|

|

市場調査レポート

商品コード

1658642

東南アジアの特殊化学品市場:用途・製品タイプ・国別の分析・予測 (2024-2034年)Southeast Asia Specialty Chemicals Market - A Regional Analysis: Focus on Application, Product Type, and Country Analysis - Analysis and Forecast, 2024-2034 |

||||||

カスタマイズ可能

|

|||||||

| 東南アジアの特殊化学品市場:用途・製品タイプ・国別の分析・予測 (2024-2034年) |

|

出版日: 2025年02月20日

発行: BIS Research

ページ情報: 英文 98 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

東南アジアの特殊化学品市場は、複数の重要な要因によって著しい成長を遂げています。

東南アジアの特殊化学品の市場規模は、2024年の468億6,000万米ドルから、予測期間中は6.04%のCAGRで推移し、2034年には842億4,000万米ドルに達すると予測されています。

この成長の主な原動力は、繊維、建設、自動車、エレクトロニクスなどの業界全体で、高性能で持続可能な化学配合物に対する需要が高まっていることです。工業化と都市化が加速する中、製造業者は製品の耐久性、効率、環境コンプライアンスを高めるために高度な特殊化学品を必要としています。さらに、厳しい環境規制や持続可能性への取り組みが、環境に優しい化学物質や環境に優しい製造プロセスの採用を後押ししており、世界のESGコミットメントに沿いながらカーボンフットプリントを削減しています。 スマートマニュファクチャリング、ナノテクノロジー、バイオベースの化学物質などを含む技術の進歩は、生産効率と製品イノベーションをさらに最適化しています。自動化された化学処理、AI主導の品質管理、高度な材料科学の台頭は、費用対効果と拡張性を向上させ、特殊化学品ソリューションを産業界にとってより魅力的なものにしています。さらに、地域的な生産拠点の急速な開拓や、世界的企業とローカル企業の戦略的パートナーシップによっても、市場の拡大が加速しています。こうした進歩はサプライチェーンの弾力性を高め、規制遵守を確実にし、この地域の成長する産業エコシステムを支えています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2024-2034年 |

| 2024年評価 | 468億6,000万米ドル |

| 2034年予測 | 842億4,000万米ドル |

| CAGR | 6.04% |

用途別では、建設・インフラ部門が市場をリード:

東南アジアの特殊化学品市場では、建設・インフラ分野が主要用途になると予測されています。この成長の原動力となっているのは、急速な都市化、スマートシティ構想に対する政府の多額の投資、建設プロジェクトにおける高性能材料への需要の高まりです。特殊化学品は、インフラの耐久性、強度、持続可能性を高める上で重要な役割を担っており、同地域の拡大する建設業界にとって不可欠なものとなっています。インフラ開発が加速する中、先端化学ソリューションの採用は、業界の長期的成長と持続可能性の目標を支える上で極めて重要です。

製品別では、繊維化学品の部門が市場をリード:

東南アジアの特殊化学品市場では、繊維化学品の部門が製品カテゴリー別で優位を占めると予測されています。この成長は、同地域の繊維・アパレル産業の拡大、高機能で持続可能な生地に対する需要の増加、化学配合の継続的な進歩が原動力となっています。染料、仕上げ剤、性能向上添加剤などの必須特殊化学品は、生地の品質、耐久性、環境持続可能性の向上に重要な役割を果たしています。さらに、消費者の意識の高まりと環境に優しい生産プロセスに対する規制の重視により、この地域全体で革新的な繊維化学ソリューションの採用がさらに加速すると予想されます。

当レポートでは、東南アジアの特殊化学品の市場を調査し、主要動向、市場影響因子の分析、法規制環境、技術開発・特許の動向、市場規模の推移・予測、各種区分・主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

