|

|

市場調査レポート

商品コード

1714081

鉱業鉄鋼産業市場 - 世界および地域別分析:エンドユーザー用途別、生産手法別、最終製品別、地域別 - 分析と予測(2025年~2035年)Mining Steel Industry Market - A Global and Regional Analysis: Focus on End-User Application, Production Methodology, End Products, and Region - Analysis and Forecast, 2025-2035 |

||||||

カスタマイズ可能

|

|||||||

| 鉱業鉄鋼産業市場 - 世界および地域別分析:エンドユーザー用途別、生産手法別、最終製品別、地域別 - 分析と予測(2025年~2035年) |

|

出版日: 2025年04月28日

発行: BIS Research

ページ情報: 英文 260 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

世界の鉱業鉄鋼産業の市場規模は、2024年に8,757億米ドルとなりました。

同市場は、4.63%のCAGRで拡大し、2035年には1兆4,503億米ドルに達すると予測されています。この成長は、建設、自動車、インフラなど様々な分野での鉄鋼需要の増加が牽引しています。市場は、電気炉(EAF)や直接還元鉄(DRI)技術の採用、再生可能エネルギーの利用など、より持続可能な慣行への業界のシフトによってさらに強化されています。加えて、鉄鉱石や原料炭など、鉄鋼生産の需要増に対応するための原材料へのニーズの高まりが、採掘事業への投資や鉄鋼製造プロセス内の技術革新を促進しています。より効率的な製鋼プロセスへの移行により、世界の鉱業鉄鋼産業は今後数年間、継続的な拡大が見込まれます。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2025年~2035年 |

| 2025年の評価 | 9,222億米ドル |

| 2035年の予測 | 1兆4,503億米ドル |

| CAGR | 4.63% |

世界の鉱業鉄鋼産業市場は、建設、自動車、エネルギー、インフラなど様々な分野で使用される基礎材料である鉄鋼の生産において重要な役割を果たしています。市場は、鉄鋼製品への需要の高まりと、再生鉄鋼やグリーン鉄鋼を含む持続可能な鉄鋼への関心の高まり、鉄鋼生産の効率化によって牽引されています。電気アーク炉(EAF)、直接還元鉄(DRI)プロセス、再生可能エネルギー源の使用などの技術の進歩は、鉄鋼メーカーの排出量削減と資源効率の向上に役立っています。高性能鉄鋼製品への需要と脱炭素化・循環型経済原則の推進により、世界の鉱業鉄鋼産業市場は継続的な成長と革新が見込まれています。

世界の鉱業鉄鋼産業市場は、様々な産業で鉄鋼製品の需要が増加し続ける中、力強い成長を遂げています。鉄鋼は、その汎用性、強度、製造における重要な役割により、経済開発にとって重要な材料であり続けています。同市場は、生産技術の進歩により、効率を改善し、コストを削減し、鉄鋼の全体的な品質を高めているのが特徴です。市場の主要参入企業は、生産プロセスの近代化、生産能力の拡大、革新的なソリューションの導入に多額の投資を行い、需要の増加に対応しています。世界のインフラ開拓が続く中、新興国市場と先進経済諸国における継続的な産業拡張の両方が原動力となり、鉱業用鋼材産業市場は持続的な成長を遂げるものと思われます。

世界の鉱業鉄鋼産業市場が産業界に与える影響は大きく、建設、自動車、インフラ、エネルギーなど幅広い分野に影響を及ぼしています。必要不可欠な原材料の生産における主要参入企業として、鉱業スチール産業市場は生産技術の進歩とサプライチェーンの効率化を推進してきました。高強度・高品質の鋼材に対する需要の高まりにより、自動化、高度な製錬プロセス、特殊鋼種の開発への投資が増加しています。

世界の鉱業鉄鋼産業に関わる企業には、Umicore、ArcelorMittal、thyssenkrupp AG、新日本製鐵、China Ansteel Group Corporation Limited、China Jianlong Steel Industriai Co Ltd.、Salzgitter AG、Tata Steel、JSW、JFE Steel Corporation、Nucor Corporation、Shandong Lenser materials Co., LTD.、HYUNDAI STEEL、Jindal Steel &Power Limited、SAIL、Cleveland-Cliffs Inc.などの主要企業が含まれます。これらの企業は、戦略的パートナーシップ、協力関係、技術の進歩を通じて能力を強化し、厳しい環境における鉱山用鋼材産業の回復力と性能を向上させています。これらの企業の継続的な研究開発投資は、持続可能な鉱山用鋼業界の幅広い動向をサポートしながら、市場の成長を推進しています。

2025年から2035年にかけて、建築・建設分野が鉱業用鋼材市場の成長を牽引すると予想されます。急速な都市化、インフラ開発、世界人口の増加に伴い、鉄鋼需要は大幅に増加します。その耐久性、柔軟性、強度から、建設における鉄鋼の重要な役割は、住宅、橋梁、高層ビルの主要材料として位置づけられています。さらに、特に新興国での大規模インフラ・プロジェクトに対する政府の投資は、鉄鋼消費を押し上げると思われます。

長期的には、グリーンビルディングや環境に優しいインフラなど、持続可能な建設慣行が重視され、低炭素鋼の需要はさらに高まると思われます。グリーン・スティール」の開発など、鉄鋼生産技術の革新は、こうした環境目標に合致し、低炭素鋼が選ばれるようになると思われます。インフラ整備の世界の推進が続く中、建築・建設は引き続き支配的なセクターであり続け、予測期間を通じて鉱業鉄鋼産業市場の成長を促進します。

高炉-基礎酸素炉(BF-BOF)プロセスは、2025年から2035年までの予測期間中、鉱業鉄鋼産業市場を独占すると予想されます。この伝統的な製鋼方法は、より低い操業コストで大量の鋼を生産できることから、引き続き最も広く使用されています。BF-BOFプロセスは、鉄鉱石、コークス、石灰石を効率的に利用し、特に建設、自動車、インフラ部門向けの高品質鋼を生産することで支持されています。

持続可能性のために電気アーク炉(EAF)へのシフトが進んでいるにもかかわらず、BF-BOFは、その確立されたインフラ、信頼性の高い生産量、規模の経済性により、不可欠な存在であり続けています。新興市場における鉄鋼需要の継続と、BF-BOFプロセスにおける炭素排出量削減を目指した技術進歩により、BF-BOFの市場リーダーシップは維持されるであろう。さらに、炭素回収技術の採用や炉設計の改善により、この方法の環境性能が向上し、鉄鋼生産業界における優位性が確保されると予想されます。

炭素鋼は、その汎用性の高い特性、費用対効果、広範な用途により、2025年~2035年の予測期間中に鉱業鉄鋼産業市場をリードすると予想されます。建設、自動車、インフラ産業のバックボーンとして、炭素鋼は引き続き市場需要を牽引します。その強度、耐久性、可鍛性により、頑丈な構造物、機械、採掘作業で使用される機器に最適です。

さらに、新興国市場を中心とした産業の近代化とインフラ開拓の動向は、炭素鋼の需要を押し上げると思われます。電気アーク炉やリサイクルの革新といった生産方法の技術的進歩は、炭素鋼の生産をより持続可能なものにしており、炭素鋼の優位性に寄与しています。加えて、炭素鋼は様々な鋼種や形状で使用できるため、多様な産業ニーズに対応でき、鉱業セクターにおける継続的な関連性が確保されています。建設と採掘活動への投資が世界的に増加する中、炭素鋼は引き続き好まれる材料として位置づけられ、2025年~2035年の予測期間にわたって市場の主導権を確保します。

アジア太平洋地域は世界の鉱業鉄鋼産業市場を独占しており、2025年から2035年までの予測期間中も支配力を維持すると予想されます。この地域には、Baowu Steel Group、Nippon Steel、JFE Steel、Tata Steel、POSCOを含む複数の鉄鋼メーカーがあります。世界鉄鋼協会によると、アジア太平洋地域は世界の鉄鋼生産量の70%以上を占めています。ArcelorMittal、Tata Steel、China Baowu Steel Group Corporation Limited、POSCO、Nippon Steelなど、様々な鉱山用鉄鋼メーカーがアジア太平洋地域で強い存在感を示しており、競争の激しい鉱業鉄鋼産業市場における市場ポジションを強化するため、生産施設をさらに拡大しています。

世界の鉱業鉄鋼産業市場における最近の動向

- 2025年4月、日本の鉄鋼メーカーであるNIPPON STEEL CORPORATIONは、タイに拠点を置く子会社NS-Siam United Steel Co., Ltd.を通じて、電気めっきライン(EPL)の能力拡張のために約5,840万米ドルを投資すると発表しました。この投資は、コンテナ製造に使用されるブリキ鋼板の需要増に対応することを目的としています。拡張の目的は、EPLライン1号と2号の年間生産能力を28万トンから35万トンに引き上げることです。2027年3月までの完成を予定しています。

- 2025年3月、モロッコ政府はアンモニア、鉄鋼、工業用燃料の生産を目的とした3,276万米ドル相当の複数の大規模グリーンプロジェクトを承認しました。U.A.E.を拠点とするTaqaとスペインを拠点とするCepsaが率いるコンソーシアムは、グリーン・アンモニアと産業用燃料の生産に注力することを目指しており、モロッコのNarevaはグリーン・スチールおよび産業用燃料の生産プロジェクトに投資します。サウジアラビアを拠点とするアクワ・パワー社は、グリーン・スチールの生産に携わる予定です。

