|

|

市場調査レポート

商品コード

1703924

MEGC(複数タンク搭載ガスコンテナ)市場 - 世界および地域別分析:用途別、製品タイプ別、国別 - 分析と予測(2024年~2034年)Multiple-Element Gas Container Market - A Global and Regional Analysis: Focus on Application, Product Type, and Country-Level Analysis - Analysis and Forecast, 2024-2034 |

||||||

カスタマイズ可能

|

|||||||

| MEGC(複数タンク搭載ガスコンテナ)市場 - 世界および地域別分析:用途別、製品タイプ別、国別 - 分析と予測(2024年~2034年) |

|

出版日: 2025年04月15日

発行: BIS Research

ページ情報: 英文 149 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

MEGC(複数タンク搭載ガスコンテナ)の市場規模は、2024年に1億8,710万米ドルとなりました。

同市場は8.59%のCAGRで拡大し、2034年には4億2,650万米ドルに達すると予測されています。この成長は、さまざまな輸送、エネルギー、産業分野でCNG、LNG、水素などの代替燃料の採用が増加していることが背景にあります。同市場では、特に安全性、効率性、費用対効果の面で、ガス貯蔵・輸送システムの著しい技術進歩が見られます。厳しい炭素排出規制とクリーンエネルギー・ソリューションの世界の推進が、このダイナミックな市場に影響を与えています。業界間の協力、複合材料の革新、水素インフラの拡大は、MEGC市場の進化を促進する主な要因です。持続可能で信頼性の高いガス輸送ソリューションへの需要が高まる中、市場は公衆衛生と環境の持続可能性を確保しつつ、エネルギー転換の需要の高まりに対応するため、先進的な貯蔵技術、インフラ開拓、安全基準に引き続き注目しています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2024年~2034年 |

| 2024年の評価 | 1億8,710万米ドル |

| 2034年の予測 | 4億2,650万米ドル |

| CAGR | 8.59% |

マルチプルエレメントガスコンテナ(MEGC)は、CNG、LNG、水素などの圧縮ガスを安全かつ効率的に輸送するために使用される特殊な貯蔵システムです。これらの容器は、複数の高圧ガスボンベを1つのフレームに取り付けたもので、最適な貯蔵容量と輸送中の安定性を確保するように設計されています。MEGCは、天然ガス配給、再生可能エネルギー、輸送など、短距離・長距離輸送に信頼性と安全性の高いガス貯蔵ソリューションが必要とされる産業において極めて重要です。複合材料と安全技術の進歩により、MEGCは燃料補給ステーション、水素モビリティ、工業用ガス供給などの用途でますます使用されるようになっており、よりクリーンなエネルギー源への移行において重要な役割を果たしています。MEGCの設計は、貯蔵効率を最大化する一方で軽量化に重点を置いており、持続可能なエネルギー・ソリューションに対する需要の高まりに欠かせないものとなっています。

MEGC市場は、CNG、LNG、水素などの圧縮ガスを輸送するための効率的で安全かつ持続可能なソリューションに対する需要の高まりにより、著しい成長を遂げています。MEGCは、1つのフレームに複数の高圧ボンベを取り付けたもので、スペース効率を最大化し、輸送中の安全性を確保する信頼性の高い貯蔵ソリューションを提供します。これらの容器は、天然ガス配給、再生可能エネルギー、水素燃料輸送などの産業で広く使用されています。市場の成長は、クリーンエネルギー・ソリューションへの世界のシフト、二酸化炭素排出量削減のための規制要件、ガス貯蔵技術改善の必要性によってもたらされています。複合材料と安全システムの継続的な進歩により、MEGCは、特に水素モビリティと産業ガス用途において、増大する燃料インフラの需要を満たすためのコスト効率と拡張性に優れたアプローチを提供します。代替燃料源の必要性が高まるにつれ、MEGC市場は技術革新、効率、持続可能性に焦点を当てながら進化を続けています。

MEGC市場の産業への影響は、エネルギー、輸送、産業ガス用途など様々な分野に及んでいます。複合材料や高圧貯蔵システムの使用など、MEGC技術の進歩が技術革新を促進し、ガス輸送の効率と安全性を高めています。こうした進歩は、ガス生産者、インフラ開発者、技術プロバイダー間の協力を促進し、より高い業界基準を設定し、持続可能なエネルギー・ソリューションの限界を押し広げます。産業界と政府がCNG、LNG、水素を含むよりクリーンな燃料を優先する中、マルチエレメント・ガス容器市場は低排出エネルギー源への移行に大きく貢献し、世界の環境・健康安全目標に合致します。その結果、より厳格な規制の枠組みが促進され、産業界による安全プロトコルの遵守が促進されます。Hexagon Composites、Luxfer Gas CylindersNPROXX、CIMC Enric Holdingsなど、MEGC市場の主要企業は、戦略的パートナーシップ、技術革新、貯蔵インフラの拡大に注力し、需要の拡大に対応しています。MEGC市場は、持続可能なエネルギーシステムを推進し、信頼性の高いガス配給を確保し、よりクリーンなエネルギー源への世界のシフトを支援する上で極めて重要な役割を果たしています。

天然ガスセグメントは、輸送部門と産業用途における圧縮天然ガス(CNG)の需要拡大に牽引され、用途別市場を独占すると予想されます。MEGCは、特に大規模なパイプライン・インフラがない地域において、長距離の天然ガスの安全かつ効率的でコスト効率の高い輸送に不可欠です。よりクリーンな代替エネルギーを求める世界の動きに伴い、CNGはガソリンやディーゼルに比べて炭素排出量が少ないため、商用車、公共交通機関、大型トラック用の燃料として好まれるようになっています。

20フィートMEGCは、容量、輸送性、コスト効率の理想的なバランスにより、製品サイズ別市場を独占すると予想されます。このコンテナ・サイズは、既存の物流ネットワークに容易に統合できる柔軟なソリューションを提供するため、CNG、LNG、水素の輸送に複数の産業で広く使用されています。20フィートMEGCは、道路、鉄道、海上で効率的に輸送できる標準サイズであり、複合一貫輸送や国際輸送に適しています。

