|

|

市場調査レポート

商品コード

1714076

諜報・監視・偵察(ISR)航空機とドローン市場- 世界および地域別分析:用途別、プラットフォーム別、コンポーネント別、サポートサービス別、国別 - 分析と予測(2025年~2035年)Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market - A Global and Regional Analysis: Focus on Application, Platform, Component, Support Service, and Country - Analysis and Forecast, 2025-2035 |

||||||

カスタマイズ可能

|

|||||||

| 諜報・監視・偵察(ISR)航空機とドローン市場- 世界および地域別分析:用途別、プラットフォーム別、コンポーネント別、サポートサービス別、国別 - 分析と予測(2025年~2035年) |

|

出版日: 2025年04月28日

発行: BIS Research

ページ情報: 英文 140 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

諜報・監視・偵察(ISR)に使用される航空機とドローンは、現在の軍事・戦略技術の最先端を代表するものです。

これらの高度なシステムは、多くの場面で有用な情報を収集し、状況認識を向上させ、意思決定プロセスを支援するように設計されています。ISR航空機は、最先端のセンサー、画像システム、通信スイートを装備することが多く、情報収集、監視、偵察活動を行うために設計された有人航空機です。一方、無人航空機(UAV)は、人的リスクを抑えながら遠隔地や危険な場所に赴くことができるため、ISR能力を一変させました。軍事作戦、災害救援、国境警備、さらには環境監視までもが、すべてISR機器に依存しています。これらは、現代の戦闘における情報支配の基本的な関連性を強調するとともに、国家安全保障の将来を形成する上でテクノロジーの影響力が増大していることを示しています。

軍事技術と戦術の成長は、情報・監視・偵察(ISR)航空機とドローンの歴史と黎明期に強く基づいています。航空偵察の実践は、初期の飛行士がカメラを手に敵陣地上空を飛行した第一次世界大戦にまでさかのぼります。しかし、ISR機能が本格的に普及したのは第二次世界大戦後のことです。それ以前は、ロッキードP-38ライトニングやスーパーマリン・スピットファイアといった象徴的な航空機にカメラが搭載され、諜報活動のために重要な画像を取得していました。戦後、ジェット推進力と優れたセンサーの開発により、U-2やSR-71ブラックバードといった偵察専門機が開発されました。冷戦時代には、これらの高高度高速機が情報収集を一変させました。

早いもので20世紀後半から21世紀初頭にかけて、無人航空機(UAV)やドローンの導入がISRに変化をもたらしました。プレデターや世界ホークのような遠隔操縦の航空機は、常時監視を行い、現代の紛争やテロ活動において重要な役割を果たしています。今日、ISRは人工知能などの最先端技術を取り入れることで進歩しており、より複雑でダイナミックな世界情勢において必要不可欠な情報を取得する能力を向上させています。

情報・監視・偵察(ISR)機やドローンの導入は、軍事作戦に根本的な変化をもたらし、現代の戦闘の中核全体を変えています。これらの最先端技術資産は、監視の力学を再構築しただけでなく、産業的・戦略的思考におけるパラダイム・チェンジの引き金にもなっています。例えば、ISR機やドローンは航空宇宙分野を変え、技術革新と最先端技術の開発に拍車をかけた。ステルス性、耐久性、自律性への要求は、材料科学、アビオニクス、推進システムにおける航空機の改良をもたらしました。その結果、防衛請負業者や製造業者は研究開発への大規模な投資を余儀なくされ、この分野の経済成長と雇用創出を促しています。

第二に、ISR能力の配備は、軍事戦略と戦術に劇的な変化をもたらしました。リアルタイムで高解像度の画像、信号情報、マルチセンサーデータを提供する能力は、軍隊が偵察や情報収集を行う方法を大きく変えました。この変革は、状況認識を向上させる一方で、軍事戦闘の本質を再構築し、正確さを重視し、巻き添え被害を抑制しています。従って、産業効果は技術だけでなく、戦略の方向転換にまで及んでおり、絶え間ない適応と、こうしたプラットフォームから生み出される膨大なデータの流れを扱い、理解できる高度な資格を持った労働力の開発が必要とされています。

諜報・監視・偵察(ISR)航空機およびドローン市場は、2024年に25%のシェアを占めた偵察・監視セグメントが牽引しています。軍事・防衛産業による偵察・監視需要の増加が、諜報・監視・偵察(ISR)航空機・ドローン市場の成長を牽引しています。

ISR航空機とドローンは、偵察・監視産業に大きなメリットを提供し、軍事偵察・監視の新たな可能性を切り開きます。最も大きな利点の1つは、高高度で動作し、広範囲をカバーし、長時間持続する任務を維持する能力があるため、これまで人間の偵察では到達できなかった、あるいは危険すぎた遠隔地や敵対的な場所を軍が監視できるようになることです。これは、脅威を追跡・阻止するために継続的な監視が必要とされる、対テロ作戦や国境警備において特に重要となっています。ボーイング、ボンバルディア、エンブラエルなどの企業は、軍事用途だけでなく商業分野でも多くの任務を遂行するため、より新しく、より高度な航空機やドローンを常に開発しています。これらの企業は、軍が導入する最新技術を搭載した信頼性の高い最先端の航空機やドローンを供給することができます。

