|

|

市場調査レポート

商品コード

1661297

歯科インプラントの世界市場:材料・デザイン・エンドユーザー・地域別の分析・予測 (2024-2034年)Dental Implants Market - A Global and Regional Analysis: Focus on Material, Design, End User, and Region - Analysis and Forecast, 2024-2034 |

||||||

カスタマイズ可能

|

|||||||

| 歯科インプラントの世界市場:材料・デザイン・エンドユーザー・地域別の分析・予測 (2024-2034年) |

|

出版日: 2025年02月25日

発行: BIS Research

ページ情報: 英文 75 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

世界の歯科インプラントの市場規模は、2023年の45億5,000万米ドルから、予測期間中は6.20%の高いCAGRを示し、2034年には86億3,000万米ドルに急増すると予測されています。

歯科インプラント市場は近年力強い成長を見せており、今後も拡大が続くと見られていますが、そのペースは状況によって異なる可能性があります。より多くの歯科医と患者が、インプラントを最後の手段と見なすのではなく、歯を失った場合の標準治療として受け入れています。欧州とアジアの一部では、インプラント治療の増加傾向が報告されています。これは、認知度の向上、訓練を受けたインプラント歯科医の増加、患者に自信を与える長期的な成功データの改善を反映しています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2024-2034年 |

| 2024年評価 | 47億3,000万米ドル |

| 2034年予測 | 86億3,000万米ドル |

| CAGR | 6.2% |

世界の歯科インプラント市場は、審美的かつ機能的な歯の修復ソリューションに対する需要の増加に後押しされ、大きな成長を遂げています。失った歯の永久的な代用品として機能する歯科インプラントは、従来のブリッジや入れ歯と比較して、優れた耐久性、生体適合性、口腔衛生を改善する能力により、広く採用されています。さらに、歯科医療支援組織 (DSO) やプライベートエクイティ投資の影響力の拡大により、インプラント治療の統合と拡張性が高まり、世界中の患者がより利用しやすくなっています。人口の高齢化、可処分所得の増加、ジルコニアやチタンをベースとしたインプラントの採用増加により、特に歯科医療へのアクセスが拡大している新興国において、市場は安定した成長を遂げると予測されています。さらに、歯科感染管理は、インプラント処置に伴う合併症の予防に重要な役割を果たしています。感染症はインプラントの失敗につながる可能性があるため、歯科開業医はリスクを軽減するために滅菌・感染予防プロトコルを採用するようになってきています。

材料別では、チタンインプラントの部門が優位に:

材料別に見ると、チタンインプラント部門が2023年に最大のシェアを占め、予測期間中はCAGR 6.07%を記録し、2034年には75億9,000万米ドルに達すると予測されています。チタンインプラントは、その優れた生体適合性、強度、高いオッセオインテグレーション成功率により、長期的な安定性と耐久性を保証するため、長い間、歯科修復の標準となってきました。特に高齢者層における無歯顎症の有病率の上昇と、先進的な歯科ソリューションに対する意識の高まりが、チタンベースのインプラントの需要に拍車をかけています。さらに、プラズマ溶射、酸エッチング、ナノコーティングなどの表面治療における最近の技術革新も、インプラントの統合を大幅に強化し、成功率を向上させ、治癒時間を短縮することから、チタンインプラントを歯科専門家と患者の両方にとって好ましい選択肢として確固たるものにしています。

デザイン別では、テーパードインプラントの部門が優位に:

デザインに基づくと、テーパードインプラントの部門が2023年に最大のシェアを占め、予測期間中に6.31%のCAGRを記録し、2034年には73億8,000万米ドルに達すると予想されており、市場をリードする見通しです。これらのインプラントは、一次安定性が高く、即時荷重や骨密度が低下した症例に理想的であるため、好まれています。円錐形の形状は自然の歯根構造を模倣しており、狭い稜線や抜歯窩のような解剖学的に制約のある部位への挿入が容易です。さらに、皮質骨とのかみ合わせが改善されるため、微小運動が減少し、オッセオインテグレーションが強化されます。

エンドユーザー別では、歯科病院・診療所部門が優位に:

