|

|

市場調査レポート

商品コード

1786311

ナトリウムイオン電池の世界市場:用途・製品・地域別の分析・予測 (2025-2035年)Sodium-Ion Battery Market - A Global and Regional Analysis: Focus on Application, Product, and Regional Analysis - Analysis and Forecast, 2025-2035 |

||||||

カスタマイズ可能

|

|||||||

| ナトリウムイオン電池の世界市場:用途・製品・地域別の分析・予測 (2025-2035年) |

|

出版日: 2025年08月08日

発行: BIS Research

ページ情報: 英文 234 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

ナトリウムイオン電池 (SIB) 市場は、エネルギー貯蔵の分野でリチウムイオン電池に代わる選択肢として世界的に注目を集め続けています。

リチウムの供給量の限界、高価格、環境への影響といった懸念が、特に電力網向けエネルギー貯蔵や短距離輸送において、SIBを有望な選択肢として位置づけています。2023年以降、政府や研究機関による支援は拡大しています。例えば、2024年4月には米国エネルギー省 (DOE) がSIBの製造促進のために1,570万ドルのイニシアチブを発表しました。EUのHorizon Europe (HE) 計画も、よりクリーンなエネルギー技術に関連する研究への資金提供を継続しています。さらに、2025年2月には米国のPacific Northwest National Laboratory (PNNL) が、Sodium-ion Advancement for Grid Energy Storage (SAGES) プロジェクトにおいて、エネルギー密度向上の進展を発表しました。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2025-2035年 |

| 2025年評価 | 5億90万米ドル |

| 2035年予測 | 120億3,640万米ドル |

| CAGR | 37.43% |

市場概要

SIB市場は、特に分散型および再生可能エネルギーを基盤とした用途において、リチウムイオン技術に代わる信頼性が高く持続可能な選択肢として勢いを増しています。2025年1月には、インドのReliance Industriesが農村部のマイクログリッドにおけるSIBのパイロット導入を発表し、輸入リチウムへの依存を減らしつつ、地域エネルギーシステムを支える技術の可能性を示しました。これは、セル化学の進歩によってエネルギー密度、サイクル寿命、コスト効率が改善される中、SIBに対する産業界の関心が高まっているというより大きな潮流を反映しています。サプライチェーンの整備や性能の最適化といった課題は残るものの、進行中の研究開発やパイロットプロジェクトがSIBの商業化を加速させています。手頃で安全かつスケーラブルなエネルギー貯蔵ソリューションへの需要が高まる中、SIBは世界的なエネルギー転換においてますます重要な役割を果たすと期待されています。

用途別では、大規模定置型エネルギー貯蔵が市場を牽引

SIBは、その手頃な価格、安全性、ナトリウムのような豊富な資源を利用する点から、大規模定置型エネルギー貯蔵市場で強い勢いを得ています。リチウム価格の変動が続き、サプライチェーンが地政学的・環境的制約に直面する中で、SIBはリチウムイオンシステムに代わる戦略的選択肢としてますます注目されています。技術の進歩によりSIBの性能は大幅に向上し、電力網レベルでの利用に十分耐えうるものとなっています。2025年3月には、BYDがリン酸鉄リチウム (LFP) 電池とのコスト同等性達成を目指し、SIBの生産ラインへの投資を行うことを確認しました。

市場の分類

セグメンテーション1:用途別

- 自動車

- エレクトロニクス

- 大規模定置型エネルギー貯蔵

- 産業用

- その他

セグメンテーション2:製品タイプ別

- 非水系SIB

- 水系SIB

- 固体SIB

セグメンテーション3:フォームファクター別

- 角型

- 円筒形

- パウチ

セグメンテーション4:システム/パックレベル電圧別

- 低電圧システム (12V~60V)

- 中電圧システム (60V~300V)

- 高電圧システム (300V以上)

セグメンテーション5:地域別

- 北米

- 欧州

- アジア太平洋

- その他の地域

当レポートでは、世界のナトリウムイオン電池 (SIB) の市場を調査し、主要動向、市場影響因子の分析、法規制環境、技術・特許の分析、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

エグゼクティブサマリー

範囲と定義

第1章 市場:業界展望

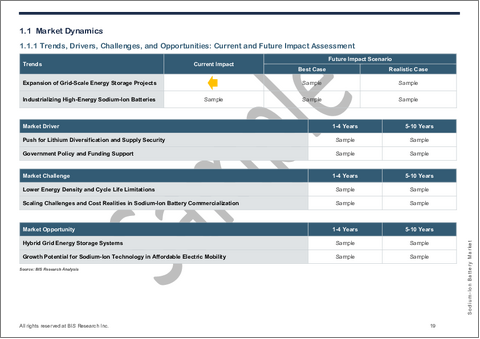

- 市場力学

- 動向、促進要因、課題、機会:現在および将来の影響評価

- 動向

- グリッドスケールエネルギー貯蔵プロジェクトの拡大

- 高エネルギーSIBの産業化

- 規制機関/認証機関

- 政府プログラム

- 調査機関・大学別プログラム

- バリューチェーン分析

- ステークホルダー分析

- ケーススタディ

- 市場力学

- 市場促進要因

- 市場の課題

- 事業戦略

- 企業戦略

- 市場機会

- スタートアップの情勢

- エコシステムにおける主要なスタートアップ

- 特許分析

- 特許出願動向 (特許件数別、年別、国別

- コスト分析

- SIBリサイクルエコシステム

第2章 用途

- 比較分析:主要用途におけるリチウムイオン電池とSIB

- 用途のサマリー

- SIB市場:用途別

- 自動車

- エレクトロニクス

- 大規模定置型エネルギー貯蔵

- 工業

- その他

第3章 製品

- 製品サマリー

- SIB市場:製品情勢

- ナトリウムイオン電池市場:タイプ別

- 非水系SIB

- 水性SIB

- 固体SIB

- SIB市場:フォームファクター別

- 角型

- 円筒形

- ポーチ

- SIB市場:システム/パックレベル電圧別

- 低電圧システム (12V~60V)

- 中電圧システム (60V~300V)

- 高電圧システム (>300V)

第4章 地域

- 地域サマリー

- 北米

- 地域概要

- 市場成長の原動力

- 市場課題

- 米国

- カナダ

- メキシコ

- 欧州

- 地域概要

- 市場成長の原動力

- 市場課題

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- その他

- アジア太平洋

- 地域概要

- 市場成長の原動力

- 市場課題

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- その他

- その他の地域

- 地域概要

- 市場成長の原動力

- 市場課題

- 南米

- 中東・

第5章 市場:競合ベンチマーキングと企業プロファイル

- Aquion Energy (Juline-Titans LLC)

- Faradion (Reliance Industries Ltd)

- HiNa Battery Technology Co., Ltd

- BENAN Energy Technology (Shanghai) Co., Ltd (BENAN ENERGY)

- AMTE Power plc (AGM Batteries Limited)

- Natron Energy, Inc

- TIAMAT

- Jiangsu Zhongna Energy Technology Co., Ltd.