北米は全地域の中で最も成長率の高い市場でした。アジア太平洋地域は、ISR能力に対する需要の高まりとアジア諸国間の国境を越えた緊張に起因する新しい手法の導入と同様に、情報・監視・偵察(ISR)航空機とドローンの導入の点で牽引力を増すと予想されます。さらに、有利な政府政策も、予測期間中の北米と欧州の情報・監視・偵察(ISR)航空機およびドローン市場の成長をサポートすると予想されます。

北米では、米国が情報・監視・偵察(ISR)航空機およびドローン市場において、北米の他の国々の中で最も高い成長を示すと予測されています。情報・監視・偵察(ISR)航空機およびドローン市場における米国の成長は主に、米国が武器、弾薬、およびその他の軍事技術の面で世界最大の支出国の1つであるという要因によるものです。この地域には、世界で最も有名な諜報・監視・偵察(ISR)航空機とドローンのメーカーがあり、このことがこの地域の企業を諜報・監視・偵察(ISR)航空機とドローンの需要増に継続的に対応させる原動力となっています。

情報・監視・偵察(ISR)航空機とドローン市場の最近の動向

- 2023年8月、General Atomicsはオランダ空軍(RNLAF)と契約を結び、オランダ空軍(RNLAF)に8機のMQ-9Aドローンを供給することになっています。この発注は、RNLAFの海上および陸上の情報・偵察・監視(ISR)能力を向上させることを目的としています。

- 2023年7月、QUANTUM-SYSTEMS GMBHは、ドイツ軍計画局、Airbus Defence, Space GmbH、Spleenlab GmbHと契約を締結し、実環境における戦術UASの群れに必要なAIの構築部分を例示し、研究します。ドイツ国防省は、KITU 2(Kunstliche Intelligenz fur taktische UAS;戦術UASのための人工知能)プロジェクトに資金を提供しています。この研究は、戦術UASの有効性に焦点を当てています。この協力により、各組織はその中核となる資産を活用し、持ち込むことができます。

- 2023年6月、ISS Aerospace は英国国防省・国防科学技術研究所(Dstl)と、ミサイル攻撃から船舶を守るための海上用高速デコイ無人機の製造に関する契約を締結しました。ISS Aerospace は、「電子チャフ」を発射して敵ミサイルを標的船からそらし、自船に向かわせるおとりドローンを開発しました。ドデカヘキサ・ドローンは、素早く200mを飛行し、高さ50mに達しました。ドデカヘキサはプロジェクト資金提供者の要求を満たし、現在も開発が続けられています。

現代の戦争は複雑で連動しているため、防衛産業におけるマルチドメイン作戦(MDO)の増加は、ISR航空機とドローン市場の主要なビジネス促進要因の1つとなっています。MDOは、陸、空、海、宇宙、サイバースペースを含む複数の領域にわたる作戦のシームレスな統合と調整を伴い、広範な情報と状況認識を必要とするダイナミックな戦場をもたらします。このMDOの変化により、リアルタイムのデータを収集し、ドメイン間で評価し、情報に基づいた意思決定を可能にするISR能力の向上が求められています。

現在の航空侵入技術の利用可能性は、ISR航空機とドローン分野に大きな脅威をもたらします。航空機やドローンなどのISRアセットが、敵対的または競合的な空域に侵入し、重要な情報を取得する能力は、航空侵入と呼ばれます。しかし、敵の反アクセス・エリア拒否(A2/AD)能力の向上により、従来のISRシステムがより大きな危険と制限に直面する可能性がある複雑な環境が生まれています。軍用機は、最新の防空システムからの深刻な脅威に直面しています。その結果、敵の空域に進入して任務を完了するためには、地上の防空システムを回避、劣化、破壊しなければならないです。敵の領域内で敵対的な目標を狩りながら発見を回避することは、2組の変数のために非常に困難です。

C5ISRとは、コマンド、コントロール、コミュニケーション、コンピュータ、サイバー、インテリジェンス、監視、偵察の頭文字をとったもので、ISR機やドローンを含む現代の軍事作戦に不可欠な技術的・運用的要素を幅広く包含する枠組みです。この統合パラダイムは、軍事指導者に効果的な意思決定、状況認識、情報の優位性を提供する上で、これらの構成要素が相互に関連し、その重要性を強調しています。

当レポートでは、世界の諜報・監視・偵察(ISR)航空機とドローン市場について調査し、市場の概要とともに、用途別、プラットフォーム別、コンポーネント別、サポートサービス別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場:業界展望

- 動向:現状と将来への影響評価

- サプライチェーンの概要

- 研究開発レビュー

- 規制状況

- ステークホルダー分析

- 各種軍用機とドローンの比較分析

- 市場力学の概要

- 成長機会と推奨事項

第2章 情報収集・監視・偵察(ISR)航空機およびドローン市場(用途別)

- 用途のセグメンテーション

- 用途のサマリー

- 情報収集・監視・偵察(ISR)航空機およびドローン市場(用途別)、金額(100万米ドル)、数量(台)

- 偵察と監視

- 電子戦

- 捜索救助活動

- 空中早期警戒能力

- 戦術作戦

- ターゲット獲得

- その他

第3章 情報収集・監視・偵察(ISR)航空機およびドローン市場(製品別)

