|

|

市場調査レポート

商品コード

1694061

先進ミリ波リフレクタとリピータ市場- 世界および地域別分析:用途別、製品別、国別 - 分析と予測(2024年~2033年)Advanced Millimeter-Wave Reflectors and Repeaters Market - A Global and Regional Analysis: Focus on Applications, Products, and Country Level Analysis - Analysis and Forecast, 2024-2033 |

||||||

カスタマイズ可能

|

|||||||

| 先進ミリ波リフレクタとリピータ市場- 世界および地域別分析:用途別、製品別、国別 - 分析と予測(2024年~2033年) |

|

出版日: 2025年04月02日

発行: BIS Research

ページ情報: 英文 169 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

高周波5Gネットワーク、衛星通信インフラ、超広帯域、低遅延、信号伝搬特性の改善を必要とする防衛レーダーシステムの急速な展開により、先進ミリ波(mmWave)リフレクタとリピータの市場が急速に拡大しています。

メタマテリアルとフェーズドアレイ技術によって提供されるインテリジェントで電気的にステア可能なリフレクタを使用することで、より正確なビームフォーミングが可能になり、混雑した都市部や直接見通し線のない農村部でのミリ波信号の到達範囲が拡大します。集積半導体アンプ、窒化ガリウム(GaN)ベースのパワーエレクトロニクス、小型マルチビームアンテナアレイの技術的進歩は、中継器の効率を大幅に向上させ、ダイナミックなネットワークカバレッジの最適化と干渉の低減を可能にしています。さらに、小型で堅牢なリフレクタ設計に焦点を当てた通信プロバイダーと防衛請負業者の業界協力は、耐久性が高く高性能なミリ波通信インフラに向けた戦略的な動きを浮き彫りにし、市場機会を拡大しています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2024年~2033年 |

| 2024年の評価 | 4,020万米ドル |

| 2033年の予測 | 5億6,210万米ドル |

| CAGR | 34.05% |

先進ミリ波リフレクタ/リピータ市場は、特に継続的な大容量無線カバレッジを必要とする人口密度の高い都市部や工業地帯で、高周波5Gおよびbeyond-5Gネットワークの展開が加速するにつれて牽引力を増しています。ネットワーク事業者のミリ波(mmWave)技術への依存度が高まるにつれ、急激な減衰や遮断といった基本的な信号伝搬の制約を克服できる先進的なリフレクタやリピータの導入が重要になっています。電子的にステアリング可能なリフレクタ、ビームフォーミング技術を搭載した統合型アクティブ・リピータ、AIを活用したリアルタイム・ネットワーク最適化によるインテリジェント・システムなどは、いずれも最先端のイノベーションの一例です。スマートシティ、自律走行車、精密産業オートメーションは、需要を牽引する主要な産業分野であり、この価値の高いニッチ市場に参入する専門メーカーやシステムインテグレーターに大きな成長の可能性をもたらしています。

先進ミリ波リフレクタとリピータ市場は、高周波5Gの展開と衛星通信ネットワークへの投資の増加により最近人気が高まっており、いずれも高性能で低遅延の信号伝播ソリューションを必要としています。大手通信事業者や衛星サービスプロバイダーは、大気条件や障害物による信号減衰など、30GHzを超える周波数に固有の伝搬上の課題に対処するため、また密集した都市部や遠隔地での接続性を最適化するため、先進的なミリ波反射器や中継器の導入を加速させています。グラフェン強化複合材料や人工メタマテリアルなどのリフレクタ材料における最近の技術革新は、小型化された電子制御ステアラブルリピータと相まって、市場環境に大きな影響を与えており、Pivotal Commware, Inc.やMovandi Corporationなどの企業は、優れた信号性能、コンパクトなフォームファクター、コスト効率の高い拡張性によって差別化を図っています。

最新のミリ波リフレクタとリピータの産業への影響は、特に人口密度の高い都市部や複雑な産業環境において、高周波通信ネットワークの改善に重要な役割を果たすことで定義されます。これらの反射器と中継器は、最先端のメタマテリアルと適応ビームフォーミング技術を使用して、ミリ波周波数での信号減衰と伝搬損失を大幅に最小化し、5Gと今後の6Gインフラのカバレッジと容量を改善します。この技術の導入により、自律的な製造プロセス、インダストリー4.0プロジェクト、拡張現実(AR)に必要とされるリアルタイムのデータ転送が可能になり、産業接続の大きな問題に取り組むことができます。その結果、スマート製造、ロジスティクス、精密オートメーションなどの分野では、生産性の大幅な向上、業務効率の改善、待ち時間の短縮が実現し、商業的価値が強化されるとともに、ミリ波技術の業界全体での採用が促進されます。

5Gネットワークと新興の6Gネットワークは、いずれも大容量データ伝送にミリ波周波数(通常24GHz~100GHz)を必要とするため、世界の商用化と規模拡大が急速に進んでいます。Verizon、AT&T、China Mobile、Deutsche Telekom、NTT Docomoなどの主要通信会社は、ミリ波インフラを改善するための設備投資を大幅に増やし、見通し伝搬の制限を克服し、密集した都市環境でのカバレッジを改善するために必要な特殊な反射器と中継器の需要を促進しています。さらに、スモールセルアーキテクチャ、特に高度な分散アンテナシステム(DAS)の使用が増加しているため、ミリ波信号の伝搬を最適化し、ネットワークの待ち時間を短縮し、重要な通信アプリケーションで必要とされる信頼性を向上させるための高度な反射器と中継器の開発が必要となっています。さらに、最近のビームフォーミングとビームステアリング技術の進歩は、インテリジェントな反射面や電子的に再構成可能なリピータと相まって、先進的なmmWaveインフラに対するネットワーク事業者の選好を著しく高め、通信を市場で最も重要かつ戦略的な成長セグメントとして確立しています。

北米は、5Gインフラ展開の大幅な進展、高周波通信技術への旺盛な投資、FCCのミリ波周波数オークションのような政府の戦略的イニシアティブにより、通信と防衛の両方で商業的導入が加速しているため、先進ミリ波リフレクタおよびリピータ市場を独占すると予想されます。この地域は、Qualcomm、Keysight Technologies、Raytheon Technologiesなどの大手企業に支えられ、高度なフェーズドアレイアンテナやアクティブリピータの生産に長けており、競争上の地位を強化しています。さらに、自律走行車、IoTエコシステム、改良型レーダーシステムなどの業界で超低遅延、広帯域幅接続ソリューションのニーズが高まっていることも、この地域市場の継続的な優位性に大きく寄与しています。

