|

|

市場調査レポート

商品コード

1594216

欧州のマイクロアレイ解析市場:製品別、タイプ別、用途別、エンドユーザー別、国別 - 分析と予測(2023年~2033年)Europe Microarray Analysis Market: Focus on Product, Type, Application, End User, and Country Level Analysis - Analysis and Forecast, 2023-2033 |

||||||

カスタマイズ可能

|

|||||||

| 欧州のマイクロアレイ解析市場:製品別、タイプ別、用途別、エンドユーザー別、国別 - 分析と予測(2023年~2033年) |

|

出版日: 2024年11月21日

発行: BIS Research

ページ情報: 英文 79 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

欧州のマイクロアレイ解析の市場規模は、2023年に16億9,020万米ドルとなりました。

同市場は、2033年には32億3,600万米ドルに達し、予測期間の2023年~2033年のCAGRは6.71%になると予測されています。欧州マイクロアレイ解析市場のこの成長は、ゲノミクスプロジェクトの増加、薬剤スクリーニングにおけるマイクロアレイ技術の利用拡大、がんスクリーニングにおける採用拡大が原動力となっています。同市場は、幅広い消耗品、機器、ソフトウェア、サービスを包含しており、同地域全体のゲノミクスと個別化医療の進歩を支えています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2023年~2033年 |

| 2023年の評価 | 16億9,020万米ドル |

| 2033年の予測 | 32億3,600万米ドル |

| CAGR | 6.71% |

欧州のマイクロアレイ解析市場は、バイオテクノロジー、個別化医療、ゲノミクス研究の市場開拓により大きく成長しています。創薬、疾病診断、バイオマーカー同定はすべて、遺伝子発現、遺伝子変異、その他の分子データの解析を可能にするマイクロアレイ技術に大きく依存しています。マイクロアレイ解析の利用は、欧州がゲノム研究とイノベーションの最前線にあるように、ヘルスケア、製薬、農業を含む多くの産業で急速に広がっています。

ハイスループットでリーズナブルな遺伝子解析ツールを求めるゲノミクス・プロジェクトや取り組みの増加が、業界を牽引しています。さらに、早期発見、個別化治療戦略、治療標的の同定を可能にする薬剤開発やがんスクリーニングにおけるマイクロアレイの利用が増加しているため、市場開拓が進んでいます。

消耗品、機器、ソフトウェア、サービスは、臨床および研究環境におけるマイクロアレイ解析の成功に不可欠な重要な市場カテゴリーです。欧州市場の大手企業は、拡張性、精度、感度を高める技術開発に注力しています。分子診断や精密医療に対するニーズの高まりとともに、欧州のマイクロアレイ解析市場はさらに成長し、バイオテクノロジーやヘルスケアの発展を促進すると予想されます。

当レポートでは、欧州のマイクロアレイ解析市場について調査し、市場の概要とともに、製品別、タイプ別、用途別、エンドユーザー別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場

- 動向:現在および将来の影響評価

- エコシステムの概要:マイクロアレイ解析市場

- 研究開発レビュー

- 規制状況

- 主要な世界的出来事の影響分析-COVID-19

- 価格分析

- 市場力学の概要

第2章 地域

- 地域別概要

- 促進要因と抑制要因

- 欧州

第3章 市場-競合ベンチマーキングと企業プロファイル

- 今後の見通し

- 競争力評価

- F. Hoffmann-La Roche Ltd.