- 製品のセグメンテーション

- 製品のサマリー

- 情報収集・監視・偵察(ISR)航空機およびドローン市場(プラットフォーム別)、金額(100万米ドル)、数量(台)

- 軍用機

- 軍用ドローン

- 軍用ヘリコプター

- 情報収集・監視・偵察(ISR)航空機およびドローン市場(コンポーネント別)、金額(100万米ドル)、数量(台)

- 監視システム

- 通信システム

- 信号諜報(SIGINT)システム

- ソフトウェア

- 情報収集・監視・偵察(ISR)航空機およびドローン市場(サポートサービス別)、金額(100万米ドル)、数量(台)

- シミュレーション

- アクティブメンテナンス

- データ分析と後処理

第4章 地域

- 情報収集・監視・偵察(ISR)航空機およびドローン市場(地域別)

- 北米

- 欧州

- アジア太平洋

- その他の地域

第5章 市場-競合情勢と企業プロファイル

- 今後の見通し

- 地理的評価

- 企業プロファイル

- BAE Systems

- Boeing

- Bombardier

- Embraer

- Dassault Aviation

- General Atomics

- Textron Systems

- IAI

- QUANTUM-SYSTEMS GMBH

- ISS Aerospace

- その他の主要企業一覧

第6章 調査手法

List of Figures

- Figure 1: Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Scenario), $Billion, 2025, 2028, and 2035

- Figure 2: Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Region), $Million, 2024, 2027, and 2035

- Figure 3: Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Application), $Million, 2024, 2027, and 2035

- Figure 4: Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Product), $Million, 2024, 2027, and 2035

- Figure 5: Competitive Landscape Snapshot

- Figure 6: Supply Chain Analysis

- Figure 7: Value Chain Analysis

- Figure 8: Patent Analysis (by Country), January 2021-April 2025

- Figure 9: Patent Analysis (by Company), January 2021-April 2025

- Figure 10: Impact Analysis of Market Navigating Factors, 2024-2035

- Figure 11: U.S. Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market, $Million, 2024-2035

- Figure 12: Canada Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market, $Million, 2024-2035

- Figure 13: Germany Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market, $Million, 2024-2035

- Figure 14: France Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market, $Million, 2024-2035

- Figure 15: U.K. Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market, $Million, 2024-2035

- Figure 16: Russia Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market, $Million, 2024-2035

- Figure 17: Rest-of-Europe Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market, $Million, 2024-2035

- Figure 18: China Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market, $Million, 2024-2035

- Figure 19: Japan Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market, $Million, 2024-2035

- Figure 20: South Korea Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market, $Million, 2024-2035

- Figure 21: India Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market, $Million, 2024-2035

- Figure 22: Rest-of-Asia-Pacific Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market, $Million, 2024-2035

- Figure 23: South America Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market, $Million, 2024-2035

- Figure 24: Middle East and Africa Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market, $Million, 2024-2035

- Figure 25: Strategic Initiatives (by Company), 2021-2025

- Figure 26: Share of Strategic Initiatives, 2021-2025

- Figure 27: Data Triangulation

- Figure 28: Top-Down and Bottom-Up Approach

- Figure 29: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Opportunities across Region

- Table 3: Trends Overview

- Table 4: Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market Pricing Forecast, 2024-2035

- Table 5: Application Summary (by Application)

- Table 6: Product Summary (by Product)

- Table 7: Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Region), $Million, 2024-2035

- Table 8: North America Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Application), $Million, 2024-2035

- Table 9: North America Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Product), $Million, 2024-2035

- Table 10: U.S. Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Application), $Million, 2024-2035

- Table 11: U.S. Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Product), $Million, 2024-2035

- Table 12: Canada Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Application), $Million, 2024-2035

- Table 13: Canada Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Product), $Million, 2024-2035

- Table 14: Europe Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Application), $Million, 2024-2035

- Table 15: Europe Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Product), $Million, 2024-2035

- Table 16: Germany Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Application), $Million, 2024-2035

- Table 17: Germany Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Product), $Million, 2024-2035

- Table 18: France Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Application), $Million, 2024-2035

- Table 19: France Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Product), $Million, 2024-2035

- Table 20: U.K. Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Application), $Million, 2024-2035

- Table 21: U.K. Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Product), $Million, 2024-2035

- Table 22: Russia Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Application), $Million, 2024-2035

- Table 23: Russia Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Product), $Million, 2024-2035

- Table 24: Rest-of-Europe Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Application), $Million, 2024-2035

- Table 25: Rest-of-Europe Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Product), $Million, 2024-2035

- Table 26: Asia-Pacific Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Application), $Million, 2024-2035

- Table 27: Asia-Pacific Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Product), $Million, 2024-2035

- Table 28: China Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Application), $Million, 2024-2035

- Table 29: China Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Product), $Million, 2024-2035

- Table 30: Japan Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Application), $Million, 2024-2035

- Table 31: Japan Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Product), $Million, 2024-2035

- Table 32: South Korea Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Application), $Million, 2024-2035

- Table 33: South Korea Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Product), $Million, 2024-2035

- Table 34: India Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Application), $Million, 2024-2035

- Table 35: India Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Product), $Million, 2024-2035

- Table 36: Rest-of-Asia-Pacific Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Application), $Million, 2024-2035

