|

|

市場調査レポート

商品コード

1520631

遺伝学的遺伝子検査の世界市場:製品タイプ別、サンプルタイプ別、技術別、遺伝子検査タイプ別、応用分野別、地域別、競合情勢 - 分析と予測(2024年~2033年)Global Hereditary Genetic Testing Market: Focus on Product, Sample Type, Technology, Genetic Testing Type, Application Area, Region, and Competitive Landscape - Analysis and Forecast, 2024-2033 |

||||||

カスタマイズ可能

|

|||||||

| 遺伝学的遺伝子検査の世界市場:製品タイプ別、サンプルタイプ別、技術別、遺伝子検査タイプ別、応用分野別、地域別、競合情勢 - 分析と予測(2024年~2033年) |

|

出版日: 2024年07月25日

発行: BIS Research

ページ情報: 英文 113 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

世界の遺伝学的遺伝子検査の市場規模は、2023年に247億8,000万米ドルとなりました。

同市場は、2033年までに819億5,000万米ドルに急増すると予測され、2024年から2033年にかけてのCAGRは12.73%と著しい伸びを示し、大幅な成長が見込まれています。同市場は、継続的な技術進歩に牽引され、2桁成長を遂げています。次世代シーケンシング(NGS)などの遺伝子シーケンシング技術の革新により、遺伝子検査の正確性、効率性、コスト効率が向上しています。遺伝性疾患の診断と管理のための遺伝子検査の利点に関する一般市民とヘルスケア専門家の意識の高まりが、需要の高まりにつながっています。遺伝性疾患と遺伝性がんの有病率の上昇は、早期診断と個別化治療オプションの必要性をさらに煽っています。出生前スクリーニング、新生児スクリーニング、腫瘍学、個別化医療を含む遺伝子検査の用途拡大は、市場の範囲を広げています。規制当局の支援と有利なガイドラインが遺伝子検査の品質と信頼性を保証し、市場の成長を促進しています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2024年~2033年 |

| 2024年の評価 | 278億8,000万米ドル |

| 2033年の予測 | 819億5,000万米ドル |

| CAGR | 12.73% |

遺伝学的遺伝子検査の状況は、戦略的提携や革新的技術の進歩によって急速に進化しています。Konica Minolta, Inc. (Ambry Genetics)が主導するInter-Organization Cancer Genetics Clinical Evidence Coalition(INTERACT)コラボレーションのようなイニシアチブは、遺伝性がん検査へのアクセスを促進する上で極めて重要であり、Quest Diagnostics IncorporatedとBroad Clinical Labsのようなパートナーシップは、出生後の発達遅延障害の診断における全ゲノムシーケンシング(WGS)の臨床的有用性を実証しています。さらに、Konica Minolta, Inc. (Ambry Genetics)とTempusとの戦略的提携のように、包括的な生殖細胞系および体細胞系検査サービスの提供が強化されています。これらの開発は、Agilent Technologies, Inc.のGenetiSure Dx Postnatal AssayやLaboratory Corporation of America Holdingsのリン酸化タウ217(pTau217)の独立血液バイオマーカー検査などの製品の承認や発売によって補完され、それぞれが遺伝子検査の選択肢の拡大に貢献しています。Myriad Genetics, Inc.によるIntermountain Precision Genomics社からの資産買収のような買収により、この業界は持続的な成長と革新の態勢を整え、個別化された遺伝的洞察による医療成果の向上を約束しています。

