|

|

市場調査レポート

商品コード

1671815

電気生理学市場- 世界および地域別分析:製品別、適応症別、エンドユーザー別、地域別 - 分析と予測(2024年~2034年)Electrophysiology Market - A Global and Regional Analysis: Focus on Product, Indication, End User, and Region - Analysis and Forecast, 2024-2034 |

||||||

カスタマイズ可能

|

|||||||

| 電気生理学市場- 世界および地域別分析:製品別、適応症別、エンドユーザー別、地域別 - 分析と予測(2024年~2034年) |

|

出版日: 2025年03月07日

発行: BIS Research

ページ情報: 英文 115 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

世界の電気生理学の市場規模は、2024年の97億7,000万米ドルから2034年には327億9,000万米ドルに達し、予測期間の2024年~2034年のCAGRは12.88%でになる予測されています。

この拡大の主な要因としては、心血管疾患、特に不整脈の有病率の上昇、3Dマッピングシステム、カテーテルアブレーションシステム、診断ツールなどの電気生理機器の技術進歩が挙げられます。

さらに、世界人口の高齢化、特に心臓疾患のリスクが高い高齢者の増加が、電気生理学的治療に対する需要の拡大に寄与しています。カテーテルを用いたアブレーションなどの低侵襲手術は、リスクが低く回復が早いことから人気を集めており、市場をさらに牽引しています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2024年~2034年 |

| 2024年の評価 | 97億7,000万米ドル |

| 2034年の予測 | 327億9,000万米ドル |

| CAGR | 12.88% |

ヘルスケアインフラの改善、心臓の健康に対する意識の高まり、政府・民間両部門からの投資により、同市場は大幅な成長を遂げようとしています。

世界の電気生理学市場は、アブレーションカテーテル、診断用カテーテル、検査機器、アクセス機器、その他の必須ツールなどの製品を含む複数の主要セグメントで構成されています。これらの製品は不整脈や心臓疾患の診断、治療、管理に不可欠です。市場成長を牽引する主な適応症には、心房細動、心房粗動、房室結節再入口頻拍(AVNRT)、ウォルフ・パーキンソン・ホワイト症候群、その他の不整脈などがあり、いずれも効果的な治療には高度な電気生理学的処置が必要です。

これらの疾患の有病率が世界的に上昇し、低侵襲治療への需要と電気生理学的装置の技術革新が相まって、市場は大幅な拡大を示しています。カテーテルベースのアブレーションシステムや高度なマッピング技術など、高度な診断・治療ツールの採用が、特にヘルスケアへのアクセスがさまざまな地域で改善するにつれて、この成長をさらに加速させています。

当レポートでは、世界の電気生理学市場について調査し、市場の概要とともに、製品別、適応症別、エンドユーザー別、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場:業界の展望

- 業界展望

- 動向:現在および将来の影響評価

- 特許分析

- 規制の枠組み

- 市場力学の概要

第2章 世界の電気生理学市場(製品別)、100万米ドル、2022年~2034年

- 実験装置

- アブレーションカテーテル

- アクセスデバイス

- 診断用カテーテル

- その他の製品

第3章 世界の電気生理学市場(適応症別)、100万米ドル、2022年~2034年

- 心房細動(AF)

- 心房粗動

- 房室結節リエントリー性頻脈(AVNRT)

- ウォルフ・パーキンソン・ホワイト症候群(WPW)

- その他

第4章 世界の電気生理学市場(エンドユーザー別)、100万米ドル、2022年~2034年

- 病院と心臓センター

- 外来手術センター(ASC)と専門クリニック

第5章 世界の電気生理学市場(地域別)、100万米ドル、2022年~2034年

- 地域別概要

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第6章 市場-競合ベンチマーキングと企業プロファイル

- 世界の電気生理学市場:競合情勢

- 企業プロファイル

- Johnson & Johnson

- Abbott Laboratories

- Medtronic plc

- Koninklijke Philips N.V.