北米は、輸送や産業用途での天然ガスや水素の採用増加により、MEGC市場を地域別にリードすることになります。米国とカナダはクリーンエネルギーの導入で大きく前進しており、特に大型トラック、公共交通機関、商用フリートなどの輸送部門で圧縮天然ガス(CNG)の需要が伸びています。さらに、米国とカナダにおける水素インフラの開発と水素燃料電池車に対する政府の優遇措置が、水素を貯蔵・輸送するMEGCの需要をさらに促進しています。

国境を越えた貿易と国際的なエネルギー市場の統合の増加は、地域間のエネルギー流通ネットワークの拡大を促進するため、MEGC市場の主要促進要因です。世界のエネルギー市場の統合が進むにつれ、圧縮天然ガス(CNG)、液化天然ガス(LNG)、水素の輸送に対する効率的で信頼性が高く、拡張性のあるソリューションに対する需要が高まっています。MEGCは、特にパイプライン・インフラが限られているか存在しない地域において、国境を越えたエネルギー取引を可能にする上で重要な役割を果たしています。MEGCは、大量のガスを輸送するための柔軟で費用対効果の高いソリューションを提供し、各国が世界のエネルギー供給を利用し、地域資源への依存を減らし、増大するエネルギー需要を満たすことを可能にします。国際貿易協定の増加、エネルギー・ハブの設立、仮想パイプラインの開発はすべてMEGC市場の拡大に寄与し、国境を越えて天然ガスと水素を安全かつ効率的に輸送する高度な貯蔵・輸送技術の必要性を促しています。エネルギー市場の統合が進むにつれ、MEGCはこの世界なエネルギー交換を促進する重要な要素であり続けると思われます。

初期投資とメンテナンスのコストが高いことは、MEGC市場にとって大きな課題です。MEGCの開発、製造、配備には多額の資本投資が必要であり、特に高圧コンポジット・シリンダーと、容器の安全性と耐久性を確保する高度な材料を製造する必要があります。さらに、CNG、LNG、水素のようなガスの安全な輸送、取り扱い、燃料補給に必要なインフラが、全体的なコストを押し上げます。MEGCのメンテナンスも懸念事項のひとつで、定期的な検査、再確認プロセス、厳格な安全基準や規制基準の遵守により、運用コストがかさむ可能性があります。こうした経済的負担は、中小企業や新規参入企業がMEGCソリューションへの投資を躊躇させ、地域によっては市場の成長を制限する可能性があります。

再生可能エネルギー・プロジェクトとの統合は、特に世界のエネルギー転換がよりクリーンで持続可能なエネルギー源に向かって加速する中で、多重要素ガス容器市場に大きな機会をもたらします。太陽光や風力などの再生可能エネルギーの利用が増加するにつれ、断続的なエネルギー生産とバランスを取ることができるエネルギー貯蔵ソリューションへのニーズが高まっています。再生可能エネルギー駆動の電気分解によって製造される水素は、エネルギー・キャリアとして脚光を浴びており、MEGGYCはグリーン水素を貯蔵し、産業用途、輸送、発電などさまざまな分野に輸送するのに理想的です。MEGCは、再生可能エネルギーが過剰な期間に生産された水素の貯蔵を容易にし、需要がピークに達した時や再生可能エネルギー発電が低い時に輸送して利用することができます。この統合は、エネルギー・グリッドを安定させ、二酸化炭素排出量を削減し、再生可能エネルギー・プロジェクトの経済性を高めるのに役立ちます。

当レポートは、MEGC(複数タンク搭載ガスコンテナ)市場を包括的に分析し、市場情勢を形成する新たな動向、技術的進歩、規制状況を企業が理解できるようにすることで、組織に大きな付加価値を与えることができます。また、CNG、LNG、水素ソリューションに対する需要の増加などの主要な促進要因や、初期投資やメンテナンスコストの高さなどの課題に関する洞察も提供しています。当レポートは、再生可能エネルギープロジェクトとMEGCの統合や国境を越えた貿易の拡大などの市場機会を特定することで、戦略的意思決定や投資計画の指針となります。さらに、安全基準と規制基準の遵守の重要性を強調し、組織がベストプラクティスに合致できるようにしています。主要市場参入企業とその戦略的動き(提携、買収、イノベーションなど)を分析することで、企業は競争上の優位性と提携の機会を見出すことができます。このような知識により、市場の拡大、業務効率の向上、長期的な収益性の改善が促進されます。

目次

エグゼクティブサマリー

第1章 市場

- 動向:現状と将来への影響評価

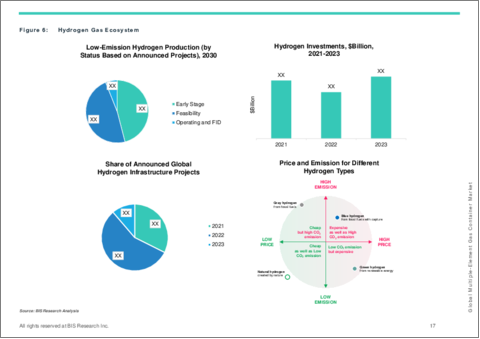

- 水素エコシステム

- 天然ガスサプライチェーンの課題と解決策

- 産業用ガスサプライチェーンの内訳

- 研究開発レビュー

- 規制状況

- 市場力学:概要

第2章 用途

- 用途のセグメンテーション

- 用途のサマリー

- MEGC市場(用途別)

- 用途

第3章 製品

- 製品のセグメンテーション

- 製品のサマリー

- MEGC市場(タイプ別)

第4章 地域

- 地域のサマリー

- 促進要因と抑制要因

- 北米

- 欧州

- アジア太平洋

- その他の地域

第5章 市場-競合ベンチマーキングと企業プロファイル

- 今後の見通し

- 地理的評価

- Hexagon Composites ASA

- Worthington Enterprises, Inc.