- Contemporary Amperex Technology Co. Limited (CATL)

- Bluetti Power

- Li-FUN Technology Corporation Limited

- Indi Energy

- Altris AB

- Farasis Energy

- BYD Company Ltd

第6章 調査手法

List of Figures

- Figure 1: Sodium-Ion Battery Market (by Scenario), Million, 2024, 2028, and 2034

- Figure 2: Global Sodium-Ion Battery Market, 2024-2035

- Figure 3: Top Countries, Global Sodium-Ion Battery Market, $Million, 2024

- Figure 4: Global Market Snapshot, 2024

- Figure 5: Global Sodium-Ion Battery Market, $Million, 2024 and 2035

- Figure 6: Sodium-Ion Battery Market (by Application), $Million, 2024, 2028, and 2035

- Figure 7: Sodium-Ion Battery Market (by Application), MWh, 2024, 2028, and 2035

- Figure 8: Sodium-Ion Battery Market (by Type), $Million, 2024, 2028, and 2035

- Figure 9: Sodium-Ion Battery Market (by Type), MWh, 2024, 2028, and 2035

- Figure 10: Sodium-Ion Battery Market (by Form Factor), $Million, 2024, 2028, and 2035

- Figure 11: Sodium-Ion Battery Market (by Form Factor), MWh, 2024, 2028, and 2035

- Figure 12: Sodium-Ion Battery Market (by System/Pack-Level Voltage), $Million, 2024, 2028, and 2035

- Figure 13: Sodium-Ion Battery Market (by System/Pack-Level Voltage), MWh, 2024, 2028, and 2035

- Figure 14: Sodium-Ion Battery Market Segmentation

- Figure 15: Japan's Battery Strategy Case Study: Transitioning from Lithium to Sodium Alternatives

- Figure 16: Factors Influencing Sodium-Ion Battery Commercialization

- Figure 17: Projected Global Stationary Battery Storage Capacity (by Scenario), 2020-2050

- Figure 18: Patent Analysis (by Year and Country), January 2020-May2025

- Figure 19: Sodium-Ion Battery: Cost Breakdown (by Component), 2024

- Figure 20: Sodium-Ion Battery: Battery Pack Energy Price (by Configuration), 2024

- Figure 21: Sodium-Ion Battery Recycling Ecosystem

- Figure 22: Global Sodium-Ion Battery Market (by Application), MWh, 2024, 2028, and 2035

- Figure 23: Global Sodium-Ion Battery Market (by Application), $Million, 2024, 2028, and 2035

- Figure 24: Global Sodium-Ion Battery Market, Automotive Country Wise, $Million, 2024

- Figure 25: Global Sodium-Ion Battery Market, Automotive Volume MWh, 2024-2035

- Figure 26: Global Sodium-Ion Battery Market, Automotive Value $Million, 2024-2035

- Figure 27: Global Sodium-Ion Battery Market, Electronics Value Country Wise, $Million, 2024

- Figure 28: Global Sodium-Ion Battery Market, Electronics Volume MWh, 2024-2035

- Figure 29: Global Sodium-Ion Battery Market, Electronics Value $Million, 2024-2035

- Figure 30: Global Sodium-Ion Battery Market, Large-Scale Stationary Energy Storage Value Country Wise, $Million, 2024

- Figure 31: Global Sodium-Ion Battery Market, Large-Scale Stationary Energy Storage Volume MWh, 2024-2035

- Figure 32: Global Sodium-Ion Battery Market, Large-Scale Stationary Energy Storage Value $Million, 2024-2035

- Figure 33: Global Sodium-Ion Battery Market, Industrial Value Country Wise, $Million, 2024

- Figure 34: Global Sodium-Ion Battery Market, Industrial Volume MWh, 2024-2035

- Figure 35: Global Sodium-Ion Battery Market, Industrial Value $Million, 2024-2035

- Figure 36: Global Sodium-Ion Battery Market, Others Value Country Wise, $Million, 2024

- Figure 37: Global Sodium-Ion Battery Market, Others Volume MWh, 2024-2035

- Figure 38: Global Sodium-Ion Battery Market, Others Value $Million, 2024-2035

- Figure 39: Global Sodium-Ion Battery Market (by Product) Volume, MWh, 2024, 2028, and 2035

- Figure 40: Global Sodium-Ion Battery Market, (by Product) Value, $Million, 2024, 2028, and 2035

- Figure 42: Global Sodium-Ion Battery Market (by Form Factor) Volume, MWh, 2024, 2028, and 2035

- Figure 43: Global Sodium-Ion Battery Market, (by Form Factor) Value, $Million, 2024, 2028, and 2035

- Figure 44: Global Sodium-Ion Battery Market (by System/Pack-Level Voltage) Volume, MWh, 2024, 2028, and 2035

- Figure 45: Global Sodium-Ion Battery Market, (by System/Pack-Level Voltage) Value, $Million, 2024, 2028, and 2035

- Figure 46: Global Sodium-Ion Battery Market, Non-Aqueous Sodium-Ion Batteries Value, $Million, 2024

- Figure 47: Global Sodium-Ion Battery Market, Non-Aqueous Sodium-Ion Batteries Volume MWh, 2024-2035

- Figure 48: Global Sodium-Ion Battery Market, Non-Aqueous Sodium-Ion Batteries Value $Million, 2024-2035

- Figure 49: Global Sodium-Ion Battery Market, Aqueous Sodium-Ion Batteries Value, $Million, 2024

- Figure 50: Global Sodium-Ion Battery Market, Aqueous Sodium-Ion Batteries Volume MWh, 2024-2035

- Figure 51: Global Sodium-Ion Battery Market, Aqueous Sodium-Ion Batteries Value $Million, 2024-2035

- Figure 52: Global Sodium-Ion Battery Market, Solid-State Sodium-Ion Batteries Volume MWh, 2024-2035

- Figure 53: Global Sodium-Ion Battery Market, Solid-State Sodium-Ion Batteries Value $Million, 2024-2035

- Figure 54: Global Sodium-Ion Battery Market, Prismatic Value, $Million, 2024

- Figure 55: Global Sodium-Ion Battery Market, Prismatic Volume MWh, 2024-2035

- Figure 56: Global Sodium-Ion Battery Market, Prismatic Value $Million, 2024-2035

- Figure 57: Global Sodium-Ion Battery Market, Cylindrical Value, $Million, 2024

- Figure 58: Global Sodium-Ion Battery Market, Cylindrical Volume MWh, 2024-2035

- Figure 59: Global Sodium-Ion Battery Market, Cylindrical Value $Million, 2024-2035

- Figure 60: Global Sodium-Ion Battery Market, Pouch Value, $Million, 2024

- Figure 61: Global Sodium-Ion Battery Market, Pouch Volume MWh, 2024-2035

- Figure 62: Global Sodium-Ion Battery Market Pouch Value $Million, 2024-2035

- Figure 63: Global Sodium-Ion Battery Market, Low Voltage System (12V-60V) Cylindrical Value, $Million, 2024

- Figure 64: Global Sodium-Ion Battery Market, Low Voltage System (12V-60V) Volume MWh, 2024-2035

- Figure 65: Global Sodium-Ion Battery Market, Low Voltage System (12V-60V) Value $Million, 2024-2035

- Figure 66: Global Sodium-Ion Battery Market, Medium Voltage System (60V-300V) Value, $Million, 2024

