|

|

市場調査レポート

商品コード

1650831

欧州の診断における質量分析とクロマトグラフィ市場:製品タイプ別、用途タイ別、国別 - 分析と予測(2024年~2033年)Europe Mass Spectrometry and Chromatography in Diagnostics Market: Focus on Product Type, Application Type, and Country - Analysis and Forecast, 2024-2033 |

||||||

カスタマイズ可能

|

|||||||

| 欧州の診断における質量分析とクロマトグラフィ市場:製品タイプ別、用途タイ別、国別 - 分析と予測(2024年~2033年) |

|

出版日: 2025年02月07日

発行: BIS Research

ページ情報: 英文 76 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

欧州の診断における質量分析とクロマトグラフィの市場規模は、2024年に2億2,400万米ドルとなりました。

同市場は、2024年から2033年にかけて9.41%のCAGRで拡大し、2033年には5億330万米ドルに達すると予測されています。欧州の分析・ライフサイエンス機器分野は、質量分析(MS)とクロマトグラフィ市場に大きく依存しています。これらの技術は、化学物質や生物学的物質の分離、同定、定量に高度な技術を提供することで、医薬品、環境モニタリング、診断、食品安全などの分野の進歩を後押ししています。質量分析とクロマトグラフィは、別々に使用されるのではなく、通常、診断のワークフローに組み込まれています。たとえば、液体クロマトグラフィ質量分析計は、質量分析計の質量分析能力と液体クロマトグラフィの分離能力を兼ね備えているため、複雑なサンプル分析に最適です。患者サンプルのハイスループット分析が、診断と治療の指針となる徹底的な洞察を提供する上で極めて重要な臨床現場では、このハイブリッド・アプローチが特に有益です。欧州におけるこれらの技術の重要な診断用途には、ビタミンプロファイリング、ホルモンプロファイリング、および成分の精密な分離と分析を必要とするその他の検査が含まれます。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2024年~2033年 |

| 2024年の評価 | 2億2,400万米ドル |

| 2033年の予測 | 5億330万米ドル |

| CAGR | 9.41% |

患者サンプルの複雑化と精密診断へのニーズの高まりが、欧州の診断用質量分析・クロマトグラフィ市場の急速な進化を促しています。臨床診断、個別化医療、バイオマーカーの探索はすべて、質量分析(MS)およびクロマトグラフィ技術に依存しています。なぜなら、質量分析(MS)およびクロマトグラフィ技術は、化学物質および生物学的物質の分離、同定、定量に高度な技術を提供するからです。

液体クロマトグラフィ-質量分析(LC-MS)のようなハイブリッドシステムは、複雑な臨床サンプルの高スループット、高精度、高信頼性の分析を可能にするため、現代の診断ワークフローに不可欠なものとなっています。これらの技術は、ビタミン、代謝物、ホルモン、バイオマーカーの分析に特に有用であり、これにより疾患の早期発見と個別の治療計画が可能になります。

メタボロミクスとプロテオミクスの治療向上も、より優れた疾患モニタリング、スクリーニング、治療計画を促進するため、市場を牽引しています。高性能診断ツールのニーズは、バイオマーカー同定と標的治療に関する研究の増加によってさらに刺激されています。

さらに、診断における質量分析とクロマトグラフィの使用は、規制当局の支援、ヘルスケアインフラの強化、AI主導のアナリティクスの組み込みにより、欧州全域で拡大しています。これらの技術が広く利用されるようになれば、さまざまな臨床用途に普及すると予想され、欧州の診断薬市場の継続的な拡大を後押ししています。

当レポートでは、欧州の診断における質量分析とクロマトグラフィ市場について調査し、市場の概要とともに、製品タイプ別、用途タイ別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 欧州の診断における質量分析とクロマトグラフィ市場:業界見通し

- 市場概要

- 主な動向

- 主要動向の機会評価

- 製品ベンチマーク

- 規制状況

第2章 地域

- 地域別概要

- 促進要因と抑制要因

- 欧州

第3章 欧州の診断における質量分析とクロマトグラフィ市場:競合ベンチマーキングと企業プロファイル

- 競合情勢

- パートナーシップ、提携、事業拡大

- 新しいサービス

- 合併と買収

- 規制当局の承認

- 主要戦略と開発

- 企業競合マトリックス

- 企業シェア分析

- 企業プロファイル

- Tecan Group Ltd.