- 2025年1月、thyssenkruppはインドの電気鉄鋼事業であるthyssenkrupp Electrical Steel India Private Ltd.の売却を完了しました。この取引は、インド最大の鉄鋼メーカーであるJSW Steel Limitedと日本のJFE Steel Corporationとの合弁事業で成立しました。インドのナーシクに位置するこの工場は、変圧器や高性能発電機に使用される粒状配向電気鋼を生産しています。売却額は約4億7,980万米ドルで、ドイツからインドへの輸送コストが高く、長期的には競争力のない工場となっていました。この売却により、ティッセンクルップの資本基盤は強化され、戦略目標に沿ったものとなっています。

都市化とインフラ成長は鉱業鉄鋼産業市場の主要促進要因であり、鉄鋼需要を大きく牽引します。都市が拡大し、経済が工業化するにつれ、道路、橋、建物、エネルギープラントなどのインフラプロジェクトを支える鋼鉄の必要性が不可欠になります。鉄鋼の強度、耐久性、多用途性は、近代的な都市化とインフラ開発のための選択材料となっています。鉄鋼は、鉄鉱石や石炭など、鉄鋼生産に使用される原材料の需要に直接影響します。この需要の増加は、鉱業と鉄鋼製造の両部門を刺激し、世界中で生産能力を拡大します。

急速な都市化の動向を利用している産業はすでにいくつかあります。インドや中国などの国々では、建設、運輸、エネルギー部門に多額の投資が行われています。中国の「一帯一路(Belt and Road)」構想は、道路、鉄道、港湾の開発を支援するため、大幅な鉄鋼消費を牽引しています。アフリカでは、ナイジェリアや南アフリカのような国々が都市人口の増加に対応するために大規模なインフラ投資を行っており、鉄鋼需要がさらに増加しています。

原材料価格の変動は、鉄鋼メーカーのコスト構造と収益性に直接影響し、鉱業鉄鋼産業に大きな課題をもたらします。鉄鉱石、石炭、鉄スクラップなどの主要原材料価格の変動は、予測不可能な生産コストにつながり、鉄鋼メーカーが安定した利益率を維持することを困難にします。この価格変動は、世界のサプライ・チェーンの混乱、地政学的要因、主要産業からの需要シフトによって大きく左右されるため、一貫した価格設定に依存して生産・投資戦略を立てている生産者にとっては不安定な環境となります。

近年、鉱業鉄鋼業界は、地政学的不確実性と世界経済のシフトに大きく左右され、著しい価格変動に見舞われています。例えば、2021年の鉄鉱石価格は、中国の建設セクターの活況とブラジルからの供給制約の予想に牽引され、過去最高値を記録しました。しかし、2022年には需要が弱まり、世界の鉄鋼生産が減速したため、価格が下落しました。このような価格変動は鉄鋼メーカーに大きなプレッシャーを与え、原材料コストの上昇や下落による財務的影響を管理するために、価格設定や生産戦略を常に適応させることを余儀なくされました。 ArcelorMittalやTata Steelのような企業は、原材料費の上昇を顧客に転嫁するのに苦労し、収益性に影響を及ぼしています。

特殊鋼製品への需要の高まりは、鉱業・鉄鋼業界にとって大きな機会です。自動車、航空宇宙、エネルギーなどの産業が発展するにつれ、高強度、耐久性、過酷な条件への耐性など、特定の特性を持つ高度な鋼材の必要性が高まっています。高合金鋼、工具鋼、ステンレス鋼を含む特殊鋼は、精度と信頼性を必要とする分野で厳しい性能基準を満たす能力があるため、高い需要があります。

この機会を受け、各国は特殊鋼製品の生産に多額の投資を行っています。例えば、インドは2025年1月、約7億3,740万米ドルの予算で特殊鋼の生産連動型奨励金(PLI)制度の第2期を開始しました。改訂されたスキームでは、冷間圧延粒延鋼(CRGO)に対する投資と生産能力の基準値を引き下げ、インセンティブを請求するための余剰生産量の翌年への繰り越しを可能にし、生産能力増強に必要な最低投資額を引き下げるなど、より多くの産業界の参加を呼び込むための変更が導入されています。

製品/イノベーション戦略:世界の鉱業鉄鋼産業市場は、様々な用途、生産手法、最終製品に基づいてセグメント化されており、貴重な洞察を提供しています。最終用途別セグメントには、輸送(自動車およびその他の輸送)、建築・建設・インフラ、消費財・家電、産業機器・製造、包装、その他が含まれます。生産手法別では、高炉-塩基性酸素炉(BF-BOF)、直接還元鉄-電気アーク炉(DRI-EAF)、その他の新興技術に分類されます。最後に、最終製品には炭素鋼、合金鋼、ステンレス鋼、高強度鋼、その他が含まれます。

成長/マーケティング戦略:世界の鉱業鉄鋼産業市場は成長を続けています。同市場は、既存および新興の市場参入企業に莫大な機会を提供しています。このセグメントで取り上げられる戦略には、M&A、製品投入、提携・協力、事業拡大、投資などがあります。企業が市場での地位を維持・強化するために好む戦略には、主に製品開発が含まれます。

競合戦略:本調査で分析・プロファイリングした世界の鉱業用鋼業界の主要企業プロファイルには、鉱業および鉄鋼業界の専門知識を有する専門家が含まれています。さらに、パートナーシップ、協定、協力などの包括的な競合情勢は、市場の未開拓の収益ポケットを理解する上で読者を支援することが期待されます。

当レポートでは、世界の鉱業鉄鋼産業市場について調査し、市場の概要とともに、エンドユーザー用途別、生産手法別、最終製品別、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場

- 動向:現状と将来への影響評価

- サプライチェーンの概要

- 特許出願動向(国別、企業別)

- 市場力学の概要

- 鉄鋼生産シナリオ

- グリーンスチール市場の見通し

第2章 用途

- 用途のセグメンテーション

- 用途のサマリー

- 世界の鉱業鉄鋼産業市場(最終用途)

- 運輸(自動車およびその他の運輸)

- 建築、建設、インフラ

- 産業機器および製造

- 消費財および家電製品

- 包装

- その他

第3章 製品

- 製品のセグメンテーション

- 製品のサマリー

- 世界の鉱業鉄鋼産業市場(生産手法)

- 世界の鉱業鉄鋼産業市場(最終製品別)

第4章 地域

- 地域のサマリー

- 北米

- 欧州

- アジア太平洋

- その他の地域

第5章 市場-競合ベンチマーキングと企業プロファイル

- 今後の見通し

- 地理的評価

- 企業プロファイル

- ArcelorMittal

- thyssenkrupp AG

- NIPPON STEEL CORPORATION

- China Ansteel Group Corporation Limited

- China Jianlong Steel Industriai Co Ltd.

- Salzgitter AG

- Tata Steel

- JSW

- JFE Steel Corporation

- Nucor Corporation

- Shandong Lenser materials Co.,LTD.

- HYUNDAI STEEL

- Jindal Steel & Power Limited

- SAIL

- Cleveland-Cliffs Inc.

第6章 調査手法

List of Figures

- Figure 1: Mining Steel Industry Market (by Scenario), $Billion, 2025, 2028, and 2035

- Figure 2: Global Mining-Steel Industry Market (by Region), $Billion, 2024, 2028, and 2035

- Figure 3: Global Mining Steel Industry Market (by End-Use Application), $Billion, 2024, 2028, and 2035

- Figure 4: Global Mining Steel Industry Market (by Production Methodology), $Billion, 2024, 2028, and 2035

- Figure 5: Global Mining Steel Industry Market (by End Products), $Billion, 2024, 2028, and 2035

- Figure 6: Key Events

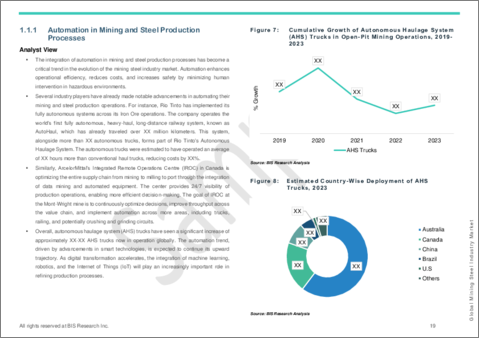

- Figure 7: Cumulative Growth of Autonomous Haulage System (AHS) Trucks in Open-Pit Mining Operations, 2019-2023

- Figure 8: Estimated Country-Wise Deployment of AHS Trucks, 2023

- Figure 9: Apparent Steel Consumption in Some of the Emerging Markets, Million Tons, 2020-2023

- Figure 10: Supply Chain

- Figure 11: Value Chain

- Figure 12: Key Iron Ore Producing Countries and their Mining Capacity, Million Tons, 2023

- Figure 13: Key Coking Coal Exporting Nations, % Share, 2023

- Figure 14: Pricing Analysis of the Global Mining Steel Industry Market, $/Ton, 2024-2035

- Figure 15: Stakeholder Mapping across Value Chain

- Figure 16: Patent Analysis (by Country), January 2022-March 2025

- Figure 17: Patent Analysis (by Company), January 2022-March 2025

- Figure 18: Global Population Living in Urban and Rural Areas, $Billion, 2019-2023

- Figure 19: Regional Private Participation in Infrastructure, $Billion, 2022 and 2023

- Figure 20: Additional Financing Included in the Bipartisan Infrastructure Law, $Billion

- Figure 21: Estimated Capital Expenditures for Top Six Large Steel Companies, $Billion

- Figure 22: Production Capacity Outlook of Global Mining Steel Industry Market, Million Tons, 2024-2034

