|

|

市場調査レポート

商品コード

1529093

グリーンボンド市場- 世界および地域別分析:用途別、製品別、地域別 - 分析と予測(2024年~2034年)Green Bonds Market - A Global and Regional Analysis: Focus on Application, Product, and Region - Analysis and Forecast, 2024-2034 |

||||||

カスタマイズ可能

|

|||||||

| グリーンボンド市場- 世界および地域別分析:用途別、製品別、地域別 - 分析と予測(2024年~2034年) |

|

出版日: 2024年08月08日

発行: BIS Research

ページ情報: 英文 100 Pages

納期: 1~5営業日

|

全表示

- 概要

- 目次

世界のグリーンボンドの市場規模は、持続可能な金融の中でも極めて重要なセグメントであり、環境の持続可能性に大きく貢献するプロジェクトの支援に特化しています。

これらの債券は、グリーンボンド原則(GBP)によって区別され、債券市場の資金を気候変動との闘い、天然資源の保全、生物多様性の向上に向けた取り組みに振り向けます。透明性、情報開示、報告を重視するGBPは、対象プロジェクトを通じて環境的に持続可能なビジネスモデルを開発するよう発行体を導きます。楽観的シナリオでは、グリーンボンドの市場規模は2024年には6億9,517万米ドルになると予想され、2034年には15億7,601万米ドルに達するなど、有望な成長見通しを示しています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2024年~2034年 |

| 2024年の評価 | 6億9,517万米ドル |

| 2034年の予測 | 15億7,601万米ドル |

| CAGR | 8.53% |

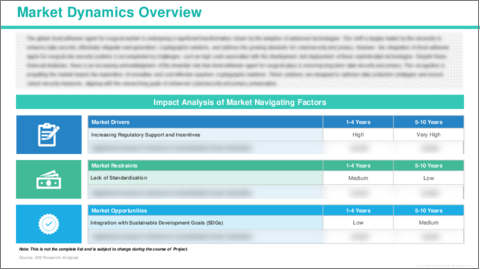

最近の動向では、グリーンボンドの枠組みや基準が拡大し、持続可能な開発目標(SDG)との幅広い統合が促進されています。この動向は、グリーンファイナンスの採用を後押しする規制上の支援やインセンティブの増加によってさらに後押しされています。市場は世界の持続可能性目標とより密接に連携し、金融活動と環境目標とのより深い結びつきを促進しています。

グリーンボンド市場の主な促進要因としては、透明性の重視の高まりや、様々な業界における持続可能な慣行の統合が挙げられます。金融機関や投資家は、投資先が環境に与える影響について詳細な情報開示を求めるようになっており、グリーンボンド発行の説明責任が高まっています。さらに、技術の進歩により、融資プロジェクトから得られる環境便益をより正確に追跡・報告することが可能になり、グリーンファイナンス分野への投資家の信頼と参加を後押ししています。

当レポートでは、世界のグリーンボンド市場について調査し、市場の概要とともに、用途別、製品別、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場:業界の展望

- 動向:現在および将来の影響評価

- サプライチェーンの概要

- R&Dレビュー

- 規制状況

- ステークホルダー分析

- 主要な世界的イベントの影響分析

- 市場力学の概要

第2章 グリーンボンド市場(用途別)

- 用途のセグメンテーション

- 用途の概要

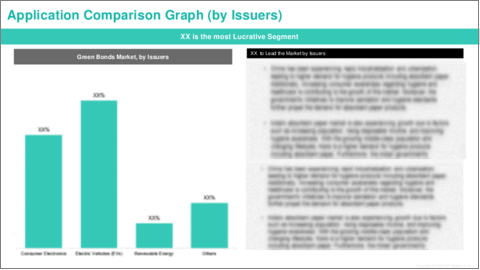

- グリーンボンド市場(発行体別)

第3章 グリーンボンド市場(商品別)

- 製品セグメンテーション

- 製品概要

- グリーンボンド市場(セクター別)

第4章 グリーンボンド市場(地域別)

- グリーンボンド市場(地域別)

- 北米

- 欧州

- アジア太平洋

- その他の地域

第5章 企業プロファイル

- 今後の見通し

- 地理的評価

- 企業プロファイル

- HSBC Holdings plc

- Credit Agricole

- Citigroup Inc.