世界の遺伝学的遺伝子検査市場は、Agilent Technologies、Ambry Genetics、Color、CENTOGENE N.V.、Natera Inc.、Myriad Genetics, Inc.、Illumina, Inc.などの企業によって推進され、産業遺伝学の展望に革命をもたらしています。次世代シーケンシング(NGS)、ポリメラーゼ連鎖反応(PCR)、マイクロアレイなどの先端技術を活用することで、これらの企業は、腫瘍遺伝学的検査、神経学的遺伝学的検査、循環器学的遺伝学的検査、希少疾患検査などに対応する幅広い製品を提供しています。これらの製品は、Agilent TechnologiesのSureMASTR Hereditary Cancerのような腫瘍組織ベースの検査から、Colorが提供するような唾液ベースの検査まで多岐にわたります。これらの進歩の影響は、研究および臨床診断に及んでおり、がん、心血管疾患、神経疾患、希少遺伝病などの様々な疾患の原因となる遺伝的要因に関する洞察を提供しています。最先端技術と広範な疾患範囲の統合を通じて、世界の遺伝学的遺伝子検査市場の産業への影響は大きく、個別化医療と遺伝子ヘルスケアの最前線を推進しています。

当レポートでは、世界の遺伝学的遺伝子検査市場について調査し、市場の概要とともに、製品タイプ別、サンプルタイプ別、技術別、遺伝子検査タイプ別、応用分野別、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 遺伝学的遺伝子検査:業界の展望

- 遺伝学的遺伝子検査の現状

- 市場の足跡と将来の可能性

- 動向:現在および将来の影響評価

- R&Dレビュー

- 総市場規模と浸透率

- 法的および規制上の枠組み

- 償還シナリオ

- 市場力学

第2章 世界の遺伝学的遺伝子検査市場(製品別)

- 概要

- キットと消耗品

- サービス

第3章 世界の遺伝学的遺伝子検査市場(サンプルタイプ別)

- 概要

- 腫瘍組織

- 骨髄

- 唾液

- 血

- その他

第4章 世界の遺伝学的検査市場(技術別)

- 概要

- 次世代シーケンシング(NGS)

- ポリメラーゼ連鎖反応(PCR)

- 免疫組織化学(IHC)

- インサイチューハイブリダイゼーション(ISH)

- マイクロアレイ技術

- その他

第5章 世界の遺伝学的遺伝子検査市場(遺伝子検査タイプ別)

- 概要

- 心臓病学

- 腫瘍学

- 神経学

- その他

第6章 世界の遺伝学的検査市場(応用分野別)

- 概要

- 学術調査

- 臨床診断、モニタリング、スクリーニング

- 創薬

第7章 地域

- 促進要因と抑制要因

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第8章 市場-競合ベンチマーキングと企業プロファイル

- 競合情勢

- 企業プロファイル

- Agilent Technologies, Inc.

- BGI Group (Beijing Genomics Institute (BGI))

- Centogene AG

- Eurofins Scientific SE

- F. Hoffmann-La Roche Ltd

- Illumina, Inc.

- Konica Minolta, Inc. (Ambry Genetics)

- Laboratory Corporation of America Holdings

- Myriad Genetics, Inc.

- Revvity, Inc. (PerkinElmer, Inc.)

- Quest Diagnostics Incorporated

- Thermo Fisher Scientific, Inc.

- 遺伝学的遺伝子検査市場における新興企業

第9章 調査手法

List of Figures

- Figure 1: Global Hereditary Genetic Testing Market, by Region, $Billion, 2023, 2027, and 2033

- Figure 2: Global Hereditary Genetic Testing Market (by Technology), $Billion, 2023 and 2033

- Figure 3: Global Hereditary Genetic Testing Market (by Product), $Billion, 2023 and 2033

- Figure 4: Global Hereditary Genetic Testing Market (by Sample Type), $Billion, 2023 and 2033

- Figure 5: Global Hereditary Genetic Testing Market (by Application Area), $Billion, 2023 and 2033

- Figure 6: Global Hereditary Genetic Testing Market (by Testing Type), $Billion, 2023 and 2033

- Figure 7: Key Events to Keep Track of in the Hereditary Genetic Testing Market

- Figure 8: Types of Hereditary Genetic Tests

- Figure 9: Global Hereditary Genetic Testing Market, Patent Analysis (by Year), January 2021-April 2024

- Figure 10: Global Hereditary Genetic Testing Market, Patent Analysis (by Country), January 2021-April 2024

