|

|

市場調査レポート

商品コード

1648555

農業ディーラーの世界市場 - 世界と地域の分析:機械、精密農業技術、投入資材ディーラーの考察Agriculture Dealers Market - A Global and Regional Analysis: Focus on Equipment, Precision Agriculture Technology, and Input Dealers |

||||||

カスタマイズ可能

|

|||||||

| 農業ディーラーの世界市場 - 世界と地域の分析:機械、精密農業技術、投入資材ディーラーの考察 |

|

出版日: 2025年02月04日

発行: BIS Research

ページ情報: 英文 87 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

農業ディーラー市場のイントロダクション

農業ディーラー市場は、メーカーとエンドユーザー(主に農家)の橋渡しをすることで、農業サプライチェーンにおいて重要な役割を果たしています。これらのディーラーは、農業機械、精密技術、種子、肥料、作物保護化学品などの投入資材の供給など、必要不可欠なサービスを提供しています。農作業の生産性、持続可能性、効率性を高めることに重点を置く農業ディーラーは、ニーズに合わせたソリューション、技術採用、付加価値サービスを通じて農家をサポートします。その重要性は、革新的な慣行を促進し、カスタマイズされた機械を提供し、さまざまな地域にわたって多様な製品へのアクセスを確保する役割によって、さらに高まっています。新たな動向や地域のニーズに戦略を合わせることで、農業ディーラーは世界の農業部門の近代化と成長の重要な寄与者として位置づけられています。

市場のイントロダクション

農業ディーラー市場は、農業サプライチェーンの極めて重要な構成要素であり、機械、精密農業技術、種子、肥料、作物保護化学品などの必須の投入資材の効率的な流通を促進しています。この市場は、特定の地域のニーズに合わせた先進のソリューションを提供することで農家を支援し、生産性の向上と持続可能な実践を可能にしています。農業ディーラーは、技術採用を促進し、カスタマイズされたツールを提供し、農家にとって重要な製品をタイムリーに入手できるようにする上で、重要な役割を果たしています。農業経営が機械化やデジタルトランスフォーメーションの進行によって進化し続ける中、農業ディーラー市場は、現代農業の需要に応えるため、精密農業ツールや環境にやさしい慣行の統合にますます重点を置くようになっています。農業ディーラー市場のダイナミックな性質は、世界の農業慣行の効率性と持続可能性を高める重要な促進要因として位置づけられています。

市場の影響

農業ディーラー市場は、生産性を高め、持続可能な農法を育成することで、世界の農業部門に大きな影響を与えています。これらのディーラーは重要な仲介役として機能し、農家が必要不可欠な機械、精密技術、農業投入資材をタイムリーに入手できるようにします。農業ディーラーは、メーカーとエンドユーザーの橋渡しをすることで、サプライチェーンを合理化し、ロジスティクスの課題を軽減します。

市場は、資源利用を最適化し、作物の収穫高を向上させる精密農業ツールなどの先進技術の採用を促進します。さらに、環境にやさしい慣行への移行をサポートし、現代の環境基準に沿った持続可能な製品を提供します。また、農業ディーラーは、農家を教育し、先進の機械や技術に関するトレーニングを提供するという重要な役割を担っています。

しかし、市場は商品価格の変動、サプライチェーンの混乱、規制要件の進化に直面しています。こうした障害にもかかわらず、持続可能な農業とデジタルツールに対する需要の高まりにより、農業ディーラー市場は農業部門の革新と成長の礎石として位置付けられ、長期的な関連性と影響力を確保しています。