- Figure 67: Global Sodium-Ion Battery Market, Medium Voltage System (60V-300V) Volume MWh, 2024-2035

- Figure 68: Global Sodium-Ion Battery Market, Medium Voltage System (60V-300V) Value $Million, 2024-2035

- Figure 69: Global Sodium-Ion Battery Market, High Voltage System (>300V) Value, $Million, 2024

- Figure 70: Global Sodium-Ion Battery Market, High Voltage System (>300V) Volume MWh, 2024-2035

- Figure 71: Global Sodium-Ion Battery Market High Voltage System (>300V) Value $Million, 2024-2035

- Figure 72: U.S. Sodium-Ion Battery Market, $Million, 2024-2035

- Figure 73: Canada Sodium-Ion Battery Market, $Million, 2024-2035

- Figure 74: Mexico Sodium-Ion Battery Market, $Million, 2024-2035

- Figure 75: Germany Sodium-Ion Battery Market, $Million, 2024-2035

- Figure 76: France Sodium-Ion Battery Market, $Million, 2024-2035

- Figure 77: U.K. Sodium-Ion Battery Market, $Million, 2024-2035

- Figure 78: Italy Sodium-Ion Battery Market, $Million, 2024-2035

- Figure 79: Spain Sodium-Ion Battery Market, $Million, 2024-2035

- Figure 80: Rest-of-Europe Sodium-Ion Battery Market, $Million, 2024-2035

- Figure 81: China Sodium-Ion Battery Market, $Million, 2024-2035

- Figure 82: Japan Sodium-Ion Battery Market, $Million, 2024-2035

- Figure 83: India Sodium-Ion Battery Market, $Million, 2024-2035

- Figure 84: South Korea Sodium-Ion Battery Market, $Million, 2024-2035

- Figure 85: Australia Sodium-Ion Battery Market, $Million, 2024-2035

- Figure 86: Rest-of-Asia-Pacific Sodium-Ion Battery Market, $Million, 2024-2035

- Figure 87: South America Sodium-Ion Battery Market, $Million, 2024-2035

- Figure 88: Middle East and Africa Sodium-Ion Battery Market, $Million, 2024-2035

- Figure 89: Strategic Initiatives, January 2020-May 2025

- Figure 90: Data Triangulation

- Figure 91: Top-Down and Bottom-Up Approach

- Figure 92: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Competitive Landscape Snapshot

- Table 3: Large Scale Grid Storage Deployments

- Table 4: Recent Sodium-Ion Battery Deployments and Technological Advancements by Key Companies

- Table 5: Regulatory/Certification Bodies in Sodium-Ion Battery Market

- Table 6: Recent Government Programs in Sodium-Ion Battery Market

- Table 7: Key Research Institutes and University Programs in Sodium-Ion Battery Market

- Table 8: Stakeholder Analysis in Sodium-Ion Battery Market

- Table 9: Key Fundings in Sodium-Ion Battery Market

- Table 10: Start-Ups and Investment Landscape

- Table 11: Sodium-Ion Battery Market (by Region), $/MWh, 2024-2035

- Table 12: Sodium-Ion Recycling Status (by Country)

- Table 13: Automotive Application: Lithium-Ion Vs. Sodium-Ion Batteries

- Table 14: Electronics Application: Lithium-Ion Vs. Sodium-Ion Batteries

- Table 15: Large-Scale Stationary Energy Storage Application: Lithium-Ion Vs. Sodium-Ion Batteries

- Table 16: Industrial Application: Lithium-Ion Vs. Sodium-Ion Batteries

- Table 17: Other Application: Lithium-Ion Vs. Sodium-Ion Batteries

- Table 18: Few Prominent Sodium-Ion Battery Products with Technical Specifications

- Table 19: Sodium-Ion Battery Market (by Region), $Million, 2024-2035

- Table 20: Sodium-Ion Battery Market (by Region), MWh, 2024-2035

- Table 21: North America Sodium-Ion Battery Market (by Application), $Million, 2024-2035

- Table 22: North America Sodium-Ion Battery Market (by Application), MWh, 2024-2035

- Table 23: North America Sodium-Ion Battery Market (by Type), $Million, 2024-2035

- Table 24: North America Sodium-Ion Battery Market (by Type), MWh, 2024-2035

- Table 25: North America Sodium-Ion Battery Market (by Form Factor), $Million, 2024-2035

- Table 26: North America Sodium-Ion Battery Market (by Form Factor), MWh, 2024-2035

- Table 27: North America Sodium-Ion Battery Market (by System/Pack-Level Voltage), $Million, 2024-2035

- Table 28: North America Sodium-Ion Battery Market (by System/Pack-Level Voltage), MWh, 2024-2035

- Table 29: U.S. Sodium-Ion Battery Market (by Application), $Million, 2024-2035

- Table 30: U.S. Sodium-Ion Battery Market (by Application), MWh, 2024-2035

- Table 31: U.S. Sodium-Ion Battery Market (by Type), $Million, 2024-2035

- Table 32: U.S. Sodium-Ion Battery Market (by Type), MWh, 2024-2035

- Table 33: U.S. Sodium-Ion Battery Market (by Form Factor), $Million, 2024-2035

- Table 34: U.S. Sodium-Ion Battery Market (by Form Factor), MWh, 2024-2035

- Table 35: U.S. Sodium-Ion Battery Market (by System/Pack-Level Voltage), $Million, 2024-2035

- Table 36: U.S. Sodium-Ion Battery Market (by System/Pack-Level Voltage), MWh, 2024-2035

- Table 37: Canada Sodium-Ion Battery Market (by Application), $Million, 2024-2035

- Table 38: Canada Sodium-Ion Battery Market (by Application), MWh, 2024-2035

- Table 39: Canada Sodium-Ion Battery Market (by Type), $Million, 2024-2035

- Table 40: Canada Sodium-Ion Battery Market (by Type), MWh, 2024-2035

- Table 41: Canada Sodium-Ion Battery Market (by Form Factor), $Million, 2024-2035

- Table 42: Canada Sodium-Ion Battery Market (by Form Factor), MWh, 2024-2035

- Table 43: Canada Sodium-Ion Battery Market (by System/Pack-Level Voltage), $Million, 2024-2035

- Table 44: Canada Sodium-Ion Battery Market (by System/Pack-Level Voltage), MWh, 2024-2035

- Table 45: Mexico Sodium-Ion Battery Market (by Application), $Million, 2024-2035

- Table 46: Mexico Sodium-Ion Battery Market (by Application), MWh, 2024-2035

- Table 47: Mexico Sodium-Ion Battery Market (by Type), $Million, 2024-2035

- Table 48: Mexico Sodium-Ion Battery Market (by Type), MWh, 2024-2035

- Table 49: Mexico Sodium-Ion Battery Market (by Form Factor), $Million, 2024-2035

- Table 50: Mexico Sodium-Ion Battery Market (by Form Factor), MWh, 2024-2035

- Table 51: Mexico Sodium-Ion Battery Market (by System/Pack-Level Voltage), $Million, 2024-2035

- Table 52: Mexico Sodium-Ion Battery Market (by System/Pack-Level Voltage), MWh, 2024-2035

