|

|

市場調査レポート

商品コード

1681007

電気自動車用ワイヤーハーネスとコネクタ市場-世界と地域別分析:車両タイプ別、推進タイプ別、用途タイプ別、製品タイプ別、材料タイプ別、部品タイプ別、地域別 - 分析と予測(2025年~2035年)Wiring Harnesses and Connectors for Electric Vehicles Market- A Global and Regional Analysis: Focus on Vehicle Type, Propulsion Type, Application Type, Product Type, Material Type, Component Type, and Regional Analysis- Analysis and Forecast, 2025-2035 |

||||||

カスタマイズ可能

|

|||||||

| 電気自動車用ワイヤーハーネスとコネクタ市場-世界と地域別分析:車両タイプ別、推進タイプ別、用途タイプ別、製品タイプ別、材料タイプ別、部品タイプ別、地域別 - 分析と予測(2025年~2035年) |

|

出版日: 2025年03月18日

発行: BIS Research

ページ情報: 英文 150 Pages

納期: 1~5営業日

|

全表示

- 概要

- 目次

電気自動車分野の急速な進歩により、ワイヤーハーネスとコネクタの需要が増加しています。

電気自動車は、従来の内燃機関車と比較して、ほぼ2倍の量の電線を使用します。したがって、電気自動車の配線の重量は増加します。その結果、OEMはワイヤーハーネスの重量を減らし、ひいては車両の航続距離を伸ばすために、アルミ製ワイヤーハーネスに容易に頼っています。さらに、電気自動車の高電圧バッテリーのエコシステムにより、高電圧電線の需要が急増しています。以上のようなワイヤーハーネス市場の開拓は、市場にも好影響を与えており、予測期間(2025~2034年)に市場は大きな成長を示すと予想されます。

乗用車用電気自動車セグメントは、予測期間を通じて市場を独占すると予想されます。これは、現在商用車と比較して乗用車の台数が多いことに直接起因しています。しかし、商用車はサイズが大きく機能が複雑であるため、より多くのワイヤーハーネスとコネクタを使用していることに留意すべきです。また、商用電気自動車がEV領域に容易に導入されているため、時間の経過とともに成長速度が速まるとみられています。

HEV用ワイヤーハーネスとコネクタは、アジア太平洋と日本でのHEV生産台数の多さから、2020年に最も大きな価値を生み出しました。日本のような国々は、電気自動車産業におけるシェアをHEVに依存しており、三菱自動車、日産自動車、ホンダのような主要企業を通じてHEVを生産しています。しかし、BEVはHEVよりも多くの電線を使用するため、予測期間中に市場はBEVにシフトすると思われます。また、BEVはバッテリーが大きいため、HEVに比べてより太く大きな高圧電線を使用します。

ボディハーネスは、2020年の市場シェアが最も高いです。このシステムで使用されるワイヤーハーネスは、電気自動車において様々な重要な役割を果たすため、現在、市場で最も金額と数量が大きいです。しかしながら、高電圧バッテリーハーネスは、電気自動車の採用が増加しているため、予測期間中に大幅な増加を示しています。