- Deutsche Bank AG

- JPMorgan Chase & Co

- BofA Securities, Inc.

- Barclays plc

- Morgan Stanley

- Apple Inc

- Bank of America

- JP Morgan Chase

- BNP Paribas

- Iberdrola SA

- Fannie Mae

- TD Securities

第6章 調査手法

Introduction to Green Bonds Market

The global green bond market, a pivotal segment within sustainable finance, is dedicated to supporting projects that significantly contribute to environmental sustainability. These bonds, distinguished by the green bond principles (GBP), channel debt market funds into initiatives that combat climate change, conserve natural resources, and enhance biodiversity. The GBP, which emphasizes transparency, disclosure, and reporting, guide issuers towards developing environmentally sustainable business models through targeted projects. In an optimistic scenario, the Green Bonds Market is anticipated to be valued at $695.17 million in 2024, showing promising growth prospects. By 2034, it is projected to reach an estimated $1,576.01 million.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2024 - 2034 |

| 2024 Evaluation | $695.17 Million |

| 2034 Forecast | $1,576.01 Million |

| CAGR | 8.53% |

In recent years, the market has witnessed an expansion of green bond frameworks and standards, facilitating a broader integration with sustainable development goals (SDGs). This trend is further propelled by increasing regulatory support and incentives, which encourage the adoption of green financing. The market is aligning more closely with global sustainability goals, fostering a deeper connection between financial activities and environmental objectives.

Key drivers of the green bond market include the growing emphasis on transparency and the integration of sustainable practices across various industries. Financial institutions and investors are increasingly demanding detailed disclosures regarding the environmental impact of their investments, enhancing the accountability of green bond issuances. Furthermore, technological advancements are enabling more precise tracking and reporting of the environmental benefits derived from financed projects, thereby boosting investor confidence and participation in the green finance sector.

These developments are creating significant market opportunities. By aligning investment flows with SDGs, green bonds are not only addressing urgent environmental issues but also offering viable financial instruments for investors seeking ethical investment opportunities. As the market matures, the continuous evolution of standards and the increasing involvement of global stakeholders are expected to drive robust growth in the green bond sector, making it an integral part of the worldwide push towards environmental sustainability and economic resilience.

Market Segmentation:

Segmentation 1: by Issuer

- Public Sector Issuers

- Private Sector Issuers

Segmentation 2: by Sectors

- Government Agencies

- Sovereigns

- Municipals

- Corporates

- Financial Institutions

- Others

Segmentation 3: by Region

- North America

- Europe

- Asia-Pacific

- Rest-of-the-World

How can this report add value to an organization?

Product/Innovation Strategy: The global green bonds market has been extensively segmented based on various categories, such as issuer, sectors, and region. This can help readers get a clear overview of which segments account for the largest share and which ones are well-positioned to grow in the coming years.

Competitive Strategy: A detailed competitive benchmarking of the players operating in the global green bonds market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Questions Answered in this Report:

- What are the main factors driving the demand for green bonds market?

- What are the major patents filed by the companies active in green bonds market?

- Who are the key players in the green bonds market, and what are their respective market shares?

- What are the strategies adopted by the key companies to gain a competitive edge in green bonds market?

- What is the futuristic outlook for the green bonds market in terms of growth potential?

- What is the current estimation of the green bonds market, and what growth trajectory is projected from 2024 to 2034?

- Which application, and product segment is expected to lead the market over the forecast period (2024-2034)?

- Which regions demonstrate the highest adoption rates for green bonds market, and what factors contribute to their leadership?