セグメンテーション1:用途別

- 農業

- 自動車・輸送

- エレクトロニクス・半導体

- ヘルスケア・医薬品

- 建設・インフラ

- 食品・飲料

- パーソナルケア・化粧品

- 水処理・環境

- その他

セグメンテーション2:製品別

- 接着剤

- 水処理薬品

- 電子化学品

- ゴム添加剤

- 潤滑油添加剤

- 化粧品原料

- 先端セラミック材料

- プラスチック添加剤

- 特殊油田用化学品

- 繊維化学品

目次

エグゼクティブサマリー

範囲と定義

第1章 市場:業界の展望

- 動向:現在および将来の影響評価

- 持続可能な/グリーンな特殊化学品の需要の高まり

- 生産プロセスのデジタル化と自動化

- 製品のカスタマイズとイノベーションの向上

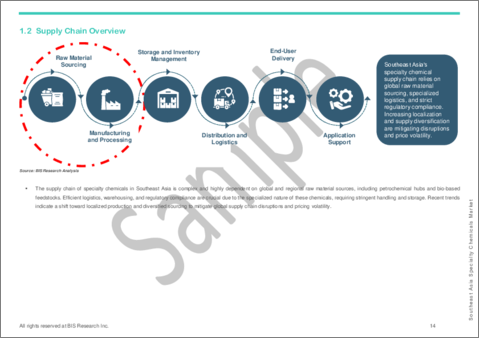

- サプライチェーンの概要

- バリューチェーン分析

- 価格予測

- 研究開発レビュー

- 特許出願動向(国・企業別)

- 規制状況

- ステークホルダー分析

- 使用事例

- 主要な世界的イベントの影響分析

- 市場力学の概要

- 市場促進要因

- 市場の課題

- 市場機会

第2章 用途

- 用途の分類

- 用途の概要

- 東南アジアの特殊化学品市場:用途別

- 用途

第3章 製品

- 製品の分類

- 製品概要

- 東南アジアの特殊化学品市場:ソリューション別

- 製品

第4章 東南アジアの特殊化学品市場:国別

- 東南アジア

- 地域概要

- 市場成長推進要因

- 市場課題

- 主要企業

- インドネシア

- マレーシア

- タイ

- ベトナム

- フィリピン

- その他

第5章 市場:競合ベンチマーキングと企業プロファイル

- 次なるフロンティア

- 地理的評価

- 企業プロファイル

- BASF

- Dow

- Clariant

- Solvay

- Evonik Industries AG

- LANXESS

- Croda International Plc

- 3M

- Petroliam Nasional Berhad (PETRONAS)

- PTT Global Chemical Public Company Limited

- Sinochem Holdings

- Huntsman International LLC

- Mitsui Chemicals, Inc.

- PT Pertamina (Persero)

- Hextar Kimia Sdn Bhd

第6章 調査手法

List of Figures

- Figure 1: Southeast Asia Specialty Chemicals Market (by Scenario), $Million, 2023, 2027, and 2034

- Figure 2: Southeast Asia Specialty Chemicals Market (by Application), $Million, 2023, 2027, and 2034

- Figure 3: Southeast Asia Specialty Chemicals Market (by Product), $Billion, 2023, 2027, and 2034

- Figure 4: Key Events

- Figure 5: Global Average Price of Speciality Chemicals (in Kg.)

- Figure 6: Impact Analysis of Southeast Asia Specialty Chemicals Market Navigating Factors, 2023-2034

- Figure 7: Indonesia Specialty Chemicals Market, $Billion, 2023-2034

- Figure 8: Malaysia Specialty Chemicals Market, $Billion, 2023-2034

- Figure 9: Thailand Specialty Chemicals Market, $Billion, 2023-2034

- Figure 10: Vietnam Specialty Chemicals Market, $Billion, 2023-2034

- Figure 11: Philippines Specialty Chemicals Market, $Billion, 2023-2034

- Figure 12: Rest-of-Southeast-Asia Specialty Chemicals Market, $Billion, 2023-2034

- Figure 13: Data Triangulation

- Figure 14: Top-Down and Bottom-Up Approach

- Figure 15: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Competitive Landscape Snapshot

- Table 3: Regulatory Landscape

- Table 4: Southeast Asia Specialty Chemicals Market (by Application),$Billion

- Table 5: Southeast Asia Specialty Chemicals Market (by Product), $Billion

- Table 6: Southeast Asia Specialty Chemicals Market (by Application), $Billion, 2023-2034

- Table 7: Southeast Asia Specialty Chemicals Market (by Product), $Billion, 2023-2034

- Table 8: Indonesia Specialty Chemicals Market (by Application), $Billion, 2023-2034

- Table 9: Indonesia Specialty Chemicals Market (by Product), $Billion, 2023-2034

- Table 10: Malaysia Specialty Chemicals Market (by Application), $Billion, 2023-2034

- Table 11: Malaysia Specialty Chemicals Market (by Product), $Billion, 2023-2034

