|

|

市場調査レポート

商品コード

1658640

アジア太平洋の屋内分散アンテナシステム(DAS)市場:用途別、製品別 - 分析と予測(2024年~2033年)Indoor Distributed Antenna System (DAS) Market in Asia-Pacific: Focus on Applications and Products Within Indoor DAS in Asia-Pacific - Analysis and Forecast, 2024-2033 |

||||||

カスタマイズ可能

|

|||||||

| アジア太平洋の屋内分散アンテナシステム(DAS)市場:用途別、製品別 - 分析と予測(2024年~2033年) |

|

出版日: 2025年02月20日

発行: BIS Research

ページ情報: 英文 234 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

アジア太平洋の屋内分散アンテナシステム(DAS)市場は、シームレスな無線接続に対する需要の高まり、スマートシティ構想の拡大、5G対応インフラの急速な導入などを背景に、大きな成長を遂げています。

2023年の市場規模は24億7,000万米ドルで、現実的なシナリオでは10.09%のCAGRで拡大し、2033年には64億6,000万米ドルに達すると予測されています。楽観的シナリオでは、5Gの展開が加速し、DASとWi-Fi 6やプライベートLTEネットワークとの統合が進めば、2033年までにCAGR 15.16%で拡大し、97億米ドルに達する可能性があります。主な成長分野は、商業ビル、交通ハブ、ヘルスケア施設、教育機関、スポーツ会場などで、ハードウェアとサービスベースのソリューションが大きく貢献しています。しかし、規制当局の承認、インフラ導入コスト、効果的なDAS統合のための高度なRF計画の必要性などの課題に直面しています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2024年~2033年 |

| 2024年の評価 | 27億2,000万米ドル |

| 2033年の予測 | 64億6,000万米ドル |

| CAGR | 10.09% |

屋内分散アンテナシステム(DAS)は、建物内の無線信号分配を強化するために設計された、共通のソースに接続された空間的に分離されたアンテナノードのネットワークです。シームレスなモバイルカバレッジを確保し、信号強度を向上させ、高速データ・トランスミッションを可能にすることで、屋内接続の課題に対処する上で重要な役割を果たしています。屋内DASソリューションは、増幅器、アンテナ、基地局などの主要コンポーネントを統合し、複合商業施設、スタジアム、病院、交通ハブなどの高密度環境でのカバレッジを最適化します。この技術は、ネットワークの混雑を緩和し、信頼性を向上させることで、5G、IoT、スマートビルディング・アプリケーションなど、現代の接続需要をサポートする上で特に不可欠です。堅牢な無線ネットワークへのニーズが高まる中、インドアDASは業界全体で採用が拡大しており、進化するデジタル要件に対応する拡張性と効率性に優れたソリューションを提供しています。

アジア太平洋の屋内分散アンテナシステム(DAS)市場は、シームレスな屋内接続に対する需要の高まり、都市インフラの拡大、5Gネットワークの採用などを背景に、急速な変貌を遂げています。同市場は現在、モバイルネットワーク事業者や企業が堅牢な接続ソリューションを求める中、商業ビル、空港、病院、交通ハブにおける無線カバレッジを強化する必要性によって活性化しています。政府や通信事業者は、高密度環境や構造的障害物によるネットワークギャップを埋めるためにDASに投資しています。日本、韓国、オーストラリアなどの国々が先進的な5Gの展開で導入をリードしている一方、インド、タイ、ベトナムなどの新興市場では、急速な都市化とサービスのデジタル化により需要が拡大しています。今後の成長は、技術の進歩、スマートシティ構想との統合、プライベートLTEとWi-Fi 6ソリューションの普及によってもたらされます。

アジア太平洋における屋内分散アンテナシステム(DAS)市場の産業への影響は甚大で、商業不動産、交通、ヘルスケア、教育、製造、小売など複数のセクターに影響を与えています。5Gの急速な普及に伴い、産業界は接続性の強化、業務の最適化、顧客体験の向上のためにDASを活用しています。商業分野では、大手ショッピングモールやオフィスビルがDASソリューションを統合してシームレスなモバイルカバレッジを確保し、企業や消費者を引き付けています。空港や地下鉄の駅では、高密度の乗客エリアやIoTアプリケーションをサポートするためにDASが導入され、交通部門が大きなメリットを得ています。ヘルスケア施設では、遠隔医療、遠隔モニタリング、安全な患者データ・トランスミッションにDASが利用されており、教育機関ではeラーニングやスマート・キャンパス構想の強化にDASが組み込まれています。製造業、特に工業地帯や物流ハブでは、自動化、IoT主導のプロセス、スマート工場運営をサポートするためにDASを活用しています。さらに、ホテルやリゾートなどのホスピタリティ・ビジネスは、宿泊客に中断のない接続性を提供するためにDASを導入しており、この地域のデジタル変革をさらに促進しています。こうした業界全体のアプリケーションは、スマートシティやデジタル化に向けた政府の取り組みと相まって、今後数年間でDASソリューションの需要を大幅に加速すると予想されます。

当レポートでは、アジア太平洋の屋内分散アンテナシステム(DAS)市場について調査し、市場の概要とともに、用途別、製品別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場:業界の展望

- 動向:現在および将来の影響評価

- サプライチェーンの概要

- ニュートラルホスティングプロバイダー別パッシブDASとアクティブDASの展開

- ニュートラルホスティングプロバイダーの成長に影響を与える要因

- ビジネスモデルの概要

- 機器分析

- 市場潜在力分析

- 主要成功要因(KSF)

第2章 アジア太平洋の屋内分散アンテナシステム(DAS)市場(用途別)

- 用途のセグメンテーション

- アジア太平洋の屋内分散アンテナシステム(DAS)市場(用途タイプ別)

- アジア太平洋の屋内分散アンテナシステム(DAS)市場(ソリューションタイプ別)

第3章 アジア太平洋の屋内分散アンテナシステム(DAS)市場(製品別)

- 製品セグメンテーション

- アジア太平洋の屋内分散アンテナシステム(DAS)市場(ビジネスモデル別)

- アジア太平洋の屋内分散アンテナシステム(DAS)市場(分散システムタイプ別)

- アジア太平洋の屋内分散アンテナシステム(DAS)市場(ユーザー施設タイプ別)

第4章 アジア太平洋の屋内分散アンテナシステム(DAS)市場(国別)

- アジア太平洋の屋内分散アンテナシステム(DAS)市場(国別)

- インドネシア

- 日本

- フィリピン

- マレーシア

- オーストラリア

- ベトナム

- 台湾

- タイ

- その他の(中国を除く)

第5章 競合情勢

- 今後の見通し

- 地理的評価

- 企業プロファイル

- EDOTCO Group Sdn Bhd

- BAI Communications

- Field Smart Farms

- JTOWER Inc.

- AT&T

- Telefonaktiebolaget LM Ericsson

- Boingo Wireless, Inc.

- CELONA INC.

- Alpha Wireless Ltd

- Philtower Consortium Inc.

- ATC TRS V LLC

- MCA Communications, Inc.

- BTI Wireless

- Colt Technology Services Group Limited

- CommScope, Inc.

第6章 調査手法

List of Figures

- Figure 1: Indoor DAS Market in Asia-Pacific (by Scenario), $Billion, 2023, 2027, and 2033

- Figure 2: Indoor DAS Market in Asia-Pacific (by Country), $Million, 2023, 2027, and 2033

- Figure 3: Indoor DAS Market in Asia-Pacific (by Application Type), $Million, 2023, 2027, and 2033

- Figure 4: Indoor DAS Market in Asia-Pacific (by Solution Type), $Million, 2023, 2027, and 2033

- Figure 5: Indoor DAS Market in Asia-Pacific (by Hardware), $Million, 2023, 2027, and 2033

- Figure 6: Indoor DAS Market in Asia-Pacific (by Services), $Million, 2023, 2027, and 2033

- Figure 7: Indoor DAS Market in Asia-Pacific (by Business Model), $Million, 2023, 2027, and 2033

- Figure 8: Indoor DAS Market in Asia-Pacific (by Signal Source), $Million, 2023, 2027, and 2033

- Figure 9: Indoor DAS Market in Asia-Pacific (by Distribution System Type), $Million, 2023, 2027, and 2033

- Figure 10: Indoor DAS Market in Asia-Pacific (by User Facility Type), $Million, 2023, 2027, and 2033

