|

|

市場調査レポート

商品コード

1622829

欧州のアグリボルタイクス(営農型太陽光発電)市場:製品別・国別動向 - 分析と予測(2023年~2033年)Europe Agrivoltaics Market: Focus on Product and Country - Analysis and Forecast, 2023-2033 |

||||||

カスタマイズ可能

|

|||||||

| 欧州のアグリボルタイクス(営農型太陽光発電)市場:製品別・国別動向 - 分析と予測(2023年~2033年) |

|

出版日: 2024年12月27日

発行: BIS Research

ページ情報: 英文 72 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

欧州アグリボルタイクス(営農型太陽光発電)の市場規模は、2023年の5億3,480万米ドルから2033年には35億4,130万米ドルに達し、予測期間の2023年~2033年のCAGRは20.81%になると予測されています。

欧州のアグリボルタイクス分野の企業は、革新的な技術を導入し、農家や太陽光発電事業者と戦略的パートナーシップを結び、再生可能エネルギーに対する政府の有利な政策や優遇措置を活用することで、チャンスを生かすことができます。この成長市場を活用するためには、研究開発への投資と強力な生産インフラの構築が不可欠です。

企業は、こうした戦術を実践することで、農業に特化した持続可能なエネルギーソリューションのリーダーとしての地位を確立することができます。欧州の再生可能エネルギー目標を推進することに加え、この戦略は、この地域の農家とエネルギー利用者の需要の変化を考慮しています。企業は協力し合い、革新することで、農業用太陽光発電を先導することができ、環境と経済の両面で利益をもたらすと同時に、欧州全域で弾力的で持続可能な農業とエネルギーの景観を形成することができます。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2023年~2033年 |

| 2023年の評価 | 5億3,480万米ドル |

| 2033年の予測 | 35億4,130万米ドル |

| CAGR | 20.81% |

欧州大陸が持続可能な農業の問題に取り組みながら、再生可能エネルギーの能力を向上させようとしているため、欧州のアグリボルタイクス市場は大きく拡大しています。アグリボルタイクスは、太陽エネルギー生産と農業慣行を組み合わせることで、土地利用を最適化する特別な機会を提供します。農作物の上にソーラーパネルを設置することで、農家がクリーンエネルギーを生産しながら農業生産を継続できるようにすることで、エネルギーと食糧の安全保障に関する懸念に対処することができます。

EUの二酸化炭素削減へのコミットメントと低炭素経済への移行、そして再生可能エネルギーへの需要の高まりは、すべて欧州におけるアグリボルタイクスの拡大に寄与しています。インセンティブや補助金を通じて、2050年までに排出量ネットゼロを達成することを目指すEUのグリーン・ディールは、こうしたプロジェクトの開発をさらに後押ししています。さらに、ソーラーパネルの効率やシステム設計の技術的進歩により、農作業とのより良い統合が可能になり、導入がさらに促進されています。

当レポートでは、欧州のアグリボルタイクス市場について調査し、市場の概要とともに、製品別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場

- 動向:現在および将来の影響評価

- サプライチェーンの概要

- 研究開発レビュー

- 規制状況

- 市場力学の概要

第2章 地域

- 地域別概要

- 欧州

第3章 市場-競合ベンチマーキングと企業プロファイル

- 今後の見通し

- 地理的評価

- Iqony Solar Energy Solutions

- BayWa AG

- Lightsource

- Enel Green Power S.p.A.

- Sun'Agri

- Next2Sun AG

第4章 調査手法

List of Figures

- Figure 1: Agrivoltaics Market (by Region), $Million, 2023, 2026, 2033

- Figure 2: Pricing Analysis for Agrivoltaics Market (Region), $ per KW/h, 2023, 2026, and 2033

- Figure 3: Europe Agrivoltaics Market (by Site of Installation), $Million, 2023, 2026, and 2033

- Figure 4: Europe Agrivoltaics Market (by Array Configuration), $Million, 2023, 2026, and 2033

- Figure 5: Europe Agrivoltaics Market (by Photovoltaic Technology), $Million, 2023, 2026, and 2033

