|

|

市場調査レポート

商品コード

1694062

二酸化炭素回収・有効利用・貯留市場- 世界および地域別分析:用途別、製品別、地域別 - 分析と予測(2025年~2034年)Carbon Capture Utilization and Storage Market - A Global and Regional Analysis: Focus on Application, Product, and Region - Analysis and Forecast, 2025-2034 |

||||||

カスタマイズ可能

|

|||||||

| 二酸化炭素回収・有効利用・貯留市場- 世界および地域別分析:用途別、製品別、地域別 - 分析と予測(2025年~2034年) |

|

出版日: 2025年04月02日

発行: BIS Research

ページ情報: 英文

納期: 1~5営業日

|

全表示

- 概要

- 目次

世界の二酸化炭素回収・有効利用・貯留市場の成長は、二酸化炭素排出量削減への関心の高まりと、石油増進回収法(EOR)の需要拡大によって牽引されると予想されます。

貯蔵施設の不足と地下貯蔵からのCO2漏出が、この業界の主な阻害要因となっています。

世界の二酸化炭素回収・有効利用・貯留市場は、まだ初期段階にあります。バイオベースの分離回収や膜分離回収のような新しい分離回収技術は、炭素分離回収プロセスのコストを削減すると期待されています。

ネット・ゼロ・エミッション達成への世界の注目が高まる中、低炭素製品や炭素クレジットなど、環境に優しい産業慣行へのシフトが資金調達の機会を増やしています。このシフトは、北米や中東といった地域の石油・ガス産業で顕著です。米国は、石油・ガス会社が回収した炭素を石油増進回収に利用しているため、二酸化炭素回収・有効利用・貯留産業が最も大きいです。

クロアチアのiCORDプロジェクトや米国のドライフォーク発電所のような新しいプラントは、2025年に運転を開始する予定です。したがって、この産業は遅れているため、大きな影響は受けていないです。

2022年3月、ExxonMobil Corporationは、米国テキサス州ベイタウンにある精製・石油化学の統合施設での水素製造施設、炭素回収・貯留プロジェクトを発表しました。2021年11月、ExxonMobil CorporationとPetronasは、マレーシアにおける炭素回収・貯留プロジェクトの可能性を共同で検討する覚書に調印しました。このMoUは、ExxonMobil CorporationとPetronasの数十年にわたる戦略的パートナーシップを強化するもので、マレーシアの排出量削減とネットゼロの野望達成を支援することを目的としています。

2021年5月、リンデplcは米国エネルギー省の国立エネルギー技術研究所(NETL)に選ばれ、イリノイ州スプリングフィールドのシティ・ウォーター・ライト・アンド・パワー(CWLP)発電所に200トン/日のCO2回収大型パイロットプラントを設置・テストすることになっています。このプロジェクトは、BASF、イリノイ大学アーバナ・シャンペーン校、ACS、CWLPと共同で実施されます。この施設の操業は、経済的に魅力的で革新的な回収技術を実証する機会を提供します。

2021年5月、リンデplcは米国エネルギー省の国立エネルギー技術研究所(NETL)に選ばれ、イリノイ州スプリングフィールドのシティ・ウォーター・ライト・アンド・パワー(CWLP)発電所に200トン/日のCO2回収大型パイロットプラントを設置し、試験を行うことになっています。このプロジェクトは、BASF、イリノイ大学アーバナ・シャンペーン校、ACS、CWLPと共同で実施されます。

成長/マーケティング戦略:事業拡大、パートナーシップ、コラボレーション、ジョイントベンチャーは、この分野で事業を展開する主要企業が採用する主要戦略です。例えば、2022年3月、ExxonMobil Corporationは、米国テキサス州ベイタウンにある同社の精製・石油化学統合施設において、水素製造施設と世界最大級の炭素回収・貯留プロジェクトの計画を発表しました。このプロジェクトは、排出量削減という国の目標達成に重要な役割を果たすことができます。