2021年3月、DKK北米は拡大する5Gポートフォリオの一環として、28GHzビームフォーミング中継器を発表し、mmWave展開の課題に対処しました。経路損失が大きく、信号が遮断されやすいため、mmWaveは信頼性の高いモバイル接続を提供するのに苦労しています。このリピータは信号トランスミッションを強化し、効率的なカバレッジとシームレスなモバイルネットワークのパフォーマンスを保証します。5G事業者をサポートすることで、この技術は通信インフラの強化に重要な役割を果たし、高速データ伝送とネットワーク拡張を促進します。先進ミリ波リフレクタとリピータ市場は、このような開発から大きな恩恵を受け、強固な信号伝搬を可能にし、ネットワーク全体の効率を高めています。

特に、高解像度ビデオストリーミング、クラウドゲーム、仮想現実(VR)、モノのインターネット(IoT)など、データ集約型のアプリケーションに産業がシフトするにつれて、広帯域通信に対する需要の高まりが、先進ミリ波(mmWave)リフレクタおよびリピータ市場の主要な促進要因となっています。これらの用途では、遅延を最小限に抑えた高速で中断のないデータ・トランスミッションが要求されるため、24GHz以上の周波数で動作するmmWave技術は、これらのニーズを満たすために不可欠なソリューションとなっています。しかし、mmWave信号は、減衰の影響を受けやすい、カバー範囲が狭い、建物、木、壁などの物理的物体による妨害など、伝搬上の大きな課題に悩まされています。こうした問題に対処するため、信号の到達範囲を広げ、データ転送を最適化し、シームレスな接続性を確保するために、高度な反射器と中継器が導入されています。

先進ミリ波リフレクタとリピータ市場は、技術導入に必要な多額の財政投資によって制約を受けています。メタサーフェスやLNAのような重要なコンポーネントは、AIによる最適化や熱制御の統合と相まって、初期開発コストを押し上げています。特に予算に制約のある地域の小規模プレーヤーは、マイクロ波システムなどの低コストの代替品を選ぶことが多く、市場浸透を制限しています。

本レポートは、進化する先進ミリ波リフレクタとリピータ市場に関する包括的な洞察を提供し、データ駆動型の意思決定と先進通信の戦略的計画を可能にすることで、組織に付加価値を与えます。主な市場動向、技術進歩、競合力学にハイライトを当て、通信、自動車、航空宇宙・防衛、産業用などの分野における新たな機会の特定を支援します。製品タイプや地域別に詳細にセグメント化しているため、企業は特定の市場をターゲットとし、提供する製品を最適化し、事業戦略を練り直すことができます。さらに、政府の奨励策、規制の枠組み、持続可能性政策を網羅しているため、企業は進化する規制へのコンプライアンスを維持することができます。本レポートを活用することで、企業は高度なミリ波技術への投資決定を十分な情報に基づいて行い、通信効率を高め、急速に拡大する電気通信分野で競争力を獲得し、市場における長期的な成長とリーダーシップを確保することができます。

目次

エグゼクティブサマリー

第1章 市場

- 動向:現在および将来の影響評価

- サプライチェーンの概要

- 研究開発レビュー

- パフォーマンスメトリック分析

- 規制状況

- ミリ波反射器と中継器の技術分析

- 市場力学の概要

- 市場促進要因

- 市場抑制要因

- 市場機会

第2章 用途

- 用途のセグメンテーション

- 用途のサマリー

- 先進ミリ波リフレクタとリピータ市場(用途別)

- 通信

- 自動車

- 航空宇宙・防衛

- 産業用

- その他

第3章 製品

- 製品セグメンテーション

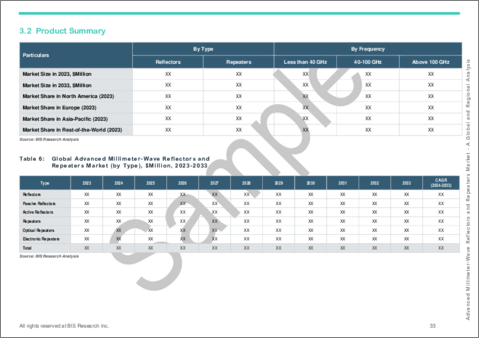

- 製品サマリー

- 先進ミリ波リフレクタとリピータ市場(タイプ別)

- リフレクタ

- リピータ

- 先進ミリ波リフレクタとリピータ市場(周波数別)

- 40GHz未満

- 40~100GHz

- 100GHz以上

第4章 地域

- 地域サマリー

- 北米

- 欧州

- アジア太平洋

- その他の地域

第5章 市場-競合ベンチマーキングと企業プロファイル

- 今後の見通し

- 先進ミリ波リフレクタとリピータメーカー

- Millimeter Wave Products Inc.

- Eravant

- DKK NA

- Dai Nippon Printing Co., Ltd.

- TMY Technology Inc.

- Anteral S.L.

- Movandi Corporation

- PIVOTAL COMMWARE

- Wilson Electronics

- FRTek

- SOLiD

- SureCall

- Greenerwave

- ミリ波技術のTier 1および2企業

- Teledyne Technologies

- L3Harris Technologies, Inc.

- HUBER+SUHNER

- Elbit Systems Ltd.

- Mitsubishi Corporation

- その他

第6章 調査手法

List of Figures

- Figure 1: Optimistic, Pessimistic, and Realistic Scenarios, $Million, 2024, 2028, 2033

- Figure 2: Advanced Millimeter-Wave Reflectors and Repeaters Market (by Region), 2023, 2026, and 2033

- Figure 3: Advanced Millimeter-Wave Reflectors and Repeaters Market (by End-Use Industry), 2023, 2026, and 2033

- Figure 4: Advanced Millimeter-Wave Reflectors and Repeaters Market (by Type), 2023, 2026, and 2033

- Figure 5: Advanced Millimeter-Wave Reflectors and Repeaters Market (by Reflector), 2023, 2026, and 2033

- Figure 6: Advanced Millimeter-Wave Reflectors and Repeaters Market (by Repeaters), 2023, 2026, and 2033

- Figure 7: Advanced Millimeter-Wave Reflectors and Repeaters Market (by Frequency), 2023, 2026, and 2033

- Figure 8: Advanced Millimeter-Wave Reflectors and Repeaters Market, Recent Developments

- Figure 9: Supply Chain and Risks within the Supply Chain

- Figure 10: Advanced Millimeter-Wave Reflectors and Repeaters Market (by Country), January 2021-December 2024

- Figure 11: Advanced Millimeter-Wave Reflectors and Repeaters Market (by Company), January 2021-December 2024