- Figure 6: Key Events

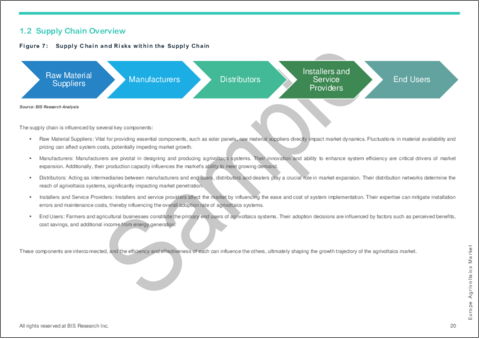

- Figure 7: Supply Chain and Risks within the Supply Chain

- Figure 8: Agrivoltaics Market (by Company), January 2020-March 2024

- Figure 9: Agrivoltaics Market (by Country), January 2020-March 2024

- Figure 10: Impact Analysis of Market Navigating Factors, 2023-2033

- Figure 11: Estimated Average Carbon Emission and Fossil Energy Demand in Agrivoltaics and Conventional Farm

- Figure 12: France Agrivoltaics Market, $Million, 2022-2033

- Figure 13: Germany Agrivoltaics Market, $Million, 2022-2033

- Figure 14: Spain Agrivoltaics Market, $Million, 2022-2033

- Figure 15: U.K. Agrivoltaics Market, $Million, 2022-2033

- Figure 16: Italy Agrivoltaics Market, $Million, 2022-2033

- Figure 17: Rest-of-Europe Agrivoltaics Market, $Million, 2022-2033

- Figure 18: Strategic Initiatives, 2020-2024

- Figure 19: Share of Strategic Initiatives, 2020-2024

- Figure 20: Data Triangulation

- Figure 21: Top-Down and Bottom-Up Approach

- Figure 22: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Opportunities across Regions

- Table 3: Recent Initiatives in Agrivoltaics

- Table 4: Agrivoltaics Market (by Region), $Million, 2022-2033

- Table 5: Europe Agrivoltaics Market (by Array Configuration), $Million, 2022-2033

- Table 6: Europe Agrivoltaics Market (by Photovoltaic Technology), $Million, 2022-2033

- Table 7: Europe Agrivoltaics Market (by Site of Installation), $Million, 2022-2033

- Table 8: France Agrivoltaics Market (by Array Configuration), $Million, 2022-2033

- Table 9: France Agrivoltaics Market (by Photovoltaic Technology), $Million, 2022-2033

- Table 10: France Agrivoltaics Market (by Site of Installation), $Million, 2022-2033

- Table 11: Key Agrivoltaics Projects in Germany

- Table 12: Germany Agrivoltaics Market (by Array Configuration), $Million, 2022-2033

- Table 13: Germany Agrivoltaics Market (by Photovoltaic Technology), $Million, 2022-2033

- Table 14: Germany Agrivoltaics Market (by Site of Installation), $Million, 2022-2033

- Table 15: Spain Agrivoltaics Market (by Array Configuration), $Million, 2022-2033

- Table 16: Spain Agrivoltaics Market (by Photovoltaic Technology), $Million, 2022-2033

- Table 17: Spain Agrivoltaics Market (by Site of Installation), $Million, 2022-2033

- Table 18: U.K. Agrivoltaics Market (by Array Configuration), $Million, 2022-2033

- Table 19: U.K. Agrivoltaics Market (by Photovoltaic Technology), $Million, 2022-2033

- Table 20: U.K. Agrivoltaics Market (by Site of Installation), $Million, 2022-2033

- Table 21: Italy Agrivoltaics Market (by Array Configuration), $Million, 2022-2033

- Table 22: Italy Agrivoltaics Market (by Photovoltaic Technology), $Million, 2022-2033

- Table 23: Italy Agrivoltaics Market (by Site of Installation), $Million, 2022-2033

- Table 24: Rest-of-Europe Agrivoltaics Market (by Array Configuration), $Million, 2022-2033