エンドユーザー別では、歯科病院・診療所の部門が2023年に最大のシェアを占め、予測期間中はCAGR 6.30%を記録し、2034年には65億米ドルに達すると予測されています。同市場が優位に立つ主な要因は、無歯顎症、歯周炎、虫歯などの歯科疾患の罹患率が上昇し、インプラント処置の需要が高まっている点にあります。歯科病院や診療所には、コンピュータ支援設計/コンピュータ支援製造 (CAD/CAM)、3Dプリンティング、ガイド付きインプラント手術などの最先端技術が備わっており、これらすべてが処置の精度と成功率を高めるため、幅広い患者層を惹きつけています。さらに、これらの施設は、インプラント埋入、補綴修復、術後ケアなどの総合的な治療ソリューションを提供しており、総合的な歯科治療を求める患者にとって好ましい選択肢となっています。

当レポートでは、世界の歯科インプラントの市場を調査し、主要動向、市場影響因子の分析、法規制環境、技術開発・特許の動向、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

市場の分類

セグメンテーション1:材料別

- チタンインプラント

- ジルコニウムインプラント

セグメンテーション2:デザイン別

- テーパードインプラント

- 平行壁インプラント

セグメンテーション3:エンドユーザー別

- 歯科病院・診療所

- 歯科支援機関

- その他

セグメンテーション4:地域別

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他

- アジア太平洋

- 日本

- 中国

- インド

- オーストラリア

- その他

- ラテンアメリカ

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

目次

エグゼクティブサマリー

範囲と定義

第1章 市場:業界の展望

- 動向:現在および将来の影響評価

- デジタル歯科と技術の統合

- 手頃な価格と価値の高いインプラント部門への移行

- 規制状況

- サプライチェーン分析

- 価格分析

- 市場力学の概要

- 影響分析

- 市場促進要因

- 市場抑制要因

- 市場機会

第2章 世界の歯科インプラント市場:材料別

- チタン材料

- ジルコニウム材料

第3章 世界の歯科インプラント市場:設計別

- テーパードインプラント

- 平行壁インプラント

第4章 世界の歯科インプラント市場:エンドユーザー別

- 歯科病院・診療所

- 歯科支援機関 (DSO)

- その他

第5章 地域

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

- 地域概要

- 市場成長の原動力

- 市場課題

- 市場規模・予測

第6章 市場:競合ベンチマーキング・企業プロファイル

- 主要戦略と開発

- 企業プロファイル

- AB Dental Devices Ltd.

- Cortex Dental Implants Industries Ltd.

- Institut Straumann AG

- Dentsply Sirona

- Envista (Nobel Biocare Services)

- Henry Schein, Inc.

- KYOCERA Corporation

- Neobiotech Co., Ltd.

- OSSTEM IMPLANT Co., Ltd.

- ZimVie Inc.

第7章 調査手法

List of Figures

- Figure 1: Global Dental Implants Market (by Material), $Billion, 2023 and 2034

- Figure 2: Global Dental Implants Market (by Design), $Billion, 2023 and 2034

- Figure 3: Global Dental Implants Market (by End User), $Billion, 2023 and 2034

- Figure 4: Key Events to Keep Track of in the Global Dental Implants Market

- Figure 5: Supply Chain Analysis: Global Dental Implants Market

- Figure 6: Impact Analysis of Dental Implants Market Navigating Factors, 2024-2034