- Figure 12: Key Pointer of the Performance Metrics

- Figure 13: Key Pointer of the Performance Metrics

- Figure 14: Impact Analysis of Market Navigating Factors, 2024-2033

- Figure 15: Types of Materials Used to Make Reflectors

- Figure 16: Uses of Advanced Millimeter-Wave Reflectors

- Figure 17: Uses of Advanced Millimeter-Wave Repeaters

- Figure 18: U.S. Advanced Millimeter-Wave Reflectors and Repeaters Market, $Million, 2023-2033

- Figure 19: Canada Advanced Millimeter-Wave Reflectors and Repeaters Market, $Million, 2023-2033

- Figure 20: Mexico Advanced Millimeter-Wave Reflectors and Repeaters Market, $Million, 2023-2033

- Figure 21: Germany Advanced Millimeter-Wave Reflectors and Repeaters Market, $Million, 2023-2033

- Figure 22: France Advanced Millimeter-Wave Reflectors and Repeaters Market, $Million, 2023-2033

- Figure 23: U.K. Advanced Millimeter-Wave Reflectors and Repeaters Market, $Million, 2023-2033

- Figure 24: Italy Advanced Millimeter-Wave Reflectors and Repeaters Market, $Million, 2023-2033

- Figure 25: Rest-of-Europe Advanced Millimeter-Wave Reflectors and Repeaters Market, $Million, 2023-2033

- Figure 26: China Advanced Millimeter-Wave Reflectors and Repeaters Market, $Million, 2023-2033

- Figure 27: Japan Advanced Millimeter-Wave Reflectors and Repeaters Market, $Million, 2023-2033

- Figure 28: India Advanced Millimeter-Wave Reflectors and Repeaters Market, $Million, 2023-2033

- Figure 29: South Korea Advanced Millimeter-Wave Reflectors and Repeaters Market, $Million, 2023-2033

- Figure 30: Rest-of-Asia-Pacific Advanced Millimeter-Wave Reflectors and Repeaters Market, $Million, 2023-2033

- Figure 31: Latin America Advanced Millimeter-Wave Reflectors and Repeaters Market, $Million, 2023-2033

- Figure 32: Middle East and Africa Advanced Millimeter-Wave Reflectors and Repeaters Market, $Million, 2023-2033

- Figure 33: Strategic Initiatives, 2021-2024

- Figure 34: Share of Strategic Initiatives, 2021-2024

- Figure 35: Data Triangulation

- Figure 36: Top-Down and Bottom-Up Approach

- Figure 37: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Opportunities across Regions

- Table 3: Frequency Licensing, Allocation, and Regulations in Countries

- Table 4: Communication Protocols and Safety Standards in Countries

- Table 5: Environmental Regulations in Countries

- Table 6: Standardization of Millimeter-Wave Components at Global And Country-Specific Levels

- Table 7: Key Differences and Applications

- Table 8: Key Points

- Table 9: Key Points

- Table 10: Global Advanced Millimeter-Wave Reflectors and Repeaters Market (by Application), $Million, 2023-2033

- Table 11: Global Advanced Millimeter-Wave Reflectors and Repeaters Market (by Type), $Million, 2023-2033

- Table 12: Global Advanced Millimeter-Wave Reflectors and Repeaters Market (by Frequency), $Million, 2023-2033

- Table 13: Global Advanced Millimeter-Wave Reflectors and Repeaters Market (by Region), $Million, 2023-2033

- Table 14: North America Advanced Millimeter-Wave Reflectors and Repeaters Market (by Application), $Million, 2023-2033

- Table 15: North America Advanced Millimeter-Wave Reflectors and Repeaters Market (by Type), $Million, 2023-2033

- Table 16: North America Advanced Millimeter-Wave Reflectors and Repeaters Market (by Frequency), $Million, 2023-2033

- Table 17: U.S. Advanced Millimeter-Wave Reflectors and Repeaters Market (by Application), $Million, 2023-2033

- Table 18: U.S. Advanced Millimeter-Wave Reflectors and Repeaters Market (by Type), $Million, 2023-2033

- Table 19: U.S. Advanced Millimeter-Wave Reflectors and Repeaters Market (by Frequency), $Million, 2023-2033

- Table 20: Canada Advanced Millimeter-Wave Reflectors and Repeaters Market (by Application), $Thousand, 2023-2033

- Table 21: Canada Advanced Millimeter-Wave Reflectors and Repeaters Market (by Type), $Thousand, 2023-2033

- Table 22: Canada Advanced Millimeter-Wave Reflectors and Repeaters Market (by Frequency), $Thousand, 2023-2033

- Table 23: Mexico Advanced Millimeter-Wave Reflectors and Repeaters Market (by Application), $Thousand, 2023-2033

- Table 24: Mexico Advanced Millimeter-Wave Reflectors and Repeaters Market (by Type), $Thousand, 2023-2033

- Table 25: Mexico Advanced Millimeter-Wave Reflectors and Repeaters Market (by Frequency), $Thousand, 2023-2033

- Table 26: Europe Advanced Millimeter-Wave Reflectors and Repeaters Market (by Application), $Million, 2023-2033

- Table 27: Europe Advanced Millimeter-Wave Reflectors and Repeaters Market (by Type), $Million, 2023-2033

- Table 28: Europe Advanced Millimeter-Wave Reflectors and Repeaters Market (by Frequency), $Million, 2023-2033

- Table 29: Germany Advanced Millimeter-Wave Reflectors and Repeaters Market (by Application), $Thousand, 2023-2033

- Table 30: Germany Advanced Millimeter-Wave Reflectors and Repeaters Market (by Type), $Thousand, 2023-2033

- Table 31: Germany Advanced Millimeter-Wave Reflectors and Repeaters Market (by Frequency), $Thousand, 2023-2033

- Table 32: France Advanced Millimeter-Wave Reflectors and Repeaters Market (by Application), $Thousand, 2023-2033

- Table 33: France Advanced Millimeter-Wave Reflectors and Repeaters Market (by Type), $Thousand, 2023-2033

- Table 34: France Advanced Millimeter-Wave Reflectors and Repeaters Market (by Frequency), $Thousand, 2023-2033

- Table 35: U.K. Advanced Millimeter-Wave Reflectors and Repeaters Market (by Application), $Thousand, 2023-2033

- Table 36: U.K. Advanced Millimeter-Wave Reflectors and Repeaters Market (by Type), $Thousand, 2023-2033

- Table 37: U.K. Advanced Millimeter-Wave Reflectors and Repeaters Market (by Frequency), $Thousand, 2023-2033

- Table 38: Italy Advanced Millimeter-Wave Reflectors and Repeaters Market (by Application), $Thousand, 2023-2033

