|

|

市場調査レポート

商品コード

1585127

アジア太平洋の石膏ボードおよび代替品市場:エンドユーザー用途別、タイプ別、材料別、国別 - 分析と予測(2023年~2033年)Asia-Pacific Gypsum-Based Plasterboard Market and Alternatives: Focus on End-User Application, Type, Material, and Country - Analysis and Forecast, 2023-2033 |

||||||

カスタマイズ可能

|

|||||||

| アジア太平洋の石膏ボードおよび代替品市場:エンドユーザー用途別、タイプ別、材料別、国別 - 分析と予測(2023年~2033年) |

|

出版日: 2024年11月08日

発行: BIS Research

ページ情報: 英文 74 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

アジア太平洋の石膏ボードおよび代替品の市場規模は、2023年に72億米ドルとなりました。

同市場は今後、8.31%のCAGRで拡大し、2033年には160億米ドルに達すると予測されています。石膏を主成分とする石膏ボードおよび代替品は、従来の化学物質の投入に比べていくつかの利点があり、アジア太平洋の建築工法に革命を起こす態勢を整えています。この市場は現在成長段階にあり、大幅な拡大が見込まれています。共同研究、施設、調査への投資を行う企業は、こうした最先端ソリューションへのニーズの高まりから利益を得ることができると見込まれています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2023年~2033年 |

| 2023年の評価 | 72億米ドル |

| 2033年の予測 | 160億米ドル |

| CAGR | 8.31% |

手頃な価格で軽量、かつ環境に優しい建材に対する消費者の要望の高まりが、アジア太平洋地域の石膏ボードおよび代替品市場を後押ししています。石膏ボードは、施工が簡単で耐火性があり、防音性があり、リサイクル可能であるという評判から、住宅と商業建築の両方で頻繁に使用されています。

石膏製品は、従来の材料よりも環境への影響が小さいため、アジア太平洋諸国が建築における持続可能性とエネルギー効率を重視するにつれて人気が高まっています。生産技術の向上は、これらの製品の堅牢性と適応性をさらに高めています。環境に優しい材料の採用は、持続可能な建築慣行を支援する法的枠組みによっても後押しされています。

リサイクル可能な材料や最先端の複合材料から派生したものなど、代替ソリューションは手ごわいライバルになりつつあります。インフラ整備、研究開発、戦略的パートナーシップを重視する市場参入企業は、この動向から利益を得る態勢を整えており、新興国市場に新たな機会を創出しています。APAC地域全体で建設活動が活発化するにつれて、石膏ボードおよび代替品に対する需要は大きく伸びると予想されます。

当レポートでは、アジア太平洋の石膏ボードおよび代替品市場について調査し、市場の概要とともに、エンドユーザー用途別、タイプ別、材料別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場

- 建設業界の動向:現状と将来

- サプライチェーンの概要

- 研究開発レビュー

- 規制状況

- ステークホルダー分析

- 市場力学:概要

- スタートアップと投資の概要

- 代替品の生産技術

- 石膏ボードおよび代替品の比較分析

第2章 地域

- 石膏ボードおよび代替品市場(地域別)

- アジア太平洋

第3章 企業プロファイル

第4章 調査手法

List of Figures

- Figure 1: Asia-Pacific Gypsum-Based Plasterboard Market and Alternatives, $Billion, 2022, 2026, and 2033

- Figure 2: Gypsum-Based Plasterboard Market and Alternatives (by Region), $Million, 2022, 2026, and 2033

- Figure 3: Asia-Pacific Gypsum-Based Plasterboard Market and Alternatives (by End-User Application), $Million, 2022, 2026, and 2033

- Figure 4: Asia-Pacific Gypsum-Based Plasterboard Market and Alternatives (by Type), $Million, 2022, 2026, and 2033

- Figure 5: Asia-Pacific Gypsum-Based Plasterboard Market and Alternatives (by Material), $Million, 2022, 2026, and 2033

