|

|

市場調査レポート

商品コード

1707990

欧州の低炭素アルミニウム市場:用途別、製品別、国別 - 分析と予測(2024年~2034年)Europe Low-Carbon Aluminum Market: Focus on Application, Product, and Country - Analysis and Forecast, 2024-2034 |

||||||

カスタマイズ可能

|

|||||||

| 欧州の低炭素アルミニウム市場:用途別、製品別、国別 - 分析と予測(2024年~2034年) |

|

出版日: 2025年04月18日

発行: BIS Research

ページ情報: 英文 106 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

欧州の低炭素アルミニウムの市場規模は、2024年の298億6,000万米ドルから2034年には527億9,000万米ドルに達し、予測期間の2024年~2034年のCAGRは5.86%で成長すると予測されています。

軽量であることが評価されている低炭素アルミニウムは、電気自動車の普及に伴い欧州での需要が高まっています。自動車製造における低炭素アルミニウムの使用拡大により、自動車産業は脱炭素化への取り組みを先導しています。自動車が軽量化されればガソリンの使用量も減るため、欧州の厳格な規則によって低炭素アルミニウムの使用はさらに奨励されています。さらに、低炭素アルミニウムはCO2排出量を大幅に削減するため、自動車用途としては環境に優しい選択であり、気候変動対策と持続可能な輸送に対するこの地域のコミットメントと一致しています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2024年~2034年 |

| 2024年の評価 | 298億6,000万米ドル |

| 2034年の予測 | 527億9,000万米ドル |

| CAGR | 5.86% |

環境の持続可能性が産業変革の重要課題として浮上する中、欧州の低炭素アルミニウム産業は急速に拡大しています。炭素排出量が多く、環境に大きな悪影響を与えることで悪名高い従来のアルミニウム生産に代わって、革新的な低炭素代替エネルギーが利用されつつあります。欧州大陸の積極的な気候変動目標を達成するため、欧州の製造業者はこのダイナミックなセクターにおいて、太陽光や風力などの再生可能エネルギーを利用した最先端の製錬方法に投資しています。

この変化にはいくつかの理由があります。建設、自動車、航空宇宙などの重工業における低炭素法の採用は、排出に関する政府の厳しい法律や政策によって加速しています。エネルギー効率を促進し、全体的なカーボンフットプリントを削減する、より強く、より軽い材料へのニーズは、電気自動車や持続可能な建築材料への需要の高まりによってさらに浮き彫りになっています。さらに、リサイクル技術の新興経済諸国が循環経済を推進し、原材料への依存度を低下させたおかげで、アルミニウムは回収して再利用できるようになっています。

市場は、多大な進歩にもかかわらず、高額な初期資本支出、移行期間中の非効率な操業、再生可能エネルギーの不安定な供給がもたらすサプライチェーンの制約などの問題に対処しなければなりません。それにもかかわらず、継続的な研究開発活動、有利な規制枠組み、財政的インセンティブにより、市場はより持続可能な慣行へとシフトしていくと予想されます。低炭素アルミニウム市場は、欧州がグリーン製造の進歩をリードし続け、経済的回復力と環境責任に関する新たな基準を設定することで、より大きな産業の脱炭素化プロセスにとって極めて重要であると予想されます。

欧州の低炭素アルミニウム市場における新たな市場開拓には、再生可能エネルギーによる環境に優しい生産方法への移行やリサイクルプログラムの増加が含まれます。厳格な政府規則、環境意識、軽量で持続可能な材料を必要とする電気自動車の急速な普及は、いずれもこうした開発の触媒となっています。最先端の製錬技術とエネルギー回収技術への戦略的投資は市場の勢いをさらに加速させ、欧州の自動車メーカーと建設会社は環境に優しい製造方法の推進に重要な役割を果たしています。高い生産コスト、合理的な価格で入手可能なグリーンエネルギー源の制限、サプライチェーンの複雑さなどが、市場の障害となっています。業界の低炭素ソリューションへの移行は、従来のアルミ製造業との激しい競合によってさらに複雑になっています。アルミ製造業は、変化する持続可能性基準を満たすために多額の資本支出と技術的進歩を要求しています。

