|

|

市場調査レポート

商品コード

1551340

電子部品洗浄・フラックス除去材料市場- 世界と地域別分析:用途別、製品別、競合情勢 - 分析と予測(2024年~2034年)Electronic Cleaning and Flux Removal Materials Market - A Global and Regional Analysis: Focus on Application, Product, and Competitive Landscape - Analysis and Forecast, 2024-2034 |

||||||

カスタマイズ可能

|

|||||||

| 電子部品洗浄・フラックス除去材料市場- 世界と地域別分析:用途別、製品別、競合情勢 - 分析と予測(2024年~2034年) |

|

出版日: 2024年09月10日

発行: BIS Research

ページ情報: 英文 105 Pages

納期: 1~5営業日

|

全表示

- 概要

- 目次

電子部品洗浄・フラックス除去材料市場は、様々な分野における精密で信頼性の高い電子部品製造への需要の高まりにより、大きな拡大を経験しています。

これらの不可欠な材料は、回路基板製造や半導体製造などの用途で広く使用されており、電子部品の性能と寿命を維持する上で重要な役割を果たしています。楽観的シナリオでは、電子部品洗浄・フラックス除去材料の市場規模は、2024年に13億8,000万米ドルになるとみられ、7.08%のCARGで拡大し、2034年には27億3,000万米ドルに達すると予測されています。

電子機器製造技術の進歩が、この市場成長の大きな力となっています。電子機器の小型化と回路設計の複雑化に伴い、繊細な部品に優しく効果的な洗浄ソリューションの必要性が高まっています。この要求が業界内の技術革新に拍車をかけ、高度な洗浄・フラックス除去製品の開発につながっています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2024年~2034年 |

| 2024年の評価額 | 13億8,000万米ドル |

| 2034年の予測 | 27億3,000万米ドル |

| CAGR | 7.08% |

さらに、同市場はエレクトロニクス業界における厳格な品質基準とコンプライアンス要件によって支えられています。製造業者は、製品の信頼性と耐久性を確保するために、厳格な清浄度基準を遵守しなければなりません。この必要性により、部品の完全性を損なうことなく高い基準を達成できる、特殊なフラックス除去剤の需要が高まっています。

環境規制も市場を形成し、企業をより安全で持続可能な洗浄ソリューションへと押し上げています。有害物質の規制強化と環境の持続可能性へのシフトに伴い、業界では規制と消費者の期待の両方を満たす環境に優しい洗浄剤への支持が高まっています。

力強い成長にもかかわらず、市場は、洗浄効果と安全性や環境への配慮とのバランス、複雑な世界的化学物質規制への対応といった課題に直面しています。しかし、特にアジア太平洋地域では、電子機器製造業の拡大と政府の積極的な取り組みにより、大きな成長が見込まれており、市場には十分な機会があります。

当レポートでは、世界の電子部品洗浄・フラックス除去材料市場について調査し、市場の概要とともに、用途別、製品別、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場:業界の展望

- 動向:現在および将来の影響評価

- サプライチェーンの概要

- R&Dレビュー

- 規制状況

- ステークホルダー分析

- 市場力学の概要

第2章 電子部品洗浄・フラックス除去材料市場(用途別)

- 用途のセグメンテーション

- 用途の概要

- 電子部品洗浄・フラックス除去材料市場、エンドユーザー別、2023年~2034年年

- 電子部品洗浄・フラックス除去材料市場、用途別、2023年~2034年年

第3章 電子部品洗浄・フラックス除去材料市場(製品別)

- 製品セグメンテーション

- 製品概要

- 電子部品洗浄・フラックス除去材料市場、洗浄技術別、2023年~2034年年

- 電子部品洗浄・フラックス除去材料市場、製品別、2023年~2034年

第4章 電子機器洗浄・フラックス除去材料市場(地域別)

- 電子部品洗浄・フラックス除去材料市場- 地域別

- 北米

- 欧州

- アジア太平洋

- その他の地域

第5章 市場-競合ベンチマーキングと企業プロファイル

- 今後の見通し

- 地域分析

- 企業プロファイル

- 3M

- ITW (Texwipe and Chemtronics)

- Electrolube

- ZESTRON

- QTEK Manufacturing Ltd

- Tech Spray

- Miller-Stephenson, Inc.