- Figure 6: Key Events

- Figure 7: Supply Chain and Risks within the Supply Chain

- Figure 8: Value Chain Analysis

- Figure 9: Patent Analysis (by Country), January 2020-December 2023

- Figure 10: Patent Analysis (by Company), January 2020-December 2023

- Figure 11: Impact Analysis of Market Navigating Factors, 2023-2033

- Figure 12: Number of People Living in Urban and Rural Areas, Billion, 2018-2021

- Figure 13: China Gypsum-Based Plasterboard Market and Alternatives, $Million, 2022-2033

- Figure 14: Japan Gypsum-Based Plasterboard Market and Alternatives, $Million, 2022-2033

- Figure 15: Australia Gypsum-Based Plasterboard Market and Alternatives, $Million, 2022-2033

- Figure 16: South Korea Gypsum-Based Plasterboard Market and Alternatives, $Million, 2022-2033

- Figure 17: India Gypsum-Based Plasterboard Market and Alternatives, $Million, 2022-2033

- Figure 18: Rest-of-Asia-Pacific Gypsum-Based Plasterboard Market and Alternatives, $Million, 2022-2033

- Figure 19: Data Triangulation

- Figure 20: Top-Down and Bottom-Up Approach

- Figure 21: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Opportunities across Region

- Table 3: Competitive Landscape Snapshot

- Table 4: Trends: Overview

- Table 5: Projects on Sustainable Construction

- Table 6: Use Cases and Applications in the Construction Industry

- Table 7: Pricing Analysis (by Type), $/Meter Square, 2022-2033

- Table 8: Key Patent Mapping

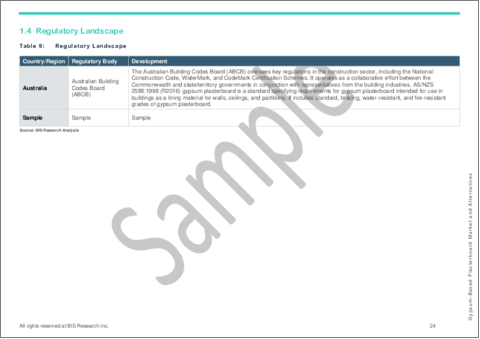

- Table 9: Regulatory Landscape

- Table 10: Stakeholder Analysis

- Table 11: Use Cases and Applications in the Construction Industry

- Table 12: Startup and Investment Landscape

- Table 13: Comparative Analysis of Gypsum-based Plasterboard and Alternatives

- Table 14: Gypsum-Based Plasterboard Market and Alternatives (by Region), $Million, 2022-2033

- Table 15: Asia-Pacific Gypsum-Based Plasterboard Market and Alternatives (by End-User Application), $Million, 2022-2033

- Table 16: Asia-Pacific Gypsum-Based Plasterboard Market and Alternatives (by Type), $Million, 2022-2033

- Table 17: Asia-Pacific Gypsum-Based Plasterboard Market and Alternatives (by Material), $Million, 2022-2033

- Table 18: China Gypsum-Based Plasterboard Market and Alternatives (by End-User Application), $Million, 2022-2033

- Table 19: China Gypsum-Based Plasterboard Market and Alternatives (by Type), $Million, 2022-2033

- Table 20: China Gypsum-Based Plasterboard Market and Alternatives (by Material), $Million, 2022-2033

- Table 21: Japan Gypsum-Based Plasterboard Market and Alternatives (by End-User Application), $Million, 2022-2033

- Table 22: Japan Gypsum-Based Plasterboard Market and Alternatives (by Type), $Million, 2022-2033

- Table 23: Japan Gypsum-Based Plasterboard Market and Alternatives (by Material), $Million, 2022-2033

- Table 24: Australia Gypsum-Based Plasterboard Market and Alternatives (by End-User Application), $Million, 2022-2033

- Table 25: Australia Gypsum-Based Plasterboard Market and Alternatives (by Type), $Million, 2022-2033

- Table 26: Australia Gypsum-Based Plasterboard Market and Alternatives (by Material), $Million, 2022-2033

- Table 27: South Korea Gypsum-Based Plasterboard Market and Alternatives (by End-User Application), $Million, 2022-2033

