|

|

市場調査レポート

商品コード

1657956

アジア太平洋の診断における質量分析とクロマトグラフィ市場:製品タイプ別、用途タイプ別、国別 - 分析と予測(2024年~2033年)Asia-Pacific Mass Spectrometry and Chromatography in Diagnostics Market: Focus on Product Type, Application Type, and Country - Analysis and Forecast, 2024-2033 |

||||||

カスタマイズ可能

|

|||||||

| アジア太平洋の診断における質量分析とクロマトグラフィ市場:製品タイプ別、用途タイプ別、国別 - 分析と予測(2024年~2033年) |

|

出版日: 2025年02月19日

発行: BIS Research

ページ情報: 英文 56 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

アジア太平洋の診断における質量分析とクロマトグラフィの市場規模は、2024年に1億5,420万米ドルとなりました。

同市場は、2033年には4億2,870万米ドルに達すると予測され、予測期間の2024年~2033年のCAGRは12.04%となる見込みです。アジア太平洋の質量分析(MS)およびクロマトグラフィ市場は、分析およびライフサイエンス機器分野の主要分野であり、生物学的および化学的対象物の分離、同定、定量化のための最先端のソリューションを提供しています。医薬品、環境モニタリング、診断、食品安全など数多くの産業が、これらの技術によって大きく発展してきました。

通常、質量分析とクロマトグラフィは別々に使用されるのではなく、診断のワークフローに組み込まれています。たとえば、液体クロマトグラフィ質量分析(LC-MS)は、質量分析の検出能力と液体クロマトグラフィの分離効率を併せ持つため、複雑なサンプル分析に非常に効果的な手法です。患者サンプルのハイスループット分析によって正確な診断と治療計画が可能になる臨床現場では、この統合が特に有益です。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2024年~2033年 |

| 2024年評価 | 1億5,420万米ドル |

| 2033年予測 | 4億2,870万米ドル |

| CAGR | 12.04% |

アジア太平洋におけるクロマトグラフィと質量分析の重要な診断用途には、ビタミンプロファイリング、ホルモン分析、バイオマーカー探索などがあります。精密医療、メタボロミクス、プロテオミクスの導入が進む中、ヘルスケア投資の増加、技術の進歩、高度な診断ツールへのアクセス拡大などを背景に、これらの技術は広範な成長が見込まれています。

アジア太平洋の診断における質量分析とクロマトグラフィ市場は、臨床診断の複雑化と精密医療へのニーズの高まりにより、大きく拡大しています。質量分析(MS)およびクロマトグラフィは、化学物質や生物学的物質の分離、同定、定量に必要なため、がん、代謝異常、感染症など多くの疾患の診断やモニタリングに不可欠なツールです。

患者サンプルのハイスループットで精密な分析は、診断ワークフローで広く使用されている液体クロマトグラフィ質量分析(LC-MS)のような技術によって可能になります。これらのハイブリッドシステムは、質量分析と分離機能を融合させることで、臨床現場における複雑なサンプル分析のための完全なソリューションを提供します。プロテオミクス、メタボロミクス、バイオマーカー探索において重要な役割を果たし、診断能力と個別化医療を強化します。

標的薬物検査、代謝分析、ビタミンとホルモンのプロファイリングは重要な診断アプリケーションです。こうした最先端の診断ツールに対するニーズは、疾病の早期発見と個別化された治療計画への注目の高まりに後押しされています。

早期発見のための政府プログラム、医療インフラの拡大、自動化やAI主導の分析などの技術開発はすべて市場開拓に貢献しています。質量分析とクロマトグラフィの市場は、アジア太平洋のヘルスケアシステムがより洗練された診断ツールを採用し、地域全体で患者の転帰とヘルスケアの有効性を高めるにつれて成長を続けると予想されます。

当レポートでは、アジア太平洋の診断における質量分析とクロマトグラフィ市場について調査し、市場の概要とともに、製品タイプ別、用途タイプ別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 診断における質量分析とクロマトグラフィ市場:業界展望

- 市場概要

- 主な動向

- 主要動向の機会評価

- 製品ベンチマーク

- 規制状況

- アジア太平洋の規制枠組み

第2章 診断における質量分析とクロマトグラフィ市場(地域別)