- Figure 23: Stakeholder Analysis in the Global Mining Steel Industry Market

- Figure 24: Estimated Installed Capacity by Blast Furnace-BOF Process in Different Regions, Million Tons, 2021-2024

- Figure 25: Estimated Installed Capacity by DRI-EAF Process in Different Regions, Million Tons, 2021-2024

- Figure 26: Estimated Steel Capacity (TTPA) by Development Status in Each Region, Million Tons, 2025

- Figure 27: Steel Production Output

- Figure 28: Green Steel Market (by Scenario), $Billion, 2023, 2026, and 2034

- Figure 29: Conventional Steel Overview

- Figure 30: Production Process Overview

- Figure 31: Companies Across the Green Steel Value Chain

- Figure 32: World Crude Steel Production by Basic Oxygen Furnace Process, Million Tons, 2019-2022

- Figure 33: World Crude Steel Production by Electric Arc Furnace (EAF) Process, Million Tons, 2019-2022

- Figure 34: Major Steel Producers in North America: Headquarters and 2023 Steel Production

- Figure 35: Estimated Crude Steel Production Capacity and Actual Crude Steel Production in North America, Million Tons, 2021-2024

- Figure 36: U.S. Mining-Steel Industry Market, $Billion, 2024-2035

- Figure 37: Total Crude Steel Production, U.S., Thousand Tons, 2021-2024

- Figure 38: Installed Capacity and Production by BF-BAF Process, Million Tons, 2021-2024

- Figure 39: Installed Capacity and Production by DRI-EAF Process, Million Tons, 2021-2024

- Figure 40: U.S. Iron and Steel Scrap Production and Consumption, Million Metric Tons, 2019-2023

- Figure 41: Breakdown of U.S. Steel's Annual Recycling and Co-Product Use

- Figure 42: Nucor Corporation's Flexible Raw Materials Mix

- Figure 43: Raw Materials Import Countries/Location

- Figure 44: Canada Mining-Steel Industry Market, $Billion, 2024-2035

- Figure 45: Total Crude Steel Production, Canada, Thousand Tons, 2021-2024

- Figure 46: Installed Capacity and Production by BF-BAF Process, Million Tons, 2021-2024

- Figure 47: Installed Capacity and Production by DRI-EAF Process, Million Tons, 2021-2024

- Figure 48: Canada Steel Scrap Exports, Million Tons, 2019-2021

- Figure 49: Share of Canada Steel Scrap Export and Import, 2021

- Figure 50: Mine Production (Shipments) of Iron Ore, by Province and Territory in Canada, 2023

- Figure 51: Raw Materials Import Countries/Location

- Figure 52: Mexico Mining-Steel Industry Market, $Billion, 2024-2035

- Figure 53: Total Crude Steel Production, Mexico, Thousand Tons, 2021-2024

- Figure 54: Installed Capacity and Production by BF-BAF Process, Million Tons, 2021-2024

- Figure 55: Installed Capacity and Production by DRI-EAF Process, Million Tons, 2021-2024

- Figure 56: Steel Scrap Exported to U.S., Million Tons, 2020-2021

- Figure 57: Raw Materials Import Countries/Location

- Figure 58: Major Steel Producers in Europe: Headquarters and 2023 Steel Production

- Figure 59: Estimated Crude Steel Production Capacity and Actual Crude Steel Production in Europe, Million Tons, 2021-2024

- Figure 60: Germany Mining-Steel Industry Market, $Billion, 2024-2035

- Figure 61: Total Crude Steel Production, Germany, Thousand Tons, 2021-2024

- Figure 62: Installed Capacity and Production by BF-BAF Process, Million Tons, 2021-2024

- Figure 63: Installed Capacity and Production by DRI-EAF Process, Million Tons, 2021-2024

- Figure 64: External Steel Scrap Exports, Germany, 2020-2021

- Figure 65: Raw Materials Import Countries/Location

- Figure 66: France Mining-Steel Industry Market, $Billion, 2024-2035

- Figure 67: Total Crude Steel Production, France, Thousand Tons, 2021-2024

- Figure 68: Installed Capacity and Production by BF-BAF Process, Million Tons, 2021-2024

- Figure 69: Installed Capacity and Production by DRI-EAF Process, Million Tons, 2021-2024

- Figure 70: Main Steel Scrap Export, France, Million Tons, 2020-2021

- Figure 71: Raw Materials Import Countries/Location

- Figure 72: Austria Mining-Steel Industry Market, $Billion, 2024-2035

- Figure 73: Total Crude Steel Production, Austria, Thousand Tons, 2021-2024

- Figure 74: Installed Capacity and Production by BF-BAF Process, Million Tons, 2021-2024

- Figure 75: Installed Capacity and Production by DRI-EAF Process, Million Tons, 2021-2024

- Figure 76: Main Steel Scrap Export, Austria, Million Tons, 2020-2021

- Figure 77: Raw Materials Import Countries/Location

- Figure 78: Italy Mining-Steel Industry Market, $Billion, 2024-2035

- Figure 79: Total Crude Steel Production, Italy, Thousand Tons, 2021-2024

- Figure 80: Installed Capacity and Production by BF-BAF Process, Million Tons, 2021-2024

- Figure 81: Installed Capacity and Production by DRI-EAF Process, Million Tons, 2021-2024

- Figure 82: Raw Materials Import Countries/Location

- Figure 83: U.K. Mining-Steel Industry Market, $Billion, 2024-2035

- Figure 84: Total Crude Steel Production, U.K., Thousand Tons, 2021-2024

- Figure 85: Installed Capacity and Production by BF-BAF Process, Million Tons, 2021-2024

- Figure 86: Installed Capacity and Production by DRI-EAF Process, Million Tons, 2021-2024

- Figure 87: Steel Scrap Export, U.K., Million Tons, 2020-2021

- Figure 88: Raw Materials Import Countries/Location

- Figure 89: Rest-of-Europe Mining-Steel Industry Market, $Billion, 2024-2035

- Figure 90: Installed Capacity and Production by BF-BAF Process, Million Tons, 2021-2024

- Figure 91: Installed Capacity and Production by DRI-EAF Process, Million Tons, 2021-2024

- Figure 92: Raw Materials Import Countries/Location

- Figure 93: North Major Steel Producers in Asia-Pacific: Headquarters and 2023 Steel Production

- Figure 94: Estimated Crude Steel Production Capacity and Actual Crude Steel Production in Asia-Pacific, Million Tons, 2021-2024

- Figure 95: China Mining-Steel Industry Market, $Billion, 2024-2035

- Figure 96: Total Crude Steel Production, China, Thousand Tons, 2021-2024

- Figure 97: Installed Capacity and Production by BF-BAF Process, Million Tons, 2021-2024

- Figure 98: Installed Capacity and Production by DRI-EAF Process, Million Tons, 2021-2024

- Figure 99: Steel Scrap Use for Steelmaking in China, Million Tons, 2019-2021

- Figure 100: Raw Materials Import Countries/Location

- Figure 101: Japan Mining-Steel Industry Market, $Billion, 2024-2035

- Figure 102: Total Crude Steel Production, Japan, Thousand Tons, 2021-2024

- Figure 103: Installed Capacity and Production by BF-BAF Process, Million Tons, 2021-2024

- Figure 104: Installed Capacity and Production by DRI-EAF Process, Million Tons, 2021-2024

- Figure 105: Raw Materials Import Countries/Location

- Figure 106: Steel Scrap Use for Steelmaking in Japan, Million Tons, 2019-2021

- Figure 107: India Mining-Steel Industry Market, $Billion, 2024-2035

- Figure 108: Total Crude Steel Production, India, Thousand Tons, 2021-2024

- Figure 109: Installed Capacity and Production by BF-BAF Process, Million Tons, 2021-2024

- Figure 110: Installed Capacity and Production by DRI-EAF Process, Million Tons, 2021-2024

- Figure 111: Steel Scrap Imports in India, Million Tons, 2019-2021

- Figure 112: Raw Materials Import Countries/Location

- Figure 113: South Korea Mining-Steel Industry Market, $Billion, 2024-2035

- Figure 114: Total Crude Steel Production, South Korea, Thousand Tons, 2021-2024

- Figure 115: Installed Capacity and Production by BF-BAF Process, Million Tons, 2021-2024

- Figure 116: Installed Capacity and Production by DRI-EAF Process, Million Tons, 2021-2024

- Figure 117: Raw Materials Import Countries/Location

- Figure 118: Australia Mining-Steel Industry Market, $Billion, 2024-2035

- Figure 119: Total Crude Steel Production, Australia, Thousand Tons, 2021-2024

- Figure 120: Installed Capacity and Production by BF-BAF Process, Million Tons, 2021-2024

- Figure 121: Installed Capacity and Production by DRI-EAF Process, Million Tons, 2021-2024

- Figure 122: Steel Scrap Exports, Australia, Million Tons, 2019-2021

- Figure 123: Raw Materials Import Countries/Location

- Figure 124: Rest-of-Asia-Pacific Mining-Steel Industry Market, $Billion, 2024-2035

- Figure 125: Installed Capacity and Production by BF-BAF Process, Million Tons, 2021-2024

- Figure 126: Installed Capacity and Production by DRI-EAF Process, Million Tons, 2021-2024

- Figure 127: Raw Materials Import Countries/Location

- Figure 128: Estimated Crude Steel Production Capacity and Actual Crude Steel Production in Rest-of-the-World, in Million Tons, 2021-2024

- Figure 129: Middle East and Africa Mining-Steel Industry Market, $Billion, 2024-2035