- Table 28: South Korea Gypsum-Based Plasterboard Market and Alternatives (by Type), $Million, 2022-2033

- Table 29: South Korea Gypsum-Based Plasterboard Market and Alternatives (by Material), $Million, 2022-2033

- Table 30: India Gypsum-Based Plasterboard Market and Alternatives (by End-User Application), $Million, 2022-2033

- Table 31: India Gypsum-Based Plasterboard Market and Alternatives (by Type), $Million, 2022-2033

- Table 32: India Gypsum-Based Plasterboard Market and Alternatives (by Material), $Million, 2022-2033

- Table 33: Rest-of-Asia-Pacific Gypsum-Based Plasterboard Market and Alternatives (by End-User Application), $Million, 2022-2033

- Table 34: Rest-of-Asia-Pacific Gypsum-Based Plasterboard Market and Alternatives (by Type), $Million, 2022-2033

- Table 35: Rest-of-Asia-Pacific Gypsum-Based Plasterboard Market and Alternatives (by Material), $Million, 2022-2033

Introduction to Asia-Pacific Gypsum-Based Plasterboard Market and Alternatives

The Asia-Pacific gypsum-based plasterboard market and alternatives was valued at $7.20 billion in 2023, and it is expected to grow at a CAGR of 8.31% and reach $16.00 billion by 2033. Gypsum-based plasterboard and its substitutes, which have several advantages over conventional chemical inputs, are poised to revolutionize building methods in the Asia-Pacific area. This market is now in a growth phase and is anticipated to increase significantly. Businesses that make investments in collaborations, facilities, and research will be in a strong position to benefit from the growing need for these cutting-edge solutions.

Market Introduction

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2023 - 2033 |

| 2023 Evaluation | $7.20 Billion |

| 2033 Forecast | $16.00 Billion |

| CAGR | 8.31% |

The growing consumer desire for affordable, lightweight, and environmentally friendly construction materials is propelling the APAC region's market for gypsum-based plasterboard and substitutes. Gypsum-based plasterboards are frequently used in both residential and commercial construction because of its reputation for being simple to install, fire resistant, soundproof, and recyclable.

Gypsum-based products are becoming more popular as APAC nations place a greater emphasis on sustainability and energy efficiency in building since they have a smaller environmental impact than conventional materials. Improvements in production techniques have further increased these goods' robustness and adaptability. Adoption of eco-friendly materials is also being aided by legislative frameworks that support sustainable building practices.

Alternative solutions are becoming formidable rivals, such as those derived from recyclable materials and cutting-edge composites. Market participants emphasizing infrastructure development, R&D, and strategic partnerships are poised to benefit from this trend, creating new opportunities in the expanding market. As construction activity increases across the APAC region, the demand for gypsum-based plasterboard and substitutes is expected to grow significantly.

Market Segmentation

Segmentation 1: by End-User Application

- Residential

- Non-Residential

Segmentation 2: by Type

- Standard Plasterboard

- Fire-Resistant Plasterboard

- Sound-Insulated Plasterboard

- Thermal Plasterboard

- Moisture-Resistant Plasterboard

- Impact-Resistant Plasterboard

- Others

Segmentation 3: by Material

- Gypsum

- Bio-Based

Segmentation 4: by Country

- China

- Japan

- Australia

- South Korea

- India

- Rest-of-Asia-Pacific

How can this report add value to an organization?

Product/Innovation Strategy: The product segment helps the reader understand the different applications of gypsum-based plasterboard and alternatives available based on end-user application (residential and non-residential), type (standard plasterboard, fire-resistant plasterboard, sound-insulated plasterboard, thermal plasterboard, moisture-resistant plasterboard, impact-resistant plasterboard, and others) and material (gypsum and bio-based) market is poised for significant expansion with ongoing technological advancements, increased investments, and growing awareness of gypsum-based plasterboard and alternatives. Therefore, this business is a high-investment and high-revenue generating model.