- GE HealthCare

- Boston Scientific Corporation

- Japan Lifeline Co., Ltd.

- Stereotaxis, Inc.

- MicroPort Scientific Corporation

- Siemens Healthineers AG

- Volta Medical

- BioSig Technologies Inc.

- CathVision ApS

- Biotronik

- Imricor Medical Systems, Inc.

第7章 調査手法

List of Figures

- Figure 1: Global Electrophysiology Market (by Region), $Billion, 2023, 2027, and 2034

- Figure 2: Global Electrophysiology Market (by Indication), $Billion, 2023, 2027, and 2034

- Figure 3: Global Electrophysiology Market (by End User), $Billion, 2023, 2027, and 2034

- Figure 4: Global Electrophysiology Market (by Product), $Billion, 2023, 2027, and 2034

- Figure 5: Key Events to Keep Track of within the Electrophysiology Market

- Figure 6: Supply Chain and Risks within the Supply Chain

- Figure 7: Global Electrophysiology Market, Patent Analysis (by Country), January 2021-December 2024

- Figure 8: Global Electrophysiology Market, Patent Analysis (by Year), January 2021-December 2024

- Figure 9: North America Electrophysiology Market, $Billion, 2022-2034

- Figure 10: U.S. Electrophysiology Market, $Billion, 2022-2034

- Figure 11: Canada Electrophysiology Market, $Billion, 2022-2034

- Figure 12: Europe Electrophysiology Market, $Billion, 2022-2034

- Figure 13: France Electrophysiology Market, $Billion, 2022-2034

- Figure 14: Italy Electrophysiology Market, $Billion, 2022-2034

- Figure 15: Germany Electrophysiology Market, $Billion, 2022-2034

- Figure 16: U.K. Electrophysiology Market, $Billion, 2022-2034

- Figure 17: Spain Electrophysiology Market, $Billion, 2022-2034

- Figure 18: Rest-of-Europe Electrophysiology Market, $Billion, 2022-2034

- Figure 19: Asia-Pacific Electrophysiology Market, $Billion, 2022-2034

- Figure 20: China Electrophysiology Market, $Billion, 2022-2034

- Figure 21: India Electrophysiology Market, $Billion, 2022-2034

- Figure 22: Australia Electrophysiology Market, $Billion, 2022-2034

- Figure 23: Japan Electrophysiology Market, $Billion, 2022-2034

- Figure 24: South Korea Electrophysiology Market, $Billion, 2022-2034

- Figure 25: Rest-of-Asia-Pacific Electrophysiology Market, $Billion, 2022-2034

- Figure 26: Latin America Electrophysiology Market, $Billion, 2022-2034

- Figure 27: Brazil Electrophysiology Market, $Billion, 2022-2034

- Figure 28: Mexico Electrophysiology Market, $Billion, 2022-2034

- Figure 29: Rest-of-Latin America Electrophysiology Market, $Billion, 2022-2034

- Figure 30: Middle East and Africa Market, $Billion, 2022-2034

- Figure 31: Corporate Strategies, January 2019-December 2024

- Figure 32: Share of Strategic Initiatives, January 2019-December 2024

- Figure 33: Strategic Initiatives (by Year), January 2019-December 2024

- Figure 34: Partnerships, Alliances, and Business Expansions, January 2019-December 2024

- Figure 35: New Offerings, January 2019-December 2024

- Figure 36: Regulatory Approval, January 2019-December 2024

- Figure 37: Funding Activities, January 2019-December 2024

- Figure 38: Merger And Acquisition, January 2019-December 2024

- Figure 39: Data Triangulation

- Figure 40: Top-Down and Bottom-Up Approach

- Figure 41: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Electrophysiology Market Trend Analysis