- Merck KGaA

第4章 調査手法

List of Figures

- Figure 1: Europe Microarray Analysis Market, $Million, 2023, 2026, and 2033

- Figure 2: Microarray Analysis Market (by Region), $Million, 2022, 2026, and 2033

- Figure 3: Europe Microarray Analysis Market (by Application), $Million, 2022, 2026, and 2033

- Figure 4: Europe Microarray Analysis Market (by Type), $Million, 2022, 2026, and 2033

- Figure 5: Europe Microarray Analysis Market (by Product), $Million, 2022, 2026, and 2033

- Figure 6: Europe Microarray Analysis Market (by End User), $Million, 2022, 2026, and 2033

- Figure 7: Key Industrial Developments in Microarray Analysis Market, 2023

- Figure 8: Opportunities in Genetic Research through AI and Automation

- Figure 9: Ecosystem Overview of Microarray Analysis Market and Operational Challenges

- Figure 10: Microarray Analysis Market, Patent Analysis (by Country), January 2020-December 2023

- Figure 11: Microarray Analysis Market, Patent Analysis (by Year), January 2020-December 2023

- Figure 12: Examples of the Key Initiative Related to Genomics

- Figure 13: Applications of Microarray Analysis Technology in Drug Discovery

- Figure 14: Microarray vs. RNA Sequencing, NGS, and PCR

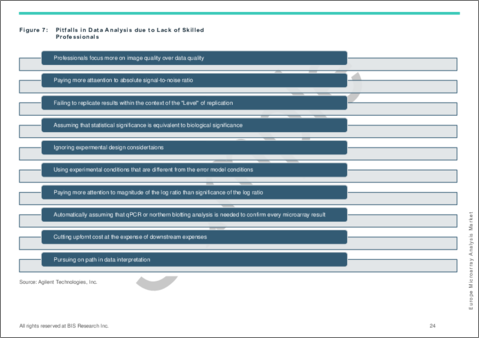

- Figure 15: Pitfalls in Data Analysis due to Lack of Skilled Professionals

- Figure 16: Key Initiatives Focused on Pharmacogenomics to Improve the Landscape of Precision Medicine

- Figure 17: Precision Medicine vs. Other Medicine

- Figure 18: Germany Microarray Analysis Market, $Million, 2022-2033

- Figure 19: U.K. Microarray Analysis Market, $Million, 2022-2033

- Figure 20: France Microarray Analysis Market, $Million, 2022-2033

- Figure 21: Italy Microarray Analysis Market, $Million, 2022-2033

- Figure 22: Spain Microarray Analysis Market, $Million, 2022-2033

- Figure 23: Strategic Initiatives, 2021-2024

- Figure 24: Share of Strategic Initiatives, 2021-2024

- Figure 25: Data Triangulation

- Figure 26: Top-Down and Bottom-Up Approach

- Figure 27: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Microarray Analysis Market, Opportunities

- Table 3: Key Companies and Technological Advancements, 2022-2023

- Table 4: Pricing Analysis of Microarray Analysis Products (Instruments and Consumables)

- Table 5: Impact Analysis of Market Navigating Factors, 2022-2033

- Table 6: Examples of Arrays Used in Cancer Screening

- Table 7: Microarray Analysis Market (by Region), $Million, 2022-2033

- Table 8: Europe Microarray Analysis Market (by Product), $Million, 2022-2033

- Table 9: Europe Microarray Analysis Market (by Type), $Million, 2022-2033

- Table 10: Europe Microarray Analysis Market (by Application), $Million, 2022-2033

- Table 11: Europe Microarray Analysis Market (by End User), $Million, 2022-2033

- Table 12: Germany Microarray Analysis Market (by Product), $Million, 2022-2033

- Table 13: Germany Microarray Analysis Market (by Type), $Million, 2022-2033

- Table 14: Germany Microarray Analysis Market (by Application), $Million, 2022-2033

- Table 15: Germany Microarray Analysis Market (by End User), $Million, 2022-2033

- Table 16: U.K. Microarray Analysis Market (by Product), $Million, 2022-2033

- Table 17: U.K. Microarray Analysis Market (by Type), $Million, 2022-2033

- Table 18: U.K. Microarray Analysis Market (by Application), $Million, 2022-2033

- Table 19: U.K. Microarray Analysis Market (by End User), $Million, 2022-2033

- Table 20: France Microarray Analysis Market (by Product), $Million, 2022-2033

- Table 21: France Microarray Analysis Market (by Type), $Million, 2022-2033

- Table 22: France Microarray Analysis Market (by Application), $Million, 2022-2033