- Table 12: Thailand Specialty Chemicals Market (by Application), $Billion, 2023-2034

- Table 13: Thailand Specialty Chemicals Market (by Product), $Billion, 2023-2034

- Table 14: Vietnam Specialty Chemicals Market (by Application), $Billion, 2023-2034

- Table 15: Vietnam Specialty Chemicals Market (by Product), $Billion, 2023-2034

- Table 16: Philippines Specialty Chemicals Market (by Application), $Billion, 2023-2034

- Table 17: Philippines Specialty Chemicals Market (by Product), $Billion, 2023-2034

- Table 18: Rest-of-Southeast-Asia Specialty Chemicals Market (by Application), $Billion, 2023-2034

- Table 19: Rest-of-Southeast-Asia Specialty Chemicals Market (by Product), $Billion, 2023-2034

- Table 20: Market Share, 2023

Introduction to the Southeast Asia Specialty Chemicals Market

The Southeast Asia specialty chemicals market has been experiencing significant growth, driven by multiple key factors. The Southeast Asia specialty chemicals market was valued at $46.86 billion in 2024 and is expected to reach $84.24 billion by 2034, witnessing a CAGR of 6.04% during the forecast period 2024-2034. A primary driver of this growth is the increasing demand for high-performance and sustainable chemical formulations across industries such as textiles, construction, automotive, and electronics. As industrialization and urbanization accelerate, manufacturers require advanced specialty chemicals to enhance product durability, efficiency, and environmental compliance. Additionally, stringent environmental regulations and sustainability initiatives are pushing the adoption of eco-friendly chemicals and green manufacturing processes, reducing carbon footprints while aligning with global ESG commitments. Technological advancements, including smart manufacturing, nanotechnology, and bio-based chemicals, are further optimizing production efficiency and product innovation. The rise of automated chemical processing, AI-driven quality control, and advanced material science is improving cost-effectiveness and scalability, making specialty chemical solutions more attractive to industries. Furthermore, the rapid development of regional production hubs and strategic partnerships between global and local players has been accelerating market expansion. These advancements enhance supply chain resilience, ensure regulatory compliance, and support the region's growing industrial ecosystem.

Southeast Asia Specialty Chemicals Market Segmentation:

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2024 - 2034 |

| 2024 Evaluation | $46.86 Billion |

| 2034 Forecast | $84.24 Billion |

| CAGR | 6.04% |

Segmentation 1: by Application

- Agriculture

- Automotive and Transportation

- Electronics and Semiconductors

- Healthcare and Pharmaceuticals

- Construction and Infrastructure

- Food and Beverages

- Personal Care and Cosmetics

- Water Treatment and Environmental Applications

- Others

Construction and Infrastructure to Lead the Southeast Asia Specialty Chemicals Market (by Application)

The construction and infrastructure sector is projected to be the dominant application in the Southeast Asia specialty chemicals market. This growth is driven by rapid urbanization, substantial government investments in smart city initiatives, and the increasing demand for high-performance materials in construction projects. Specialty chemicals play a critical role in enhancing infrastructure's durability, strength, and sustainability, making them essential to the region's expanding construction industry. As infrastructure development accelerates, the adoption of advanced chemical solutions will be pivotal in supporting long-term industry growth and sustainability objectives.

Segmentation 2: by Product

- Adhesives

- Water Treatment Chemicals

- Electronic Chemicals

- Rubber Additives

- Lubricating Oil Additives

- Cosmetic Ingredients

- Advanced Ceramic Materials

- Plastic Additives

- Speciality Oilfield Chemicals

- Textile Chemicals

Textile Chemicals Segment to Lead the Southeast Asia Specialty Chemicals Market (by Product)

The textile chemicals segment is projected to dominate the Southeast Asia specialty chemicals market by product category. This growth is driven by the region's expanding textile and apparel industry, increasing demand for high-performance and sustainable fabrics, and continuous advancements in chemical formulations. Essential specialty chemicals, including dyes, finishing agents, and performance-enhancing additives, play a crucial role in enhancing fabric quality, durability, and environmental sustainability. Furthermore, growing consumer awareness and regulatory emphasis on eco-friendly production processes are expected to further accelerate the adoption of innovative textile chemical solutions across the region.