- Figure 11: Key Events

- Figure 12: Supply Chain and Risks within the Supply Chain

- Figure 13: Value Chain

- Figure 14: Active and Passive DAS Model Differences

- Figure 15: Collaborative Models

- Figure 16: Case Study: CloudExtel's Neutral-Host NaaS Solution at Mumbai Central

- Figure 17: Case Study: JTOWER's 5G Infrastructure Sharing in Japan

- Figure 18: Impact Analysis of 5G Rollout on Neutral Hosting Strategies in Asia-Pacific

- Figure 19: Dependencies in Indoor Network Deployment

- Figure 20: Case Study: Enhancing Wireless Connectivity at the Grand Hyatt Rio de Janeiro with Active DAS Solution

- Figure 21: Case Study: Enhancing Connectivity at Marvel Stadium with Telstra's 4G/5G Distributed Antenna System

- Figure 22: Working of Off-Air Antennas

- Figure 23: Working of Base-Transceiver Station

- Figure 24: Strategic Initiatives (by Company), 2020-2024

- Figure 25: Share of Strategic Initiatives, 2020-2024

- Figure 26: Data Triangulation

- Figure 27: Top-Down and Bottom-Up Approach

- Figure 28: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Competitive Landscape Snapshot

- Table 3: Trends: Overview

- Table 4: Active and Passive DAS Model Difference (by Parameters)

- Table 5: Active and Passive DAS Model Pros and Cons

- Table 6: Spectrum Allocation Policies (by Country)

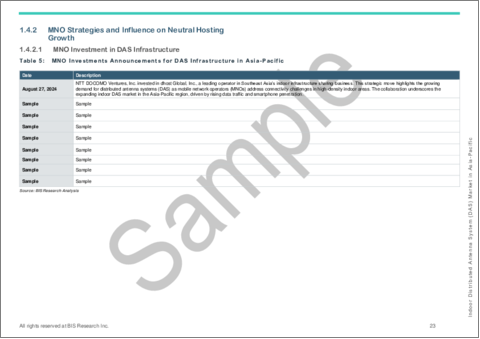

- Table 7: MNO Investments Announcements for DAS Infrastructure in Asia-Pacific

- Table 8: Announcements of Key Neutral Hosting Provider Strategies and Investments

- Table 9: Contract Forms Analysis Across Regions

- Table 10: Analysis of Legal Regulations and its Impact on Foreign Investment

- Table 11: Regulatory Environment Analysis APAC vs. Europe

- Table 12: Market Trends in Asia-Pacific Market in Indoor DAS

- Table 13: Market Trends in Global Market in Indoor DAS

- Table 14: Analyst Views of Asia-Pacific vs. Global Indoor DAS Market

- Table 15: Application Summary for Indoor DAS Market in Asia-Pacific, $Million

- Table 16: Indoor DAS Market in Asia-Pacific (by Application Type), $Million, 2023-2033

- Table 17: Indoor DAS Market in Asia-Pacific (by Solution Type), $Million, 2023-2033

- Table 18: Product Summary for Indoor DAS Market in Asia-Pacific, $Million

- Table 19: Indoor DAS Market in Asia-Pacific (by Business Model), $Million, 2023-2033

- Table 20: Indoor DAS Market in Asia-Pacific (by Signal Source), $Million, 2023-2033

- Table 21: Indoor DAS Market in Asia-Pacific (by Distribution System Type), $Million, 2023-2033

- Table 22: Indoor DAS Market in Asia-Pacific (by User Facility Type), $Million, 2023-2033

- Table 23: Indonesia Indoor Distributed Antenna System (DAS) Market (by Application Type), $Million, 2023-2033

- Table 24: Indonesia Indoor Distributed Antenna System (DAS) Market (by Solution Type), $Million, 2023-2033

- Table 25: Indonesia Indoor Distributed Antenna System (DAS) Market (by Business Model), $Million, 2023-2033

- Table 26: Indonesia Indoor Distributed Antenna System (DAS) Market (by Signal Source), $Million, 2023-2033

- Table 27: Indonesia Indoor Distributed Antenna System (DAS) Market (by Distribution System Type), $Million, 2023-2033

- Table 28: Indonesia Indoor Distributed Antenna System (DAS) Market (by User Facility Type), $Million, 2023-2033

- Table 29: Total Number of Buildings, Thousand Units, 2019-2033

- Table 30: Number of New Buildings, Thousand Units, 2021-2033

- Table 31: Number of Buildings (by Installation Type), Thousand Units, 2023-2033

- Table 32: Number of Buildings (by Distribution System Type), Thousand Units, 2023-2033

- Table 33: Number of Buildings (by Distribution System Type), Thousand Units, 2023-2033

- Table 34: Indonesia Neutral Host Providers, Market Share, 2023

- Table 35: Japan Indoor Distributed Antenna System (DAS) Market (by Application Type), $Million, 2023-2033

- Table 36: Japan Indoor Distributed Antenna System (DAS) Market (by Solution Type), $Million, 2023-2033

- Table 37: Japan Indoor Distributed Antenna System (DAS) Market (by Business Model), $Million, 2023-2033

- Table 38: Japan Indoor Distributed Antenna System (DAS) Market (by Signal Source), $Million, 2023-2033

- Table 39: Japan Indoor Distributed Antenna System (DAS) Market (by Distribution System Type), $Million, 2023-2033

- Table 40: Japan Indoor Distributed Antenna System (DAS) Market (by User Facility Type), $Million, 2023-2033

- Table 41: Total Number of Buildings, Thousand Units, 2019-2033

- Table 42: Number of New Buildings, Thousand Units, 2021-2033

- Table 43: Number of Buildings (by Installation Type), Thousand Units, 2023-2033

- Table 44: Number of Buildings (by Distribution System Type), Thousand Units, 2023-2033

- Table 45: Number of Buildings (by Distribution System Type), Thousand Units, 2023-2033

- Table 46: Japan Neutral Host Providers, Market Share, 2023

- Table 47: Philippines Indoor Distributed Antenna System (DAS) Market (by Application Type), $Million, 2023-2033

- Table 48: Philippines Indoor Distributed Antenna System (DAS) Market (by Solution Type), $Million, 2023-2033

- Table 49: Philippines Indoor Distributed Antenna System (DAS) Market (by Business Model), $Million, 2023-2033

- Table 50: Philippines Indoor Distributed Antenna System (DAS) Market (by Signal Source), $Million, 2023-2033

- Table 51: Philippines Indoor Distributed Antenna System (DAS) Market (by Distribution System Type), $Million, 2023-2033

- Table 52: Philippines Indoor Distributed Antenna System (DAS) Market (by User Facility Type), $Million, 2023-2033

- Table 53: Total Number of Buildings, Thousand Units, 2019-2033

- Table 54: Number of New Buildings, Thousand Units, 2021-2033

- Table 55: Number of Buildings (by Installation Type), Thousand Units, 2023-2033

- Table 56: Number of Buildings (by Distribution System Type), Thousand Units, 2023-2033

- Table 57: Number of Buildings (by Distribution System Type), Thousand Units, 2023-2033

- Table 58: Philippines Neutral Host Providers, Market Share, 2023

- Table 59: Malaysia Indoor Distributed Antenna System (DAS) Market (by Application Type), $Million, 2023-2033

- Table 60: Malaysia Indoor Distributed Antenna System (DAS) Market (by Solution Type), $Million, 2023-2033

- Table 61: Malaysia Indoor Distributed Antenna System (DAS) Market (by Business Model), $Million, 2023-2033

- Table 62: Malaysia Indoor Distributed Antenna System (DAS) Market (by Signal Source), $Million, 2023-2033

- Table 63: Malaysia Indoor Distributed Antenna System (DAS) Market (by Distribution System Type), $Million, 2023-2033

- Table 64: Malaysia Indoor Distributed Antenna System (DAS) Market (by User Facility Type), $Million, 2023-2033

- Table 65: Total Number of Buildings, Thousand Units, 2019-2033

- Table 66: Number of New Buildings, Thousand Units, 2021-2033

- Table 67: Number of Buildings (by Installation Type), Thousand Units, 2023-2033

- Table 68: Number of Buildings (by Distribution System Type), Thousand Units, 2023-2033

- Table 69: Number of Buildings (by Distribution System Type), Thousand Units, 2023-2033

- Table 70: Malaysia Neutral Host Providers, Market Share, 2023

- Table 71: Australia Indoor Distributed Antenna System (DAS) Market (by Application Type), $Million, 2023-2033