- Table 23: France Microarray Analysis Market (by End User), $Million, 2022-2033

- Table 24: Italy Microarray Analysis Market (by Product), $Million, 2022-2033

- Table 25: Italy Microarray Analysis Market (by Type), $Million, 2022-2033

- Table 26: Italy Microarray Analysis Market (by Application), $Million, 2022-2033

- Table 27: Italy Microarray Analysis Market (by End User), $Million, 2022-2033

- Table 28: Spain Microarray Analysis Market (by Product), $Million, 2022-2033

- Table 29: Spain Microarray Analysis Market (by Type), $Million, 2022-2033

- Table 30: Spain Microarray Analysis Market (by Application), $Million, 2022-2033

- Table 31: Spain Microarray Analysis Market (by End User), $Million, 2022-2033

- Table 32: Rest-of-Europe Microarray Analysis Market, $Million, 2022-2033

- Table 33: Rest-of-Europe Microarray Analysis Market (by Product), $Million, 2022-2033

- Table 34: Rest-of-Europe Microarray Analysis Market (by Type), $Million, 2022-2033

- Table 35: Rest-of-Europe Microarray Analysis Market (by Application), $Million, 2022-2033

- Table 36: Rest-of-Europe Microarray Analysis Market (by End User), $Million, 2022-2033

- Table 37: Company Market Share, 2022

Introduction to Europe Microarray Analysis Market

The Europe microarray analysis market was valued at $1,690.2 million in 2023 and is expected to reach $3,236.0 million by 2033, growing at a CAGR of 6.71% during the forecast period 2023-2033. This growth in the Europe microarray analysis market is driven by the increasing number of genomics projects, the growing use of microarray technology in drug screening, and its expanding adoption in cancer screening. The market encompasses a wide range of consumables, instruments, software, and services, supporting advancements in genomics and personalized medicine across the region.

Market Introduction

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2023 - 2033 |

| 2023 Evaluation | $1,690.2 Million |

| 2033 Forecast | $3,236.0 Million |

| CAGR | 6.71% |

The market for microarray analysis in Europe has grown significantly due to developments in biotechnology, personalized medicine, and genomics research. Drug discovery, disease diagnosis, and biomarker identification all heavily rely on microarray technology, which makes it possible to analyze gene expression, genetic variation, and other molecular data. The use of microarray analysis is spreading quickly across a number of industries, including healthcare, pharmaceuticals, and agriculture, as Europe remains at the forefront of genomic research and innovation.

The growing number of genomics projects and efforts, which call for high-throughput and reasonably priced genetic analysis tools, is driving the industry. Additionally, the market is expanding because to the increasing use of microarrays in drug development and cancer screening, which allow for early detection, individualized treatment strategies, and the identification of therapeutic targets.

Consumables, instruments, software, and services are important market categories that are essential to the success of microarray analysis in clinical and research settings. Leading firms in the European market are concentrating on developing technologies to increase scalability, precision, and sensitivity. With the growing need for molecular diagnostics and precision medicine, the European microarray analysis market is expected to grow further, propelling biotechnology and healthcare developments.

Market Segmentation:

Segmentation 1: by Product Type

- Instruments

- Consumables

- Software and Services

Segmentation 2: by Type

- DNA Microarray

- Protein Microarray

- Other Microarray

Segmentation 3: by Application

- Clinical Diagnostics

- Drug Discovery and Translational Research

- Others

Segmentation 4: by End User

- Pharmaceutical and Biotechnology Companies

- Diagnostic Laboratories

- Academic and Research Institutes

- Others

Segmentation 5: by Country

- France

- Germany

- Italy

- Spain

- U.K.

- Rest-of-Europe

How can this report add value to an organization?

Workflow/Innovation Strategy: The Europe microarray analysis market (by product) has been segmented into detailed segments, including different types of consumables, such as arrays, kits and reagents, and accessories as well as instruments, and software and services.

