|

|

市場調査レポート

商品コード

1650834

欧州の 遺伝学的検査市場:遺伝子検査タイプ別、国別 - 分析と予測(2024年~2033年)Europe Hereditary Genetic Testing Market: Focus on Genetic Testing Type and Country - Analysis and Forecast, 2024-2033 |

||||||

カスタマイズ可能

|

|||||||

| 欧州の 遺伝学的検査市場:遺伝子検査タイプ別、国別 - 分析と予測(2024年~2033年) |

|

出版日: 2025年02月07日

発行: BIS Research

ページ情報: 英文 60 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

欧州の 遺伝学的検査の市場規模は、2024年に71億3,000万米ドルとなりました。

同市場は、2034年には210億6,000万米ドルに達すると予測され、予測期間の2024年~2034年のCAGRは12.79%になると見込まれています。欧州市場は、継続的な技術向上により急速に拡大しています。遺伝子シーケンシング技術、特に次世代シーケンシング(NGS)の進歩により、遺伝子検査はより正確で効率的、かつ手頃な価格になっています。ヘルスケア専門家や一般市民の間で、遺伝性疾患の診断と治療のための遺伝子検査の利点に対する認識が高まっていることが、需要を牽引しています。さらに、早期診断と個別化治療ソリューションの必要性は、遺伝性疾患と遺伝性がんの発生率の上昇によって強調されています。出生前検査や新生児スクリーニング、腫瘍学、精密医療など、遺伝子検査の用途が拡大していることが、市場の成長をさらに後押ししています。遺伝子検査の品質と信頼性は、規制当局の支援と調和された欧州のガイドラインによって保証されており、この地域全体での市場拡大を促進しています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2024年~2033年 |

| 2024年の評価 | 71億3,000万米ドル |

| 2033年の予測 | 210億6,000万米ドル |

| CAGR | 12.79% |

欧州の遺伝学的遺伝子検査市場は、遺伝子配列決定技術の開発、意識の高まり、個別化医療へのニーズの高まりにより急成長しています。遺伝性疾患の診断、遺伝性疾患素因の検出、希少遺伝性疾患、嚢胞性線維症、遺伝性がんなどの早期介入を促進するためには、 遺伝学的検査が不可欠です。

次世代シーケンシング(NGS)技術の普及により、遺伝子検査の精度、有効性、手頃な価格は劇的に向上し、患者やヘルスケア専門家が遺伝子検査にアクセスできるようになっています。市場の拡大をさらに後押ししているのは、新生児スクリーニングやキャリア検査プログラムを支援する政府のイニシアティブや、有利な規制の枠組みや償還政策です。

遺伝性疾患や遺伝性がんの罹患率が上昇していることが、包括的な検査ソリューションの需要を促進しています。さらに、医師の処方箋なしに遺伝情報を入手できる消費者直接(DTC)遺伝子検査サービスの人気も高まっています。生殖医療検査、腫瘍遺伝学、個別化医療への多額の投資により、市場の範囲はさらに拡大しています。

欧州が精密医療と疾患の早期発見を優先する限り、遺伝学的遺伝子検査市場は安定的に成長すると予想されます。この成長は、技術の進歩、規制の調和、一般市民の意識の高まりによって助長されると見込まれています。

当レポートでは、欧州の 遺伝学的検査市場について調査し、市場の概要とともに、遺伝子検査タイプ別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 遺伝学的検査:業界の見通し

- 遺伝学的検査の現状

- 市場の足跡と将来の可能性

- 動向:現在および将来の影響評価

- R&Dレビュー

- 総市場規模と浸透率

- 法的および規制上の枠組み

- 償還シナリオ

- 市場力学

第2章 地域

- 促進要因と抑制要因

- 欧州

第3章 市場-競合ベンチマーキングと企業プロファイル

- 競合情勢

- 主要戦略と開発

- 企業シェア分析

- 企業プロファイル

- Centogene AG

- Eurofins Scientific SE

- F. Hoffmann-La Roche Ltd

第4章 調査手法

List of Figures

- Figure 1: Hereditary Genetic Testing Market, by Region, $Billion, 2023, 2027, and 2033

- Figure 2: Europe Hereditary Genetic Testing Market (by Testing Type), $Billion, 2023 and 2033

- Figure 3: Key Events to Keep Track of in the Hereditary Genetic Testing Market

- Figure 4: Types of Hereditary Genetic Tests

- Figure 5: Hereditary Genetic Testing Market, Patent Analysis (by Year), January 2021-April 2024

- Figure 6: Hereditary Genetic Testing Market, Patent Analysis (by Country), January 2021-April 2024