- Figure 11: Global Hereditary Genetic Testing Market Scenario, 2023

- Figure 12: Analysis of Market Navigating Factors, 2024-2033

- Figure 13: Rising Prevalence of Genetic Disorders

- Figure 14: Prevalence of a Few Rare Diseases

- Figure 15: Few Major Inorganic Growth Activities in the Hereditary Genetic Testing Market

- Figure 16: Number of Hereditary Genetic Tests Registered on Genetic Testing Registry, by Year

- Figure 17: Need for More Genetic Counselors

- Figure 18: Key Expansions in the Past Few Years

- Figure 19: U.S. Hereditary Genetic Testing Market, $Billion, 2022-2033

- Figure 20: Canada Hereditary Genetic Testing Market, $Billion, 2022-2033

- Figure 21: France Hereditary Genetic Testing Market, $Billion, 2022-2033

- Figure 22: Germany Hereditary Genetic Testing Market, $Billion, 2022-2033

- Figure 23: U.K. Hereditary Genetic Testing Market, $Billion, 2022-2033

- Figure 24: Spain Hereditary Genetic Testing Market, $Billion, 2022-2033

- Figure 25: Netherlands Hereditary Genetic Testing Market, $Billion, 2022-2033

- Figure 26: Rest-of-Europe Hereditary Genetic Testing Market, $Billion, 2022-2033

- Figure 27: China Hereditary Genetic Testing Market, $Billion, 2022-2033

- Figure 28: India Hereditary Genetic Testing Market, $Billion, 2022-2033

- Figure 29: Australia Hereditary Genetic Testing Market, $Billion, 2022-2033

- Figure 30: Japan Hereditary Genetic Testing Market, $Billion, 2022-2033

- Figure 31: Singapore Hereditary Genetic Testing Market, $Billion, 2022-2033

- Figure 32: Rest-of-Asia-Pacific Hereditary Genetic Testing Market, $Billion, 2022-2033

- Figure 33: Brazil Hereditary Genetic Testing Market, $Billion, 2022-2033

- Figure 34: Mexico Hereditary Genetic Testing Market, $Billion, 2022-2033

- Figure 35: Rest-of-Latin America Hereditary Genetic Testing Market, $Billion, 2022-2033

- Figure 36: Number of Mergers and Acquisitions (by Company), January 2021-April 2024

- Figure 37: Number of Product Launches (by Company), January 2021-April 2024

- Figure 38: Synergistic Activities Share (by Company), January 2021-April 2024

- Figure 39: Business Expansion Activities Share (by Company), January 2021-April 2024

- Figure 40: Global Hereditary Genetic Testing Market, Company Revenue Share Analysis, $Billion, 2023

- Figure 41: Data Triangulation

- Figure 42: Top-Down and Bottom-Up Approach

- Figure 43: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Opportunities across Regions

- Table 3: Global Hereditary Genetic Testing Market, Product Launches and Regulatory Approvals

- Table 4: Regulatory Bodies Governing Hereditary Genetic Testing

- Table 5: Global Hereditary Genetic Testing Market (by Product), $Billion, 2022-2033

- Table 6: Global Hereditary Genetic Testing Market (by Sample Type), $Billion, 2022-2033

- Table 7: Global Hereditary Genetic Testing Market (by Technology), $Billion, 2022-2033

- Table 8: Global Hereditary Genetic Testing Market (by Oncology Genetic Testing Type), $Billion, 2022-2033

- Table 9: Global Hereditary Genetic Testing Market (by Cardiology Genetic Testing Type), $Billion, 2022-2033

- Table 10: Global Hereditary Genetic Testing Market (by Neurology Genetic Testing Type), $Billion, 2022-2033

- Table 11: Global Hereditary Genetic Testing Market (by Other Genetic Testing Type), $Billion, 2022-2033

- Table 12: Global Hereditary Genetic Testing Market (by Application Area), $Billion, 2022-2033

- Table 13: North America Hereditary Genetic Testing Market (by Genetic Testing Type), $Billion, 2022-2033

- Table 14: Europe Hereditary Genetic Testing Market (by Genetic Testing Type), $Billion, 2022-2033