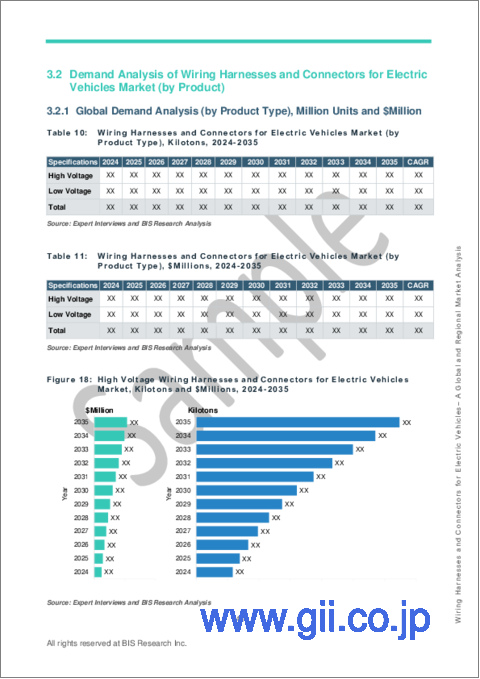

低電圧ワイヤーハーネスが市場を独占していますが、予測期間の終わりには電気自動車用の高圧電線に追い越されると予想されます。低電圧ハーネスは、電気自動車に存在するワイヤーハーネス全体のほぼ70%を占めています。低電圧ハーネスは、インフォテインメント・システム、ドア、シート、HVAC、エンジンなど、電気自動車のすべての補助機能に必要です。しかし、電気自動車の普及が進むにつれて、高電圧電線の必要性は高まっています。

電気自動車は、通常内燃機関車の2倍の銅を使用します。しかし電気自動車のOEMにとっては、車両の軽量化のためにアルミが好んで使われるようになりつつあります。しかし予測期間を通して、銅が市場を独占することになるとみられています。

当レポートでは、世界の電気自動車用ワイヤーハーネスとコネクタ市場について調査し、市場の概要とともに、車両タイプ別、推進タイプ別、用途タイプ別、製品タイプ別、材料タイプ別、部品タイプ別、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場:業界の展望

- 動向:現在および将来の影響評価

- ステークホルダー分析

- 市場力学の概要

- 規制状況

- 特許分析

- スタートアップの情勢

- サプライチェーン分析

- バリューチェーン分析

- 世界価格分析

- 業界の魅力

- 今後の道

第2章 電気自動車用ワイヤーハーネスとコネクタ市場(用途別)

- 用途別セグメンテーション

- 用途別サマリー

- 電気自動車用ワイヤーハーネスとコネクタ市場(車両タイプ別)

- 電気自動車用ワイヤーハーネスとコネクタ市場(推進タイプ別)

- 電気自動車用ワイヤーハーネスとコネクタ市場(用途別)

第3章 電気自動車用ワイヤーハーネスとコネクタ市場(製品別)

- 製品別セグメンテーション

- 製品別サマリー

- 電気自動車用ワイヤーハーネスとコネクタ市場(製品タイプ別)

- 電気自動車用ワイヤーハーネスとコネクタ市場(材料タイプ別)

- 電気自動車用ワイヤーハーネスとコネクタ市場(部品タイプ別)

第4章 電気自動車用ワイヤーハーネスとコネクタ市場(地域別)

- 電気自動車用ワイヤーハーネスとコネクタ市場(地域別)

- 北米

- 欧州

- アジア太平洋

- その他の地域

第5章 市場-競合ベンチマーキングと企業プロファイル

- 今後の見通し

- 地理的評価

- 企業プロファイル

- Sumitomo Electric Industries, Ltd.

- Leoni AG

- Aptiv PLC

- Fujikura Ltd

- Kromberg & Schubert GmbH

- Coroplast Group

- SINBON Electronics Co., Ltd.

- Korea Electric Terminal Co., Ltd.

- EG Electronics

- LS Cable & System Ltd

- TE Connectivity

- ACOME

- Gebauer & Griller

- Continental AG

- Lear Corporation

第6章 調査手法

Global Wiring Harnesses and Connectors for Electric Vehicles Market: Industry Overview

According to recent studies, the rapid advancement in the field of electric vehicles is favoring the increased demand for wiring harnesses and connectors. Electric vehicles use almost double the amount of wires when compared to a traditional ICE vehicle. Therefore, the weight of wiring in electric vehicles increases. As a consequence, OEMs are readily resorting to aluminum wiring harnesses in order to reduce the weight of wiring harnesses, and in turn, increase the range of their vehicles. Moreover, the demand for high voltage wires has been ramped up due to the high voltage battery ecosystems in electric vehicles. All of the above-mentioned developments in the wiring harness market have also impacted the market in a positive way, by virtue of which the market is expected to exhibit significant growth over the forecast period (2025-2034).