- Table 72: Australia Indoor Distributed Antenna System (DAS) Market (by Solution Type), $Million, 2023-2033

- Table 73: Australia Indoor Distributed Antenna System (DAS) Market (by Business Model), $Million, 2023-2033

- Table 74: Australia Indoor Distributed Antenna System (DAS) Market (by Signal Source), $Million, 2023-2033

- Table 75: Australia Indoor Distributed Antenna System (DAS) Market (by Distribution System Type), $Million, 2023-2033

- Table 76: Australia Indoor Distributed Antenna System (DAS) Market (by User Facility Type), $Million, 2023-2033

- Table 77: Total Number of Buildings, Thousand Units, 2019-2033

- Table 78: Number of New Buildings, Thousand Units, 2021-2033

- Table 79: Number of Buildings (by Installation Type), Thousand Units, 2023-2033

- Table 80: Number of Buildings (by Distribution System Type), Thousand Units, 2023-2033

- Table 81: Number of Buildings (by Distribution System Type), Thousand Units, 2023-2033

- Table 82: Australia Neutral Host Providers, Market Share, 2023

- Table 83: Vietnam Indoor Distributed Antenna System (DAS) Market (by Application Type), $Million, 2023-2033

- Table 84: Vietnam Indoor Distributed Antenna System (DAS) Market (by Solution Type), $Million, 2023-2033

- Table 85: Vietnam Indoor Distributed Antenna System (DAS) Market (by Business Model), $Million, 2023-2033

- Table 86: Vietnam Indoor Distributed Antenna System (DAS) Market (by Signal Source), $Million, 2023-2033

- Table 87: Vietnam Indoor Distributed Antenna System (DAS) Market (by Distribution System Type), $Million, 2023-2033

- Table 88: Vietnam Indoor Distributed Antenna System (DAS) Market (by User Facility Type), $Million, 2023-2033

- Table 89: Total Number of Buildings, Thousand Units, 2019-2033

- Table 90: Number of New Buildings, Thousand Units, 2021-2033

- Table 91: Number of Buildings (by Installation Type), Thousand Units, 2023-2033

- Table 92: Number of Buildings (by Distribution System Type), Thousand Units, 2023-2033

- Table 93: Number of Buildings (by Distribution System Type), Thousand Units, 2023-2033

- Table 94: Vietnam Neutral Host Providers, Market Share, 2023

- Table 95: Taiwan Indoor Distributed Antenna System (DAS) Market (by Application Type), $Million, 2023-2033

- Table 96: Taiwan Indoor Distributed Antenna System (DAS) Market (by Solution Type), $Million, 2023-2033

- Table 97: Taiwan Indoor Distributed Antenna System (DAS) Market (by Business Model), $Million, 2023-2033

- Table 98: Taiwan Indoor Distributed Antenna System (DAS) Market (by Signal Source), $Million, 2023-2033

- Table 99: Taiwan Indoor Distributed Antenna System (DAS) Market (by Distribution System Type), $Million, 2023-2033

- Table 100: Taiwan Indoor Distributed Antenna System (DAS) Market (by User Facility Type), $Million, 2023-2033

- Table 101: Total Number of Buildings, Thousand Units, 2019-2033

- Table 102: Number of New Buildings, Thousand Units, 2021-2033

- Table 103: Number of Buildings (by Installation Type), Thousand Units, 2023-2033

- Table 104: Number of Buildings (by Distribution System Type), Thousand Units, 2023-2033

- Table 105: Number of Buildings (by Distribution System Type), Thousand Units, 2023-2033

- Table 106: Taiwan Neutral Host Providers, Market Share, 2023

- Table 107: Thailand Indoor Distributed Antenna System (DAS) Market (by Application Type), $Million, 2023-2033

- Table 108: Thailand Indoor Distributed Antenna System (DAS) Market (by Solution Type), $Million, 2023-2033

- Table 109: Thailand Indoor Distributed Antenna System (DAS) Market (by Business Model), $Million, 2023-2033

- Table 110: Thailand Indoor Distributed Antenna System (DAS) Market (by Signal Source), $Million, 2023-2033

- Table 111: Thailand Indoor Distributed Antenna System (DAS) Market (by Distribution System Type), $Million, 2023-2033

- Table 112: Thailand Indoor Distributed Antenna System (DAS) Market (by User Facility Type), $Million, 2023-2033

- Table 113: Total Number of Buildings, Thousand Units, 2019-2033

- Table 114: Number of New Buildings, Thousand Units, 2021-2033

- Table 115: Number of Buildings (by Installation Type), Thousand Units, 2023-2033

- Table 116: Number of Buildings (by Distribution System Type), Thousand Units, 2023-2033

- Table 117: Number of Buildings (by Distribution System Type), Thousand Units, 2023-2033

- Table 118: Thailand Neutral Host Providers, Market Share, 2023

- Table 119: Rest-of-Asia-Pacific Indoor Distributed Antenna System (DAS) Market (by Application Type), $Million, 2023-2033

- Table 120: Rest-of-Asia-Pacific Indoor Distributed Antenna System (DAS) Market (by Solution Type), $Million, 2023-2033

- Table 121: Rest-of-Asia-Pacific Indoor Distributed Antenna System (DAS) Market (by Business Model), $Million, 2023-2033

- Table 122: Rest-of-Asia-Pacific Indoor Distributed Antenna System (DAS) Market (by Signal Source), $Million, 2023-2033

- Table 123: Rest-of-Asia-Pacific Indoor Distributed Antenna System (DAS) Market (by Distribution System Type), $Million, 2023-2033

- Table 124: Rest-of-Asia-Pacific Indoor Distributed Antenna System (DAS) Market (by User Facility Type), $Million, 2023-2033

- Table 125: Total Number of Buildings, Thousand Units, 2019-2033

- Table 126: Number of New Buildings, Thousand Units, 2021-2033

- Table 127: Number of Buildings (by Installation Type), Thousand Units, 2023-2033

- Table 128: Number of Buildings (by Distribution System Type), Thousand Units, 2023-2033

- Table 129: Number of Buildings (by Distribution System Type), Thousand Units, 2023-2033

- Table 130: Rest-of-Asia-Pacific Neutral Host Providers, Market Share, 2023

- Table 131: List of Key Emerging Players and Startups in the In-Building Solutions Ecosystem

Indoor Distributed Antenna System (DAS) Market in Asia-Pacific Overview

The indoor distributed antenna system (DAS) market in the Asia-Pacific region has been experiencing significant growth, driven by the rising demand for seamless wireless connectivity, the expansion of smart city initiatives, and the rapid adoption of 5G-ready infrastructure. The market was valued at $2.47 billion in 2023 and is projected to reach $6.46 billion by 2033, growing at a CAGR of 10.09% under a realistic scenario. In an optimistic scenario, with accelerated 5G rollouts and increased integration of DAS with Wi-Fi 6 and private LTE networks, the market could reach $9.70 billion by 2033 with a CAGR of 15.16%. The major growth sectors include commercial buildings, transportation hubs, healthcare facilities, educational institutions, and sports venues, with hardware and service-based solutions contributing significantly. However, the industry faces challenges such as regulatory approvals, infrastructure deployment costs, and the need for advanced RF planning for effective DAS integration.

Introduction of Indoor Distributed Antenna System (DAS)

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2024 - 2033 |

| 2024 Evaluation | $2.72 Billion |

| 2033 Forecast | $6.46 Billion |

| CAGR | 10.09% |

An indoor distributed antenna system (DAS) is a network of spatially separated antenna nodes connected to a common source designed to enhance wireless signal distribution within buildings. It plays a crucial role in addressing indoor connectivity challenges by ensuring seamless mobile coverage, improving signal strength, and enabling high-speed data transmission. Indoor DAS solutions integrate key components such as amplifiers, antennas, and base stations to optimize coverage in high-density environments, including commercial complexes, stadiums, hospitals, and transportation hubs. The technology is particularly vital in supporting modern connectivity demands, including 5G, IoT, and smart building applications, by reducing network congestion and enhancing reliability. With the growing need for robust wireless networks, Indoor DAS is increasingly adopted across industries, offering scalable and efficient solutions to meet evolving digital requirements.

