|

|

市場調査レポート

商品コード

1657950

インドのルームエアコン市場:用途別、製品別 - 分析と予測(2024年~2034年)India Room ACs Market: Focus on India Room ACs Applications and Products - Analysis and Forecast, 2024-2034 |

||||||

カスタマイズ可能

|

|||||||

| インドのルームエアコン市場:用途別、製品別 - 分析と予測(2024年~2034年) |

|

出版日: 2025年02月19日

発行: BIS Research

ページ情報: 英文 99 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

インドのルームエアコン市場は、都市化の進展、可処分消費者所得の増加、エネルギー効率の高い冷房ソリューションに対する需要の高まりを背景に、著しい成長を遂げています。

2024年の市場規模は61億7,850万米ドルで、9.41%のCAGRで拡大し、2034年には151億8,960万米ドルに達すると予測されています。気温の上昇、生活水準の向上、エコ家電を推進する政府の取り組みなどの要因が需要を促進しています。インバーターやスマートACへのシフトに伴い、メーカーは市場での地位を強化するため、技術の進歩と持続可能性に注力しています。

環境に対する関心の高まりと厳しいエネルギー効率規制がインドのルームエアコン市場の需要を牽引しています。急速な都市化、可処分所得の増加、中間層の消費者層の拡大が市場成長を促進する主な要因です。加えて、エネルギー効率の高い家電製品を促進する政府の義務付けや優遇措置が、消費者に高度な冷却ソリューションの採用を促しています。さらに、メーカーは持続可能性の目標に沿うため、省エネ技術や環境に優しい冷媒の開発に注力しています。気候変動と省エネルギーに対する意識が高まるにつれ、市場は今後数年間で着実に拡大すると予想されます。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2024年~2034年 |

| 2024年の評価 | 61億8,000万米ドル |

| 2034年の予測 | 151億9,000万米ドル |

| CAGR | 9.41% |

しかし、インドのルームエアコン市場は、高い製造コストや研究開発コスト、不安定な原材料価格、サプライチェーンの混乱など、いくつかの課題に直面しています。また、ブランド間の価格競争も激しく、価格に敏感な市場でもあります。しかし、こうした課題は、イノベーション、コストの最適化、バリューチェーン全体にわたる戦略的協力の機会を生み出します。企業は、コスト圧力を乗り切るため、現地生産、エネルギー効率の高い技術、代替素材に注力しています。さらに、スマートACやプレミアムACの開発により、ブランドは差別化を図り、ニッチな消費者市場を獲得する余地があります。

住宅用は、家庭の快適性と生活水準の向上に対する需要の増加により、インドのルームエアコン(AC)市場をリードしています。気温の上昇と可処分所得の増加、都市化が相まって、家庭でのエアコンの導入が進んでいます。さらに、小型でエネルギー効率の高いユニットへのシフトが市場の成長を促進しています。室内空気の質と健康に対する意識の高まりも、住宅用エアコンの需要急増に寄与しています。その結果、住宅部門は今後数年間も市場シェアを支配し続けると予想されます。

スプリットAC製品は、その優れた冷却効率と美的魅力により、インドのルームエアコン(AC)市場をリードしています。これらのユニットは、窓用ACに比べて運転音が静かで、住宅や商業スペースに理想的です。さらに、省エネ機能とともに設置の柔軟性により、スプリットACの人気が高まっています。スマートコネクティビティ、高度なろ過、デザインオプションなどのプレミアム機能への嗜好の高まりは、市場での地位をさらに強化しています。消費者が冷房ソリューションに快適さと技術を優先させるため、この動向は続くと予想されます。

当レポートでは、インドのルームエアコン市場について調査し、市場の概要とともに、用途別、製品別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場

- 動向:現在および将来の影響評価

- 市場力学の概要

第2章 用途

- 用途のセグメンテーション

- 用途の概要

- インドのルームエアコン市市場(用途別)