- Table 39: Italy Advanced Millimeter-Wave Reflectors and Repeaters Market (by Type), $Thousand, 2023-2033

- Table 40: Italy Advanced Millimeter-Wave Reflectors and Repeaters Market (by Frequency), $Thousand, 2023-2033

- Table 41: Rest-of-Europe Advanced Millimeter-Wave Reflectors and Repeaters Market (by Application), $Thousand, 2023-2033

- Table 42: Rest-of-Europe Advanced Millimeter-Wave Reflectors and Repeaters Market (by Type), $Thousand, 2023-2033

- Table 43: Rest-of-Europe Advanced Millimeter-Wave Reflectors and Repeaters Market (by Frequency), $Thousand, 2023-2033

- Table 44: Asia-Pacific Advanced Millimeter-Wave Reflectors and Repeaters Market (by Application), $Million, 2023-2033

- Table 45: Asia-Pacific Advanced Millimeter-Wave Reflectors and Repeaters Market (by Type), $Million, 2023-2033

- Table 46: Asia-Pacific Advanced Millimeter-Wave Reflectors and Repeaters Market (by Frequency), $Million, 2023-2033

- Table 47: China Advanced Millimeter-Wave Reflectors and Repeaters Market (by Application), $Thousand, 2023-2033

- Table 48: China Advanced Millimeter-Wave Reflectors and Repeaters Market (by Type), $Thousand, 2023-2033

- Table 49: China Advanced Millimeter-Wave Reflectors and Repeaters Market (by Frequency), $Thousand, 2023-2033

- Table 50: Japan Advanced Millimeter-Wave Reflectors and Repeaters Market (by Application), $Thousand, 2023-2033

- Table 51: Japan Advanced Millimeter-Wave Reflectors and Repeaters Market (by Type), $Thousand, 2023-2033

- Table 52: Japan Advanced Millimeter-Wave Reflectors and Repeaters Market (by Frequency), $Thousand, 2023-2033

- Table 53: India Advanced Millimeter-Wave Reflectors and Repeaters Market (by Application), $Thousand, 2023-2033

- Table 54: India Advanced Millimeter-Wave Reflectors and Repeaters Market (by Type), $Thousand, 2023-2033

- Table 55: India Advanced Millimeter-Wave Reflectors and Repeaters Market (by Frequency), $Thousand, 2023-2033

- Table 56: South Korea Advanced Millimeter-Wave Reflectors and Repeaters Market (by Application), $Thousand, 2023-2033

- Table 57: South Korea Advanced Millimeter-Wave Reflectors and Repeaters Market (by Type), $Thousand, 2023-2033

- Table 58: South Korea Advanced Millimeter-Wave Reflectors and Repeaters Market (by Frequency), $Thousand, 2023-2033

- Table 59: Rest-of-Asia-Pacific Advanced Millimeter-Wave Reflectors and Repeaters Market (by Application), $Thousand, 2023-2033

- Table 60: Rest-of-Asia-Pacific Advanced Millimeter-Wave Reflectors and Repeaters Market (by Type), $Thousand, 2023-2033

- Table 61: Rest-of-Asia-Pacific Advanced Millimeter-Wave Reflectors and Repeaters Market (by Frequency), $Thousand, 2023-2033

- Table 62: Rest-of-the-World Advanced Millimeter-Wave Reflectors and Repeaters Market (by Application), $Thousand, 2023-2033

- Table 63: Rest-of-the-World Advanced Millimeter-Wave Reflectors and Repeaters Market (by Type), $Thousand, 2023-2033

- Table 64: Rest-of-the-World Advanced Millimeter-Wave Reflectors and Repeaters Market (by Frequency), $Thousand, 2023-2033

- Table 65: Latin America Advanced Millimeter-Wave Reflectors and Repeaters Market (by Application), $Thousand, 2023-2033

- Table 66: Latin America Advanced Millimeter-Wave Reflectors and Repeaters Market (by Type), $Thousand, 2023-2033

- Table 67: Latin America Advanced Millimeter-Wave Reflectors and Repeaters Market (by Frequency), $Thousand, 2023-2033

- Table 68: Middle East and Africa Advanced Millimeter-Wave Reflectors and Repeaters Market (by Application), $Thousand, 2023-2033

- Table 69: Middle East and Africa Advanced Millimeter-Wave Reflectors and Repeaters Market (by Type), $Thousand, 2023-2033

- Table 70: Middle East and Africa Advanced Millimeter-Wave Reflectors and Repeaters Market (by Frequency), $Thousand, 2023-2033

- Table 71: Market Share, 2023

Advanced Millimeter-Wave Reflectors and Repeaters Market Overview

The market for advanced millimeter-wave (mmWave) reflectors and repeaters has been rapidly expanding, driven by the rapid deployment of high-frequency 5G networks, satellite communications infrastructure, and defense radar systems that require ultra-high bandwidth, low latency, and improved signal propagation characteristics. The use of intelligent, electrically steerable reflectors provided by meta-materials and phased-array technology allows for more precise beamforming capabilities, expanding mmWave signal reach in crowded urban contexts and rural areas without direct line-of-sight. Technological advances in integrated semiconductor amplifiers, Gallium Nitride (GaN)-based power electronics, and small multi-beam antenna arrays are considerably increasing repeater efficiency, allowing for dynamic network coverage optimization and interference reduction. Furthermore, industry cooperation between telecom providers and defense contractors focused on tiny, ruggedized reflector designs highlights a strategic move toward durable, high-performance mmWave communications infrastructure, which expands market opportunities.

Introduction of Advanced Millimeter-Wave Reflectors and Repeaters Market

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2024 - 2033 |

| 2024 Evaluation | $40.2 Million |

| 2033 Forecast | $562.1 Million |

| CAGR | 34.05% |

The advanced millimeter-wave reflectors and repeaters market is gaining traction as the deployment of high-frequency 5G and beyond-5G networks accelerates, particularly in densely populated urban and industrial areas that require continuous, high-capacity wireless coverage. As network operators increasingly rely on millimeter-wave (mmWave) technology, the introduction of advanced reflectors and repeaters capable of overcoming fundamental signal propagation limitations, such as rapid attenuation and blockage, is becoming critical. Electronically steerable reflectors, integrated active repeaters with beamforming technology, and intelligent systems powered by AI-driven real-time network optimization are all examples of cutting-edge innovation. Smart cities, autonomous vehicles, and precision industrial automation are key industry verticals driving demand, creating significant growth potential for specialized manufacturers and system integrators joining this high-value niche market.