- Figure 7: Europe Hereditary Genetic Testing Market Scenario, 2023

- Figure 8: Analysis of Market Navigating Factors, 2024-2033

- Figure 9: Rising Prevalence of Genetic Disorders

- Figure 10: Prevalence of a Few Rare Diseases

- Figure 11: Few Major Inorganic Growth Activities in the Hereditary Genetic Testing Market

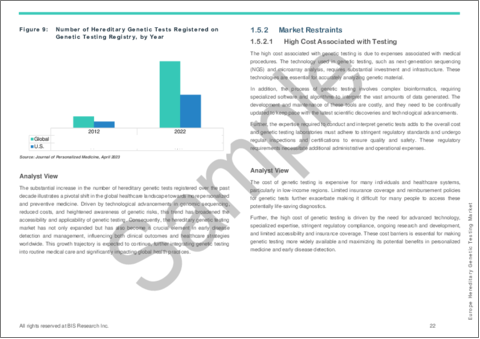

- Figure 12: Number of Hereditary Genetic Tests Registered on Genetic Testing Registry, by Year

- Figure 13: Need for More Genetic Counselors

- Figure 14: Key Expansions in the Past Few Years

- Figure 15: France Hereditary Genetic Testing Market, $Billion, 2022-2033

- Figure 16: Germany Hereditary Genetic Testing Market, $Billion, 2022-2033

- Figure 17: U.K. Hereditary Genetic Testing Market, $Billion, 2022-2033

- Figure 18: Spain Hereditary Genetic Testing Market, $Billion, 2022-2033

- Figure 19: Netherlands Hereditary Genetic Testing Market, $Billion, 2022-2033

- Figure 20: Rest-of-Europe Hereditary Genetic Testing Market, $Billion, 2022-2033

- Figure 21: Number of Mergers and Acquisitions (by Company), January 2021-April 2024

- Figure 22: Number of Product Launches (by Company), January 2021-April 2024

- Figure 23: Synergistic Activities Share (by Company), January 2021-April 2024

- Figure 24: Business Expansion Activities Share (by Company), January 2021-April 2024

- Figure 25: Hereditary Genetic Testing Market, Company Revenue Share Analysis, $Billion, 2023

- Figure 26: Data Triangulation

- Figure 27: Top-Down and Bottom-Up Approach

- Figure 28: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Opportunities across Regions

- Table 3: Hereditary Genetic Testing Market, Product Launches and Regulatory Approvals

- Table 4: Regulatory Bodies Governing Hereditary Genetic Testing

- Table 5: Europe Hereditary Genetic Testing Market (by Genetic Testing Type), $Billion, 2022-2033

Introduction to Europe Hereditary Genetic Testing Market

The Europe hereditary genetic testing market was valued at $7.13 billion in 2024 and is anticipated to reach $21.06 billion by 2034, witnessing a CAGR of 12.79% during the forecast period 2024-2034. The market in Europe is expanding rapidly due to continuous technological improvements. Genetic testing is now more accurate, efficient, and affordable thanks to advancements in genetic sequencing technologies, especially next-generation sequencing (NGS). Demand is being driven by growing awareness of the advantages of genetic testing for diagnosing and treating hereditary conditions among healthcare professionals and the public. Additionally, the need for early diagnosis and individualized treatment solutions is highlighted by the rising incidence of genetic disorders and hereditary cancers. The expanding applications of genetic testing, such as prenatal and newborn screening, oncology, and precision medicine, further bolster the market's growth. The quality and dependability of genetic tests are guaranteed by regulatory support and harmonized European guidelines, which promote market expansion throughout the region.

Market Introduction

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2024 - 2033 |

| 2024 Evaluation | $7.13 Billion |

| 2033 Forecast | $21.06 Billion |

| CAGR | 12.79% |

The market for hereditary genetic testing in Europe is growing quickly due to developments in genetic sequencing technologies, rising awareness, and a growing need for individualized medical care. In order to diagnose inherited disorders, detect genetic disease predispositions, and facilitate early interventions for conditions like rare genetic disorders, cystic fibrosis, and hereditary cancers, hereditary genetic testing is essential.

The accuracy, effectiveness, and affordability of genetic tests have increased dramatically with the widespread use of next-generation sequencing (NGS) technologies, opening up access to them for patients and healthcare professionals alike. Further propelling market expansion are government initiatives supporting newborn screening and carrier testing programs, as well as advantageous regulatory frameworks and reimbursement policies.

The rising incidence of genetic disorders and hereditary cancers is driving demand for comprehensive testing solutions. Additionally growing in popularity are direct-to-consumer (DTC) genetic testing services, which give people access to genetic information without a doctor's prescription. The market's scope is being further expanded by significant investments in reproductive health testing, oncology genetics, and personalized medicine.

