|

|

市場調査レポート

商品コード

1661295

米国のヘルスケアAI市場:提供区分・エンドユーザー別の分析・予測 (2024-2034年)U.S. AI in Healthcare Market: Focus on Offerings and End Users - Analysis and Forecast, 2024-2034 |

||||||

カスタマイズ可能

|

|||||||

| 米国のヘルスケアAI市場:提供区分・エンドユーザー別の分析・予測 (2024-2034年) |

|

出版日: 2025年02月25日

発行: BIS Research

ページ情報: 英文 76 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

米国のヘルスケアAIの市場規模は、2023年の52億5,430万米ドルから、予測期間中は40.41%と著しいCAGRで推移し、2034年には2,296億9,940万米ドルに急成長すると予測されています。

この目覚しい成長は、ヘルスケアの提供を根本的に作り変えつつある急速な技術の進歩に後押しされています。機械学習と深層学習アルゴリズムの画期的な進歩は、高精度の診断ツールと個別化された治療計画の開発を推進し、患者の転帰と業務効率を改善します。ウェアラブルデバイスや遠隔医療などのデジタルヘルスソリューションの統合は、AIの能力をさらに拡大し、リアルタイムのモニタリングや遠隔患者管理を可能にします。民間と公的機関の両方からの多額の投資が研究開発を加速させ、革新と適用の継続的なサイクルを促進しています。さらに、従来のヘルスケアの枠組みの中でAIソリューションをシームレスに導入するための道を開いているのは、規制面での支援環境であり、業界のステークホルダー間の戦略的パートナーシップが知識の交換と技術の統合を促進しています。これらの要因は、今後10年間の米国ヘルスケアAI市場の急成長を支え、強固なエコシステムを生み出します。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2024-2034年 |

| 2024年評価 | 77億1,000万米ドル |

| 2034年予測 | 2,297億米ドル |

| CAGR | 40.41% |

提供区分別では、ソフトウェア・サービスの部門が優位に:

提供区分別では、ソフトウェアおよびサービスの部門が2023年に72%のシェアを占め、市場をリードしています。ソフトウェアおよびサービスは、予測分析や診断支援から、電子カルテ統合や自然言語処理に至る包括的なソリューションスイートを提供し、ヘルスケア提供者の臨床的意思決定と業務効率の強化を支援します。これらのツールは、リアルタイムのデータ処理と個別化された治療計画を可能にし、最終的に患者の転帰改善と大幅なコスト削減に貢献します。さまざまなアプリケーションをシームレスに統合してパフォーマンスを最適化する高度なオペレーティングシステムのように、これらのソフトウェア主導型ソリューションは、ヘルスケアにおけるデジタル変革のバックボーンとして機能し、ワークフローを合理化し、より迅速で正確な診断を促進します。デジタルヘルスイノベーションへの継続的な投資により、ソフトウェアおよびサービスの重要性は拡大し続け、より効率的で患者中心のヘルスケア環境を形成する上で極めて重要な役割を果たすと予想されています。

エンドユーザー別では、その他のヘルスケア提供者の部門が優位に:

エンドユーザー別にみると、その他のヘルスケア提供者の部門が2023年に46%のシェアを占め、市場を牽引しました。その他のヘルスケア提供者とは、専門診断センター、外来診療所、外来ケアセンター、独立系ラボなどを含むグループです。これらの事業体は、診断精度を高め、所要時間を短縮し、より良い患者の転帰のために治療プロトコルを調整するために、AI主導の検査ソリューションの採用を増やしています。高度なアルゴリズムとリアルタイムのデータ分析を活用することで、従来の検査法では見過ごされていたパターンや異常を特定することができます。これらのプロバイダーは、相互に連携したヘルスケアシステムにおける専門医のネットワークのように、最先端の診断技術へのアクセスを拡大し、ヘルスケアのデジタルトランスフォーメーションを推進し、最終的にはより効率的で個別化されたケアの提供に貢献する上で重要な役割を果たしています。

市場の分類

セグメンテーション1:製品別

- ハードウェア

- ソフトウェア・サービス

セグメンテーション2:エンドユーザー別

- ヘルスケア提供者

- ヘルスケア保険者

- 患者

- その他のヘルスケア提供者

当レポートでは、米国のヘルスケアAIの市場を調査し、主要動向、市場影響因子の分析、法規制環境、技術開発・特許の動向、ケーススタディ、市場規模の推移・予測、各種区分別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

