|

|

市場調査レポート

商品コード

1622835

欧州の海上サイバーセキュリティ市場:エンドユーザー別、ソリューション別、サービス別、脅威タイプ別、国別 - 分析と予測(2023年~2033年)Europe Maritime Cybersecurity Market: Focus on End User, Solution, Service, Threat Type, and Country-Wise Analysis - Analysis and Forecast, 2023-2033 |

||||||

カスタマイズ可能

|

|||||||

| 欧州の海上サイバーセキュリティ市場:エンドユーザー別、ソリューション別、サービス別、脅威タイプ別、国別 - 分析と予測(2023年~2033年) |

|

出版日: 2024年12月27日

発行: BIS Research

ページ情報: 英文 73 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

欧州の海上サイバーセキュリティの市場規模は、2023年の9億7,230万米ドルから2033年には34億9,290万米ドルに達し、予測期間の2023年~2033年のCAGRは13.64%になると予測されています。

海事産業のデジタル資産とネットワークをオンラインの脅威から守ることが、欧州における海事サイバーセキュリティの主な目標です。海上業務のデジタル技術への依存度が高まるにつれ、サイバーセキュリティは効率性、安全性、リスク軽減を確保する上で極めて重要になっています。こうした危険は、ウイルスや詐欺のような広範なサイバー攻撃から、陸上のインフラや船舶システムを標的にしたより複雑な攻撃まで多岐にわたります。サイバーセキュリティの侵害によって、事業運営の中断、金銭的損失、環境への害、さらには死亡など、深刻な影響が生じる可能性があります。海運会社、港湾当局、規制機関、業界団体は、欧州の海事サイバーセキュリティ市場における重要な参入企業です。

効果的なサイバーセキュリティ管理には、リスクアセスメント、アクセス制御、インシデント対応計画、継続的な従業員研修などの手法が必要です。国際海事機関(IMO)や国際船舶・港湾施設セキュリティコード(ISPSコード)が定めるような世界のルールは、海事セクターにおけるサイバーセキュリティを向上させるための枠組みを提供しています。サイバー脅威に効果的に対処するためには、技術革新や情報共有とともに、官民の協力が不可欠です。海事産業がデジタル化を進める中、欧州の海事事業全体の回復力と持続可能性を確保するためには、強固なサイバーセキュリティ対策が不可欠です。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2023年~2033年 |

| 2023年の評価 | 9億7,230万米ドル |

| 2033年の予測 | 34億9,290万米ドル |

| CAGR | 13.64% |

海事セクターの通信、航行、業務におけるデジタル技術への依存度の高まりが、欧州の海事サイバーセキュリティ市場の顕著な拡大を促しています。強力なサイバーセキュリティは、船舶、港湾、関連インフラを保護する上で極めて重要です。なぜなら、このようなデジタル化の進展に伴い、サイバー攻撃に対する感受性が高まっているからです。このような危険は、業務の中断、金銭的損失、環境破壊、人的安全への脅威を引き起こす可能性があります。ウイルスやフィッシング詐欺から、重要なシステムを標的にしたより巧妙な攻撃まで、その範囲は多岐にわたります。

海運業界では、クラウド・コンピューティング、自動化、モノのインターネット(IoT)デバイスの利用が増加しており、市場を後押ししています。ISPSコードや国際海事機関(IMO)の規制などの国際基準を遵守するため、海運会社、港湾当局、規制機関などの主要な業界参加者は、サイバーセキュリティの枠組みを強化することに注力しています。さらに、変化するサイバーセキュリティの課題に取り組むには、官民の協力、脅威検知の改善、スタッフの継続的な訓練が必要です。欧州が海事産業におけるデジタル変革を受け入れ、より安全で堅牢なオペレーションを保証し続ける中で、効率的なサイバーセキュリティ・ソリューションのニーズは高まると予想されます。

当レポートでは、欧州の海上サイバーセキュリティ市場について調査し、市場の概要とともに、エンドユーザー別、ソリューション別、サービス別、脅威タイプ別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場

- 動向:現在および将来の影響評価

- サプライチェーンの概要

- 規制と環境に関する考慮事項

- エコシステム/進行中のプログラム

- スタートアップ資金調達の概要

- 市場力学の概要

第2章 地域

- 地域別概要

- 促進要因と抑制要因

- 欧州

第3章 市場-競合ベンチマーキングと企業プロファイル

- 今後の見通し

- 地理的評価

- SAAB AB

- Thales

- Leonardo S.p.A.

- Airbus SE

- BAE Systems

- Terma

- Westminster Group Plc

- Kongsberg Digital

- Smiths Group plc

- Nettitude Ltd.