- Kyzen

- International Products Corporation

- Solvents Company

- M.G. Chemicals

- CRC Industries

- WD-40 Company

- A.W. Chesterton Company

- SANKYO CHEMICAL CO.,LTD.

第6章 調査手法

Introduction to Electronic Cleaning and Flux Removal Materials Market

The electronic cleaning and flux removal materials market is experiencing significant expansion, driven by the growing demand for precise and reliable electronic manufacturing across various sectors. These essential materials are widely used in applications such as circuit board production and semiconductor manufacturing, where they play a critical role in maintaining the performance and longevity of electronic components. In an optimistic scenario, the electronic cleaning and flux removal materials market is valued at $1.38 Billion in 2024 and is projected to grow at a CARG of 7.08% to reach $2.73 Billion by 2034.

Advancements in electronics manufacturing technology are a major force behind this market growth. As electronics become smaller and circuit designs more intricate, there is an increasing need for effective cleaning solutions that are gentle yet effective on sensitive components. This requirement has spurred innovation within the industry, leading to the development of advanced cleaning and flux removal products.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2024 - 2034 |

| 2024 Evaluation | $1.38 Billion |

| 2034 Forecast | $2.73 Billion |

| CAGR | 7.08% |

Moreover, the market is buoyed by strict quality standards and compliance requirements in the electronics industry. Manufacturers must adhere to rigorous cleanliness standards to ensure their products are reliable and durable. This necessity has elevated the demand for specialized flux removal chemicals that can achieve these high standards without compromising the integrity of the components.

Environmental regulations are also shaping the market, pushing companies towards safer and more sustainable cleaning solutions. With tighter controls on hazardous substances and a shift towards environmental sustainability, the industry is increasingly favoring green cleaning products that meet both regulatory and consumer expectations.

Despite its robust growth, the market faces challenges such as balancing cleaning efficacy with safety and environmental considerations and navigating complex global chemical regulations. However, the market offers ample opportunities, especially in the Asia Pacific region, which is expected to see significant growth thanks to its expanding electronics manufacturing sector and favorable government initiatives.

Key players in the market, including 3M Company, and ITW (Texwipe and Chemtronics), are leading the charge in innovation, developing safer and more efficient cleaning solutions. Their focus on product development and strategic partnerships is helping them stay at the forefront of the industry trends, catering to the evolving needs of the global market and securing their competitive position. ahead of industry trends and meet the evolving needs of their customers, ensuring their competitive edge in a dynamic market.

Market Segmentation:

Segmentation 1: by End-User

- Electronics

- Automotive

- Aerospace and Defense

- Medical Devices

- Telecommunications

- Others

Segmentation 2: by Application

- Displays and Touch Panels

- Semiconductor Devices

- Aerospace and Defense Electronics

- Printed Circuit Boards

- Sensors and Actuators

- Medical Electronics

- Others

Segmentation 3: by Cleaning Technique

- Manual Cleaning

- Automated Cleaning

- Hybrid Cleaning

- Ultrasonic Cleaning

- Vapor Phase Cleaning

- Others

Segmentation 4: by Product

- Solvent Cleaners

- Water-Based Cleaners

- Aqueous Cleaners

- Semi-Aqueous Cleaners

- Non-Chemical Cleaning Methods

- Microfiber Wipes and Swabs

- Others

Segmentation 5: by Region

- North America

- Europe

- Asia-Pacific

- Rest-of-the-World

How can this report add value to an organization?

Product/Innovation Strategy: The global electronic cleaning and flux removal materials market has been extensively segmented based on various categories, such as end-user, application, cleaning technique, and product. This can help readers get a clear overview of which segments account for the largest share and which ones are well-positioned to grow in the coming years.

Competitive Strategy: A detailed competitive benchmarking of the players operating in the global electronic cleaning and flux removal materials market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on thorough secondary research, which includes analyzing company coverage, product portfolio, market penetration, and insights gathered from primary experts.