- Table 37: Rest-of-Asia-Pacific Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Product), $Million, 2024-2035

- Table 38: Rest-of-the-World Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Application), $Million, 2024-2035

- Table 39: Rest-of-the-World Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Product), $Million, 2024-2035

- Table 40: South America Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Application), $Million, 2024-2035

- Table 41: South America Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Product), $Million, 2024-2035

- Table 42: Middle East and Africa Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Application), $Million, 2024-2035

- Table 43: Middle East and Africa Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Product), $Million, 2024-2035

- Table 44: Market Share

Introduction of Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones

Aircraft and drones used for intelligence, surveillance, and reconnaissance (ISR) represent the leading edge of current military and strategic technologies. These advanced systems are designed to collect useful information, improve situational awareness, and aid decision-making processes in a number of settings. ISR aircraft, which are frequently outfitted with cutting-edge sensors, imaging systems, and communication suites, are manned aircraft designed for gathering intelligence, performing surveillance, and carrying out reconnaissance operations. Drones, or unmanned aerial vehicles (UAVs), on the other hand, have transformed ISR capabilities due to their capacity to visit remote or dangerous places while limiting human risk. Military operations, disaster relief, border security, and even environmental monitoring have all relied on ISR equipment. These emphasize the fundamental relevance of information domination in modern combat, as well as the growing influence of technology in molding the future of national security.

Market Introduction

The growth of military technology and tactics is strongly based on the history and early days of intelligence, surveillance, and reconnaissance (ISR) aircraft and drones. The practice of aerial reconnaissance goes back to World War I when early aviators flew over enemy positions with cameras in hand. However, ISR capabilities did not really take off until World War II. Previously, cameras were installed in iconic aircraft such as the Lockheed P-38 Lightning and the Supermarine Spitfire to acquire important imagery for intelligence reasons. The development of jet propulsion and superior sensors in the postwar era resulted in the development of specialist reconnaissance aircraft such as the U-2 and the SR-71 Blackbird. During the Cold War, these high-altitude, high-speed vehicles changed intelligence gathering.

Fast forward to the late twentieth and early twenty-first centuries, the introduction of unmanned aerial vehicles (UAVs) or drones has altered ISR. Remotely piloted aircraft, such as the Predator and Global Hawk, provide constant surveillance and have played critical roles in modern conflicts and terrorist activities. Today, ISR is advancing with the incorporation of cutting-edge technology, such as artificial intelligence, which improves the capacity to acquire essential intelligence in more complex and dynamic global situations.

Industrial Impact

The introduction of intelligence, surveillance, and reconnaissance (ISR) planes and drones has brought about a fundamental change in military operations, altering the entire core of modern combat. These cutting-edge technology assets have not only reshaped the dynamics of monitoring, but they have also triggered a paradigm change in industrial and strategic thinking. For instance, ISR aircraft and drones have altered the aerospace sector, spurring innovation and the development of cutting-edge technologies. The requirement for stealth, endurance, and autonomy has resulted in aircraft improvements in materials science, avionics, and propulsion systems. As a result, defense contractors and manufacturers have been forced to invest extensively in R&D, encouraging economic growth and job creation in this sector.

Second, the deployment of ISR capabilities has resulted in a dramatic shift in military strategy and tactics. Their capacity to deliver real-time, high-resolution imaging, signals intelligence, and multi-sensor data has profoundly changed the way armed forces undertake reconnaissance and information gathering. This transformation has improved situational awareness while also reshaping the nature of military battles, stressing accuracy and limiting collateral damage. Thus, the industrial effect extends beyond technology to a strategy reorientation that necessitates constant adaptation and the development of a highly qualified workforce capable of handling and understanding the huge streams of data produced by these platforms.

Market Segmentation:

Segmentation 1: Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Application)

- Reconnaissance and Surveillance

- Electronic Warfare

- Search and Rescue Operations

- Airborne Early Warning Capabilities

- Tactical Operations

- Target Acquisition

- Others

Reconnaissance and Surveillance Segment to Dominate the Global Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Application)

The intelligence, surveillance, and reconnaissance (ISR) aircraft and drones market is led by the reconnaissance and surveillance segment, which held a 25% share in 2024. Increasing demand for reconnaissance and surveillance by the military and defense industry is driving the growth of the intelligence, surveillance, and reconnaissance (ISR) aircraft and drones market.

ISR aircraft and drones provide major benefits to the reconnaissance and surveillance industries, opening up new possibilities for military reconnaissance and surveillance. One of the most significant advantages is that they enable military forces to monitor remote and hostile places that were previously unreachable or too dangerous for human reconnaissance due to their capacity to operate at high altitudes, cover large areas, and maintain long-endurance missions. This has become especially important in counterterrorism operations and border security, where continuous monitoring is required to track and intercept threats. Companies such as Boeing, Bombardier, and Embraer are constantly developing newer and more advanced aircraft and drones to carry out a number of tasks not only for military applications but for commercial segments as well. These companies can supply reliable, cutting-edge aircraft and drones fitted with the latest technology to be implemented by the military.