- 住宅

- 商業

第3章 製品

- 製品セグメンテーション

- 製品概要

- インドのルームエアコン市市場(製品別)

- ウィンドウとポータブル

- スプリット

- マルチスプリット

- タワー

- 可変冷媒流量(VRF)

- インドのルームエアコン市市場(モード別)

- 冷房のみ

- 温冷ハイブリッド

第4章 市場-競合ベンチマーキングと企業プロファイル

- 今後の見通し

- VOLTAS

- Blue Star Limited

- Carrier

- DAIKIN INDUSTRIES, Ltd.

- Hitachi, Ltd.

- LG Electronics

- SAMSUNG

- Panasonic

- Godrej Group

- Whirlpool Corporation

- Haier Inc.

- Havells India Ltd.

- IFB Appliances

- FUJITSU GENERAL

- Midea

第5章 調査手法

List of Figures

- Figure 1: India Room ACs Market (by Application), 2023, 2026, and 2033

- Figure 2: India Room ACs Market (by Product), 2023, 2026, and 2033

- Figure 3: India Room ACs Market (by Mode), 2023, 2026, and 2033

- Figure 4: India Room ACs Market, Recent Developments

- Figure 5: Impact Analysis of Market Navigating Factors, 2024-2033

- Figure 6: Data Triangulation

- Figure 7: Top-Down and Bottom-Up Approach

- Figure 8: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: India Room ACs Market (by Application), $Million, 2023-2033

- Table 3: India Room ACs Market (by Application), Thousand Units, 2023-2033

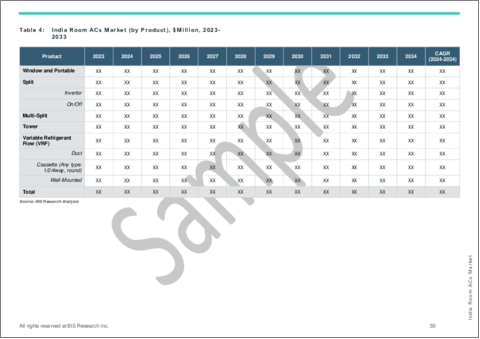

- Table 4: India Room ACs Market (by Product), $Million, 2023-2033

- Table 5: India Room ACs Market (by Product), Thousand Units, 2023-2033

- Table 6: India Room ACs Market (by Mode), $Million, 2023-2033

- Table 7: India Room ACs Market (by Mode), Thousand Units, 2023-2033

- Table 8: Market Share, 2023

Introduction to India Room ACs Market

The India room ACs market has been witnessing significant growth, driven by increasing urbanization, rising disposable consumer income, and a growing demand for energy-efficient cooling solutions. Valued at $6,178.5 million in 2024, the market is projected to expand at a CAGR of 9.41%, reaching $15,189.6 million by 2034. Factors such as rising temperatures, improved living standards, and government initiatives promoting eco-friendly appliances are fueling demand. With a shift toward inverter and smart ACs, manufacturers are focusing on technological advancements and sustainability to strengthen their market position.

Growing environmental concerns and strict energy efficiency regulations are driving demand in the India room ACs market. Rapid urbanization, rising disposable incomes, and an expanding middle-class consumer base are key factors fueling market growth. Additionally, government mandates and incentives promoting energy-efficient appliances are encouraging consumers to adopt advanced cooling solutions. Moreover, manufacturers are focusing on developing energy-saving technologies and eco-friendly refrigerants to align with sustainability goals. As awareness about climate change and energy conservation increases, the market is expected to witness steady expansion in the coming years.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2024 - 2034 |

| 2024 Evaluation | $6.18 Billion |

| 2034 Forecast | $15.19 Billion |

| CAGR | 9.41% |

However, the India room ACs market faces several challenges, including high manufacturing and R&D costs, volatile raw material prices, and supply chain disruptions. The industry is also highly competitive, with brands competing on pricing, making it a price-sensitive market. However, these challenges create opportunities for innovation, cost optimization, and strategic collaborations across the value chain. Companies are focusing on localized production, energy-efficient technologies, and alternative materials to navigate cost pressures. Additionally, the development of smart and premium AC segments provides room for brands to differentiate and capture niche consumer markets.