当レポートでは、世界の農業ディーラー市場について調査分析し、市場に影響を与える要因の分析や、各セグメントの見通し、ステークホルダーへの提言などを提供しています。

目次

エグゼクティブサマリー

第1章 市場:影響の分析

- 経済要因

- 通貨の変動

- 政策と規制の影響

- 貿易政策

- 政府の支援

- 環境要因

- 気候変動と農業

- 農業ディーラーの役割

- ビジネスと企業戦略

- ディーラーの成功に不可欠な戦略

- コア機能

- 統合アプリケーション

第2章 市場のセグメンテーション

- 機械ディーラー

- 製品と価格の分析

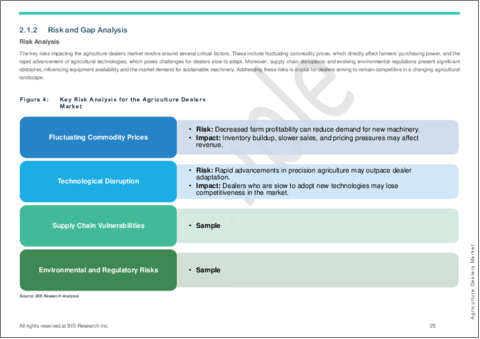

- リスクとギャップの分析

- 機械ディーラーが採用する戦略

- 今後の見通しと動向

- 国の分析

- 主要OEMディーラーの比較と見通し

- 農業機械ディーラーからの推定結果と考察

- ディーラーのエンドユーザー収益の内訳:雇用規模別(2022年)

- 各OEMディーラーのエンドユーザー収益の内訳(2022年)

- 主要ディーラーのリスト

- 主要OEM企業のディーラー

- 投入資材ディーラー

- 製品と価格の分析

- リスクとギャップの分析

- 投入資材ディーラーが採用する戦略

- 今後の見通しと動向

- 国の分析

- 主要投入資材企業の比較と見通し

- 主要ディーラーのリスト

- 精密農業ディーラー

- ディーラーの精密サービス提供

- 精密サービス提供の収益性

- 成長と拡大の障壁

第3章 提言と今後の見通し

- 市場の各ステークホルダーへの提言

- 機械メーカーへの提言

- 農業投入資材メーカーへの提言

- 精密農業ソリューションプロバイダーへの提言

- 農家への提言

第4章 調査手法

List of Figures

- Figure 1: Key Impact of Currency Fluctuations on Agriculture Dealers

- Figure 2: Key Impacts of Climate Change on the Agriculture Dealers Market

- Figure 3: Core Capabilities of Agriculture Dealers

- Figure 4: Integrated Applications of Agriculture Dealers

- Figure 5: Key Risk Analysis for the Agriculture Dealers Market

- Figure 6: Key Gaps Analysis for the Agriculture Dealers Market

- Figure 7: Percentage Share of Agriculture Dealers Utilizing Precision Agriculture Equipment/Technology, U.S., 2022-2023

- Figure 8: Anticipated Challenges Facing North American Ag Equipment Dealers in 2024

- Figure 9: 2024 Trends in Automation Preferences for Service Processes Among Equipment Dealers

- Figure 10: Dealers Set to Boost Online Sales and E-commerce Strategies in 2024

- Figure 11: Dealership Adoption of Text Messaging for Service Updation in North America

- Figure 12: Dealership Adoption of Data Analytics and Reporting for Decision-Making

- Figure 13: End User Revenue Break-up of Dealers with 1-20 Employees

- Figure 14: End User Revenue Break-up of Dealers with 21-40 Employees

- Figure 15: End User Revenue Break-up of Dealers with 41-60 Employees

- Figure 16: End User Revenue Break-up of Dealers with 60+ Employees

- Figure 17: Fluctuations in the Market

- Figure 18: Innovation-Driven Changes in Technology

- Figure 19: Environmental Concerns

- Figure 20: Gap Analysis

- Figure 21: Strategies Adopted by Input Dealers Overview

- Figure 22: Current and Future Adoption of Agricultural Technology Offerings (by Dealerships)

- Figure 23: Profitability of Agricultural Services Based on Dealer Offerings

- Figure 24: Dealers Facing Key Barriers to Precision Agriculture Growth (2017-2023): Financial and Human Resource Barriers

- Figure 25: Dealers Facing Operational and Technological Barriers to Precision Agriculture Growth (2017-2023)

- Figure 26: Data Triangulation

List of Tables

- Table 1: Opportunities and Challenges across Regions

- Table 2: Comparison of Dealers

- Table 3: Corporate Strategies

- Table 4: Business Strategies

- Table 5: Product Analysis

- Table 6: Pricing Analysis

Introduction to the Agriculture Dealers Market

The agriculture dealers market plays a crucial role in the agricultural supply chain by bridging the gap between manufacturers and end users, primarily farmers. These dealers provide essential services, including supplying agricultural equipment, precision technologies, and inputs such as seeds, fertilizers, and crop protection chemicals. With a strong focus on enhancing productivity, sustainability, and efficiency in farming practices, agriculture dealers support farmers through tailored solutions, technology adoption, and value-added services. Their significance is further amplified by their role in promoting innovative practices, offering customized equipment, and ensuring accessibility to diverse products across various regions. By aligning their strategies with emerging trends and regional needs, agriculture dealers are positioned as key contributors to the modernization and growth of the global agricultural sector.