- 地域別概要

- アジア太平洋

第3章 診断における質量分析とクロマトグラフィ市場:競合ベンチマーキングと企業プロファイル

- 競合情勢

- パートナーシップ、提携、事業拡大

- 新しいサービス

- 合併と買収

- 規制当局の承認

- 主要戦略と開発

- 企業競合マトリックス

- 企業シェア分析

- 企業プロファイル

- Shimadzu Corporation

第4章 調査手法

List of Figures

- Figure 1: Asia-Pacific Mass Spectrometry and Chromatography in Diagnostics Market, $Million, 2024, 2028, and 2033

- Figure 2: Asia-Pacific Mass Spectrometry and Chromatography in Diagnostics Market (by Product Type), $Million, 2023, 2027, and 2033

- Figure 3: Asia-Pacific Mass Spectrometry and Chromatography in Diagnostics Market (by Application), $Million, 2023, 2027, and 2033

- Figure 4: Product Benchmarking (Mass Spectrometry and Chromatography (by Instruments))

- Figure 5: Japan Mass Spectrometry and Chromatography in Diagnostics Market, $Million, 2023-2033

- Figure 6: China Mass Spectrometry and Chromatography in Diagnostics Market, $Million, 2023-2033

- Figure 7: India Mass Spectrometry and Chromatography in Diagnostics Market, $Million, 2023-2033

- Figure 8: Rest-of-Asia-Pacific Mass Spectrometry and Chromatography in Diagnostics Market, $Million, 2023-2033

- Figure 9: Partnerships, Alliances, and Business Expansions, January 2015- June 2024

- Figure 10: New Offerings, January 2015- June 2024

- Figure 11: Mergers and Acquisitions, January 2015- June 2024

- Figure 12: New Offerings, January 2015- June 2024

- Figure 13: Mass Spectrometry and Chromatography in Diagnostics Market, Company Competition Matrix

- Figure 14: Mass Spectrometry and Chromatography in Diagnostics Market, % Share, 2023

- Figure 15: Data Triangulation

- Figure 16: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Current State and Future Potential of Key Trends in the Asia-Pacific Mass Spectrometry and Chromatography in Diagnostics Market

- Table 3: Mass Spectrometry and Chromatography in Diagnostics Market (by Region), $Million, 2023-2033

- Table 4: Asia-Pacific Mass Spectrometry and Chromatography in Diagnostics Market (by Product Type), $Million, 2023-2033

- Table 5: Asia-Pacific Mass Spectrometry and Chromatography in Diagnostics Market (by Sample Preparation), $Million, 2023-2033

- Table 6: Asia-Pacific Mass Spectrometry and Chromatography in Diagnostics Market (by Mass Spectrometry and Chromatography), $Million, 2023-2033

- Table 7: Asia-Pacific Mass Spectrometry and Chromatography in Diagnostics Market (by Application Type), $Million, 2023-2033

- Table 8: Asia-Pacific Mass Spectrometry and Chromatography in Diagnostics Market (by Vitamins), $Million, 2023-2033

- Table 9: Asia-Pacific Mass Spectrometry and Chromatography in Diagnostics Market (by Hormones), $Million, 2023-2033

- Table 10: Japan Mass Spectrometry and Chromatography in Diagnostics Market (by Product Type), $Million, 2023-2033

- Table 11: Japan Mass Spectrometry and Chromatography in Diagnostics Market (by Sample Preparation), $Million, 2023-2033

- Table 12: Japan Mass Spectrometry and Chromatography in Diagnostics Market (by Mass Spectrometry and Chromatography), $Million, 2023-2033

- Table 13: Japan Mass Spectrometry and Chromatography in Diagnostics Market (by Application Type), $Million, 2023-2033

- Table 14: Japan Mass Spectrometry and Chromatography in Diagnostics Market (by Vitamins), $Million, 2023-2033

- Table 15: Japan Mass Spectrometry and Chromatography in Diagnostics Market (by Hormones), $Million, 2023-2033

- Table 16: China Mass Spectrometry and Chromatography in Diagnostics Market (by Product Type), $Million, 2023-2033

- Table 17: China Mass Spectrometry and Chromatography in Diagnostics Market (by Sample Preparation), $Million, 2023-2033

- Table 18: China Mass Spectrometry and Chromatography in Diagnostics Market (by Mass Spectrometry and Chromatography), $Million, 2023-2033

- Table 19: China Mass Spectrometry and Chromatography in Diagnostics Market (by Application Type), $Million, 2023-2033

- Table 20: China Mass Spectrometry and Chromatography in Diagnostics Market (by Vitamins), $Million, 2023-2033