当レポートでは、世界の二酸化炭素回収・有効利用・貯留市場について調査し、市場の概要とともに、用途別、製品別、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場:業界の展望

- 動向:現在および将来の影響評価

- ステークホルダー分析

- 市場力学の概要

- 規制と政策の影響分析

- 特許分析

- スタートアップの情勢

- 総アドレス可能市場

- 主要産業別CO2排出量

- 投資情勢と研究開発動向

- 今後の展望と市場ロードマップ

- サプライチェーン分析

- バリューチェーン分析

- 世界価格分析

- 業界の魅力

第2章 炭素回収・利用・貯留市場(用途別)

- 用途のセグメンテーション

- 用途のサマリー

- 二酸化炭素回収・有効利用・貯留市場(用途別)

- 石油・ガス産業

- 電力業界

- その他

第3章 炭素回収・利用・貯留市場(製品別)

- 製品セグメンテーション

- 製品サマリー

- 二酸化炭素回収・有効利用・貯留市場(回収技術別)

- 燃焼前炭素回収

- 燃焼後炭素回収

- 酸素燃焼による炭素回収

第4章 炭素回収・利用・貯留市場(地域別)

- 炭素回収・利用・貯留市場(地域別)

- 北米

- 欧州

- アジア太平洋

- 中東

- その他の地域

第5章 市場-競合ベンチマーキングと企業プロファイル

- 今後の見通し

- 地理的評価

- 企業プロファイル

- Fluor Corporation

- ExxonMobil Corporation

- Linde plc

- Shell plc

- Mitsubishi Heavy Industries, Ltd

- JGC Holdings Corporation

- Equinor ASA

- Schlumberger Limited

- Aker Carbon Capture

- Carbon Clean Solutions Limited

- C-Capture

- Halliburton

- Siemens

- Hitachi, Ltd

- Honeywell International Inc

- Mirreco

- SeeO2 Energy Inc.

- Neustark AG

- CarbonFree

- Cemvita Factory Inc.

第6章 調査手法

Global Carbon Capture Utilization and Storage Industry Overview

The growth in the global carbon capture utilization and storage market is expected to be driven by an increasing focus on reducing carbon emissions and the growing demand for enhanced oil recovery (EOR). Lack of storage facilities and leakage of CO2 from underground storage are some key restraining factors of the industry.

Carbon Capture Utilization and Storage Market Lifecycle Stage

The global carbon capture utilization and storage market is still in a nascent phase. New capturing technologies such as bio-based capturing and membrane capturing are expected to reduce the carbon capture process cost.

Industrial Impact

With an increased worldwide focus on achieving net-zero emissions, the shift to eco-friendly industrial practices such as low-carbon products, and carbon credits, increases financing opportunities. The shift is more prominent in the oil and gas industry in regions such as North America and the Middle East. The U.S. has the largest carbon capture utilization and storage industry as oil and gas companies use captured carbon for enhanced oil recovery.

The new plants, such as the iCORD project in Croatia and Dry Fork Power Plant in the U.S., will start operation in 2025. Therefore, due to the delayed nature of the industry, it did not suffer any significant impact.

Carbon Capture Utilization and Storage Market Segmentation

Segmentation 1: by Application

- Oil and Gas Industry

- Power Industry

- Others (Cement Industry and Chemical Industry)

Segmentation 2: by Capture Technology

- Post-Combustion Carbon Capture

- Pre-Combustion Carbon Capture

- Oxy-Fuel Combustion Carbon Capture

Segmentation 3: by Region

- North America - U.S. and Canada

- Europe - Belgium, Norway, Croatia, Iceland, and Rest-of-Europe

- Asia-Pacific - China and Australia

- Middle East- U.A.E., Qatar, and Saudi Arabia

- Rest-of-the-World

Recent Developments in Global Carbon Capture Utilization and Storage Market

- In March 2022, ExxonMobil Corporation announced hydrogen production facility, carbon capture, and storage projects at its integrated refining and petrochemical site in Baytown, Texas, U.S. This would support companies in reducing emissions from local industries and company operations.