The residential application is leading the India room air conditioners (ACs) market due to the increasing demand for home comfort and improved living standards. Rising temperatures, coupled with growing disposable incomes and urbanization, have led to a higher adoption of air conditioning in households. Additionally, the shift towards smaller, energy-efficient units is driving market growth. The growing awareness of indoor air quality and health has also contributed to the surge in residential AC demand. As a result, the residential sector is expected to continue dominating the market share in the coming years.

The Split AC product is leading the India room air conditioners (ACs) market due to its superior cooling efficiency and aesthetic appeal. These units offer quieter operation compared to window ACs, making them ideal for residential and commercial spaces. Additionally, the flexibility of installation, along with energy-saving features, has made Split ACs increasingly popular. The growing preference for premium features such as smart connectivity, advanced filtration, and design options further strengthens their market position. This trend is expected to continue as consumers prioritize comfort and technology in their cooling solutions.

The Cold Only product is leading the India ACs market due to its affordability and energy efficiency. These units are specifically designed to provide cooling without the added complexity of heating features, making them an ideal choice for regions with predominantly hot climates. With rising temperatures and a focus on cost-effective solutions, Cold Only ACs are gaining traction in both residential and commercial applications. Additionally, their lower purchase and maintenance costs further contribute to their widespread adoption, positioning them as the preferred choice for budget-conscious consumers.

Regulations in the India room ACs market focus on promoting energy efficiency and reducing environmental impact. These regulations typically mandate the use of eco-friendly refrigerants, improve energy consumption standards, and encourage the use of sustainable materials in production. Compliance with such regulations often involves meeting specific energy performance criteria and certifications, which accelerate the adoption of energy-efficient AC units. Furthermore, regulations require clear product labeling to inform consumers about energy ratings and environmental attributes, thereby driving informed purchasing decisions and encouraging the use of greener AC solutions.

Leading players in the India room ACs market, including Voltas, Blue Star, Daikin, LG, and Samsung, are driving market growth through technological advancements and strategic partnerships. These companies are heavily investing in R&D, manufacturing expansion, and supply chain optimization to strengthen their market presence. To meet rising demand, brands are focusing on energy-efficient technologies, inverter ACs, and eco-friendly refrigerants that align with government regulations and consumer preferences. For instance, several manufacturers are setting up new production facilities and expanding existing ones to cater to the growing demand for premium and smart ACs. Additionally, investments in distribution networks, service infrastructure, and localized manufacturing are crucial for enhancing product availability and affordability. Companies are also exploring AI-driven cooling solutions, IoT-enabled appliances, and sustainable refrigerants to stay competitive and meet evolving customer needs.

Market Segmentation:

Segmentation 1: by Application

- Residential

- Commercial

Segmentation 2: by Product

- Window and Portable

- Split

- Invertor

- On/Off

- Multi-Split

- Tower

- Variable Refrigerant Flow (VRF)

- Duct

- Cassette (Any Type: 1/2/4way, Round)

- Wall-Mounted

Segmentation 3: by Mode

- Cold Only

- Hot and Cold Hybrid

Key Questions Answered in this Report:

- What is the estimated global market size for India room air conditioners (ACs)?

- Which are the primary suppliers of India room air conditioners (ACs)?

- What are the different types of India room air conditioners (ACs) available in the market?

- Which geographical area holds the largest share in the India room air conditioners (ACs) market?

- What are the primary factors driving the growth of the India room air conditioners (ACs) market?

- What are the future trends expected in the India room air conditioners (ACs) market?