Market Segmentation:

Segmentation 1: by Vehicle Type

- Passenger

- Commercial

Passenger electric vehicles segment is expected to dominate the market throughout the forecast period. It can be directly attributed to the larger number of passenger vehicles when compared to commercial vehicles currently. However, it is to be noted that commercial vehicles use more wiring harnesses and connectors owing to their larger sizes and complex functions. It will also grow at a faster rate over time as commercial electric vehicles are readily being introduced in the EV domain.

Segmentation 2: by Propulsion Type

- Battery Electric Vehicle (BEV)

- Hybrid Electric Vehicle (HEV)

- Plug-In Hybrid Electric Vehicle (PHEV)

Wiring harnesses and connectors for HEVs generated the most value in 2020 owing to a large number of HEV production in Asia-Pacific and Japan. Countries such as Japan rely on HEVs for their share in the electric vehicle industry and are one of the largest producers of HEVs through leading companies such as Mitsubishi, Nissan Motor Company, and Honda. However, the market will shift toward BEVs over the forecast period as BEVs use a larger number of wires than HEV. Also, BEV deploys larger and thicker high voltage wires when compared with HEVs owing to the bigger battery.

Segmentation 3: by Application Type

- Body Harness

- High Voltage Battery Harness

- Dashboard/Cabin Harness

- HVAC Harness

- Others

Body harness occupied the largest share in the market in 2020. The wiring harness used in this system performs various important in electric vehicles, and therefore, has the most value and volume in the market currently. Nevertheless, high voltage battery harness shows a significant increase during the forecast period due to the growing adoption of electric vehicles.

Segmentation 4: by Product Type

- High Voltage

- Low Voltage

The low voltage wiring harness segment dominates the market, albeit it will be surpassed by high voltage wires for electric vehicles by the end of the forecast period. Low voltage harnesses make up almost 70% of the total wiring harnesses present in an electric vehicle. It is needed for all the auxiliary functions in EVs, such as infotainment systems, doors, seats, HVAC, and engines. However, the need for high voltage wires is increasing as the adoption of electric vehicles is ramping up.

Segmentation 5: by Material Type

- Copper

- Aluminum

- Optical Fiber

Electric vehicles use double the amount of copper which is usually required by ICE vehicles. Moreover, all the wires in vehicles are constructed using copper owing to its excellent conductivity and mechanical strength; however, aluminum is emerging as the favorite material for electric vehicle OEMs in order for them to reduce the weight of their vehicles. However, copper will be dominating the market throughout the forecast period.

Segmentation 6: by Component Type

- Wires

- Connectors

- Others

Wires form the main component of wiring harnesses. Therefore, it will dominate the market throughout the forecast period. Wires are generally made up of copper with one or multiple layers of insulation around them for protection and for prevention of energy loss. Also, in luxury electric vehicles, a large number of wires are involved for complex electrical functions. Moreover, larger cars tend to use larger and heavier wires in conjunction with connectors to carry out operations.

Segmentation 7: by Region

- North America - U.S., Canada, and Mexico

- Europe - Germany, Italy, Spain, France, U.K., and Rest-of-Europe

- Asia-Pacific and Japan - China, Japan, India, South Korea, and Rest-of-Asia-Pacific

- Rest-of-the-World

China is expected to be the largest market for wiring harnesses and connectors for electric vehicles in 2034, in addition to being the 2nd largest market for wiring harness and connectors for electric vehicles after Asia-Pacific and Japan. The electric vehicle market in China was the largest in terms of volume in 2023 and is expected to increase exponentially. Therefore, the use of wiring harnesses in China is also increasing. Also, there is a large number of electric vehicles in the commercial fleet of China that have been deployed for cab services. Moreover, China is readily electrifying its existing ICE fleet into electric vehicles, which would deploy additional usage of high voltage wiring harnesses and connectors.

How Can This Report Add Value to an Organization?

Product/Innovation Strategy: The product segment helps the reader understand the different types of wiring harness and connectors for electric vehicles market available for deployment and their potential globally. Moreover, the study provides the reader a detailed understanding of wiring harness and connectors for electric vehicles market by application and by product segmentations.