- Table 21: China Mass Spectrometry and Chromatography in Diagnostics Market (by Hormones), $Million, 2023-2033

- Table 22: India Mass Spectrometry and Chromatography in Diagnostics Market (by Product Type), $Million, 2023-2033

- Table 23: India Mass Spectrometry and Chromatography in Diagnostics Market (by Sample Preparation), $Million, 2023-2033

- Table 24: India Mass Spectrometry and Chromatography in Diagnostics Market (by Mass Spectrometry and Chromatography), $Million, 2023-2033

- Table 25: India Mass Spectrometry and Chromatography in Diagnostics Market (by Application Type), $Million, 2023-2033

- Table 26: India Mass Spectrometry and Chromatography in Diagnostics Market (by Vitamins), $Million, 2023-2033

- Table 27: India Mass Spectrometry and Chromatography in Diagnostics Market (by Hormones), $Million, 2023-2033

- Table 28: Rest-of-Asia-Pacific Mass Spectrometry and Chromatography in Diagnostics Market (by Product Type), $Million, 2023-2033

- Table 29: Rest-of-Asia-Pacific Mass Spectrometry and Chromatography in Diagnostics Market (by Sample Preparation), $Million, 2023-2033

- Table 30: Rest-of-Asia-Pacific Mass Spectrometry and Chromatography in Diagnostics Market (by Mass Spectrometry and Chromatography), $Million, 2023-2033

- Table 31: Rest-of-Asia-Pacific Mass Spectrometry and Chromatography in Diagnostics Market (by Application Type), $Million, 2023-2033

- Table 32: Rest-of-Asia-Pacific Mass Spectrometry and Chromatography in Diagnostics Market (by Vitamins), $Million, 2023-2033

- Table 33: Rest-of-Asia-Pacific Mass Spectrometry and Chromatography in Diagnostics Market (by Hormones), $Million, 2023-2033

- Table 34: Mass Spectrometry and Chromatography in Diagnostics Market, Key Development Analysis, January 2015-June 2024

Introduction to Asia-Pacific Mass Spectrometry and Chromatography in Diagnostics Market

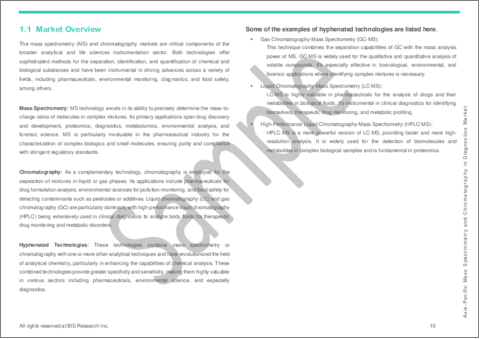

The Asia-Pacific mass spectrometry and chromatography in diagnostics market was valued at $154.2 million in 2024 and is expected to reach $428.7 million by 2033, growing at a CAGR of 12.04% during the forecast period 2024-2033. The APAC Mass Spectrometry (MS) and Chromatography Market is a key player in the analytical and life sciences instrumentation sector, providing cutting-edge solutions for the separation, identification, and quantification of biological and chemical objects. Numerous industries, including pharmaceuticals, environmental monitoring, diagnostics, and food safety, have advanced significantly as a result of these technologies.

Instead of being used separately, mass spectrometry and chromatography are usually incorporated into workflows in diagnostics. For example, liquid chromatography-mass spectrometry (LC-MS) is a highly effective method for complex sample analysis because it combines the detection capabilities of mass spectrometry with the separation efficiency of liquid chromatography. In clinical settings, where accurate diagnosis and treatment planning are made possible by high-throughput analysis of patient samples, this integration is especially beneficial.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2024 - 2033 |

| 2024 Evaluation | $154.2 Million |

| 2033 Forecast | $428.7 Million |

| CAGR | 12.04% |

Important diagnostic uses for chromatography and mass spectrometry in the APAC region include vitamin profiling, hormone analysis, and biomarker discovery. With increasing adoption in precision medicine, metabolomics, and proteomics, these technologies are expected to see widespread growth, driven by rising healthcare investments, technological advancements, and expanding access to advanced diagnostic tools.

Market Introduction

The market for APAC mass spectrometry and chromatography in diagnostics is expanding significantly due to the rising complexity of clinical diagnostics and the growing need for precision medicine. Mass spectrometry (MS) and chromatography are vital tools in the diagnosis and monitoring of many diseases, such as cancer, metabolic disorders, and infectious diseases, because they are necessary for the separation, identification, and quantification of chemical and biological substances.