- HGH

- その他の主要企業

第4章 調査手法

List of Figures

- Figure 1: Maritime Cybersecurity Market (by Region), $Million, 2022, 2023, and 2033

- Figure 2: Europe Maritime Cybersecurity Market (by End User), $Million, 2022, 2023, and 2033

- Figure 3: Europe Maritime Cybersecurity Market (by Solution), $Million, 2022, 2023, and 2033

- Figure 4: Europe Maritime Cybersecurity Market (by Service), $Million, 2022, 2023, and 2033

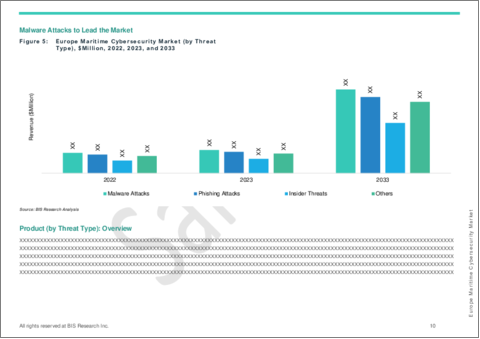

- Figure 5: Europe Maritime Cybersecurity Market (by Threat Type), $Million, 2022, 2023, and 2033

- Figure 6: Maritime Cybersecurity Market, Recent Developments

- Figure 7: Value Chain Analysis

- Figure 8: Impact Analysis of Market Navigating Factors, 2023-2033

- Figure 9: U.K. Maritime Cybersecurity Market, $Million, 2022-2033

- Figure 10: Germany Maritime Cybersecurity Market, $Million, 2022-2033

- Figure 11: France Maritime Cybersecurity Market, $Million, 2022-2033

- Figure 12: Rest-of-Europe Maritime Cybersecurity Market, $Million, 2022-2033

- Figure 13: Strategic Initiatives, 2020-2024

- Figure 14: Share of Strategic Initiatives, 2020-2024

- Figure 15: Data Triangulation

- Figure 16: Top-Down and Bottom-Up Approach

- Figure 17: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Maritime Cybersecurity Market, Opportunities across Regions

- Table 3: From a policy perspective, the U.K. and the U.S. are the leading geographies with a seemingly favorable environment.

- Table 4: Maritime Cybersecurity (by Region), $Million, 2022-2033

- Table 5: Europe Maritime Cybersecurity Market (by End User), $Million, 2022-2033

- Table 6: Europe Maritime Cybersecurity Market (by Solution), $Million, 2022-2033

- Table 7: Europe Maritime Cybersecurity Market (by Service), $Million, 2022-2033

- Table 8: Europe Maritime Cybersecurity Market (by Threat Type), $Million, 2022-2033

- Table 9: U.K. Maritime Cybersecurity Market (by End User), $Million, 2022-2033

- Table 10: U.K. Maritime Cybersecurity Market (by Solution), $Million, 2022-2033

- Table 11: U.K. Maritime Cybersecurity Market (by Service), $Million, 2022-2033

- Table 12: U.K. Maritime Cybersecurity Market (by Threat Type), $Million, 2022-2033

- Table 13: Germany Maritime Cybersecurity Market (by End User), $Million, 2022-2033

- Table 14: Germany Maritime Cybersecurity Market (by Solution), $Million, 2022-2033

- Table 15: Germany Maritime Cybersecurity Market (by Service), $Million, 2022-2033

- Table 16: Germany Maritime Cybersecurity Market (by Threat Type), $Million, 2022-2033

- Table 17: France Maritime Cybersecurity Market (by End User), $Million, 2022-2033

- Table 18: France Maritime Cybersecurity Market (by Solution), $Million, 2022-2033

- Table 19: France Maritime Cybersecurity Market (by Service), $Million, 2022-2033

- Table 20: France Maritime Cybersecurity Market (by Threat Type), $Million, 2022-2033

- Table 21: Rest-of-Europe Maritime Cybersecurity Market (by End User), $Million, 2022-2033

- Table 22: Rest-of-Europe Maritime Cybersecurity Market (by Solution), $Million, 2022-2033

- Table 23: Rest-of-Europe Maritime Cybersecurity Market (by Service), $Million, 2022-2033

- Table 24: Rest-of-Europe Maritime Cybersecurity Market (by Threat Type), $Million, 2022-2033

Introduction to Europe Maritime Cybersecurity Market

The Europe maritime cybersecurity market is projected to reach $3,492.9 million by 2033 from $972.3 million in 2023, growing at a CAGR of 13.64% during the forecast period 2023-2033. Protecting digital assets and networks in the maritime industry from online threats is the main goal of maritime cybersecurity in Europe. As maritime operations depend more and more on digital technologies, cybersecurity has become crucial to ensuring efficiency, safety, and risk mitigation. These dangers range from widespread cyberattacks like viruses and scams to more complex attacks that target shore-based infrastructure and vessel systems. Serious repercussions, including interruptions in business operations, monetary losses, harm to the environment, and even death, can result from cybersecurity breaches. Shipping firms, port authorities, regulatory agencies, and trade associations are important participants in the European maritime cybersecurity market. Techniques like risk assessment, access control, incident response planning, and continuous employee training are necessary for effective cybersecurity management. Global rules, like those established by the International Maritime Organization (IMO) and the International Ship and Port Facility Security (ISPS) Code, provide frameworks for improving cybersecurity within the maritime sector. Collaboration between public and private sectors, along with technological innovation and information sharing, is crucial to address cyber threats effectively. As the maritime industry continues its digital transformation, robust cybersecurity measures will be vital for ensuring resilience and sustainability across European maritime operations.