エグゼクティブサマリー

範囲と定義

第1章 市場:業界の展望

- 市場概要

- ヘルスケアAIの導入

- ヘルスケアAIの活用事例

- AIで使用される技術

- 市場動向と採用率

- デジタル技術の導入拡大

- 資金調達の取り組みの拡大

- ヘルスケアAIの新たな用途

- AIの導入と市場の準備

- 参入障壁と機会

- ケーススタディと影響

- 規制状況

- 市場力学の概要

- 影響分析

- 市場促進要因

- 市場の課題

- 市場機会

第2章 米国のヘルスケアAI市場:提供区分別

- ハードウェア

- ソフトウェア・サービス

第3章 米国のヘルスケアAI市場:エンドユーザー別

- ヘルスケア提供者

- ヘルスケア保険者

- 患者

- その他のヘルスケア提供者

第4章 市場:競合ベンチマーキング・企業プロファイル

- 主要戦略と開発

- 投資情勢 (資金調達とM&A活動)

- 主要なAI製品とスタートアップ

- Viz.ai

- Abridge

- Insilico Medicine

- Tempus

- 企業プロファイル

- International Business Machines Corporation

- Google LLC

- Microsoft Corporation

- Amazon.com, Inc.

- NVIDIA Corporation

- GE HealthCare

- Koninklijke Philips N.V.

- Tempus Labs, Inc.

- PathAI

第5章 調査手法

List of Figures

- Figure 1: U.S. AI in healthcare Market (by Offering), $Billion, 2023 and 2034

- Figure 2: U.S. AI in healthcare Market (by End User), $Billion, 2023 and 2034

- Figure 3: Key Events to Keep Track of in the U.S. AI in Healthcare Market

- Figure 4: AI Adoption Vs. Market Readiness Across Healthcare Applications

- Figure 5: Share of Strategic Initiatives, January 2019-December 2023

- Figure 6: Strategic Initiatives (by Year), January 2019-December 2023

- Figure 7: Partnerships, Alliances, and Business Expansions, January 2019-December 2023

- Figure 8: Funding Activities, January 2019-December 2023

- Figure 9: Merger and Acquisition, January 2019-December 2023

- Figure 10: New Offerings and Regulatory Approval, January 2019-December 2023

- Figure 11: Data Triangulation

- Figure 12: Top-Down and Bottom-Up Approach

- Figure 13: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Impact Analysis of U.S. AI in Healthcare Market Navigating Factors, 2024-2034

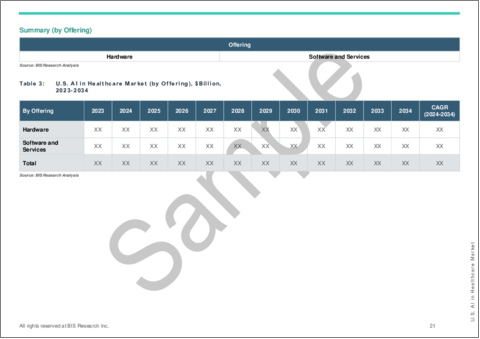

- Table 3: U.S. AI in Healthcare Market (by Offering), $Billion, 2023-2034

- Table 4: U.S. AI in Healthcare Market (by End User), $Billion, 2023-2034

Introduction of U.S. AI in Healthcare Market

The U.S. AI in healthcare market, initially valued at $5,254.3 million in 2023, is set for substantial growth, projected to surge to $229,699.4 million by 2034, marking a remarkable compound annual growth rate (CAGR) of 40.41% over the period from 2024 to 2034. This impressive trajectory is fuelled by rapid technological advancements that are fundamentally reshaping healthcare delivery. Breakthroughs in machine learning and deep learning algorithms drive the development of highly accurate diagnostic tools and personalized treatment plans, improving patient outcomes and operational efficiencies. The integration of digital health solutions, such as wearable devices and telemedicine, further expands the capabilities of AI, enabling real-time monitoring and remote patient management. Significant investments from both private and public sectors are accelerating research and development, fostering a continuous cycle of innovation and application. Additionally, a supportive regulatory environment is paving the way for seamless adoption of AI solutions within traditional healthcare frameworks, while strategic partnerships among industry stakeholders are facilitating knowledge exchange and technological integration. Together, these factors create a robust ecosystem that not only supports but actively propels the rapid growth of the U.S. AI in healthcare market over the coming decade.