- Figure 7: North America Dental Implants Market, $Billion, 2022-2034

- Figure 8: U.S. Dental Implants Market, $Billion, 2022-2034

- Figure 9: Canada Dental Implants Market, $Billion, 2022-2034

- Figure 10: Europe Dental Implants Market, $Billion, 2022-2034

- Figure 11: Germany Dental Implants Market, $Billion, 2022-2034

- Figure 12: U.K. Dental Implants Market, $Billion, 2022-2034

- Figure 13: France Dental Implants Market, $Billion, 2022-2034

- Figure 14: Italy Dental Implants Market, $Billion, 2022-2034

- Figure 15: Spain Dental Implants Market, $Billion, 2022-2034

- Figure 16: Rest-of-Europe Dental Implants Market, $Billion, 2022-2034

- Figure 17: Asia-Pacific Dental Implants Market, $Billion, 2022-2034

- Figure 18: Japan Dental Implants Market, $Billion, 2022-2034

- Figure 19: China Dental Implants Market, $Billion, 2022-2034

- Figure 20: India Dental Implants Market, $Billion, 2022-2034

- Figure 21: Rest-of-Asia-Pacific Dental Implants Market, $Billion, 2022-2034

- Figure 22: Latin America Dental Implants Market, $Billion, 2022-2034

- Figure 23: Brazil Dental Implants Market, $Billion, 2022-2034

- Figure 24: Mexico Dental Implants Market, $Billion, 2022-2034

- Figure 25: Rest-of-Latin America Dental Implants Market, $Billion, 2022-2034

- Figure 26: Middle East and Africa Dental Implants Market, $Billion, 2022-2034

- Figure 27: Strategic Initiatives, January 2019-January 2025

- Figure 28: Data Triangulation

- Figure 29: Top-Down and Bottom-Up Approach

- Figure 30: Assumptions and Limitations

List of Tables

- Table 1: Key Trends, Global Dental Implants Market

- Table 2: Pricing of Dental Implants, by Material

- Table 3: Percentage of Dental Practices Offering Cosmetic Dentistry Procedures, U.S., 2017, 2019 and 2021

- Table 4: Cost of Dental Treatment in India, U.S., and Australia ($)

- Table 5: Global Dental Implants Market (by Material), $Billion, 2022-2034

- Table 6: Global Dental Implants Market (by Design), $Billion, 2022-2034

- Table 7: Global Dental Implants Market (by End User), $Billion, 2022-2034

- Table 8: Global Dental Implants Market (by Region), $Billion, 2022-2034

- Table 9: Some of the Recent Developments by Companies in the Global Dental Implants Market, 2023 and 2024

Introduction of Dental Implants

The global dental implants market, initially valued at $4.55 billion in 2023, is set to witness substantial growth, projected to surge to $8.63 billion by 2034, marking a remarkable compound annual growth rate (CAGR) of 6.20% over the period from 2024 to 2034. The dental implants market has shown robust growth in recent years and is poised to continue expanding, though the pace may vary under different conditions. More dentists and patients are embracing implants as the standard of care for missing teeth rather than seeing them as a last resort. Trends of rising implant procedures are reported in Europe and parts of Asia. This reflects greater awareness, more trained implant dentists, and improved long-term success data that give patients confidence.

Market Introduction

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2024 - 2034 |

| 2024 Evaluation | $4.73 Billion |

| 2034 Forecast | $8.63 Billion |

| CAGR | 6.2% |

The global dental implants market has been experiencing significant growth, fueled by increasing demand for aesthetic and functional tooth restoration solutions. Dental implants, which serve as permanent replacements for missing teeth, have gained widespread adoption due to their superior durability, biocompatibility, and ability to improve oral health compared to traditional bridges and dentures. Additionally, the expanding influence of dental support organizations (DSOs) and private equity investments has led to increased consolidation and scalability in implant procedures, making them more accessible to patients worldwide. With an aging population, rising disposable incomes, and the increasing adoption of zirconia and titanium-based implants, the market is projected to witness steady growth, particularly in emerging economies where access to dental care is expanding. Additionally, dental infection control plays a critical role in preventing complications associated with implant procedures. As infections can lead to implant failure thus, dental practitioners are increasingly adopting sterilization and infection prevention protocols to moderate risks.

Industrial Impact

The dental implants market has significantly influenced the healthcare landscape, driven by key players such as Straumann Group, Envista (Nobel Biocare), Dentsply Sirona, and ZimVie, Inc. (Zimmer Biomet). These companies have been at the forefront, providing cutting-edge products for dental implants.

Moreover, the market has been further shaped by strategic collaborations, mergers, and R&D investments, which enable companies to expand their global presence and introduce innovative solutions. With the increasing focus on understanding tissue architecture and disease mechanisms, the competitive landscape of the dental implants market is dynamic, with innovation and customer-centric approaches driving differentiation and growth.