- Merck KGaA

- Chromsystems Instruments & Chemicals GmbH.

- RECIPE Chemicals + Instruments GmbH

- SENTINEL CH. SpA

第4章 調査手法

List of Figures

- Figure 1: Europe Mass Spectrometry and Chromatography in Diagnostics Market, $Million, 2024, 2028, and 2033

- Figure 2: Mass Spectrometry and Chromatography in Diagnostics Market (by Region), $Million, 2023, 2027, and 2033

- Figure 3: Europe Mass Spectrometry and Chromatography in Diagnostics Market (by Product Type), $Million, 2023, 2027, and 2033

- Figure 4: Europe Mass Spectrometry and Chromatography in Diagnostics Market (by Application), $Million, 2023, 2027, and 2033

- Figure 5: Product Benchmarking (Mass Spectrometry and Chromatography (by Instruments))

- Figure 6: EU IVD Regulation

- Figure 7: U.K. Mass Spectrometry and Chromatography in Diagnostics Market, $Million, 2023-2033

- Figure 8: Germany Mass Spectrometry and Chromatography in Diagnostics Market, $Million, 2023-2033

- Figure 9: France Mass Spectrometry and Chromatography in Diagnostics Market, $Million, 2023-2033

- Figure 10: Italy Mass Spectrometry and Chromatography in Diagnostics Market, $Million, 2023-2033

- Figure 11: Spain Mass Spectrometry and Chromatography in Diagnostics Market, $Million, 2023-2033

- Figure 12: Rest-of-Europe Mass Spectrometry and Chromatography in Diagnostics Market, $Million, 2023-2033

- Figure 13: Partnerships, Alliances, and Business Expansions, January 2015- June 2024

- Figure 14: New Offerings, January 2015- June 2024

- Figure 15: Mergers and Acquisitions, January 2015- June 2024

- Figure 16: New Offerings, January 2015- June 2024

- Figure 17: Mass Spectrometry and Chromatography in Diagnostics Market, Company Competition Matrix

- Figure 18: Mass Spectrometry and Chromatography in Diagnostics Market, % Share, 2023

- Figure 19: Data Triangulation

- Figure 20: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Current State and Future Potential of Key Trends in the Europe Mass Spectrometry and Chromatography in Diagnostics Market

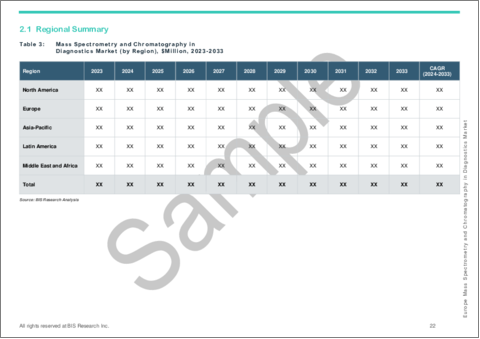

- Table 3: Mass Spectrometry and Chromatography in Diagnostics Market (by Region), $Million, 2023-2033

- Table 4: Europe Mass Spectrometry and Chromatography in Diagnostics Market (by Product Type), $Million, 2023-2033

- Table 5: Europe Mass Spectrometry and Chromatography in Diagnostics Market (by Sample Preparation), $Million, 2023-2033

- Table 6: Europe Mass Spectrometry and Chromatography in Diagnostics Market (by Mass Spectrometry and Chromatography), $Million, 2023-2033

- Table 7: Europe Mass Spectrometry and Chromatography in Diagnostics Market (by Application Type), $Million, 2023-2033

- Table 8: Europe Mass Spectrometry and Chromatography in Diagnostics Market (by Vitamins), $Million, 2023-2033

- Table 9: Europe Mass Spectrometry and Chromatography in Diagnostics Market (by Hormones), $Million, 2023-2033

- Table 10: U.K. Mass Spectrometry and Chromatography in Diagnostics Market (by Product Type), $Million, 2023-2033

- Table 11: U.K. Mass Spectrometry and Chromatography in Diagnostics Market (by Sample Preparation), $Million, 2023-2033