Growth/Marketing Strategy: The growth and marketing strategy for the wiring harness and connectors market in electric vehicles (EVs) requires a mix of innovation, strategic partnerships, and digital outreach. Companies should focus on lightweight, high-efficiency wiring solutions to enhance EV performance. Building alliances with EV manufacturers ensures early adoption. Expanding into emerging EV markets, leveraging government incentives, and investing in R&D for smart, high-voltage connectors will drive competitive advantage. Sustainability messaging can further differentiate brands in the eco-conscious EV sector.

Competitive Strategy: Key players in the wiring harness and connectors for electric vehicles market analyzed and profiled in the study involve wiring harness and connectors for electric vehicles market manufacturers. Moreover, a detailed competitive benchmarking of the players operating in the wiring harness and connectors for electric vehicles market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, and market penetration.

Some of the prominent names established in this market are:

- Sumitomo Electric Industries, Ltd.

- Leoni AG

- Aptiv PLC

- Fujikura Ltd.

- Kromberg & Schubert GmbH

- Coroplast Group

- SINBON Electronics Co.

- Korea Electric Terminal Co., Ltd.

- EG Electronics

- LS Cable & System Ltd.

- TE Connectivity

- ACOME

- Gebauer & Griller

- Continental AG

- Lear Corporation

Companies that are not a part of the above-mentioned pool have been well represented across different sections of the report (wherever applicable).

Table of Contents

Executive Summary

Scope and Definition

Market/Product Definition

Key Questions Answered

Analysis and Forecast Note

1. Markets: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.2 Stakeholder Analysis

- 1.2.1 Use Case

- 1.2.2 End User and Buying Criteria

- 1.3 Market Dynamics Overview

- 1.3.1 Market Drivers

- 1.3.2 Market Restraints

- 1.3.3 Market Opportunities

- 1.4 Regulatory Landscape

- 1.5 Patent Analysis

- 1.6 Start-Up Landscape

- 1.7 Supply Chain Analysis

- 1.8 Value Chain Analysis

- 1.9 Global Pricing Analysis

- 1.10 Industry Attractiveness

- 1.11 The Road Ahead

2. Wiring Harnesses and Connectors for Electric Vehicles Market (by Application)

- 2.1 Application Segmentation

- 2.2 Application Summary

- 2.3 Wiring Harnesses and Connectors for Electric Vehicles Market (by Vehicle Type)

- 2.3.1 Passenger

- 2.3.2 Commercial

- 2.4 Wiring Harnesses and Connectors for Electric Vehicles Market (by Propulsion Type)

- 2.4.1 Battery Electric Vehicle (BEV)

- 2.4.2 Hybrid Electric Vehicle (HEV)

- 2.4.3 Plug-In Hybrid Electric Vehicle (PHEV)

- 2.5 Wiring Harnesses and Connectors for Electric Vehicles Market (by Application)

- 2.5.1 Body Harness

- 2.5.2 High Voltage Battery Harness

- 2.5.3 Dashboard/Cabin Harness

- 2.5.4 HVAC Harness

- 2.5.5 Others

3. Wiring Harnesses and Connectors for Electric Vehicles Market (by Product)

- 3.1 Product Segmentation

- 3.2 Product Summary

- 3.3 Wiring Harnesses and Connectors for Electric Vehicles Market (by Product Type)

- 3.3.1 High Voltage

- 3.3.2 Low Voltage

- 3.4 Wiring Harnesses and Connectors for Electric Vehicles Market (by Material Type)

- 3.4.1 Copper

- 3.4.2 Aluminum

- 3.4.3 Optical Fiber

- 3.5 Wiring Harnesses and Connectors for Electric Vehicles Market (by Component Type)

- 3.5.1 Wires

- 3.5.2 Connectors

- 3.5.3 Others

4. Wiring Harnesses and Connectors for Electric Vehicles Market (by Region)

- 4.1 Wiring Harnesses and Connectors for Electric Vehicles Market (by Region)

- 4.2 North America

- 4.2.1 Regional Overview

- 4.2.2 Driving Factors for Market Growth

- 4.2.3 Factors Challenging the Market

- 4.2.4 Key Companies

- 4.2.5 Application

- 4.2.6 Product

- 4.2.7 U.S.