Market Introduction

The agriculture dealers market is a pivotal component of the agricultural supply chain, facilitating the efficient distribution of equipment, precision agriculture technologies, and essential inputs such as seeds, fertilizers, and crop protection chemicals. This market supports farmers by offering advanced solutions tailored to specific regional needs, enabling increased productivity and sustainable practices. Agriculture dealers play a critical role in promoting technology adoption, providing customized tools, and ensuring the timely availability of vital products to farmers. As farming operations continue to evolve with mechanization and advancements in digital transformation, the agriculture dealers market has become increasingly focused on integrating precision agriculture tools and eco-friendly practices to meet modern farming demands. The dynamic nature of the agriculture dealers market positions it as a key driver in enhancing the efficiency and sustainability of global agricultural practices.

Market Impact

The agriculture dealers market significantly impacts the global agricultural sector by enhancing productivity and fostering sustainable farming practices. These dealers act as critical intermediaries, ensuring farmers have timely access to essential equipment, precision technologies, and agricultural inputs. Agriculture dealers streamline supply chains and reduce logistical challenges by bridging the gap between manufacturers and end users.

The market drives the adoption of advanced technologies, such as precision farming tools, which optimize resource utilization and improve crop yields. Additionally, it supports the transition toward eco-friendly practices, offering sustainable products that align with modern environmental standards. Agriculture dealers also play a vital role in educating farmers and providing training on advanced equipment and techniques.

However, the market faces fluctuating commodity prices, supply chain disruptions, and evolving regulatory requirements. Despite these obstacles, the increasing demand for sustainable agriculture and digital tools positions the agriculture dealers market as a cornerstone for innovation and growth in the agricultural sector, ensuring its long-term relevance and impact.

Agriculture Dealers Market Segmentation:

- Equipment Dealers

- Input Dealers

- Precision Agriculture Dealers

Recent developments of Precision Agriculture Technology Providers:

- On September 19, 2023, King Ranch Ag & Turf, a Texas-based dealer of John Deere products, acquired Brookside Equipment, a dealership with nine locations around Houston. This acquisition expanded King Ranch's network to 14 locations, including new stores in Huntsville and Livingston, and introduced turfgrass sales and job creation plans.

- On July 13, 2023, TTG Equipment and Kenn-Feld Group, based in Ohio, announced their merger, effective August 21, 2023, under the new name TRULAND Equipment. This merger consolidated 18 John Deere dealership locations across Indiana and Ohio, offering an enhanced product range without relocating staff.

- On April 24, 2023, TTG Equipment and Kenn-Feld Group finalized their plans to merge into TRULAND Equipment, uniting 18 John Deere dealership locations across Indiana and Ohio. This merger retained existing headquarters and staff while expanding product offerings.

- On February 14, 2023, Hutson Inc., a multi-state John Deere dealership, acquired Classic Power Equipment in Williamsburg, Michigan. This acquisition further strengthened Hutson's network of 31 locations across several states, aiming to deliver enhanced value through economies of scale.

How can this report add value to an organization?

Innovation Strategy: This offers insights into various products and solutions that align with agriculture dealers. By gaining a comprehensive understanding of the agriculture dealers market and evaluating the challenges and opportunities presented by the market, stakeholders in the market can assess the potential impact on their respective organizations.

Growth/Marketing Strategy: The agriculture dealers market has been experiencing rapid growth due to innovations and collaborations among major industry players. Dealers and companies have been forming strategic partnerships and expanding operations to reach broader markets, with a focus on providing advanced solutions. By offering advanced precision agriculture tools, including AI-driven platforms and IoT-enabled solutions, dealers can cater to both large-scale agribusinesses and smaller farms. Emphasizing product development and data-driven farming practices will allow dealers to penetrate new markets, enhance agricultural productivity, and promote sustainability in farming operations.