- In November 2021, ExxonMobil Corporation and Petronas signed a Memorandum of Understanding (MoU) to collaborate and jointly explore potential carbon capture and storage projects in Malaysia. This MoU would strengthen a decades-long strategic partnership between ExxonMobil and Petronas and has the objective of helping Malaysia reduce emissions and achieve its net-zero ambitions.

- In May 2021, Linde plc was selected by the U.S. Department of Energy's National Energy Technology Laboratory (NETL) to install and test a 200 tons/day CO2 capture large pilot plant at the City Water, Light & Power (CWLP) power plant in Springfield, IL. The project would be executed in collaboration with the BASF, the University of Illinois at Urbana Champaign, ACS, and CWLP. The operation of this facility provides an opportunity to demonstrate economically attractive and innovative capture techniques.

- In May 2021, Linde plc was selected by the U.S. Department of Energy's National Energy Technology Laboratory (NETL) to install and test a 200 tons/day CO2 capture large pilot plant at the City Water, Light & Power (CWLP) power plant in Springfield, IL. The project will be executed in collaboration with the BASF, the University of Illinois at Urbana Champaign, ACS, and CWLP.

Demand - Drivers and Limitations

Following are the demand drivers for the global carbon capture utilization and storage market:

- Favorable government policies driving the deployment of CCUS technology

- Increasing demand for CO2 for enhanced oil recovery (EOR)

- Rise in adoption of net-zero targets.

The carbon capture utilization and storage market is expected to face some limitations too due to the following challenges:

- High initial cost of carbon capture utilization and storage process

- CO2 leakage from the underground storage reservoirs

How Can This Report Add Value to an Organization?

Product/Innovation Strategy: The product segment helps the reader understand the different types of technology available for carbon capture and their potential globally. Moreover, the study provides the reader a detailed understanding of the different carbon capture utilization and storage application in industries such as the oil and gas industry, power industry, and others (cement and chemical industry).

Growth/Marketing Strategy: Business expansion, partnership, collaboration, and joint venture are some key strategies adopted by key players operating in the space. For instance, in March 2022, ExxonMobil Corporation announced its plans for a hydrogen production facility and one of the world's largest carbon capture and storage projects at its integrated refining and petrochemical site in Baytown, Texas, U.S. This supports companies' efforts to reduce emissions from local industries and company operations. This project can play an important role in achieving the country's goal of reducing emissions.

Competitive Strategy: Key players in the global carbon capture utilization and storage market analyzed and profiled in the study involve technology providers and companies capturing, utilizing, and storing carbon. Moreover, a detailed competitive benchmarking of the players operating in the global carbon capture utilization and storage market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the carbon capture utilization and storage market.

Key Carbon Capture Utilization and Storage Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, and market penetration.

Some prominent names established in carbon capture utilization and storage market are:

- Fluor Corporation

- Exxon Mobil

- Mitsubishi Heavy Industries

- Linde Plc

- Aker Carbon Capture

- Royal Dutch Shell

- Climeworks

Table of Contents

Executive Summary

Scope and Definition

Market/Product Definition

Key Questions Answered

Analysis and Forecast Note

1. Markets: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.2 Stakeholder Analysis

- 1.2.1 Use Case

- 1.2.2 End User and Buying Criteria

- 1.3 Market Dynamics Overview

- 1.3.1 Market Drivers

- 1.3.2 Market Restraints

- 1.3.3 Market Opportunities

- 1.4 Regulatory & Policy Impact Analysis

- 1.5 Patent Analysis

- 1.6 Start-Up Landscape

- 1.7 Total Addressable Market

- 1.8 CO2 Emission by Major Industries

- 1.9 Investment Landscape and R&D Trends

- 1.10 Future Outlook and Market Roadmap

- 1.11 Supply Chain Analysis

- 1.12 Value Chain Analysis

- 1.13 Global Pricing Analysis

- 1.14 Industry Attractiveness

2. Carbon Capture Utilization and Storage Market (by Application)

- 2.1 Application Segmentation

- 2.2 Application Summary

- 2.3 Carbon Capture Utilization and Storage Market (by Application)