- Figure 130: Installed Capacity and Production by BF-BAF Process, Million Tons, 2021-2024

- Figure 131: Installed Capacity and Production by DRI-EAF Process, Million Tons, 2021-2024

- Figure 132: Raw Materials Import Countries/Location

- Figure 133: South America Mining-Steel Industry Market, 2024-2035

- Figure 134: Installed Capacity and Production by BF-BAF Process, Million Tons, 2021-2024

- Figure 135: Installed Capacity and Production by DRI-EAF Process, Million Tons, 2021-2024

- Figure 136: Raw Materials Import Countries/Location

- Figure 137: Strategic Initiatives, January 2022-March 2025

- Figure 138: Share of Strategic Initiatives, 2023

- Figure 139: Data Triangulation

- Figure 140: Top-Down and Bottom-Up Approach

- Figure 141: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Opportunities across Region

- Table 3: Competitive Landscape Snapshot

- Table 4: Trends Overview

- Table 5: Impact Analysis of Market Navigating Factors, 2024-2035

- Table 6: Major Infrastructure Projects and Expected Steel Demand Increase

- Table 7: Regulations/Standards in the Global Mining Steel Industry

- Table 8: Upcoming Projects and Capacity Additions in the Global Mining Steel Industry Market

- Table 9: World's Largest Iron Ore Producers and their Capacity

- Table 10: Ongoing Investments in the Global Mining Steel Industry Market

- Table 11: Lifespan of Steel Products and their Recycling Rates

- Table 12: Recycled Steel Use in Crude Steel Production, Million Tons, 2022

- Table 13: Climate Targets of Global Steel Manufacturers

- Table 14: Green Steelmaking Initiatives

- Table 15: Application Summary (by End-Use Application)

- Table 16: Product Summary (by Production Methodology)

- Table 17: Product Summary (by End Products)

- Table 18: Global Mining-Steel Industry Market (by Region), $Billion, 2024-2035

- Table 19: North America Mining-Steel Industry Market (by End-Use Application), $Billion, 2024-2035

- Table 20: North America Mining-Steel Industry Market (by Production Methodology), $Billion, 2024-2035

- Table 21: North America Mining-Steel Industry Market (by End Products), $Billion, 2024-2035

- Table 22: U.S. Mining-Steel Industry Market (by End-Use Application), $Billion, 2024-2035

- Table 23: U.S. Mining-Steel Industry Market (by Production Methodology), $Billion, 2024-2035

- Table 24: U.S. Mining-Steel Industry Market (by End Products), $Billion, 2024-2035

- Table 25: List of Upcoming Projects in U.S.

- Table 26: Investment Scenario in U.S.

- Table 27: Estimated Consumption of Raw Materials by Key Companies in U.S.

- Table 28: Canada Mining-Steel Industry Market (by End-Use Application), $Billion, 2024-2035

- Table 29: Canada Mining-Steel Industry Market (by Production Methodology), $Billion, 2024-2035

- Table 30: Canada Mining-Steel Industry Market (by End Products), $Billion, 2024-2035

- Table 31: List of Upcoming Projects in Canada

- Table 32: Investment Scenario in Canada

- Table 33: Mexico Mining-Steel Industry Market (by End-Use Application), $Billion, 2024-2035

- Table 34: Mexico Mining-Steel Industry Market (by Production Methodology), $Billion, 2024-2035

- Table 35: Mexico Mining-Steel Industry Market (by End Products), $Billion, 2024-2035

- Table 36: List of Upcoming Projects in Mexico

- Table 37: Investment Scenario in Mexico

- Table 38: Europe Mining-Steel Industry Market (by End-Use Application), $Billion, 2024-2035

- Table 39: Europe Mining-Steel Industry Market (by Production Methodology), $Billion, 2024-2035

- Table 40: Europe Mining-Steel Industry Market (by End Products), $Billion, 2024-2035

- Table 41: Germany Mining-Steel Industry Market (by End-Use Application), $Billion, 2024-2035

- Table 42: Germany Mining-Steel Industry Market (by Production Methodology), $Billion, 2024-2035

- Table 43: Germany Mining-Steel Industry Market (by End Products), $Billion, 2024-2035

- Table 44: List of Upcoming Projects in Germany

- Table 45: Investment Scenario in Germany

- Table 46: France Mining-Steel Industry Market (by End-Use Application), $Billion, 2024-2035

- Table 47: France Mining-Steel Industry Market (by Production Methodology), $Billion, 2024-2035

- Table 48: France Mining-Steel Industry Market (by End Products), $Billion, 2024-2035

- Table 49: List of Upcoming Projects in France

- Table 50: Investment Scenario in France

- Table 51: Austria Mining-Steel Industry Market (by End-Use Application), $Billion, 2024-2035

- Table 52: Austria Mining-Steel Industry Market (by Production Methodology), $Billion, 2024-2035

- Table 53: Austria Mining-Steel Industry Market (by End Products), $Billion, 2024-2035

- Table 54: List of Upcoming Projects in Austria

- Table 55: Investment Scenario in Austria

- Table 56: Italy Mining-Steel Industry Market (by End-Use Application), $Billion, 2024-2035

- Table 57: Italy Mining-Steel Industry Market (by Production Methodology), $Billion, 2024-2035

- Table 58: Italy Mining-Steel Industry Market (by End Products), $Billion, 2024-2035

- Table 59: List of Upcoming Projects in Italy

- Table 60: Investment Scenario in Italy

- Table 61: U.K. Mining-Steel Industry Market (by End-Use Application), $Billion, 2024-2035

- Table 62: U.K. Mining-Steel Industry Market (by Production Methodology), $Billion, 2024-2035

- Table 63: U.K. Mining-Steel Industry Market (by End Products), $Billion, 2024-2035

- Table 64: List of Upcoming Projects in U.K.

- Table 65: Investment Scenario in U.K.

- Table 66: Rest-of-Europe Mining-Steel Industry Market (by End-Use Application), $Billion, 2024-2035

- Table 67: Rest-of-Europe Mining-Steel Industry Market (by Production Methodology), $Billion, 2024-2035

- Table 68: Rest-of-Europe Mining-Steel Industry Market (by End Products), $Billion, 2024-2035

- Table 69: List of Upcoming Projects in Rest-of-Europe

- Table 70: Investment Scenario in Rest-of-Europe

- Table 71: Asia-Pacific Mining-Steel Industry Market (by End-Use Application), $Billion, 2024-2035

- Table 72: Asia-Pacific Mining-Steel Industry Market (by Production Methodology), $Billion, 2024-2035

- Table 73: Asia-Pacific Mining-Steel Industry Market (by End Products), $Billion, 2024-2035

- Table 74: China Mining-Steel Industry Market (by End-Use Application), $Billion, 2024-2035

- Table 75: China Mining-Steel Industry Market (by Production Methodology), $Billion, 2024-2035

- Table 76: China Mining-Steel Industry Market (by End Products), $Billion, 2024-2035

- Table 77: List of Upcoming Projects in China

- Table 78: Investment Scenario in China

- Table 79: Japan Mining-Steel Industry Market (by End-Use Application), $Billion, 2024-2035

- Table 80: Japan Mining-Steel Industry Market (by Production Methodology), $Billion, 2024-2035

- Table 81: Japan Mining-Steel Industry Market (by End Products), $Billion, 2024-2035

- Table 82: List of Upcoming Projects in Japan

- Table 83: Investment Scenario in Japan

- Table 84: India Mining-Steel Industry Market (by End-Use Application), $Billion, 2024-2035

- Table 85: India Mining-Steel Industry Market (by Production Methodology), $Billion, 2024-2035

- Table 86: India Mining-Steel Industry Market (by End Products), $Billion, 2024-2035

- Table 87: List of Upcoming Projects in India

- Table 88: Investment Scenario in India

- Table 89: South Korea Mining-Steel Industry Market (by End-Use Application), $Billion, 2024-2035

- Table 90: South Korea Mining-Steel Industry Market (by Production Methodology), $Billion, 2024-2035

- Table 91: South Korea Mining-Steel Industry Market (by End Products), $Billion, 2024-2035

- Table 92: List of Upcoming Projects in South Korea

- Table 93: Investment Scenario in South Korea

- Table 94: Australia Mining-Steel Industry Market (by End-Use Application), $Billion, 2024-2035

- Table 95: Australia Mining-Steel Industry Market (by Production Methodology), $Billion, 2024-2035

- Table 96: Australia Mining-Steel Industry Market (by End Products), $Billion, 2024-2035

- Table 97: List of Upcoming Projects in Australia

- Table 98: Investment Scenario in Australia

- Table 99: Rest-of-Asia-Pacific Mining-Steel Industry Market (by End-Use Application), $Billion, 2024-2035

- Table 100: Rest-of-Asia-Pacific Mining-Steel Industry Market (by Production Methodology), $Billion, 2024-2035

- Table 101: Rest-of-Asia-Pacific Mining-Steel Industry Market (by End Products), $Billion, 2024-2035

- Table 102: List of Upcoming Projects in Rest-of-Asia-Pacific

- Table 103: Investment Scenario in Rest-of-Asia-Pacific

- Table 104: Rest-of-the-World Mining-Steel Industry Market (by End-Use Application), $Billion, 2024-2035

- Table 105: Rest-of-the-World Mining-Steel Industry Market (by Production Methodology), $Billion, 2024-2035

- Table 106: Rest-of-the-World Mining-Steel Industry Market (by End Products), $Billion, 2024-2035

- Table 107: Middle East and Africa Mining-Steel Industry Market (by End-Use Application), $Billion, 2024-2035

