|

|

市場調査レポート

商品コード

1637364

欧州のゲノムシーケンシング市場:製品・エンドユーザー・国別の分析・予測 (2024-2033年)Europe Genome Sequencing Market: Focus on Product, End User, and Country - Analysis and Forecast: 2024-2033 |

||||||

カスタマイズ可能

|

|||||||

| 欧州のゲノムシーケンシング市場:製品・エンドユーザー・国別の分析・予測 (2024-2033年) |

|

出版日: 2025年01月20日

発行: BIS Research

ページ情報: 英文 67 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

欧州のゲノムシーケンシングの市場規模は、2024年の22億2,000万米ドルから、予測期間中は14.04%のCAGRで推移し、2033年には72億3,000万米ドルの規模に成長すると予測されています。

ゲノムシーケンシングの生物のDNAの全塩基配列を特定するプロセスを通じて、科学者はその全遺伝子構成を解読することができます。このプロセスは、遺伝的変異とそれらが健康や病気に及ぼす潜在的な影響の特定に役立ちます。欧州のゲノムシーケンシング市場は、シーケンシングコストの低下、ゲノム検査の導入拡大、次世代シーケンシング技術を活用した出生前・新生児スクリーニングプログラムの需要拡大などの要因により拡大しています。

複雑な遺伝情報のより詳細で正確な洞察を提供するロングリードシーケンシングの用途拡大が、市場成長をさらに後押ししています。また、欧州全域のゲノムシーケンシングプロジェクトに対する政府の投資やイニシアチブがアクセシビリティと採用を大幅に後押ししています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2024-2033年 |

| 2024年評価 | 22億2,000万米ドル |

| 2033年予測 | 72億3,000万米ドル |

| CAGR | 14.04% |

ヘルスケアと精密医療の開発に注目が集まる中、ゲノムシーケンシングは診断、個別化治療、疾病予防を改善するための重要なツールとなりつつあります。こうした動向が欧州のゲノムシーケンシング市場の将来を形成し、継続的な技術革新と消費者のアクセス拡大を確実なものにする見通しです。

遺伝子検査に対する需要の高まり、精密医療の利用の拡大、シーケンシング技術の向上などが欧州のゲノムシーケンシング市場の顕著な成長に寄与しています。研究、診断、個別化医療においてますます重要なツールとなっているのが、生物の全DNA配列を解読するゲノムシーケンシングです。

市場セグメンテーション

セグメンテーション1:製品別

- キット

- 機器

- ソフトウェア

セグメンテーション2:エンドユーザー別

- 製薬・バイオテクノロジー企業

- 病院・診断ラボ

- 集団シーケンシング機関

- 研究・学術機関

- その他

セグメンテーション3:地域別

- 欧州

- ドイツ

- 英国

- スペイン

- イタリア

- フランス

- その他

当レポートでは、欧州のゲノムシーケンシングの市場を調査し、主要動向、市場影響因子の分析、法規制環境、技術開発・特許の動向、市場規模の推移・予測、各種区分・主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

エグゼクティブサマリー

範囲と定義

第1章 欧州のゲノムシーケンシング市場:業界分析

- 主な動向:現在および将来の影響評価

- ゲノムシーケンシングにおけるAIと機械学習の統合

- 主要企業間のパートナーシップ、提携、事業拡大の増加

- 規制分析

- 価値とサプライチェーンの分析

第2章 欧州のゲノムシーケンシング市場:将来の展望

- 特許分析

- 特許分析(年別)

- 特許分析(国別)

- 競合ベンチマーキング

- 市場シェア

- ブランド認知

- 臨床導入の順序

- 今後の展望

第3章 ゲノムシーケンシング市場:地域別

- 地域概要

- 推進要因・抑制要因

- 欧州

- 地域概要

- 市場成長推進要因

- 市場課題

- 製品別

- エンドユーザー別

- ドイツ

- 英国

- スペイン

- イタリア

- フランス

- その他

第4章 ゲノムシーケンシング市場:競合ベンチマーキング・企業プロファイル

- 主要戦略と開発

- パートナーシップ、提携、事業拡大

- 法規制

- 新しいサービス

- M&A

- 資金調達活動

- 企業プロファイル

- Eurofins Scientific S.E.

- F. Hoffmann-La Roche Ltd.

- OncoDNA

- Oxford Nanopore Technologies plc

- QIAGEN N.V.