Segmentation 2: Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Product)

Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (By Platform)

- Military Aircraft

- Military Drones

- Military Helicopters

Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (By Military Aircraft)

- Fighter Jets

- Special Mission Aircraft

- Transport Aircraft

Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (By Military Drones)

- Medium-Altitude Long Endurance (MALE) Drones

- High-Altitude Long Endurance (HALE) Drones

- Small Drones

Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (By Components)

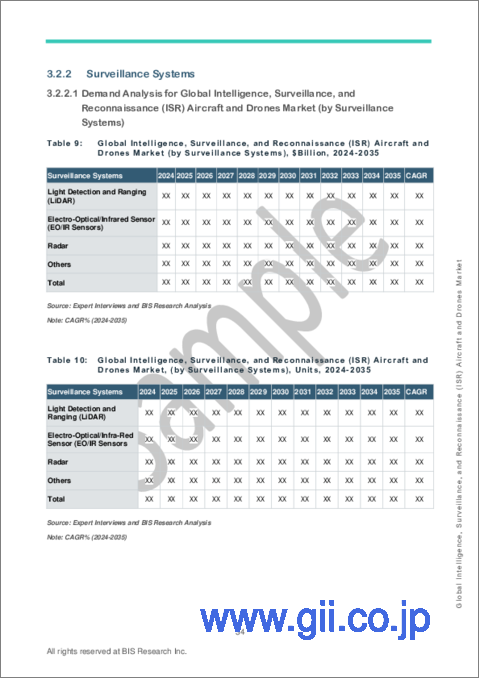

- Surveillance Systems

- Communication Systems

- Signal Intelligence (SIGINT) Systems

- Software

Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (By Surveillance Systems)

- Light Detection and Ranging (LiDAR)

- Electro-Optical/Infra-Red Sensor (EO/IR Sensors)

- Radar

- Others

Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (By Signal Intelligence (SIGINT) Systems)

- Electronic Intelligence (ELINT)

- Communication Intelligence (COMINT)

Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (By Support Services)

- Simulation

- Active Maintenance

- Data Analytics and Post-Processing

Segmentation 3: Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Region)

- North America - U.S. and Canada

- Europe - U.K., Germany, France, Russia, and Rest-of-Europe

- Asia-Pacific - Japan, India, China, South Korea, and Rest-of-Asia-Pacific

- Rest-of-the-World - Middle East and Africa and South America

North America was the highest-growing market among all the regions. Asia-Pacific is anticipated to gain traction in terms of intelligence, surveillance, and reconnaissance (ISR) aircraft and drone adoption, as well as the introduction of newer methods owing to the growing demand for ISR capabilities and cross-border tensions among Asian countries. Moreover, favorable government policies are also expected to support the growth of the intelligence, surveillance, and reconnaissance (ISR) aircraft and drones market in North America and Europe during the forecast period.

In North America, the U.S. is anticipated to show the highest growth in the intelligence, surveillance, and reconnaissance (ISR) aircraft and drones market among other countries in North America.. The growth of the U.S. in the intelligence, surveillance, and reconnaissance (ISR) aircraft and drone market is mainly due to the factor that the U.S. is one of the biggest spending countries in terms of arms, ammunition, and other technologies for its military in the world. The region is home to some of the world's most renowned manufacturers of intelligence, surveillance, and reconnaissance (ISR) aircraft and drones, and this drives the companies in this region to continuously cope with the increasing demand for intelligence, surveillance, and reconnaissance (ISR) aircraft and drones.

Recent Developments in the Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market

- In August 2023, General Atomics signed a contract with the Royal Netherlands Air Force (RNLAF), under which it would supply the Royal Netherlands Air Force (RNLAF) with 8 MQ-9A drones. The order comes for the purpose of increasing the RNLAF's maritime and overland intelligence, reconnaissance, and surveillance (ISR) capacity.

- In July 2023, QUANTUM-SYSTEMS GMBH signed a contract with the Planning Office of the German Armed Forces, Airbus Defence, Space GmbH, and Spleenlab GmbH to illustrate and study the AI building pieces needed for swarms of tactical UAS in a real-world environment. The German Ministry of Defense is funding the KITU 2 (Kunstliche Intelligenz fur taktische UAS; Artificial Intelligence for tactical UAS) project. The study focuses on the efficacy of tactical UAS. The collaboration allows each organization to capitalize on and bring in its core assets.

- In June 2023, ISS Aerospace signed a contract with the U.K. Ministry of Defence and Defence, Science and Technology Laboratory (Dstl) for the production of high-speed decoy drones for maritime applications to protect ships from missile attacks. ISS Aerospace developed a decoy drone that emits 'electronic chaff' to divert a hostile missile away from the target ship and toward itself. The Dodecahexa drone quickly covered 200 m and reached a height of 50 m. It had a peak speed of 110 miles per hour and a linear range of 10 miles. It satisfied the project funders' requirements, and the development is still ongoing.

Demand - Drivers, Challenges, and Opportunities

Market Demand Drivers: Increasing Multi-Domain Operations (MDO) in the Defense Sector

Due to the complex and linked nature of contemporary warfare, increasing multi-domain operations (MDO) in the defense industry acts as one of the primary business drivers for the ISR aircraft and drones market. MDO entails the seamless integration and coordination of operations across several domains, including land, air, sea, space, and cyberspace, resulting in a dynamic battlespace that necessitates extensive information and situational awareness. This MDO change demands improved ISR capabilities to collect real-time data, evaluate it across domains, and allow informed decision-making.