- Table 15: Asia-Pacific Hereditary Genetic Testing Market (by Genetic Testing Type), $Billion, 2022-2033

- Table 16: Latin America Hereditary Genetic Testing Market (by Genetic Testing Type), $Billion, 2022-2033

- Table 17: Middle East and Africa Genetic Testing Market (by Genetic Testing Type), $Billion, 2022-2033

- Table 18: Emerging Companies in Hereditary Genetic Testing Market

Global Hereditary Genetic Testing Market Industry Overview

The global hereditary genetic testing market, initially valued at $24.78 billion in 2023, is poised for substantial growth, projected to surge to $81.95 billion by 2033, marking a remarkable compound annual growth rate (CAGR) of 12.73% over the period from 2024 to 2033. The market is witnessing double-digit growth, driven by continuous technological advancements. Innovations in genetic sequencing technologies, such as next-generation sequencing (NGS), have made genetic testing more accurate, efficient, and cost-effective. Increased awareness among the public and healthcare professionals about the benefits of genetic testing for diagnosing and managing hereditary conditions has led to higher demand. The rising prevalence of genetic disorders and hereditary cancers further fuels the need for early diagnosis and personalized treatment options. The expanding applications of genetic testing, including prenatal screening, newborn screening, oncology, and personalized medicine, are broadening the market scope. Regulatory support and favorable guidelines ensure the quality and reliability of genetic tests, facilitating market growth.

Market Introduction

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2024 - 2033 |

| 2024 Evaluation | $27.88 Billion |

| 2033 Forecast | $81.95 Billion |

| CAGR | 12.73% |

The landscape of hereditary genetic testing is rapidly evolving, fuelled by strategic collaborations and innovative advancements in technology. Initiatives such as the Inter-Organization Cancer Genetics Clinical Evidence Coalition (INTERACT) Collaboration, led by Konica Minolta, Inc. (Ambry Genetics), are pivotal in promoting access to hereditary cancer testing, while partnerships such as that between Quest Diagnostics Incorporated and Broad Clinical Labs are demonstrating the clinical utility of whole genome sequencing (WGS) for diagnosing developmental delay disorders post-birth. Moreover, strategic alliances such as the one between Konica Minolta, Inc. (Ambry Genetics) and Tempus are enhancing the provision of comprehensive germline and somatic testing services. These developments are complemented by product approvals and launches, such as Agilent Technologies, Inc.'s GenetiSure Dx Postnatal Assay and Laboratory Corporation of America Holdings' independent blood biomarker test for phosphorylated tau 217 (pTau217), each contributing to the expanding toolkit of genetic testing options. With acquisitions such as Myriad Genetics, Inc.'s acquisition of assets from Intermountain Precision Genomics, the industry is poised for sustained growth and innovation, promising improved healthcare outcomes through personalized genetic insights.

Industrial Impact

The global hereditary genetic testing market, propelled by companies such as Agilent Technologies, Ambry Genetics, Color, CENTOGENE N.V., Natera Inc., Myriad Genetics, Inc., and Illumina, Inc., has revolutionized the landscape of industrial genetics. By utilizing advanced technologies such as next-generation sequencing (NGS), polymerase chain reaction (PCR), and microarray, these companies offer a wide array of products catering to oncology genetic testing, neurology genetic testing, cardiology genetic testing, and rare disease testing, among others. These products range from tumor tissue-based tests such as SureMASTR Hereditary Cancer by Agilent Technologies to saliva-based tests such as those offered by Color. The impact of these advancements extends across research and clinical diagnostics, offering insights into hereditary factors contributing to various diseases such as cancer, cardiovascular disorders, neurological conditions, and rare genetic diseases. Through the integration of cutting-edge technologies and expansive disease coverage, the industrial impact of the global hereditary genetic testing market is profound, driving forward the frontiers of personalized medicine and genetic healthcare.

