|

|

市場調査レポート

商品コード

1539260

木製衛星市場- 世界および地域別分析:エンドユーザー別、タイプ別、地域別 - 分析と予測(2024年~2034年)Wooden Satellite Market - A Global and Regional Analysis: Focus on End User, Type, and Region - Analysis and Forecast, 2024-2034 |

||||||

カスタマイズ可能

|

|||||||

| 木製衛星市場- 世界および地域別分析:エンドユーザー別、タイプ別、地域別 - 分析と予測(2024年~2034年) |

|

出版日: 2024年08月23日

発行: BIS Research

ページ情報: 英文 110 Pages

納期: 1~5営業日

|

全表示

- 概要

- 目次

木製衛星市場は、様々な市場促進要因に後押しされ、大きな成長を遂げています。

楽観的シナリオでは、木製衛星の市場規模は、2024年に6,630万米ドルになるとみられ、CAGR 7.41%で拡大し、2034年には1億3,550万米ドルに達すると予測されています。

広範な航空宇宙分野の中で、木製衛星市場は創造的で生態学的に敏感なニッチ市場です。この専門市場は、木材や他の生分解性材料で作られた衛星の製作と応用に関係しています。その主な目的は、地球の大気圏に再突入すると完全に分解する素材を使用することで、宇宙ミッションが環境に与える悪影響を軽減し、汚染やスペースデブリを減らすことです。初期のテストが成功し、木材が厳しい宇宙環境でも使用可能であることが示された後、かつては突飛だったこのアイデアは支持を得るようになっています。同市場には、小型衛星、超小型衛星、超小型衛星などさまざまなタイプの衛星があり、それぞれ商業通信、軍事監視、科学研究など特定の用途を目的としています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2024年~2034年 |

| 2024年の評価 | 6,630万米ドル |

| 2034年の予測 | 1億3,550万米ドル |

| CAGR | 7.41% |

木製衛星の市場は、多くの重要な考慮事項により拡大しています。持続可能性と環境保全の重視の高まりは、主な動機の一つです。金属や複合材料で作られた従来の衛星は、スペースデブリを増やし、進行中および今後の宇宙ミッションを危険にさらします。木製衛星は完全に生分解性であるため、この問題に対する持続可能な解決策となります。さらに、衛星技術の発展や打ち上げコストの低下により、木材のような新素材の実験も可能になっています。宇宙探査ミッションの増加や、環境に優しい技術への関心の高まりにより、市場は拡大しています。さらに、国際宇宙ステーションのようなプラットフォームで木材の安定性と宇宙環境への耐性が実証されたことで、木材の有望な用途への信頼が高まっています。

北米は、その広範な航空宇宙インフラ、多額の研究開発費、トップクラスの宇宙技術企業の集積により、木製衛星業界をリードする立場にあります。宇宙ミッションの持続可能性と革新性をリードするSpaceXなど、重要な業界参加者がこの地域に拠点を置いています。環境やスペースデブリへの影響を軽減するため、これらの企業は生分解性素材を積極的に調査し、衛星設計に取り入れています。さらに、木製衛星の開発と導入は、政府の積極的な取り組みとパートナーシップ、そして北米の確立された衛星製造能力によって支えられています。NASAのような組織を通じて最先端の宇宙技術に重要な資金を提供する米国政府によって、この発展途上の分野におけるこの地域のリーダーシップは強化されています。

木製衛星の製造と利用を支援するために、世界各国政府がいくつかのイニシアチブを立ち上げています。日本で京都大学と住友林業が共同で開発したリグノサット・プロジェクトは、木製の衛星を打ち上げ、宇宙における木材の利用可能性を評価することを目的としています。このプログラムは、持続可能な宇宙技術で主導権を握るという日本の大きなイニシアティブの一部です。同様に、欧州宇宙機関(ESA)は、合板の軌道上での挙動を調査するため、史上初の木製衛星を打ち上げるWISA Woodsatミッションを設計しました。これらのプログラムは、木製衛星の将来性を示すとともに、環境に優しい宇宙研究の創造性を支援するための各国政府の献身を示しています。

当レポートでは、世界の木製衛星市場について調査し、市場の概要とともに、エンドユーザー別、タイプ別、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場:業界の展望