- Table 53: Europe Sodium-Ion Battery Market (by Application), $Million, 2024-2035

- Table 54: Europe Sodium-Ion Battery Market (by Application), MWh, 2024-2035

- Table 55: Europe Sodium-Ion Battery Market (by Type), $Million, 2024-2035

- Table 56: Europe Sodium-Ion Battery Market (by Type), MWh, 2024-2035

- Table 57: Europe Sodium-Ion Battery Market (by Form Factor), $Million, 2024-2035

- Table 58: Europe Sodium-Ion Battery Market (by Form Factor), MWh, 2024-2035

- Table 59: Europe Sodium-Ion Battery Market (by System/Pack-Level Voltage), $Million, 2024-2035

- Table 60: Europe Sodium-Ion Battery Market (by System/Pack-Level Voltage), MWh, 2024-2035

- Table 61: Germany Sodium-Ion Battery Market (by Application), $Million, 2024-2035

- Table 62: Germany Sodium-Ion Battery Market (by Application), MWh, 2024-2035

- Table 63: Germany Sodium-Ion Battery Market (by Type), $Million, 2024-2035

- Table 64: Germany Sodium-Ion Battery Market (by Type), MWh, 2024-2035

- Table 65: Germany Sodium-Ion Battery Market (by Form Factor), $Million, 2024-2035

- Table 66: Germany Sodium-Ion Battery Market (by Form Factor), MWh, 2024-2035

- Table 67: Germany Sodium-Ion Battery Market (by System/Pack-Level Voltage), $Million, 2024-2035

- Table 68: Germany Sodium-Ion Battery Market (by System/Pack-Level Voltage), MWh, 2024-2035

- Table 69: France Sodium-Ion Battery Market (by Application), $Million, 2024-2035

- Table 70: France Sodium-Ion Battery Market (by Application), MWh, 2024-2035

- Table 71: France Sodium-Ion Battery Market (by Type), $Million, 2024-2035

- Table 72: France Sodium-Ion Battery Market (by Type), MWh, 2024-2035

- Table 73: France Sodium-Ion Battery Market (by Form Factor), $Million, 2024-2035

- Table 74: France Sodium-Ion Battery Market (by Form Factor), MWh, 2024-2035

- Table 75: France Sodium-Ion Battery Market (by System/Pack-Level Voltage), $Million, 2024-2035

- Table 76: France Sodium-Ion Battery Market (by System/Pack-Level Voltage), MWh, 2024-2035

- Table 77: U.K. Sodium-Ion Battery Market (by Application), $Million, 2024-2035

- Table 78: U.K. Sodium-Ion Battery Market (by Application), MWh, 2024-2035

- Table 79: U.K. Sodium-Ion Battery Market (by Type), $Million, 2024-2035

- Table 80: U.K. Sodium-Ion Battery Market (by Type), MWh, 2024-2035

- Table 81: U.K. Sodium-Ion Battery Market (by Form Factor), $Million, 2024-2035

- Table 82: U.K. Sodium-Ion Battery Market (by Form Factor), MWh, 2024-2035

- Table 83: U.K. Sodium-Ion Battery Market (by System/Pack-Level Voltage), $Million, 2024-2035

- Table 84: U.K. Sodium-Ion Battery Market (by System/Pack-Level Voltage), MWh, 2024-2035

- Table 85: Italy Sodium-Ion Battery Market (by Application), $Million, 2024-2035

- Table 86: Italy Sodium-Ion Battery Market (by Application), MWh, 2024-2035

- Table 87: Italy Sodium-Ion Battery Market (by Type), $Million, 2024-2035

- Table 88: Italy Sodium-Ion Battery Market (by Type), MWh, 2024-2035

- Table 89: Italy Sodium-Ion Battery Market (by Form Factor), $Million, 2024-2035

- Table 90: Italy Sodium-Ion Battery Market (by Form Factor), MWh, 2024-2035

- Table 91: Italy Sodium-Ion Battery Market (by System/Pack-Level Voltage), $Million, 2024-2035

- Table 92: Italy Sodium-Ion Battery Market (by System/Pack-Level Voltage), MWh, 2024-2035

- Table 93: Spain Sodium-Ion Battery Market (by Application), $Million, 2024-2035

- Table 94: Spain Sodium-Ion Battery Market (by Application), MWh, 2024-2035

- Table 95: Spain Sodium-Ion Battery Market (by Type), $Million, 2024-2035

- Table 96: Spain Sodium-Ion Battery Market (by Type), MWh, 2024-2035

- Table 97: Spain Sodium-Ion Battery Market (by Form Factor), $Million, 2024-2035

- Table 98: Spain Sodium-Ion Battery Market (by Form Factor), MWh, 2024-2035

- Table 99: Spain Sodium-Ion Battery Market (by System/Pack-Level Voltage), $Million, 2024-2035

- Table 100: Spain Sodium-Ion Battery Market (by System/Pack-Level Voltage), MWh, 2024-2035

- Table 101: Rest-of-the-Europe Sodium-Ion Battery Market (by Application), $Million, 2024-2035

- Table 102: Rest-of-the-Europe Sodium-Ion Battery Market (by Application), MWh, 2024-2035

- Table 103: Rest-of-the-Europe Sodium-Ion Battery Market (by Type), $Million, 2024-2035

- Table 104: Rest-of-the-Europe Sodium-Ion Battery Market (by Type), MWh, 2024-2035

- Table 105: Rest-of-the-Europe Sodium-Ion Battery Market (by Form Factor), $Million, 2024-2035

- Table 106: Rest-of-the-Europe Sodium-Ion Battery Market (by Form Factor), MWh, 2024-2035

- Table 107: Rest-of-the-Europe Sodium-Ion Battery Market (by System/Pack-Level Voltage), $Million, 2024-2035

- Table 108: Rest-of-the-Europe Sodium-Ion Battery Market (by System/Pack-Level Voltage), MWh, 2024-2035

- Table 109: Asia-Pacific Sodium-Ion Battery Market (by Application), $Million, 2024-2035

- Table 110: Asia-Pacific Sodium-Ion Battery Market (by Application), MWh, 2024-2035

- Table 111: Asia-Pacific Sodium-Ion Battery Market (by Type), $Million, 2024-2035

- Table 112: Asia-Pacific Sodium-Ion Battery Market (by Type), MWh, 2024-2035

- Table 113: Asia-Pacific Sodium-Ion Battery Market (by Form Factor), $Million, 2024-2035

- Table 114: Asia-Pacific Sodium-Ion Battery Market (by Form Factor), MWh, 2024-2035

- Table 115: Asia-Pacific Sodium-Ion Battery Market (by System/Pack-Level Voltage), $Million, 2024-2035

- Table 116: Asia-Pacific Sodium-Ion Battery Market (by System/Pack-Level Voltage), MWh, 2024-2035

- Table 117: China Sodium-Ion Battery Market (by Application), $Million, 2024-2035

- Table 118: China Sodium-Ion Battery Market (by Application), MWh, 2024-2035

- Table 119: China Sodium-Ion Battery Market (by Type), $Million, 2024-2035

- Table 120: China Sodium-Ion Battery Market (by Type), MWh, 2024-2035

- Table 121: China Sodium-Ion Battery Market (by Form Factor), $Million, 2024-2035