Market Segmentation:

Segmentation 1: by Product

- Kits and Consumables

- Services

Services Segment to Dominate the Hereditary Genetic Testing Market (by Product)

Based on product, the global hereditary genetic testing market was led by the services segment, which held a 69.33% share in 2023. This substantial market share indicates the high demand for services related to hereditary genetic testing, which includes genetic counseling, testing, and result interpretation. The prominence of the services segment highlights the importance of comprehensive support and expertise in genetic testing processes, ensuring accurate diagnosis and personalized healthcare solutions.

Segmentation 2: by Sample Type

- Tumor Tissue

- Bone Marrow

- Saliva

- Blood

- Other Sample Types

Blood Segment to Dominate the Hereditary Genetic Testing Market (by Sample Type)

Based on sample type, the global hereditary genetic testing market was led by the blood segment, which held a 41.79% share in 2023. This dominant market share underscores the preference for blood samples in hereditary genetic testing due to their reliability and ease of collection. Blood samples provide a rich source of DNA, which is essential for accurate and comprehensive genetic analysis. The prominence of the blood segment reflects the established protocols and widespread acceptance of blood-based testing in clinical and research settings. This trend highlights the crucial role of blood samples in facilitating precise diagnosis and management of hereditary conditions, ultimately contributing to improved patient care and outcomes.

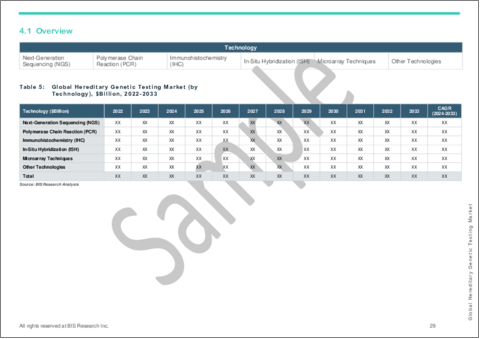

Segmentation 3: by Technology

- Next-Generation Sequencing (NGS)

- Polymerase Chain Reaction (PCR)

- Immunohistochemistry (IHC)

- In-Situ Hybridization (ISH)

- Microarray Techniques

- Other Technologies

Next-Generation Sequencing Segment to Dominate the Hereditary Genetic Testing Market (by Technology)

Based on technology, the global hereditary genetic testing market was led by the next-generation sequencing segment, which held a 32.08% share in 2023. This significant market share highlights the advanced capabilities and growing adoption of NGS technology in hereditary genetic testing. NGS offers high-throughput sequencing, enabling the rapid and comprehensive analysis of multiple genes simultaneously, which is crucial for identifying a wide range of genetic mutations associated with hereditary conditions. The prominence of the NGS segment reflects its efficiency, accuracy, and cost-effectiveness, making it the preferred choice for both clinical diagnostics and research applications. This trend underscores the transformative impact of NGS on the genetic testing landscape, driving innovations and improving the detection and management of hereditary diseases.

Segmentation 4: by Oncology Genetic Testing Type

- Breast Cancer

- Lung Cancer

- Prostate Cancer

- Colorectal Cancer

- Melanoma

- Other Oncology Hereditary Genetic Testing

Breast Cancer Segment to Dominate the Hereditary Genetic Testing Market (by Oncology Genetic Testing Type)

Based on oncology genetic testing type, the global hereditary genetic testing market was led by the breast cancer segment, which held a 41.97% share in 2023. This significant market share underscores the high demand for genetic testing for breast cancer, reflecting the critical importance of early detection and risk assessment in managing this prevalent condition. Genetic testing for breast cancer, particularly for BRCA1 and BRCA2 mutations, plays a crucial role in identifying individuals at higher risk, enabling preventive measures and personalized treatment strategies.

Segmentation 5: by Cardiology Genetic Testing Type

- Cardiomyopathy

- Aortopathy

- Arrhythmia

- Other Cardiology Hereditary Genetic Testing

Cardiomyopathy Segment to Dominate the Hereditary Genetic Testing Market (by Cardiology Genetic Testing Type)

Based on cardiology genetic testing type, the global hereditary genetic testing market was led by the cardiomyopathy segment, which held a 33.47% share in 2023. This substantial market share underscores the growing recognition of the importance of genetic testing in diagnosing and managing cardiomyopathies, which are often hereditary and can lead to severe cardiac conditions if not detected early. Genetic testing for cardiomyopathies helps identify specific genetic mutations that cause various forms of the disease, facilitating early intervention, personalized treatment plans, and better management of at-risk individuals.