- Table 108: Middle East and Africa Mining-Steel Industry Market (by Production Methodology), $Billion, 2024-2035

- Table 109: Middle East and Africa Mining-Steel Industry Market (by End Products), $Billion, 2024-2035

- Table 110: List of Upcoming Projects in Middle East and Africa

- Table 111: Investment Scenario in Middle East and Africa

- Table 112: South America Mining-Steel Industry Market (by End-Use Application), $Billion, 2024-2035

- Table 113: South America Mining-Steel Industry Market (by Production Methodology), $Billion, 2024-2035

- Table 114: South America Mining-Steel Industry Market (by End Products), $Billion, 2024-2035

- Table 115: List of Upcoming Projects in South America

- Table 116: Investment Scenario in South America

- Table 117: Market Share

Global Mining Steel Industry Market Overview

The global mining steel industry market was valued at $875.7 billion in 2024 and is projected to grow at a CAGR of 4.63%, reaching $1,450.3 billion by 2035. This growth has been driven by the increasing demand for steel across various sectors, including construction, automotive, and infrastructure. The market is further strengthened by the industry's shift toward more sustainable practices, such as adopting electric arc furnaces (EAF), direct reduced iron (DRI) technologies, and using renewable energy sources. Additionally, the growing need for raw materials, including iron ore and coking coal, to meet the escalating demand for steel production has been driving investment in mining operations and technological innovations within the steel manufacturing process. The transition to a more efficient steelmaking process positions the global mining steel industry for continued expansion in the years ahead.

Introduction to the Global Mining Steel Industry Market

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2025 - 2035 |

| 2025 Evaluation | $922.2 Billion |

| 2035 Forecast | $1,450.3 Billion |

| CAGR | 4.63% |

The global mining steel industry market plays a critical role in the production of steel, which is a foundational material used across various sectors such as construction, automotive, energy, and infrastructure. The market has been driven by the growing demand for steel products and the increasing focus on sustainable steel including recycled and green steel and efficiency in steel production. Advances in technologies, such as electric arc furnaces (EAF), direct reduced iron (DRI) processes, and the use of renewable energy sources, are helping steel manufacturers reduce emissions and improve resource efficiency. The demand for high-performance steel products and the push for decarbonization and circular economy principles position the global mining steel industry market for continued growth and innovation.

Mining Steel Industry Market Introduction

The global mining steel industry market has been experiencing robust growth as demand for steel products continues to rise across various industries. Steel remains a critical material for economic development, driven by its versatility, strength, and essential role in manufacturing. The market is characterized by advancements in production technologies, which are improving efficiency, reducing costs, and increasing the overall quality of steel. Key players in the market are investing heavily in modernizing their production processes, expanding their capacity, and adopting innovative solutions to meet the growing demand. As global infrastructure development continues, the mining steel industry market is set to experience sustained growth, driven by both emerging markets and continued industrial expansion in developed economies.

Mining Steel Industry Market: Industrial Impact

The industrial impact of the global mining steel industry market is vast, influencing a wide range of sectors such as construction, automotive, infrastructure, and energy. As a key player in the production of essential raw materials, the mining steel industry market has been driving advancements in production technologies and enhancing supply chain efficiencies. The growing demand for high-strength and high-quality steel has led to increased investments in automation, advanced smelting processes, and the development of specialized steel grades.

The companies involved in the global mining steel industry market include major industry players such as Umicore, ArcelorMittal, thyssenkrupp AG, NIPPON STEEL CORPORATION, China Ansteel Group Corporation Limited, China Jianlong Steel Industriai Co Ltd., Salzgitter AG, Tata Steel, JSW, JFE Steel Corporation, Nucor Corporation, Shandong Lenser materials Co., LTD., HYUNDAI STEEL, Jindal Steel & Power Limited, SAIL, and Cleveland-Cliffs Inc. These companies are enhancing their capabilities through strategic partnerships, collaborations, and technology advancements to improve the resilience and performance of the mining steel industry in demanding environments. Their continued research and development investments drive the market's growth while supporting the broader trends in the sustainable mining steel industry.

Mining Steel Industry Market Segmentation:

Segmentation 1: by End-Use Application

- Transportation (Automotive and Other Transportation)

- Building, Construction, and Infrastructure

- Consumer Goods and Appliances

- Industrial Equipment and Manufacturing

- Packaging

- Others

Building and Construction to Lead the Mining Steel Industry Market (by End-Use Application)

The building and construction sector is expected to be the leading driver of growth in the mining steel industry market from 2025 to 2035. With rapid urbanization, infrastructure development, and rising global population, steel demand will increase significantly. Due to its durability, flexibility, and strength, Steel's essential role in construction positions it as a key material for housing, bridges, and skyscrapers. Moreover, governments' investments in large-scale infrastructure projects, especially in emerging economies, will boost steel consumption.

In the long term, the emphasis on sustainable construction practices, including green buildings and eco-friendly infrastructure, will further fuel demand for low-carbon steel. Innovations in steel production technologies, such as the development of "green steel," will align with these environmental goals, making it a preferred choice. As the global push for infrastructure development continues, building and construction will remain the dominant sector, propelling the growth of the mining steel industry market throughout the forecast period.

Segmentation 2: by Production Methodology

- Blast Furnace-Basic Oxygen Furnace (BF-BOF)

- Direct Reduced Iron - Electric Arc Furnace (DRI-EAF)

- Other Emerging Technologies

Blast Furnace-Basic Oxygen Furnace (BF-BOF) to Lead the Mining Steel Industry Market (by Production Methodology)

The blast furnace-basic oxygen furnace (BF-BOF) process is expected to dominate the mining steel industry market during the forecast period from 2025 to 2035. This traditional steelmaking method continues to be the most widely used due to its ability to produce large volumes of steel at lower operational costs. The BF-BOF process is favored for its efficiency in utilizing iron ore, coke, and limestone to produce high-quality steel, particularly for construction, automotive, and infrastructure sectors.

Despite the increasing shift toward electric arc furnaces (EAF) for sustainability, BF-BOF remains integral due to its established infrastructure, reliable output, and economies of scale. The continued demand for steel in emerging markets and technological advancements aimed at reducing carbon emissions in the BF-BOF process will maintain its market leadership. Furthermore, the adoption of carbon capture technologies and improvements in furnace design are expected to enhance the environmental performance of this method, ensuring its dominance in the steel production industry.

Segmentation 3: by End Products

- Carbon Steel

- Alloy Steel

- Stainless Steel

- High-Strength Steel

- Others

Carbon Steel to Lead the Mining Steel Industry Market (by End-Products)

Carbon steel is expected to lead the mining steel industry market during the forecast period of 2025-2035 due to its versatile properties, cost-effectiveness, and widespread applications. As the backbone of the construction, automotive, and infrastructure industries, carbon steel continues to drive market demand. Its strength, durability, and malleability make it ideal for heavy-duty structures, machinery, and equipment used in mining operations.

Moreover, the ongoing trend toward industrial modernization and infrastructural development, particularly in emerging markets, will boost the demand for carbon steel. Technological advancements in production methods, such as electric arc furnaces and innovations in recycling, are making carbon steel production more sustainable, contributing to its dominance. Additionally, carbon steel's ability to be used in various grades and forms caters to diverse industry needs, ensuring its continued relevance in the mining sector. With increasing investments in construction and mining activities globally, carbon steel is positioned to remain the preferred material, securing its market leadership over the forecast period 2025-2035.

Segmentation 4: by Region

- North America: U.S., Canada, and Mexico

- Europe: Germany, France, Austria, Italy, U.K., Rest-of-Europe

- Asia-Pacific: China, Japan, India, South Korea, Australia, Rest-of-Asia-Pacific

- Rest-of-the-World: Middle East and Africa, South America

The Asia-Pacific region dominated the global mining steel industry market and is expected to maintain dominance over the forecast period from 2025 to 2035. The region is home to multiple steel producers, including Baowu Steel Group, Nippon Steel, JFE Steel, Tata Steel, and POSCO. According to the World Steel Association, the Asia-Pacific region accounts for more than 70% of the total global steel production. Various mining steel industry manufacturers, such as ArcelorMittal, Tata Steel, China Baowu Steel Group Corporation Limited, POSCO, and Nippon Steel, have a strong presence in the Asia-Pacific region and are further expanding their production facilities to enhance their market positions in the competitive mining steel industry market.

Recent Developments in the Global Mining Steel Industry Market

- In April 2025, Japan steelmaker NIPPON STEEL CORPORATION announced an investment of approximately $58.4 million through its Thailand-based subsidiary NS-Siam United Steel Co., Ltd. to expand the capacity of its electric plating line (EPL). This investment aims to meet the growing demand for tinplate steel used in container manufacturing. The expansion aims to increase the annual production capacity of EPL lines Nos. 1 and 2 from 280,000 metric tons to 350,000 metric tons. The project is scheduled for completion by March 2027.

- In March 2025, the government of Morocco approved several large-scale green projects worth $32.76 million aimed at producing ammonia, steel, and industrial fuel. A consortium led by U.A.E.-based Taqa and Spain-based Cepsa aims to focus on producing green ammonia and industrial fuel, while Morocco's Nareva will invest in a project for green steel and industrial fuel production. Saudi Arabia-based Acwa Power is expected to be involved in producing green steel.