- City Machine & Welding, Inc.

- Luxfer Gas Cylinders

- Koyuncu Gas and Gas Equipment

- Gaznet OU

- EKC

- Quantum Fuel Systems LLC.

- Faber Industrie SPA

- Beijing Tianhai Industry Co., Ltd.

- FIBA Technologies, Inc.

- Pico Flow Controls Group (PFC Group )

- NPROXX

- Rheinmetall AG

- CIMC Enric Holdings Limited

- その他

第6章 調査手法

List of Figures

- Figure 1: Multiple-Element Gas Container Market (by Scenario), $Million, 2023, 2027, and 2034

- Figure 2: Multiple-Element Gas Container Market (by Region), $Million, 2023, 2027, and 2034

- Figure 3: Multiple-Element Gas Container Market, Pricing Analysis (by Region), $Thousand/Unit, 2023, 2027, and 2034

- Figure 4: Multiple-Element Gas Container Market (by Application), $Million, 2023, 2027, and 2034

- Figure 5: Multiple-Element Gas Container Market (by Type), $Million, 2023, 2027, and 2034

- Figure 6: Key Events

- Figure 7: Share of Sources of Electricity Generation in U.S., 2023

- Figure 8: Global Electricity Generation from Natural Gas, Terawatt-hours, 2019-2022

- Figure 9: Hydrogen Gas Ecosystem

- Figure 10: Snapshot of Oil and Gas Supply Chain

- Figure 11: Value Chain Analysis

- Figure 12: Patent Analysis (by Company), January 2021-March 2025

- Figure 13: Patent Analysis (by Patent Office), January 2021-March 2025

- Figure 14: U.S. Multiple-Element Gas Container Market, $Million, 2023-2034

- Figure 15: Canada Multiple-Element Gas Container Market, $Million, 2023-2034

- Figure 16: Mexico Multiple-Element Gas Container Market, $Million, 2023-2034

- Figure 17: Germany Multiple-Element Gas Container Market, $Million, 2023-2034

- Figure 18: France Multiple-Element Gas Container Market, $Million, 2023-2034

- Figure 19: U.K. Multiple-Element Gas Container Market, $Million, 2023-2034

- Figure 20: Italy Multiple-Element Gas Container Market, $Million, 2023-2034

- Figure 21: Spain Multiple-Element Gas Container Market, $Million, 2023-2034

- Figure 22: Netherlands Multiple-Element Gas Container Market, $Million, 2023-2034

- Figure 23: Rest-of-Europe Multiple-Element Gas Container Market, $Million, 2023-2034

- Figure 24: China Multiple-Element Gas Container Market, $Million, 2023-2034

- Figure 25: Japan Multiple-Element Gas Container Market, $Million, 2023-2034

- Figure 26: Australia Multiple-Element Gas Container Market, $Million, 2023-2034

- Figure 27: South Korea Multiple-Element Gas Container Market, $Million, 2023-2034

- Figure 28: India Multiple-Element Gas Container Market, $Million, 2023-2034

- Figure 29: Rest-of-Asia-Pacific Multiple-Element Gas Container Market, $Million, 2023-2034

- Figure 30: Brazil Multiple-Element Gas Container Market, $Million, 2023-2034

- Figure 31: U.A.E. Multiple-Element Gas Container Market, $Million, 2023-2034

- Figure 32: Other Multiple-Element Gas Container Market, $Million, 2023-2034

- Figure 33: Strategic Initiatives (by Company), 2020-March 2025

- Figure 34: Share of Strategic Initiatives, January 2020-March 2025

- Figure 35: Data Triangulation

- Figure 36: Top-Down and Bottom-Up Approach

- Figure 37: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Opportunities across Regions

- Table 3: Competitive Landscape Snapshot

- Table 4: Trends Overview

- Table 5: Natural Gas Supply Chain Challenges and Remedies

- Table 6: Multiple-Element Gas Container Market, Pricing Forecast (by Type), $Thousand/Unit, 2023-2034

- Table 7: Global Multiple-Element Gas Container Market-Related R&D Investments

- Table 8: Impact Analysis of Market Navigating Factors, 2023-2034

- Table 9: Global Multiple-Element Gas Container Market (by Region), Units, 2023-2034

- Table 10: Global Multiple-Element Gas Container Market (by Region), $Million, 2023-2034

- Table 11: North America Multiple-Element Gas Container Market (by Application), Units, 2023-2034

- Table 12: North America Multiple-Element Gas Container Market (by Application), $Million, 2023-2034

- Table 13: North America Multiple-Element Gas Container Market (by Type), Units, 2023-2034

- Table 14: North America Multiple-Element Gas Container Market (by Type), $Million, 2023-2034

- Table 15: U.S. Multiple-Element Gas Container Market (by Application), Units, 2023-2034

- Table 16: U.S. Multiple-Element Gas Container Market (by Application), $Million, 2023-2034

- Table 17: U.S. Multiple-Element Gas Container Market (by Type), Units, 2023-2034

- Table 18: U.S. Multiple-Element Gas Container Market (by Type), $Million, 2023-2034

- Table 19: Canada Multiple-Element Gas Container Market (by Application), Units, 2023-2034

- Table 20: Canada Multiple-Element Gas Container Market (by Application), $Million, 2023-2034

- Table 21: Canada Multiple-Element Gas Container Market (by Type), Units, 2023-2034

- Table 22: Canada Multiple-Element Gas Container Market (by Type), $Million, 2023-2034

- Table 23: Mexico Multiple-Element Gas Container Market (by Application), Units, 2023-2034

- Table 24: Mexico Multiple-Element Gas Container Market (by Application), $Million, 2023-2034

- Table 25: Mexico Multiple-Element Gas Container Market (by Type), Units, 2023-2034

- Table 26: Mexico Multiple-Element Gas Container Market (by Type), $Million, 2023-2034

- Table 27: Europe Multiple-Element Gas Container Market (by Application), Units, 2023-2034