- Table 12: U.K. Mass Spectrometry and Chromatography in Diagnostics Market (by Mass Spectrometry and Chromatography), $Million, 2023-2033

- Table 13: U.K. Mass Spectrometry and Chromatography in Diagnostics Market (by Application Type), $Million, 2023-2033

- Table 14: U.K. Mass Spectrometry and Chromatography in Diagnostics Market (by Vitamins), $Million, 2023-2033

- Table 15: U.K. Mass Spectrometry and Chromatography in Diagnostics Market (by Hormones), $Million, 2023-2033

- Table 16: Germany Mass Spectrometry and Chromatography in Diagnostics Market (by Product Type), $Million, 2023-2033

- Table 17: Germany Mass Spectrometry and Chromatography in Diagnostics Market (by Sample Preparation), $Million, 2023-2033

- Table 18: Germany Mass Spectrometry and Chromatography in Diagnostics Market (by Mass Spectrometry and Chromatography), $Million, 2023-2033

- Table 19: Germany Mass Spectrometry and Chromatography in Diagnostics Market (by Application Type), $Million, 2023-2033

- Table 20: Germany Mass Spectrometry and Chromatography in Diagnostics Market (by Vitamins), $Million, 2023-2033

- Table 21: Germany Mass Spectrometry and Chromatography in Diagnostics Market (by Hormones), $Million, 2023-2033

- Table 22: France Mass Spectrometry and Chromatography in Diagnostics Market (by Product Type), $Million, 2023-2033

- Table 23: France Mass Spectrometry and Chromatography in Diagnostics Market (by Sample Preparation), $Million, 2023-2033

- Table 24: France Mass Spectrometry and Chromatography in Diagnostics Market (by Mass Spectrometry and Chromatography), $Million, 2023-2033

- Table 25: France Mass Spectrometry and Chromatography in Diagnostics Market (by Application Type), $Million, 2023-2033

- Table 26: France Mass Spectrometry and Chromatography in Diagnostics Market (by Vitamins), $Million, 2023-2033

- Table 27: France Mass Spectrometry and Chromatography in Diagnostics Market (by Hormones), $Million, 2023-2033

- Table 28: Italy Mass Spectrometry and Chromatography in Diagnostics Market (by Product Type), $Million, 2023-2033

- Table 29: Italy Mass Spectrometry and Chromatography in Diagnostics Market (by Sample Preparation), $Million, 2023-2033

- Table 30: Italy Mass Spectrometry and Chromatography in Diagnostics Market (by Mass Spectrometry and Chromatography), $Million, 2023-2033

- Table 31: Italy Mass Spectrometry and Chromatography in Diagnostics Market (by Application Type), $Million, 2023-2033

- Table 32: Italy Mass Spectrometry and Chromatography in Diagnostics Market (by Vitamins), $Million, 2023-2033

- Table 33: Italy Mass Spectrometry and Chromatography in Diagnostics Market (by Hormones), $Million, 2023-2033

- Table 34: Spain Mass Spectrometry and Chromatography in Diagnostics Market (by Product Type), $Million, 2023-2033

- Table 35: Spain Mass Spectrometry and Chromatography in Diagnostics Market (by Sample Preparation), $Million, 2023-2033

- Table 36: Spain Mass Spectrometry and Chromatography in Diagnostics Market (by Mass Spectrometry and Chromatography), $Million, 2023-2033

- Table 37: Spain Mass Spectrometry and Chromatography in Diagnostics Market (by Application Type), $Million, 2023-2033

- Table 38: Spain Mass Spectrometry and Chromatography in Diagnostics Market (by Vitamins), $Million, 2023-2033

- Table 39: Spain Mass Spectrometry and Chromatography in Diagnostics Market (by Hormones), $Million, 2023-2033

- Table 40: Rest-of-Europe Mass Spectrometry and Chromatography in Diagnostics Market (by Product Type), $Million, 2023-2033

- Table 41: Rest-of-Europe Mass Spectrometry and Chromatography in Diagnostics Market (by Sample Preparation), $Million, 2023-2033

- Table 42: Rest-of-Europe Mass Spectrometry and Chromatography in Diagnostics Market (by Mass Spectrometry and Chromatography), $Million, 2023-2033