- In January 2025, thyssenkrupp completed the sale of its India electrical steel business, thyssenkrupp Electrical Steel India Private Ltd. The transaction was closed with a joint venture between India's largest steelmaker, JSW Steel Limited, and Japan's JFE Steel Corporation. Located in Nashik, India, the plant produces grain-oriented electrical steel used in transformers and high-performance generators. The sale, valued at approximately $479.8 million, was driven by high transportation costs from Germany to India, making the site uncompetitive in the long term. The sale strengthens thyssenkrupp's capital base and aligns with its strategic goals.

Mining Steel Industry Market Demand - Drivers, Limitations, and Opportunities

Mining Steel Industry Market Drivers: Urbanization and Infrastructure Growth

Urbanization and infrastructure growth are key drivers in the mining steel industry market, driving significant demand for steel. As cities expand and economies industrialize, the need for steel to support infrastructure projects such as roads, bridges, buildings, and energy plants becomes essential. Steel's strength, durability, and versatility make it the material of choice for modern urbanization and infrastructure development. It directly influences the demand for raw materials used in steel production, such as iron ore and coal. This increased demand stimulates both mining and steel manufacturing sectors, expanding production capacities worldwide.

Several industries have already capitalized on the trend of rapid urbanization. In countries such as India and China, substantial investments are being made in the construction, transportation, and energy sectors. China's Belt and Road Initiative has been driving significant steel consumption to support the development of roads, railways, and ports. In Africa, nations such as Nigeria and South Africa are making major infrastructure investments to accommodate their growing urban populations, further increasing steel demand.

Mining Steel Industry Market Challenges: Volatility in Raw Material Prices

Volatility in raw material prices poses a significant challenge to the mining steel industry, directly impacting steel manufacturers' cost structure and profitability. Fluctuations in the prices of key raw materials such as iron ore, coal, and scrap steel can lead to unpredictable production costs, making it difficult for steel producers to maintain stable profit margins. This price volatility is largely driven by global supply chain disruptions, geopolitical factors, and shifts in demand from key industries, creating an unstable environment for producers who rely on consistent pricing to plan production and investment strategies.

In recent years, the mining steel industry has experienced significant price volatility, driven largely by geopolitical uncertainties and shifts in the global economy. For example, in 2021, iron ore prices hit record highs, driven by China's booming construction sector and anticipated supply constraints from Brazil. However, in 2022, prices fell as demand weakened and global steel production decelerated. These price fluctuations have placed considerable pressure on steel producers, forcing them to constantly adapt their pricing and production strategies to manage the financial impact of rising or falling raw material costs. Companies such as ArcelorMittal and Tata Steel have struggled to pass on higher raw material expenses to customers, impacting their profitability.

Mining Steel Industry Market Opportunities: Growing Demand for Specialty Steel Products

The growing demand for specialty steel products presents a significant opportunity for the mining and steel industry. As industries such as automotive, aerospace, and energy evolve, the need for advanced steel products with specific properties, such as high strength, durability, and resistance to extreme conditions, has increased. Specialty steels, including high-alloy steels, tool steels, and stainless steels, are in high demand due to their ability to meet stringent performance standards in sectors that require precision and reliability.

In response to this opportunity, countries have been making substantial investments in the production of specialty steel products. For instance, in January 2025, India launched the second phase of its production linked incentive (PLI) scheme for specialty steel, with a budget of approximately $737.4 million. The revised scheme introduces changes to attract more industry participation, such as lowering investment and capacity thresholds for cold-rolled grain-oriented (CRGO) steel, allowing for the carry-forward of excess production to subsequent years for claiming incentives and reducing the minimum investment required for capacity augmentation.

How can this report add value to an organization?

Product/Innovation Strategy: The global mining steel industry market is segmented based on various applications, production methodology, and end-products, which provides valuable insights. By end-use application segment includes transportation (automotive and other transportation), building, construction, and infrastructure, consumer goods and appliances, industrial equipment and manufacturing, packaging, and others. By production methodology, the market is categorized into a blast furnace-basic oxygen furnace (BF-BOF), direct reduced iron-electric arc furnace (DRI-EAF), and other emerging technologies. Lastly, the end products include carbon steel, alloy steel, stainless steel, high-strength steel, and others.

Growth/Marketing Strategy: The global mining steel industry market has been growing. The market offers enormous opportunities for existing and emerging market players. Some of the strategies covered in this segment are mergers and acquisitions, product launches, partnerships and collaborations, business expansions, and investments. The strategies preferred by companies to maintain and strengthen their market position primarily include product development.

Competitive Strategy: The key players in the global mining steel industry market analyzed and profiled in the study include professionals with expertise in the mining and steel industry. Additionally, a comprehensive competitive landscape such as partnerships, agreements, and collaborations are expected to aid the reader in understanding the untapped revenue pockets in the market.

Research Methodology

Factors for Data Prediction and Modelling

- The base currency considered for the market analysis is US$. Currencies other than the US$ have been converted to the US$ for all statistical calculations, considering the average conversion rate for that particular year.

- The currency conversion rate was taken from the historical exchange rate on the Oanda website.

- Nearly all the recent developments from January 2022 to March 2025 have been considered in this research study.

- The information rendered in the report is a result of in-depth primary interviews, surveys, and secondary analysis.

- Where relevant information was not available, proxy indicators and extrapolation were employed.

- Any economic downturn in the future has not been taken into consideration for the market estimation and forecast.

- Technologies currently used are expected to persist through the forecast with no major technological breakthroughs.

Market Estimation and Forecast

This research study involves the usage of extensive secondary sources, such as certified publications, articles from recognized authors, white papers, annual reports of companies, directories, and major databases to collect useful and effective information for an extensive, technical, market-oriented, and commercial study of the global mining steel industry market.

The market engineering process involves the calculation of the market statistics, market size estimation, market forecast, market crackdown, and data triangulation (the methodology for such quantitative data processes is explained in further sections). The primary research study has been undertaken to gather information and validate the market numbers for segmentation types and industry trends of the key players in the market.

Primary Research

The primary sources involve industry experts from the global mining steel industry market and various stakeholders in the ecosystem. Respondents such as CEOs, vice presidents, marketing directors, and technology and innovation directors have been interviewed to obtain and verify both qualitative and quantitative aspects of this research study.

The key data points taken from primary sources include:

- validation and triangulation of all the numbers and graphs

- validation of reports segmentation and key qualitative findings

- understanding the competitive landscape

- validation of the numbers of various markets for market type

- percentage split of individual markets for geographical analysis

Secondary Research

This research study of the global mining steel industry market involves the usage of extensive secondary research, directories, company websites, and annual reports. It also makes use of databases, such as Hoovers, Bloomberg, Businessweek, and Factiva, to collect useful and effective information for an extensive, technical, market-oriented, and commercial study of the global market. In addition to the aforementioned data sources, the study has been undertaken with the help of other data sources and websites, such as IRENA and IEA.

Secondary research was done in order to obtain crucial information about the industry's value chain, revenue models, the market's monetary chain, the total pool of key players, and the current and potential use cases and applications.

The key data points taken from secondary research include:

- segmentations and percentage shares

- data for market value

- key industry trends of the top players of the market

- qualitative insights into various aspects of the market, key trends, and emerging areas of innovation

- quantitative data for mathematical and statistical calculations

Key Mining Steel Industry Market Players and Competition Synopsis

The companies that are profiled in the global mining steel industry market have been selected based on inputs gathered from primary experts who have analyzed company coverage, product portfolio, and market penetration.

Some of the prominent names in this market are:

- ArcelorMittal

- thyssenkrupp AG

- NIPPON STEEL CORPORATION

- China Ansteel Group Corporation Limited

- China Jianlong Steel Industriai Co Ltd.

- Salzgitter AG

- Tata Steel

- JSW

- JFE Steel Corporation

- Nucor Corporation

- Shandong Lenser materials Co.,LTD.

- HYUNDAI STEEL

- Jindal Steel & Power Limited

- SAIL

- Cleveland-Cliffs Inc.

Companies not part of the aforementioned pool have been well represented across different sections of the report (wherever applicable).

Table of Contents

Executive Summary

Scope and Definition

1 Markets

- 1.1 Trends: Current and Future Impact Assessment

- 1.1.1 Automation in Mining and Steel Production Processes

- 1.1.2 Increased Demand from Emerging Markets

- 1.2 Supply Chain Overview

- 1.2.1 Value Chain Analysis

- 1.2.1.1 Key Iron Ore Producing Nations and Mining Capacity

- 1.2.1.2 Key Coking Coal Exporting Nations

- 1.2.2 Supply Chain Constraints

- 1.2.3 Impact of Geopolitical Issues on Steel Production

- 1.2.4 Trump's Impact on U.S. Steel Imports and Exports

- 1.2.5 Pricing Analysis

- 1.2.6 Market Map (Stakeholder Mapping across Value Chain)

- 1.2.1 Value Chain Analysis

- 1.3 Patent Filing Trend (by Country, Company)

- 1.4 Market Dynamics Overview

- 1.4.1 Market Drivers

- 1.4.1.1 Urbanization and Infrastructure Growth

- 1.4.1.2 Public-Private Investments in Infrastructure

- 1.4.2 Market Restraints

- 1.4.2.1 Volatility in Raw Material Prices

- 1.4.2.2 Geopolitical and Trade Tensions

- 1.4.3 Market Opportunities

- 1.4.3.1 Growing Demand for Specialty Steel Products

- 1.4.3.2 Technological Innovation in Steelmaking

- 1.4.1 Market Drivers

- 1.5 Steel Production Scenario

- 1.5.1 Production Capacity Outlook (2024-2034)

- 1.5.2 Regulatory Landscape

- 1.5.3 Stakeholder Analysis

- 1.5.4 Installed Capacity by Production Process (Blast Furnace-BOF and DRI-EAF)