- 4.2.7.1 Market by Application

- 4.2.7.2 Market by Product

- 4.2.8 Canada

- 4.2.8.1 Market by Application

- 4.2.8.2 Market by Product

- 4.2.9 Mexico

- 4.2.9.1 Market by Application

- 4.2.9.2 Market by Product

- 4.3 Europe

- 4.3.1 Regional Overview

- 4.3.2 Driving Factors for Market Growth

- 4.3.3 Factors Challenging the Market

- 4.3.4 Key Companies

- 4.3.5 Application

- 4.3.6 Product

- 4.3.7 Germany

- 4.3.7.1 Market by Application

- 4.3.7.2 Market by Product

- 4.3.8 France

- 4.3.8.1 Market by Application

- 4.3.8.2 Market by Product

- 4.3.9 Italy

- 4.3.9.1 Market by Application

- 4.3.9.2 Market by Product

- 4.3.10 Spain

- 4.3.10.1 Market by Application

- 4.3.10.2 Market by Product

- 4.3.11 U.K.

- 4.3.11.1 Market by Application

- 4.3.11.2 Market by Product

- 4.3.12 Rest-of-Europe

- 4.3.12.1 Market by Application

- 4.3.12.2 Market by Product

- 4.4 Asia-Pacific

- 4.4.1 Regional Overview

- 4.4.2 Driving Factors for Market Growth

- 4.4.3 Factors Challenging the Market

- 4.4.4 Key Companies

- 4.4.5 Application

- 4.4.6 Product

- 4.4.7 China

- 4.4.7.1 Market by Application

- 4.4.7.2 Market by Product

- 4.4.8 Japan

- 4.4.8.1 Market by Application

- 4.4.8.2 Market by Product

- 4.4.9 India

- 4.4.9.1 Market by Application

- 4.4.9.2 Market by Product

- 4.4.10 South Korea

- 4.4.10.1 Market by Application

- 4.4.10.2 Market by Product

- 4.4.11 Rest-of-Asia-Pacific

- 4.4.11.1 Market by Application

- 4.4.11.2 Market by Product

- 4.5 Rest-of-the-World

- 4.5.1 Regional Overview

- 4.5.2 Driving Factors for Market Growth

- 4.5.3 Factors Challenging the Market

- 4.5.4 Key Companies

- 4.5.5 Application

- 4.5.6 Product

- 4.5.7 South America

- 4.5.7.1 Market by Application

- 4.5.7.2 Market by Product

- 4.5.8 Middle East and Africa

- 4.5.8.1 Market by Application

- 4.5.8.2 Market by Product

5. Markets - Competitive Benchmarking & Company Profiles

- 5.1 Next Frontiers

- 5.2 Geographic Assessment

- 5.3 Company Profiles

- 5.3.1 Sumitomo Electric Industries, Ltd.