Industrial Trends for the Southeast Asia Specialty Chemicals Market

Growing Demand for Sustainable/Green Specialty Chemicals

- The Southeast Asia specialty chemicals market is increasingly prioritizing sustainability, with manufacturers shifting from fossil-based raw materials to bio-based and renewable feedstocks. This transition is driven by regulatory requirements and growing consumer demand for environmentally responsible products. Industry players are actively developing bio-based alternatives designed to integrate seamlessly into existing production processes, ensuring reduced environmental impact without compromising performance or efficiency. Additionally, there is a rising focus on eco-friendly additives, solvents, and polymers that offer high functionality with lower toxicity, aligning with sustainability objectives. As a result, biodegradable plastics, plant-based surfactants, and other sustainable specialty chemicals are gaining significant traction. This strategic shift toward green chemistry and sustainable product development has positioned sustainability as a key competitive differentiator in the Southeast Asia specialty chemicals market.

- Furthermore, the increasing focus on green chemistry is expected to play a transformative role in shaping product development and portfolio strategies within the Southeast Asia specialty chemicals market. Innovations aimed at reducing emissions, hazardous waste, and resource consumption will serve as key differentiators in the market, driving competitive advantage. In Southeast Asia, local producers have been actively exploring renewable feedstocks, such as palm oil derivatives, while investing in circular economy initiatives, including recycling and waste-to-chemical conversion technologies. Evolving consumer preferences for sustainable products, provided they maintain high performance and quality standards, will further accelerate this transition. As companies continue to align with global environmental regulations and sustainability frameworks, the specialty chemicals market in the region is set for long-term evolution, characterized by greater innovation, enhanced environmental responsibility, and the widespread adoption of sustainable solutions over the next decade.

Industrial Driver for the Southeast Asia Specialty Chemicals Market

Rapid Industrialization and Urbanization in Southeast Asia

- Southeast Asia's rapid industrialization and urbanization are driving significant demand for the Southeast Asia specialty chemicals market, particularly in the emerging five economies. Expanding industrial zones and manufacturing hubs in Indonesia, Vietnam, and the Philippines are accelerating the need for advanced coatings, adhesives, and process chemicals to support industrial production. Simultaneously, large-scale infrastructure projects and urban expansion initiatives are increasing the consumption of construction chemicals, water treatment solutions, and high-performance materials. With continued economic growth and rising urban populations, specialty chemicals are becoming essential in enhancing industrial processes, improving construction materials, and supporting critical utilities across the region.

Analyst View

- The region's sustained economic expansion remains a key driver of the Southeast Asia specialty chemicals market, as industrial and urban development growth directly translates into increased material demand. The diversification of manufacturing sectors, particularly in automotive and electronics, is expanding the range of chemical applications, creating opportunities for both local and global market players. However, this growth also presents challenges, including the need for sustainable production processes and efficient supply chain management to comply with evolving regulatory and environmental standards. Companies that prioritize innovation and the development of high-performance, sustainable solutions tailored to Southeast Asia's unique market requirements will be well-positioned to gain a competitive edge as the region solidifies its status as a global industrial hub.

Industrial Restraint for the Southeast Asia Specialty Chemicals Market

Strategic Government Support and Investments in Chemical Infrastructure

- Southeast Asian governments recognize the specialty chemicals industry as a key driver of economic growth and have been actively implementing policies to strengthen local production capabilities. Countries such as Malaysia, Indonesia, Thailand, Vietnam, and the Philippines are introducing strategic roadmaps, investment incentives, and infrastructure development initiatives to attract both domestic and foreign market players. These efforts include tax benefits for high-value chemical projects, grants for R&D in green and sustainable chemicals, and the development of industrial zones and dedicated chemical parks. National industrial policies are focused on reducing reliance on chemical imports, promoting downstream chemical production, and supporting critical sectors such as agriculture, electronics, and pharmaceuticals. Additionally, investments in logistics infrastructure, including deep-sea ports and chemical storage terminals, are enhancing the efficient transportation and distribution of specialty chemical products. These initiatives are making the Southeast Asia specialty chemicals market more robust and competitive.

Analyst View

- Government-driven policies are shaping self-sufficiency and innovation in the Southeast Asia specialty chemicals market. By fostering investment-friendly environments, regional governments enhance supply chain resilience and drive technological advancements in high-value specialty chemicals. However, challenges such as regulatory compliance, environmental sustainability, and global trade uncertainties persist. The successful growth of the industry will depend on the effective implementation of policies, the adoption of sustainable manufacturing practices, and alignment with international quality and safety standards. With continued public-sector support, private investments in advanced chemical manufacturing, R&D, and localization strategies are expected to increase, further positioning Southeast Asia as an emerging global hub for specialty chemical production.