- Table 122: China Sodium-Ion Battery Market (by Form Factor), MWh, 2024-2035

- Table 123: China Sodium-Ion Battery Market (by System/Pack-Level Voltage), $Million, 2024-2035

- Table 124: China -Ion Battery Market (by System/Pack-Level Voltage), MWh, 2024-2035

- Table 125: Japan Sodium-Ion Battery Market (by Application), $Million, 2024-2035

- Table 126: Japan Sodium-Ion Battery Market (by Application), MWh, 2024-2035

- Table 127: Japan Sodium-Ion Battery Market (by Type), $Million, 2024-2035

- Table 128: Japan Sodium-Ion Battery Market (by Type), MWh, 2024-2035

- Table 129: Japan Sodium-Ion Battery Market (by Form Factor), $Million, 2024-2035

- Table 130: Japan Sodium-Ion Battery Market (by Form Factor), MWh, 2024-2035

- Table 131: Japan Sodium-Ion Battery Market (by System/Pack-Level Voltage), $Million, 2024-2035

- Table 132: Japan Sodium-Ion Battery Market (by System/Pack-Level Voltage), MWh, 2024-2035

- Table 133: India Sodium-Ion Battery Market (by Application), $Million, 2024-2035

- Table 134: India Sodium-Ion Battery Market (by Application), MWh, 2024-2035

- Table 135: India Sodium-Ion Battery Market (by Type), $Million, 2024-2035

- Table 136: India Sodium-Ion Battery Market (by Type), MWh, 2024-2035

- Table 137: India Sodium-Ion Battery Market (by Form Factor), $Million, 2024-2035

- Table 138: India Sodium-Ion Battery Market (by Form Factor), MWh, 2024-2035

- Table 139: India Sodium-Ion Battery Market (by System/Pack-Level Voltage), $Million, 2024-2035

- Table 140: India Sodium-Ion Battery Market (by System/Pack-Level Voltage), MWh, 2024-2035

- Table 141: South Korea Sodium-Ion Battery Market (by Application), $Million, 2024-2035

- Table 142: South Korea Sodium-Ion Battery Market (by Application), MWh, 2024-2035

- Table 143: South Korea Sodium-Ion Battery Market (by Type), $Million, 2024-2035

- Table 144: South Korea Sodium-Ion Battery Market (by Type), MWh, 2024-2035

- Table 145: South Korea Sodium-Ion Battery Market (by Form Factor), $Million, 2024-2035

- Table 146: South Korea Sodium-Ion Battery Market (by Form Factor), MWh, 2024-2035

- Table 147: South Korea Sodium-Ion Battery Market (by System/Pack-Level Voltage), $Million, 2024-2035

- Table 148: South Korea Sodium-Ion Battery Market (by System/Pack-Level Voltage), MWh, 2024-2035

- Table 149: Australia Sodium-Ion Battery Market (by Application), $Million, 2024-2035

- Table 150: Australia Sodium-Ion Battery Market (by Application), MWh, 2024-2035

- Table 151: Australia Sodium-Ion Battery Market (by Type), $Million, 2024-2035

- Table 152: Australia Sodium-Ion Battery Market (by Type), MWh, 2024-2035

- Table 153: Australia Sodium-Ion Battery Market (by Form Factor), $Million, 2024-2035

- Table 154: Australia Sodium-Ion Battery Market (by Form Factor), MWh, 2024-2035

- Table 155: Australia Sodium-Ion Battery Market (by System/Pack-Level Voltage), $Million, 2024-2035

- Table 156: Australia Sodium-Ion Battery Market (by System/Pack-Level Voltage), MWh, 2024-2035

- Table 157: Rest-of-Asia-Pacific Sodium-Ion Battery Market (by Application), $Million, 2024-2035

- Table 158: Rest-of-Asia-Pacific Sodium-Ion Battery Market (by Application), MWh, 2024-2035

- Table 159: Rest-of-Asia-Pacific Sodium-Ion Battery Market (by Type), $Million, 2024-2035

- Table 160: Rest-of-Asia-Pacific Sodium-Ion Battery Market (by Type), MWh, 2024-2035

- Table 161: Rest-of-Asia-Pacific Sodium-Ion Battery Market (by Form Factor), $Million, 2024-2035

- Table 162: Rest-of-Asia-Pacific Sodium-Ion Battery Market (by Form Factor), MWh, 2024-2035

- Table 163: Rest-of-Asia-Pacific Sodium-Ion Battery Market (by System/Pack-Level Voltage), $Million, 2024-2035

- Table 164: Rest-of-Asia-Pacific Sodium-Ion Battery Market (by System/Pack-Level Voltage), MWh, 2024-2035

- Table 165: Rest-of-the-World Sodium-Ion Battery Market (by Application), $Million, 2024-2035

- Table 166: Rest-of-the-World Sodium-Ion Battery Market (by Application), MWh, 2024-2035

- Table 167: Rest-of-the-World Sodium-Ion Battery Market (by Type), $Million, 2024-2035

- Table 168: Rest-of-the-World Sodium-Ion Battery Market (by Type), MWh, 2024-2035

- Table 169: Rest-of-the-World Sodium-Ion Battery Market (by Form Factor), $Million, 2024-2035

- Table 170: Rest-of-the-World Sodium-Ion Battery Market (by Form Factor), MWh, 2024-2035

- Table 171: Rest-of-the-World Sodium-Ion Battery Market (by System/Pack-Level Voltage), $Million, 2024-2035

- Table 172: Rest-of-the-World Sodium-Ion Battery Market (by System/Pack-Level Voltage), MWh, 2024-2035

- Table 173: South America Sodium-Ion Battery Market (by Application), $Million, 2024-2035

- Table 174: South America Sodium-Ion Battery Market (by Application), MWh, 2024-2035

- Table 175: South America Sodium-Ion Battery Market (by Type), $Million, 2024-2035

- Table 176: South America Sodium-Ion Battery Market (by Type), MWh, 2024-2035

- Table 177: South America Sodium-Ion Battery Market (by Form Factor), $Million, 2024-2035

- Table 178: South America Sodium-Ion Battery Market (by Form Factor), MWh, 2024-2035

- Table 179: South America Sodium-Ion Battery Market (by System/Pack-Level Voltage), $Million, 2024-2035

- Table 180: South America Sodium-Ion Battery Market (by System/Pack-Level Voltage), MWh, 2024-2035

- Table 181: Middle East and Africa Sodium-Ion Battery Market (by Application), $Million, 2024-2035

- Table 182: Middle East and Africa Sodium-Ion Battery Market (by Application), MWh, 2024-2035

- Table 183: Middle East and Africa Sodium-Ion Battery Market (by Type), $Million, 2024-2035

- Table 184: Middle East and Africa Sodium-Ion Battery Market (by Type), MWh, 2024-2035

- Table 185: Middle East and Africa Sodium-Ion Battery Market (by Form Factor), $Million, 2024-2035

- Table 186: Middle East and Africa Sodium-Ion Battery Market (by Form Factor), MWh, 2024-2035

- Table 187: Middle East and Africa Sodium-Ion Battery Market (by System/Pack-Level Voltage), $Million, 2024-2035

- Table 188: Middle East and Africa Sodium-Ion Battery Market (by System/Pack-Level Voltage), MWh, 2024-2035

- Table 189: Global Market Share, 2024

This report can be delivered within 1 working day.