- Table 3: Impact Analysis of Market Navigating Factors, 2024-2034

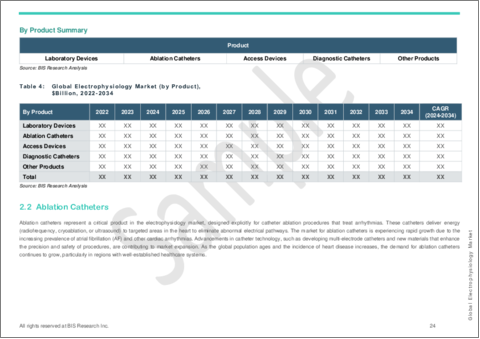

- Table 4: Global Electrophysiology Market (by Product), $Billion, 2022-2034

- Table 5: Global Electrophysiology Market (by Indication), $Billion, 2022-2034

- Table 6: Global Electrophysiology Market (by End User), $Billion, 2022-2034

- Table 7: Global Electrophysiology Market (by Region), $Billion, 2022-2034

Introduction to Electrophysiology Market

The global electrophysiology market is projected to reach $32.79 billion by 2034 from $9.77 billion in 2024, growing at a CAGR of 12.88% during the forecast period 2024-2034. Key factors fueling this expansion include the rising prevalence of cardiovascular diseases, particularly arrhythmias, as well as technological advancements in electrophysiology devices such as 3D mapping systems, catheter ablation systems, and diagnostic tools.

Additionally, the aging global population, particularly the increase in elderly individuals at higher risk for heart conditions, is contributing to the growing demand for electrophysiology treatments. Minimally invasive procedures, such as catheter-based ablation, are gaining popularity due to their lower risks and quicker recovery times, further driving the market.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2024 - 2034 |

| 2024 Evaluation | $9.77 Billion |

| 2034 Forecast | $32.79 Billion |

| CAGR | 12.88% |

With improvements in healthcare infrastructure, rising awareness of heart health, and investments from both government and private sectors, the market is poised for substantial growth.

Market Introduction

The global electrophysiology market comprises several key segments, including products such as ablation catheters, diagnostic catheters, laboratory devices, access devices, and other essential tools. These products are crucial for the diagnosis, treatment, and management of arrhythmias and heart conditions. Major indications driving market growth include atrial fibrillation, atrial flutter, atrioventricular nodal re-entry tachycardia (AVNRT), Wolff-Parkinson-White syndrome, and other arrhythmias, all of which require advanced electrophysiology procedures for effective treatment.

As the prevalence of these conditions rises globally, coupled with the demand for minimally invasive treatments and technological innovations in electrophysiology devices, the market is witnessing significant expansion. The adoption of sophisticated diagnostic and therapeutic tools, including catheter-based ablation systems and advanced mapping technologies, is further accelerating this growth, especially as healthcare access improves across various regions.

Impact Analysis:

The electrophysiology market has made an impact in the following ways:

- Improved Patient Outcomes:

- Enhanced treatment precision and higher success rates due to advanced mapping and robotic-assisted procedures

- Faster recovery times with minimally invasive procedures, leading to reduced complications

- Reduction in Healthcare Costs:

- Lower hospitalization costs due to minimally invasive procedures and shorter hospital stays

- Long-term savings from reduced recurrence of heart conditions and fewer repeat procedures

- Increased Access to Treatments:

- Expanded healthcare access in emerging markets such as India, China, and Southeast Asia

- Growth in medical tourism for electrophysiology services, offering affordable treatments globally

- Personalized Treatment Approaches:

- Tailored therapies enabled by advanced diagnostic and mapping technologies

- More effective, targeted ablation procedures, thereby reducing damage to healthy heart tissues

- Improved Quality of Life:

- Better management of chronic arrhythmias, leading to reduced symptoms and hospitalizations

- Reduced risk of stroke, particularly for atrial fibrillation patients, improving long-term health

- Technological Advancements and Innovation:

- Continued innovations in ablation catheters, mapping systems, and robotic-assisted devices

- Integration of AI and machine learning to improve diagnostic accuracy and treatment planning

- Growing Awareness and Early Diagnosis:

- Increased public awareness, leading to earlier diagnoses and more timely interventions