Market Introduction

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2023 - 2033 |

| 2023 Evaluation | $972.3 Million |

| 2033 Forecast | $3,492.9 Million |

| CAGR | 13.64% |

The maritime sector's growing dependence on digital technologies for communication, navigation, and operations is driving a notable expansion in the European maritime cybersecurity market. Strong cybersecurity is crucial to protecting ships, ports, and associated infrastructure because of the increased susceptibility to cyberattacks that comes with this increased digitization. These dangers can cause operational disruptions, monetary losses, environmental harm, and threats to human safety. They range from viruses and phishing scams to more sophisticated attacks that target vital systems.

The increasing use of cloud computing, automation, and Internet of Things (IoT) devices in the maritime industry is propelling the market. In order to adhere to international standards like the ISPS Code and the regulations of the International Maritime Organization (IMO), major industry participants, including shipping companies, port authorities, and regulatory bodies, are concentrating on fortifying their cybersecurity frameworks. Furthermore, tackling changing cybersecurity challenges requires cooperation between the public and private sectors, improvements in threat detection, and continual staff training. The need for efficient cybersecurity solutions is anticipated to increase as Europe continues to embrace digital transformation in the maritime industry, guaranteeing safer and more robust operations.

Market Segmentation:

Segmentation 1: by Solution

- Threat Detection and Response

- Identity and Access Management

- Network Security

- Data Protection and Encryption

- Others

Segmentation 2: by Service

- Training and Consulting Services

- Risk Assessment and Investigation

- Support and Maintenance

- Managed Services

Segmentation 3: by Threat Type

- Malware Attacks

- Phishing Attacks

- Insider Threats

- Others

Segmentation 4: by End User

- Port Authorities

- Shipping Companies and Transportation

- Maritime Insurers

- Others

Segmentation 5: by Country

- U.K.

- Germany

- France

- Rest-of-Europe

How can this report add value to an organization?

Product/Innovation Strategy: The product segment helps the reader understand the different types of services available for deployment and their potential in Europe region. Moreover, the study provides the reader with a detailed understanding of the Europe maritime cybersecurity market by products based on solution, service, and threat type.

Growth/Marketing Strategy: The Europe maritime cybersecurity market has seen major development by key players operating in the market, such as business expansion, partnership, collaboration, and joint venture. The favored strategy for the companies has been partnerships to strengthen their position in the Europe maritime cybersecurity market

Competitive Strategy: Key players in the Europe maritime cybersecurity market analyzed and profiled in the study involve maritime cybersecurity products and service offering companies. Moreover, a detailed competitive benchmarking of the players operating in the Europe maritime cybersecurity market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Table of Contents

Executive Summary

Scope and Definition

1 Markets

- 1.1 Trends: Current and Future Impact Assessment

- 1.1.1 Artificial Intelligence and Machine Learning in Cybersecurity

- 1.1.2 Increased Connectivity

- 1.1.3 Zero Trust Architecture (ZTA)

- 1.2 Supply Chain Overview

- 1.3 Regulatory and Environmental Considerations

- 1.3.1 Regulatory Implications

- 1.4 Ecosystem/Ongoing Programs

- 1.4.1 Series of Assessments, including Threat Modeling and Open-Source Intelligence, Performed by NCC Group

- 1.5 Startup Funding Summary

- 1.6 Market Dynamics Overview

- 1.6.1 Business Drivers

- 1.6.1.1 Increasing Cyber Threats and Attacks

- 1.6.1.2 Digitalization of Maritime Operations

- 1.6.1.3 Global Supply Chain Reliance on Maritime Transport

- 1.6.2 Business Challenges

- 1.6.2.1 Lack of Trained Personnel

- 1.6.2.2 Complex Regulatory Environment

- 1.6.3 Business Opportunities

- 1.6.3.1 Cybersecurity for Autonomous Vessels

- 1.6.3.2 Integration of Internet of Things (IoT) and Operational Technology (OT) Security

- 1.6.1 Business Drivers

2 Regions

- 2.1 Regional Summary

- 2.2 Drivers and Restraints

- 2.3 Europe

- 2.3.1 Regional Overview

- 2.3.2 Driving Factors for Market Growth

- 2.3.3 Factors Challenging the Market

- 2.3.4 Application

- 2.3.5 Product

- 2.3.6 U.K.