Market Introduction

The indoor distributed antenna system (DAS) market in Asia-Pacific is undergoing rapid transformation, driven by the increasing demand for seamless indoor connectivity, the expansion of urban infrastructure, and the adoption of 5G networks. The market is currently fueled by the need to enhance wireless coverage in commercial buildings, airports, hospitals, and transportation hubs as mobile network operators and enterprises seek robust connectivity solutions. Governments and telecom operators are investing in DAS to bridge network gaps caused by high-density environments and structural obstructions. Countries such as Japan, South Korea, and Australia have been leading the adoption with advanced 5G rollouts, while emerging markets such as India, Thailand, and Vietnam are experiencing growing demand due to rapid urbanization and the digitization of services. Future growth will be driven by technological advancements, integration with smart city initiatives, and the proliferation of private LTE and Wi-Fi 6 solutions.

Industrial Impact

The industrial impact of the indoor distributed antenna system (DAS) market in the Asia-Pacific region is profound, influencing multiple sectors, including commercial real estate, transportation, healthcare, education, manufacturing, and retail. With the rapid growth of 5G adoption, industries have been leveraging DAS to enhance connectivity, optimize operations, and improve customer experience. In the commercial sector, major shopping malls and office buildings have been integrating DAS solutions to ensure seamless mobile coverage, attracting businesses and consumers. The transportation sector benefits significantly, with airports and metro stations deploying DAS to support high-density passenger areas and IoT applications. Healthcare facilities are using DAS for telemedicine, remote monitoring, and secure patient data transmission, while educational institutions integrate it to enhance e-learning and smart campus initiatives. The manufacturing industry, particularly in industrial zones and logistics hubs, is utilizing DAS to support automation, IoT-driven processes, and smart factory operations. Moreover, hospitality businesses, including hotels and resorts, are implementing DAS to provide uninterrupted connectivity for guests, further driving digital transformation in the region. These industry-wide applications, coupled with government initiatives for smart cities and digitalization, are expected to significantly accelerate the demand for DAS solutions in the coming years.

Market Segmentation:

Segmentation 1: by Application Type

- Commercial Buildings

- Hospitality

- Government

- Healthcare

- Educational Institutes

- Manufacturing and Warehouses

- Transportation

- Sports Venues

- Residentials

Commercial Buildings Segment to Dominate the Indoor Distributed Antenna System (DAS) Market in Asia-Pacific (by Application)

The commercial buildings segment leads the market due to the increasing demand for uninterrupted wireless connectivity in corporate offices, shopping malls, and retail centers. DAS solutions ensure seamless indoor coverage as businesses rely heavily on mobile connectivity for operations, customer engagement, and digital payments. The rise of smart buildings and IoT integration is further driving the adoption of DAS in commercial spaces, making it the fastest-growing and most revenue-generating segment.

Segmentation 2: by Solution Type

- Hardware

- Antenna Node/Radio Node

- Donor Antenna

- Bidirectional Amplifiers

- Radio Units

- Head-End Units

- Others

- Services

- Installation Services

- Other Support Services

Hardware to Dominate the Indoor Distributed Antenna System (DAS) Market in Asia-Pacific (by Solution)

Hardware components, including antenna nodes, bidirectional amplifiers, and radio units, dominate the DAS market as they form the core infrastructure for signal distribution. The shift toward fiber-based and 5G-ready DAS solutions is fueling demand for advanced hardware capable of handling higher frequencies and increased data traffic. Moreover, the expansion of high-rise commercial and residential buildings necessitates the deployment of robust DAS hardware to mitigate network coverage gaps.

Segmentation 3: by Business Model

- Carrier Model

- Enterprise Model

- Neutral Host Model

Neutral Host Model to have the Highest Growth Rate in the Indoor Distributed Antenna System (DAS) Market in Asia-Pacific (by Business Model)

The neutral host model is gaining traction as it allows multiple mobile network operators (MNOs) to share DAS infrastructure, reducing costs and improving network efficiency. This model is particularly popular in large venues such as airports, stadiums, and metro stations, where independent deployments by multiple MNOs would be costly and inefficient. Governments in Asia-Pacific are promoting shared infrastructure models to accelerate DAS adoption and enhance network accessibility in high-density areas.

Segmentation 4: by Signal Source

- Off-Air Antennas

- Base-Transceiver Station (BTS)

- Small Cells

Base-Transceiver Station (BTS) to Dominate the Indoor Distributed Antenna System (DAS) Market in Asia-Pacific (by Signal Source)

Among signal sources, base-transceiver stations (BTS) lead the market as they provide dedicated and high-capacity signal sources for DAS networks. Unlike off-air antennas, which depend on external signals, BTS-based DAS ensures stronger, more reliable connectivity in large facilities such as corporate hubs and hospitals. The growing demand for private LTE and 5G networks has further accelerated the deployment of BTS-integrated DAS solutions.

Segmentation 5: by Distribution System Type

- Active DAS

- Passive DAS

- Hybrid DAS

Hybrid DAS to Dominate the Indoor Distributed Antenna System (DAS) Market in Asia-Pacific (by Distribution System)

In the Asia-Pacific indoor DAS market, hybrid distribution systems are dominant due to their ability to balance performance, scalability, and affordability by combining active and passive components. This makes them ideal for diverse applications, from commercial buildings to transportation hubs, with varying coverage and capacity needs. Their support for advanced technologies like 5G and adaptability to existing infrastructure further strengthens their appeal. Driven by the need for cost-effective, efficient solutions capable of addressing both coverage and capacity challenges, especially in 5G deployments, and the growing adoption of mixed-use infrastructure, hybrid systems are experiencing accelerated growth and market leadership.

Segmentation 6: by User Facility Type

- >500K sq. ft.

- 200K-500K sq. ft.

- <200K sq. ft.

>500K sq. ft. to Dominate the Indoor Distributed Antenna System (DAS) Market in Asia-Pacific (by Facility Type)

Large-scale venues such as airports, convention centers, stadiums, and shopping malls are the primary adopters of DAS solutions, making facilities over 500,000 sq. ft. the leading segment. These locations experience high foot traffic, heavy mobile data usage, and demand for uninterrupted connectivity, necessitating robust DAS deployments. The hospitality and tourism boom in Asia-Pacific and smart infrastructure initiatives are further propelling growth in this segment.

Segmentation 7: by Country

- Indonesia

- Japan

- Philippines

- Malaysia

- Australia

- Vietnam

- Taiwan

- Thailand

- Rest-of-Asia-Pacific (Excluding China)

Japan to Dominate the Indoor Distributed Antenna System (DAS) Market in Asia-Pacific (by Country)

Japan is the leading country in the indoor distributed antenna system (DAS) market in the Asia-Pacific region. Japan's leadership is attributed to its advanced regulatory frameworks, early adoption of 5G technologies, and strong collaboration between public and private entities. Companies such as JTOWER are driving innovations in the market, notably through 5G infrastructure-sharing deployments at high-traffic venues such as airports. Japan's focus on smart city initiatives and efficient spectrum utilization, combined with significant investments in shared infrastructure, ensures the country remains at the forefront of DAS market development.

Recent Developments in the Indoor Distributed Antenna System (DAS) Market in Asia-Pacific

- On October 17, 2024, Frog Cellsat introduced its 5G active DAS solution, smart mini boosters, and VHF repeaters at the India Mobile Congress. These technologies are designed to boost connectivity at major venues, such as airports and metro systems, underscoring the shift toward 5G-ready DAS solutions to meet the increasing demand for high-capacity networks and be-distributed antenna system innovation.

- NEC Corporation announced a breakthrough in radio-over-fiber technology on June 17, 2024, introducing a 1-bit fiber transmission method. This innovation will facilitate cost-effective millimeter-wave communication networks, essential for Beyond 5G/6G applications in high-density indoor environments such as high-rise buildings and factories.

- Wilson Connectivity revealed its Private 5G solution, integrating hybrid DAS with active distributed antenna systems at the Mobile World Congress in 2024. This solution is tailored to support both public and private 5G networks, enhancing indoor coverage while addressing the growing demand for scalable, secure wireless infrastructure in Asia-Pacific's emerging smart cities.