Market Segmentation for Dental Implants Market:

Segmentation 1: by Material

- Titanium Implants

- Zirconium Implants

Titanium Implants Segment to Dominate the Dental Implants Market (by Material)

Based on material, the global dental implants market was led by the titanium implants segment, which accounted for the largest share in 2023 and is expected to reach $7.59 billion by 2034, registering a CAGR of 6.07% during the forecast period 2024-2034. Titanium implants have long been the standard in dental restoration due to their superior biocompatibility, strength, and high osseointegration success rate, ensuring long-term stability and durability. The rising prevalence of edentulism, particularly among the aging demographic, combined with growing awareness of advanced dental solutions, has fueled the demand for titanium-based implants. Additionally, recent technological innovations in surface treatments-such as plasma spraying, acid etching, and nano-coatings have significantly enhanced implant integration, improved success rates, and reduced healing times, solidifying titanium implants as a preferred choice for both dental professionals and patients.

Segmentation 2: by Design

- Tapered Implants

- Parallel-Walled Implants

Tapered Implants Segment to Dominate the Dental Implants Market (by Design)

Based on design, the global dental implants market was led by the tapered implants segment, which accounted for the largest share in 2023 and is expected to reach $7.38 billion by 2034, registering a CAGR of 6.31% during the forecast period 2024-2034. These implants are preferred for their ability to achieve higher primary stability, making them ideal for immediate loading and cases involving compromised bone density. Their conical shape mimics the natural root structure, facilitating better insertion in anatomically constrained sites, such as narrow ridges or extraction sockets. Additionally, they provide improved engagement with the cortical bone, reducing micromovements and enhancing osseointegration, which is particularly beneficial in challenging clinical scenarios.

Segmentation 3: by End User

- Dental Hospitals and Clinics

- Dental Support Organizations

- Others

Dental Hospitals and Clinics Segment to Dominate the Dental Implants Market (by End User)

Based on end user, dental hospitals and clinics accounted for the largest share in 2023 and are expected to reach $6.50 billion by 2034, registering a CAGR of 6.30% during the forecast period 2024-2034. A key factor contributing to the market's dominance is the rising incidence of dental conditions, such as edentulism, periodontitis, and tooth decay, which are driving the demand for implant procedures. Dental hospitals and clinics are equipped with state-of-the-art technologies, including computer-aided design/computer-aided manufacturing (CAD/CAM), 3D printing, and guided implant surgery, all of which enhance procedural precision and success rates, thereby attracting a broader patient demographic. Furthermore, these healthcare facilities provide integrated treatment solutions, offering implant placement, prosthetic restorations, and post-operative care, which positions them as the preferred choice for patients seeking comprehensive dental care.

Segmentation 4: by Region

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Rest-of-Europe

- Asia-Pacific

- Japan

- China

- India

- Australia

- Rest-of-Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

In 2023, Europe region dominated the global dental implants market; however, the Asia-Pacific region is expected to register the highest CAGR of 7.33% during the forecast period 2024-2034. Increased prevalence of dental diseases, the aging population, and need for oral health are few factors driving growth of the region. There are high rates of dental caries and periodontal diseases across Europe, especially among children. This results in a growing demand for restorative treatments, including implants, as patients age. Additionally, Europe has one of the world's oldest populations, with over 21% of Europeans aged 65 or older in 2022. This demographic trend increases the prevalence of tooth loss and the need for dental implants and prosthetics.

Recent Developments in the Dental Implants Market

- In July 2024, ZimVie received FDA 510(k) clearance and officially launched its GenTek restorative components portfolio in the U.S. This expansion enhances ZimVie's range of genuine prosthetic parts designed for its dental implant systems. The GenTek portfolio aims to provide high-quality, compatible restorative solutions, improving precision and durability for dental professionals and patients while strengthening ZimVie's position in the market.