- Enhanced diagnostic capabilities, helping healthcare providers detect arrhythmias earlier

- Boost to Research and Development:

- Accelerated cardiovascular research driven by demand for better electrophysiology tools

- Ongoing clinical trials testing new devices and therapies to improve patient care

Market Segmentation:

Segmentation 1: by Product

- Laboratory Devices

- Ablation Catheters

- Access Devices

- Diagnostic Catheters

- Other Products

Ablation Catheters Segment to Continue Dominating the Electrophysiology Market (by Product)

Based on product, the electrophysiology market is led by ablation catheters, which held a 45.00% share in 2022.

Segmentation 2: by Indication

- Atrial fibrillation (AF)

- Atrial Flutter

- Atrio-Ventricular Nodal Reentry Tachycardia (AVNRT)

- Wolff-Parkinson-White Syndrome (WPW)

- Other indications

Atrial Fibrillation (AF) Segment to Continue Dominating the Electrophysiology Market (by Indication)

Based on indication, the electrophysiology market is led by atrial fibrillation (AF), which held a 41.00% share in 2022.

Segmentation 3: by End User

- Hospitals and Cardiac Centers

- Ambulatory Surgery Centers (ASCs) and Specialty Clinics

Hospitals and Cardiac Centers Segment to Continue Holding its Dominance in the Electrophysiology Market (by End User)

Based on end user, the electrophysiology market is led by hospitals and cardiac centers, which held an 89.00% share in 2022.

Segmentation 4: by Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Italy

- Spain

- Rest-of-Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest-of-Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest-of-Latin America

- Middle East and Africa

China dominated the Asia-Pacific electrophysiology market in 2022, driven by several key factors. The country's large and aging population has significantly increased the prevalence of cardiovascular diseases, particularly arrhythmias, creating a high demand for electrophysiology services.

Additionally, government healthcare initiatives, such as increased investment in healthcare infrastructure and expanded access to medical insurance, have made advanced treatments more accessible. Technological advancements, including the adoption of cutting-edge devices such as 3D mapping systems and ablation catheters, have further fueled market growth.

China's rapidly growing healthcare sector, along with the rise in medical tourism and the presence of major global electrophysiology device manufacturers, has reinforced its position as the market leader in the region. Furthermore, the increasing focus on preventive healthcare has driven earlier diagnoses and interventions, further contributing to the market's expansion.

Recent Developments in the Electrophysiology Market

- In November 2024, Johnson & Johnson announced the U.S. Food & Drug Administration (FDA) had approved its VARIPULSE Platform for the treatment of drug-refractory paroxysmal atrial fibrillation (AFib). This milestone reinforces the company's commitment to advancing innovative therapies that meet critical patient needs and drive market leadership in cardiovascular care.

- In July 2024, BioSig Technologies signed a letter of intent to acquire Neuro-Kinesis Corp.'s novel EP catheter (Huygens) and robotic arm platform (Proteus) via stock transaction. The proposed acquisition (pending due diligence and shareholder vote) would bring advanced robotic catheter navigation technology into BioSig's portfolio.

- In June 2024, Imricor commenced the VISABL-AFL IDE clinical trial (for U.S. FDA approval of Imricor's Vision-MR 2.0 ablation system) with the first two atrial flutter ablation cases performed at the Cardiovascular Institute of South Paris. This marked a significant step toward validating real-time iCMR ablation in a multi-center setting.

- In January 2024, Boston Scientific Corporation announced that it had secured U.S. Food and Drug Administration (FDA) approval for its FARAPULSE Pulsed Field Ablation (PFA) System. This regulatory milestone underscores the company's commitment to pioneering advanced therapeutic solutions in cardiac care and reinforces its position as a leader in innovation.

Demand - Drivers and Limitations

Market Demand Drivers:

Innovative Technological Developments: Innovations such as pulsed-field ablation (PFA), high-density mapping, and integrated imaging solutions are revolutionizing electrophysiology (EP) procedures, enhancing precision, reducing procedure times, and improving patient safety. However, despite their clinical advantages, market adoption can be slow due to the conservative nature of the industry and the strong presence of legacy systems.