Growth/Marketing Strategy: The Asia-Pacific gypsum-based plasterboard market and alternatives has been growing at a rapid pace. The market offers enormous opportunities for existing and emerging market players. Some of the strategies covered in this segment are mergers and acquisitions, product launches, partnerships and collaborations, business expansions, and investments. The strategies preferred by companies to maintain and strengthen their market position primarily include product development and partnerships and collaborations.

Competitive Strategy: The key players in the Asia-Pacific gypsum-based plasterboard market and alternatives analyzed and profiled in the study include gypsum-based plasterboard manufacturers. Additionally, a comprehensive competitive landscape such as partnerships, agreements, and collaborations are expected to aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled in the Asia-Pacific gypsum-based plasterboard market and alternatives have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, and market penetration.

Some of the prominent names in the market are:

- China National Building Material Company Limited

- Strawcture Eco

Table of Contents

Executive Summary

Scope and Definition

1 Markets

- 1.1 Construction Industry Trends: Current and Future

- 1.1.1 Growing Emphasis on Sustainable Construction Practices

- 1.1.2 Adoption of Digitalization and Generative AI

- 1.2 Supply Chain Overview

- 1.2.1 Value Chain Analysis

- 1.2.2 Price Comparison

- 1.3 Research and Development Review

- 1.3.1 Patent Filing Trend (by Country, Company)

- 1.4 Regulatory Landscape

- 1.5 Stakeholder Analysis

- 1.6 Market Dynamics: Overview

- 1.6.1 Market Drivers

- 1.6.1.1 Increase in Construction Activities Due to Rapid Urbanization, Population Growth, and Economic Development

- 1.6.1.2 Increase in Investments for Infrastructural Development

- 1.6.1.3 Rise in Demand for Environment-Friendly, Sound-Reducing, and Thermal Insulating Plasterboard Alternatives

- 1.6.2 Market Challenges

- 1.6.2.1 Price Volatility of Raw Materials

- 1.6.2.2 Limited Awareness of Gypsum Plasterboard Applications and Competition from Alternative Construction Materials

- 1.6.3 Market Opportunities

- 1.6.3.1 Advancements in Technology and Product Innovation

- 1.6.3.2 Untapped Opportunities in Emerging Markets for Infrastructure Development

- 1.6.1 Market Drivers

- 1.7 Startup and Investment Summary

- 1.8 Production Technologies for Alternatives

- 1.9 Comparative Analysis of Gypsum-Based Plasterboard and Alternatives

2 Regions

- 2.1 Gypsum-Based Plasterboard Market and Alternatives (by Region)

- 2.2 Asia-Pacific

- 2.2.1 Market

- 2.2.1.1 Key Market Participants in Asia-Pacific

- 2.2.1.2 Business Drivers

- 2.2.1.3 Business Challenges

- 2.2.2 Application

- 2.2.3 Product

- 2.2.4 Asia-Pacific (by Country)

- 2.2.4.1 China

- 2.2.4.2 Japan

- 2.2.4.3 Australia

- 2.2.4.4 South Korea

- 2.2.4.5 India

- 2.2.4.6 Rest-of-Asia-Pacific

- 2.2.1 Market

3 Company Profile

- 3.1 Company Profiles

- 3.1.1 China National Building Material Company Limited

- 3.1.1.1 Overview

- 3.1.1.2 Top Products/Product Portfolio

- 3.1.1.3 Top Competitors

- 3.1.1.4 Target Customers

- 3.1.1.5 Key Personnel

- 3.1.1.6 Analyst View

- 3.1.1.7 Market Share

- 3.1.2 Strawcture Eco

- 3.1.2.1 Overview

- 3.1.2.2 Top Products/Product Portfolio

- 3.1.2.3 Top Competitors

- 3.1.2.4 Target Customers

- 3.1.2.5 Key Personnel

- 3.1.2.6 Analyst View

- 3.1.2.7 Market Share

- 3.1.1 China National Building Material Company Limited

4 Research Methodology

- 4.1 Data Sources

- 4.1.1 Primary Data Sources

- 4.1.2 Secondary Data Sources

- 4.1.3 Data Triangulation

- 4.2 Market Estimation and Forecast