- In October 2024, Lucence collaborated with the Diagnostics Development Hub (DxD Hub) at A*STAR to adapt its dental implant test, LucenceINSIGHT, for use with alternative sample types. This partnership marked a significant advancement in making cancer screening more accessible. Additionally, they partnered with local hospitals to recruit eligible patients for the study, aiming to extend the reach and impact of their research through the support of respected healthcare partners.

- In January 2021, Dentsply Sirona acquired Byte, a direct-to-consumer clear aligner company. This strategic acquisition allows Dentsply Sirona to expand its presence in the fast-growing clear aligner market, competing more aggressively with brands such as Invisalign (Align Technology). The deal aligns with Dentsply Sirona's long-term digital transformation strategy, enhancing its market reach and positioning it as a key player in the evolving clear aligner and teledentistry space.

Demand - Drivers, Challenges, and Opportunities

Market Drivers:

Increasing Dental Implant Procedures: The rising number of dental implant procedures is a key driver for the growth of the dental implants market worldwide. Several factors contribute to this trend, including the increasing prevalence of edentulism (tooth loss), growing patient awareness, advancements in implant technology, and a shift toward more permanent dental solutions. Additionally, technological innovations, such as computer-aided design/computer-aided manufacturing (CAD/CAM), 3D printing, and guided implant surgery, have made implant procedures more precise, efficient, and accessible, reducing surgery time and improving patient outcomes. Additionally, advancements in implant surface treatments, immediate-load implants, and digital dentistry have increased success rates and shortened healing periods, further encouraging adoption.

Market Challenges:

High Cost of Dental Implants and Limited Reimbursement: The high cost of dental implants remains a significant barrier to market growth, limiting accessibility, especially for patients in middle- and low-income segments. A single-tooth implant can range from $1,500 to $6,000, while full-mouth restorations can exceed $20,000 to $50,000, depending on materials, surgeon expertise, and geographical location. These costs include implant surgery, abutments, prosthetics, diagnostic procedures, and post-surgical care, making the treatment financially challenging for many patients. Additionally, limited reimbursement policies further restrict affordability. Unlike other dental procedures, implants are often classified as elective or cosmetic treatments and are not fully covered by public or private insurance providers. In countries with universal healthcare systems, such as the U.K. (NHS), Canada, and parts of Europe, insurance typically covers only basic tooth replacement options rather than implants.

Market Opportunities:

Growing Dental Tourism: Dental tourism has emerged as a significant growth driver for the dental implants market, as patients from high-cost regions travel abroad for affordable, high-quality dental care. Countries such as Hungary, Turkey, Mexico, Thailand, and India have become major hubs for dental implant procedures, offering advanced treatments at a fraction of the cost compared to markets such as the U.S., Canada, and Western Europe. This trend is fueled by the rising cost of dental procedures in developed nations, longer waiting times, and limited insurance coverage for implants.

How can this report add value to an organization?

Product/Innovation Strategy: The global dental implants market has been extensively segmented based on various categories, such as material, design, end user, and region.

Growth/Marketing Strategy: Mergers, acquisitions, and product launches accounted for the maximum number of key developments.

Competitive Strategy: The global dental implants market has numerous established players with product portfolios. Key players in the global dental implants market analyzed and profiled in the study involve established players offering products for dental implants.

Methodology

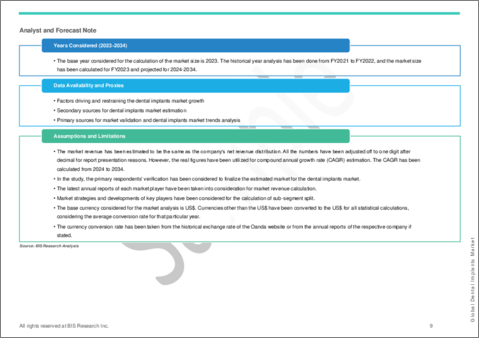

Key Considerations and Assumptions in Market Engineering and Validation

- The base year considered for the calculation of the market size is 2023. A historical year analysis has been done for the period FY2021-FY2022. The market size has been estimated for FY2023 and projected for the period FY2024-FY2034.

- The scope of this report has been carefully derived based on interactions with experts in different companies across the world. This report provides a market study of upstream and downstream products of the dental implants market.

