|

|

市場調査レポート

商品コード

1570639

欧州のデジタル診断市場:用途別、製品別、エンドユーザー別、国別 - 分析と予測(2023年~2033年)Europe Digital Diagnostics Market: Focus on Application, Product, End User, and Country - Analysis and Forecast, 2023-2033 |

||||||

カスタマイズ可能

|

|||||||

| 欧州のデジタル診断市場:用途別、製品別、エンドユーザー別、国別 - 分析と予測(2023年~2033年) |

|

出版日: 2024年10月17日

発行: BIS Research

ページ情報: 英文 64 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

欧州のデジタル診断の市場規模は、2023年の4億2,520万米ドルから2033年には25億3,820万米ドルに達すると予測され、予測期間の2023年~2033年のCAGRは19.56%になるとみられています。

欧州のデジタル診断市場は、既存企業と新興企業が市場の覇権を争っており、高いライバル関係にあります。この業界の予測される成長機会と進化は課題と機会をもたらし、将来的に注目すべき魅力的な分野となっています。デジタル診断業界の成長に伴い、企業はデータセキュリティ、市場の飽和、規制遵守などの課題に直面すると予測されます。しかし、変化するクライアントの期待に応え、戦略的提携を構築し、新技術を迅速に採用できる人材には多くのチャンスがあります。

市場イントロダクション

| 主要市場統計 | |

|---|---|

| 予測期間 | 2023年~2033年 |

| 2023年の評価 | 4億2,520万米ドル |

| 2033年の予測 | 25億3,820万米ドル |

| CAGR | 19.56% |

欧州のデジタル診断市場は、効果的なヘルスケアソリューションに対するニーズの高まりと技術向上の両方により大きく拡大しています。

遠隔医療の普及、診断におけるAIと機械学習の活用、個別化医療への注目の高まりが、この拡大の重要な推進力となっています。リアルタイムのデータとアナリティクスの利用により、これらの技術革新は従来の診断手順に革命をもたらし、医療従事者がより多くの情報に基づいた判断を下せるようになっています。

さらに、COVID-19の大流行はデジタル診断への移行を促進し、迅速かつ遠隔での検査オプションの必要性を強調しています。欧州の規制当局も、デジタル診断ツールの承認やヘルスケアシステムへの組み込みを容易にする枠組みを整備することで、この移行を後押ししています。

欧州のデジタル診断市場は、遠隔モニタリングや診断ソリューションに対する需要の高まりにより、大幅な成長が見込まれています。これにより、ヘルスケア業界の進化するニーズに適応できる革新的な企業に新たなビジネスチャンスがもたらされます。

当レポートでは、欧州のデジタル診断市場について調査し、市場の概要とともに、用途別、製品別、エンドユーザー別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場

- 動向:現在および将来の影響評価

- 研究開発レビュー

- 規制状況

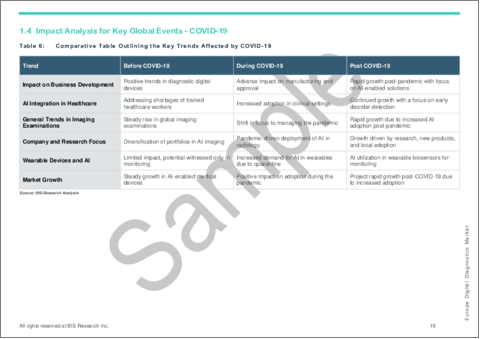

- 主要な世界的出来事の影響分析-COVID-19

- 市場力学:概要

第2章 地域

- 地域別概要

- 促進要因と抑制要因

- 欧州

第3章 市場-競合ベンチマーキングと

企業プロファイル

- 地理的評価

- Koninklijke Philips N.V.

- Siemens Healthineers

- Medtronic plc

- Nano-X Imaging Ltd.

- Brainomix

第4章 調査手法

List of Figures

- Figure 1: Digital Diagnostics Market (by Region), $Million, 2022, 2026, and 2033

- Figure 2: Europe Digital Diagnostics Market (by Application), $Million, 2022, 2026, and 2033

- Figure 3: Europe Digital Diagnostics Market (by End User), $Million, 2022, 2026, and 2033

- Figure 4: Europe Digital Diagnostics Market (by Product), $Million, 2022, 2026, and 2033

- Figure 5: Key Events to Keep a Track of Digital Diagnostics Market

- Figure 6: Digital Diagnostics Market (by Country), January 2020-December 2023

- Figure 7: Digital Diagnostics Market (by Year), January 2020-December 2023

- Figure 8: Proportion of People Suffering from Cancer for Five Years Based on the Stage of Diagnosis