Market Challenges: Availability of Modern Systems for Air Penetration

The availability of current air penetration technologies poses a significant threat to the ISR aircraft and drone sector. The capacity of ISR assets, such as planes and drones, to penetrate hostile or contested airspace and obtain important intelligence is referred to as air penetration. However, possible enemies' improvement of anti-access and area denial (A2/AD) capabilities has created a complicated environment in which classic ISR systems may face greater dangers and restrictions. Military aircraft face a serious threat from modern air defense systems. As a result, they must evade, degrade, or destroy ground-based air defense systems in order to enter the enemy's airspace and complete their mission. Avoiding discovery while hunting for hostile targets within the adversary's area is extremely difficult due to two sets of variables.

Market Opportunities: Adoption of C5ISR

C5ISR, which stands for command, control, communications, computers, cyber, intelligence, surveillance, and reconnaissance, is a broad framework that encompasses a wide range of technological and operational elements critical to modern military operations, including those involving ISR aircraft and drones. This integrated paradigm emphasizes the interconnection of these components and their significance in providing military leaders with effective decision-making, situational awareness, and information superiority.

How can this report add value to an organization?

Product/Innovation Strategy: The product segment helps the reader understand the different types of products available for deployment and their potential globally. Moreover, the study provides the reader with a detailed understanding of the intelligence, surveillance, and reconnaissance (ISR) aircraft and drones market by application on the basis of application (reconnaissance and surveillance, electronic warfare, search and rescue operations, airborne early warning capabilities, tactical operations, target acquisition, others), and product on the basis of platform(ISR aircraft, ISR drones, and ISR helicopters), by component (surveillance systems, communications systems, signal (SIGINT) systems, software, others), by support services (simulation, active maintenance, and data analytics and post-processing).

Growth/Marketing Strategy: The intelligence, surveillance, and reconnaissance (ISR) aircraft and drones market has seen major development by key players operating in the market, such as business expansion, partnership, collaboration, and joint venture. The favored strategy for the companies has been merger and acquisition to strengthen their position in the intelligence, surveillance, and reconnaissance (ISR) aircraft and drones market. For instance, in May 2023, Bombardier signed a collaboration with General Dynamics to provide cutting-edge airborne capabilities by merging Bombardier's Global 6500 aircraft with General Dynamics Mission Systems-Canada's completely interoperable mission system technology and sensors to create the ultimate no-compromise future platform. This next-generation platform builds on General Dynamics Mission Systems-Canada's expertise in submarine hunting technology and its global reputation for providing anti-submarine warfare and airborne intelligence, surveillance, and reconnaissance (ISR), as well as maritime and overland capabilities to militaries around the world.

Competitive Strategy: Key players in the intelligence, surveillance, and reconnaissance (ISR) aircraft and drones market analyzed and profiled in the study involve major intelligence, surveillance, and reconnaissance (ISR) aircraft and drones offering companies providing aircraft and drones for the purpose. Moreover, a detailed competitive benchmarking of the players operating in the intelligence, surveillance, and reconnaissance (ISR) aircraft and drones market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Methodology: The research methodology design adopted for this specific study includes a mix of data collected from primary and secondary data sources. Both primary resources (key players, market leaders, and in-house experts) and secondary research (a host of paid and unpaid databases), along with analytical tools, are employed to build the predictive and forecast models.

Data and validation have been taken into consideration from both primary sources as well as secondary sources.

Key Considerations and Assumptions in Market Engineering and Validation

- Detailed secondary research has been done to ensure maximum coverage of manufacturers/suppliers operational in a country.

- Exact revenue information, up to a certain extent, will be extracted for each company from secondary sources and databases. Revenues specific to product/service/technology will then be estimated for each market player based on fact-based proxy indicators as well as primary inputs.

- Based on the classification, the average selling price (ASP) is calculated using the weighted average method.

- The currency conversion rate has been taken from the historical exchange rate of Oanda and/or other relevant websites.

- Any economic downturn in the future has not been taken into consideration for the market estimation and forecast.

- The base currency considered for the market analysis is US$. Currencies other than the US$ have been converted to the US$ for all statistical calculations, considering the average conversion rate for that particular year.

- The term "product" in this document may refer to "service" or "technology" as and where relevant.

- The term "manufacturers/suppliers" may refer to "service providers" or "technology providers" as and where relevant.

Primary Research

The primary sources involve industry experts from the aerospace and defense industry, including ISR capability aircraft and drone providers, defense-related industry, and ISR component manufacturers. Respondents such as CEOs, vice presidents, marketing directors, and technology and innovation directors have been interviewed to obtain and verify both qualitative and quantitative aspects of this research study.

Secondary Research

This study involves the usage of extensive secondary research, company websites, directories, and annual reports. It also makes use of databases, such as Businessweek, and others, to collect effective and useful information for a market-oriented, technical, commercial, and extensive study of the global market. In addition to the data sources, the study has been undertaken with the help of other data sources and websites, such as www.nasa.gov.

Secondary research was done to obtain critical information about the industry's value chain, the market's monetary chain, revenue models, the total pool of key players, and the current and potential use cases and applications.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on thorough secondary research, which includes analyzing company coverage, product portfolio, market penetration, and insights gathered from primary experts.