To accelerate adoption and maximize the impact of these advancements, companies must prioritize:

- Strategic partnerships to integrate technologies within established workflows

- Robust clinical validation to demonstrate long-term efficacy and safety

Proliferation of New Entrants and Its Market Implications: The influx of new entrants into the electrophysiology market presents both opportunities and challenges. On the one hand, these newcomers are fostering innovation by introducing cutting-edge technologies and disruptive business models. This dynamic encourages established players to intensify their research and development initiatives, ultimately improving clinical outcomes. The heightened competition also has the potential to enhance patient care and drive cost efficiencies over time.

Market Restraints:

Increasing Disease Incidence and Procedural Volume: The increasing prevalence of conditions such as atrial fibrillation (AF) and the growing volume of electrophysiology (EP) procedures serve as major growth drivers for the electrophysiology sector. These trends reinforce the clinical demand for advanced electrophysiology technologies while generating recurring revenue streams for device manufacturers. The expansion of procedural volumes supports further investments in electrophysiology lab infrastructure and incentivizes continuous innovation in mapping, ablation, and diagnostic technologies.

Increasing Device Reuse and Reprocessing Trends: The increasing trend toward device reuse and reprocessing in the electrophysiology market is emerging as a cost-containment and sustainability strategy. On one hand, this approach offers healthcare providers a means to reduce capital expenditures and extend the lifecycle of expensive devices, thereby improving overall resource efficiency. On the other hand, it introduces challenges such as ensuring strict regulatory compliance, maintaining rigorous quality control, and safeguarding device performance to ensure patient safety. While device reuse and reprocessing can deliver significant cost savings and environmental benefits, successful implementation will require a careful balance between economic efficiency and the uncompromised efficacy of clinical outcomes.

Market Opportunities:

Expansion of Emerging Markets: Emerging markets offer a compelling growth opportunity for the electrophysiology sector. Regions such as Asia-Pacific, Latin America, and the Middle East and Africa, characterized by lower device penetration and a growing cardiovascular disease burden, are investing in improved healthcare infrastructure. This evolving landscape enables companies to expand distribution networks, develop cost-effective products, and implement robust local physician training, ultimately driving long-term market growth despite regional challenges.

How can this report add value to an organization?

Product/Innovation Strategy: The global electrophysiology market has been extensively segmented based on various categories, such as product, indication, end user, and region. This can help readers get a clear overview of which segments account for the largest share and which ones are well-positioned to grow in the coming years.

Growth/Marketing Strategy: The partnership, alliance, and business expansion accounted for the maximum number of key developments in the global electrophysiology market between January 2022 and December 2024.

Competitive Strategy: The global electrophysiology market has numerous established players with product and service portfolios. Key players in the global electrophysiology market analyzed and profiled in the study involve established players offering electrophysiology products and services.

Methodology

Key Considerations and Assumptions in Market Engineering and Validation

- Detailed secondary research was performed to ensure maximum coverage of manufacturers/suppliers operational in a country.

- Exact revenue information, up to a certain extent, was extracted for each company from secondary sources and databases. The revenues specific to the product, indication, end user, and region were then estimated for each market player based on fact-based proxy indicators as well as primary inputs.

- The scope of this report has been carefully derived based on interactions with experts in different companies across the world. This report provides a market study of electrophysiology.

- The market contribution of the electrophysiology anticipated to be launched in the future has been calculated based on historical analysis. This analysis has been supported by proxy factors such as the innovation scale of the companies, the status of funding, collaborations, customer base, and patent scenario.

- The scope of availability of electrophysiology products and services in a particular region has been assessed based on a comprehensive analysis of companies' prospects, regional end-user perception, and other factors impacting the launch of electrophysiology products and services in that region.