Demand - Drivers, Limitations, and Opportunities

Market Demand Drivers: Expansion of 5G Networks

The implementation of 5G networks in Indonesia is a key driver of the indoor DAS industry. 5G technology provides faster communication rates and supports more connected devices, but its higher frequency signals have limited penetration capabilities, particularly inside. To solve this difficulty, interior DAS installations are required to extend 5G coverage within buildings, allowing users to enjoy the benefits of 5G connectivity fully. This necessity has been driving investment in indoor DAS infrastructure across the country. For instance, in September 2024, Telkomsel, a pioneer in 5G connectivity in Indonesia, announced its plan to significantly expand its Hyper 5G network in the country, beginning with Denpasar and Badung in Bali. This plan is a broader part of the company's spectrum to expand its 5G coverage across Indonesia.

Market Challenges: Technical Complexity in Diverse Building Environments

The country's unique architectural landscape complicates indoor DAS deployments in Indonesia. Buildings differ greatly in design, construction materials, and layout, affecting signal propagation and necessitating site-specific solutions. For instance, current high-rise constructions of energy-efficient materials can block signal penetration, necessitating specialized engineering to ensure optimal coverage. Creating specialized DAS systems for such diverse contexts necessitates extensive technical knowledge and resources, complicating deployment efforts.

Market Opportunities: Growing Demand for Reliable and High-Speed Wireless Communication in Urban and Commercial Areas

Singapore's high smartphone penetration and increased use of data-intensive applications have fueled demand for seamless indoor connectivity. Indoor DAS improves signal strength within buildings, ensuring continuous mobile services in situations where standard signals may fail. This is especially important in urban areas with dense infrastructures, where regular communication is essential for both personal and professional activity. Moreover, the country was one of the first to launch 5G services in 2021. Singtel is Singapore's major service provider. It competes with Starhub and M1, the other major operators in the country. Both StarHub and M1 provide 5G services throughout the country. Earlier this year, in 2024, StarHub announced 99% penetration of their outdoor 5G network. By July 2024, all three telcos intend to phase out 3G services to free up spectrum for 5G expansion. Also, according to the Infocomm Media Development Authority (IMDA), Singapore had 18,64,800 5G customers by the end of December 2023. Singtel claimed to have more than 1 million 5G clients by the end of September 2023.

How can this report add value to an organization?

This report adds value to an organization by providing comprehensive insights into the evolving DAS market, enabling data-driven decision-making and strategic planning for growth. It highlights key market trends, technological advancements, and competitive dynamics, helping businesses identify emerging opportunities in sectors such as commercial buildings, healthcare, transportation, and smart cities. The report's detailed segmentation by application type, solution type, business model, signal source, and distribution system type allows organizations to target specific markets, optimize their offerings, and improve business strategies. Additionally, its coverage of government policies, regulatory frameworks, and sustainability initiatives ensures companies remain compliant with the evolving landscape of DAS infrastructure. By leveraging this report, organizations can make informed investment decisions in DAS technology, enhance their operational efficiency, and gain a competitive edge in the rapidly expanding indoor wireless connectivity sector, ensuring long-term growth and leadership in the market.

Research Methodology

Factors for Data Prediction and Modelling

- The base currency considered for the market analysis is US$. Currencies other than the US$ have been converted to the US$ for all statistical calculations, considering the average conversion rate for that particular year.

- The currency conversion rate was taken from the historical exchange rate on the Oanda website.

- Nearly all the recent developments from January 2021 to November 2024 have been considered in this research study.

- The information rendered in the report is a result of in-depth primary interviews, surveys, and secondary analysis.

- Where relevant information was not available, proxy indicators and extrapolation were employed.

- Any economic downturn in the future has not been taken into consideration for the market estimation and forecast.

- Technologies currently used are expected to persist through the forecast with no major technological breakthroughs.

Market Estimation and Forecast

This research study involves the usage of extensive secondary sources, such as certified publications, articles from recognized authors, white papers, annual reports of companies, directories, and major databases to collect useful and effective information for an extensive, technical, market-oriented, and commercial study of the indoor distributed antenna system (DAS) market in Asia-Pacific.

The market engineering process involves the calculation of the market statistics, market size estimation, market forecast, market crackdown, and data triangulation (the methodology for such quantitative data processes is explained in further sections). The primary research study has been undertaken to gather information and validate the market numbers for segmentation types and industry trends of the key players in the market.

Primary Research

The primary sources involve industry experts from the indoor distributed antenna system (DAS) market in Asia-Pacific and various stakeholders in the ecosystem. Respondents such as CEOs, vice presidents, marketing directors, and technology and innovation directors have been interviewed to obtain and verify both qualitative and quantitative aspects of this research study.

The key data points taken from primary sources include:

- validation and triangulation of all the numbers and graphs

- validation of reports segmentation and key qualitative findings

- understanding the competitive landscape

- validation of the numbers of various markets for market type

- percentage split of individual markets for geographical analysis

Secondary Research

This research study involves the usage of extensive secondary research, directories, company websites, and annual reports. It also makes use of databases, such as Hoovers, Bloomberg, Businessweek, and Factiva, to collect useful and effective information for an extensive, technical, market-oriented, and commercial study of the global market. In addition to the data sources, the study has been undertaken with the help of other data sources and websites, such as the Census Bureau, OICA, and ACEA.

Secondary research was done to obtain crucial information about the industry's value chain, revenue models, the market's monetary chain, the total pool of key players, and the current and potential use cases and applications.

The key data points taken from secondary research include:

- segmentations and percentage shares

- data for market value

- key industry trends of the top players of the market

- qualitative insights into various aspects of the market, key trends, and emerging areas of innovation

- quantitative data for mathematical and statistical calculations

Key Market Players and Competition Synopsis

The companies that are profiled in the indoor distributed antenna system (DAS) market in Asia-Pacific have been selected based on inputs gathered from primary experts who have analyzed company coverage, product portfolio, and market penetration.

Some of the prominent names in this market are:

- AT&T

- Telefonaktiebolaget LM Ericsson

- CELONA INC.

- Boingo Wireless, Inc.

- Alpha Wireless

- Philtower Consortium Inc.

- ATC TRS V LLC

- Colt Technology Services Group Limited

- CommScope Holding Company

- EDOTCO Group Sdn Bhd

- BAI Communications

- Field Smart Farms

- JTOWER Inc.

- MCA Communications, Inc.

- BTI Wireless

Companies not part of the aforementioned pool have been well represented across different sections of the report (wherever applicable).

Table of Contents

Executive Summary

Scope and Definition

1 Markets: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.1.1 Trend: Overview

- 1.1.1.1 Adoption of 5G-Ready DAS Systems

- 1.1.1.2 Fiber-Distributed Antenna System

- 1.1.1 Trend: Overview

- 1.2 Supply Chain Overview

- 1.2.1 Value Chain Analysis

- 1.3 Passive vs. Active DAS Deployment by Neutral Hosting Providers

- 1.3.1 Pros and Cons of Active and Passive DAS Models

- 1.4 Influencing Factors on Neutral Hosting Providers' Growth

- 1.4.1 Government Policy and Regulations

- 1.4.1.1 Spectrum Allocation Policies

- 1.4.1.2 Government Incentives and Support for Neutral Hosting Providers

- 1.4.2 MNO Strategies and Influence on Neutral Hosting Growth

- 1.4.2.1 MNO Investment in DAS Infrastructure

- 1.4.2.2 Collaborative Models between MNOs and Neutral Hosting Providers

- 1.4.2.2.1 Infrastructure Leasing Model:

- 1.4.2.2.1.1 Key Features of this Model

- 1.4.2.2.2 Managed Services Model

- 1.4.2.2.2.1 Key Features of this Model

- 1.4.2.2.3 Pay-Per-Use or Pay-As-You-Go Model:

- 1.4.2.2.3.1 Key features of this model include:

- 1.4.2.2.4 Revenue-Sharing Model:

- 1.4.2.2.4.1 Key features of this model include:

- 1.4.2.2.5 Build-Operate-Transfer (BOT) Model:

- 1.4.2.2.5.1 Key features of this model include:

- 1.4.2.2.6 Enterprise or Venue-Paid Model:

- 1.4.2.2.6.1 Key features of this model include:

- 1.4.2.2.7 Public-Private Partnership (PPP) Model:

- 1.4.2.2.7.1 Key features of this model include:

- 1.4.2.2.8 Hybrid Model:

- 1.4.2.2.8.1 Key features of this model include:

- 1.4.2.2.9 Case Studies

- 1.4.2.2.9.1 Enhancing Urban Rail Connectivity: CloudExtel's Neutral-Host NaaS Solution at Mumbai Central

- 1.4.2.2.9.2 JTOWER's 5G Infrastructure Sharing in Japan

- 1.4.2.2.1 Infrastructure Leasing Model:

- 1.4.2.3 Impact of 5G Rollout on Neutral Hosting Strategies

- 1.4.3 Key Neutral Hosting Provider Strategies and Investments

- 1.4.1 Government Policy and Regulations

- 1.5 Business Model Overview

- 1.5.1 Power Balance Between Developers, MNOs, and Indoor DAS Operators

- 1.5.2 Entry Points for New Businesses

- 1.5.3 Contract Forms Analysis Across Regions

- 1.6 Equipment Analysis

- 1.6.1 Current Equipment Configurations

- 1.6.1.1 Fiber Deployment Status

- 1.6.1.2 Role of Chinese-Made Equipment

- 1.6.1.3 Equipment Owned by Indoor DAS Operators and MNOs

- 1.6.2 Equipment Transition to 5G

- 1.6.2.1 Impact of 5G on Equipment Configurations

- 1.6.2.2 Modernization for Mobile User Needs

- 1.6.1 Current Equipment Configurations

- 1.7 Market Potential Analysis

- 1.7.1 Understanding of MNOs

- 1.7.1.1 Company Analysis on Selling or Retaining In-Building Solutions

- 1.7.1.1.1 Financial Considerations of Large MNOs

- 1.7.1.1.2 Market Strategy of Smaller MNOs

- 1.7.1.2 MNO Intentions to Introduce Open Radio Access Network (RAN)

- 1.7.1.1 Company Analysis on Selling or Retaining In-Building Solutions

- 1.7.2 Possibility to Expand to Active Hosting

- 1.7.2.1 Intentions of MNOs, Governments, and Related Authorities

- 1.7.2.2 Movements toward Institutionalization of Active Hosting

- 1.7.3 Market Entry/Growth Barriers

- 1.7.3.1 Legal Regulations Impacting Foreign Investment

- 1.7.3.2 Regulatory Environment in APAC vs. Europe

- 1.7.3.3 Licensing Systems and Restrictions on Foreign Investments

- 1.7.3.4 Challenges for Foreign Capital Entry in the Indoor DAS Market

- 1.7.1 Understanding of MNOs

- 1.8 Key Success Factors (KSF)

- 1.8.1 Comparison Between Asia-Pacific and Global Markets for Indoor DAS

- 1.8.2 Key Market Trends in APAC vs. Global Market for Indoor DAS

2 Asia-Pacific Indoor Distributed Antenna System (DAS) Market (by Application)

- 2.1 Application Segmentation

- 2.1.1 Application Summary

- 2.2 Asia-Pacific Indoor Distributed Antenna System (DAS) Market (by Application Type)

- 2.2.1 Commercial Buildings

- 2.2.2 Hospitality

- 2.2.3 Government

- 2.2.4 Healthcare

- 2.2.5 Educational Institutes

- 2.2.6 Manufacturing and Warehouse

- 2.2.7 Transportation

- 2.2.8 Sports Venues

- 2.2.9 Residentials

- 2.3 Asia-Pacific Indoor Distributed Antenna System (DAS) Market (by Solution Type)

- 2.3.1 Hardware

- 2.3.1.1 Antenna Node/Radio Node

- 2.3.1.2 Donor Antenna

- 2.3.1.3 Bidirectional Amplifiers

- 2.3.1.4 Radio Units

- 2.3.1.5 Head-End units

- 2.3.1.6 Others

- 2.3.2 Services

- 2.3.2.1 Installation Services

- 2.3.2.2 Others

- 2.3.1 Hardware

3 Asia-Pacific Indoor Distributed Antenna System (DAS) Market (by Products)

- 3.1 Product Segmentation

- 3.1.1 Product Summary

- 3.2 Asia-Pacific Indoor Distributed Antenna System (DAS) Market (by Business Model)

- 3.2.1 Carrier

- 3.2.2 Enterprise

- 3.2.3 Neutral Host

- 3.2.4 Asia-Pacific Indoor Distributed Antenna System (DAS) Market (by Signal Source)

- 3.2.5 Off-Air Antennas

- 3.2.6 Base-Transceiver Station

- 3.2.7 Small Cells

- 3.3 Asia-Pacific Indoor Distributed Antenna System (DAS) Market (by Distribution System Type)

- 3.3.1 Active

- 3.3.2 Passive

- 3.3.3 Hybrid

- 3.4 Asia-Pacific Indoor Distributed Antenna System (DAS) Market (by User Facility Type)

- 3.4.1 >500K sq ft

- 3.4.2 200K-500K sq ft

- 3.4.3 <200K sq ft

4 Asia-Pacific Indoor Distributed Antenna System (DAS) Market (by Country)

- 4.1 Indoor Distributed Antenna System (DAS) Market in Asia-Pacific (by Country)

- 4.2 Indonesia

- 4.2.1 Market Size and Growth Projections for the Indoor DAS Market in Indonesia

- 4.2.1.1 Application

- 4.2.1.2 Products

- 4.2.2 In-Building Solutions Sites Analysis

- 4.2.2.1 Factors Driving Growth

- 4.2.2.2 MNO's Plans for Growth in In-Building Solutions Sites

- 4.2.2.3 Challenges and Pain Points for MNOs

- 4.2.3 Number of Buildings Analysis and Growth Forecast

- 4.2.3.1 Total Number of Buildings

- 4.2.3.1.1 Number of Existing Buildings (Pre-2020)

- 4.2.3.1.2 Number of New Buildings (Post-2020)

- 4.2.3.2 Number of Buildings with Indoor DAS Installations

- 4.2.3.2.1 Key Barriers in the Adoption of Indoor DAS In Indonesia

- 4.2.3.2.2 Number of Buildings (by Distribution System Type)

- 4.2.3.2.3 Number of Buildings (by Business Model)

- 4.2.3.2.3.1 Factors for Self-Deployment By Carrier/MNOs In Indonesia

- 4.2.3.1 Total Number of Buildings

- 4.2.4 Key Players and Strategic Initiatives

- 4.2.4.1 Market Share Range of Leading Neutral Host Providers (% Share)

- 4.2.1 Market Size and Growth Projections for the Indoor DAS Market in Indonesia

- 4.3 Japan

- 4.3.1 Market Size and Growth Projections for the Indoor DAS Market in Japan

- 4.3.1.1 Application

- 4.3.1.2 Products

- 4.3.2 In-Building Solutions Sites Analysis

- 4.3.2.1 Factors Driving Growth

- 4.3.2.2 MNO's Plans for Growth in In-Building Solutions Sites

- 4.3.2.3 Challenges and Pain Points for MNOs

- 4.3.3 Number of Buildings Analysis and Growth Forecast

- 4.3.3.1 Total Number of Buildings

- 4.3.3.1.1 Number of Existing Buildings (Pre-2020)

- 4.3.3.1.2 Number of New Buildings (Post-2020)

- 4.3.3.2 Number of Buildings with Indoor DAS Installations

- 4.3.3.2.1 Key Barriers in the Adoption of Indoor DAS In Japan

- 4.3.3.2.2 Number of Buildings (by Distribution System Type)

- 4.3.3.2.3 Number of Buildings (by Business Model)

- 4.3.3.2.3.1 Factors for Self-Deployment By Carrier/MNOs In Japan

- 4.3.3.1 Total Number of Buildings

- 4.3.4 Key Players and Strategic Initiatives

- 4.3.4.1 Market Share Range of Leading Neutral Host Providers (% Share)

- 4.3.1 Market Size and Growth Projections for the Indoor DAS Market in Japan

- 4.4 Philippines

- 4.4.1 Market Size and Growth Projections for the Indoor DAS Market in the Philippines

- 4.4.1.1 Application

- 4.4.1.2 Products

- 4.4.2 In-Building Solutions Sites Analysis

- 4.4.2.1 Factors Driving Growth

- 4.4.2.2 MNO's Plans for Growth in In-Building Solutions Sites

- 4.4.2.3 Challenges and Pain Points for MNOs

- 4.4.3 Number of Buildings Analysis and Growth Forecast

- 4.4.3.1 Total Number of Buildings

- 4.4.3.1.1 Number of Existing Buildings (Pre-2020)

- 4.4.3.1.2 Number of New Buildings (Post-2020)

- 4.4.3.2 Number of Buildings with Indoor DAS Installations

- 4.4.3.2.1 Key Barriers in the Adoption of Indoor DAS In Philippines

- 4.4.3.2.2 Number of Buildings (by Distribution System Type)