製品セグメントは、読者が低炭素アルミニウム市場に関わるさまざまな生産源と製品を理解するのに役立ちます。さらに、輸送、建築・建設、電気産業、消費財、ホイル・包装、機械・設備などのエンドユーザーに基づく低炭素アルミニウム市場の詳細な理解を読者に提供します。持続可能な技術における製造部品への低炭素アルミニウムの採用の増加は、市場の成長を促進すると予想されます。

欧州の低炭素アルミニウム市場は、事業拡大、パートナーシップ、提携、M&A、合弁事業など、市場で事業を展開する主要企業による主要な開拓が見られます。各社が好んでとる戦略は、低炭素アルミニウム市場での地位を強化するための事業拡大です。

本調査で分析・プロファイリングした欧州低炭素アルミ市場の主要企業には、低炭素アルミメーカーやエコシステム全体が含まれます。さらに、低炭素アルミニウム市場で事業を展開する参入企業の詳細な競合ベンチマーキングを実施し、読者が明確な市場情勢を提示することで、参入企業同士のスタック状況を理解できるようにしています。さらに、パートナーシップ、契約、買収、提携などの包括的な競合戦略は、読者が市場の未開拓の収益ポケットを理解するのに役立ちます。

欧州の低炭素アルミニウム市場でプロファイルされている企業は、主要な専門家から収集した情報に基づいて選択されており、企業のカバレッジ、プロジェクトポートフォリオ、市場浸透度を分析しています。

当レポートでは、欧州の低炭素アルミニウム市場について調査し、市場の概要とともに、用途別、製品別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場:業界展望

- 動向:現状と将来への影響評価

- 低炭素アルミニウムへの投資増加

- 低炭素インフラ整備に向けた政府の取り組み

- サプライチェーンの概要

- 低炭素アルミニウム市場のエコシステム

- 市場力学の概要

- スタートアップの情勢

- 特許分析

- 平均価格分析:世界および地域レベル、低炭素アルミニウム

- アルミニウム生産における炭素排出

- 貿易分析:アルミニウム、2021年~2023年

- 2023年における主要な稼働アルミニウム工場

第2章 地域

- 地域サマリー

- 欧州

- 地域概要

- 市場成長促進要因

- 市場成長抑制要因

- ドイツ

- フランス

- ロシア

- イタリア

- スペイン

- 英国

- その他

第3章 市場-競合ベンチマーキングと企業プロファイル

- 今後の見通し

- 地理的評価

- RUSAL

- Norsk Hydro ASA

- Constellium SE

- Volta Aluminium Company Limited

- Rio Tinto

- Speira GmbH

- Aluminium Dunkerque

第4章 調査手法

List of Figures

- Figure 1: Europe Low-Carbon Aluminum Market, $Billion, 2024, 2028, and 2034

- Figure 2: Low-Carbon Aluminum Market (by Region), $Billion, 2023, 2028, and 2034

- Figure 3: Europe Low-Carbon Aluminum Market (by End User), $Billion, 2023, 2028, and 2034

- Figure 4: Europe Low-Carbon Aluminum Market (by Production Pathway at Smelter Level), $Billion, 2023, 2028, and 2034

- Figure 5: Key Events

- Figure 6: Sector-Wide Emissions Reduction Trajectory

- Figure 7: Primary Electricity-Related Emissions, in Ton CO2 per Ton Aluminum Produced, 2020-2050

- Figure 8: Primary All Other Emissions, in Ton CO2 per Ton Aluminum Produced, 2020-2025

- Figure 9: Production Volumes in Europe, Metric Tons, 2015 and 2021

- Figure 10: European GHG Emissions, Per Ton of Aluminum Ingot and Type of Emissions, 2023

- Figure 11: GHG Footprint of the Aluminum Sector, 2023

- Figure 12: Reductions by Decade Compared to 2021

- Figure 13: Global End-Use of Aluminum, 2019

- Figure 14: Impact Analysis of Low-Carbon Aluminum Market Navigating Factors, 2024-2034