- The base year considered for the calculation of the market size is 2023. A historical year analysis has been done for the period FY2020-FY2022. The market size has been estimated for FY2023 and projected for the period FY2024-FY2034.

- Revenues of the companies have been referenced from their annual reports for FY2020-FY2023. For private companies, revenues have been estimated based on factors such as inputs obtained from primary research, funding history, product approval status, market collaborations, and operational history.

- Regional distribution of the market revenue has been estimated based on the companies in each region and the adoption rate of electrophysiology. All the numbers have been adjusted to a single digit after the decimal for better presentation in the report. However, the real figures have been utilized for compound annual growth rate (CAGR) estimation. The CAGR has been calculated for the period 2024-2034.

- The market has been mapped based on the available electrophysiology. All the key companies with significant offerings in this field have been considered and profiled in this report.

- Market strategies and developments of key players have been considered for the calculation of the potential of the market in the forecast period.

Primary Research:

The primary sources involve industry experts in the electrophysiology market, including the market players offering electrophysiology solutions. Resources such as CXOs, vice presidents, product managers, directors, territory managers, and business development have been interviewed to obtain and verify both qualitative and quantitative aspects of this research study.

The key data points taken from the primary sources include:

- Validation and triangulation of all the numbers and graphs

- Validation of the report's segmentation and key qualitative findings for electrophysiology

- Understanding the competitive landscape and business model

- Current and proposed production values of a product by market players

- Validation of the numbers of the different segments of the market in focus

- Percentage split of individual markets for regional analysis

Secondary Research

Open Sources

- European Medicines Agency (EMA), American Chemical Society (ACS), Frontiers, World Health Organization (WHO), and National Center for Biotechnology Information (NCBI), among others

- Annual reports, SEC filings, and investor presentations of the leading market players

- Company websites and detailed study of their portfolios

- Gold standard magazines, journals, whitepapers, press releases, and news articles

- Databases

The key data points taken from the secondary sources include:

- Segmentation and percentage share estimates

- Company and country understanding and data for market value estimation

- Key industry/market trends

- Developments among top players

- Qualitative insights into various aspects of the market, key trends, and emerging areas of innovation

- Quantitative data for mathematical and statistical calculations

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analyzing company coverage, type portfolio, and market penetration.

Some prominent names in the global electrophysiology market include:

- Abbott Laboratories

- Johnson & Johnson

- Medtronic plc

- Boston Scientific Corporation

- Japan Lifeline Co., Ltd.

- Stereotaxis, Inc.

- Siemens Healthineers AG

- GE HealthCare

- Koninklijke Philips N.V.

- BioSig Technologies, Inc.

Table of Contents

Executive Summary

Scope and Definition

1 Market: Industry Outlook

- 1.1 Industry Outlook

- 1.1.1 Supply Chain Overview

- 1.1.1.1 Risks within the Supply Chain

- 1.1.2 Reimbursement Scenario

- 1.1.2.1 Overview

- 1.1.2.2 U.S.

- 1.1.2.3 Europe

- 1.1.2.4 Asia-Pacific

- 1.1.3 Value Chain Analysis

- 1.1.3.1 Overview

- 1.1.3.2 Stakeholders at Each Stage of the Value Chain

- 1.1.3.3 Strategic Partnerships, Mergers, and Acquisitions in the Value Chain

- 1.1.1 Supply Chain Overview

- 1.2 Trends: Current and Future Impact Assessment

- 1.2.1 Increasing Adoption of Advanced 3D Mapping Systems and Real-Time Imaging

- 1.2.2 Emerging Use of Artificial Intelligence in Predictive Modelling and Personalized Treatment

- 1.3 Patent Analysis

- 1.3.1 Patent Filing Trend (by Country, Year)

- 1.4 Regulatory Framework

- 1.4.1 U.S.

- 1.4.2 Canada

- 1.4.3 European Union (EU)

- 1.4.4 U.K.