Table of Contents

Executive Summary

Scope and Definition

1 Markets

- 1.1 Trends: Current and Future Impact Assessment

- 1.1.1 Trend: Overview

- 1.1.2 Shift toward Energy-Efficient (Inverter) ACs

- 1.1.3 Embodied Carbon Reduction Efforts

- 1.1.4 Growing Demand for Smart/IoT-Enabled ACs

- 1.2 Market Dynamics Overview

- 1.2.1 Market Drivers

- 1.2.1.1 Rapid Urbanization and Rising Disposable Incomes

- 1.2.1.2 Corporate Sustainability Initiatives

- 1.2.1.3 Government Mandates and Incentives for Energy Efficiency

- 1.2.2 Market Restraints

- 1.2.2.1 High Manufacturing and R&D Costs

- 1.2.2.2 Volatile Raw Material Prices and Supply Chain Issues

- 1.2.2.3 Intense Market Competition and Price Sensitivity

- 1.2.3 Market Opportunities

- 1.2.3.1 Untapped Potential in Tier-II and Tier-III Cities

- 1.2.3.2 Upgradation and Replacement of Outdated AC Units

- 1.2.3.3 E-commerce Platforms Driving Wider Reach and Sales

- 1.2.1 Market Drivers

2 Application

- 2.1 Application Segmentation

- 2.2 Application Summary

- 2.3 India Room ACs Market (by Application)

- 2.3.1 Residential

- 2.3.2 Commercial

3 Products

- 3.1 Product Segmentation

- 3.2 Product Summary

- 3.3 India Room ACs Market (by Product)

- 3.3.1 Window and Portable

- 3.3.2 Split

- 3.3.2.1 Invertor

- 3.3.2.2 On/Off

- 3.3.3 Multi-Split

- 3.3.4 Tower

- 3.3.5 Variable Refrigerant Flow (VRF)

- 3.3.5.1 Duct

- 3.3.5.2 Cassette (Any type: 1/2/4way, round)

- 3.3.5.3 Wall-Mounted

- 3.4 India Room ACs Market (by Mode)

- 3.4.1 Cold Only

- 3.4.2 Hot and Cold Hybrid

4 Markets - Competitive Benchmarking & Company Profiles

- 4.1 Next Frontiers

- 4.1.1 VOLTAS

- 4.1.1.1 Overview

- 4.1.1.2 Top Products/Product Portfolio

- 4.1.1.3 Top Competitors

- 4.1.1.4 Target Customers

- 4.1.1.5 Key Personnel

- 4.1.1.6 Analyst View

- 4.1.1.7 Market Share, 2023

- 4.1.2 Blue Star Limited

- 4.1.2.1 Overview

- 4.1.2.2 Top Products/Product Portfolio

- 4.1.2.3 Top Competitors

- 4.1.2.4 Target Customers

- 4.1.2.5 Key Personnel

- 4.1.2.6 Analyst View

- 4.1.2.7 Market Share, 2023

- 4.1.3 Carrier

- 4.1.3.1 Overview

- 4.1.3.2 Top Products/Product Portfolio

- 4.1.3.3 Top Competitors

- 4.1.3.4 Target Customers

- 4.1.3.5 Key Personnel

- 4.1.3.6 Analyst View

- 4.1.3.7 Market Share, 2023

- 4.1.4 DAIKIN INDUSTRIES, Ltd.

- 4.1.4.1 Overview

- 4.1.4.2 Top Products/Product Portfolio

- 4.1.4.3 Top Competitors

- 4.1.4.4 Target Customers

- 4.1.4.5 Key Personnel

- 4.1.4.6 Analyst View

- 4.1.4.7 Market Share, 2023

- 4.1.5 Hitachi, Ltd.