- Table 28: Europe Multiple-Element Gas Container Market (by Application), $Million, 2023-2034

- Table 29: Europe Multiple-Element Gas Container Market (by Type), Units, 2023-2034

- Table 30: Europe Multiple-Element Gas Container Market (by Type), $Million, 2023-2034

- Table 31: Germany Multiple-Element Gas Container Market (by Application), Units, 2023-2034

- Table 32: Germany Multiple-Element Gas Container Market (by Application), $Million, 2023-2034

- Table 33: Germany Multiple-Element Gas Container Market (by Type), Units, 2023-2034

- Table 34: Germany Multiple-Element Gas Container Market (by Type), $Million, 2023-2034

- Table 35: France Multiple-Element Gas Container Market (by Application), Units, 2023-2034

- Table 36: France Multiple-Element Gas Container Market (by Application), $Million, 2023-2034

- Table 37: France Multiple-Element Gas Container Market (by Type), Units, 2023-2034

- Table 38: France Multiple-Element Gas Container Market (by Type), $Million, 2023-2034

- Table 39: U.K. Multiple-Element Gas Container Market (by Application), Units, 2023-2034

- Table 40: U.K. Multiple-Element Gas Container Market (by Application), $Million, 2023-2034

- Table 41: U.K. Multiple-Element Gas Container Market (by Type), Units, 2023-2034

- Table 42: U.K. Multiple-Element Gas Container Market (by Type), $Million, 2023-2034

- Table 43: Italy Multiple-Element Gas Container Market (by Application), Units, 2023-2034

- Table 44: Italy Multiple-Element Gas Container Market (by Application), $Million, 2023-2034

- Table 45: Italy Multiple-Element Gas Container Market (by Type), Units, 2023-2034

- Table 46: Italy Multiple-Element Gas Container Market (by Type), $Million, 2023-2034

- Table 47: Spain Multiple-Element Gas Container Market (by Application), Units, 2023-2034

- Table 48: Spain Multiple-Element Gas Container Market (by Application), $Million, 2023-2034

- Table 49: Spain Multiple-Element Gas Container Market (by Type), Units, 2023-2034

- Table 50: Spain Multiple-Element Gas Container Market (by Type), $Million, 2023-2034

- Table 51: Netherlands Multiple-Element Gas Container Market (by Application), Units, 2023-2034

- Table 52: Netherlands Multiple-Element Gas Container Market (by Application), $Million, 2023-2034

- Table 53: Netherlands Multiple-Element Gas Container Market (by Type), Units, 2023-2034

- Table 54: Netherlands Multiple-Element Gas Container Market (by Type), $Million, 2023-2034

- Table 55: Rest-of-Europe Multiple-Element Gas Container Market (by Application), Units, 2023-2034

- Table 56: Rest-of-Europe Multiple-Element Gas Container Market (by Application), $Million, 2023-2034

- Table 57: Rest-of-Europe Multiple-Element Gas Container Market (by Type), Units, 2023-2034

- Table 58: Rest-of-Europe Multiple-Element Gas Container Market (by Type), $Million, 2023-2034

- Table 59: Asia-Pacific Multiple-Element Gas Container Market (by Application), Units, 2023-2034

- Table 60: Asia-Pacific Multiple-Element Gas Container Market (by Application), $Million, 2023-2034

- Table 61: Asia-Pacific Multiple-Element Gas Container Market (by Type), Units, 2023-2034

- Table 62: Asia-Pacific Multiple-Element Gas Container Market (by Type), $Million, 2023-2034

- Table 63: China Multiple-Element Gas Container Market (by Application), Units, 2023-2034

- Table 64: China Multiple-Element Gas Container Market (by Application), $Million, 2023-2034

- Table 65: China Multiple-Element Gas Container Market (by Type), Units, 2023-2034

- Table 66: China Multiple-Element Gas Container Market (by Type), $Million, 2023-2034

- Table 67: Japan Multiple-Element Gas Container Market (by Application), Units, 2023-2034

- Table 68: Japan Multiple-Element Gas Container Market (by Application), $Million, 2023-2034

- Table 69: Japan Multiple-Element Gas Container Market (by Type), Units, 2023-2034

- Table 70: Japan Multiple-Element Gas Container Market (by Type), $Million, 2023-2034

- Table 71: Australia Multiple-Element Gas Container Market (by Application), Units, 2023-2034

- Table 72: Australia Multiple-Element Gas Container Market (by Application), $Million, 2023-2034

- Table 73: Australia Multiple-Element Gas Container Market (by Type), Units, 2023-2034

- Table 74: Australia Multiple-Element Gas Container Market (by Type), $Million, 2023-2034

- Table 75: South Korea Multiple-Element Gas Container Market (by Application), Units, 2023-2034

- Table 76: South Korea Multiple-Element Gas Container Market (by Application), $Million, 2023-2034

- Table 77: South Korea Multiple-Element Gas Container Market (by Type), Units, 2023-2034

- Table 78: South Korea Multiple-Element Gas Container Market (by Type), $Million, 2023-2034

- Table 79: India Multiple-Element Gas Container Market (by Application), Units, 2023-2034

- Table 80: India Multiple-Element Gas Container Market (by Application), $Million, 2023-2034

- Table 81: India Multiple-Element Gas Container Market (by Type), Units, 2023-2034

- Table 82: India Multiple-Element Gas Container Market (by Type), $Million, 2023-2034

- Table 83: Rest-of-Asia-Pacific Multiple-Element Gas Container Market (by Application), Units, 2023-2034

- Table 84: Rest-of-Asia-Pacific Multiple-Element Gas Container Market (by Application), $Million, 2023-2034

- Table 85: Rest-of-Asia-Pacific Multiple-Element Gas Container Market (by Type), Units, 2023-2034

- Table 86: Rest-of-Asia-Pacific Multiple-Element Gas Container Market (by Type), $Million, 2023-2034

- Table 87: Rest-of-the-World Multiple-Element Gas Container Market (by Application), Units, 2023-2034