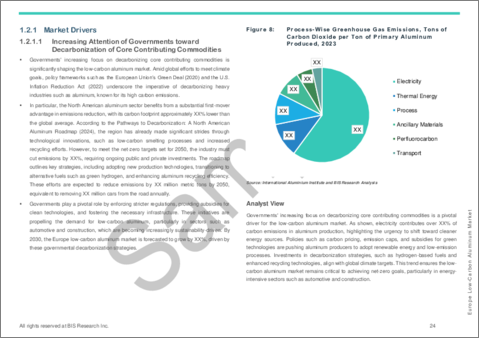

- Figure 15: Process-Wise Greenhouse Gas Emissions, Tons of Carbon Dioxide per Ton of Primary Aluminum Produced, 2023

- Figure 16: Patent Analysis (by Year), January 2021-December 2024

- Figure 17: Patent Analysis (by Country), January 2021-December 2024

- Figure 18: Aluminum Trade Analysis - Net Trade (by Region), $Billion, 2021-2023

- Figure 19: Aluminum Trade Analysis - Net Trade (by Region), $Billion, 2021-2023

- Figure 20: Germany Low-Carbon Aluminum Market, $Billion, 2023-2034

- Figure 21: France Low-Carbon Aluminum Market, $Billion, 2023-2034

- Figure 22: Russia Low-Carbon Aluminum Market, $Billion, 2023-2034

- Figure 23: Italy Low-Carbon Aluminum Market, $Billion, 2023-2034

- Figure 24: Spain Low-Carbon Aluminum Market, $Billion, 2023-2034

- Figure 25: U.K. Low-Carbon Aluminum Market, $Billion, 2023-2034

- Figure 26: Rest-of-Europe Low-Carbon Aluminum Market, $Billion, 2023-2034

- Figure 27: Strategic Initiatives, January 2021-December 2024

- Figure 28: Data Triangulation

- Figure 29: Top-Down and Bottom-Up Approach

- Figure 30: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Opportunities across Regions

- Table 3: Competitive Landscape Snapshot

- Table 4: Recent Investments in Low-Carbon Aluminum

- Table 5: Recent Government Activities toward Low-Carbon Infrastructure

- Table 6: Timeline of the ASI-Endorsed Method

- Table 7: Scenario-Based Forecasted Electricity Grid Developments

- Table 8: Regulatory/Certification Bodies in Low-Carbon Aluminum Market

- Table 9: Recent Government Programs in Low-Carbon Aluminum Market

- Table 10: Key Research Institutes and University Programs in Low-Carbon Aluminum Market

- Table 11: Recent R&D Initiatives in Low-Carbon Aluminum Market

- Table 12: Start-ups and Investment Landscape

- Table 13: Low-Carbon Aluminum Market (by Region), $/Ton, 2023-2034

- Table 14: Greenhouse Gas Emissions Intensity - Primary Aluminum, Tons of CO2e per Ton of Primary Aluminum, 2023

- Table 15: Greenhouse Gas Emissions - Aluminum Sector, Overall CO2 Emissions, Million Tons of CO2e, 2023

- Table 16: List of Key Operating Aluminum Plants, 2023

- Table 17: Low-Carbon Aluminum Market (by Region), $Billion, 2023-2034

- Table 18: Europe Low-Carbon Aluminum Market (by End User), $Billion, 2023-2034

- Table 19: Europe Low-Carbon Aluminum Market (by Production Pathway at Smelter Level), $Billion, 2023-2034

- Table 20: Germany Low-Carbon Aluminum Market (by End User), $Billion, 2023-2034

- Table 21: Germany Low-Carbon Aluminum Market (by Production Pathway at Smelter Level), $Billion, 2023-2034

- Table 22: France Low-Carbon Aluminum Market (by End User), $Billion, 2023-2034

- Table 23: France Low-Carbon Aluminum Market (by Production Pathway at Smelter Level), $Billion, 2023-2034

- Table 24: Russia Low-Carbon Aluminum Market (by End User), $Billion, 2023-2034

- Table 25: Russia Low-Carbon Aluminum Market (by Production Pathway at Smelter Level), $Billion, 2023-2034