- 1.5.5 Upcoming Projects and Capacity Additions (2025-2035)

- 1.5.6 Ongoing Investments

- 1.5.7 Scrap Recycling Market Overview

- 1.5.8 Emission Reduction Initiatives (Mining Steel Industry Transition)

- 1.6 Green-Steel Market Outlook

- 1.6.1 Market Size and Growth Forecast (2024-2034)

- 1.6.2 Impact of Green Steel on Conventional Steel Market

- 1.6.3 Challenges and Enablers for Green-Steel Adoption

- 1.6.4 Key Green-Steel Projects and Initiatives

2 Application

- 2.1 Application Segmentation

- 2.2 Application Summary

- 2.3 Global Mining Steel Industry Market (by End-Use Application)

- 2.3.1 Transportation (Automotive and Other Transportation)

- 2.3.2 Building, Construction, and Infrastructure

- 2.3.3 Industrial Equipment and Manufacturing

- 2.3.4 Consumer Goods and Appliances

- 2.3.5 Packaging

- 2.3.6 Others

3 Products

- 3.1 Product Segmentation

- 3.2 Product Summary

- 3.3 Global Mining Steel Industry Market (by Production Methodology)

- 3.3.1 Blast Furnace - Basic Oxygen Furnace (BF-BOF)

- 3.3.2 Direct Reduced Iron - Electric Arc Furnace (DRI-EAF)

- 3.3.3 Other Emerging Technologies

- 3.4 Global Mining Steel Industry Market (by End-Products)

- 3.4.1 Carbon Steel

- 3.4.2 Alloy Steel

- 3.4.3 Stainless Steel

- 3.4.4 High-Strength Steel

- 3.4.5 Others

4 Regions

- 4.1 Regional Summary

- 4.2 North America

- 4.2.1 Markets

- 4.2.1.1 Key Market Participants in North America

- 4.2.1.2 Driving Factors for Market Growth

- 4.2.1.3 Factors Challenging the Market

- 4.2.2 Application

- 4.2.3 Product

- 4.2.4 Mining-Steel Industry Production Scenario

- 4.2.5 North America (by Country)

- 4.2.5.1 U.S.

- 4.2.5.1.1 Application

- 4.2.5.1.2 Product

- 4.2.5.1.3 Installed Capacity and Production by Process

- 4.2.5.1.3.1 Upcoming Projects

- 4.2.5.1.3.2 Ongoing Investments

- 4.2.5.1.3.3 Scrap Recycling Overview

- 4.2.5.1.4 Raw Material Analysis (Iron Ore, Coking Coal, Scrap)

- 4.2.5.1.4.1 Consumption by Key Companies

- 4.2.5.1.4.2 Import Locations/Countries

- 4.2.5.2 Canada

- 4.2.5.2.1 Application

- 4.2.5.2.2 Product

- 4.2.5.2.3 Installed Capacity and Production by Process

- 4.2.5.2.3.1 Upcoming Projects

- 4.2.5.2.3.2 Ongoing Investments

- 4.2.5.2.3.3 Scrap Recycling Overview

- 4.2.5.2.4 Raw Material Analysis (Iron Ore, Coking Coal, Scrap)

- 4.2.5.2.4.1 Consumption by Key Companies

- 4.2.5.2.4.2 Import Locations/Countries

- 4.2.5.3 Mexico

- 4.2.5.3.1 Application

- 4.2.5.3.2 Product

- 4.2.5.3.3 Installed Capacity and Production by Process

- 4.2.5.3.3.1 Upcoming Projects

- 4.2.5.3.3.2 Ongoing Investments

- 4.2.5.3.3.3 Scrap Recycling Overview

- 4.2.5.3.4 Raw Material Analysis (Iron Ore, Coking Coal, Scrap)

- 4.2.5.3.4.1 Consumption by Key Companies

- 4.2.5.3.4.2 Import Locations/Countries

- 4.2.5.1 U.S.

- 4.2.1 Markets

- 4.3 Europe

- 4.3.1 Markets

- 4.3.1.1 Key Market Participants in Europe

- 4.3.1.2 Driving Factors for Market Growth

- 4.3.1.3 Factors Challenging the Market

- 4.3.2 Application

- 4.3.3 Product

- 4.3.4 Mining-Steel Industry Production Scenario

- 4.3.5 Europe (by Country)

- 4.3.5.1 Germany

- 4.3.5.1.1 Application

- 4.3.5.1.2 Product

- 4.3.5.1.3 Installed Capacity and Production by Process

- 4.3.5.1.3.1 Upcoming Projects

- 4.3.5.1.3.2 Ongoing Investments

- 4.3.5.1.3.3 Scrap Recycling Overview

- 4.3.5.1.4 Raw Material Analysis (Iron Ore, Coking Coal, Scrap)

- 4.3.5.1.4.1 Consumption by Key Companies

- 4.3.5.1.4.2 Import Locations/Countries

- 4.3.5.2 France

- 4.3.5.2.1 Application

- 4.3.5.2.2 Product

- 4.3.5.2.3 Installed Capacity and Production by Process

- 4.3.5.2.3.1 Upcoming Projects

- 4.3.5.2.3.2 Ongoing Investments

- 4.3.5.2.3.3 Scrap Recycling Overview

- 4.3.5.2.4 Raw Material Analysis (Iron Ore, Coking Coal, Scrap)

- 4.3.5.2.4.1 Consumption by Key Companies

- 4.3.5.2.4.2 Import Locations/Countries

- 4.3.5.3 Austria

- 4.3.5.3.1 Application

- 4.3.5.3.2 Product

- 4.3.5.3.3 Installed Capacity and Production by Process

- 4.3.5.3.3.1 Upcoming Projects

- 4.3.5.3.3.2 Ongoing Investments

- 4.3.5.3.3.3 Scrap Recycling Overview

- 4.3.5.3.4 Raw Material Analysis (Iron Ore, Coking Coal, Scrap)

- 4.3.5.3.4.1 Consumption by Key Companies

- 4.3.5.3.4.2 Import Locations/Countries

- 4.3.5.4 Italy

- 4.3.5.4.1 Application

- 4.3.5.4.2 Product

- 4.3.5.4.3 Installed Capacity and Production by Process

- 4.3.5.4.3.1 Upcoming Projects

- 4.3.5.4.3.2 Ongoing Investments

- 4.3.5.4.3.3 Scrap Recycling Overview

- 4.3.5.4.4 Raw Material Analysis (Iron Ore, Coking Coal, Scrap)

- 4.3.5.4.4.1 Consumption by Key Companies

- 4.3.5.4.4.2 Import Locations/Countries

- 4.3.5.5 U.K.

- 4.3.5.5.1 Application

- 4.3.5.5.2 Product

- 4.3.5.5.3 Installed Capacity and Production by Process

- 4.3.5.5.3.1 Upcoming Projects

- 4.3.5.5.3.2 Ongoing Investments

- 4.3.5.5.3.3 Scrap Recycling Overview

- 4.3.5.5.4 Raw Material Analysis (Iron Ore, Coking Coal, Scrap)

- 4.3.5.5.4.1 Consumption by Key Companies

- 4.3.5.5.4.2 Import Locations/Countries

- 4.3.5.6 Rest-of-Europe

- 4.3.5.6.1 Application

- 4.3.5.6.2 Product

- 4.3.5.6.3 Installed Capacity and Production by Process

- 4.3.5.6.3.1 Upcoming Projects

- 4.3.5.6.3.2 Ongoing Investments

- 4.3.5.6.3.3 Scrap Recycling Overview

- 4.3.5.6.4 Raw Material Analysis (Iron Ore, Coking Coal, Scrap)

- 4.3.5.6.4.1 Consumption by Key Companies

- 4.3.5.6.4.2 Import Locations/Countries

- 4.3.5.1 Germany

- 4.3.1 Markets

- 4.4 Asia-Pacific

- 4.4.1 Markets

- 4.4.1.1 Key Market Participants in Asia-Pacific

- 4.4.1.2 Driving Factors for Market Growth

- 4.4.1.3 Factors Challenging the Market

- 4.4.2 Application

- 4.4.3 Product

- 4.4.4 Mining-Steel Industry Production Scenario

- 4.4.5 Asia-Pacific (by Country)

- 4.4.5.1 China

- 4.4.5.1.1 Application

- 4.4.5.1.2 Product

- 4.4.5.1.3 Installed Capacity and Production by Process

- 4.4.5.1.3.1 Upcoming Projects

- 4.4.5.1.3.2 Ongoing Investments

- 4.4.5.1.3.3 Scrap Recycling Overview

- 4.4.5.1.4 Raw Material Analysis (Iron Ore, Coking Coal, Scrap)

- 4.4.5.1.4.1 Consumption by Key Companies

- 4.4.5.1.4.2 Import Locations/Countries

- 4.4.5.2 Japan

- 4.4.5.2.1 Application

- 4.4.5.2.2 Product

- 4.4.5.2.3 Installed Capacity and Production by Process

- 4.4.5.2.3.1 Upcoming Projects

- 4.4.5.2.3.2 Ongoing Investments

- 4.4.5.2.3.3 Scrap Recycling Overview

- 4.4.5.2.4 Raw Material Analysis (Iron Ore, Coking Coal, Scrap)