- 2.3.7 Application

- 2.3.8 Product

- 2.3.9 Germany

- 2.3.10 Application

- 2.3.11 Product

- 2.3.12 France

- 2.3.13 Application

- 2.3.14 Product

- 2.3.15 Rest-of-Europe

- 2.3.16 Application

- 2.3.17 Product

3 Markets - Competitive Benchmarking & Company Profiles

- 3.1 Next Frontiers

- 3.2 Geographic Assessment

- 3.2.1 SAAB AB

- 3.2.1.1 Overview

- 3.2.1.2 Top Products/Product Portfolio

- 3.2.1.3 Top Competitors

- 3.2.1.4 Target Customers

- 3.2.1.5 Key Personnel

- 3.2.1.6 Analyst View

- 3.2.1.7 Market Share, 2022

- 3.2.2 Thales

- 3.2.2.1 Overview

- 3.2.2.2 Top Products/Product Portfolio

- 3.2.2.3 Top Competitors

- 3.2.2.4 Target Customers

- 3.2.2.5 Key Personnel

- 3.2.2.6 Analyst View

- 3.2.2.7 Market Share, 2022

- 3.2.3 Leonardo S.p.A.

- 3.2.3.1 Overview

- 3.2.3.2 Top Products/Product Portfolio

- 3.2.3.3 Top Competitors

- 3.2.3.4 Target Customers

- 3.2.3.5 Key Personnel

- 3.2.3.6 Analyst View

- 3.2.3.7 Market Share, 2022

- 3.2.4 Airbus SE

- 3.2.4.1 Overview

- 3.2.4.2 Top Products/Product Portfolio

- 3.2.4.3 Top Competitors

- 3.2.4.4 Target Customers

- 3.2.4.5 Key Personnel

- 3.2.4.6 Analyst View

- 3.2.4.7 Market Share, 2022

- 3.2.5 BAE Systems

- 3.2.5.1 Overview

- 3.2.5.2 Top Products/Product Portfolio

- 3.2.5.3 Top Competitors

- 3.2.5.4 Target Customers

- 3.2.5.5 Key Personnel

- 3.2.5.6 Analyst View

- 3.2.5.7 Market Share, 2022

- 3.2.6 Terma

- 3.2.6.1 Overview

- 3.2.6.2 Top Products/Product Portfolio

- 3.2.6.3 Top Competitors

- 3.2.6.4 Target Customers

- 3.2.6.5 Key Personnel

- 3.2.6.6 Analyst View

- 3.2.6.7 Market Share, 2022

- 3.2.7 Westminster Group Plc

- 3.2.7.1 Overview

- 3.2.7.2 Top Products/Product Portfolio

- 3.2.7.3 Top Competitors

- 3.2.7.4 Target Customers

- 3.2.7.5 Key Personnel

- 3.2.7.6 Analyst View

- 3.2.7.7 Market Share, 2022

- 3.2.8 Kongsberg Digital

- 3.2.8.1 Overview

- 3.2.8.2 Top Products/Product Portfolio

- 3.2.8.3 Top Competitors

- 3.2.8.4 Target Customers

- 3.2.8.5 Key Personnel

- 3.2.8.6 Analyst View

- 3.2.8.7 Market Share, 2022

- 3.2.9 Smiths Group plc

- 3.2.9.1 Overview

- 3.2.9.2 Top Products/Product Portfolio

- 3.2.9.3 Top Competitors

- 3.2.9.4 Target Customers

- 3.2.9.5 Key Personnel

- 3.2.9.6 Analyst View

- 3.2.9.7 Market Share, 2022

- 3.2.10 Nettitude Ltd.

- 3.2.10.1 Overview

- 3.2.10.2 Top Products/Product Portfolio

- 3.2.10.3 Top Competitors

- 3.2.10.4 Target Customers

- 3.2.10.5 Key Personnel

- 3.2.10.6 Analyst View

- 3.2.10.7 Market Share, 2022

- 3.2.11 HGH

- 3.2.11.1 Overview

- 3.2.11.2 Top Products/Product Portfolio

- 3.2.11.3 Top Competitors

- 3.2.11.4 Target Customers

- 3.2.11.5 Key Personnel

- 3.2.11.6 Analyst View

- 3.2.11.7 Market Share, 2022

- 3.2.12 Other Key Players

- 3.2.1 SAAB AB

4 Research Methodology

- 4.1 Data Sources

- 4.1.1 Primary Data Sources

- 4.1.2 Secondary Data Sources

- 4.1.3 Data Triangulation

- 4.2 Market Estimation and Forecast