Table of Contents

Executive Summary

Scope and Definition

Market/Product Definition

Key Questions Answered

Analysis and Forecast Note

1. Markets: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.2 Supply Chain Overview

- 1.2.1 Value Chain Analysis

- 1.2.2 Pricing Forecast

- 1.3 R&D Review

- 1.3.1 Patent Filing Trend by Country, by Company

- 1.4 Regulatory Landscape

- 1.5 Stakeholder Analysis

- 1.5.1 Use Case

- 1.5.2 End User and Buying Criteria

- 1.6 Impact Analysis for Key Global Events

- 1.7 Market Dynamics Overview

- 1.7.1 Market Drivers

- 1.7.2 Market Restraints

- 1.7.3 Market Opportunities

2. Green Bonds Market (by Application)

- 2.1 Application Segmentation

- 2.2 Application Summary

- 2.3 Green Bonds Market (by Issuer)

- 2.3.1 Public Sector Issuers

- 2.3.2 Private Sector Issuers

3. Green Bonds Market (by Product)

- 3.1 Product Segmentation

- 3.2 Product Summary

- 3.3 Green Bonds Market (by Sectors)

- 3.3.1 Government Agencies

- 3.3.2 Sovereigns

- 3.3.3 Municipals

- 3.3.4 Corporates

- 3.3.5 Financial Institutions

- 3.3.6 Others

4. Green Bonds Market (by Region)

- 4.1 Green Bonds Market (by Region)

- 4.2 North America

- 4.2.1 Regional Overview

- 4.2.2 Driving Factors for Market Growth

- 4.2.3 Factors Challenging the Market

- 4.2.4 Application

- 4.2.5 Product

- 4.2.6 North America Green Bonds Market (by Country)

- 4.2.6.1 U.S.

- 4.2.6.1.1 Market by Application

- 4.2.6.1.2 Market by Product

- 4.2.6.2 Canada

- 4.2.6.3 Mexico

- 4.2.6.1 U.S.

- 4.3 Europe

- 4.3.1 Regional Overview

- 4.3.2 Driving Factors for Market Growth

- 4.3.3 Factors Challenging the Market

- 4.3.4 Application

- 4.3.5 Product

- 4.3.6 Europe Green Bonds Market (by Country)

- 4.3.6.1 Germany

- 4.3.6.1.1 Market by Application

- 4.3.6.1.2 Market by Product

- 4.3.6.2 France

- 4.3.6.3 U.K.

- 4.3.6.4 Italy

- 4.3.6.5 Others

- 4.3.6.1 Germany

- 4.4 Asia-Pacific

- 4.4.1 Regional Overview

- 4.4.2 Driving Factors for Market Growth

- 4.4.3 Factors Challenging the Market

- 4.4.4 Application

- 4.4.5 Product

- 4.4.6 Asia-Pacific Green Bonds Market (by Country)

- 4.4.6.1 China

- 4.4.6.1.1 Market by Application

- 4.4.6.1.2 Market by Product

- 4.4.6.2 Japan

- 4.4.6.3 India

- 4.4.6.4 Others

- 4.4.6.1 China

- 4.5 Rest-of-the-World

- 4.5.1 Regional Overview

- 4.5.2 Driving Factors for Market Growth

- 4.5.3 Factors Challenging the Market

- 4.5.4 Application

- 4.5.5 Product

- 4.5.6 Rest-of-the-World Green Bonds Market (by Region)

- 4.5.6.1 South America

- 4.5.6.1.1 Market by Application

- 4.5.6.1.2 Market by Product

- 4.5.6.2 Middle East and Africa

- 4.5.6.2.1 Market by Application

- 4.5.6.2.2 Market by Product

- 4.5.6.1 South America

5. Companies Profiled

- 5.1 Next Frontiers

- 5.2 Geographic Assessment

- 5.3 Company Profiles

- 5.3.1 HSBC Holdings plc

- 5.3.1.1 Overview

- 5.3.1.2 Top Products/Product Portfolio

- 5.3.1.3 Top Competitors

- 5.3.1.4 Target Customers

- 5.3.1.5 Key Personnel

- 5.3.1.6 Analyst View

- 5.3.1.7 Market Share

- 5.3.2 Credit Agricole

- 5.3.2.1 Overview

- 5.3.2.2 Top Products/Product Portfolio

- 5.3.2.3 Top Competitors

- 5.3.2.4 Target Customers

- 5.3.2.5 Key Personnel

- 5.3.2.6 Analyst View

- 5.3.2.7 Market Share

- 5.3.3 Citigroup Inc.