- Table 88: Rest-of-the-World Multiple-Element Gas Container Market (by Application), $Million, 2023-2034

- Table 89: Rest-of-the-World Multiple-Element Gas Container Market (by Type), Units, 2023-2034

- Table 90: Rest-of-the-World Multiple-Element Gas Container Market (by Type), $Million, 2023-2034

- Table 91: Brazil Multiple-Element Gas Container Market (by Application), Units, 2023-2034

- Table 92: Brazil Multiple-Element Gas Container Market (by Application), $Million, 2023-2034

- Table 93: Brazil Multiple-Element Gas Container Market (by Type), Units, 2023-2034

- Table 94: Brazil Multiple-Element Gas Container Market (by Type), $Million, 2023-2034

- Table 95: U.A.E. Multiple-Element Gas Container Market (by Application), Units, 2023-2034

- Table 96: U.A.E. Multiple-Element Gas Container Market (by Application), $Million, 2023-2034

- Table 97: U.A.E. Multiple-Element Gas Container Market (by Type), Units, 2023-2034

- Table 98: U.A.E. Multiple-Element Gas Container Market (by Type), $Million, 2023-2034

- Table 99: Other Multiple-Element Gas Container Market (by Application), Units, 2023-2034

- Table 100: Other Multiple-Element Gas Container Market (by Application), $Million, 2023-2034

- Table 101: Other Multiple-Element Gas Container Market (by Type), Units, 2023-2034

- Table 102: Other Multiple-Element Gas Container Market (by Type), $Million, 2023-2034

- Table 103: Market Share, 2023

Multiple-Element Gas Container Market Overview

The multiple-element gas container market was valued at $187.1 million in 2024, and it is expected to grow at a CAGR of 8.59%, reaching $426.5 million by 2034. This growth is driven by the increasing adoption of alternative fuels such as CNG, LNG, and hydrogen in various transportation, energy, and industry sectors. The market has been witnessing significant technological advancements in gas storage and transportation systems, particularly in terms of safety, efficiency, and cost-effectiveness. Stringent carbon emissions regulations and the global push for clean energy solutions have been influencing this dynamic market. Industry collaborations, innovations in composite materials, and the expansion of hydrogen infrastructure are key factors driving the multiple-element gas container market evolution. As the demand for sustainable and reliable gas transport solutions rises, the market continues to focus on advanced storage technologies, infrastructure development, and safety standards to meet the growing energy transition demands while ensuring public health and environmental sustainability.

Introduction of Multiple-Element Gas Containers

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2024 - 2034 |

| 2024 Evaluation | $187.1 Million |

| 2034 Forecast | $426.5 Million |

| CAGR | 8.59% |

Multiple-element gas containers (MEGCs) are specialized storage systems used for the safe and efficient transportation of compressed gases such as CNG, LNG, and hydrogen. These containers consist of multiple high-pressure gas cylinders mounted on a single frame, designed to ensure optimal storage capacity and stability during transport. MEGCs are crucial in industries such as natural gas distribution, renewable energy, and transportation, where reliable and safe gas storage solutions are required for short- and long-distance transportation. With advancements in composite materials and safety technologies, MEGCs are increasingly used for applications such as fueling stations, hydrogen mobility, and industrial gas supply, playing a vital role in the transition to cleaner energy sources. Their design focuses on reducing weight while maximizing storage efficiency, making them essential to the growing demand for sustainable energy solutions.

Market Introduction

The multiple-element gas container market has been witnessing significant growth due to the increasing demand for efficient, safe, and sustainable solutions for transporting compressed gases such as CNG, LNG, and hydrogen. MEGCs consist of multiple high-pressure cylinders mounted on a single frame, providing a reliable storage solution that maximizes space efficiency and ensures safety during transportation. These containers are widely used in industries such as natural gas distribution, renewable energy, and hydrogen fuel transportation. The growth of the market has been driven by the global shift toward clean energy solutions, regulatory requirements for reduced carbon emissions, and the need for improved gas storage technologies. With ongoing advancements in composite materials and safety systems, MEGCs offer a cost-effective and scalable approach to meet the demands of growing fuel infrastructure, particularly in hydrogen mobility and industrial gas applications. As the need for alternative fuel sources increases, the MEGC market continues to evolve, focusing on innovation, efficiency, and sustainability.

Industrial Impact

The industrial impact of the multiple-element gas container market extends across various sectors, including energy, transportation, and industrial gas applications. Advancements in MEGC technology, such as the use of composite materials and high-pressure storage systems, are driving innovation and enhancing the efficiency and safety of gas transportation. These advancements foster collaborations between gas producers, infrastructure developers, and technology providers, setting higher industry standards and pushing the boundaries of sustainable energy solutions. As industries and governments prioritize cleaner fuels, including CNG, LNG, and hydrogen, the multiple-element gas container market contributes significantly to the transition toward low-emission energy sources, aligning with global environmental and health safety objectives. This, in turn, promotes more stringent regulatory frameworks and drives industrial compliance with safety protocols. Key players in the MEGC market, such as Hexagon Composites, Luxfer Gas Cylinders, NPROXX, and CIMC Enric Holdings, are focusing on strategic partnerships, technological innovation, and expansion of storage infrastructure to meet growing demand. The multiple-element gas container market plays a pivotal role in advancing sustainable energy systems, ensuring reliable gas distribution, and supporting the global shift toward cleaner energy sources.

Market Segmentation:

Segmentation 1: by Application

- Natural Gas

- Hydrogen

- Industrial Gas

Natural Gas Segment to Dominate the Multiple-Element Gas Container Market (by Application)

The natural gas segment is expected to dominate the multiple-element gas container market by application, driven by the growing demand for compressed natural gas (CNG) in the transportation sector and industrial applications. MEGCs are critical for the safe,-0efficient, and cost-effective transportation of natural gas over long distances, especially in regions lacking extensive pipeline infrastructure. With the global push for cleaner energy alternatives, CNG is becoming a preferred fuel for commercial vehicles, public transportation, and heavy-duty trucks due to its lower carbon emissions compared to gasoline and diesel.