- Table 26: Italy Low-Carbon Aluminum Market (by End User), $Billion, 2023-2034

- Table 27: Italy Low-Carbon Aluminum Market (by Production Pathway at Smelter Level), $Billion, 2023-2034

- Table 28: Spain Low-Carbon Aluminum Market (by End User), $Billion, 2023-2034

- Table 29: Spain Low-Carbon Aluminum Market (by Production Pathway at Smelter Level), $Billion, 2023-2034

- Table 30: U.K. Low-Carbon Aluminum Market (by End User), $Billion, 2023-2034

- Table 31: U.K. Low-Carbon Aluminum Market (by Production Pathway at Smelter Level), $Billion, 2023-2034

- Table 32: Rest-of-Europe Low-Carbon Aluminum Market (by End User), $Billion, 2023-2034

- Table 33: Rest-of-Europe Low-Carbon Aluminum Market (by Production Pathway at Smelter Level), $Billion, 2023-2034

- Table 34: Global Market Share, 2023

Introduction to Europe Low-Carbon Aluminum Market

The Europe low-carbon aluminum market is projected to reach $52.79 billion by 2034 from $29.86 billion in 2024, growing at a CAGR of 5.86% during the forecast period 2024-2034. Low-carbon aluminum, which is valued for its lightweight qualities, is becoming more and more in demand in Europe as electric vehicles gain popularity. With a growing use of low-carbon aluminum in vehicle manufacturing, the automotive industry is leading the way in decarbonisation efforts. Its use is further encouraged by strict European rules, since lighter vehicles use less petrol. Furthermore, low-carbon aluminum is an environmentally friendly choice for automotive applications since it drastically reduces CO2 emissions, which is consistent with the region's commitment to climate action and sustainable transportation.

Market Introduction

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2024 - 2034 |

| 2024 Evaluation | $29.86 Billion |

| 2034 Forecast | $52.79 Billion |

| CAGR | 5.86% |

As environmental sustainability emerges as a key subject in industrial change, the low-carbon aluminum industry in Europe is expanding quickly. Innovative low-carbon alternatives are replacing traditional aluminum production, which is notorious for its high carbon emissions and has a substantial negative environmental impact. In order to meet the continent's aggressive climate goals, European producers are investing in cutting-edge smelting methods driven by renewable energy sources like solar and wind in this dynamic sector.

There are several reasons for this change. Adoption of low-carbon methods in heavy industries, such as construction, automotive, and aerospace, has accelerated due to strict government laws and policies on emissions. The need for stronger yet lighter materials that promote energy efficiency and reduce overall carbon footprints is further highlighted by the growing demand for electric vehicles and sustainable building materials. Furthermore, aluminum can now be recovered and reused thanks to developments in recycling technology, which promote a circular economy and lessen reliance on raw materials.

The market still has to deal with issues including costly initial capital expenditure, inefficient operations during the transition period, and supply chain limitations brought on by the erratic supply of renewable energy, despite tremendous advancements. Nonetheless, the market is expected to shift towards more sustainable practices due to the continuous R&D activities, favourable regulatory frameworks, and financial incentives. The market for low-carbon aluminum is expected to be crucial to the larger industrial decarbonisation process as Europe continues to lead the way in green manufacturing advances, setting new standards for economic resilience and environmental responsibility.

Market Segmentation

Segmentation 1: by End-User

- Transportation

- Building and Construction

- Electrical Industry

- Consumer Goods

- Foil and Packaging

- Machinery and Equipment

- Others

Segmentation 2: by Production Pathway at Smelter Level

- Primary Aluminum Production

- Renewable-Powered Electrolysis (Traditional Hall-Heroult Process with Renewable Energy)

Solar Energy

Wind Energy

Hydro Energy

Hydrogen Powered Electrolysis

- CCUS Integration to Reduce Process Emissions

- Inert Anode Technology

- Drained Cathode Cell

- Recycled or Secondary Aluminum Production

Segmentation 3: by Country

- Germany

- France

- Russia

- Italy

- Spain

- U.K.