- 5.3.3.1 Overview

- 5.3.3.2 Top Products/Product Portfolio

- 5.3.3.3 Top Competitors

- 5.3.3.4 Target Customers

- 5.3.3.5 Key Personnel

- 5.3.3.6 Analyst View

- 5.3.3.7 Market Share

- 5.3.4 Deutsche Bank AG

- 5.3.4.1 Overview

- 5.3.4.2 Top Products/Product Portfolio

- 5.3.4.3 Top Competitors

- 5.3.4.4 Target Customers

- 5.3.4.5 Key Personnel

- 5.3.4.6 Analyst View

- 5.3.4.7 Market Share

- 5.3.5 JPMorgan Chase & Co

- 5.3.5.1 Overview

- 5.3.5.2 Top Products/Product Portfolio

- 5.3.5.3 Top Competitors

- 5.3.5.4 Target Customers

- 5.3.5.5 Key Personnel

- 5.3.5.6 Analyst View

- 5.3.5.7 Market Share

- 5.3.6 BofA Securities, Inc.

- 5.3.6.1 Overview

- 5.3.6.2 Top Products/Product Portfolio

- 5.3.6.3 Top Competitors

- 5.3.6.4 Target Customers

- 5.3.6.5 Key Personnel

- 5.3.6.6 Analyst View

- 5.3.6.7 Market Share

- 5.3.7 Barclays plc

- 5.3.7.1 Overview

- 5.3.7.2 Top Products/Product Portfolio

- 5.3.7.3 Top Competitors

- 5.3.7.4 Target Customers

- 5.3.7.5 Key Personnel

- 5.3.7.6 Analyst View

- 5.3.7.7 Market Share

- 5.3.8 Morgan Stanley

- 5.3.8.1 Overview

- 5.3.8.2 Top Products/Product Portfolio

- 5.3.8.3 Top Competitors

- 5.3.8.4 Target Customers

- 5.3.8.5 Key Personnel

- 5.3.8.6 Analyst View

- 5.3.8.7 Market Share

- 5.3.9 Apple Inc

- 5.3.9.1 Overview

- 5.3.9.2 Top Products/Product Portfolio

- 5.3.9.3 Top Competitors

- 5.3.9.4 Target Customers

- 5.3.9.5 Key Personnel

- 5.3.9.6 Analyst View

- 5.3.9.7 Market Share

- 5.3.10 Bank of America

- 5.3.10.1 Overview

- 5.3.10.2 Top Products/Product Portfolio

- 5.3.10.3 Top Competitors

- 5.3.10.4 Target Customers

- 5.3.10.5 Key Personnel

- 5.3.10.6 Analyst View

- 5.3.10.7 Market Share

- 5.3.11 JP Morgan Chase

- 5.3.11.1 Overview

- 5.3.11.2 Top Products/Product Portfolio

- 5.3.11.3 Top Competitors

- 5.3.11.4 Target Customers

- 5.3.11.5 Key Personnel

- 5.3.11.6 Analyst View

- 5.3.11.7 Market Share

- 5.3.12 BNP Paribas

- 5.3.12.1 Overview

- 5.3.12.2 Top Products/Product Portfolio

- 5.3.12.3 Top Competitors

- 5.3.12.4 Target Customers

- 5.3.12.5 Key Personnel

- 5.3.12.6 Analyst View

- 5.3.12.7 Market Share

- 5.3.13 Iberdrola SA

- 5.3.13.1 Overview

- 5.3.13.2 Top Products/Product Portfolio

- 5.3.13.3 Top Competitors

- 5.3.13.4 Target Customers

- 5.3.13.5 Key Personnel

- 5.3.13.6 Analyst View

- 5.3.13.7 Market Share

- 5.3.14 Fannie Mae

- 5.3.14.1 Overview

- 5.3.14.2 Top Products/Product Portfolio

- 5.3.14.3 Top Competitors

- 5.3.14.4 Target Customers

- 5.3.14.5 Key Personnel

- 5.3.14.6 Analyst View

- 5.3.14.7 Market Share

- 5.3.15 TD Securities

- 5.3.15.1 Overview

- 5.3.15.2 Top Products/Product Portfolio

- 5.3.15.3 Top Competitors

- 5.3.15.4 Target Customers

- 5.3.15.5 Key Personnel

- 5.3.15.6 Analyst View

- 5.3.15.7 Market Share

- 5.3.1 HSBC Holdings plc