Industrial Opportunity for the Southeast Asia Specialty Chemicals Market

Expansion into High Value-Added Niche Market

- Specialty chemical producers in Southeast Asia have the opportunity to transition toward high-value niche markets, moving beyond bulk commodity segments to focus on specialized applications. Key growth areas include electronic chemicals for semiconductor manufacturing, biocides for disease control, aerospace-grade composites, and natural extract-based cosmetic ingredients. These segments demand advanced formulations, strict quality standards, and industry-specific certifications, creating high entry barriers that limit direct competition. Additionally, regional manufacturers can leverage local resources to develop unique specialty products catering to the Southeast Asia specialty chemicals market requirements, such as halal-certified chemicals for food and cosmetics. Expanding into these high-margin, technology-intensive segments provides stronger market positioning and enhances profitability.

- To effectively capture niche market opportunities, Southeast Asian specialty chemical companies must prioritize R&D investments to develop proprietary formulations that comply with stringent industry and regulatory standards. Establishing strategic partnerships with global chemical leaders, research institutions, and regulatory bodies can facilitate knowledge transfer, streamline the certification process, and improve technological capabilities. Additionally, forming joint ventures with multinational firms can provide access to specialized expertise and advanced manufacturing technologies. Companies should also focus on sustainable and region-specific solutions, such as bio-based specialty chemicals derived from locally available raw materials, aligning with the growing demand for environment-friendly products. Strengthening supply chain integration and ensuring compliance with international industry standards will further enhance competitiveness and market credibility. By implementing these strategies, regional specialty chemical producers can establish a strong foothold in high-value segments, ensuring the long-term growth of the Southeast Asia specialty chemicals market.

Analyst View

- To effectively capitalize on niche markets, Southeast Asian specialty chemical companies must prioritize research and development (R&D) investments to create proprietary formulations that adhere to strict quality and regulatory standards. Establishing strategic partnerships with global industry leaders, research institutions, and local governments can facilitate knowledge exchange, expedite certification processes, and enhance technological capabilities. Additionally, forming joint ventures with multinational corporations can provide access to specialized expertise and advanced manufacturing technologies, further strengthening market competitiveness. Companies should also focus on sustainable and region-specific solutions, such as bio-based specialty chemicals derived from locally available raw materials, aligning with the increasing demand for environmentally friendly products. Furthermore, reinforcing supply chain integration and ensuring compliance with international industry standards will be essential in maintaining a competitive edge. By implementing these strategies, regional specialty chemical manufacturers can successfully establish a presence in high-margin market segments and achieve sustained long-term growth within the Southeast Asia specialty chemicals market.

Key Players of Southeast Asia Specialty Chemicals Market

- BASF

- Dow

- Clariant

- Solvay

- Evonik Industries AG

- LANXESS

- Croda International Plc

- 3M

- Petroliam Nasional Berhad (PETRONAS)

- PTT Global Chemical Public Company Limited

- Sinochem Holdings

- Huntsman International LLC

- Mitsui Chemicals, Inc.

- PT Pertamina (Persero)

- Hextar Kimia Sdn Bhd

Table of Contents

Executive Summary

Scope and Definition

1 Market: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.1.1 Growing Demand for Sustainable/Green Specialty Chemicals

- 1.1.2 Digitalization and Automation in Production Processes

- 1.1.3 Increased Product Customization and Innovation

- 1.2 Supply Chain Overview

- 1.2.1 Value Chain Analysis

- 1.2.2 Pricing Forecast

- 1.3 Research and Development Review

- 1.3.1 Patent Filing Trend (by Country and Company)

- 1.4 Regulatory Landscape

- 1.5 Stakeholder Analysis

- 1.5.1 Use Case

- 1.6 Impact Analysis for Key Global Events

- 1.7 Market Dynamics Overview

- 1.7.1 Market Drivers

- 1.7.1.1 Rapid Industrialization and Urbanization in Southeast Asia

- 1.7.1.2 Rising Demand from End-Use Sectors

- 1.7.1.3 Strategic Government Support and Investments in Chemical Infrastructure