Market Introduction

The advanced millimeter-wave reflectors and repeaters market has lately grown in popularity, owing to increased investment in high-frequency 5G deployments and satellite communication networks, both of which require high-performance, low-latency signal propagation solutions. Leading telecom operators and satellite service providers are increasingly deploying advanced millimeter-wave reflectors and repeaters to address inherent propagation challenges at frequencies greater than 30 GHz, such as signal attenuation caused by atmospheric conditions and obstacles, as well as to optimize connectivity in dense urban and remote areas. Recent technological innovations in reflector materials, such as graphene-enhanced composites and engineered metamaterials, combined with miniaturized electronically steerable repeaters, are having a significant impact on the market landscape, allowing companies such as Pivotal Commware, Inc. and Movandi Corporation to differentiate through superior signal performance, compact form factors, and cost-effective scalability.

Industrial Impact

The industrial impact of modern millimeter-wave reflectors and repeaters is defined by their critical role in improving high-frequency communication networks, particularly in densely populated urban areas and complicated industrial settings. These reflectors and repeaters use cutting-edge metamaterials and adaptive beamforming technologies to drastically minimize signal attenuation and propagation losses at millimeter-wave frequencies, improving the coverage and capacity of 5G and upcoming 6G infrastructures. Their deployment tackles significant industrial connectivity difficulties by enabling real-time data transfer, which is required for autonomous manufacturing processes, Industry 4.0 projects, and augmented reality applications. As a result, sectors such as smart manufacturing, logistics, and precision automation experience significant productivity improvements, operational efficiency, and reduced latency, strengthening the commercial value and boosting industry-wide adoption of millimeter-wave technologies.

Market Segmentation:

Segmentation 1: by Application

- Telecommunications

- Automotive

- Aerospace and Defense

- Industrial Applications

- Others

Telecommunications Segment to Dominate the Advanced Millimeter-Wave Reflectors and Repeaters Market (by Application)

The telecommunications segment is expected to dominate the advanced millimeter-wave reflectors and repeaters market due to the rapid global commercialization and scaling of 5G and emerging 6G networks, both of which require millimeter-wave frequencies (typically ranging from 24 GHz to 100 GHz) for high-capacity data transmission. Key telecommunications companies such as Verizon, AT&T, China Mobile, Deutsche Telekom, and NTT Docomo have significantly increased capital expenditures to improve millimeter-wave infrastructure, driving demand for specialized reflectors and repeaters required to overcome line-of-sight propagation limitations and improve coverage in dense urban environments. Furthermore, the increasing use of small-cell architectures, particularly advanced distributed antenna systems (DAS), necessitates the development of advanced reflectors and repeaters to optimize mmWave signal propagation, reduce network latency, and improve the reliability required by critical telecommunications applications. Furthermore, recent advances in beamforming and beam steering technologies, combined with intelligent, reflective surfaces and electronically reconfigurable repeaters, have significantly increased network operators' preference for advanced mmWave infrastructure, establishing telecommunications as the most significant and strategic growth segment in the market.

Segmentation 2: by Type

- Reflectors

- Passive Reflectors

- Active Reflectors

- Repeaters

- Optical Repeaters

- Electronic Repeaters

Repeaters Segment to Dominate the Advanced Millimeter-Wave Reflectors and Repeaters Market (by Type)

The repeaters segment is expected to dominate the advanced millimeter-wave reflectors and repeaters market owing to their superior ability to overcome the line-of-sight (LoS) limitations inherent in millimeter-wave (mmWave) frequencies, allowing for greater network coverage and reliability in dense urban and indoor environments. Recent technological advancements, such as integrated active repeater systems with phased-array antenna architectures, have significantly improved signal regeneration and amplification, allowing for dynamic beam-steering while minimizing signal attenuation, which is critical for 5G and beyond-5G (B5G) deployments. Furthermore, the growing use of intelligent relay mechanisms, which use AI-based adaptive signal processing algorithms to reduce interference and assure effective bandwidth utilization, puts repeaters ahead of passive reflector systems. Furthermore, strategic investments by leading telecom operators in small, low-power repeaters that support network densification initiatives demonstrate the segment's continued relevance, particularly in locations where high-frequency wireless infrastructures are quickly expanding.

Segmentation 3: by Frequency

- Less than 40Ghz

- 40-100Ghz

- Above 100Ghz

Less than 40Ghz Segment to Dominate the Advanced Millimeter-Wave Reflectors and Repeaters Market (by Frequency)

The less than 40GHz frequency segment is expected to dominate the advanced millimeter-wave reflectors and repeaters market, owing to its superior balance of propagation characteristics and cost-effective deployment options. Frequencies below 40GHz provide greater signal penetration and lower atmospheric attenuation, particularly in urban and congested situations, allowing for dependable non-line-of-sight communications, which is crucial for broad 5G and fixed wireless access (FWA) installations. Furthermore, regulatory frameworks worldwide, including key markets such as North America and Europe, offer attractive licensing conditions for sub-40GHz bands, hastening commercialization efforts. Furthermore, equipment makers and telecom operators choose these frequency bands because they have lower component and system prices and greater component availability, resulting in shorter deployment cycles and reduced overall capital expenditure. These benefits collectively establish the sub-40GHz frequency band as the most realistic alternative for enabling rapid scalability while retaining high-performance standards in next-generation telecommunications systems.

Segmentation 4: by Region

- North America (U.S., Canada, and Mexico)

- Europe (Germany, France, Italy, U.K., and Rest-of-Europe)

- Asia-Pacific (China, Japan, India, South Korea, and Rest-of-Asia-Pacific)

- Rest-of-the-World (Latin America and Middle East and Africa)

North America to Dominate the Advanced Millimeter-Wave Reflectors and Repeaters Market (by Region)

North America is expected to dominate the advanced millimeter-wave reflectors and repeaters market due to significant advances in 5G infrastructure deployment, strong investments in high-frequency communication technologies, and strategic government initiatives such as the FCC's mmWave spectrum auctions, which have accelerated commercial adoption in both telecommunications and defense applications. The region's prowess in producing advanced phased-array antennas and active repeaters, backed by significant firms such as Qualcomm, Keysight Technologies, and Raytheon Technologies, strengthens its competitive position. Furthermore, the growing need for ultra-low latency, high-bandwidth connection solutions in industries such as autonomous vehicles, IoT ecosystems, and improved radar systems contributes significantly to the regional market's continued dominance.