- Table 43: Rest-of-Europe Mass Spectrometry and Chromatography in Diagnostics Market (by Application Type), $Million, 2023-2033

- Table 44: Rest-of-Europe Mass Spectrometry and Chromatography in Diagnostics Market (by Vitamins), $Million, 2023-2033

- Table 45: Rest-of-Europe Mass Spectrometry and Chromatography in Diagnostics Market (by Hormones), $Million, 2023-2033

- Table 46: Mass Spectrometry and Chromatography in Diagnostics Market, Key Development Analysis, January 2015-June 2024

Introduction to Europe Mass Spectrometry and Chromatography in Diagnostics Market

The Europe mass spectrometry and chromatography in diagnostics market was valued at $224.0 million in 2024 and is expected to reach $503.3 million by 2033, growing at a CAGR of 9.41% between 2024 and 2033. The analytical and life sciences instrumentation sector in Europe relies heavily on the mass spectrometry (MS) and chromatography markets. These technologies propel advancements in pharmaceuticals, environmental monitoring, diagnostics, and food safety, among other fields, by offering sophisticated techniques for the separation, identification, and quantification of chemical and biological substances. Instead of being used separately, mass spectrometry and chromatography are usually incorporated into workflows in diagnostics. For instance, liquid chromatography-mass spectrometry is perfect for complex sample analysis because it combines the mass analysis capability of mass spectrometry with the separation power of liquid chromatography. In clinical settings, where high-throughput analysis of patient samples is crucial for offering thorough insights that guide diagnosis and treatment, this hybrid approach is especially beneficial. Important diagnostic uses for these technologies in Europe include vitamin profiling, hormone profiling, and other tests that require precise separation and analysis of components.

Market Introduction

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2024 - 2033 |

| 2024 Evaluation | $224.0 Million |

| 2033 Forecast | $503.3 Million |

| CAGR | 9.41% |

The growing complexity of patient samples and the growing need for precision diagnostics are driving the rapid evolution of the Europe mass spectrometry and chromatography in diagnostics market. Clinical diagnostics, personalized medicine, and the search for biomarkers all depend on mass spectrometry (MS) and chromatography technologies because they offer advanced techniques for the separation, identification, and quantification of chemical and biological materials.

Because they provide high-throughput, precise, and dependable analysis for complicated clinical samples, hybrid systems like liquid chromatography-mass spectrometry (LC-MS) have become essential to contemporary diagnostic workflows. These technologies are especially useful for analyzing vitamins, metabolites, hormones, and biomarkers, which allows for early disease detection and individualized treatment plans.

Improvements in metabolomics and proteomics are also driving the market since they are facilitating better disease monitoring, screening, and treatment planning. The need for high-performance diagnostic tools is being further stimulated by growing research into biomarker identification and targeted therapies.

Furthermore, the use of mass spectrometry and chromatography in diagnostics is expanding throughout Europe due to regulatory support, enhanced healthcare infrastructure, and the incorporation of AI-driven analytics. The use of these technologies is anticipated to spread across a variety of clinical applications as they become more widely available, propelling the European diagnostics market's ongoing expansion.

Market Segmentation:

Segmentation 1: by Product Type

- Sample Preparation

- Mass Spectrometry and Chromatography

Segmentation 2: by Application Type

- Therapeutic Drug Monitoring

- Vitamins

- Hormones

- Methylmalonic Acid

- Immunosuppressants

- Others

Segmentation 3: by Country

- Germany

- U.K.

- Spain

- Italy

- France

- Rest-of-Europe

How can this report add value to an organization?

Product/Innovation Strategy: The Europe mass spectrometry and chromatography in diagnostics market has been segmented based on various categories, such as by product type, application type, and country. This can help readers get a clear overview of which segments account for the largest share and which ones are well-positioned to grow in the coming years.

Competitive Strategy: The Europe mass spectrometry and chromatography market consists of various public and few private companies. Key players in the Europe mass spectrometry and chromatography in diagnostics market analyzed and profiled in the study involve established players that offer various kinds of products.

Key Market Players and Competition Synopsis

The companies profiled have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, and market penetration.