第5章 調査手法

List of Figures

- Figure 1: Europe Genome Sequencing Market, $Billion, 2024, 2028, and 2033

- Figure 2: Genome Sequencing Market (by Region), $Billion, 2023, 2027, and 2033

- Figure 3: Europe Genome Sequencing Market (by End User), $Billion, 2023, 2027, and 2033

- Figure 4: Europe Genome Sequencing Market (by Product), $Billion, 2023, 2027, and 2033

- Figure 5: Key Players' Strategic Priorities

- Figure 6: Potential Future Directions

- Figure 7: Companies Utilizing Artificial Intelligence in Genomics

- Figure 8: Share of Partnerships, Alliances, and Business Expansions vs Other Strategies

- Figure 9: Some of the Key Partnerships, Alliances, and Business Expansions and their Impact on the Sequencing Market

- Figure 10: Value and Supply Chain Analysis, Genome Sequencing Market

- Figure 11: Genome Sequencing Market, Patent Analysis (by Year), January 2021-December 2023

- Figure 12: Genome Sequencing Market, Patent Analysis (by Country), January 2021-December 2023

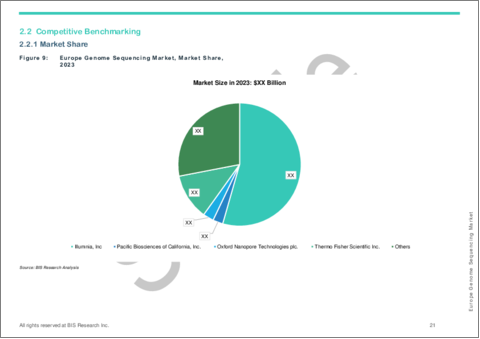

- Figure 13: Europe Genome Sequencing Market, Market Share, 2023

- Figure 14: Clinical Utility of Genome Sequencing

- Figure 15: Future Outlook for Genome Sequencing

- Figure 16: Germany Genome Sequencing Market, $Billion, 2023-2033

- Figure 17: U.K. Genome Sequencing Market, $Billion, 2023-2033

- Figure 18: Spain Genome Sequencing Market, $Billion, 2022-2023

- Figure 19: Italy Genome Sequencing Market, $Billion, 2023-2033

- Figure 20: France Genome Sequencing Market, $Billion, 2023-2033

- Figure 21: Partnerships, Alliances, and Business Expansions Activities, January 2020-April 2024

- Figure 22: Regulatory and Legal Activities, January 2020-April 2024

- Figure 23: New Offerings, January 2020-April 2024

- Figure 24: Mergers and Acquisitions, January 2020-April 2024

- Figure 25: Funding Activities, January 2020-April 2024

- Figure 26: Data Triangulation

- Figure 27: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Genome Sequencing Market, Market Opportunities

- Table 3: Current and Future Impact of Trends

- Table 4: Regulatory Landscape (by Country)

- Table 5: Comparison of Some of the Key Sequencers

- Table 6: Genome Sequencing Market (by Region), $Billion, 2023-2033

- Table 7: Europe Genome Sequencing Market (by Product), $Billion, 2023-2033

- Table 8: Canada Genome Sequencing Market (by End User), $Billion, 2023-2033

- Table 9: Germany Genome Sequencing Market (by Product), $Billion, 2023-2033

- Table 10: U.K. Genome Sequencing Market (by Product), $Billion, 2023-2033

- Table 11: Spain Genome Sequencing Market (by Product), $Billion, 2023-2033

- Table 12: Italy Genome Sequencing Market (by Product), $Billion, 2023-2033

- Table 13: France Genome Sequencing Market (by Product), $Billion, 2023-2033

- Table 14: Rest-of-Europe Genome Sequencing Market, $Billion, 2023-2033

- Table 15: Rest-of-Europe Genome Sequencing Market (by Product), $Billion, 2023-2033

- Table 16: Europe Genome Sequencing Market, Key Development Analysis, January 2020-April 2024

Introduction to Europe Genome Sequencing Market

The Europe genome sequencing market was valued at $2.22 billion in 2024 and is expected to reach $7.23 billion by 2033, growing at a CAGR of 14.04% between 2024 and 2033. Through the process of identifying the entire sequence of an organism's DNA, genome sequencing allows scientists to decipher its entire genetic composition. This process helps identify genetic variations and their potential impact on health and disease. The genome sequencing market in Europe is expanding due to factors such as the decreasing cost of sequencing, increasing adoption of genome testing, and the growing demand for prenatal and newborn screening programs that leverage next-generation sequencing technologies.

The expanding applications of long-read sequencing, which provide more detailed and accurate insights into complex genetic information, further drive market growth. In addition, government investments and initiatives in genome sequencing projects across Europe have significantly boosted accessibility and adoption.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2024 - 2033 |

| 2024 Evaluation | $2.22 Billion |

| 2033 Forecast | $7.23 Billion |

| CAGR | 14.04% |

As the area keeps its attention on developments in healthcare and precision medicine, genome sequencing is becoming a critical tool for improving diagnostics, personalized treatments, and disease prevention. These trends are set to shape the future of the genome sequencing market in Europe, ensuring continued innovation and wider consumer access.

Market Introduction

The growing demand for genetic testing, the growing use of precision medicine, and improvements in sequencing technologies are all contributing to the notable growth of the European genome sequencing market. An increasingly important tool in research, diagnostics, and individualized healthcare is genome sequencing, which decodes an organism's entire DNA sequence.

As next-generation sequencing (NGS) becomes more widely available and sequencing costs decline, the technology becomes more accessible, facilitating its integration into European healthcare systems. Prenatal and neonatal screening, cancer diagnosis, rare disease detection, and pharmacogenomics are important uses.