Recent Developments in the Advanced Millimeter-Wave Reflectors and Repeaters Market

- In January 2024, TMY Technology Inc. (TMYTEK) and HCMF Group introduced an in-car child presence detection (CPD) system along with a millimeter-wave intelligent car door sensing technology at CES 2024. This collaboration leverages mmWave radar to enhance vehicle safety by detecting occupants inside the vehicle and addressing risks related to heatstroke incidents. This system is designed to comply with global safety regulations, including Euro NCAP and U.S. Infrastructure Investment and Jobs Act mandates.

- In November 2023, TMY Technology Inc. (TMYTEK) unveiled its Wideband FR2/FR3 Testing Solution at the 2023 Microwave Workshops and Exhibition (MWE) in Pacifico Yokohama. This solution enhances mass production efficiency for millimeter-wave chipsets, modules, and devices, addressing frequency complexity and port count challenges. By upgrading sub-6 GHz testing capabilities, this innovation supports the advancement of 5G/6G networks, satellite communication (Satcom), and radar sensing.

- In March 2021, DKK North America introduced its 28GHz Beamforming Repeater as part of its expanding 5G portfolio to address the challenges of mmWave deployment. Due to high path loss and susceptibility to signal blockages, mmWave struggles to provide reliable mobile connectivity. This repeater enhances signal transmission, ensuring efficient coverage and seamless mobile network performance. By supporting 5G operators, the technology plays a crucial role in strengthening telecommunications infrastructure, facilitating high-speed data transmission and network expansion. The advanced millimeter-wave reflectors and repeaters market benefits significantly from such developments, enabling robust signal propagation and enhancing overall network efficiency.

Demand - Drivers, Limitations, and Opportunities

Market Demand Drivers: Growing Demand for High-Bandwidth Communications

The increasing demand for high-bandwidth communications is a key driver in the advanced millimeter wave (mmWave) reflectors and repeaters market, particularly as industries shift toward data-intensive applications such as high-definition video streaming, cloud gaming, virtual reality (VR), and the Internet of Things (IoT). These applications require fast, uninterrupted data transmission with minimal latency, making mmWave technology, which operates at frequencies above 24 GHz, an essential solution for meeting these needs. However, mmWave signals suffer from significant propagation challenges, including high susceptibility to attenuation, limited coverage range, and obstruction by physical objects such as buildings, trees, and walls. To counter these issues, advanced reflectors and repeaters are deployed to enhance signal reach, optimize data transfer, and ensure seamless connectivity.

Market Challenges: High Costs of Technology Adoption

The advanced mmWave reflectors and repeaters market has been constrained by the substantial financial investments required for technology adoption. Critical components such as metasurfaces and LNAs, coupled with the integration of AI-driven optimization and thermal controls, drive up initial development costs. Smaller players, especially in budget-constrained regions, often opt for lower-cost alternatives such as microwave systems, limiting market penetration.

Market Opportunities: Innovative Solutions in Reflector and Repeater Design

The evolution of cutting-edge reflector and repeater designs is creating substantial growth prospects in the advanced millimeter-wave (mmWave) reflectors and repeaters market by addressing fundamental limitations such as high signal loss, short transmission range, and costly infrastructure requirements. Conventional mmWave networks often struggle with penetration issues and limited reach, making their deployment challenging in metropolitan and enclosed spaces. To overcome these barriers, companies are developing reconfigurable intelligent surfaces (RIS), metamaterial-based reflectors, and smart beamforming technologies to boost signal coverage, efficiency, and strength. A notable example is AGC Inc.'s RIS-based reflector, designed for indoor placement on walls and ceilings, which allows radio waves to be redirected more effectively, enhancing 5G mmWave connectivity without the need for additional base stations or costly network expansions. These solutions are critical in ensuring wider and more consistent network performance while reducing telecom providers' capital expenditure.

How can this report add value to an organization?

This report adds value to an organization by providing comprehensive insights into the evolving advanced millimeter-wave reflectors and repeaters market, enabling data-driven decision-making and strategic planning for advanced communication. It highlights key market trends, technological advancements, and competitive dynamics, helping businesses identify emerging opportunities in sectors such as telecommunications, automotive, aerospace and defense, industrial applications, and others. The report's detailed segmentation by type and region allows organizations to target specific markets, optimize product offerings, and refine business strategies. Additionally, its coverage of government incentives, regulatory frameworks, and sustainability policies ensures companies remain compliant with evolving regulations. By leveraging this report, organizations can make informed investment decisions in advanced millimeter wave technology, enhance communication efficiency, and gain a competitive edge in the rapidly expanding telecom sector, ensuring long-term growth and leadership in the market.

Research Methodology

Factors for Data Prediction and Modelling

- The base currency considered for the market analysis is US$. Currencies other than the US$ have been converted to the US$ for all statistical calculations, considering the average conversion rate for that particular year.

- The currency conversion rate was taken from the historical exchange rate on the Oanda website.

- Nearly all the recent developments from January 2021 to January 2025 have been considered in this research study.

- The information rendered in the report is a result of in-depth primary interviews, surveys, and secondary analysis.

- Where relevant information was not available, proxy indicators and extrapolation were employed.

- Any economic downturn in the future has not been taken into consideration for the market estimation and forecast.

- Technologies currently used are expected to persist through the forecast with no major technological breakthroughs.

Market Estimation and Forecast

This research study involves the usage of extensive secondary sources, such as certified publications, articles from recognized authors, white papers, annual reports of companies, directories, and major databases to collect useful and effective information for an extensive, technical, market-oriented, and commercial study of the advanced millimeter-wave reflectors and repeaters market.

The market engineering process involves the calculation of the market statistics, market size estimation, market forecast, market crackdown, and data triangulation (the methodology for such quantitative data processes has been explained in further sections). The primary research study has been undertaken to gather information and validate the market numbers for segmentation types and industry trends of the key players in the market.

Primary Research

The primary sources involve industry experts from the advanced millimeter-wave reflectors and repeaters market and various other stakeholders in the ecosystem. Respondents such as CEOs, vice presidents, marketing directors, and technology and innovation directors have been interviewed to obtain and verify both qualitative and quantitative aspects of this research study.

The key data points taken from primary sources include:

- validation and triangulation of all the numbers and graphs

- validation of reports segmentation and key qualitative findings

- understanding the competitive landscape

- validation of the numbers of various markets for market type

- percentage split of individual markets for geographical analysis

Secondary Research

This research study involves the usage of extensive secondary research, directories, company websites, and annual reports. It also makes use of databases, such as Hoovers, Bloomberg, Businessweek, and Factiva, to collect useful and effective information for an extensive, technical, market-oriented, and commercial study of the global market. In addition to the data sources, the study has been undertaken with the help of other data sources and websites, such as the Census Bureau, OICA, and ACEA.