Segmentation 2: by Product

- 20 Ft

- 40 Ft and Above

20 Ft to Dominate the Multiple-Element Gas Container Market (by Product)

The 20 ft multiple-element gas container is expected to dominate the multiple-element gas container market by product size due to its ideal balance of capacity, transportability, and cost-effectiveness. This container size is widely used across multiple industries for the transportation of CNG, LNG, and hydrogen, as it offers a flexible solution that can be easily integrated into existing logistics networks. The 20 ft MEGC is a standard size that can be efficiently transported by road, rail, and sea, making it suitable for intermodal transport and international shipments.

Segmentation 3: by Region

- North America: U.S., Canada, Mexico

- Europe: Germany, France, U.K., Italy, Spain, Netherlands and Rest-of-Europe

- Asia-Pacific: China, Japan, Australia, South Korea, India, and Rest-of-Asia-Pacific

- Rest-of-the-World: Brazil, U.A.E., Other

North America is set to lead the multiple-element gas container market by region, driven by the increasing adoption of natural gas and hydrogen for transportation and industrial applications. The U.S. and Canada have been making significant strides in clean energy adoption, with a growing demand for compressed natural gas (CNG) in the transportation sector, particularly in heavy-duty trucks, public transit, and commercial fleets. Additionally, the development of hydrogen infrastructure in the U.S. and Canada, along with government incentives for hydrogen fuel cell vehicles, is further fueling the demand for MEGCs to store and transport hydrogen.

Demand - Drivers, Limitations, and Opportunities

Market Demand Drivers: Increase in Cross-Border Trade and International Energy Market Integration

An increase in cross-border trade and international energy market integration is a key driver for the multiple-element gas container market, as it facilitates the expansion of energy distribution networks across regions. As global energy markets become more integrated, the demand for efficient, reliable, and scalable solutions for the transportation of compressed natural gas (CNG), liquefied natural gas (LNG), and hydrogen increases. MEGCs play a critical role in enabling cross-border energy trade, particularly in areas where pipeline infrastructure is limited or non-existent. They offer a flexible and cost-effective solution for transporting large volumes of gas, allowing countries to tap into global energy supplies, reduce dependency on local resources, and meet growing energy needs. The rise in international trade agreements, the establishment of energy hubs, and the development of virtual pipelines all contribute to the expansion of the MEGC market, driving the need for advanced storage and transportation technologies that ensure the safe and efficient delivery of natural gas and hydrogen across borders. As energy markets continue to integrate, MEGCs will remain a critical component in facilitating this global energy exchange.

Market Challenges: High Initial Investment and Maintenance Costs

High initial investment and maintenance costs represent a significant challenge for the multiple-element gas container market. The development, manufacturing, and deployment of MEGCs require substantial capital investment, particularly to produce high-pressure composite cylinders and advanced materials that ensure the safety and durability of the containers. Additionally, the infrastructure required for the safe transport, handling, and refueling of gases such as CNG, LNG, and hydrogen adds to the overall costs. The maintenance of MEGCs is another concern, as regular inspections, requalification processes, and compliance with stringent safety and regulatory standards can result in high operational costs. These financial burdens may deter smaller players and new entrants from investing in MEGC solutions, limiting market growth in some regions.

Market Opportunities: Integration with Renewable Energy Projects

Integration with renewable energy projects presents a significant opportunity for the multiple-element gas container market, particularly as the global energy transition accelerates toward cleaner, more sustainable sources. As the use of renewable energy, such as solar and wind, increases, there is a growing need for energy storage solutions that can balance intermittent energy production. Hydrogen, produced through renewable energy-driven electrolysis, is gaining prominence as an energy carrier, and MEGCs are ideal for storing and transporting green hydrogen to various sectors, including industrial applications, transportation, and power generation. MEGCs facilitate the storage of hydrogen produced during periods of excess renewable energy, which can then be transported and utilized when demand peaks or renewable generation is low. This integration helps stabilize the energy grid, reduce carbon emissions, and enhance the economic viability of renewable energy projects.

How can this report add value to an organization?

This report can add significant value to an organization by comprehensively analyzing the multiple-element gas container market and helping companies understand emerging trends, technological advancements, and regulatory requirements that shape the market landscape. It offers insights into key drivers, such as the increasing demand for CNG, LNG, and hydrogen solutions, alongside challenges, such as high initial investment and maintenance costs. The report can guide strategic decision-making and investment planning by identifying market opportunities, including the integration of MEGCs with renewable energy projects and cross-border trade expansion. Furthermore, it highlights the importance of compliance with safety and regulatory standards, ensuring organizations can align with best practices. The analysis of key market players and their strategic moves, such as partnerships, acquisitions, and innovations, enables businesses to identify competitive advantages and partnership opportunities. This knowledge can drive market expansion, foster operational efficiencies, and improve long-term profitability.

Research Methodology

Factors for Data Prediction and Modeling

- The base currency considered for the market analysis is US$. Currencies other than the US$ have been converted to the US$ for all statistical calculations, considering the average conversion rate for that particular year.

- The currency conversion rate has been taken from the historical exchange rate of the Oanda website.

- Nearly all the recent developments from January 2021 to March 2025 have been considered in this research study.

- The information rendered in the report is a result of in-depth primary interviews, surveys, and secondary analysis.

- Where relevant information was not available, proxy indicators and extrapolation were employed.

- Any economic downturn in the future has not been taken into consideration for the market estimation and forecast.

- Technologies currently used are expected to persist through the forecast with no major technological breakthroughs.

Market Estimation and Forecast

This research study involves the usage of extensive secondary sources, such as certified publications, articles from recognized authors, white papers, annual reports of companies, directories, and major databases to collect useful and effective information for an extensive, technical, market-oriented, and commercial study of the multiple-element gas container market.

The process of market engineering involves the calculation of the market statistics, market size estimation, market forecast, market crackdown, and data triangulation (the methodology for such quantitative data processes is explained in further sections). The primary research study has been undertaken to gather information and validate the market numbers for segmentation types and industry trends of the key players in the multiple-element gas container market.