The intelligence, surveillance, and reconnaissance (ISR) aircraft and drones market comprises key players who have established themselves thoroughly and have the proper understanding of the market, accompanied by start-ups who are looking forward to establishing themselves in this highly competitive market. With the growing need for military reconnaissance purposes arising, more players will enter the global intelligence, surveillance, and reconnaissance (ISR) aircraft and drones market with each passing year.

Some prominent names established in this market are:

- BAE Systems

- Boeing

- Bombardier

- Embraer

- Dassault Aviation

- General Atomic

- Textron Systems

- IAI

- QUANTUM-SYSTEMS GMBH

- ISS Aerospace

Table of Contents

Executive Summary

Scope and Definition

Market/Product Definition

Key Questions Answered

Analysis and Forecast Note

1. Markets: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.2 Supply Chain Overview

- 1.2.1 Value Chain Analysis

- 1.2.2 Pricing Analysis

- 1.3 Research and Development Review

- 1.3.1 Patent Filing Trend by Country and by Company

- 1.4 Regulatory Landscape

- 1.5 Stakeholder Analysis

- 1.5.1 Use Case

- 1.5.2 End User and Buying Criteria

- 1.6 Comparative Analysis of Various Military Aircraft and Drones

- 1.6.1 Military Aircraft

- 1.6.2 Military Drones

- 1.7 Market Dynamics Overview

- 1.7.1 Market Drivers

- 1.7.2 Market Restraints

- 1.7.3 Market Opportunities

- 1.8 Growth Opportunities and Recommendations

- 1.8.1 Adoption of Autonomous UAS in ISR

- 1.8.2 Enhanced Data Fusion and Real-Time Processing for Enhanced ISR Outputs

2. Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Application)

- 2.1 Application Segmentation

- 2.2 Application Summary

- 2.3 Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Application), Value ($Million) and Volume (Units)

- 2.3.1 Reconnaissance and Surveillance

- 2.3.2 Electronic Warfare

- 2.3.3 Search and Rescue Operations

- 2.3.4 Airborne Early Warning Capabilities

- 2.3.5 Tactical Operations

- 2.3.6 Target Acquisition

- 2.3.7 Others

3. Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Product)

- 3.1 Product Segmentation

- 3.2 Product Summary

- 3.3 Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Platform), Value ($Million) and Volume (Units)

- 3.3.1 Military Aircraft

- 3.3.1.1 Fighter Jets

- 3.3.1.2 Special Mission Aircraft

- 3.3.1.3 Military Transport Aircraft

- 3.3.2 Military Drones

- 3.3.2.1 Medium-Altitude Long Endurance (MALE) Drones

- 3.3.2.2 High-Altitude Long Endurance (HALE) Drones

- 3.3.2.3 Small Drones

- 3.3.3 Military Helicopters

- 3.3.1 Military Aircraft

- 3.4 Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Component), Value ($Million) and Volume (Units)

- 3.4.1 Surveillance Systems

- 3.4.1.1 Light Detection and Ranging (LiDAR)

- 3.4.1.2 Electro-Optical/Infrared Sensor (EO/IR Sensors)

- 3.4.1.3 Radar

- 3.4.1.4 Others

- 3.4.2 Communication Systems

- 3.4.2.1 SATCOM

- 3.4.2.2 Antenna

- 3.4.2.3 Datalinks

- 3.4.3 Signal Intelligence (SIGINT) Systems

- 3.4.3.1 Electronic Intelligence (ELINT)

- 3.4.3.2 Communication Intelligence (COMINT)

- 3.4.4 Software

- 3.4.4.1 Mission Management

- 3.4.4.2 Threat Detection

- 3.4.1 Surveillance Systems

- 3.5 Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Support Services), Value ($Million) and Volume (Units)

- 3.5.1 Simulation

- 3.5.2 Active Maintenance

- 3.5.3 Data Analytics and Post-Processing

4. Region

- 4.1 Intelligence, Surveillance, and Reconnaissance (ISR) Aircraft and Drones Market (by Region)

- 4.2 North America

- 4.2.1 Regional Overview

- 4.2.2 Driving Factors for Market Growth

- 4.2.3 Factors Challenging the Market

- 4.2.4 Application

- 4.2.5 Product

- 4.2.6 North America (by Country)

- 4.2.6.1 U.S.

- 4.2.6.1.1 Application

- 4.2.6.1.2 Product

- 4.2.6.2 Canada

- 4.2.6.2.1 Application

- 4.2.6.2.2 Product

- 4.2.6.1 U.S.

- 4.3 Europe

- 4.3.1 Regional Overview

- 4.3.2 Driving Factors for Market Growth

- 4.3.3 Factors Challenging the Market

- 4.3.4 Application

- 4.3.5 Product

- 4.3.6 Europe (by Country)

- 4.3.6.1 Germany

- 4.3.6.1.1 Application

- 4.3.6.1.2 Product

- 4.3.6.2 France

- 4.3.6.2.1 Application

- 4.3.6.2.2 Product

- 4.3.6.3 U.K.