The market for hereditary genetic testing is expected to grow steadily as long as Europe prioritizes precision medicine and early disease detection. This growth will be aided by technological advancements, harmonized regulations, and rising public awareness.

Market Segmentation:

Segmentation 1: by Genetic Testing Type

- Oncology Genetic Testing

- Cardiology Genetic Testing

- Neurology Genetic Testing

- Newborn Screening

- Prenatal Screening (NIPT) and Preimplantation Testing

- Rare Disease Testing

- Direct-to-consumer (DTC) Testing

Segmentation 2: by Region

- Europe

- Germany

- U.K.

- France

- Spain

- Netherlands

- Rest-of-Europe

How can this report add value to an organization?

Product/Innovation Strategy: The Europe hereditary genetic testing market has been extensively segmented based on various categories, such as genetic testing type and country. This can help readers get a clear overview of which segments account for the largest share and which ones are well-positioned to grow in the coming years.

Growth/Marketing Strategy: Partnerships, alliances, and collaborations accounted for the maximum number of key developments.

Competitive Strategy: The Europe hereditary genetic testing market has numerous established players with product portfolios. Key players in the Europe hereditary genetic testing market analyzed and profiled in the study involve established players offering products for hereditary genetic testing.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, and market penetration.

Some prominent names established in this market are:

- Centogene AG

- Eurofins Scientific SE

- F. Hoffmann-La Roche Ltd

Table of Contents

Executive Summary

Scope and Definition

1 Hereditary Genetic Testing: Industry Outlook

- 1.1 Current State of Hereditary Genetic Testing

- 1.2 Market Footprint and Future Potential

- 1.3 Trends: Current and Future Impact Assessment

- 1.3.1 Increasing Demand for Direct-to-consumer Testing

- 1.3.2 Increasing Launch of Innovative Products and Regulatory Approvals in Genetic Testing Ecosystem

- 1.4 R&D Review

- 1.4.1 Patent Filing Trend (by Year, Country)

- 1.5 Total Addressable Market and Penetration

- 1.6 Legal and Regulatory Framework

- 1.6.1 Europe

- 1.6.1.1 Germany

- 1.6.1.2 France

- 1.6.1.3 Italy

- 1.6.1 Europe

- 1.7 Reimbursement Scenario

- 1.8 Market Dynamics

- 1.8.1 Market Drivers

- 1.8.1.1 Rising Prevalence of Genetic Disorders along with Rare Diseases

- 1.8.1.2 Increasing Inorganic Growth Activities in the Field of Hereditary Genetic Testing

- 1.8.1.3 Increasing Number of Hereditary Genetic Tests

- 1.8.2 Market Restraints

- 1.8.2.1 High Cost Associated with Testing

- 1.8.2.2 Shortage of Genetic Counselors

- 1.8.3 Market Opportunities

- 1.8.3.1 Expansion into Emerging Markets

- 1.8.1 Market Drivers

2 Region

- 2.1 Drivers and Restraints

- 2.2 Europe

- 2.2.1 Regional Overview

- 2.2.2 Driving Factors for Market Growth

- 2.2.3 Factors Challenging the Market

- 2.2.4 France

- 2.2.5 Germany

- 2.2.6 U.K.

- 2.2.7 Spain

- 2.2.8 Netherlands

- 2.2.9 Rest-of-Europe

3 Markets - Competitive Benchmarking & Company Profiles

- 3.1 Competitive Landscape

- 3.1.1 Key Strategies and Development

- 3.1.1.1 Mergers and Acquisitions

- 3.1.1.2 Product Launches

- 3.1.1.3 Synergistic Activities

- 3.1.1.4 Business Expansion Activities and Others

- 3.1.2 Company Share Analysis

- 3.1.1 Key Strategies and Development

- 3.2 Company Profiles

- 3.2.1 Centogene AG

- 3.2.1.1 Overview

- 3.2.1.2 Top Products/Product Portfolio

- 3.2.1.3 Top Competitors

- 3.2.1.4 Key Personnel

- 3.2.1.5 Analyst View

- 3.2.2 Eurofins Scientific SE

- 3.2.2.1 Overview

- 3.2.2.2 Top Products

- 3.2.2.3 Top Competitors

- 3.2.2.4 Key Personnel

- 3.2.2.5 Analyst View

- 3.2.3 F. Hoffmann-La Roche Ltd

- 3.2.3.1 Top Products

- 3.2.3.2 Top Competitors

- 3.2.3.3 Key Personnel

- 3.2.3.4 Analyst View

- 3.2.1 Centogene AG

4 Research Methodology

- 4.1 Data Sources

- 4.1.1 Primary Data Sources

- 4.1.2 Secondary Data Sources

- 4.1.3 Data Triangulation

- 4.2 Market Estimation and Forecast

- 4.3 Criteria for Company Profiling