- 5.3.1.1 Overview

- 5.3.1.2 Top Products/Product Portfolio

- 5.3.1.3 Top Competitors

- 5.3.1.4 Target Customers

- 5.3.1.5 Key Personnel

- 5.3.1.6 Analyst View

- 5.3.1.7 Market Share

- 5.3.2 Leoni AG

- 5.3.2.1 Overview

- 5.3.2.2 Top Products/Product Portfolio

- 5.3.2.3 Top Competitors

- 5.3.2.4 Target Customers

- 5.3.2.5 Key Personnel

- 5.3.2.6 Analyst View

- 5.3.2.7 Market Share

- 5.3.3 Aptiv PLC

- 5.3.3.1 Overview

- 5.3.3.2 Top Products/Product Portfolio

- 5.3.3.3 Top Competitors

- 5.3.3.4 Target Customers

- 5.3.3.5 Key Personnel

- 5.3.3.6 Analyst View

- 5.3.3.7 Market Share

- 5.3.4 Fujikura Ltd

- 5.3.4.1 Overview

- 5.3.4.2 Top Products/Product Portfolio

- 5.3.4.3 Top Competitors

- 5.3.4.4 Target Customers

- 5.3.4.5 Key Personnel

- 5.3.4.6 Analyst View

- 5.3.4.7 Market Share

- 5.3.5 Kromberg & Schubert GmbH

- 5.3.5.1 Overview

- 5.3.5.2 Top Products/Product Portfolio

- 5.3.5.3 Top Competitors

- 5.3.5.4 Target Customers

- 5.3.5.5 Key Personnel

- 5.3.5.6 Analyst View

- 5.3.5.7 Market Share

- 5.3.6 Coroplast Group

- 5.3.6.1 Overview

- 5.3.6.2 Top Products/Product Portfolio

- 5.3.6.3 Top Competitors

- 5.3.6.4 Target Customers

- 5.3.6.5 Key Personnel

- 5.3.6.6 Analyst View

- 5.3.6.7 Market Share

- 5.3.7 SINBON Electronics Co., Ltd.

- 5.3.7.1 Overview

- 5.3.7.2 Top Products/Product Portfolio

- 5.3.7.3 Top Competitors

- 5.3.7.4 Target Customers

- 5.3.7.5 Key Personnel

- 5.3.7.6 Analyst View

- 5.3.7.7 Market Share

- 5.3.8 Korea Electric Terminal Co., Ltd.

- 5.3.8.1 Overview

- 5.3.8.2 Top Products/Product Portfolio

- 5.3.8.3 Top Competitors

- 5.3.8.4 Target Customers

- 5.3.8.5 Key Personnel

- 5.3.8.6 Analyst View

- 5.3.8.7 Market Share

- 5.3.9 EG Electronics

- 5.3.9.1 Overview

- 5.3.9.2 Top Products/Product Portfolio

- 5.3.9.3 Top Competitors

- 5.3.9.4 Target Customers

- 5.3.9.5 Key Personnel

- 5.3.9.6 Analyst View

- 5.3.9.7 Market Share

- 5.3.10 LS Cable & System Ltd

- 5.3.10.1 Overview

- 5.3.10.2 Top Products/Product Portfolio

- 5.3.10.3 Top Competitors

- 5.3.10.4 Target Customers

- 5.3.10.5 Key Personnel

- 5.3.10.6 Analyst View

- 5.3.10.7 Market Share

- 5.3.11 TE Connectivity

- 5.3.11.1 Overview

- 5.3.11.2 Top Products/Product Portfolio

- 5.3.11.3 Top Competitors

- 5.3.11.4 Target Customers

- 5.3.11.5 Key Personnel

- 5.3.11.6 Analyst View

- 5.3.11.7 Market Share

- 5.3.12 ACOME

- 5.3.12.1 Overview

- 5.3.12.2 Top Products/Product Portfolio

- 5.3.12.3 Top Competitors

- 5.3.12.4 Target Customers

- 5.3.12.5 Key Personnel

- 5.3.12.6 Analyst View

- 5.3.12.7 Market Share

- 5.3.13 Gebauer & Griller

- 5.3.13.1 Overview

- 5.3.13.2 Top Products/Product Portfolio

- 5.3.13.3 Top Competitors

- 5.3.13.4 Target Customers

- 5.3.13.5 Key Personnel

- 5.3.13.6 Analyst View

- 5.3.13.7 Market Share

- 5.3.14 Continental AG

- 5.3.14.1 Overview

- 5.3.14.2 Top Products/Product Portfolio

- 5.3.14.3 Top Competitors

- 5.3.14.4 Target Customers

- 5.3.14.5 Key Personnel

- 5.3.14.6 Analyst View

- 5.3.14.7 Market Share

- 5.3.15 Lear Corporation

- 5.3.15.1 Overview

- 5.3.15.2 Top Products/Product Portfolio

- 5.3.15.3 Top Competitors

- 5.3.15.4 Target Customers

- 5.3.15.5 Key Personnel

- 5.3.15.6 Analyst View

- 5.3.15.7 Market Share

- 5.3.1 Sumitomo Electric Industries, Ltd.