5.1.1 Performance Testing

- 1.5.1.2 Durability Testing

- 1.5.1.3 Electrical Testing

- 1.5.1.4 Thermal Testing

- 1.5.1.5 Abuse and Crash Testing

- 1.5.1.6 Non-Destructive Testing (NDT)

- 1.5.2 Inspection

- 1.5.2.1 Visual Inspection

- 1.5.2.2 Safety Inspection

- 1.5.2.3 Quality Control Inspection

- 1.5.3 Certification

- 1.5.3.1 Product Certification (ISO, IEC)

- 1.5.3.2 Safety and Compliance Certification

- 1.5.3.3 Environmental Certification (RoHS, WEEE)

- 1.5.3.4 Regulatory Certification

- 1.5.1 Testing

- 1.6 Impact of COVID-19 on the Industry

- 1.7 Market Dynamics Overview

- 1.7.1 Market Drivers

- 1.7.1.1 Rising Electric Car Sales Accelerating Demand for Reliable and Certified Batteries

- 1.7.1.2 Growing Emphasis on Safety Standards for EV Batteries

- 1.7.2 Market Challenges

- 1.7.2.1 High Costs of Advanced EV Battery Testing Equipment and Facilities

- 1.7.2.2 Lack of Standardized Testing and Certification Requirements for EV Batteries across Markets

- 1.7.3 Market Opportunities

- 1.7.3.1 Increasing Development of Next-Generation EV Batteries

- 1.7.3.2 Expanding Market for Second-Life Applications and Recycling of EV Batteries

- 1.7.1 Market Drivers

2 Regions

- 2.1 Regional Summary

- 2.2 Asia-Pacific

- 2.2.1 Regional Overview

- 2.2.2 Driving Factors for Market Growth

- 2.2.3 Factors Challenging the Market

- 2.2.3.1 Application

- 2.2.3.2 Product

- 2.2.4 China

- 2.2.4.1 Application

- 2.2.4.2 Product

- 2.2.5 Japan

- 2.2.5.1 Application

- 2.2.5.2 Product

- 2.2.6 South Korea

- 2.2.6.1 Application

- 2.2.6.2 Product

- 2.2.7 India

- 2.2.7.1 Application

- 2.2.7.2 Product

- 2.2.8 Rest-of-Asia-Pacific

- 2.2.8.1 Application

- 2.2.8.2 Product

3 Markets - Competitive Landscaped and Companies Profiled

- 3.1 Next Frontiers

- 3.2 Geographical Assessment

- 3.3 Competitive Landscape

- 3.4 Company Profiles

- 3.4.1 The Hong Kong Standards and Testing Centre Limited

- 3.4.1.1 Overview

- 3.4.1.2 Top Services/Service Portfolio

- 3.4.1.3 Top Competitors

- 3.4.1.4 Target Customers

- 3.4.1.5 Key Personnel

- 3.4.1.6 Analyst View

- 3.4.1.7 Market Share, 2023

- 3.4.2 ATIC (Guangzhou) Co., Ltd.

- 3.4.2.1 Overview

- 3.4.2.2 Top Services/Service Portfolio

- 3.4.2.3 Top Competitors

- 3.4.2.4 Target Customers

- 3.4.2.5 Key Personnel

- 3.4.2.6 Analyst View

- 3.4.2.7 Market Share, 2023

- 3.4.1 The Hong Kong Standards and Testing Centre Limited

4 Research Methodology

- 4.1 Data Sources

- 4.1.1 Primary Data Sources

- 4.1.2 Secondary Data Sources

- 4.1.3 Data Triangulation

- 4.2 Market Estimation and Forecast