Primary Research

The primary sources involve industry experts from the multiple-element gas container market and various stakeholders in the ecosystem. Respondents such as CEOs, vice presidents, marketing directors, and technology and innovation directors have been interviewed to obtain and verify both qualitative and quantitative aspects of this research study.

The key data points taken from primary sources include:

- validation and triangulation of all the numbers and graphs

- validation of reports segmentation and key qualitative findings

- understanding the competitive landscape

- validation of the numbers of various markets for market type

- percentage split of individual markets for geographical analysis

Secondary Research

This research study involves the usage of extensive secondary research, directories, company websites, and annual reports. It also makes use of databases, such as Hoovers, Bloomberg, Businessweek, and Factiva, to collect useful and effective information for an extensive, technical, market-oriented, and commercial study of the global market. In addition to the data sources, the study has been undertaken with the help of other data sources and websites, such as the Census Bureau, OICA, and ACEA.

Secondary research was done to obtain crucial information about the industry's value chain, revenue models, the market's monetary chain, the total pool of key players, and the current and potential use cases and applications.

The key data points taken from secondary research include:

- segmentations and percentage shares

- data for market value

- key industry trends of the top players of the market

- qualitative insights into various aspects of the market, key trends, and emerging areas of innovation

- quantitative data for mathematical and statistical calculations

Key Market Players and Competition Synopsis

The companies that are profiled in the multiple-element gas container market have been selected based on inputs gathered from primary experts, who have analyzed company coverage, product portfolio, and market penetration.

Some of the prominent names in the multiple-element gas container market are:

- Hexagon Composites ASA

- Worthington Enterprises, Inc.

- City Machine & Welding, Inc.

- Luxfer Gas Cylinders

- Koyuncu Gas and Gas Equipment

- Gaznet OU

- EKC

- Quantum Fuel Systems LLC

- Faber Industrie SPA

- Beijing Tianhai Industry Co., Ltd.

- FIBA Technologies, Inc.

- Pico Flow Controls Group (PFC Group)

- NPROXX

- Rheinmetall AG

- CIMC Enric Holdings Limited

Companies that are not a part of the aforementioned pool have been well represented across different sections of the report (wherever applicable).

Table of Contents

Executive Summary

Scope and Definition

1 Markets

- 1.1 Trends: Current and Future Impact Assessment

- 1.1.1 Trends: Overview

- 1.1.2 Growing Electricity Generation from Natural Gas

- 1.1.3 Increase in the Adoption of Natural Gas Vehicles

- 1.2 Hydrogen Ecosystem

- 1.3 Natural Gas Supply Chain Challenges and Remedies

- 1.4 Industrial Gas Supply Chain Breakdown

- 1.4.1 Value Chain Analysis

- 1.4.2 Pricing Comparison

- 1.5 Research and Development Review

- 1.5.1 Patent Filing Trend (by Company)

- 1.5.2 Patent Filing Trend (by Patent Office)

- 1.6 Regulatory Landscape

- 1.7 Market Dynamics: Overview

- 1.7.1 Market Drivers

- 1.7.1.1 Increase in Cross-Border Trade and International Energy Market Integration

- 1.7.1.2 Rising Investments in Industrial Gas Applications

- 1.7.2 Market Restraints

- 1.7.2.1 High Initial Investment and Maintenance Costs

- 1.7.2.2 Transportation and Logistic Hurdles

- 1.7.3 Market Opportunities

- 1.7.3.1 Integration with Renewable Energy Projects

- 1.7.3.2 Digitalization and Smart Container Solutions

- 1.7.1 Market Drivers

2 Application

- 2.1 Application Segmentation

- 2.2 Application Summary

- 2.3 Multiple-Element Gas Container Market (by Application)

- 2.3.1 Application

- 2.3.1.1 Natural Gas

- 2.3.1.2 Hydrogen

- 2.3.1.3 Industrial Gases

- 2.3.1 Application

3 Products

- 3.1 Product Segmentation

- 3.2 Product Summary

- 3.3 Multiple-Element Gas Container Market (by Type)

- 3.3.1 Type

- 3.3.1.1 20 Ft

- 3.3.1.2 40 Ft and Above

- 3.3.1 Type

4 Regions

- 4.1 Regional Summary

- 4.2 Drivers and Restraints

- 4.3 North America

- 4.3.1 Regional Overview

- 4.3.2 Driving Factors for Market Growth

- 4.3.3 Factors Challenging the Market

- 4.3.4 Application

- 4.3.5 Product

- 4.3.6 North America (by Country)

- 4.3.6.1 U.S.

- 4.3.6.2 Canada

- 4.3.6.3 Mexico

- 4.4 Europe

- 4.4.1 Regional Overview

- 4.4.2 Driving Factors for Market Growth

- 4.4.3 Factors Challenging the Market

- 4.4.4 Application

- 4.4.5 Product

- 4.4.6 Europe (by Country)

- 4.4.6.1 Germany

- 4.4.6.2 France

- 4.4.6.3 U.K.

- 4.4.6.4 Italy

- 4.4.6.5 Spain

- 4.4.6.6 Netherlands

- 4.4.6.7 Rest-of-Europe

- 4.5 Asia-Pacific

- 4.5.1 Regional Overview

- 4.5.2 Driving Factors for Market Growth

- 4.5.3 Factors Challenging the Market

- 4.5.4 Application

- 4.5.5 Product

- 4.5.6 Asia-Pacific (by Country)

- 4.5.6.1 China

- 4.5.6.2 Japan

- 4.5.6.3 Australia

- 4.5.6.4 South Korea

- 4.5.6.5 India

- 4.5.6.6 Rest-of-Asia-Pacific

- 4.6 Rest-of-the-World

- 4.6.1 Regional Overview

- 4.6.2 Driving Factors for Market Growth

- 4.6.3 Factors Challenging the Market

- 4.6.4 Application

- 4.6.5 Product

- 4.6.6 Rest-of-the-World (by Country)

- 4.6.6.1 Brazil

- 4.6.6.2 U.A.E.