Market Introduction

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2024 - 2034 |

| 2024 Evaluation | $7.71 Billion |

| 2034 Forecast | $229.70 Billion |

| CAGR | 40.41% |

The AI in healthcare market in the U.S. has been experiencing significant growth, driven by rapid technological innovation, evolving regulatory support, and a surge in strategic investments. Advanced AI applications, including predictive analytics and sophisticated diagnostic tools, are transforming traditional healthcare practices by enabling more accurate and timely clinical decision-making. This shift is further bolstered by the integration of digital health solutions, such as wearable devices and telemedicine, which facilitate continuous patient monitoring and remote care. Additionally, healthcare providers are increasingly embracing data-driven approaches to enhance personalized treatment protocols and improve overall patient outcomes. As these technological advancements align with a broader move towards preventive care and operational efficiency, the U.S. AI in healthcare market is witnessing a paradigm shift reshaping healthcare delivery's future.

Industrial Impact

The U.S. AI in healthcare market is set for steady growth, driven by rapid technological advancements, supportive regulatory frameworks, and increased investments in digital health innovation. Emerging AI algorithms and machine learning platforms are enhancing diagnostic accuracy and enabling personalized treatment plans, while streamlined government initiatives and evolving FDA guidelines are creating an environment conducive to integrating AI into clinical practices.

The industrial impact of AI in healthcare is profound, fundamentally reshaping clinical processes and operational efficiencies across the sector. AI-driven solutions have been shown to reduce diagnostic errors by up to 30%, leading to more accurate treatments and significant cost savings, bolstering the $500 million in venture capital funding secured by U.S.-based healthcare AI startups in 2023. This influx of investment is accelerating innovation, paving the way for advanced diagnostic tools and predictive analytics that are streamlining workflows in hospitals and clinics alike. Moreover, governmental initiatives, including those by the U.S. Department of Health and Human Services, project up to $150 billion in annual savings by 2026 through optimized treatment protocols and reduced misdiagnoses. These factors collectively are not only enhancing patient outcomes but are also transforming healthcare institutions into agile, data-driven entities, much like a well-orchestrated industrial upgrade that replaces outdated systems with next-generation technologies, thereby setting new benchmarks for efficiency and quality in healthcare delivery.

Market Segmentation:

Segmentation 1: by Offering

- Hardware

- Software and Services

Software and Services Offering Segment to Dominate the U.S. AI in Healthcare Market (by Offering)

Based on offering, the U.S. AI in healthcare market was led by the software and services offering segment, which held a 72% share in 2023. Software and services offer a comprehensive suite of solutions, ranging from predictive analytics and diagnostic support to electronic health record integration and natural language processing, that empower healthcare providers to enhance clinical decision-making and operational efficiency. These tools enable real-time data processing and personalized treatment planning, ultimately contributing to improved patient outcomes and significant cost savings. Much like an advanced operating system that seamlessly integrates various applications to optimize performance, these software-driven solutions serve as the backbone of digital transformation in healthcare, streamlining workflows and facilitating faster, more accurate diagnoses. With ongoing investments in digital health innovation, the prominence of software and services is expected to continue expanding, solidifying its pivotal role in shaping a more efficient and patient-centric healthcare landscape.

Segmentation 2: by End User

- Healthcare Providers

- Healthcare Payers

- Patients

- Other Healthcare Providers

Other Healthcare Providers Segment to Dominate the U.S. AI in Healthcare Market (by End User)

Based on the end user, the U.S. AI in healthcare market was led by the other healthcare providers segment, which held a 46% share in 2023. Other healthcare providers are a diverse group that includes specialized diagnostic centers, outpatient clinics, ambulatory care centers, and independent laboratories. These entities are increasingly adopting AI-driven testing solutions to enhance diagnostic accuracy, reduce turnaround times, and tailor treatment protocols for better patient outcomes. By leveraging advanced algorithms and real-time data analytics, they are able to identify patterns and anomalies that might otherwise be overlooked in traditional testing methods. Much like a network of interconnected specialists in a well-coordinated healthcare system, these providers play a crucial role in expanding access to cutting-edge diagnostic technologies, driving the digital transformation of healthcare, and ultimately contributing to more efficient and personalized care delivery.