Introduction of Sodium-Ion Battery Market

The sodium-ion battery market has been steadily gaining attention as the world explores alternatives to lithium-ion (Li-ion) for energy storage. Concerns about lithium's limited availability, high cost, and environmental impact have positioned sodium-ion batteries as a promising option, particularly for grid energy storage and short-distance transport. Since 2023, government and research support has grown. For instance, in April 2024, the U.S. Department of Energy (DOE) announced a $15.7 million initiative to advance the manufacturing of sodium-ion batteries. The European Union's (EU) Horizon Europe (HE) program continues to fund research related to cleaner energy technologies. In February 2025, the Pacific Northwest National Laboratory (PNNL) highlighted progress in improving energy density under the Sodium-ion Advancement for Grid Energy Storage (SAGES) project.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2025 - 2035 |

| 2025 Evaluation | $500.9 Million |

| 2035 Forecast | $12,036.4 Million |

| CAGR | 37.43% |

Market Introduction

The sodium-ion battery (SIB) market has been gaining momentum as a reliable and sustainable alternative to lithium-ion technology, particularly for decentralized and renewable-based energy applications. In January 2025, Reliance Industries in India announced pilot deployments of SIBs in rural microgrids, showcasing the technology's potential to support localized energy systems while reducing reliance on imported lithium. This reflects a broader trend of growing industrial interest in SIBs as advancements in cell chemistry continue to improve energy density, cycle life, and cost-effectiveness. Although challenges remain in terms of supply chain development and performance optimization, ongoing R&D efforts and pilot projects have been accelerating the commercialization of SIBs. As demand for affordable, safe, and scalable energy storage solutions rises, sodium-ion batteries are expected to play an increasingly important role in the global energy transition.

Industrial Impact

The sodium-ion battery market has been experiencing steady growth, driven by increasing demand for safe, cost-effective, and sustainable energy storage solutions. With increasing pressure to diversify beyond lithium-based technologies, sodium-ion batteries offer a compelling alternative due to their reliance on abundant raw materials and lower production costs. Advances in electrode materials and battery design are improving energy density, cycle life, and charging performance, making these batteries increasingly suitable for applications such as grid storage, microgrids, and electric mobility. The market is further supported by growing investments from battery manufacturers and national initiatives aimed at strengthening energy security and supply chain resilience. As efforts to decarbonize energy systems accelerate globally, the sodium-ion battery market is expected to expand significantly, playing a crucial role in supporting the integration of renewable energy and broadening access to clean energy.

Market Segmentation:

Segmentation 1: by Application

- Automotive

- Electronics

- Large Scale Stationary Energy Storage

- Industrial

- Others

Large Scale Stationary Energy Storage to Lead the Market (by Application)

Sodium-ion batteries have been gaining strong momentum in the large-scale stationary energy storage market due to their affordability, safety, and use of abundant materials such as sodium. They are increasingly seen as a strategic alternative to lithium-ion systems, particularly as lithium prices remain volatile and supply chains face geopolitical and environmental constraints. Technological advancements have significantly improved sodium-ion battery performance, making them viable for grid-level applications. In March 2025, BYD confirmed investments in sodium-ion production lines aimed at achieving cost parity with lithium-iron-phosphate (LFP) batteries.

Segmentation 2: by Product Type

- Non-Aqueous Sodium-Ion Batteries

- Aqueous Sodium-Ion Batteries

- Solid State Sodium-Ion Batteries

Segmentation 3: by Form Factor

- Prismatic

- Cylindrical

- Pouch

Segmentation 4: by System/Pack-Level Voltage

- Low Voltage System (12V-60V)

- Medium Voltage System (60V-300V)

- High Voltage System (>300V)

Segmentation 5: by Region

- North America

- Europe

- Asia-Pacific

- Rest-of-the-World

Recent Developments in the Sodium-Ion Battery Market

- In April 2025, Contemporary Amperex Technology (CATL) expanded its sodium-ion battery production capacity to meet growing demand from EV manufacturers seeking low-cost alternatives to lithium-ion.

- In March 2025, Altris AB secured an investment from the Volvo Cars Tech Fund to co-develop sodium-ion batteries for next-generation electric vehicles and energy storage systems, with a focus on cost reduction and sustainability.

- In March 2025, Natron Energy partnered with Draslovka to scale up production of Prussian blue cathode materials, a key component in its sodium-ion batteries, with a new facility planned in Kolin, Czech Republic.

- In March 2024, TIAMAT formed a strategic alliance with a European consortium to establish a sodium-ion battery supply chain supported by EU green energy funding.

How can this report add value to an organization?

Product/Innovation Strategy: This report provides a detailed analysis of the sodium-ion battery market segmented by product type, form factor, and system/pack-level voltage. It covers various battery types, including non-aqueous, aqueous, and solid-state sodium-ion batteries, offering insights into their evolving chemistries and technical advantages. Additionally, the form factor segmentation, i.e., prismatic, cylindrical, and pouch, helps stakeholders understand design trends based on application-specific requirements. The voltage-level analysis (low, medium, and high voltage systems) adds further granularity for organizations developing energy storage solutions across diverse use cases. The report helps product teams identify innovation opportunities and adapt their strategies to meet performance, integration, and cost-efficiency demands.

Growth/Marketing Strategy: The sodium-ion battery market has been rapidly evolving, with major players engaging in capacity expansion, strategic alliances, and pilot deployments to strengthen their market position. This report tracks those developments and provides insights into how key companies are entering or expanding in application segments such as automotive, electronics, large-scale stationary energy storage, industrial use, and others. It supports marketing teams in identifying high-growth sectors, aligning value propositions with end-user expectations, and crafting targeted go-to-market strategies based on regional dynamics and technological readiness.

Competitive Strategy: A thorough competitive landscape is provided, profiling leading players based on their product offerings, innovation pipelines, partnerships, and expansion plans. Competitive benchmarking enables readers to evaluate how companies are positioned across product types and application areas.

Research Methodology

Data Sources

Primary Data Sources

The primary sources involve industry experts from the sodium-ion battery market and various stakeholders in the ecosystem. Respondents, including CEOs, vice presidents, marketing directors, and technology and innovation directors, have been interviewed to gather and verify both qualitative and quantitative aspects of this research study.

The key data points taken from primary sources include:

- validation and triangulation of all the numbers and graphs

- validation of report segmentation and key qualitative findings

- understanding the competitive landscape

- validation of the numbers of various markets for market type

- percentage split of individual markets for geographical analysis

Secondary Data Sources

This research study involves the usage of extensive secondary research, directories, company websites, and annual reports. It also makes use of databases, such as Hoovers, Bloomberg, Businessweek, and Factiva, to collect useful and effective information for an extensive, technical, market-oriented, and commercial study of the global market. In addition to core data sources, the study referenced insights from reputable organizations and websites such as the International Energy Agency (IEA), World Economic Forum (WEF), International Organization of Motor Vehicle Manufacturers (OICA), and the European Automobile Manufacturers' Association (ACEA) to understand trends in energy storage, mobility, and sustainability impacting sodium-ion battery adoption.