Segmentation 6: by Neurology Genetic Testing Type

- Epilepsy

- Neurodegenerative Disorders

- Neuromuscular Disorders

- Other Neurology Hereditary Genetic Testing

Epilepsy Segment to Dominate the Hereditary Genetic Testing Market (by Neurology Genetic Testing Type)

Based on neurology genetic testing type, the global hereditary genetic testing market was led by the epilepsy segment, which held a 35.55% share in 2023. This significant market share highlights the critical role of genetic testing in diagnosing and managing epilepsy, a neurological disorder with various hereditary forms. Genetic testing for epilepsy helps identify specific genetic mutations that can influence the condition, enabling more accurate diagnoses and the development of personalized treatment plans. The dominance of the epilepsy segment reflects the growing importance of genetic insights in understanding the underlying causes of epilepsy, leading to improved patient care and outcomes.

Segmentation 7: by Other Genetic Testing Type

- Newborn Screening

- Prenatal Screening (NIPT) and Preimplantation Testing

- Rare Disease Testing

- Direct-to-Consumer Testing

Rare Disease Testing Segment to Dominate the Hereditary Genetic Testing Market (by Other Genetic Testing Type)

Based on other genetic testing type, the global hereditary genetic testing market was led by the rare disease testing segment, which held a 39.13% share in 2023. This substantial market share highlights the crucial role of genetic testing in diagnosing rare diseases, which often have a hereditary component. Genetic tests for rare diseases are essential for identifying specific mutations that may not be well understood or easily diagnosed through traditional methods. The dominance of the rare disease testing segment reflects the growing awareness and need for precise diagnostic tools to manage and treat these conditions effectively.

Segmentation 8: by Application Area

- Academic and Research

- Clinical Diagnostics, Monitoring and Screening

- Drug Discovery

Clinical Diagnostics Segment to Dominate the Hereditary Genetic Testing Market (by Application Area)

Based on application area, the global hereditary genetic testing market was led by the clinical diagnostics segment, which held a 40.99% share in 2023. This substantial market share highlights the crucial role of clinical diagnostics in hereditary genetic testing, emphasizing the importance of accurate and early detection of genetic conditions for effective medical intervention. The dominance of the clinical diagnostics segment reflects the growing reliance on genetic tests to guide clinical decisions and personalize treatment plans, ultimately improving patient outcomes. This trend underscores the significance of integrating advanced genetic diagnostics into routine clinical practice to address the rising prevalence of hereditary disorders and enhance healthcare delivery.

Segmentation 9: by Region

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Spain

- Netherlands

- Rest-of-Europe

- Asia-Pacific

- Japan

- India

- China

- Singapore

- Australia

- Rest-of-Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest-of-Latin America

- Middle East and Africa

The hereditary genetic testing market in the North America region is expected to witness a significant growth rate of 11.41% during the forecast period. This notable growth can be attributed to several key factors. Continuous advancements in genetic testing technologies are enhancing the accuracy and accessibility of hereditary genetic tests, driving market expansion. Growing awareness about the importance of genetic testing for early diagnosis and management of inherited conditions is leading to higher adoption rates among healthcare providers and patients. Supportive government policies and funding for genetic research and testing are fostering a conducive environment for market growth in the region. However, the Asia-Pacific region is expected to reach $21.97 billion in 2033 from $5.36 billion in 2023, at a CAGR of 15.18% during the forecast period 2024-2033.

Recent Developments in the Hereditary Genetic Testing Market

- In April 2024, Agilent Technologies, Inc. received Class C Certification under the European Union In Vitro Diagnostic Regulation (IVDR) for its GenetiSure Dx Postnatal Assay. The GenetiSure Dx Postnatal Assay device helps clinical geneticists detect genetic anomalies earlier and more accurately than traditional methods.