Recent Developments in the U.S. AI in Healthcare Market

- In October 2023, Medtronic Plc partnered with Nvidia to build an AI platform for medical devices.

- In July 2022, Amazon.com, Inc. acquired One Medical for $3.9 billion, expanding AI-enabled primary care.

Demand - Drivers, Challenges, and Opportunities

Market Drivers:

Growing Need for Early Detection and Diagnosis: The growing need for early detection and diagnosis has become increasingly critical as the complexity of healthcare challenges continues to rise. Timely identification of diseases allows for prompt and targeted intervention, which can significantly enhance treatment effectiveness. Innovative diagnostic technologies, particularly AI-powered, enable clinicians to detect subtle changes and early warning signs that might otherwise go unnoticed. Early diagnosis paves the way for personalized care plans and reduces the risk of severe complications. By shifting the focus toward prevention rather than reaction, healthcare systems are better equipped to manage patient outcomes proactively. This proactive approach alleviates long-term burdens on healthcare resources and minimizes overall treatment costs. Ultimately, the emphasis on early detection is driving a transformative shift toward precision medicine and a more sustainable future for patient care.

Market Challenges:

Concerns Regarding Data Privacy: Data privacy concerns in healthcare have become increasingly significant as AI systems process vast amounts of sensitive patient information. The aggregation of data from diverse sources introduces vulnerabilities that can lead to unauthorized access and data breaches, putting personal health records at risk. Regulatory frameworks, although robust, often struggle to keep pace with rapid technological advancements and the complexities of cross-border data flows. This situation underscores the challenge of balancing the benefits of AI-driven healthcare innovations with the imperative to protect patient confidentiality. Healthcare organizations are, therefore, investing heavily in cybersecurity measures, such as advanced encryption and data anonymization, to mitigate these risks. At the same time, ongoing updates to privacy regulations and best practices are essential to address evolving cyber threats. Ultimately, maintaining stringent data protection protocols is critical to preserving patient trust and ensuring the ethical use of AI in healthcare.

Market Opportunities:

Pain Management and Personalized Care: AI-driven innovations are revolutionizing pain management by offering highly personalized care tailored to each patient's unique needs. Continuous monitoring through wearable devices and sensors captures real-time data on pain levels, enabling clinicians to adjust treatments promptly and effectively. Advanced data analytics identify individual pain triggers and patterns, paving the way for targeted and efficient interventions. Enhanced diagnostic imaging further refines these approaches by accurately pinpointing the sources of pain, which supports the development of more precise treatment strategies. Integration with telemedicine platforms also plays a crucial role, allowing remote monitoring and timely consultations that ensure care remains responsive and accessible. By combining historical patient data with live insights, clinicians can create dynamic pain management plans that evolve with each patient's condition. Ultimately, this personalized approach improves pain control and enhances overall quality of life, empowering patients through tailored, proactive care.

How can this report add value to an organization?

Product/Innovation Strategy: The U.S. AI in healthcare market has been extensively segmented based on various categories, such as offerings and end users. This can help readers understand which segments account for the largest share and which are well-positioned to grow in the coming years.

Growth/Marketing Strategy: Mergers, acquisitions, and product launches accounted for the maximum number of key developments, i.e., nearly 41.67% of the total developments in the U.S. AI in healthcare market were between January 2019 and December 2023.

Competitive Strategy: The U.S. AI in healthcare market has numerous established players with product portfolios. Key players in the U.S. AI in healthcare market analyzed and profiled in the study involve established players offering products for U.S. AI in healthcare.

Methodology

Key Considerations and Assumptions in U.S. AI in Healthcare Market Engineering and Validation

- The base year considered for the calculation of the U.S. AI in healthcare market size is 2023. A historical year analysis has been done for the period FY2021-FY2022. The U.S. AI in healthcare market size has been estimated for FY2023 and projected for the period FY2024-FY2034.

- The scope of this report has been carefully derived based on interactions with experts in different companies. This report provides a market study of upstream and downstream technologies of the U.S. AI in healthcare market.

- The U.S. AI in healthcare market contribution of U.S. AI in healthcare is anticipated to be launched and calculated based on a historical analysis of the solutions.