Secondary research was done to obtain crucial information about the industry's value chain, revenue models, the market's monetary chain, the total pool of key players, and the current and potential use cases and applications.

The key data points taken from secondary research include:

- segmentations and percentage shares

- data for market value

- key industry trends of the top players of the market

- qualitative insights into various aspects of the market, key trends, and emerging areas of innovation

- quantitative data for mathematical and statistical calculations

Key Market Players and Competition Synopsis

The companies that have been profiled in the advanced millimeter-wave reflectors and repeaters market have been selected based on inputs gathered from primary experts who have analyzed company coverage, product portfolio, and market penetration.

Some of the prominent names in this market are:

- Private Companies:

- Pivotal Commware

- FRTek

- Wilson Electronics

- DKK (Denki Kogyo)

- Movandi

- Millimeter Wave Products Inc.

- TMY Technology (TMYTek)

- SureCall

- Eravant (SAGE Millimeter)

- Anteral S.L.

- Greenerwave

- Public Companies:

- Dai Nippon Printing (DNP)

- SOLiD

Companies not part of the aforementioned pool have been well represented across different sections of the advanced millimeter-wave reflectors and repeaters market report (wherever applicable).

Table of Contents

Executive Summary

Scope and Definition

1 Markets

- 1.1 Trends: Current and Future Impact Assessment

- 1.1.1 Trend: Overview

- 1.1.1.1 Emerging Applications for Millimeter-Wave Reflectors and Repeaters

- 1.1.1.2 Innovations in Reflector and Repeater Designs

- 1.1.1.3 Integration of 5G and Upcoming 6G

- 1.1.1.4 Miniaturization and Efficiency Enhancements in Devices

- 1.1.1.5 Adoption of Advanced Materials for Better Performance

- 1.1.1 Trend: Overview

- 1.2 Supply Chain Overview

- 1.2.1 Value Chain Analysis

- 1.2.2 Pricing Trend and Analysis

- 1.3 Research and Development Review

- 1.3.1 Patent Filing Trend (by Country, Company)

- 1.4 Performance Metrics Analysis

- 1.4.1 Signal Gain and Power Amplification

- 1.4.2 Noise Figure and System Losses

- 1.4.3 Efficiency and Latency

- 1.4.4 Signal Range and Coverage

- 1.4.5 Thermal Management and Heat Dissipation

- 1.4.6 Reliability and Lifespan of Components

- 1.5 Regulatory Landscape

- 1.5.1 Industry Regulation and Compliance Standards

- 1.5.1.1 Frequency Licensing and Allocation

- 1.5.1.2 Communication Protocols and Safety Standards

- 1.5.2 Environmental Regulations

- 1.5.3 Standardization of Millimeter-Wave Components

- 1.5.1 Industry Regulation and Compliance Standards

- 1.6 Millimeter-Wave Reflectors and Repeaters Technology Analysis

- 1.6.1 Working Principle of Millimeter-Wave Reflectors and Repeaters

- 1.6.2 Key Technologies and Components

- 1.6.3 Comparison with Other Communication Technologies

- 1.7 Market Dynamics Overview

- 1.7.1 Market Drivers

- 1.7.1.1 Growing Demand for High-Bandwidth Communications

- 1.7.1.2 Increased Demand for Low-Latency Communications

- 1.7.1.3 Emerging Applications in Automotive and Aerospace

- 1.7.2 Market Restraints

- 1.7.2.1 High Costs of Technology Adoption

- 1.7.2.2 Regulatory Challenges

- 1.7.2.3 Signal Interference and Attenuation Issues

- 1.7.3 Market Opportunities

- 1.7.3.1 Applications in Autonomous Vehicles and Smart Cities

- 1.7.3.2 Innovative Solutions in Reflector and Repeater Design

- 1.7.1 Market Drivers

2 Application

- 2.1 Application Segmentation

- 2.2 Application Summary

- 2.3 Advanced Millimeter-Wave Reflectors and Repeaters Market (by Application)

- 2.3.1 Telecommunications

- 2.3.2 Automotive

- 2.3.3 Aerospace and Defense

- 2.3.4 Industrial Applications

- 2.3.5 Others

3 Products

- 3.1 Product Segmentation

- 3.2 Product Summary

- 3.3 Advanced Millimeter-Wave Reflectors and Repeaters Market (by Type)

- 3.3.1 Reflectors

- 3.3.1.1 Passive Reflectors

- 3.3.1.2 Active Reflectors

- 3.3.2 Repeaters

- 3.3.2.1 Optical Repeaters

- 3.3.2.2 Electronic Repeaters

- 3.3.1 Reflectors

- 3.4 Advanced Millimeter-Wave Reflectors and Repeaters Market (by Frequency)

- 3.4.1 Less than 40 GHz

- 3.4.2 40-100 GHz

- 3.4.3 Above 100 GHz

4 Regions

- 4.1 Regional Summary

- 4.2 North America

- 4.2.1 Regional Overview

- 4.2.2 Driving Factors for Market Growth

- 4.2.3 Factors Challenging the Market

- 4.2.4 Application

- 4.2.5 Product

- 4.2.6 North America: Country Level Analysis

- 4.2.6.1 U.S.

- 4.2.6.2 Canada

- 4.2.6.3 Mexico

- 4.3 Europe

- 4.3.1 Regional Overview

- 4.3.2 Driving Factors for Market Growth

- 4.3.3 Factors Challenging the Market

- 4.3.4 Application

- 4.3.5 Product

- 4.3.6 Europe: Country-Level Analysis

- 4.3.6.1 Germany

- 4.3.6.2 France

- 4.3.6.3 U.K.

- 4.3.6.4 Italy

- 4.3.6.5 Rest-of-Europe

- 4.4 Asia-Pacific

- 4.4.1 Regional Overview

- 4.4.2 Driving Factors for Market Growth

- 4.4.3 Factors Challenging the Market

- 4.4.4 Application

- 4.4.5 Product

- 4.4.6 Asia-Pacific: Country-Level Analysis

- 4.4.6.1 China

- 4.4.6.2 Japan

- 4.4.6.3 India

- 4.4.6.4 South Korea

- 4.4.6.5 Rest-of-Asia-Pacific

- 4.5 Rest-of-the-World

- 4.5.1 Regional Overview

- 4.5.2 Driving Factors for Market Growth

- 4.5.3 Factors Challenging the Market

- 4.5.4 Application

- 4.5.5 Product

- 4.5.6 Region Level Analysis

- 4.5.6.1 Latin America

- 4.5.6.2 Middle East and Africa

5 Markets - Competitive Benchmarking & Company Profiles

- 5.1 Next Frontiers

- 5.2 Geographic Assessment

- 5.3 Advanced Millimeter-Wave Reflector and Repeater Manufacturers

- 5.3.1 Millimeter Wave Products Inc.