High-throughput, precise analysis of patient samples is made possible by technologies like liquid chromatography-mass spectrometry (LC-MS), which are being widely used in diagnostic workflows. These hybrid systems provide complete solutions for intricate sample analysis in clinical settings by fusing mass analysis and separation capabilities. They play a key role in proteomics, metabolomics, and biomarker discovery, which enhances diagnostic capabilities and personalized medicine.

Targeted drug testing, metabolic analysis, and vitamin and hormone profiling are important diagnostic applications. The need for these cutting-edge diagnostic tools is being driven by the increased focus on early disease detection and individualized treatment plans.

Government programs for early detection, growing healthcare infrastructure, and technological developments like automation and AI-driven analytics all contribute to market expansion. The market for mass spectrometry and chromatography is expected to keep growing as APAC's healthcare systems embrace more sophisticated diagnostic tools, which will enhance patient outcomes and healthcare effectiveness throughout the region.

Market Segmentation

Segmentation 1: by Product Type

- Sample Preparation

- Mass Spectrometry and Chromatography

Segmentation 2: by Application Type

- Therapeutic Drug Monitoring

- Vitamins

- Hormones

- Methylmalonic Acid

- Immunosuppressants

- Others

Segmentation 3: by Region

- Asia-Pacific

- Japan

- India

- China

- Rest-of-Asia-Pacific

How can this report add value to an organization?

Product/Innovation Strategy: The Asia-Pacific mass spectrometry and chromatography in diagnostics market has been segmented based on various categories, such as by product type, application type, and country.

Competitive Strategy: The Asia-Pacific mass spectrometry and chromatography market consists of various public and few private companies. Key players in the mass spectrometry and chromatography in diagnostics market analyzed and profiled in the study involve established players that offer various kinds of products.

Table of Contents

Executive Summary

Scope and Definition

1 Mass Spectrometry and Chromatography in Diagnostics Market: Industry Outlook

- 1.1 Market Overview

- 1.2 Key Trends

- 1.2.1 Shift toward Utilization of Liquid Chromatography-Tandem Mass Spectrometry (LC-MS/MS) as Standard Technique in Diagnostics

- 1.2.2 Utilization of Automated Sample Preparation Technologies

- 1.3 Opportunity Assessment of Key Trends

- 1.4 Product Benchmarking

- 1.5 Regulatory Landscape

- 1.5.1 Regulatory Framework in Asia-Pacific

- 1.5.1.1 China

- 1.5.1 Regulatory Framework in Asia-Pacific

2 Mass Spectrometry and Chromatography in Diagnostics Market (by Region)

- 2.1 Regional Summary

- 2.2 Asia-Pacific

- 2.2.1 Regional Overview

- 2.2.2 Driving Factors for Market Growth

- 2.2.3 Factors Challenging the Market

- 2.2.4 By Product Type

- 2.2.5 By Application Type

- 2.2.6 Japan

- 2.2.6.1 By Product Type

- 2.2.6.2 By Application Type

- 2.2.7 China

- 2.2.7.1 By Product Type

- 2.2.7.2 By Application Type

- 2.2.8 India

- 2.2.8.1 By Product Type

- 2.2.8.2 By Application Type

- 2.2.9 Rest-of-Asia-Pacific

- 2.2.9.1 By Product Type

- 2.2.9.2 By Application Type

3 Mass Spectrometry and Chromatography in Diagnostics Market: Competitive Benchmarking and Company Profile

- 3.1 Competitive Landscape

- 3.1.1 Partnerships, Alliances, and Business Expansions

- 3.1.2 New Offerings

- 3.1.3 Mergers and Acquisitions

- 3.1.4 Regulatory Approvals

- 3.2 Key Strategies and Development

- 3.3 Company Competition Matrix

- 3.4 Company Share Analysis

- 3.5 Company Profiles

- 3.5.1 Shimadzu Corporation

- 3.5.1.1 Overview

- 3.5.1.2 Top Products

- 3.5.1.3 Top Competitors

- 3.5.1.4 Top Customers

- 3.5.1.5 Key Personnel

- 3.5.1.6 Analyst View

- 3.5.1 Shimadzu Corporation

4 Research Methodology

- 4.1 Data Sources

- 4.1.1 Primary Data Sources

- 4.1.2 Secondary Data Sources

- 4.1.3 Data Triangulation