- The company's revenue has been referenced from their annual reports for FY2022 and FY2023. For private companies, revenues have been estimated based on factors such as inputs obtained from primary research, funding history, market collaborations, and operational history.

- The U.S. AI in healthcare market has been mapped based on the available U.S. AI in healthcare data. This report has considered and profiled all the key companies with significant offerings in this field.

Primary Research:

The primary sources involve industry experts in U.S. AI in healthcare, including the market players offering products and services. Resources such as CEOs, vice presidents, marketing directors, and technology and innovation directors have been interviewed to obtain and verify both qualitative and quantitative aspects of this research study.

The key data points taken from the primary sources include:

- Validation and triangulation of all the numbers and graphs

- Validation of the report's segmentation and key qualitative findings

- Understanding the competitive landscape and business model

- Current and proposed production values of a product by market players

- Validation of the numbers of the different segments of the U.S. AI in healthcare market in focus

- Percentage split of individual markets for regional analysis

Secondary Research

Open Sources

- Certified publications, articles from recognized authors, white papers, directories, and major databases, among others

- Annual reports, SEC filings, and investor presentations of the leading market players

- Company websites and detailed study of their product portfolio

- Gold standard magazines, journals, white papers, press releases, and news articles

- Paid databases

The key data points taken from the secondary sources include:

- Segmentations and percentage shares

- Data for market value

- Key industry trends of the top players of the U.S. AI in healthcare market

- Qualitative insights into various aspects of the U.S. AI in healthcare market, key trends, and emerging areas of innovation

- Quantitative data for mathematical and statistical calculations

Key Market Players and Competition Synopsis

Profiled companies have been selected based on inputs gathered from primary experts, who have analysed company coverage, product portfolio, and market penetration.

Some prominent names established in this market are:

- International Business Machines Corporation

- Google LLC

- Microsoft Corporation

- Amazon.com, Inc.

- NVIDIA Corporation

- GE HealthCare

Table of Contents

Executive Summary

Scope and Definition

1 Market: Industry Outlook

- 1.1 Market Overview

- 1.1.1 AI Adoption in Healthcare

- 1.1.2 AI Use Cases in Healthcare

- 1.1.2.1 Diagnostics and Imaging

- 1.1.2.2 Drug Discovery and Development

- 1.1.2.3 Personalized Medicine and Treatment Plans

- 1.1.2.4 AI in Patient Management and Virtual Healthcare

- 1.1.2.5 Remote Patient Monitoring (RPM)

- 1.1.2.6 Hospital Operations and Administrative Automation

- 1.1.2.7 AI in Surgery and Robotics

- 1.1.2.8 AI for Disease Prediction and Early Detection

- 1.1.3 Technology Used in AI

- 1.1.3.1 Machine Learning

- 1.1.3.2 Natural Language Processing (NLP)

- 1.1.3.3 Generative AI

- 1.1.3.4 Computer Vision

- 1.1.3.5 Image Analysis

- 1.2 Market Trends and Adoption Rates

- 1.2.1 Increasing Adoption of Digital Technology

- 1.2.2 Increasing Funding Initiatives

- 1.2.3 Emerging Applications of AI in Healthcare

- 1.3 AI Adoption vs Market Readiness

- 1.4 Entry Barriers and Opportunities

- 1.4.1 Barriers

- 1.4.1.1 Regulatory Uncertainty

- 1.4.1.2 Integration Complexity

- 1.4.1.3 Workforce Transition

- 1.4.1.4 Data Strategy

- 1.4.1.5 ROI Realization

- 1.4.2 Opportunities

- 1.4.2.1 Strategic Differentiation

- 1.4.2.2 New Services and Revenue Streams

- 1.4.2.3 Addressing Workforce Shortages

- 1.4.2.4 Collaboration and Ecosystem Building

- 1.4.1 Barriers

- 1.5 Case Studies and Impact

- 1.5.1 Stroke Care (Viz.ai)

- 1.5.2 Sepsis Early Detection-Mixed Results

- 1.5.3 Diagnostic Accuracy

- 1.5.4 Patient Satisfaction-AI Patient Communication

- 1.5.5 Telehealth Triage-Kaiser's Chatbot

- 1.6 Regulatory Landscape

- 1.6.1 Regulatory and Policy Landscape in the U.S.