- 4.1.5.1 Overview

- 4.1.5.2 Top Products/Product Portfolio

- 4.1.5.3 Top Competitors

- 4.1.5.4 Target Customers

- 4.1.5.5 Key Personnel

- 4.1.5.6 Analyst View

- 4.1.5.7 Market Share, 2023

- 4.1.6 LG Electronics

- 4.1.6.1 Overview

- 4.1.6.2 Top Products/Product Portfolio

- 4.1.6.3 Top Competitors

- 4.1.6.4 Target Customers

- 4.1.6.5 Key Personnel

- 4.1.6.6 Analyst View

- 4.1.6.7 Market Share, 2023

- 4.1.7 SAMSUNG

- 4.1.7.1 Overview

- 4.1.7.2 Top Products/Product Portfolio

- 4.1.7.3 Top Competitors

- 4.1.7.4 Target Customers

- 4.1.7.5 Key Personnel

- 4.1.7.6 Analyst View

- 4.1.7.7 Market Share, 2023

- 4.1.8 Panasonic

- 4.1.8.1 Overview

- 4.1.8.2 Top Products/Product Portfolio

- 4.1.8.3 Top Competitors

- 4.1.8.4 Target Customers

- 4.1.8.5 Key Personnel

- 4.1.8.6 Analyst View

- 4.1.8.7 Market Share, 2023

- 4.1.9 Godrej Group

- 4.1.9.1 Overview

- 4.1.9.2 Top Products/Product Portfolio

- 4.1.9.3 Top Competitors

- 4.1.9.4 Target Customers

- 4.1.9.5 Key Personnel

- 4.1.9.6 Analyst View

- 4.1.9.7 Market Share, 2023

- 4.1.10 Whirlpool Corporation

- 4.1.10.1 Overview

- 4.1.10.2 Top Products/Product Portfolio

- 4.1.10.3 Top Competitors

- 4.1.10.4 Target Customers

- 4.1.10.5 Key Personnel

- 4.1.10.6 Analyst View

- 4.1.10.7 Market Share, 2023

- 4.1.11 Haier Inc.

- 4.1.11.1 Overview

- 4.1.11.2 Top Products/Product Portfolio

- 4.1.11.3 Top Competitors

- 4.1.11.4 Target Customers

- 4.1.11.5 Key Personnel

- 4.1.11.6 Analyst View

- 4.1.11.7 Market Share, 2023

- 4.1.12 Havells India Ltd.

- 4.1.12.1 Overview

- 4.1.12.2 Top Products/Product Portfolio

- 4.1.12.3 Top Competitors

- 4.1.12.4 Target Customers

- 4.1.12.5 Key Personnel

- 4.1.12.6 Analyst View

- 4.1.12.7 Market Share, 2023

- 4.1.13 IFB Appliances

- 4.1.13.1 Overview

- 4.1.13.2 Top Products/Product Portfolio

- 4.1.13.3 Top Competitors

- 4.1.13.4 Target Customers

- 4.1.13.5 Key Personnel

- 4.1.13.6 Analyst View

- 4.1.13.7 Market Share, 2023

- 4.1.14 FUJITSU GENERAL

- 4.1.14.1 Overview

- 4.1.14.2 Top Products/Product Portfolio

- 4.1.14.3 Top Competitors

- 4.1.14.4 Target Customers

- 4.1.14.5 Key Personnel

- 4.1.14.6 Analyst View

- 4.1.14.7 Market Share, 2023

- 4.1.15 Midea

- 4.1.15.1 Overview

- 4.1.15.2 Top Products/Product Portfolio

- 4.1.15.3 Top Competitors

- 4.1.15.4 Target Customers

- 4.1.15.5 Key Personnel

- 4.1.15.6 Analyst View

- 4.1.15.7 Market Share, 2023

- 4.1.1 VOLTAS

5 Research Methodology

- 5.1 Data Sources

- 5.1.1 Primary Data Sources

- 5.1.2 Secondary Data Sources

- 5.1.3 Data Triangulation

- 5.2 Market Estimation and Forecast