Some of the prominent companies in this market are:

- ZESTRON

- M.G. Chemicals

- Kyzen

- Miller-Stephenson, Inc.

- 3M

Key Questions Answered in this Report:

- What are the main factors driving the demand for electronic cleaning and flux removal materials market?

- What are the major patents filed by the companies active in electronic cleaning and flux removal materials market?

- Who are the key players in the electronic cleaning and flux removal materials market, and what are their respective market shares?

- What are the strategies adopted by the key companies to gain a competitive edge in electronic cleaning and flux removal materials market?

- What is the futuristic outlook for the electronic cleaning and flux removal materials market in terms of growth potential?

- What is the current estimation of the electronic cleaning and flux removal materials market, and what growth trajectory is projected from 2024 to 2034?

- Which application, and product segment is expected to lead the market over the forecast period (2024-2034)?

- Which regions demonstrate the highest adoption rates for electronic cleaning and flux removal materials market, and what factorscontribute to their leadership?

Table of Contents

Executive Summary

Scope and Definition

Market/Product Definition

Key Questions Answered

Analysis and Forecast Note

1. Markets: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.2 Supply Chain Overview

- 1.2.1 Value Chain Analysis

- 1.2.2 Pricing Forecast

- 1.3 R&D Review

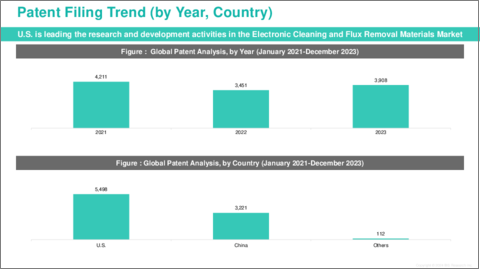

- 1.3.1 Patent Filing Trend by Country, by Company

- 1.4 Regulatory Landscape

- 1.4.1 PFAS Ban

- 1.4.2 Emission Regulations

- 1.4.3 Chemical Production and Hazard Policies

- 1.5 Stakeholder Analysis

- 1.6 Market Dynamics Overview

- 1.6.1 Market Drivers

- 1.6.2 Market Restraints

- 1.6.3 Market Opportunities

2. Electronic Cleaning and Flux Removal Materials Market, by Application

- 2.1 Application Segmentation

- 2.2 Application Summary

- 2.3 Electronic Cleaning and Flux Removal Materials Market, by End-User, 2023-2034

- 2.3.1 Electronics

- 2.3.2 Automotive

- 2.3.3 Aerospace and Defense

- 2.3.4 Medical Devices

- 2.3.5 Telecommunications

- 2.3.6 Others

- 2.4 Electronic Cleaning and Flux Removal Materials Market, by Application, 2023-2034

- 2.4.1 Displays and Touch Panels

- 2.4.2 Semiconductor Devices

- 2.4.3 Aerospace and Defense Electronics

- 2.4.4 Printed Circuit Boards

- 2.4.5 Sensors and Actuators

- 2.4.6 Medical Electronics

- 2.4.7 Others

3. Electronic Cleaning and Flux Removal Materials Market, by Product

- 3.1 Product Segmentation

- 3.2 Product Summary

- 3.3 Electronic Cleaning and Flux Removal Materials Market, by Cleaning Technique, 2023-2034

- 3.3.1 Manual Cleaning

- 3.3.2 Automated Cleaning

- 3.3.3 Hybrid Cleaning

- 3.3.4 Ultrasonic Cleaning

- 3.3.5 Vapor Phase Cleaning

- 3.3.6 Others

- 3.4 Electronic Cleaning and Flux Removal Materials Market, by Product 2023-2034

- 3.4.1 Solvent Cleaners

- 3.4.2 Water-Based Cleaners

- 3.4.3 Aqueous Cleaners

- 3.4.4 Semi-Aqueous Cleaners

- 3.4.5 Non-Chemical Cleaning Methods

- 3.4.6 Microfiber Wipes and Swabs

- 3.4.7 Others

4. Electronic Cleaning and Flux Removal Materials Market, by Region

- 4.1 Electronic Cleaning and Flux Removal Materials Market - by Region

- 4.2 North America

- 4.2.1 Regional Overview

- 4.2.2 Driving Factors for Market Growth

- 4.2.3 Factors Challenging the Market

- 4.2.4 Application

- 4.2.5 Product

- 4.2.6 U.S.