- Rest-of-Europe

Market Trends, Drives and Challenges of Europe Low-Carbon Aluminum Market

New developments in the low-carbon aluminum market in Europe include a shift to greener production methods driven by renewable energy sources and a rise in recycling programs. Strict government rules, environmental consciousness, and the quick uptake of electric vehicles-which require lightweight, sustainable materials-all serve as catalysts for these developments. Strategic investments in cutting-edge smelting and energy recovery technologies further accelerate market momentum, while European automakers and construction companies play a key role in promoting greener manufacturing practices. High production costs, restricted availability of reasonably priced green energy sources, and supply chain complexity are some of the market's obstacles. The industry's shift to low-carbon solutions is further complicated by the intense competition from traditional aluminum manufacturing, which demands large capital expenditures and technological advancements to fulfil changing sustainability criteria.

How can this report add value to an organization?

Product/Innovation Strategy: The product segment helps the reader understand the different sources of production and products involved in the low-carbon aluminum market. Moreover, the study provides the reader with a detailed understanding of the low-carbon aluminum market based on end users, including transportation, building and construction, the electrical industry, consumer goods, foil and packaging, machinery and equipment, and others. The increasing adoption of low-carbon aluminum in manufacturing components in sustainable technologies is expected to fuel the growth of the market.

Growth/Marketing Strategy: The Europe low-carbon aluminum market has seen major development by key players operating in the market, such as business expansions, partnerships, collaborations, mergers and acquisitions, and joint ventures. The favored strategy for the companies has been business expansions to strengthen their position in the low-carbon aluminum market.

Competitive Strategy: Key players in the Europe low-carbon aluminum market analyzed and profiled in the study involve low-carbon aluminum producers and the overall ecosystem. Moreover, a detailed competitive benchmarking of the players operating in the low-carbon aluminum market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, acquisitions, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled in the Europe low-carbon aluminum market have been selected based on input gathered from primary experts and analyzing company coverage, project portfolio, and market penetration.

Some of the prominent companies in this market are:

- RUSAL

- Norsk Hydro ASA

- Constellium SE

- Volta Aluminium Company Limited

- Rio Tinto

- Speira GmbH

- Aluminium Dunkerque

Table of Contents

Executive Summary

Scope and Definition

1 Market: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.1.1 Increasing Investments in Low-Carbon Aluminum

- 1.1.2 Government Activities Toward the Establishment of Low-Carbon Infrastructure

- 1.2 Supply Chain Overview

- 1.3 Ecosystem of the Low-Carbon Aluminum Market

- 1.3.1 Consortiums and Associations

- 1.3.1.1 Analysis of ASI GHG Production Pathway

- 1.3.1.2 Analysis of European Aluminium Association Science-Based Decarbonization Pathways

- 1.3.1.3 Analysis of Pathway Set by World Economic Forum

- 1.3.2 Regulatory/Certification Bodies

- 1.3.3 Government Programs

- 1.3.4 Programs by Research Institutions and Universities

- 1.3.1 Consortiums and Associations

- 1.4 Market Dynamics Overview

- 1.4.1 Market Drivers

- 1.4.1.1 Increasing Attention of Governments toward Decarbonization of Core Contributing Commodities

- 1.4.1.2 Growing Research and Development Activities to Achieve Near Zero Emissions

- 1.4.2 Market Challenges

- 1.4.2.1 Lower Recycling Rates for Aluminum in Various Industries

- 1.4.2.2 Volatile Low-Carbon Aluminum Prices

- 1.4.3 Business Strategies

- 1.4.3.1 Product Developments

- 1.4.3.2 Market Developments

- 1.4.4 Corporate Strategies

- 1.4.4.1 Partnerships and Joint Ventures

- 1.4.5 Market Opportunities

- 1.4.5.1 Low-Carbon Aluminum in Niche Segments such as Ultra-Low-CO2 Grades

- 1.4.5.2 Climate Mitigation Initiatives to Increase Demand for Sustainably Sourced Aluminum

- 1.4.1 Market Drivers

- 1.5 Start-Ups Landscape

- 1.5.1 Key Start-Ups in the Ecosystem

- 1.6 Patent Analysis

- 1.6.1 Patent Filing Trend (by Number of Patents, by Year and by Country)