- 4.4.3.2.3 Number of Buildings (by Business Model)

- 4.4.3.2.3.1 Factors for Self-Deployment By Carrier/MNOs In Philippines

- 4.4.3.1 Total Number of Buildings

- 4.4.4 Key Players and Strategic Initiatives

- 4.4.4.1 Market Share Range of Leading Neutral Host Providers (% Share)

- 4.4.1 Market Size and Growth Projections for the Indoor DAS Market in the Philippines

- 4.5 Malaysia

- 4.5.1 Market Size and Growth Projections for the Indoor DAS Market in Malaysia

- 4.5.1.1 Application

- 4.5.1.2 Products

- 4.5.2 In-Building Solutions Sites Analysis

- 4.5.2.1 Factors Driving Growth

- 4.5.2.2 MNO's Plans for Growth in In-Building Solutions Sites

- 4.5.2.3 Challenges and Pain Points for MNOs

- 4.5.3 Number of Buildings Analysis and Growth Forecast

- 4.5.3.1 Total Number of Buildings

- 4.5.3.1.1 Number of Existing Buildings (Pre-2020)

- 4.5.3.1.2 Number of New Buildings (Post-2020)

- 4.5.3.2 Number of Buildings with Indoor DAS Installations

- 4.5.3.2.1 Key Barriers in the Adoption of Indoor DAS In Malaysia

- 4.5.3.2.2 Number of Buildings (by Distribution System Type)

- 4.5.3.2.3 Number of Buildings (by Business Model)

- 4.5.3.2.3.1 Factors for Self-Deployment By Carrier/MNOs In Malaysia

- 4.5.3.1 Total Number of Buildings

- 4.5.4 Key Players and Strategic Initiatives

- 4.5.4.1 Market Share Range of Leading Neutral Host Providers (% share)

- 4.5.1 Market Size and Growth Projections for the Indoor DAS Market in Malaysia

- 4.6 Australia

- 4.6.1 Market Size and Growth Projections for the Indoor DAS Market in Australia

- 4.6.1.1 Application

- 4.6.1.2 Products

- 4.6.2 In-Building Solutions Sites Analysis

- 4.6.2.1 Factors Driving Growth

- 4.6.2.2 MNO's Plans for Growth in In-Building Solutions Sites

- 4.6.2.3 Challenges and Pain Points for MNOs

- 4.6.3 Number of Buildings Analysis and Growth Forecast

- 4.6.3.1 Total Number of Buildings

- 4.6.3.1.1 Number of Existing Buildings (Pre-2020)

- 4.6.3.1.2 Number of New Buildings (Post-2020)

- 4.6.3.2 Number of Buildings with Indoor DAS Installations

- 4.6.3.2.1 Key Barriers in the Adoption of Indoor DAS In Australia

- 4.6.3.2.2 Number of Buildings (by Distribution System Type)

- 4.6.3.2.3 Number of Buildings (by Business Model)

- 4.6.3.2.3.1 Factors for Self-Deployment By Carrier/MNOs In Australia

- 4.6.3.1 Total Number of Buildings

- 4.6.4 Key Players and Strategic Initiatives

- 4.6.4.1 Market Share Range of Leading Neutral Host Providers (% Share)

- 4.6.1 Market Size and Growth Projections for the Indoor DAS Market in Australia

- 4.7 Vietnam

- 4.7.1 Market Size and Growth Projections for the Indoor DAS Market in Vietnam

- 4.7.1.1 Application

- 4.7.1.2 Products

- 4.7.2 In-Building Solutions Sites Analysis

- 4.7.2.1 Factors Driving Growth

- 4.7.2.2 MNO's Plans for Growth in In-Building Solutions Sites

- 4.7.2.3 Challenges and Pain Points for MNOs

- 4.7.3 Number of Buildings Analysis and Growth Forecast

- 4.7.3.1 Total Number of Buildings

- 4.7.3.1.1 Number of Existing Buildings (Pre-2020)

- 4.7.3.1.2 Number of New Buildings (Post-2020)

- 4.7.3.2 Number of Buildings with Indoor DAS Installations

- 4.7.3.2.1 Key Barriers in the Adoption of Indoor DAS In Vietnam

- 4.7.3.2.2 Number of Buildings (by Distribution System Type)

- 4.7.3.2.3 Number of Buildings (by Business Model)

- 4.7.3.2.3.1 Factors for Self-Deployment By Carrier/MNOs In Vietnam

- 4.7.3.1 Total Number of Buildings

- 4.7.4 Key Players and Strategic Initiatives

- 4.7.4.1 Market Share Range of Leading Neutral Host Providers (% Share)

- 4.7.1 Market Size and Growth Projections for the Indoor DAS Market in Vietnam

- 4.8 Taiwan

- 4.8.1 Market Size and Growth Projections for the Indoor DAS Market in Taiwan

- 4.8.1.1 Application

- 4.8.1.2 Products

- 4.8.2 In-Building Solutions Sites Analysis

- 4.8.2.1 Factors Driving Growth

- 4.8.2.2 MNO's Plans for Growth in In-Building Solutions Sites

- 4.8.2.3 Challenges and Pain Points for MNOs

- 4.8.3 Number of Buildings Analysis and Growth Forecast

- 4.8.3.1 Total Number of Buildings

- 4.8.3.1.1 Number of Existing Buildings (Pre-2020)

- 4.8.3.1.2 Number of New Buildings (Post-2020)

- 4.8.3.2 Number of Buildings with Indoor DAS Installations

- 4.8.3.2.1 Key Barriers in the Adoption of Indoor DAS In Taiwan

- 4.8.3.2.2 Number of Buildings (by Distribution System Type)

- 4.8.3.2.3 Number of Buildings (by Business Model)

- 4.8.3.2.3.1 Factors for Self-Deployment By Carrier/MNOs In Taiwan

- 4.8.3.1 Total Number of Buildings

- 4.8.4 Key Players and Strategic Initiatives

- 4.8.4.1 Market Share Range of Leading Neutral Host Providers (% Share)

- 4.8.1 Market Size and Growth Projections for the Indoor DAS Market in Taiwan

- 4.9 Thailand

- 4.9.1 Market Size and Growth Projections for the Indoor DAS Market in Thailand

- 4.9.1.1 Application

- 4.9.1.2 Products

- 4.9.2 In-Building Solutions Sites Analysis

- 4.9.2.1 Factors Driving Growth

- 4.9.2.2 MNO's Plans for Growth in In-Building Solutions Sites

- 4.9.2.3 Challenges and Pain Points for MNOs

- 4.9.3 Number of Buildings Analysis and Growth Forecast

- 4.9.3.1 Total Number of Buildings

- 4.9.3.1.1 Number of Existing Buildings (Pre-2020)

- 4.9.3.1.2 Number of New Buildings (Post-2020)

- 4.9.3.2 Number of Buildings with Indoor DAS Installations

- 4.9.3.2.1 Key Barriers in the Adoption of Indoor DAS In Thailand

- 4.9.3.2.2 Number of Buildings (by Distribution System Type)

- 4.9.3.2.3 Number of Buildings (by Business Model)

- 4.9.3.2.3.1 Factors for Self-Deployment By Carrier/MNOs In Thailand

- 4.9.3.1 Total Number of Buildings

- 4.9.4 Key Players and Strategic Initiatives

- 4.9.4.1 Market Share Range of Leading Neutral Host Providers (% Share)

- 4.9.1 Market Size and Growth Projections for the Indoor DAS Market in Thailand

- 4.1 Rest-of-Asia-Pacific (Excluding China)

- 4.10.1 Market Size and Growth Projections for the Indoor DAS Market in Rest-of-Asia-Pacific

- 4.10.1.1 Application

- 4.10.1.2 Products

- 4.10.1.3 Rest-of-Asia-Pacific In-Building Solutions Site Analysis (by Country)