- 1.7.2 Market Challenges

- 1.7.2.1 Volatility in Raw Material Prices

- 1.7.2.2 Stringent Regulatory and Environmental Compliance Requirements

- 1.7.2.3 Intense Global Competition and Cost Pressures

- 1.7.3 Market Opportunities

- 1.7.3.1 Expansion into High Value-Added Niche Market

- 1.7.3.2 Development of Eco-Friendly and Sustainable Chemical Solutions

- 1.7.3.3 Strategic Partnerships, Joint Ventures, and M&As for Market Consolidation

- 1.7.1 Market Drivers

2 Application

- 2.1 Application Segmentation

- 2.2 Application Summary

- 2.3 Southeast Asia Specialty Chemicals Market (by Application)

- 2.3.1 Application

- 2.3.1.1 Agriculture

- 2.3.1.2 Automotive and Transportation

- 2.3.1.3 Electronics and Semiconductors

- 2.3.1.4 Healthcare and Pharmaceuticals

- 2.3.1.5 Construction and Infrastructure

- 2.3.1.6 Food and Beverages

- 2.3.1.7 Personal Care and Cosmetics

- 2.3.1.8 Water Treatment and Environmental Applications

- 2.3.1.9 Others

- 2.3.1 Application

3 Products

- 3.1 Product Segmentation

- 3.2 Product Summary

- 3.3 Southeast Asia Specialty Chemicals Market (by Solution)