Some prominent names established in this market are:

- Tecan Group Ltd.

- Merck KGaA

- Chromsystems Instruments & Chemicals GmbH

- RECIPE Chemicals + Instruments GmbH

- SENTINEL CH. SpA

Table of Contents

Executive Summary

Scope and Definition

1 Mass Spectrometry and Chromatography in Diagnostics Market: Industry Outlook

- 1.1 Market Overview

- 1.2 Key Trends

- 1.2.1 Shift toward Utilization of Liquid Chromatography-Tandem Mass Spectrometry (LC-MS/MS) as Standard Technique in Diagnostics

- 1.2.2 Utilization of Automated Sample Preparation Technologies

- 1.3 Opportunity Assessment of Key Trends

- 1.4 Product Benchmarking

- 1.5 Regulatory Landscape

- 1.5.1 Regulatory Framework in Europe

- 1.5.1.1 Recommendations for Diagnostic Approval

- 1.5.1 Regulatory Framework in Europe

2 Region

- 2.1 Regional Summary

- 2.2 Drivers and Restraints

- 2.3 Europe

- 2.3.1 Regional Overview

- 2.3.2 Driving Factors for Market Growth

- 2.3.3 Factors Challenging the Market

- 2.3.4 By Product Type

- 2.3.5 By Application Type

- 2.3.6 U.K.

- 2.3.6.1 By Product Type

- 2.3.6.2 By Application Type

- 2.3.7 Germany

- 2.3.7.1 By Product Type

- 2.3.7.2 By Application Type

- 2.3.8 France

- 2.3.8.1 By Product Type

- 2.3.8.2 By Application Type

- 2.3.9 Italy

- 2.3.9.1 By Product Type

- 2.3.9.2 By Application Type

- 2.3.10 Spain

- 2.3.10.1 By Product Type

- 2.3.10.2 By Application Type

- 2.3.11 Rest-of-Europe

- 2.3.11.1 By Product Type

- 2.3.11.2 By Application Type

3 Mass Spectrometry and Chromatography in Diagnostics Market: Competitive Benchmarking and Company Profile

- 3.1 Competitive Landscape

- 3.1.1 Partnerships, Alliances, and Business Expansions

- 3.1.2 New Offerings

- 3.1.3 Mergers and Acquisitions

- 3.1.4 Regulatory Approvals

- 3.2 Key Strategies and Development

- 3.3 Company Competition Matrix

- 3.4 Company Share Analysis

- 3.5 Company Profiles

- 3.5.1 Tecan Group Ltd.

- 3.5.1.1 Overview

- 3.5.1.2 Top Products

- 3.5.1.3 Top Competitors

- 3.5.1.4 Top Customers

- 3.5.1.5 Key Personnel

- 3.5.1.6 Analyst View

- 3.5.2 Merck KGaA

- 3.5.2.1 Overview

- 3.5.2.2 Top Products

- 3.5.2.3 Top Competitors

- 3.5.2.4 Top Customers

- 3.5.2.5 Key Personnel

- 3.5.2.6 Analyst View

- 3.5.3 Chromsystems Instruments & Chemicals GmbH.

- 3.5.3.1 Overview

- 3.5.3.2 Top Products

- 3.5.3.3 Top Competitors

- 3.5.3.4 Top Customers

- 3.5.3.5 Key Personnel

- 3.5.3.6 Analyst View

- 3.5.4 RECIPE Chemicals + Instruments GmbH

- 3.5.4.1 Overview

- 3.5.4.2 Top Products

- 3.5.4.3 Top Competitors

- 3.5.4.4 Top Customers

- 3.5.4.5 Key Personnel

- 3.5.4.6 Analyst View

- 3.5.5 SENTINEL CH. SpA

- 3.5.5.1 Overview

- 3.5.5.2 Top Products

- 3.5.5.3 Top Competitors

- 3.5.5.4 Top Customers

- 3.5.5.5 Key Personnel

- 3.5.5.6 Analyst View

- 3.5.1 Tecan Group Ltd.

4 Research Methodology

- 4.1 Data Sources

- 4.1.1 Primary Data Sources

- 4.1.2 Secondary Data Sources

- 4.1.3 Data Triangulation