- 1.4.5 France

- 1.4.6 Germany

- 1.4.7 Italy

- 1.4.8 Spain

- 1.4.9 Japan

- 1.4.10 China

- 1.4.11 India

- 1.4.12 South Korea

- 1.4.13 Australia

- 1.4.14 Brazil

- 1.4.15 Mexico

- 1.5 Market Dynamics Overview

- 1.5.1 Market Drivers

- 1.5.1.1 Innovative Technological Developments

- 1.5.1.2 Proliferation of New Entrants and Its Market Implications

- 1.5.1.3 Expanding Investments, Funding, and Grant Support for Cardiac Surgery and Electrophysiology

- 1.5.1.4 Increasing Disease Incidence and Procedural Volume

- 1.5.2 Market Restraints

- 1.5.2.1 High Product Costs and Inadequate Reimbursement Policies

- 1.5.2.2 Increasing Device Reuse and Reprocessing Trends

- 1.5.3 Market Opportunities

- 1.5.3.1 Expansion of Emerging Markets

- 1.5.3.2 Next-Generation Ablation Technologies

- 1.5.1 Market Drivers

2 Global Electrophysiology Market (by Product), $Million, 2022-2034

- 2.1 Laboratory Devices

- 2.2 Ablation Catheters

- 2.3 Access Devices

- 2.4 Diagnostic Catheters

- 2.5 Other Products

3 Global Electrophysiology Market (by Indication), $Million, 2022-2034

- 3.1 Atrial fibrillation (AF)

- 3.2 Atrial Flutter

- 3.3 Atrio-ventricular nodal Reentry Tachycardia (AVNRT)

- 3.4 Wolff-Parkinson-White Syndrome (WPW)

- 3.5 Other Indications

4 Global Electrophysiology Market (by End User), $Million, 2022-2034

- 4.1 Hospitals and Cardiac Centers

- 4.2 Ambulatory Surgery Centers (ASCs) and Specialty Clinics

5 Global Electrophysiology Market (by Region), $Million, 2022-2034

- 5.1 Regional Summary

- 5.2 North America

- 5.2.1 Regional Overview

- 5.2.2 Driving Factors for Market Growth

- 5.2.3 Factors Challenging the Market

- 5.2.4 U.S.

- 5.2.5 Canada

- 5.3 Europe

- 5.3.1 Regional Overview

- 5.3.2 Driving Factors for Market Growth

- 5.3.3 Factors Challenging the Market

- 5.3.4 France

- 5.3.5 Italy

- 5.3.6 Germany

- 5.3.7 U.K.