- 2.3.1 Oil and Gas Industry

- 2.3.2 Power Industry

- 2.3.3 Others

- 2.3.3.1 Cement Industry

- 2.3.3.2 Chemical Industry

3. Carbon Capture Utilization and Storage Market (by Product)

- 3.1 Product Segmentation

- 3.2 Product Summary

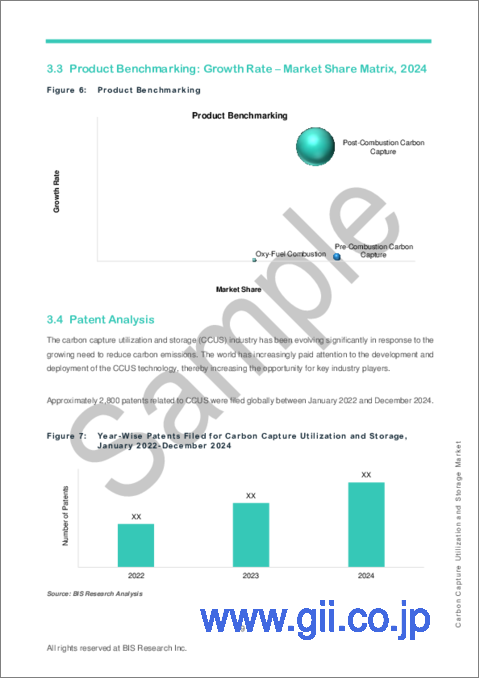

- 3.3 Carbon Capture Utilization and Storage Market (by Capture Technology)

- 3.3.1 Pre-Combustion Carbon Capture

- 3.3.2 Post-Combustion Carbon Capture

- 3.3.3 Oxy-Fuel Combustion Carbon Capture

4. Carbon Capture Utilization and Storage Market (by Region)

- 4.1 Carbon Capture Utilization and Storage Market (by Region)

- 4.2 North America

- 4.2.1 Regional Overview

- 4.2.2 Driving Factors for Market Growth

- 4.2.3 Factors Challenging the Market

- 4.2.4 Key Companies

- 4.2.5 Application

- 4.2.6 Product

- 4.2.7 U.S.

- 4.2.7.1 Market by Application

- 4.2.7.2 Market by Product

- 4.2.8 Canada

- 4.2.8.1 Market by Application

- 4.2.8.2 Market by Product

- 4.3 Europe

- 4.3.1 Regional Overview

- 4.3.2 Driving Factors for Market Growth

- 4.3.3 Factors Challenging the Market

- 4.3.4 Key Companies

- 4.3.5 Application

- 4.3.6 Product

- 4.3.7 Norway

- 4.3.7.1 Market by Application

- 4.3.7.2 Market by Product

- 4.3.8 Belgium

- 4.3.8.1 Market by Application

- 4.3.8.2 Market by Product

- 4.3.9 Iceland

- 4.3.9.1 Market by Application

- 4.3.9.2 Market by Product

- 4.3.10 Croatia

- 4.3.10.1 Market by Application

- 4.3.10.2 Market by Product

- 4.3.11 Rest-of-Europe

- 4.3.11.1 Market by Application

- 4.3.11.2 Market by Product

- 4.4 Asia-Pacific

- 4.4.1 Regional Overview

- 4.4.2 Driving Factors for Market Growth

- 4.4.3 Factors Challenging the Market

- 4.4.4 Key Companies

- 4.4.5 Application

- 4.4.6 Product

- 4.4.7 China

- 4.4.7.1 Market by Application

- 4.4.7.2 Market by Product

- 4.4.8 Australia

- 4.4.8.1 Market by Application

- 4.4.8.2 Market by Product

- 4.4.9 Rest-of-Asia-Pacific

- 4.4.9.1 Market by Application

- 4.4.9.2 Market by Product

- 4.5 Middle East

- 4.5.1 Regional Overview

- 4.5.2 Driving Factors for Market Growth

- 4.5.3 Factors Challenging the Market

- 4.5.4 Key Companies

- 4.5.5 Application

- 4.5.6 Product

- 4.5.7 Saudi Arabia

- 4.5.7.1 Market by Application

- 4.5.7.2 Market by Product

- 4.5.8 U.A.E.