- 動向:現在および将来の影響評価

- サプライチェーンの概要

- R&Dレビュー

- 規制状況

- ステークホルダー分析

- 主要な世界的イベントの影響分析

- 市場力学の概要

第2章 木製衛星市場(用途別)

- 用途のセグメンテーション

- 用途の概要

- 木製衛星市場(エンドユーザー別)

第3章 木製衛星市場(製品別)

- 製品セグメンテーション

- 製品概要

- 木製衛星市場(タイプ別)

第4章 木材衛星市場(地域別)

- 木材衛星市場(地域別)

- 北米

- 欧州

- アジア太平洋

- その他の地域

第5章 企業プロファイル

- 今後の見通し

- 地理的評価

- 企業プロファイル

- Cobham Limited

- China Aerospace Science and Technology Corporation (CASC)

- SES S.A.

- SKY Perfect JSAT Corporation

- EchoStar Corporation

- Intelsat

- L3Harris Technologies Inc.

- Thales

- Thuraya Telecommunications Company

- Viasat, Inc.

- Airbus SE

- Maxar Technologies Inc

- Space Exploration Technologies Corp.

- Swarm Technologies, Inc

- その他

第6章 調査手法

Introduction to Wooden Satellites Market

The wooden satellites market is undergoing significant growth, propelled by various key factors and market drivers. In an optimistic scenario, the market is evaluated at a valuation of $66.3 million in 2024 and is projected to expand at a CAGR of 7.41% to reach $135.5. million by 2034.

In the broad aerospace sector, the market for wooden satellites is a creative and ecologically sensitive niche. This specialized market is concerned with the creation and application of satellites made of wood or other biodegradable materials. The main goal is to lessen the negative effects of space missions on the environment by using materials that completely disintegrate upon re-entry into Earth's atmosphere, which will reduce pollution and space debris. After successful initial testing showed that timber materials could be used in severe space circumstances, the once-outlandish idea has gained support. The market includes a range of satellite types, such as minisatellites, microsatellites, and nanosatellites, each intended for a particular use case, such as commercial telecommunications, military surveillance, and scientific research.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2024 - 2034 |

| 2024 Evaluation | $66.3 Million |

| 2034 Forecast | $135.5 Million |

| CAGR | 7.41% |

The market for wooden satellites is expanding due to a number of important considerations. The growing emphasis on sustainability and environmental preservation is one of the main motivators. Conventional satellites, constructed of metals and composite materials, add to space debris and endanger ongoing and upcoming space missions. Given that wooden satellites are completely biodegradable, they provide a sustainable solution to this issue. Additionally, it is now possible to experiment with novel materials like wood due to developments in satellite technology and a decrease in launch costs. The market is rising as a result of an increase in space exploration missions as well as a growth in interest in ecologically friendly technologies. Furthermore, faith in wood's prospective uses has been reinforced by the successful testing of its stability and tolerance to space conditions on platforms like the International Space Station.

North America, with its extensive aerospace infrastructure, large R&D expenditures, and concentration of top space technology businesses, is well-positioned to lead the wooden satellite industry. Important industry participants, such Space Exploration Technologies Corp. (SpaceX), which leads the way in sustainability and innovation for space missions, are based in the area. In an effort to lessen the influence on the environment and space debris, these companies are actively investigating and incorporating biodegradable materials into their satellite designs. Furthermore, the development and implementation of wooden satellites are supported by proactive government initiatives and partnerships, as well as North America's well-established satellite manufacturing capabilities. The region's leadership in this developing sector has been reinforced by the U.S. government's crucial funding of cutting-edge space technologies through organizations like NASA.

Several initiatives have been launched by governments globally to assist in the creation and use of wooden satellites. The LignoSat project, developed in Japan in partnership with Kyoto University and Sumitomo Forestry, intends to launch a wooden satellite to evaluate the feasibility of wood in space applications. This program is a component of Japan's larger initiatives to take the lead in sustainable space technologies. Comparably, the European Space Agency (ESA) designed the WISA Woodsat mission to launch the first-ever wooden satellite in order to research how plywood behaves in orbit. These programs demonstrate the promise of wooden satellites as well as the dedication of different governments to supporting creativity in environmentally friendly space research.