Competitive Strategy: The report provides an analysis and profiling of key dealers within the agriculture dealers market with a focus on revenue streams, pricing models, distribution channels, and more. Additionally, it thoroughly examines equipment dealers, input dealers, and precision agriculture dealers, enabling readers to understand how market players compare and presenting a clear view of the competitive landscape.

Research Methodology

- The scope of this report focuses on the agriculture dealers market and key companies operating in the agriculture dealers market.

- The base currency considered for the market analysis is US$. Currencies other than the US$ have been converted to the US$ for all statistical calculations, considering the average conversion rate for that particular year.

- The currency conversion rate was taken from the historical exchange rate on the FxTop website.

- Recent developments from January 2021 to November 2024 have been considered in this research study.

- The information rendered in the report is a result of in-depth primary interviews, surveys, and secondary analysis.

- Where relevant information was not available, proxy indicators and extrapolation were employed.

- Technologies currently used are expected to persist with no major breakthroughs in technology.

Secondary Research

This research study of the agriculture dealers market involves the usage of extensive secondary research, directories, company websites, and annual reports. It also makes use of databases, such as ITU, Hoovers, Bloomberg, Businessweek, and Factiva, to collect useful and effective information for an extensive, technical, market-oriented study.

Table of Contents

Executive Summary

Scope and Definition

1 Market: Impact Analysis

- 1.1 Economic Factors

- 1.1.1 Currency Fluctuation

- 1.2 Policy and Regulatory Influences

- 1.2.1 Trade Policies

- 1.2.2 Government Support

- 1.3 Environmental Factors

- 1.3.1 Climate Change and Agriculture

- 1.3.2 Role of Agriculture Dealers

- 1.4 Business and Corporate Strategies

- 1.5 Essential Strategies for Dealers' Success

- 1.5.1 Core Capabilities

- 1.5.2 Integrated Applications

2 Market Segmentation

- 2.1 Equipment Dealers

- 2.1.1 Product and Pricing Analysis

- 2.1.2 Risk and Gap Analysis

- 2.1.3 Strategies Adopted by Equipment Dealers

- 2.1.4 Future Outlook and Trends

- 2.1.5 Country Analysis

- 2.1.5.1 U.S.

- 2.1.5.2 China

- 2.1.5.3 India

- 2.1.5.4 Germany

- 2.1.5.5 Brazil

- 2.1.6 Comparison and Outlook of Key OEM Dealers

- 2.1.7 Insights and Estimated Results from Agricultural Equipment Dealers

- 2.1.8 End User Revenue Break-up of Dealers (by Employment Size), 2022

- 2.1.9 End User Revenue Break-up of Different OEM Dealers, 2022

- 2.1.10 List of Key Dealers

- 2.1.11 Dealers of Major OEM Companies

- 2.2 Input Dealers

- 2.2.1 Product and Pricing Analysis

- 2.2.2 Risk and Gap Analysis

- 2.2.2.1 Risks for Input Dealers

- 2.2.2.2 Gaps

- 2.2.3 Strategies Adopted by Input Dealers

- 2.2.4 Future Outlook and Trends

- 2.2.5 Country Analysis

- 2.2.5.1 U.S.

- 2.2.5.2 China

- 2.2.5.3 India

- 2.2.5.4 Germany

- 2.2.5.5 Brazil

- 2.2.6 Comparison and Outlook of Key Input Companies

- 2.2.7 List of Key Dealers

- 2.3 Precision Agriculture Dealers

- 2.3.1 Dealer Offerings of Precision Services

- 2.3.2 Profitability Of Precision Service Offerings

- 2.3.3 Barriers to Growth and Expansion

- 2.3.3.1 Dealer Barriers

3 Recommendations and Future Outlook

- 3.1 Recommendations for Different Stakeholders in the Market

- 3.1.1 Recommendations for Equipment Manufacturers

- 3.1.2 Recommendations for Agriculture Input Producers

- 3.1.3 Recommendations Precision Agriculture Solution Providers

- 3.1.4 Recommendations for Farmers

4 Research Methodology

- 4.1 Data Sources

- 4.1.1 Primary Data Sources

- 4.1.2 Secondary Data Sources

- 4.1.3 Data Triangulation