- 4.5.8.1 Market by Application

- 4.5.8.2 Market by Product

- 4.5.9 Qatar

- 4.5.9.1 Market by Application

- 4.5.9.2 Market by Product

- 4.6 Rest-of-the-World

- 4.6.1 Regional Overview

- 4.6.2 Driving Factors for Market Growth

- 4.6.3 Factors Challenging the Market

- 4.6.4 Key Companies

- 4.6.5 Application

- 4.6.6 Product

5. Markets - Competitive Benchmarking & Company Profiles

- 5.1 Next Frontiers

- 5.2 Geographic Assessment

- 5.3 Company Profiles

- 5.3.1 Fluor Corporation

- 5.3.1.1 Overview

- 5.3.1.2 Top Products/Product Portfolio

- 5.3.1.3 Top Competitors

- 5.3.1.4 Target Customers

- 5.3.1.5 Key Personnel

- 5.3.1.6 Analyst View

- 5.3.1.7 Market Share

- 5.3.2 ExxonMobil Corporation

- 5.3.2.1 Overview

- 5.3.2.2 Top Products/Product Portfolio

- 5.3.2.3 Top Competitors

- 5.3.2.4 Target Customers

- 5.3.2.5 Key Personnel

- 5.3.2.6 Analyst View

- 5.3.2.7 Market Share

- 5.3.3 Linde plc

- 5.3.3.1 Overview

- 5.3.3.2 Top Products/Product Portfolio

- 5.3.3.3 Top Competitors

- 5.3.3.4 Target Customers

- 5.3.3.5 Key Personnel

- 5.3.3.6 Analyst View

- 5.3.3.7 Market Share

- 5.3.4 Shell plc

- 5.3.4.1 Overview

- 5.3.4.2 Top Products/Product Portfolio

- 5.3.4.3 Top Competitors

- 5.3.4.4 Target Customers

- 5.3.4.5 Key Personnel

- 5.3.4.6 Analyst View

- 5.3.4.7 Market Share

- 5.3.5 Mitsubishi Heavy Industries, Ltd

- 5.3.5.1 Overview

- 5.3.5.2 Top Products/Product Portfolio

- 5.3.5.3 Top Competitors

- 5.3.5.4 Target Customers

- 5.3.5.5 Key Personnel

- 5.3.5.6 Analyst View

- 5.3.5.7 Market Share

- 5.3.6 JGC Holdings Corporation

- 5.3.6.1 Overview

- 5.3.6.2 Top Products/Product Portfolio

- 5.3.6.3 Top Competitors

- 5.3.6.4 Target Customers

- 5.3.6.5 Key Personnel

- 5.3.6.6 Analyst View

- 5.3.6.7 Market Share

- 5.3.7 Equinor ASA

- 5.3.7.1 Overview

- 5.3.7.2 Top Products/Product Portfolio

- 5.3.7.3 Top Competitors

- 5.3.7.4 Target Customers

- 5.3.7.5 Key Personnel

- 5.3.7.6 Analyst View

- 5.3.7.7 Market Share

- 5.3.8 Schlumberger Limited

- 5.3.8.1 Overview

- 5.3.8.2 Top Products/Product Portfolio

- 5.3.8.3 Top Competitors

- 5.3.8.4 Target Customers

- 5.3.8.5 Key Personnel

- 5.3.8.6 Analyst View

- 5.3.8.7 Market Share

- 5.3.9 Aker Carbon Capture

- 5.3.9.1 Overview

- 5.3.9.2 Top Products/Product Portfolio

- 5.3.9.3 Top Competitors

- 5.3.9.4 Target Customers

- 5.3.9.5 Key Personnel

- 5.3.9.6 Analyst View

- 5.3.9.7 Market Share

- 5.3.10 Carbon Clean Solutions Limited