The need to lessen space debris and the environmental impact of regular satellites is driving the market for wooden satellites as an innovative and sustainable alternative within the aerospace industry. The primary factors driving this market are the growing number of space exploration missions, cost reductions, and advancements in satellite technology. Governmental programs like the European Space Agency's WISA Woodsat mission and Japan's LignoSat project highlight international efforts to promote innovation in biodegradable satellite materials. Because of its well-established aerospace infrastructure, significant R&D expenditures, and the existence of industry-leading space technology businesses like SpaceX, North America is expected to lead this market. These companies are leading the way in incorporating sustainable practices into satellite manufacturing thanks to important government collaborations and efforts. Taken together, these elements set wooden satellites up as a feasible and sustainable substitute for upcoming space missions, underscoring the sector's transition to sustainability.

Market Segmentation:

Segmentation 1: by End User

- Military and Defense

- Commercial

Segmentation 2: by Type

- Nano Satellite

- Micro Satellite

- Mini Satellite

- Large Satellite

Segmentation 3: by Region

- North America

- Europe

- Asia-Pacific

- Rest-of-the-World

How can this Report add value to an Organization?

Product/Innovation Strategy: The global wooden satellite market has been extensively segmented based on various categories, such as end user, type and region. This can help readers get a clear overview of which segments account for the largest share and which ones are well-positioned to grow in the coming years.

Competitive Strategy: A detailed competitive benchmarking of the players operating in the global wooden satellite market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on thorough secondary research, which includes analyzing company coverage, product portfolio, market penetration, and insights gathered from primary experts.

Some of the prominent companies in this market are:

- Cobham Limited

- China Aerospace Science and Technology Corporation (CASC)

- SES S.A.

- SKY Perfect JSAT Corporation

- EchoStar Corporation

- L3Harris Technologies Inc.

Key Questions Answered in this Report:

- What are the main factors driving the demand for the global wooden satellites market?

- What are the major patents filed by the companies active in the global wooden satellites market?

- Who are the key players in the global wooden satellites market, and what are the irrespective market shares?

- What are the strategies adopted by the key companies to gain a competitive edge in the global wooden satellites market?

- What is the futuristic outlook for the global wooden satellites market in terms of growth potential?

- What is the current estimation of the global wooden satellites market, and what growth trajectory is projected from 2024 to 2034?

- Which application, and product segment is expected to lead the market over the forecast period (2024-2034)?

- Which regions demonstrate the highest adoption rates for the global wooden satellites market, and what factors contribute to their leadership?

Table of Contents

Executive Summary

Scope and Definition

Market/Product Definition

Key Questions Answered

Analysis and Forecast Note

1. Markets: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.2 Supply Chain Overview

- 1.2.1 Value Chain Analysis

- 1.3 R&D Review

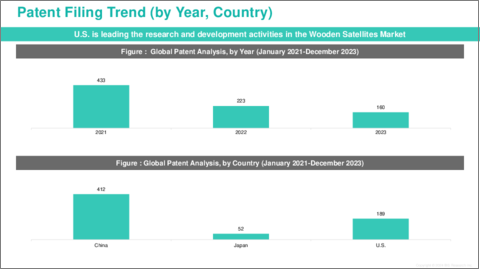

- 1.3.1 Patent Filing Trend by Country, by Company

- 1.4 Regulatory Landscape

- 1.5 Stakeholder Analysis

- 1.5.1 Use Case

- 1.5.2 End User and Buying Criteria

- 1.6 Impact Analysis for Key Global Events

- 1.7 Market Dynamics Overview

- 1.7.1 Market Drivers

- 1.7.2 Market Restraints

- 1.7.3 Market Opportunities

2. Wooden Satellite Market (by Application)

- 2.1 Application Segmentation

- 2.2 Application Summary

- 2.3 Wooden Satellite Market (by End User)

- 2.3.1 Military and Defense

- 2.3.2 Commercial

3. Wooden Satellite Market (by Product)

- 3.1 Product Segmentation

- 3.2 Product Summary

- 3.3 Wooden Satellite Market (by Type)

- 3.3.1 Nano Satellite

- 3.3.2 Micro Satellite

- 3.3.3 Mini Satellite

- 3.3.4 Large Satellite

4. Wooden Satellite Market (by Region)

- 4.1 Wooden Satellite Market (by Region)

- 4.2 North America

- 4.2.1 Regional Overview

- 4.2.2 Driving Factors for Market Growth

- 4.2.3 Factors Challenging the Market

- 4.2.4 Application

- 4.2.5 Product

- 4.2.6 North America Wooden Satellite Market (by Country)

- 4.2.6.1 U.S.