Secondary research was done to obtain crucial information about the industry's value chain, revenue models, the market's monetary chain, the total pool of key players, and the current and potential use cases and applications.

The key data points taken from secondary research include:

- segmentations and percentage shares

- data for market value

- key industry trends of the top players in the market

- qualitative insights into various aspects of the market, key trends, and emerging areas of innovation

- quantitative data for mathematical and statistical calculations

Data Triangulation

This research study utilizes extensive secondary sources, including certified publications, articles by recognized authors, white papers, company annual reports, directories, and major databases, to collect useful and effective information for a comprehensive, technical, market-oriented, and commercial study of the sodium-ion battery market.

The process of market engineering involves the calculation of the market statistics, market size estimation, market forecast, market crackdown, and data triangulation (the methodology for such quantitative data processes has been explained in further sections). A primary research study has been undertaken to gather information and validate market numbers for segmentation types and industry trends among key players in the market.

Key Market Players and Competition Synopsis

The sodium-ion battery (SIB) market has been witnessing strong momentum, with significant deployments and technological advancements. In July 2024, China's state-owned Datang Group connected a 50?MW/100?MWh SIB energy storage system in Qianjiang, underscoring the technology's readiness for grid-scale use. In May 2025, China Southern Power Grid commissioned a 200?MW hybrid storage station in Yunnan, combining SIB and lithium-ion batteries to stabilize output from over 30 wind and solar plants. These projects, supported by government initiatives, demonstrate the value of SIBs in multi-hour renewable energy buffering, driving greater investor confidence and adoption.

On the manufacturing front, the market is shifting rapidly from prototype to large-scale production. In late 2023, Farasis Energy launched commercial SIB packs, achieving energy densities of 140-160 Wh/kg. In early 2024, BYD and its partners began constructing a 30 GWh/year SIB facility. Meanwhile, in early 2025, Yadea introduced electric scooters powered by SIBs, offering over 1,500 cycles and fast charging capabilities. These developments reflect a rising demand across both the mobility and stationary storage sectors, prompting manufacturers to scale up their operations and enhance battery performance to meet evolving market needs.

Some prominent names established in this market are:

- Aquion Energy (Juline-Titans LLC)

- Faradion (Reliance Industries Ltd)

- HiNa Battery Technology Co., Ltd

- BENAN Energy Technology (Shanghai) Co., Ltd (BENAN ENERGY)

- AMTE Power plc (AGM Batteries Limited)

- Natron Energy, Inc

- TIAMAT

- Jiangsu Zhongna Energy Technology Co., Ltd.

- Contemporary Amperex Technology Co. Limited (CATL)

- Bluetti Power

- Li-FUN Technology Corporation Limited

- Indi Energy

- Altris AB

- Farasis Energy

- BYD Company Ltd

Table of Contents

Executive Summary

Scope and Definition

1 Market: Industry Outlook

- 1.1 Market Dynamics

- 1.1.1 Trends, Drivers, Challenges, and Opportunities: Current and Future Impact Assessment

- 1.2 Trends

- 1.2.1 Expansion of Grid-Scale Energy Storage Projects

- 1.2.2 Industrializing High-Energy Sodium-Ion Batteries

- 1.3 Regulatory/Certification Bodies

- 1.4 Government Programs

- 1.5 Programs by Research Institutions and Universities

- 1.6 Value Chain Analysis

- 1.7 Stakeholder Analysis

- 1.8 Case Study

- 1.8.1 Baochi Energy Storage Station, China

- 1.8.2 Hina's Fast-Charge Sodium-Ion Battery for Commercial EVs

- 1.9 Market Dynamics

- 1.9.1 Market Drivers

- 1.9.1.1 Push for Lithium Diversification and Supply Security

- 1.9.1.2 Government Policy and Funding Support

- 1.9.1.3 Rising Momentum for Sodium-Ion Battery Commercialization

- 1.9.2 Market Challenges

- 1.9.2.1 Lower Energy Density and Cycle Life Limitations

- 1.9.2.2 Scaling Challenges and Cost Realities in Sodium-Ion Battery Commercialization

- 1.9.3 Business Strategies

- 1.9.3.1 Product Developments

- 1.9.3.2 Market Developments

- 1.9.4 Corporate Strategies

- 1.9.4.1 Partnerships and Joint Ventures

- 1.9.5 Market Opportunities

- 1.9.5.1 Hybrid Grid Energy Storage Systems

- 1.9.5.2 Growth Potential for Sodium-Ion Technology in Affordable Electric Mobility

- 1.9.5.3 Launch of Key Affordable Electric Vehicle using Sodium-Ion Battery

- 1.9.1 Market Drivers

- 1.1 Start-Ups Landscape

- 1.10.1 Key Start-Ups in the Ecosystem

- 1.11 Patent Analysis

- 1.11.1 Patent Filing Trend (by Number of Patents, by Year and by Country)

- 1.12 Cost Analysis

- 1.12.1 Cost Breakdown (by Component)

- 1.12.2 Battery Pack Energy Price (by Configuration)

- 1.12.3 Average Pricing Analysis: Global and Regional Level, Sodium-Ion Battery

- 1.13 Sodium-Ion Battery Recycling Ecosystem

2 Application

- 2.1 Comparative Analysis: Lithium-Ion Vs. Sodium-Ion Batteries Across Key Applications

- 2.2 Application Summary

- 2.3 Sodium-Ion Battery Market (by Application)

- 2.3.1 Automotive

- 2.3.2 Electronics

- 2.3.3 Large Scale Stationary Energy Storage

- 2.3.4 Industrial

- 2.3.5 Others

3 Products

- 3.1 Product Summary

- 3.2 Sodium-Ion Battery Market: Product Landscape

- 3.2.1 Few Prominent Sodium-Ion Battery Products with Technical Specifications

- 3.2.2 Sodium-Ion Batteries: A Strategic Alternative in a Changing Energy Storage Landscape

- 3.3 Sodium-Ion Battery Market (by Type)

- 3.3.1 Non-Aqueous Sodium-Ion Batteries

- 3.3.2 Aqueous Sodium-Ion Batteries

- 3.3.3 Solid State Sodium-Ion Batteries

- 3.4 Sodium-Ion Battery Market (by Form Factor)

- 3.4.1 Prismatic

- 3.4.2 Cylindrical

- 3.4.3 Pouch

- 3.5 Sodium-Ion Battery Market (by System/Pack-Level Voltage)

- 3.5.1 Low Voltage System (12V - 60V)

- 3.5.2 Medium Voltage System (60V-300V)

- 3.5.3 High Voltage System (>300V)

4 Region

- 4.1 Regional Summary

- 4.2 North America

- 4.2.1 Regional Overview

- 4.2.2 Driving Factors for Market Growth

- 4.2.3 Factors Challenging the Market

- 4.2.3.1 Application

- 4.2.3.2 Product

- 4.2.4 U.S.