- Figure 9: Technological Advancements in the Field of AI

- Figure 10: France Digital Diagnostics Market, $Million, 2022-2033

- Figure 11: Germany Digital Diagnostics Market, $Million, 2022-2033

- Figure 12: U.K. Digital Diagnostics Market, $Million, 2022-2033

- Figure 13: Spain Digital Diagnostics Market, $Million, 2022-2033

- Figure 14: Italy Digital Diagnostics Market, $Million, 2022-2033

- Figure 15: Rest-of-Europe Digital Diagnostics Market, $Million, 2022-2033

- Figure 16: Strategic Initiatives, 2020-2023

- Figure 17: Data Triangulation

- Figure 18: Top-Down and Bottom-Up Approach

- Figure 19: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Opportunities Across Regions

- Table 3: Startups Entering in the Digital Diagnostics Market

- Table 4: Digital Diagnostics Market, Key Partnerships and Collaborations

- Table 5: Digital Diagnostics Market, Regulatory Landscape

- Table 6: Comparative Table Outlining the Key Trends Affected by COVID-19

- Table 7: Impact Analysis of Market Navigating Factors, 2023-2033

- Table 8: Government Initiatives across Different Countries

- Table 9: Digital Diagnostics Market Players and Their Partnerships with Hospitals and Diagnostic Centers

- Table 10: Digital Diagnostics Market (by Region), $Million, 2022-2033

- Table 11: Europe Digital Diagnostics Market (by Application), $Million, 2022-2033

- Table 12: Europe Digital Diagnostics Market (by End User), $Million, 2022-2033

- Table 13: Europe Digital Diagnostics Market (by Product), $Million, 2022-2033

- Table 14: France Digital Diagnostics Market (by Application), $Million, 2022-2033

- Table 15: France Digital Diagnostics Market (by End User), $Million, 2022-2033

- Table 16: France Digital Diagnostics Market (by Product), $Million, 2022-2033

- Table 17: Germany Digital Diagnostics Market (by Application), $Million, 2022-2033

- Table 18: Germany Digital Diagnostics Market (by End User), $Million, 2022-2033

- Table 19: Germany Digital Diagnostics Market (by Product), $Million, 2022-2033

- Table 20: U.K. Digital Diagnostics Market (by Application), $Million, 2022-2033

- Table 21: U.K. Digital Diagnostics Market (by End User), $Million, 2022-2033

- Table 22: U.K. Digital Diagnostics Market (by Product), $Million, 2022-2033

- Table 23: Spain Digital Diagnostics Market (by Application), $Million, 2022-2033

- Table 24: Spain Digital Diagnostics Market (by End User), $Million, 2022-2033

- Table 25: Spain Digital Diagnostics Market (by Product), $Million, 2022-2033

- Table 26: Italy Digital Diagnostics Market (by Application), $Million, 2022-2033

- Table 27: Italy Digital Diagnostics Market (by End User), $Million, 2022-2033

- Table 28: Italy Digital Diagnostics Market (by Product), $Million, 2022-2033

- Table 29: Rest-of-Europe Digital Diagnostics Market (by Application), $Million, 2022-2033

- Table 30: Rest-of-Europe Digital Diagnostics Market (by End User), $Million, 2022-2033

- Table 31: Rest-of-Europe Digital Diagnostics Market (by Product), $Million, 2022-2033

Introduction to Europe Digital Diagnostics Market

The Europe digital diagnostics market is projected to reach $2,538.2 million by 2033 from $425.2 million in 2023, growing at a CAGR of 19.56% during the forecast period 2023-2033. The European digital diagnostics market is typified by high rivalry, with both established enterprises and emerging players striving for market dominance. The predicted growth and evolution of this industry bring challenges and opportunities, making it a fascinating area to watch in the future years. Businesses will encounter challenges with data security, market saturation, and regulatory compliance as the digital diagnostics industry grows. But there are lots of chances for people who can fulfill changing client expectations, create strategic alliances, and quickly adopt new technologies.

Market Introduction

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2023 - 2033 |

| 2023 Evaluation | $425.2 Million |

| 2033 Forecast | $2,538.2 Million |

| CAGR | 19.56% |

The market for digital diagnostics in Europe is expanding significantly due to both the growing need for effective healthcare solutions and technological improvements.

The spread of telemedicine, the use of AI and machine learning in diagnostics, and the increased focus on personalized care are important drivers of this expansion. With the use of real-time data and analytics, these innovations are revolutionizing traditional diagnostic procedures and empowering medical practitioners to make more informed judgments.

Furthermore, the pandemic of COVID-19 has expedited the transition to digital diagnostics, emphasizing the necessity for quick and remote testing options. European regulatory agencies are also aiding with this shift by putting in place frameworks that make it easier to approve and incorporate digital diagnostic tools into healthcare systems.

The European digital diagnostics market is expected to grow significantly due to the increasing demand for remote monitoring and diagnostic solutions. This will present new opportunities for innovative firms that can adjust to the evolving needs of the healthcare industry.