- 4.2.6.1.1 Market by Application

- 4.2.6.1.2 Market by Product

- 4.2.6.2 Canada

- 4.2.6.2.1 Market by Application

- 4.2.6.2.2 Market by Product

- 4.2.6.1 U.S.

- 4.3 Europe

- 4.3.1 Regional Overview

- 4.3.2 Driving Factors for Market Growth

- 4.3.3 Factors Challenging the Market

- 4.3.4 Application

- 4.3.5 Product

- 4.3.6 Europe Wooden Satellite Market (by Country)

- 4.3.6.1 Germany

- 4.3.6.1.1 Market by Application

- 4.3.6.1.2 Market by Product

- 4.3.6.2 France

- 4.3.6.2.1 Market by Application

- 4.3.6.2.2 Market by Product

- 4.3.6.3 U.K.

- 4.3.6.3.1 Market by Application

- 4.3.6.3.2 Market by Product

- 4.3.6.4 Spain

- 4.3.6.4.1 Market by Application

- 4.3.6.4.2 Market by Product

- 4.3.6.5 Russia

- 4.3.6.5.1 Market by Application

- 4.3.6.5.2 Market by Product

- 4.3.6.6 Rest-of-Europe

- 4.3.6.6.1 Market by Application

- 4.3.6.6.2 Market by Product

- 4.3.6.1 Germany

- 4.4 Asia-Pacific

- 4.4.1 Regional Overview

- 4.4.2 Driving Factors for Market Growth

- 4.4.3 Factors Challenging the Market

- 4.4.4 Application

- 4.4.5 Product

- 4.4.6 Asia-Pacific Wooden Satellite Market (by Country)

- 4.4.6.1 China

- 4.4.6.1.1 Market by Application

- 4.4.6.1.2 Market by Product

- 4.4.6.2 Japan

- 4.4.6.2.1 Market by Application

- 4.4.6.2.2 Market by Product

- 4.4.6.3 India

- 4.4.6.3.1 Market by Application

- 4.4.6.3.2 Market by Product

- 4.4.6.4 South Korea

- 4.4.6.4.1 Market by Application

- 4.4.6.4.2 Market by Product

- 4.4.6.5 Rest-of-Asia-Pacific

- 4.4.6.5.1 Market by Application

- 4.4.6.5.2 Market by Product

- 4.4.6.1 China

- 4.5 Rest-of-the-World

- 4.5.1 Regional Overview

- 4.5.2 Driving Factors for Market Growth

- 4.5.3 Factors Challenging the Market

- 4.5.4 Application

- 4.5.5 Product

- 4.5.6 Rest-of-the-World Wooden Satellite Market (by Region)

- 4.5.6.1 South America

- 4.5.6.1.1 Market by Application

- 4.5.6.1.2 Market by Product

- 4.5.6.2 Middle East and Africa

- 4.5.6.2.1 Market by Application

- 4.5.6.2.2 Market by Product

- 4.5.6.1 South America

5. Companies Profiled

- 5.1 Next Frontiers

- 5.2 Geographic Assessment

- 5.3 Company Profiles

- 5.3.1 Cobham Limited

- 5.3.1.1 Overview

- 5.3.1.2 Top Products/Product Portfolio

- 5.3.1.3 Top Competitors

- 5.3.1.4 Target Customers

- 5.3.1.5 Key Personnel

- 5.3.1.6 Analyst View

- 5.3.1.7 Market Share

- 5.3.2 China Aerospace Science and Technology Corporation (CASC)

- 5.3.2.1 Overview

- 5.3.2.2 Top Products/Product Portfolio

- 5.3.2.3 Top Competitors

- 5.3.2.4 Target Customers

- 5.3.2.5 Key Personnel

- 5.3.2.6 Analyst View

- 5.3.2.7 Market Share

- 5.3.3 SES S.A.