- 4.6.6.3 Other

5 Markets - Competitive Benchmarking & Company Profiles

- 5.1 Next Frontiers

- 5.2 Geographic Assessment

- 5.2.1 Hexagon Composites ASA

- 5.2.1.1 Overview

- 5.2.1.2 Top Products/Product Portfolio

- 5.2.1.3 Top Competitors

- 5.2.1.4 Target Customers

- 5.2.1.5 Key Personnel

- 5.2.1.6 Analyst View

- 5.2.1.7 Market Share, 2023

- 5.2.2 Worthington Enterprises, Inc.

- 5.2.2.1 Overview

- 5.2.2.2 Top Products/Product Portfolio

- 5.2.2.3 Top Competitors

- 5.2.2.4 Target Customers

- 5.2.2.5 Key Personnel

- 5.2.2.6 Analyst View

- 5.2.2.7 Market Share, 2023

- 5.2.3 City Machine & Welding, Inc.

- 5.2.3.1 Overview

- 5.2.3.2 Top Products/Product Portfolio

- 5.2.3.3 Top Competitors

- 5.2.3.4 Target Customers

- 5.2.3.5 Key Personnel

- 5.2.3.6 Analyst View

- 5.2.3.7 Market Share, 2023

- 5.2.4 Luxfer Gas Cylinders

- 5.2.4.1 Overview

- 5.2.4.2 Top Products/Product Portfolio

- 5.2.4.3 Top Competitors

- 5.2.4.4 Target Customers

- 5.2.4.5 Key Personnel

- 5.2.4.6 Analyst View

- 5.2.4.7 Market Share, 2023

- 5.2.5 Koyuncu Gas and Gas Equipment

- 5.2.5.1 Overview

- 5.2.5.2 Top Products/Product Portfolio

- 5.2.5.3 Top Competitors

- 5.2.5.4 Target Customers

- 5.2.5.5 Key Personnel

- 5.2.5.6 Analyst View

- 5.2.5.7 Market Share, 2023

- 5.2.6 Gaznet OU

- 5.2.6.1 Overview

- 5.2.6.2 Top Products/Product Portfolio

- 5.2.6.3 Top Competitors

- 5.2.6.4 Target Customers

- 5.2.6.5 Key Personnel

- 5.2.6.6 Analyst View

- 5.2.6.7 Market Share, 2023

- 5.2.7 EKC

- 5.2.7.1 Overview

- 5.2.7.2 Top Products/Product Portfolio

- 5.2.7.3 Top Competitors

- 5.2.7.4 Target Customers

- 5.2.7.5 Key Personnel

- 5.2.7.6 Analyst View

- 5.2.7.7 Market Share, 2023

- 5.2.8 Quantum Fuel Systems LLC.

- 5.2.8.1 Overview

- 5.2.8.2 Top Products/Product Portfolio

- 5.2.8.3 Top Competitors

- 5.2.8.4 Target Customers

- 5.2.8.5 Key Personnel

- 5.2.8.6 Analyst View

- 5.2.8.7 Market Share, 2023

- 5.2.9 Faber Industrie SPA

- 5.2.9.1 Overview

- 5.2.9.2 Top Products/Product Portfolio

- 5.2.9.3 Top Competitors

- 5.2.9.4 Target Customers

- 5.2.9.5 Key Personnel

- 5.2.9.6 Analyst View

- 5.2.9.7 Market Share, 2023

- 5.2.10 Beijing Tianhai Industry Co., Ltd.

- 5.2.10.1 Overview

- 5.2.10.2 Top Products/Product Portfolio

- 5.2.10.3 Top Competitors

- 5.2.10.4 Target Customers

- 5.2.10.5 Key Personnel

- 5.2.10.6 Analyst View

- 5.2.10.7 Market Share, 2023

- 5.2.11 FIBA Technologies, Inc.

- 5.2.11.1 Overview

- 5.2.11.2 Top Products/Product Portfolio

- 5.2.11.3 Top Competitors

- 5.2.11.4 Target Customers

- 5.2.11.5 Key Personnel

- 5.2.11.6 Analyst View

- 5.2.11.7 Market Share, 2023

- 5.2.12 Pico Flow Controls Group (PFC Group )

- 5.2.12.1 Overview

- 5.2.12.2 Top Products/Product Portfolio

- 5.2.12.3 Top Competitors

- 5.2.12.4 Target Customers

- 5.2.12.5 Key Personnel

- 5.2.12.6 Analyst View

- 5.2.12.7 Market Share, 2023

- 5.2.13 NPROXX

- 5.2.13.1 Overview

- 5.2.13.2 Top Products/Product Portfolio

- 5.2.13.3 Top Competitors

- 5.2.13.4 Target Customers

- 5.2.13.5 Key Personnel

- 5.2.13.6 Analyst View

- 5.2.13.7 Market Share, 2023

- 5.2.14 Rheinmetall AG

- 5.2.14.1 Overview

- 5.2.14.2 Top Products/Product Portfolio

- 5.2.14.3 Top Competitors

- 5.2.14.4 Target Customers

- 5.2.14.5 Key Personnel

- 5.2.14.6 Analyst View

- 5.2.14.7 Market Share, 2023

- 5.2.15 CIMC Enric Holdings Limited

- 5.2.15.1 Overview

- 5.2.15.2 Top Products/Product Portfolio

- 5.2.15.3 Top Competitors

- 5.2.15.4 Target Customers

- 5.2.15.5 Key Personnel

- 5.2.15.6 Analyst View

- 5.2.15.7 Market Share, 2023

- 5.2.1 Hexagon Composites ASA

- 5.3 Other Key Players

6 Research Methodology

- 6.1 Data Sources

- 6.1.1 Primary Data Sources

- 6.1.2 Secondary Data Sources

- 6.1.3 Data Triangulation

- 6.2 Market Estimation and Forecast