- 3.3.1 Product

- 3.3.1.1 Adhesives

- 3.3.1.2 Water Treatment Chemicals

- 3.3.1.3 Electronic Chemicals

- 3.3.1.4 Rubber Additives

- 3.3.1.5 Lubricating Oil Additives

- 3.3.1.6 Cosmetic Ingredients

- 3.3.1.7 Advanced Ceramic Materials

- 3.3.1.8 Plastic Additives

- 3.3.1.9 Specialty Oilfield Chemicals

- 3.3.1.10 Textile Chemicals

- 3.3.1 Product

4 Southeast Asia Specialty Chemicals Market (by Countries)

- 4.1 Southeast Asia

- 4.1.1 Regional Overview

- 4.1.2 Driving Factors for Market Growth

- 4.1.3 Factors Challenging the Market

- 4.1.4 Key Companies

- 4.1.4.1 Application

- 4.1.4.2 Product

- 4.1.5 Indonesia

- 4.1.5.1 Application

- 4.1.5.2 Product

- 4.1.6 Malaysia

- 4.1.6.1 Application

- 4.1.6.2 Product

- 4.1.7 Thailand

- 4.1.7.1 Application

- 4.1.7.2 Product

- 4.1.8 Vietnam

- 4.1.8.1 Application

- 4.1.8.2 Product

- 4.1.9 Philippines

- 4.1.9.1 Application

- 4.1.9.2 Product

- 4.1.10 Rest-of-Southeast-Asia

- 4.1.10.1 Application

- 4.1.10.2 Product

5 Markets - Competitive Benchmarking & Company Profiles

- 5.1 Next Frontiers

- 5.2 Geographic Assessment

- 5.3 Company Profiles

- 5.3.1 BASF

- 5.3.1.1 Overview

- 5.3.1.2 Top Products/Product Portfolio

- 5.3.1.3 Top Competitors

- 5.3.1.4 Target Customers

- 5.3.1.5 Key Personnel

- 5.3.1.6 Analyst View

- 5.3.1.7 Market Share, 2023

- 5.3.2 Dow

- 5.3.2.1 Overview

- 5.3.2.2 Top Products/Product Portfolio

- 5.3.2.3 Top Competitors

- 5.3.2.4 Target Customers

- 5.3.2.5 Key Personnel

- 5.3.2.6 Analyst View

- 5.3.2.7 Market Share, 2023

- 5.3.3 Clariant

- 5.3.3.1 Overview

- 5.3.3.2 Top Products/Product Portfolio

- 5.3.3.3 Top Competitors

- 5.3.3.4 Target Customers

- 5.3.3.5 Key Personnel

- 5.3.3.6 Analyst View

- 5.3.3.7 Market Share, 2023

- 5.3.4 Solvay

- 5.3.4.1 Overview

- 5.3.4.2 Top Products/Product Portfolio

- 5.3.4.3 Top Competitors

- 5.3.4.4 Target Customers

- 5.3.4.5 Key Personnel

- 5.3.4.6 Analyst View

- 5.3.4.7 Market Share, 2023

- 5.3.5 Evonik Industries AG

- 5.3.5.1 Overview

- 5.3.5.2 Top Products/Product Portfolio

- 5.3.5.3 Top Competitors

- 5.3.5.4 Target Customers

- 5.3.5.5 Key Personnel

- 5.3.5.6 Analyst View

- 5.3.5.7 Market Share, 2023

- 5.3.6 LANXESS

- 5.3.6.1 Overview

- 5.3.6.2 Top Products/Product Portfolio

- 5.3.6.3 Top Competitors

- 5.3.6.4 Target Customers

- 5.3.6.5 Key Personnel

- 5.3.6.6 Analyst View

- 5.3.6.7 Market Share, 2023

- 5.3.7 Croda International Plc

- 5.3.7.1 Overview

- 5.3.7.2 Top Products/Product Portfolio

- 5.3.7.3 Top Competitors

- 5.3.7.4 Target Customers

- 5.3.7.5 Key Personnel

- 5.3.7.6 Analyst View

- 5.3.7.7 Market Share, 2023

- 5.3.8 3M

- 5.3.8.1 Overview

- 5.3.8.2 Top Products/Product Portfolio

- 5.3.8.3 Top Competitors

- 5.3.8.4 Target Customers

- 5.3.8.5 Key Personnel

- 5.3.8.6 Analyst View

- 5.3.8.7 Market Share, 2023

- 5.3.9 Petroliam Nasional Berhad (PETRONAS)

- 5.3.9.1 Overview

- 5.3.9.2 Top Products/Product Portfolio

- 5.3.9.3 Top Competitors

- 5.3.9.4 Target Customers

- 5.3.9.5 Key Personnel

- 5.3.9.6 Analyst View

- 5.3.9.7 Market Share, 2023

- 5.3.10 PTT Global Chemical Public Company Limited

- 5.3.10.1 Overview

- 5.3.10.2 Top Products/Product Portfolio

- 5.3.10.3 Top Competitors

- 5.3.10.4 Target Customers

- 5.3.10.5 Key Personnel

- 5.3.10.6 Analyst View

- 5.3.10.7 Market Share, 2023

- 5.3.11 Sinochem Holdings

- 5.3.11.1 Overview

- 5.3.11.2 Top Products/Product Portfolio

- 5.3.11.3 Top Competitors

- 5.3.11.4 Target Customers

- 5.3.11.5 Key Personnel

- 5.3.11.6 Analyst View

- 5.3.11.7 Market Share, 2023

- 5.3.12 Huntsman International LLC

- 5.3.12.1 Overview

- 5.3.12.2 Top Products/Product Portfolio

- 5.3.12.3 Top Competitors

- 5.3.12.4 Target Customers

- 5.3.12.5 Key Personnel

- 5.3.12.6 Analyst View

- 5.3.12.7 Market Share, 2023

- 5.3.13 Mitsui Chemicals, Inc.

- 5.3.13.1 Overview

- 5.3.13.2 Top Products/Product Portfolio

- 5.3.13.3 Top Competitors

- 5.3.13.4 Target Customers

- 5.3.13.5 Key Personnel

- 5.3.13.6 Analyst View

- 5.3.13.7 Market Share, 2023

- 5.3.14 PT Pertamina (Persero)

- 5.3.14.1 Overview

- 5.3.14.2 Top Products/Product Portfolio

- 5.3.14.3 Top Competitors

- 5.3.14.4 Target Customers

- 5.3.14.5 Key Personnel

- 5.3.14.6 Analyst View

- 5.3.14.7 Market Share, 2023

- 5.3.15 Hextar Kimia Sdn Bhd

- 5.3.15.1 Overview

- 5.3.15.2 Top Products/Product Portfolio

- 5.3.15.3 Top Competitors

- 5.3.15.4 Target Customers

- 5.3.15.5 Key Personnel

- 5.3.15.6 Analyst View

- 5.3.15.7 Market Share, 2023

- 5.3.1 BASF

6 Research Methodology

- 6.1 Data Sources

- 6.1.1 Primary Data Sources

- 6.1.2 Secondary Data Sources

- 6.1.3 Data Triangulation

- 6.2 Market Estimation and Forecast