- In April 2024, Konica Minolta, Inc. (Ambry Genetics) initiated the Inter-Organization Cancer Genetics Clinical Evidence Coalition (INTERACT) Collaboration with the aim of promoting hereditary cancer testing. The coalition's objective is to enhance access to genetic testing for individuals affected by or at risk of hereditary cancers. Additionally, the coalition endeavors to influence medical professionals and industry guidelines pertaining to such testing.

- In April 2024, Quest Diagnostics Incorporated and Broad Clinical Labs revealed a research partnership aimed at showcasing the clinical utility of whole genome sequencing (WGS) as the primary genetic test for diagnosing developmental delay disorders after birth. The collaboration aims to illustrate that WGS can offer insights obtained from a single blood test that is at least as clinically precise as the multiple conventional tests typically employed by healthcare providers to diagnose patients.

- In January 2024, Myriad Genetics, Inc. disclosed its definitive agreement to acquire specific assets from the Intermountain Precision Genomics (IPG) laboratory division. These assets include the Precise Tumor Test, the Precise Liquid Test, and IPG's CLIA-certified laboratory located in St. George, Utah, where the Precise Tumor Test is presently conducted.

- In January 2024, Natera, Inc. disclosed the acquisition of specific assets about Invitae's non-invasive prenatal screening and carrier screening business. Natera, Inc. has already provided an initial payment of $10 million, with an additional $42.5 million pending, to be disbursed in cash, milestone payments, and litigation credits. The reproductive health portfolio comprises genetic tests offering non-invasive prenatal screening and carrier screening.

Demand - Drivers, Challenges, and Opportunities

Market Drivers:

Rising Prevalence of Genetic Disorders along with Rare Diseases: Genetic diseases stem from abnormalities within an individual's DNA. They can arise through inheritance from one or both parents or manifest due to spontaneous genetic mutations. These conditions may result from a mutation in a single gene (monogenic), a chromosomal alteration involving an abnormal number of copies, or complex disorders influenced by the combined effects of multiple genes (polygenic). Next-generation sequencing techniques are widely used for the diagnosis of genetic diseases. Increasing widespread use of NGS in diagnostic laboratories has enhanced the accuracy of genetic diagnostics with high consistency.

Market Challenges:

Privacy and Ethical Concerns Due to Increased Risk of Security Breaches: Privacy and ethical concerns have become significant challenges in the hereditary genetic testing market, especially with the increasing risk of security breaches. As genetic data contain detailed personal information, they have become a prime target for cyberattacks. The implications of such breaches are profound, considering the sensitivity of genetic information, which can reveal predispositions to certain diseases and other personal attributes.

Market Opportunities:

Rise of Direct-to-Consumer (DTC) Testing Services: The increasing number of direct-to-consumer (DTC) hereditary genetic tests is set to significantly influence the global hereditary genetic testing market. As defined by the U.S. FDA, DTC tests allow consumers to bypass traditional healthcare systems by sending specimens directly to testing companies. This accessibility is appealing as it eliminates many of the barriers associated with traditional genetic testing, such as the need for a healthcare provider's referral, potentially lengthy wait times, and sometimes prohibitive costs. Companies such as 23andMe have pioneered this approach, becoming the first to obtain FDA approval for such tests, signaling a robust regulatory framework that supports consumer safety while encouraging innovation.

How can this report add value to an organization?

Product/Innovation Strategy: The global hereditary genetic testing market has been extensively segmented based on various categories, such as technology, product, sample type, application area, and region. This can help readers get a clear overview of which segments account for the largest share and which ones are well-positioned to grow in the coming years.

Growth/Marketing Strategy: Partnerships, alliances, and collaborations accounted for the maximum number of key developments, i.e., nearly 37.14% of the total developments in the global hereditary genetic testing market were between January 2020 and April 2024.