- 4.2.4.1 Application

- 4.2.4.2 Product

- 4.2.5 Canada

- 4.2.5.1 Application

- 4.2.5.2 Product

- 4.2.6 Mexico

- 4.2.6.1 Application

- 4.2.6.2 Product

- 4.3 Europe

- 4.3.1 Regional Overview

- 4.3.2 Driving Factors for Market Growth

- 4.3.3 Factors Challenging the Market

- 4.3.3.1 Application

- 4.3.3.2 Product

- 4.3.4 Germany

- 4.3.4.1 Application

- 4.3.4.2 Product

- 4.3.5 France

- 4.3.5.1 Application

- 4.3.5.2 Product

- 4.3.6 U.K.

- 4.3.6.1 Application

- 4.3.6.2 Product

- 4.3.7 Italy

- 4.3.7.1 Application

- 4.3.7.2 Product

- 4.3.8 Spain

- 4.3.8.1 Application

- 4.3.8.2 Product

- 4.3.9 Rest-of-Europe

- 4.3.9.1 Application

- 4.3.9.2 Product

- 4.4 Asia-Pacific

- 4.4.1 Regional Overview

- 4.4.2 Driving Factors for Market Growth

- 4.4.3 Factors Challenging the Market

- 4.4.3.1 Application

- 4.4.3.2 Product

- 4.4.4 China

- 4.4.4.1 Application

- 4.4.4.2 Product

- 4.4.5 Japan

- 4.4.5.1 Application

- 4.4.5.2 Product

- 4.4.6 India

- 4.4.6.1 Application

- 4.4.6.2 Product

- 4.4.7 South Korea

- 4.4.7.1 Application

- 4.4.7.2 Product

- 4.4.8 Australia

- 4.4.8.1 Application

- 4.4.8.2 Product

- 4.4.9 Rest-of-Asia-Pacific

- 4.4.9.1 Application

- 4.4.9.2 Product

- 4.5 Rest-of-the-World

- 4.5.1 Regional Overview

- 4.5.2 Driving Factors for Market Growth

- 4.5.3 Factors Challenging the Market

- 4.5.3.1 Application

- 4.5.3.2 Product

- 4.5.4 South America

- 4.5.4.1 Application

- 4.5.4.2 Product

- 4.5.5 Middle East and Africa

- 4.5.5.1 Application

- 4.5.5.2 Product

5 Markets - Competitive Benchmarking & Company Profiles

- 5.1 Aquion Energy (Juline-Titans LLC)

- 5.1.1 Overview

- 5.1.2 Top Products/Product Portfolio

- 5.1.3 Top Competitors

- 5.1.4 Target Customers

- 5.1.5 Key Personal

- 5.1.6 Analyst View

- 5.1.7 Market Share, 2024

- 5.2 Faradion (Reliance Industries Ltd)

- 5.2.1 Overview

- 5.2.2 Top Products/Product Portfolio

- 5.2.3 Top Competitors

- 5.2.4 Target Customers

- 5.2.5 Key Personal

- 5.2.6 Analyst View

- 5.2.7 Market Share, 2024

- 5.3 HiNa Battery Technology Co., Ltd

- 5.3.1 Overview

- 5.3.2 Top Products/Product Portfolio

- 5.3.3 Top Competitors

- 5.3.4 Target Customers

- 5.3.5 Key Personal

- 5.3.6 Analyst View

- 5.3.7 Market Share, 2024

- 5.4 BENAN Energy Technology (Shanghai) Co., Ltd (BENAN ENERGY)

- 5.4.1 Overview

- 5.4.2 Top Products/Product Portfolio

- 5.4.3 Top Competitors

- 5.4.4 Target Customers

- 5.4.5 Key Personal

- 5.4.6 Analyst View

- 5.4.7 Market Share, 2024

- 5.5 AMTE Power plc (AGM Batteries Limited)

- 5.5.1 Overview

- 5.5.2 Top Products/Product Portfolio

- 5.5.3 Top Competitors

- 5.5.4 Target Customers

- 5.5.5 Key Personal

- 5.5.6 Analyst View

- 5.5.7 Market Share, 2024

- 5.6 Natron Energy, Inc

- 5.6.1 Overview

- 5.6.2 Top Products/Product Portfolio

- 5.6.3 Top Competitors

- 5.6.4 Target Customers

- 5.6.5 Key Personal

- 5.6.6 Analyst View

- 5.6.7 Market Share, 2024

- 5.7 TIAMAT

- 5.7.1 Overview

- 5.7.2 Top Products/Product Portfolio

- 5.7.3 Top Competitors

- 5.7.4 Target Customers

- 5.7.5 Key Personal

- 5.7.6 Analyst View

- 5.7.7 Market Share, 2024

- 5.8 Jiangsu Zhongna Energy Technology Co., Ltd.

- 5.8.1 Overview

- 5.8.2 Top Products/Product Portfolio

- 5.8.3 Top Competitors

- 5.8.4 Target Customers

- 5.8.5 Key Personal

- 5.8.6 Analyst View

- 5.8.7 Market Share, 2024

- 5.9 Contemporary Amperex Technology Co. Limited (CATL)

- 5.9.1 Overview

- 5.9.2 Top Products/Product Portfolio

- 5.9.3 Top Competitors

- 5.9.4 Target Customers

- 5.9.5 Key Personal

- 5.9.6 Analyst View

- 5.9.7 Market Share, 2024

- 5.10 Bluetti Power

- 5.10.1 Overview

- 5.10.2 Top Products/Product Portfolio

- 5.10.3 Top Competitors

- 5.10.4 Target Customers

- 5.10.5 Key Personal

- 5.10.6 Analyst View

- 5.10.7 Market Share, 2024

- 5.11 Li-FUN Technology Corporation Limited

- 5.11.1 Overview

- 5.11.2 Top Products/Product Portfolio

- 5.11.3 Top Competitors

- 5.11.4 Target Customers

- 5.11.5 Key Personal

- 5.11.6 Analyst View

- 5.11.7 Market Share, 2024

- 5.12 Indi Energy

- 5.12.1 Overview

- 5.12.2 Top Products/Product Portfolio

- 5.12.3 Top Competitors

- 5.12.4 Target Customers

- 5.12.5 Key Personal

- 5.12.6 Analyst View

- 5.12.7 Market Share, 2024

- 5.13 Altris AB

- 5.13.1 Overview

- 5.13.2 Top Products/Product Portfolio

- 5.13.3 Top Competitors

- 5.13.4 Target Customers

- 5.13.5 Key Personal

- 5.13.6 Analyst View

- 5.13.7 Market Share, 2024

- 5.14 Farasis Energy

- 5.14.1 Overview

- 5.14.2 Top Products/Product Portfolio

- 5.14.3 Top Competitors

- 5.14.4 Target Customers

- 5.14.5 Key Personal

- 5.14.6 Analyst View

- 5.14.7 Market Share, 2024

- 5.15 BYD Company Ltd

- 5.15.1 Overview

- 5.15.2 Top Products/Product Portfolio

- 5.15.3 Top Competitors

- 5.15.4 Target Customers

- 5.15.5 Key Personal

- 5.15.6 Analyst View

- 5.15.7 Market Share, 2024

6 Research Methodology

- 6.1 Data Sources

- 6.1.1 Primary Data Sources

- 6.1.2 Secondary Data Sources

- 6.1.3 Data Triangulation

- 6.2 Market Estimation and Forecast