- 4.3.6.3.1 Application

- 4.3.6.3.2 Product

- 4.3.6.4 Russia

- 4.3.6.4.1 Application

- 4.3.6.4.2 Product

- 4.3.6.5 Rest-of-Europe

- 4.3.6.5.1 Application

- 4.3.6.5.2 Product

- 4.3.6.1 Germany

- 4.4 Asia-Pacific

- 4.4.1 Regional Overview

- 4.4.2 Driving Factors for Market Growth

- 4.4.3 Factors Challenging the Market

- 4.4.4 Application

- 4.4.5 Product

- 4.4.6 Asia-Pacific (by Country)

- 4.4.6.1 China

- 4.4.6.1.1 Application

- 4.4.6.1.2 Product

- 4.4.6.2 Japan

- 4.4.6.2.1 Application

- 4.4.6.2.2 Product

- 4.4.6.3 South Korea

- 4.4.6.3.1 Application

- 4.4.6.3.2 Product

- 4.4.6.4 India

- 4.4.6.4.1 Application

- 4.4.6.4.2 Product

- 4.4.6.5 Rest-of-Asia-Pacific

- 4.4.6.5.1 Application

- 4.4.6.5.2 Product

- 4.4.6.1 China

- 4.5 Rest-of-the-World

- 4.5.1 Regional Overview

- 4.5.2 Driving Factors for Market Growth

- 4.5.3 Factors Challenging the Market

- 4.5.4 Application

- 4.5.5 Product

- 4.5.6 Rest-of-the-World (by Region)

- 4.5.6.1 South America

- 4.5.6.1.1 Application

- 4.5.6.1.2 Product

- 4.5.6.2 Middle East and Africa

- 4.5.6.2.1 Application

- 4.5.6.2.2 Product

- 4.5.6.1 South America

5. Markets - Competitive Landscape & Company Profiles

- 5.1 Next Frontiers

- 5.2 Geographic Assessment

- 5.3 Company Profiles

- 5.3.1 BAE Systems

- 5.3.1.1 Overview

- 5.3.1.2 Top Products/Product Portfolio

- 5.3.1.3 Top Competitors

- 5.3.1.4 Target Customers

- 5.3.1.5 Key Personnel

- 5.3.1.6 Analyst View

- 5.3.1.7 Market Share

- 5.3.2 Boeing

- 5.3.2.1 Overview

- 5.3.2.2 Top Products/Product Portfolio

- 5.3.2.3 Top Competitors

- 5.3.2.4 Target Customers

- 5.3.2.5 Key Personnel

- 5.3.2.6 Analyst View

- 5.3.2.7 Market Share

- 5.3.3 Bombardier

- 5.3.3.1 Overview

- 5.3.3.2 Top Products/Product Portfolio

- 5.3.3.3 Top Competitors

- 5.3.3.4 Target Customers

- 5.3.3.5 Key Personnel

- 5.3.3.6 Analyst View

- 5.3.3.7 Market Share

- 5.3.4 Embraer

- 5.3.4.1 Overview

- 5.3.4.2 Top Products/Product Portfolio

- 5.3.4.3 Top Competitors

- 5.3.4.4 Target Customers

- 5.3.4.5 Key Personnel

- 5.3.4.6 Analyst View

- 5.3.4.7 Market Share

- 5.3.5 Dassault Aviation

- 5.3.5.1 Overview

- 5.3.5.2 Top Products/Product Portfolio

- 5.3.5.3 Top Competitors

- 5.3.5.4 Target Customers

- 5.3.5.5 Key Personnel

- 5.3.5.6 Analyst View

- 5.3.5.7 Market Share

- 5.3.6 General Atomics

- 5.3.6.1 Overview

- 5.3.6.2 Top Products/Product Portfolio

- 5.3.6.3 Top Competitors

- 5.3.6.4 Target Customers

- 5.3.6.5 Key Personnel

- 5.3.6.6 Analyst View

- 5.3.6.7 Market Share

- 5.3.7 Textron Systems

- 5.3.7.1 Overview

- 5.3.7.2 Top Products/Product Portfolio

- 5.3.7.3 Top Competitors

- 5.3.7.4 Target Customers

- 5.3.7.5 Key Personnel

- 5.3.7.6 Analyst View

- 5.3.7.7 Market Share

- 5.3.8 IAI

- 5.3.8.1 Overview

- 5.3.8.2 Top Products/Product Portfolio

- 5.3.8.3 Top Competitors

- 5.3.8.4 Target Customers

- 5.3.8.5 Key Personnel

- 5.3.8.6 Analyst View

- 5.3.8.7 Market Share

- 5.3.9 QUANTUM-SYSTEMS GMBH

- 5.3.9.1 Overview

- 5.3.9.2 Top Products/Product Portfolio

- 5.3.9.3 Top Competitors

- 5.3.9.4 Target Customers

- 5.3.9.5 Key Personnel

- 5.3.9.6 Analyst View

- 5.3.9.7 Market Share

- 5.3.10 ISS Aerospace

- 5.3.10.1 Overview

- 5.3.10.2 Top Products/Product Portfolio

- 5.3.10.3 Top Competitors

- 5.3.10.4 Target Customers

- 5.3.10.5 Key Personnel

- 5.3.10.6 Analyst View

- 5.3.10.7 Market Share

- 5.3.1 BAE Systems

- 5.4 List of Other Key Companies