- 1.7 Average Pricing Analysis: Global and Regional Level, Low-Carbon Aluminum

- 1.8 Embedded Carbon Emissions in Aluminum Production

- 1.9 Trade Analysis: Aluminum, 2021-2023

- 1.1 Key Operating Aluminum Plants, 2023

2 Region

- 2.1 Regional Summary

- 2.2 Europe

- 2.2.1 Regional Overview

- 2.2.2 Driving Factors for Market Growth

- 2.2.3 Factors Challenging the Market

- 2.2.3.1 Application

- 2.2.3.2 Product

- 2.2.4 Germany

- 2.2.4.1 Application

- 2.2.4.2 Product

- 2.2.5 France

- 2.2.5.1 Application

- 2.2.5.2 Product

- 2.2.6 Russia

- 2.2.6.1 Application

- 2.2.6.2 Product

- 2.2.7 Italy

- 2.2.7.1 Application

- 2.2.7.2 Product

- 2.2.8 Spain

- 2.2.8.1 Application

- 2.2.8.2 Product

- 2.2.9 U.K.

- 2.2.9.1 Application

- 2.2.9.2 Product

- 2.2.10 Rest-of-Europe

- 2.2.10.1 Application

- 2.2.10.2 Product

3 Markets - Competitive Benchmarking &

Company Profiles

- 3.1 Next Frontiers

- 3.2 Geographic Assessment

- 3.2.1 RUSAL

- 3.2.1.1 Overview

- 3.2.1.2 Top Competitors

- 3.2.1.3 Top Products/Product Portfolio

- 3.2.1.4 Target Customers/End-Use Industries

- 3.2.1.5 Key Personnel

- 3.2.1.6 Analyst View

- 3.2.1.7 Market Share, 2023

- 3.2.2 Norsk Hydro ASA

- 3.2.2.1 Overview

- 3.2.2.2 Top Competitors

- 3.2.2.3 Top Products/Product Portfolio

- 3.2.2.4 Target Customers/End-Use Industries

- 3.2.2.5 Key Personnel

- 3.2.2.6 Analyst View

- 3.2.2.7 Market Share, 2023

- 3.2.3 Constellium SE

- 3.2.3.1 Overview

- 3.2.3.2 Top Competitors

- 3.2.3.3 Top Products/Product Portfolio

- 3.2.3.4 Target Customers/End-Use Industries

- 3.2.3.5 Key Personnel

- 3.2.3.6 Analyst View

- 3.2.3.7 Market Share, 2023

- 3.2.4 Volta Aluminium Company Limited

- 3.2.4.1 Overview

- 3.2.4.2 Top Competitors

- 3.2.4.3 Top Products/Product Portfolio

- 3.2.4.4 Target Customers/End-Use Industries

- 3.2.4.5 Key Personnel

- 3.2.4.6 Analyst View

- 3.2.4.7 Market Share, 2023

- 3.2.5 Rio Tinto

- 3.2.5.1 Overview

- 3.2.5.2 Top Competitors

- 3.2.5.3 Top Products/Product Portfolio

- 3.2.5.4 Target Customers/End-Use Industries

- 3.2.5.5 Key Personnel

- 3.2.5.6 Analyst View

- 3.2.5.7 Market Share, 2023

- 3.2.6 Speira GmbH

- 3.2.6.1 Overview

- 3.2.6.2 Top Competitors

- 3.2.6.3 Top Products/Product Portfolio

- 3.2.6.4 Target Customers/End-Use Industries

- 3.2.6.5 Key Personnel

- 3.2.6.6 Analyst View

- 3.2.6.7 Market Share, 2023

- 3.2.7 Aluminium Dunkerque

- 3.2.7.1 Overview

- 3.2.7.2 Top Competitors

- 3.2.7.3 Top Products/Product Portfolio

- 3.2.7.4 Target Customers/End-Use Industries

- 3.2.7.5 Key Personnel

- 3.2.7.6 Analyst View

- 3.2.7.7 Market Share, 2023

- 3.2.1 RUSAL

4 Research Methodology

- 4.1 Data Sources

- 4.1.1 Primary Data Sources

- 4.1.2 Secondary Data Sources

- 4.1.3 Data Triangulation

- 4.2 Market Estimation and Forecast