- 4.4.5.2.4.1 Consumption by Key Companies

- 4.4.5.2.4.2 Import Locations/Countries

- 4.4.5.3 India

- 4.4.5.3.1 Application

- 4.4.5.3.2 Product

- 4.4.5.3.3 Installed Capacity and Production by Process

- 4.4.5.3.3.1 Upcoming Projects

- 4.4.5.3.3.2 Ongoing Investments

- 4.4.5.3.3.3 Scrap Recycling Overview

- 4.4.5.3.4 Raw Material Analysis (Iron Ore, Coking Coal, Scrap)

- 4.4.5.3.4.1 Consumption by Key Companies

- 4.4.5.3.4.2 Import Locations/Countries

- 4.4.5.4 South Korea

- 4.4.5.4.1 Application

- 4.4.5.4.2 Product

- 4.4.5.4.3 Installed Capacity and Production by Process

- 4.4.5.4.3.1 Upcoming Projects

- 4.4.5.4.3.2 Ongoing Investments

- 4.4.5.4.3.3 Scrap Recycling Overview

- 4.4.5.4.4 Raw Material Analysis (Iron Ore, Coking Coal, Scrap)

- 4.4.5.4.4.1 Consumption by Key Companies

- 4.4.5.4.4.2 Import Locations/Countries

- 4.4.5.5 Australia

- 4.4.5.5.1 Application

- 4.4.5.5.2 Product

- 4.4.5.5.3 Installed Capacity and Production by Process

- 4.4.5.5.3.1 Upcoming Projects

- 4.4.5.5.3.2 Ongoing Investments

- 4.4.5.5.3.3 Scrap Recycling Overview

- 4.4.5.5.4 Raw Material Analysis (Iron Ore, Coking Coal, Scrap)

- 4.4.5.5.4.1 Consumption by Key Companies

- 4.4.5.5.4.2 Import Locations/Countries

- 4.4.5.6 Rest-of-Asia-Pacific

- 4.4.5.6.1 Application

- 4.4.5.6.2 Product

- 4.4.5.6.3 Installed Capacity and Production by Process

- 4.4.5.6.3.1 Upcoming Projects

- 4.4.5.6.3.2 Ongoing Investments

- 4.4.5.6.3.3 Scrap Recycling Overview

- 4.4.5.6.4 Raw Material Analysis (Iron Ore, Coking Coal, Scrap)

- 4.4.5.6.4.1 Consumption by Key Companies

- 4.4.5.6.4.2 Import Locations/Countries

- 4.4.5.1 China

- 4.4.1 Markets

- 4.5 Rest-of-the-World

- 4.5.1 Markets

- 4.5.1.1 Driving Factors for Market Growth

- 4.5.1.2 Factors Challenging the Market

- 4.5.2 Application

- 4.5.3 Product

- 4.5.4 Mining-Steel Industry Production Scenario

- 4.5.5 Rest-of-the-World (by Region)

- 4.5.5.1 Middle East and Africa

- 4.5.5.1.1 Application

- 4.5.5.1.2 Product

- 4.5.5.1.3 Installed Capacity and Production by Process

- 4.5.5.1.3.1 Upcoming Projects

- 4.5.5.1.3.2 Ongoing Investments

- 4.5.5.1.3.3 Scrap Recycling Overview

- 4.5.5.1.4 Raw Material Analysis (Iron Ore, Coking Coal, Scrap)

- 4.5.5.1.4.1 Consumption by Key Companies

- 4.5.5.1.4.2 Import Locations/Countries

- 4.5.5.2 South America

- 4.5.5.2.1 Application

- 4.5.5.2.2 Product

- 4.5.5.2.3 Installed Capacity and Production by Process

- 4.5.5.2.3.1 Upcoming Projects

- 4.5.5.2.3.2 Ongoing Investments

- 4.5.5.2.3.3 Scrap Recycling Overview

- 4.5.5.2.4 Raw Material Analysis (Iron Ore, Coking Coal, Scrap)

- 4.5.5.2.4.1 Consumption by Key Companies

- 4.5.5.2.4.2 Import Locations/Countries

- 4.5.5.1 Middle East and Africa

- 4.5.1 Markets

5 Markets - Competitive Benchmarking and Company Profiles

- 5.1 Next Frontiers

- 5.2 Geographic Assessment

- 5.3 Company Profiles

- 5.3.1 ArcelorMittal

- 5.3.1.1 Overview

- 5.3.1.2 Top Products/Product Portfolio

- 5.3.1.3 Top Competitors

- 5.3.1.4 End-Use Industry

- 5.3.1.5 Key Personnel

- 5.3.1.6 Analyst View

- 5.3.1.7 Market Share, 2023

- 5.3.2 thyssenkrupp AG

- 5.3.2.1 Overview

- 5.3.2.2 Top Products/Product Portfolio

- 5.3.2.3 Top Competitors

- 5.3.2.4 End-Use Industry

- 5.3.2.5 Key Personnel

- 5.3.2.6 Analyst View

- 5.3.2.7 Market Share, 2023

- 5.3.3 NIPPON STEEL CORPORATION

- 5.3.3.1 Overview

- 5.3.3.2 Top Products/Product Portfolio

- 5.3.3.3 Top Competitors

- 5.3.3.4 End-Use Industry

- 5.3.3.5 Key Personnel

- 5.3.3.6 Analyst View

- 5.3.3.7 Market Share, 2023

- 5.3.4 China Ansteel Group Corporation Limited

- 5.3.4.1 Overview

- 5.3.4.2 Top Products/Product Portfolio

- 5.3.4.3 Top Competitors

- 5.3.4.4 End-Use Industry

- 5.3.4.5 Key Personnel

- 5.3.4.6 Analyst View

- 5.3.4.7 Market Share, 2023

- 5.3.5 China Jianlong Steel Industriai Co Ltd.

- 5.3.5.1 Overview

- 5.3.5.2 Top Products/Product Portfolio

- 5.3.5.3 Top Competitors

- 5.3.5.4 End-Use Industry

- 5.3.5.5 Analyst View

- 5.3.5.6 Market Share, 2023

- 5.3.6 Salzgitter AG

- 5.3.6.1 Overview

- 5.3.6.2 Top Products/Product Portfolio

- 5.3.6.3 Top Competitors

- 5.3.6.4 End-Use Industry

- 5.3.6.5 Key Personnel

- 5.3.6.6 Analyst View

- 5.3.6.7 Market Share, 2023

- 5.3.7 Tata Steel

- 5.3.7.1 Overview

- 5.3.7.2 Top Products/Product Portfolio

- 5.3.7.3 Top Competitors

- 5.3.7.4 End-Use Industry

- 5.3.7.5 Key Personnel

- 5.3.7.6 Analyst View

- 5.3.7.7 Market Share, 2023

- 5.3.8 JSW

- 5.3.8.1 Overview

- 5.3.8.2 Top Products/Product Portfolio

- 5.3.8.3 Top Competitors

- 5.3.8.4 End-Use Industry

- 5.3.8.5 Key Personnel

- 5.3.8.6 Analyst View

- 5.3.8.7 Market Share, 2023

- 5.3.9 JFE Steel Corporation

- 5.3.9.1 Overview

- 5.3.9.2 Top Products/Product Portfolio

- 5.3.9.3 Top Competitors

- 5.3.9.4 End-Use Industry

- 5.3.9.5 Key Personnel

- 5.3.9.6 Analyst View

- 5.3.9.7 Market Share, 2023

- 5.3.10 Nucor Corporation

- 5.3.10.1 Overview

- 5.3.10.2 Top Products/Product Portfolio

- 5.3.10.3 Top Competitors

- 5.3.10.4 End-Use Industry

- 5.3.10.5 Key Personnel

- 5.3.10.6 Analyst View

- 5.3.10.7 Market Share, 2023

- 5.3.11 Shandong Lenser materials Co.,LTD.

- 5.3.11.1 Overview

- 5.3.11.2 Top Products/Product Portfolio

- 5.3.11.3 Top Competitors

- 5.3.11.4 End-Use Industry

- 5.3.11.5 Analyst View

- 5.3.11.6 Market Share, 2023

- 5.3.12 HYUNDAI STEEL

- 5.3.12.1 Overview

- 5.3.12.2 Top Products/Product Portfolio

- 5.3.12.3 Top Competitors

- 5.3.12.4 End-Use Industry

- 5.3.12.5 Key Personnel

- 5.3.12.6 Analyst View

- 5.3.12.7 Market Share, 2023

- 5.3.13 Jindal Steel & Power Limited

- 5.3.13.1 Overview

- 5.3.13.2 Top Products/Product Portfolio

- 5.3.13.3 Top Competitors

- 5.3.13.4 End-Use Industry

- 5.3.13.5 Key Personnel

- 5.3.13.6 Analyst View

- 5.3.13.7 Market Share, 2023

- 5.3.14 SAIL

- 5.3.14.1 Overview

- 5.3.14.2 Top Products/Product Portfolio

- 5.3.14.3 Top Competitors

- 5.3.14.4 End-Use Industry

- 5.3.14.5 Key Personnel

- 5.3.14.6 Analyst View

- 5.3.14.7 Market Share, 2023

- 5.3.15 Cleveland-Cliffs Inc.

- 5.3.15.1 Overview

- 5.3.15.2 Top Products/Product Portfolio

- 5.3.15.3 Top Competitors

- 5.3.15.4 End-Use Industry

- 5.3.15.5 Key Personnel

- 5.3.15.6 Analyst View

- 5.3.15.7 Market Share, 2023

- 5.3.1 ArcelorMittal

6 Research Methodology

- 6.1 Data Sources

- 6.1.1 Primary Data Sources

- 6.1.2 Secondary Data Sources

- 6.1.3 Data Triangulation

- 6.2 Market Estimation and Forecast