- The market size was estimated and validated using both bottom-up and top-down analyses. The market size for each technology and end user was estimated for the bottom-up approach. These were further added to cumulate the market size of the global dental implants market.

- The top-down analysis was conducted to arrive at the market contributions of various segments as defined in the scope.

- The base currency considered for the market analysis is US$. Currencies other than the US$ have been converted to the US$ for all statistical calculations, considering the average conversion rate for that particular year.

- The market has been mapped based on available dental implants. All the key companies with significant offerings in this field have been considered and profiled in this report.

Primary Research:

The primary sources involve industry experts in dental implants, including the market players offering products and services. Resources such as CEOs, vice presidents, marketing directors, and technology and innovation directors have been interviewed to obtain and verify both qualitative and quantitative aspects of this research study.

The key data points taken from the primary sources include:

- validation and triangulation of all the numbers and graphs

- validation of the report's segmentation and key qualitative findings

- understanding the competitive landscape and business model

- current and proposed production values of a product by market players

- validation of the numbers of the different segments of the market in focus

- percentage split of individual markets for regional analysis

Secondary Research

Open Sources

- Certified publications, articles from recognized authors, white papers, directories, and major databases, among others

- Annual reports, SEC filings, and investor presentations of the leading market players

- Company websites and detailed study of their product portfolio

- Gold standard magazines, journals, white papers, press releases, and news articles

- Paid databases

The key data points taken from the secondary sources include:

- segmentations and percentage shares

- data for market value

- key industry trends of the top players of the market

- qualitative insights into various aspects of the market, key trends, and emerging areas of innovation

- quantitative data for mathematical and statistical calculations

Key Market Players and Competition Synopsis

The companies profiled have been selected based on inputs gathered from primary experts, who have analyzed company coverage, product portfolio, and market penetration.

Some prominent names established in this market are:

- Dentsply Sirona

- Institut Straumann AG

- ZimVie Inc.

- Henry Schein, Inc.

Table of Contents

Executive Summary

Scope and Definition

1 Market: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.1.1 Digital Dentistry and Technology Integration

- 1.1.2 Shift toward Affordable and Value Implant Segments

- 1.2 Regulatory Landscape

- 1.2.1 U.S.

- 1.2.2 European Union

- 1.2.3 China

- 1.2.4 Other Countries

- 1.3 Supply Chain Analysis

- 1.4 Pricing Analysis

- 1.5 Market Dynamics Overview

- 1.5.1 Impact Analysis

- 1.5.2 Market Drivers

- 1.5.2.1 Increasing Dental Implant Procedures

- 1.5.2.2 Increasing Cosmetic Dentistry Treatment

- 1.5.2.3 Technological Advancements

- 1.5.2.4 Aging Population Driving Preventive and Restorative Dental Care

- 1.5.3 Market Restraints

- 1.5.3.1 High Cost of Dental Implants

- 1.5.4 Market Opportunities

- 1.5.4.1 Growing Dental Tourism

2 Global Dental Implants Market, by Material

- 2.1 Titanium Materials

- 2.2 Zirconium Materials

3 Global Dental Implants Market, by Design

- 3.1 Tapered Implants

- 3.2 Parallel-Walled Implants

4 Global Dental Implants Market, by End User

- 4.1 Dental Hospitals and Clinics

- 4.2 Dental Support Organizations (DSOs)

- 4.3 Others

5 Regions

- 5.1 North America

- 5.1.1 Regional Overview

- 5.1.2 Driving Factors for Market Growth

- 5.1.3 Factors Challenging the Market

- 5.1.4 Market Sizing and Forecast

- 5.1.4.1 U.S.

- 5.1.4.2 Canada

- 5.2 Europe

- 5.2.1 Regional Overview

- 5.2.2 Driving Factors for Market Growth

- 5.2.3 Factors Challenging the Market

- 5.2.4 Market Sizing and Forecast

- 5.2.4.1 Germany

- 5.2.4.2 U.K.