- 4.10.1.3.1 Singapore

- 4.10.1.3.1.1 In-Building Solutions Sites Analysis

- 4.10.1.3.1.1.1 Factors Driving Growth

- 4.10.1.3.1.1.2 MNO's Plans for Growth in In-Building Solutions Sites

- 4.10.1.3.1.1.3 Challenges and Pain Points for MNOs

- 4.10.1.3.2 South Korea

- 4.10.1.3.2.1 In-Building Solutions Sites Analysis

- 4.10.1.3.2.1.1 Factors Driving Growth

- 4.10.1.3.2.1.2 MNO's Plans for Growth in In-Building Solutions Sites

- 4.10.1.3.2.1.3 Challenges and Pain Points for MNOs

- 4.10.1.3.3 India

- 4.10.1.3.3.1 In-Building Solutions Sites Analysis

- 4.10.1.3.3.1.1 Factors Driving Growth

- 4.10.1.3.3.1.2 MNO's Plans for Growth in In-Building Solutions Sites

- 4.10.1.3.3.1.3 Challenges and Pain Points for MNOs

- 4.10.1.3.1 Singapore

- 4.10.2 Number of Buildings Analysis and Growth Forecast

- 4.10.2.1 Total Number of Buildings

- 4.10.2.1.1 Number of Existing Buildings (Pre-2020)

- 4.10.2.1.2 Number of New Buildings (Post-2020)

- 4.10.2.2 Number of Buildings with Indoor DAS Installations

- 4.10.2.2.1 Key Barriers in the Adoption of Indoor DAS In Rest-of-Asia-Pacific

- 4.10.2.2.2 Number of Buildings (by Distribution System Type)

- 4.10.2.2.3 Number of Buildings (by Business Model)

- 4.10.2.2.3.1 Factors for Self-Deployment By Carrier/MNOs In Rest-of-Asia-Pacific

- 4.10.2.1 Total Number of Buildings

- 4.10.3 Key Players and Strategic Initiatives

- 4.10.3.1 Market Share Range of Leading Neutral Host Providers (% share)

- 4.10.1 Market Size and Growth Projections for the Indoor DAS Market in Rest-of-Asia-Pacific

5 Competitive Landscape

- 5.1 Next Frontiers

- 5.2 Geographic Assessment

- 5.3 Company Profiles

- 5.3.1 EDOTCO Group Sdn Bhd

- 5.3.1.1 Overview

- 5.3.1.2 Top Products/Product Portfolio

- 5.3.1.3 Top Competitors

- 5.3.1.4 Target Customers/End Users

- 5.3.1.5 Key Personnel

- 5.3.1.6 Value Propositions and Strategies

- 5.3.1.7 SWOT Analysis

- 5.3.1.8 Analyst View

- 5.3.2 BAI Communications

- 5.3.2.1 Overview

- 5.3.2.2 Top Products/Product Portfolio

- 5.3.2.3 Top Competitors

- 5.3.2.4 Target Customers/End Users

- 5.3.2.5 Key Personnel

- 5.3.2.6 Value Propositions and Strategies

- 5.3.2.7 SWOT Analysis

- 5.3.2.8 Analyst View

- 5.3.3 Field Smart Farms

- 5.3.3.1 Overview

- 5.3.3.2 Top Products/Product Portfolio

- 5.3.3.3 Top Competitors

- 5.3.3.4 Target Customers/End Users

- 5.3.3.5 Key Personnel

- 5.3.3.6 Value Propositions and Strategies

- 5.3.3.7 SWOT Analysis

- 5.3.3.8 Analyst View

- 5.3.4 JTOWER Inc.

- 5.3.4.1 Overview

- 5.3.4.2 Top Products/Product Portfolio

- 5.3.4.3 Top Competitors

- 5.3.4.4 Target Customers/End Users

- 5.3.4.5 Key Personnel

- 5.3.4.6 Value Propositions and Strategies

- 5.3.4.7 SWOT Analysis

- 5.3.4.8 Analyst View

- 5.3.5 AT&T

- 5.3.5.1 Overview

- 5.3.5.2 Top Products/Product Portfolio

- 5.3.5.3 Top Competitors

- 5.3.5.4 Target Customers/End Users

- 5.3.5.5 Key Personnel

- 5.3.5.6 Value Propositions and Strategies

- 5.3.5.7 SWOT Analysis

- 5.3.5.8 Analyst View

- 5.3.6 Telefonaktiebolaget LM Ericsson

- 5.3.6.1 Overview

- 5.3.6.2 Top Products/Product Portfolio

- 5.3.6.3 Top Competitors

- 5.3.6.4 Target Customers/End Users

- 5.3.6.5 Key Personnel

- 5.3.6.6 Value Propositions and Strategies

- 5.3.6.7 SWOT Analysis

- 5.3.6.8 Analyst View

- 5.3.7 Boingo Wireless, Inc.

- 5.3.7.1 Overview

- 5.3.7.2 Top Products/Product Portfolio

- 5.3.7.3 Top Competitors

- 5.3.7.4 Target Customers/End Users

- 5.3.7.5 Key Personnel

- 5.3.7.6 Value Propositions and Strategies

- 5.3.7.7 SWOT Analysis

- 5.3.7.8 Analyst View

- 5.3.8 CELONA INC.

- 5.3.8.1 Overview

- 5.3.8.2 Top Products/Product Portfolio

- 5.3.8.3 Top Competitors

- 5.3.8.4 Target Customers/End Users

- 5.3.8.5 Key Personnel

- 5.3.8.6 Value Propositions and Strategies

- 5.3.8.7 SWOT Analysis

- 5.3.8.8 Analyst View

- 5.3.9 Alpha Wireless Ltd

- 5.3.9.1 Overview

- 5.3.9.2 Top Products/Product Portfolio

- 5.3.9.3 Top Competitors

- 5.3.9.4 Target Customers/End Users

- 5.3.9.5 Key Personnel

- 5.3.9.6 Value Propositions and Strategies

- 5.3.9.7 SWOT Analysis

- 5.3.9.8 Analyst View

- 5.3.10 Philtower Consortium Inc.

- 5.3.10.1 Overview

- 5.3.10.2 Top Products/Product Portfolio

- 5.3.10.3 Top Competitors

- 5.3.10.4 Target Customers/End Users

- 5.3.10.5 Key Personnel

- 5.3.10.6 Value Propositions and Strategies

- 5.3.10.7 SWOT Analysis

- 5.3.10.8 Analyst View

- 5.3.11 ATC TRS V LLC

- 5.3.11.1 Overview

- 5.3.11.2 Top Products/Product Portfolio

- 5.3.11.3 Top Competitors

- 5.3.11.4 Target Customers/End Users

- 5.3.11.5 Key Personnel

- 5.3.11.6 Value Propositions and Strategies

- 5.3.11.7 SWOT Analysis

- 5.3.11.8 Analyst View

- 5.3.12 MCA Communications, Inc.

- 5.3.12.1 Overview

- 5.3.12.2 Top Products/Product Portfolio

- 5.3.12.3 Top Competitors

- 5.3.12.4 Target Customers/End Users

- 5.3.12.5 Key Personnel

- 5.3.12.6 Value Propositions and Strategies

- 5.3.12.7 SWOT Analysis

- 5.3.12.8 Analyst View

- 5.3.13 BTI Wireless

- 5.3.13.1 Overview

- 5.3.13.2 Top Products/Product Portfolio

- 5.3.13.3 Top Competitors

- 5.3.13.4 Target Customers/End Users

- 5.3.13.5 Key Personnel

- 5.3.13.6 Value Propositions and Strategies

- 5.3.13.7 SWOT Analysis

- 5.3.13.8 Analyst View

- 5.3.14 Colt Technology Services Group Limited

- 5.3.14.1 Overview

- 5.3.14.2 Top Products/Product Portfolio

- 5.3.14.3 Top Competitors

- 5.3.14.4 Target Customers/End Users

- 5.3.14.5 Key Personnel

- 5.3.14.6 Value Propositions and Strategies

- 5.3.14.7 SWOT Analysis

- 5.3.14.8 Analyst View

- 5.3.15 CommScope, Inc.

- 5.3.15.1 Overview

- 5.3.15.2 Top Products/Product Portfolio

- 5.3.15.3 Top Competitors

- 5.3.15.4 Target Customers/End Users

- 5.3.15.5 Key Personnel

- 5.3.15.6 Value Propositions and Strategies

- 5.3.15.7 SWOT Analysis

- 5.3.15.8 Analyst View

- 5.3.1 EDOTCO Group Sdn Bhd

- 5.4 Emerging Players and Startups in the In-Building Solutions Ecosystem

6 Research Methodology

- 6.1 Data Sources

- 6.1.1 Primary Data Sources

- 6.1.2 Secondary Data Sources

- 6.1.3 Data Triangulation

- 6.2 Market Estimation and Forecast