Market Segmentation:

Segmentation 1: by Application

- Cardiology

- Oncology

- Neurology

- Pathology

- Others

Segmentation 2: by End User

- Hospitals

- Clinical Laboratories

- Others

Segmentation 3: by Product

- Hardware

- Software

Segmentation 4: by Country

- Germany

- France

- Italy

- Spain

- U.K.

- Rest-of-Europe

How can this report add value to an organization?

Workflow/Innovation Strategy: The Europe digital diagnostics market (by application) has been segmented into detailed segments of the application of digital diagnostics based on disease indications, including cardiology, oncology, neurology, pathology, and others. Moreover, the study provides the reader with a detailed understanding of the products that are majorly segmented into hardware and software.

Growth/Marketing Strategy: The digital diagnostics market encompasses a range of digital devices available in the market. Since the market is growing, there are upcoming technologies that can further enhance the adoption of digital diagnostics and AI in the market.

Competitive Strategy: Key players in the Europe digital diagnostics market have been analyzed and profiled in the study, including manufacturers involved in new product launches, acquisitions, expansions, and strategic collaborations. Moreover, a detailed competitive benchmarking of the players operating in the Europe digital diagnostics market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Table of Contents

Executive Summary

Scope and Definition

1 Markets

- 1.1 Trends: Current and Future Impact Assessment

- 1.1.1 Digital Diagnostics Market Trend Analysis

- 1.1.2 Increasing Number of Startups in the Market

- 1.1.3 Partnerships and Collaborations among Market Players

- 1.2 Research and Development Review

- 1.2.1 Patent Filing Trend (by Country, Year)

- 1.3 Regulatory Landscape

- 1.4 Impact Analysis for Key Global Events - COVID-19

- 1.5 Market Dynamics: Overview

- 1.5.1 Market Drivers

- 1.5.1.1 Growing Burden of Chronic Diseases

- 1.5.1.2 Increasing Adoption of Advanced Technologies

- 1.5.1.3 AI Adoption in Digital Diagnostic Devices

- 1.5.2 Market Restraints

- 1.5.2.1 Challenges Regarding Biased Data Leading to Miscalculations in Data-Driven Diagnostic Software

- 1.5.2.2 Lack of Stringent Regulatory Guidelines

- 1.5.3 Market Opportunities

- 1.5.3.1 Increasing Opportunities for Digital Diagnostic Solutions in Emerging Economies

- 1.5.3.2 Synergetic Partnership Opportunities with Hospitals and Diagnostic Centers to Reduce Wait Times and Burden

- 1.5.1 Market Drivers

2 Regions

- 2.1 Regional Summary

- 2.2 Drivers and Restraints

- 2.3 Europe

- 2.3.1 Regional Overview

- 2.3.1.1 Driving Factors for Market Growth

- 2.3.1.2 Factors Challenging the Market

- 2.3.2 Application

- 2.3.3 Product

- 2.3.4 France

- 2.3.5 Germany

- 2.3.6 U.K.

- 2.3.7 Spain

- 2.3.8 Italy

- 2.3.9 Rest-of-Europe

- 2.3.1 Regional Overview

3 Markets -Competitive Benchmarking &

Company Profiles

- 3.1 Geographic Assessment

- 3.1.1 Koninklijke Philips N.V.

- 3.1.1.1 Overview

- 3.1.1.2 Top Products/Product Portfolio

- 3.1.1.3 Target Customers

- 3.1.1.4 Key Personnel

- 3.1.1.5 Analyst View

- 3.1.2 Siemens Healthineers

- 3.1.2.1 Overview

- 3.1.2.2 Top Products/Product Portfolio

- 3.1.2.3 Target Customers

- 3.1.2.4 Key Personnel

- 3.1.2.5 Analyst View

- 3.1.3 Medtronic plc

- 3.1.3.1 Overview

- 3.1.3.2 Top Products

- 3.1.3.3 Target Customers

- 3.1.3.4 Key Personnel

- 3.1.3.5 Analyst View

- 3.1.4 Nano-X Imaging Ltd.

- 3.1.4.1 Overview

- 3.1.4.2 Top Products

- 3.1.4.3 Target Customers

- 3.1.4.4 Key Personnel

- 3.1.4.5 Analyst View

- 3.1.5 Brainomix

- 3.1.5.1 Overview

- 3.1.5.2 Top Products

- 3.1.5.3 Target Customers

- 3.1.5.4 Key Personnel

- 3.1.5.5 Analyst View

- 3.1.1 Koninklijke Philips N.V.

4 Research Methodology

- 4.1 Data Sources

- 4.1.1 Primary Data Sources

- 4.1.2 Secondary Data Sources

- 4.1.3 Data Triangulation

- 4.2 Market Estimation and Forecast