- 5.2.4.3 France

- 5.2.4.4 Italy

- 5.2.4.5 Spain

- 5.2.4.6 Rest-of-Europe

- 5.3 Asia-Pacific

- 5.3.1 Regional Overview

- 5.3.2 Driving Factors for Market Growth

- 5.3.3 Factors Challenging the Market

- 5.3.4 Market Sizing and Forecast

- 5.3.4.1 Japan

- 5.3.4.2 China

- 5.3.4.3 India

- 5.3.4.4 Rest-of-Asia-Pacific

- 5.4 Latin America

- 5.4.1 Regional Overview

- 5.4.2 Driving Factors for Market Growth

- 5.4.3 Factors Challenging the Market

- 5.4.4 Market Sizing and Forecast

- 5.4.4.1 Brazil

- 5.4.4.2 Mexico

- 5.4.4.3 Rest-of-Latin America

- 5.5 Middle East and Africa

- 5.5.1 Regional Overview

- 5.5.2 Driving Factors for Market Growth

- 5.5.3 Factors Challenging the Market

- 5.5.4 Market Sizing and Forecast

6 Markets - Competitive Benchmarking & Company Profiles

- 6.1 Key Strategies and Development

- 6.2 Company Profiles

- 6.2.1 AB Dental Devices Ltd.

- 6.2.1.1 Overview

- 6.2.1.2 Top Products/Product Portfolio

- 6.2.1.3 Top Competitors

- 6.2.1.4 Target Customers

- 6.2.1.5 Analyst View

- 6.2.2 Cortex Dental Implants Industries Ltd.

- 6.2.2.1 Overview

- 6.2.2.2 Top Products/Product Portfolio

- 6.2.2.3 Top Competitors

- 6.2.2.4 Target Customers

- 6.2.2.5 Analyst View

- 6.2.3 Institut Straumann AG

- 6.2.3.1 Overview

- 6.2.3.2 Top Products/Product Portfolio

- 6.2.3.3 Top Competitors

- 6.2.3.4 Target Customers

- 6.2.3.5 Analyst View

- 6.2.4 Dentsply Sirona

- 6.2.4.1 Overview

- 6.2.4.2 Top Products/Product Portfolio

- 6.2.4.3 Top Competitors

- 6.2.4.4 Target Customers

- 6.2.4.5 Analyst View

- 6.2.5 Envista (Nobel Biocare Services)

- 6.2.5.1 Overview

- 6.2.5.2 Top Products/Product Portfolio

- 6.2.5.3 Top Competitors

- 6.2.5.4 Target Customers

- 6.2.5.5 Analyst View

- 6.2.6 Henry Schein, Inc.

- 6.2.6.1 Overview

- 6.2.6.2 Top Products/Product Portfolio

- 6.2.6.3 Top Competitors

- 6.2.6.4 Target Customers

- 6.2.6.5 Analyst View

- 6.2.7 KYOCERA Corporation

- 6.2.7.1 Overview

- 6.2.7.2 Top Products/Product Portfolio

- 6.2.7.3 Top Competitors

- 6.2.7.4 Target Customers

- 6.2.7.5 Analyst View

- 6.2.8 Neobiotech Co., Ltd.

- 6.2.8.1 Overview

- 6.2.8.2 Top Products/Product Portfolio

- 6.2.8.3 Top Competitors

- 6.2.8.4 Target Customers

- 6.2.8.5 Analyst View

- 6.2.9 OSSTEM IMPLANT Co., Ltd.

- 6.2.9.1 Overview

- 6.2.9.2 Top Products/Product Portfolio

- 6.2.9.3 Top Competitors

- 6.2.9.4 Target Customers

- 6.2.9.5 Analyst View

- 6.2.10 ZimVie Inc.

- 6.2.10.1 Overview

- 6.2.10.2 Top Products/Product Portfolio

- 6.2.10.3 Top Competitors

- 6.2.10.4 Target Customers

- 6.2.10.5 Analyst View

- 6.2.1 AB Dental Devices Ltd.

7 Research Methodology

- 7.1 Data Sources

- 7.1.1 Primary Data Sources

- 7.1.2 Secondary Data Sources

- 7.1.3 Data Triangulation

- 7.2 Market Estimation and Forecast