- 4.2.6.1 Market by Application

- 4.2.6.2 Market by Product

- 4.2.7 Canada

- 4.2.7.1 Market by Application

- 4.2.7.2 Market by Product

- 4.2.8 Mexico

- 4.2.8.1 Market by Application

- 4.2.8.2 Market by Product

- 4.3 Europe

- 4.3.1 Regional Overview

- 4.3.2 Driving Factors for Market Growth

- 4.3.3 Factors Challenging the Market

- 4.3.4 Application

- 4.3.5 Product

- 4.3.6 Germany

- 4.3.6.1 Market by Application

- 4.3.6.2 Market by Product

- 4.3.7 France

- 4.3.7.1 Market by Application

- 4.3.7.2 Market by Product

- 4.3.8 U.K.

- 4.3.8.1 Market by Application

- 4.3.8.2 Market by Product

- 4.3.9 Netherlands

- 4.3.9.1 Market by Application

- 4.3.9.2 Market by Product

- 4.3.10 Rest-of-Europe

- 4.3.10.1 Market by Application

- 4.3.10.2 Market by Product

- 4.4 Asia-Pacific

- 4.4.1 Regional Overview

- 4.4.2 Driving Factors for Market Growth

- 4.4.3 Factors Challenging the Market

- 4.4.4 Application

- 4.4.5 Product

- 4.4.6 China

- 4.4.6.1 Market by Application

- 4.4.6.2 Market by Product

- 4.4.7 Japan

- 4.4.7.1 Market by Application

- 4.4.7.2 Market by Product

- 4.4.8 India

- 4.4.8.1 Market by Application

- 4.4.8.2 Market by Product

- 4.4.9 South Korea

- 4.4.9.1 Market by Application

- 4.4.9.2 Market by Product

- 4.4.10 Rest-of-Asia-Pacific

- 4.4.10.1 Market by Application

- 4.4.10.2 Market by Product

- 4.5 Rest-of-the-World

- 4.5.1 Regional Overview

- 4.5.2 Driving Factors for Market Growth

- 4.5.3 Factors Challenging the Market

- 4.5.4 Application

- 4.5.5 Product

- 4.5.6 South America

- 4.5.6.1 Market by Application

- 4.5.6.2 Market by Product

- 4.5.7 Middle East and Africa

- 4.5.7.1 Market by Application

- 4.5.7.2 Market by Product

5. Markets - Competitive Benchmarking and Companies Profiled

- 5.1 Next Frontier

- 5.2 Geographical Analysis

- 5.3 Company Profiles

- 5.3.1 3M

- 5.3.1.1 Overview

- 5.3.1.2 Top Products / Product Portfolio

- 5.3.1.3 Top Competitors

- 5.3.1.4 Target Customers/End-Users

- 5.3.1.5 Key Personnel

- 5.3.1.6 Analyst View

- 5.3.1.7 Market Share

- 5.3.2 ITW (Texwipe and Chemtronics)