- 5.3.8 Spain

- 5.3.9 Rest-of-Europe

- 5.4 Asia-Pacific

- 5.4.1 Regional Overview

- 5.4.2 Driving Factors for Market Growth

- 5.4.3 Factors Challenging the Market

- 5.4.4 China

- 5.4.5 India

- 5.4.6 Australia

- 5.4.7 Japan

- 5.4.8 South Korea

- 5.4.9 Rest-of-Asia-Pacific

- 5.5 Latin America

- 5.5.1 Regional Overview

- 5.5.2 Driving Factors for Market Growth

- 5.5.3 Factors Challenging the Market

- 5.5.4 Brazil

- 5.5.5 Mexico

- 5.5.6 Rest-of-Latin America

- 5.6 Middle East and Africa

- 5.6.1 Regional Overview

- 5.6.2 Driving Factors for Market Growth

- 5.6.3 Factors Challenging the Market

6 Markets - Competitive Benchmarking & Company Profiles

- 6.1 Global Electrophysiology Market: Competitive Landscape

- 6.1.1 Corporate Strategies, January 2019-December 2024

- 6.1.2 Strategic Initiatives (by Year), January 2019-December 2024

- 6.1.3 Partnerships, Alliances, and Business Expansions

- 6.1.4 New Offerings

- 6.1.5 Regulatory Approval

- 6.1.6 Funding Activities

- 6.1.7 Merger and Acquisition

- 6.1.8 Key Developments and Milestones, 2015-2023

- 6.2 Company Profiles

- 6.2.1 Johnson & Johnson

- 6.2.1.1 Overview

- 6.2.1.2 Top Products

- 6.2.1.3 Top Competitors

- 6.2.1.4 Target Customers

- 6.2.1.5 Analyst View

- 6.2.2 Abbott Laboratories

- 6.2.2.1 Overview

- 6.2.2.2 Top Products

- 6.2.2.3 Top Competitors

- 6.2.2.4 Target Customers

- 6.2.2.5 Analyst View

- 6.2.3 Medtronic plc

- 6.2.3.1 Overview

- 6.2.3.2 Top Products

- 6.2.3.3 Top Competitors

- 6.2.3.4 Target Customers

- 6.2.3.5 Analyst View

- 6.2.4 Koninklijke Philips N.V.

- 6.2.4.1 Overview

- 6.2.4.2 Top Products

- 6.2.4.3 Top Competitors

- 6.2.4.4 Target Customers

- 6.2.4.5 Analyst View

- 6.2.5 GE HealthCare

- 6.2.5.1 Overview

- 6.2.5.2 Top Products

- 6.2.5.3 Top Competitors

- 6.2.5.4 Target Customers

- 6.2.5.5 Analyst View

- 6.2.6 Boston Scientific Corporation

- 6.2.6.1 Overview

- 6.2.6.2 Top Products

- 6.2.6.3 Top Competitors

- 6.2.6.4 Target Customers

- 6.2.6.5 Analyst View

- 6.2.7 Japan Lifeline Co., Ltd.

- 6.2.7.1 Overview

- 6.2.7.2 Top Products

- 6.2.7.3 Top Competitors

- 6.2.7.4 Target Customers

- 6.2.7.5 Analyst View

- 6.2.8 Stereotaxis, Inc.

- 6.2.8.1 Overview

- 6.2.8.2 Top Products

- 6.2.8.3 Top Competitors

- 6.2.8.4 Target Customers

- 6.2.8.5 Analyst View

- 6.2.9 MicroPort Scientific Corporation

- 6.2.9.1 Overview

- 6.2.9.2 Top Products

- 6.2.9.3 Top Competitors

- 6.2.9.4 Target Customers

- 6.2.9.5 Analyst View

- 6.2.10 Siemens Healthineers AG

- 6.2.10.1 Overview

- 6.2.10.2 Top Products

- 6.2.10.3 Top Competitors

- 6.2.10.4 Target Customers

- 6.2.10.5 Analyst View

- 6.2.11 Volta Medical

- 6.2.11.1 Overview

- 6.2.11.2 Top Products

- 6.2.11.3 Top Competitors

- 6.2.11.4 Target Customers

- 6.2.11.5 Analyst View

- 6.2.12 BioSig Technologies Inc.

- 6.2.12.1 Overview

- 6.2.12.2 Top Products

- 6.2.12.3 Top Competitors

- 6.2.12.4 Target Customers

- 6.2.12.5 Analyst View

- 6.2.13 CathVision ApS

- 6.2.13.1 Overview

- 6.2.13.2 Top Products

- 6.2.13.3 Top Competitors

- 6.2.13.4 Target Customers

- 6.2.13.5 Analyst View

- 6.2.14 Biotronik

- 6.2.14.1 Overview

- 6.2.14.2 Top Products

- 6.2.14.3 Top Competitors

- 6.2.14.4 Target Customers

- 6.2.14.5 Analyst View

- 6.2.15 Imricor Medical Systems, Inc.

- 6.2.15.1 Overview

- 6.2.15.2 Top Products

- 6.2.15.3 Top Competitors

- 6.2.15.4 Target Customers

- 6.2.15.5 Analyst View

- 6.2.1 Johnson & Johnson

7 Research Methodology

- 7.1 Data Sources

- 7.1.1 Primary Data Sources

- 7.1.2 Secondary Data Sources

- 7.1.3 Data Triangulation

- 7.2 Market Estimation and Forecast