- 5.3.3.1 Overview

- 5.3.3.2 Top Products/Product Portfolio

- 5.3.3.3 Top Competitors

- 5.3.3.4 Target Customers

- 5.3.3.5 Key Personnel

- 5.3.3.6 Analyst View

- 5.3.3.7 Market Share

- 5.3.4 SKY Perfect JSAT Corporation

- 5.3.4.1 Overview

- 5.3.4.2 Top Products/Product Portfolio

- 5.3.4.3 Top Competitors

- 5.3.4.4 Target Customers

- 5.3.4.5 Key Personnel

- 5.3.4.6 Analyst View

- 5.3.4.7 Market Share

- 5.3.5 EchoStar Corporation

- 5.3.5.1 Overview

- 5.3.5.2 Top Products/Product Portfolio

- 5.3.5.3 Top Competitors

- 5.3.5.4 Target Customers

- 5.3.5.5 Key Personnel

- 5.3.5.6 Analyst View

- 5.3.5.7 Market Share

- 5.3.6 Intelsat

- 5.3.6.1 Overview

- 5.3.6.2 Top Products/Product Portfolio

- 5.3.6.3 Top Competitors

- 5.3.6.4 Target Customers

- 5.3.6.5 Key Personnel

- 5.3.6.6 Analyst View

- 5.3.6.7 Market Share

- 5.3.7 L3Harris Technologies Inc.

- 5.3.7.1 Overview

- 5.3.7.2 Top Products/Product Portfolio

- 5.3.7.3 Top Competitors

- 5.3.7.4 Target Customers

- 5.3.7.5 Key Personnel

- 5.3.7.6 Analyst View

- 5.3.7.7 Market Share

- 5.3.8 Thales

- 5.3.8.1 Overview

- 5.3.8.2 Top Products/Product Portfolio

- 5.3.8.3 Top Competitors

- 5.3.8.4 Target Customers

- 5.3.8.5 Key Personnel

- 5.3.8.6 Analyst View

- 5.3.8.7 Market Share

- 5.3.9 Thuraya Telecommunications Company

- 5.3.9.1 Overview

- 5.3.9.2 Top Products/Product Portfolio

- 5.3.9.3 Top Competitors

- 5.3.9.4 Target Customers

- 5.3.9.5 Key Personnel

- 5.3.9.6 Analyst View

- 5.3.9.7 Market Share

- 5.3.10 Viasat, Inc.

- 5.3.10.1 Overview

- 5.3.10.2 Top Products/Product Portfolio

- 5.3.10.3 Top Competitors

- 5.3.10.4 Target Customers

- 5.3.10.5 Key Personnel

- 5.3.10.6 Analyst View

- 5.3.10.7 Market Share

- 5.3.11 Airbus SE

- 5.3.11.1 Overview

- 5.3.11.2 Top Products/Product Portfolio

- 5.3.11.3 Top Competitors

- 5.3.11.4 Target Customers

- 5.3.11.5 Key Personnel

- 5.3.11.6 Analyst View

- 5.3.11.7 Market Share

- 5.3.12 Maxar Technologies Inc

- 5.3.12.1 Overview

- 5.3.12.2 Top Products/Product Portfolio

- 5.3.12.3 Top Competitors

- 5.3.12.4 Target Customers

- 5.3.12.5 Key Personnel

- 5.3.12.6 Analyst View

- 5.3.12.7 Market Share

- 5.3.13 Space Exploration Technologies Corp.

- 5.3.13.1 Overview

- 5.3.13.2 Top Products/Product Portfolio

- 5.3.13.3 Top Competitors

- 5.3.13.4 Target Customers

- 5.3.13.5 Key Personnel

- 5.3.13.6 Analyst View

- 5.3.13.7 Market Share

- 5.3.14 Swarm Technologies, Inc.

- 5.3.14.1 Overview

- 5.3.14.2 Top Products/Product Portfolio

- 5.3.14.3 Top Competitors

- 5.3.14.4 Target Customers

- 5.3.14.5 Key Personnel

- 5.3.14.6 Analyst View

- 5.3.14.7 Market Share

- 5.3.15 Other Key Players

- 5.3.1 Cobham Limited