- 5.3.2.1 Overview

- 5.3.2.2 Top Products / Product Portfolio

- 5.3.2.3 Top Competitors

- 5.3.2.4 Target Customers/End-Users

- 5.3.2.5 Key Personnel

- 5.3.2.6 Analyst View

- 5.3.2.7 Market Share

- 5.3.3 Electrolube

- 5.3.3.1 Overview

- 5.3.3.2 Top Products / Product Portfolio

- 5.3.3.3 Top Competitors

- 5.3.3.4 Target Customers/End-Users

- 5.3.3.5 Key Personnel

- 5.3.3.6 Analyst View

- 5.3.3.7 Market Share

- 5.3.4 ZESTRON

- 5.3.4.1 Overview

- 5.3.4.2 Top Products / Product Portfolio

- 5.3.4.3 Top Competitors

- 5.3.4.4 Target Customers/End-Users

- 5.3.4.5 Key Personnel

- 5.3.4.6 Analyst View

- 5.3.4.7 Market Share

- 5.3.5 QTEK Manufacturing Ltd

- 5.3.5.1 Overview

- 5.3.5.2 Top Products / Product Portfolio

- 5.3.5.3 Top Competitors

- 5.3.5.4 Target Customers/End-Users

- 5.3.5.5 Key Personnel

- 5.3.5.6 Analyst View

- 5.3.5.7 Market Share

- 5.3.6 Tech Spray

- 5.3.6.1 Overview

- 5.3.6.2 Top Products / Product Portfolio

- 5.3.6.3 Top Competitors

- 5.3.6.4 Target Customers/End-Users

- 5.3.6.5 Key Personnel

- 5.3.6.6 Analyst View

- 5.3.6.7 Market Share

- 5.3.7 Miller-Stephenson, Inc.

- 5.3.7.1 Overview

- 5.3.7.2 Top Products / Product Portfolio

- 5.3.7.3 Top Competitors

- 5.3.7.4 Target Customers/End-Users

- 5.3.7.5 Key Personnel

- 5.3.7.6 Analyst View

- 5.3.7.7 Market Share

- 5.3.8 Kyzen

- 5.3.8.1 Overview

- 5.3.8.2 Top Products / Product Portfolio

- 5.3.8.3 Top Competitors

- 5.3.8.4 Target Customers/End-Users

- 5.3.8.5 Key Personnel

- 5.3.8.6 Analyst View

- 5.3.8.7 Market Share

- 5.3.9 International Products Corporation

- 5.3.9.1 Overview

- 5.3.9.2 Top Products / Product Portfolio

- 5.3.9.3 Top Competitors

- 5.3.9.4 Target Customers/End-Users

- 5.3.9.5 Key Personnel

- 5.3.9.6 Analyst View

- 5.3.9.7 Market Share

- 5.3.10 Solvents Company

- 5.3.10.1 Overview

- 5.3.10.2 Top Products / Product Portfolio

- 5.3.10.3 Top Competitors

- 5.3.10.4 Target Customers/End-Users

- 5.3.10.5 Key Personnel

- 5.3.10.6 Analyst View

- 5.3.10.7 Market Share

- 5.3.11 M.G. Chemicals

- 5.3.11.1 Overview

- 5.3.11.2 Top Products / Product Portfolio

- 5.3.11.3 Top Competitors

- 5.3.11.4 Target Customers/End-Users

- 5.3.11.5 Key Personnel

- 5.3.11.6 Analyst View

- 5.3.11.7 Market Share

- 5.3.12 CRC Industries

- 5.3.12.1 Overview

- 5.3.12.2 Top Products / Product Portfolio

- 5.3.12.3 Top Competitors

- 5.3.12.4 Target Customers/End-Users

- 5.3.12.5 Key Personnel

- 5.3.12.6 Analyst View

- 5.3.12.7 Market Share

- 5.3.13 WD-40 Company

- 5.3.13.1 Overview

- 5.3.13.2 Top Products / Product Portfolio

- 5.3.13.3 Top Competitors

- 5.3.13.4 Target Customers/End-Users

- 5.3.13.5 Key Personnel

- 5.3.13.6 Analyst View

- 5.3.13.7 Market Share

- 5.3.14 A.W. Chesterton Company

- 5.3.14.1 Overview

- 5.3.14.2 Top Products / Product Portfolio

- 5.3.14.3 Top Competitors

- 5.3.14.4 Target Customers/End-Users

- 5.3.14.5 Key Personnel

- 5.3.14.6 Analyst View

- 5.3.14.7 Market Share

- 5.3.15 SANKYO CHEMICAL CO.,LTD.

- 5.3.15.1 Overview

- 5.3.15.2 Top Products / Product Portfolio

- 5.3.15.3 Top Competitors

- 5.3.15.4 Target Customers/End-Users

- 5.3.15.5 Key Personnel

- 5.3.15.6 Analyst View

- 5.3.15.7 Market Share

- 5.3.1 3M