- 1.6.2 EU vs. U.S. Differences

- 1.7 Market Dynamics Overview

- 1.7.1 Impact Analysis

- 1.7.2 Market Drivers

- 1.7.2.1 Growing Need for Early Detection and Diagnosis

- 1.7.2.2 The Rapid Proliferation of AI in the Healthcare Sector

- 1.7.2.3 Exponential Growth in Data Volume and Complexity Due to Surging Adoption of Digital Technologies

- 1.7.2.4 Operational Efficiency and Cost Reduction

- 1.7.3 Market Challenges

- 1.7.3.1 Concerns Regarding Data Privacy

- 1.7.4 Market Opportunities

- 1.7.4.1 Pain Management and Personalized Care

2 U.S. AI in Healthcare Market (by Offering), $Billion, 2023-2034

- 2.1 Hardware

- 2.2 Software and Services

3 U.S. AI in Healthcare Market (by End User), $Billion, 2023-2034

- 3.1 Healthcare Providers

- 3.2 Healthcare Payers

- 3.3 Patients

- 3.4 Other Healthcare Providers

4 Markets - Competitive Benchmarking & Company Profiles

- 4.1 Key Strategies and Development

- 4.1.1 Partnerships, Alliances, and Business Expansions

- 4.1.2 Funding Activities

- 4.1.3 Merger and Acquisition

- 4.1.4 New Offerings and Regulatory Approval

- 4.2 Investment Landscape (Funding and M&A Activity)

- 4.3 Major AI Products and Startups (2023-2025)

- 4.3.1 Viz.ai

- 4.3.2 Abridge

- 4.3.3 Insilico Medicine

- 4.3.4 Tempus

- 4.4 Company Profiles

- 4.4.1 International Business Machines Corporation

- 4.4.1.1 Overview

- 4.4.1.2 Top Products/Services

- 4.4.1.3 Top Competitors

- 4.4.1.4 Target Customers

- 4.4.1.5 Analyst View

- 4.4.2 Google LLC

- 4.4.2.1 Overview

- 4.4.2.2 Top Products/Services

- 4.4.2.3 Top Competitors

- 4.4.2.4 Target Customers

- 4.4.2.5 Analyst View

- 4.4.3 Microsoft Corporation

- 4.4.3.1 Overview

- 4.4.3.2 Top Products/ Services

- 4.4.3.3 Top Competitors

- 4.4.3.4 Target Customers

- 4.4.3.5 Analyst View

- 4.4.4 Amazon.com, Inc.

- 4.4.4.1 Overview

- 4.4.4.2 Top Products/ Services

- 4.4.4.3 Top Competitors

- 4.4.4.4 Target Customers

- 4.4.4.5 Analyst View

- 4.4.5 NVIDIA Corporation

- 4.4.5.1 Overview

- 4.4.5.2 Top Products/ Services

- 4.4.5.3 Top Competitors

- 4.4.5.4 Target Customers

- 4.4.5.5 Analyst View

- 4.4.6 GE HealthCare

- 4.4.6.1 Overview

- 4.4.6.2 Top Products/ Services

- 4.4.6.3 Top Competitors

- 4.4.6.4 Target Customers

- 4.4.6.5 Analyst View

- 4.4.7 Koninklijke Philips N.V.

- 4.4.7.1 Overview

- 4.4.7.2 Top Products/ Services

- 4.4.7.3 Top Competitors

- 4.4.7.4 Target Customers

- 4.4.7.5 Analyst View

- 4.4.8 Tempus Labs, Inc.

- 4.4.8.1 Overview

- 4.4.8.2 Top Products/ Services

- 4.4.8.3 Top Competitors

- 4.4.8.4 Target Customers

- 4.4.8.5 Analyst View

- 4.4.9 PathAI

- 4.4.9.1 Overview

- 4.4.9.2 Top Products/Services

- 4.4.9.3 Top Competitors

- 4.4.9.4 Target Customers

- 4.4.9.5 Analyst View

- 4.4.1 International Business Machines Corporation

5 Research Methodology

- 5.1 Data Sources

- 5.1.1 Primary Data Sources

- 5.1.2 Secondary Data Sources

- 5.1.3 Data Triangulation

- 5.2 Market Estimation and Forecast