- Table 25: Rest-of-Europe Agrivoltaics Market (by Photovoltaic Technology), $Million, 2022-2033

- Table 26: Rest-of-Europe Agrivoltaics Market (by Site of Installation), $Million, 2022-2033

- Table 27: Market Share, 2022

Introduction to Europe Agrivoltaics Market

The Europe agrivoltaics market is projected to reach $3,541.3 million by 2033 from $534.8 million in 2023, growing at a CAGR of 20.81% during the forecast period 2023-2033. Companies in the European agrivoltaics sector can capitalize on opportunities by implementing innovative technologies, forming strategic partnerships with farmers and solar energy providers, and leveraging favorable government policies and incentives for renewable energy. To take advantage of this growing market, it is essential to make investments in R&D and build a strong production infrastructure.

Businesses can establish themselves as leaders in agriculturally specific sustainable energy solutions by putting these tactics into practice. In addition to advancing Europe's renewable energy objectives, this strategy takes into account the changing demands of the region's farmers and energy users. Companies can lead the way in agrivoltaics by working together and innovating, bringing about both environmental and economic benefits while forming a resilient and sustainable agricultural and energy landscape throughout Europe.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2023 - 2033 |

| 2023 Evaluation | $534.8 Million |

| 2033 Forecast | $3,541.3 Million |

| CAGR | 20.81% |

Market Introduction

The European market for agrivoltaics is expanding significantly as the continent looks to improve its capacity for renewable energy while tackling the issues of sustainable agriculture. Agrivoltaics presents a special chance to optimize land use by combining solar energy production with agricultural practices. Concerns about energy and food security are addressed by enabling farmers to continue agricultural production while producing clean energy by erecting solar panels above crops.

The EU's commitment to carbon reduction and the shift to a low-carbon economy, along with the growing demand for renewable energy, have all contributed to the expansion of agrivoltaics in Europe. Through incentives and subsidies, the EU's Green Deal, which aims to achieve net-zero emissions by 2050, further encourages the development of such projects. Additionally, technological advancements in solar panel efficiency and system design are enabling better integration with farming practices, further driving adoption.

Rising environmental consciousness has also benefited Europe's agrivoltaics market, with farmers and landowners recognizing the dual benefits of increased crop yields and energy generation. Agrivoltaics is viewed as a feasible solution that fits with sustainability and the demand for creative farming methods as European nations work to meet renewable energy targets. As the area adopts sustainable farming methods and renewable energy, this market is expected to grow further.

Market Segmentation

Segmentation 1: by Array Configuration

- Fixed

- Single-Axis Tracking

Segmentation 2: by Photovoltaic Technology

- Monofacial Solar Panels

- Bifacial Solar Panels

- Translucent Photovoltaic Technology

- Others

Segmentation 3: by Site of Installation

- Grassland Farming

- Horticulture and Arable Farming

- Indoor Farming

- Pollinator Habitat

Segmentation 4: by Region

- France

- Germany

- Italy

- Spain

- U.K.

- Rest-of-Europe

How can this report add value to an organization?

Product/Innovation Strategy: The product segment helps the reader understand the different applications of agrivoltaics products in the market. The market is poised for significant expansion with ongoing technological advancements, increased investments, and growing awareness of the use of agrivoltaics. Therefore, agrivoltaics are a high-investment and high-revenue generating model.

Growth/Marketing Strategy: The Europe agrivoltaics market is growing at a rapid pace. The market offers enormous opportunities for existing and emerging market players. Some of the strategies covered in this segment are mergers and acquisitions, product launches, partnerships and collaborations, business expansions, and investments. The strategies preferred by companies to maintain and strengthen their market position primarily include partnerships and collaborations.

Competitive Strategy: The key players in the Europe agrivoltaics market analyzed and profiled in the study include agrivoltaics projects. Additionally, a comprehensive competitive landscape such as partnerships, agreements, and collaborations are expected to aid the reader in understanding the untapped revenue pockets in the market.