- 5.3.1.1 Overview

- 5.3.1.2 Top Products/Product Portfolio

- 5.3.1.3 Top Competitors

- 5.3.1.4 Target Customers

- 5.3.1.5 Key Personnel

- 5.3.1.6 Analyst View

- 5.3.1.7 Market Share, 2023

- 5.3.2 Eravant

- 5.3.2.1 Overview

- 5.3.2.2 Top Products/Product Portfolio

- 5.3.2.3 Top Competitors

- 5.3.2.4 Target Customers

- 5.3.2.5 Key Personnel

- 5.3.2.6 Analyst View

- 5.3.2.7 Market Share, 2023

- 5.3.3 DKK NA

- 5.3.3.1 Overview

- 5.3.3.2 Top Products/Product Portfolio

- 5.3.3.3 Top Competitors

- 5.3.3.4 Target Customers

- 5.3.3.5 Key Personnel

- 5.3.3.6 Analyst View

- 5.3.3.7 Market Share, 2023

- 5.3.4 Dai Nippon Printing Co., Ltd.

- 5.3.4.1 Overview

- 5.3.4.2 Top Products/Product Portfolio

- 5.3.4.3 Top Competitors

- 5.3.4.4 Target Customers

- 5.3.4.5 Key Personnel

- 5.3.4.6 Analyst View

- 5.3.4.7 Market Share, 2023

- 5.3.5 TMY Technology Inc.

- 5.3.5.1 Overview

- 5.3.5.2 Top Products/Product Portfolio

- 5.3.5.3 Top Competitors

- 5.3.5.4 Target Customers

- 5.3.5.5 Key Personnel

- 5.3.5.6 Analyst View

- 5.3.5.7 Market Share, 2023

- 5.3.6 Anteral S.L.

- 5.3.6.1 Overview

- 5.3.6.2 Top Products/Product Portfolio

- 5.3.6.3 Top Competitors

- 5.3.6.4 Target Customers

- 5.3.6.5 Key Personnel

- 5.3.6.6 Analyst View

- 5.3.6.7 Market Share, 2023

- 5.3.7 Movandi Corporation

- 5.3.7.1 Overview

- 5.3.7.2 Top Products/Product Portfolio

- 5.3.7.3 Top Competitors

- 5.3.7.4 Target Customers

- 5.3.7.5 Key Personnel

- 5.3.7.6 Analyst View

- 5.3.7.7 Market Share, 2023

- 5.3.8 PIVOTAL COMMWARE

- 5.3.8.1 Overview

- 5.3.8.2 Top Products/Product Portfolio

- 5.3.8.3 Top Competitors

- 5.3.8.4 Target Customers

- 5.3.8.5 Key Personnel

- 5.3.8.6 Analyst View

- 5.3.8.7 Market Share, 2023

- 5.3.9 Wilson Electronics

- 5.3.9.1 Overview

- 5.3.9.2 Top Products/Product Portfolio

- 5.3.9.3 Top Competitors

- 5.3.9.4 Target Customers

- 5.3.9.5 Key Personnel

- 5.3.9.6 Analyst View

- 5.3.9.7 Market Share, 2023

- 5.3.10 FRTek

- 5.3.10.1 Overview

- 5.3.10.2 Top Products/Product Portfolio

- 5.3.10.3 Top Competitors

- 5.3.10.4 Target Customers

- 5.3.10.5 Key Personnel

- 5.3.10.6 Analyst View

- 5.3.10.7 Market Share, 2023

- 5.3.11 SOLiD

- 5.3.11.1 Overview

- 5.3.11.2 Top Products/Product Portfolio

- 5.3.11.3 Top Competitors

- 5.3.11.4 Target Customers

- 5.3.11.5 Key Personnel

- 5.3.11.6 Analyst View

- 5.3.11.7 Market Share, 2023

- 5.3.12 SureCall

- 5.3.12.1 Overview

- 5.3.12.2 Top Products/Product Portfolio

- 5.3.12.3 Top Competitors

- 5.3.12.4 Target Customers

- 5.3.12.5 Key Personnel

- 5.3.12.6 Analyst View

- 5.3.12.7 Market Share, 2023

- 5.3.13 Greenerwave

- 5.3.13.1 Overview

- 5.3.13.2 Top Products/Product Portfolio

- 5.3.13.3 Top Competitors

- 5.3.13.4 Target Customers

- 5.3.13.5 Key Personnel

- 5.3.13.6 Analyst View

- 5.3.13.7 Market Share, 2023

- 5.3.1 Millimeter Wave Products Inc.

- 5.4 Tier 1 and 2 Companies in Millimeter Wave Technology

- 5.4.1 Teledyne Technologies

- 5.4.1.1 Overview

- 5.4.1.2 Top Products/Product Portfolio

- 5.4.1.3 Top Competitors

- 5.4.1.4 Target Customers

- 5.4.1.5 Key Personnel

- 5.4.1.6 Analyst View

- 5.4.2 L3Harris Technologies, Inc.

- 5.4.2.1 Overview

- 5.4.2.2 Top Products/Product Portfolio

- 5.4.2.3 Top Competitors

- 5.4.2.4 Target Customers

- 5.4.2.5 Key Personnel

- 5.4.2.6 Analyst View

- 5.4.3 HUBER+SUHNER

- 5.4.3.1 Overview

- 5.4.3.2 Top Products/Product Portfolio

- 5.4.3.3 Top Competitors

- 5.4.3.4 Target Customers

- 5.4.3.5 Key Personnel

- 5.4.3.6 Analyst View

- 5.4.4 Elbit Systems Ltd.

- 5.4.4.1 Overview

- 5.4.4.2 Top Products/Product Portfolio

- 5.4.4.3 Top Competitors

- 5.4.4.4 Target Customers

- 5.4.4.5 Key Personnel

- 5.4.4.6 Analyst View

- 5.4.5 Mitsubishi Corporation

- 5.4.5.1 Overview

- 5.4.5.2 Top Products/Product Portfolio

- 5.4.5.3 Top Competitors

- 5.4.5.4 Target Customers

- 5.4.5.5 Key Personnel

- 5.4.5.6 Analyst View

- 5.4.6 Other Players

- 5.4.1 Teledyne Technologies

6 Research Methodology

- 6.1 Data Sources

- 6.1.1 Primary Data Sources

- 6.1.2 Secondary Data Sources

- 6.1.3 Data Triangulation

- 6.2 Market Estimation and Forecast