Growth/Marketing Strategy: A strategic growth and marketing approach for the microarray analysis market would involve positioning the company as a leader in innovative solutions that address the evolving needs of researchers, clinicians, and pharmaceutical partners. This would entail leveraging technological advancements to develop cutting-edge products with enhanced sensitivity, specificity, and scalability, while also investing in comprehensive customer support, training programs, and collaborative partnerships to foster customer loyalty and drive market penetration.

Competitive Strategy: Key players in the Europe microarray analysis market have been focusing on innovation, differentiation, and strategic collaborations to gain a competitive edge. By investing in research and development, companies can develop novel detection methods, improve assay sensitivity, and expand application areas. Differentiation through the development of proprietary technologies, customizable solutions, and value-added services can help companies stand out in a crowded market. to strengthen market positions, acquire new technologies, and broaden product portfolios.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on thorough secondary research, which includes analyzing company coverage, product portfolio, market penetration, and insights gathered from primary experts.

Some prominent names established in this market are:

- F. Hoffmann-La Roche Ltd.

- Merck KGaA

Table of Contents

Executive Summary

Scope and Definition

1 Markets

- 1.1 Trends: Current and Future Impact Assessment

- 1.1.1 Key Trends

- 1.1.1.1 Technological Advancements in Microarray Analysis

- 1.1.1.2 Developing Focus on Automation and Artificial Intelligence Integration in Microarray Analysis

- 1.1.1 Key Trends

- 1.2 Ecosystem Overview: Microarray Analysis Market

- 1.2.1 Value Addition Across the Process

- 1.3 Research and Development Review

- 1.3.1 Patent Filing Trend (by Country, Company)

- 1.4 Regulatory Landscape

- 1.5 Impact Analysis for Key Global Events - COVID-19

- 1.6 Pricing Analysis

- 1.7 Market Dynamics Overview

- 1.7.1 Market Drivers

- 1.7.1.1 Rising Numbers of Genomics Projects Fuelling the Growth of Microarray Analysis Market

- 1.7.1.2 Use of Microarray Technology in Drug Discovery

- 1.7.1.3 Increasing Adoption of Microarray Technology in Cancer Screening

- 1.7.2 Market Restraints

- 1.7.2.1 Competition from Alternative Technologies such as NGS

- 1.7.2.2 Challenges in Complex Data Analysis due to Lack of Skilled Professionals

- 1.7.3 Market Opportunities

- 1.7.3.1 Novel Biomarker Discovery with the Use of Microarray Technology

- 1.7.3.2 Utilization of Predictive Genomics for the Development of Personalized Medicines

- 1.7.1 Market Drivers

2 Regions

- 2.1 Regional Summary

- 2.2 Drivers and Restraints

- 2.3 Europe

- 2.3.1 Regional Overview

- 2.3.2 Driving Factors for Market Growth

- 2.3.3 Factors Challenging the Market

- 2.3.4 Germany

- 2.3.5 U.K.

- 2.3.6 France

- 2.3.7 Italy

- 2.3.8 Spain

- 2.3.9 Rest-of-Europe

3 Markets - Competitive Benchmarking & Company Profiles

- 3.1 Next Frontiers

- 3.2 Competitive Assessment

- 3.2.1 F. Hoffmann-La Roche Ltd.

- 3.2.1.1 Overview

- 3.2.1.2 Top Products/Product Portfolio

- 3.2.1.3 Top Competitors

- 3.2.1.4 Key Personnel

- 3.2.1.5 Analyst View

- 3.2.2 Merck KGaA

- 3.2.2.1 Overview

- 3.2.2.2 Top Products/Product Portfolio

- 3.2.2.3 Top Competitors

- 3.2.2.4 Key Personnel

- 3.2.2.5 Analyst View

- 3.2.1 F. Hoffmann-La Roche Ltd.

4 Research Methodology

- 4.1 Data Sources

- 4.1.1 Primary Data Sources

- 4.1.2 Secondary Data Sources

- 4.1.3 Data Triangulation

- 4.2 Market Estimation and Forecast