Table of Contents

Executive Summary

Scope and Definition

1 Markets

- 1.1 Trends: Current and Future Impact Assessment

- 1.1.1 Potential for Rural Electric Vehicle Charging

- 1.1.2 Increasing Demand for Renewable Energy

- 1.2 Supply Chain Overview

- 1.2.1 Value Chain Analysis

- 1.3 Research and Development Review

- 1.3.1 Patent Filing Trend (by Company)

- 1.3.2 Patent Filing Trend (by Country)

- 1.4 Regulatory Landscape

- 1.5 Market Dynamics Overview

- 1.5.1 Market Drivers

- 1.5.1.1 Dual-Revenue Streams for Farmers

- 1.5.1.2 Agrivoltaics as a Sustainable Solution for Agriculture

- 1.5.2 Market Restraints

- 1.5.2.1 High Installation Costs

- 1.5.2.2 Limited Compatibility to Certain Crops

- 1.5.3 Market Opportunities

- 1.5.3.1 Reduced Emissions through Improved Farm Electrification

- 1.5.3.2 Increased Government Initiatives to Boost R&D in Agrivoltaics

- 1.5.1 Market Drivers

2 Regions

- 2.1 Regional Summary

- 2.2 Europe

- 2.2.1 Regional Overview

- 2.2.2 Driving Factors for Market Growth

- 2.2.3 Factors Challenging the Market

- 2.2.4 Product

- 2.2.5 France

- 2.2.6 Germany

- 2.2.7 Spain

- 2.2.8 U.K.

- 2.2.9 Italy

- 2.2.10 Rest-of-Europe

3 Markets - Competitive Benchmarking & Company Profiles

- 3.1 Next Frontiers

- 3.2 Geographic Assessment

- 3.2.1 Iqony Solar Energy Solutions

- 3.2.1.1 Overview

- 3.2.1.2 Top Project Portfolio

- 3.2.1.3 Top Competitors

- 3.2.1.4 Target Customers

- 3.2.1.5 Key Personnel

- 3.2.1.6 Analyst View

- 3.2.1.7 Market Share, 2023

- 3.2.2 BayWa AG

- 3.2.2.1 Overview

- 3.2.2.2 Top Project Portfolio

- 3.2.2.3 Top Competitors

- 3.2.2.4 Target Customers

- 3.2.2.5 Key Personnel

- 3.2.2.6 Analyst View

- 3.2.2.7 Market Share, 2023

- 3.2.3 Lightsource

- 3.2.3.1 Overview

- 3.2.3.2 Top Project Portfolio

- 3.2.3.3 Top Competitors

- 3.2.3.4 Target Customers

- 3.2.3.5 Key Personnel

- 3.2.3.6 Analyst View

- 3.2.3.7 Market Share, 2023

- 3.2.4 Enel Green Power S.p.A.

- 3.2.4.1 Overview

- 3.2.4.2 Top Project Portfolio

- 3.2.4.3 Top Competitors

- 3.2.4.4 Target Customers

- 3.2.4.5 Key Personnel

- 3.2.4.6 Analyst View

- 3.2.4.7 Market Share, 2023

- 3.2.5 Sun'Agri

- 3.2.5.1 Overview

- 3.2.5.2 Top Project Portfolio

- 3.2.5.3 Top Competitors

- 3.2.5.4 Target Customers

- 3.2.5.5 Key Personnel

- 3.2.5.6 Analyst View

- 3.2.5.7 Market Share, 2023

- 3.2.6 Next2Sun AG

- 3.2.6.1 Overview

- 3.2.6.2 Top Project Portfolio

- 3.2.6.3 Top Competitors

- 3.2.6.4 Target Customers

- 3.2.6.5 Key Personnel

- 3.2.6.6 Analyst View

- 3.2.6.7 Market Share, 2023

- 3.2.1 Iqony Solar Energy Solutions

4 Research Methodology

- 4.1 Data Sources

- 4.1.1 Primary Data Sources

- 4.1.2 Secondary Data Sources

- 4.1.3 Data Triangulation

- 4.2 Market Estimation and Forecast