- 5.3.10.1 Overview

- 5.3.10.2 Top Products/Product Portfolio

- 5.3.10.3 Top Competitors

- 5.3.10.4 Target Customers

- 5.3.10.5 Key Personnel

- 5.3.10.6 Analyst View

- 5.3.10.7 Market Share

- 5.3.11 C-Capture

- 5.3.11.1 Overview

- 5.3.11.2 Top Products/Product Portfolio

- 5.3.11.3 Top Competitors

- 5.3.11.4 Target Customers

- 5.3.11.5 Key Personnel

- 5.3.11.6 Analyst View

- 5.3.11.7 Market Share

- 5.3.12 Halliburton

- 5.3.12.1 Overview

- 5.3.12.2 Top Products/Product Portfolio

- 5.3.12.3 Top Competitors

- 5.3.12.4 Target Customers

- 5.3.12.5 Key Personnel

- 5.3.12.6 Analyst View

- 5.3.12.7 Market Share

- 5.3.13 Siemens

- 5.3.13.1 Overview

- 5.3.13.2 Top Products/Product Portfolio

- 5.3.13.3 Top Competitors

- 5.3.13.4 Target Customers

- 5.3.13.5 Key Personnel

- 5.3.13.6 Analyst View

- 5.3.13.7 Market Share

- 5.3.14 Hitachi, Ltd

- 5.3.14.1 Overview

- 5.3.14.2 Top Products/Product Portfolio

- 5.3.14.3 Top Competitors

- 5.3.14.4 Target Customers

- 5.3.14.5 Key Personnel

- 5.3.14.6 Analyst View

- 5.3.14.7 Market Share

- 5.3.15 Honeywell International Inc

- 5.3.15.1 Overview

- 5.3.15.2 Top Products/Product Portfolio

- 5.3.15.3 Top Competitors

- 5.3.15.4 Target Customers

- 5.3.15.5 Key Personnel

- 5.3.15.6 Analyst View

- 5.3.15.7 Market Share

- 5.3.16 Mirreco

- 5.3.16.1 Overview

- 5.3.16.2 Top Products/Product Portfolio

- 5.3.16.3 Top Competitors

- 5.3.16.4 Target Customers

- 5.3.16.5 Key Personnel

- 5.3.16.6 Analyst View

- 5.3.16.7 Market Share

- 5.3.17 SeeO2 Energy Inc.

- 5.3.17.1 Overview

- 5.3.17.2 Top Products/Product Portfolio

- 5.3.17.3 Top Competitors

- 5.3.17.4 Target Customers

- 5.3.17.5 Key Personnel

- 5.3.17.6 Analyst View

- 5.3.17.7 Market Share

- 5.3.18 Neustark AG

- 5.3.18.1 Overview

- 5.3.18.2 Top Products/Product Portfolio

- 5.3.18.3 Top Competitors

- 5.3.18.4 Target Customers

- 5.3.18.5 Key Personnel

- 5.3.18.6 Analyst View

- 5.3.18.7 Market Share

- 5.3.19 CarbonFree

- 5.3.19.1 Overview

- 5.3.19.2 Top Products/Product Portfolio

- 5.3.19.3 Top Competitors

- 5.3.19.4 Target Customers

- 5.3.19.5 Key Personnel

- 5.3.19.6 Analyst View

- 5.3.19.7 Market Share

- 5.3.20 Cemvita Factory Inc.

- 5.3.20.1 Overview

- 5.3.20.2 Top Products/Product Portfolio

- 5.3.20.3 Top Competitors

- 5.3.20.4 Target Customers

- 5.3.20.5 Key Personnel

- 5.3.20.6 Analyst View

- 5.3.20.7 Market Share

- 5.3.1 Fluor Corporation