The market is being further stimulated by government programs and investments in genomic research projects, such as the UK's 100,000 Genomes Project. More precise and thorough genetic analysis is now possible thanks to the growing use of long-read sequencing technologies, improving clinical outcomes.

As Europe continues to prioritize innovation in healthcare, the genome sequencing market is set to play a pivotal role in advancing medical research and delivering personalized treatments.

Market Segmentation

Segmentation 1: by Product

- Kits

- Instruments

- Software

Segmentation 2: by End User

- Pharmaceutical and Biotechnology Companies

- Hospitals and Diagnostic Laboratories

- Population Sequencing Organizations

- Research and Academic Institutes

- Others

Segmentation 3: by Region

- Europe

- Germany

- U.K.

- Spain

- Italy

- France

- Rest-of-Europe

How can this report add value to an organization?

Product/Innovation Strategy: The Europe genome sequencing market has been segmented based on various categories, such as by product, end user, and country. This can help readers get a clear overview of which segments account for the largest share and which ones are well-positioned to grow in the coming years.

Competitive Strategy: The Europe genome sequencing market is a highly fragmented market, with many public and few private companies. Key players in the genome sequencing market analyzed and profiled in the study involve established players that offer various kinds of products.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, and market penetration.

Some prominent names established in this market are:

- Eurofins Scientific S.E.

- F. Hoffmann-La Roche Ltd.

- OncoDNA

- Oxford Nanopore Technologies plc

- QIAGEN N.V.

Table of Contents

Executive Summary

Scope and Definition

1 Europe Genome Sequencing Market: Industry Analysis

- 1.1 Key Trends: Current and Future Impact Assessment

- 1.1.1 Integration of Artificial Intelligence and Machine Learning in Genome Sequencing

- 1.1.2 Increasing Partnerships, Alliances, and Business Expansions among Key Players

- 1.2 Regulatory Analysis

- 1.3 Value and Supply Chain Analysis

2 Europe Genome Sequencing Market: Future Outlook

- 2.1 Patent Analysis

- 2.1.1 Patent Analysis (by Year)

- 2.1.2 Patent Analysis (by Country)

- 2.2 Competitive Benchmarking

- 2.2.1 Market Share

- 2.2.2 Brand Recognition

- 2.3 Sequencing Clinical Adoption

- 2.4 Future Outlook

3 Genome Sequencing Market (By Region)

- 3.1 Regional Summary

- 3.2 Drivers and Restraints

- 3.3 Europe

- 3.3.1 Regional Overview

- 3.3.2 Driving Factors for Market Growth

- 3.3.3 Factors Challenging the Market

- 3.3.4 By Product

- 3.3.5 By End User

- 3.3.6 Germany

- 3.3.6.1 By Product

- 3.3.7 U.K.

- 3.3.7.1 By Product

- 3.3.8 Spain

- 3.3.8.1 By Product

- 3.3.9 Italy

- 3.3.9.1 By Product

- 3.3.10 France

- 3.3.10.1 By Product

- 3.3.11 Rest-of-Europe

- 3.3.11.1 By Product

4 Genome Sequencing Market - Competitive Benchmarking and Company Profiles

- 4.1 Key Strategies and Development

- 4.1.1 Partnerships, Alliances, and Business Expansions

- 4.1.2 Regulatory and Legal Activities

- 4.1.3 New Offerings

- 4.1.4 Mergers and Acquisitions

- 4.1.5 Funding Activities

- 4.2 Company Profiles

- 4.2.1 Eurofins Scientific S.E.

- 4.2.1.1 Overview

- 4.2.1.2 Top Products and Services

- 4.2.1.3 Top Competitors

- 4.2.1.4 Key Personnel

- 4.2.1.5 Analyst View

- 4.2.2 F. Hoffmann-La Roche Ltd.

- 4.2.2.1 Overview

- 4.2.2.2 Top Products and Services

- 4.2.2.3 Top Competitors

- 4.2.2.4 Key Personnel

- 4.2.2.5 Analyst View

- 4.2.3 OncoDNA

- 4.2.3.1 Overview

- 4.2.3.2 Top Products and Services

- 4.2.3.3 Top Competitors

- 4.2.3.4 Key Personnel

- 4.2.3.5 Analyst View

- 4.2.4 Oxford Nanopore Technologies plc

- 4.2.4.1 Overview

- 4.2.4.2 Top Products and Services

- 4.2.4.3 Top Competitors

- 4.2.4.4 Key Personnel

- 4.2.4.5 Analyst View

- 4.2.5 QIAGEN N.V.

- 4.2.5.1 Overview

- 4.2.5.2 Top Products and Services

- 4.2.5.3 Top Competitors

- 4.2.5.4 Key Personnel

- 4.2.5.5 Analyst View

- 4.2.1 Eurofins Scientific S.E.

5 Research Methodology

- 5.1 Data Sources

- 5.1.1 Primary Data Sources

- 5.1.2 Secondary Data Sources

- 5.1.3 Data Triangulation