Competitive Strategy: The global hereditary genetic testing market has numerous established players with product portfolios. Key players in the global hereditary genetic testing market analyzed and profiled in the study involve established players offering products for hereditary genetic testing.

Methodology

Key Considerations and Assumptions in Market Engineering and Validation

- The base year considered for the calculation of the market size is 2023. A historical year analysis has been done for the period FY2019-FY2021. The market size has been estimated for FY2024 and projected for the period FY2024-FY2033.

- The scope of this report has been carefully derived based on interactions with experts in different companies across the world. This report provides a market study of upstream and downstream products of hereditary genetic testing.

- The market contribution of hereditary genetic testing is anticipated to be launched in the future and has been calculated based on the historical analysis of the solutions.

- Revenues of the companies have been referenced from their annual reports for FY2022 and FY2023. For private companies, revenues have been estimated based on factors such as inputs obtained from primary research, funding history, market collaborations, and operational history.

- The market has been mapped based on the available hereditary genetic testing solutions. All the key companies with significant offerings in this field have been considered and profiled in this report.

Primary Research:

The primary sources involve industry experts in hereditary genetic testing, including the market players offering products and services. Resources such as CEOs, vice presidents, marketing directors, and technology and innovation directors have been interviewed to obtain and verify both qualitative and quantitative aspects of this research study.

The key data points taken from the primary sources include:

- Validation and triangulation of all the numbers and graphs

- Validation of the report's segmentation and key qualitative findings

- Understanding the competitive landscape and business model

- Current and proposed production values of a product by market players

- Validation of the numbers of the different segments of the market in focus

- Percentage split of individual markets for regional analysis

Secondary Research

Open Sources

- Certified publications, articles from recognized authors, white papers, directories, and major databases, among others

- Annual reports, SEC filings, and investor presentations of the leading market players

- Company websites and detailed study of their product portfolio

- Gold standard magazines, journals, white papers, press releases, and news articles

- Paid databases

The key data points taken from the secondary sources include:

- Segmentations and percentage shares

- Data for market value

- Key industry trends of the top players of the market

- Qualitative insights into various aspects of the market, key trends, and emerging areas of innovation

- Quantitative data for mathematical and statistical calculations

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, and market penetration.

Some prominent names established in this market are:

- Agilent Technologies, Inc.

- BGI Group (Beijing Genomics Institute (BGI))

- Centogene AG

- Eurofins Scientific SE

- F. Hoffmann-La Roche Ltd

- Illumina, Inc.

- Konica Minolta, Inc. (Ambry Genetics)

- Laboratory Corporation of America Holdings

- Myriad Genetics, Inc.

- Revvity, Inc. (PerkinElmer, Inc.)

- Quest Diagnostics Incorporated

- Thermo Fisher Scientific Inc.

Table of Contents

Executive Summary

Scope and Definition

1 Hereditary Genetic Testing: Industry Outlook

- 1.1 Current State of Hereditary Genetic Testing

- 1.2 Market Footprint and Future Potential

- 1.3 Trends: Current and Future Impact Assessment

- 1.3.1 Increasing Demand for Direct-to-consumer Testing

- 1.3.2 Increasing Launch of Innovative Products and Regulatory Approvals in Genetic Testing Ecosystem

- 1.4 R&D Review

- 1.4.1 Patent Filing Trend (by Year, Country)

- 1.5 Total Addressable Market and Penetration

- 1.6 Legal and Regulatory Framework

- 1.6.1 U.S.

- 1.6.2 Europe

- 1.6.2.1 Germany

- 1.6.2.2 France

- 1.6.2.3 Italy

- 1.6.3 Asia-Pacific

- 1.6.3.1 China

- 1.6.3.2 Japan

- 1.6.3.3 Australia

- 1.7 Reimbursement Scenario

- 1.8 Market Dynamics

- 1.8.1 Market Drivers

- 1.8.1.1 Rising Prevalence of Genetic Disorders along with Rare Diseases

- 1.8.1.2 Increasing Inorganic Growth Activities in the Field of Hereditary Genetic Testing

- 1.8.1.3 Increasing Number of Hereditary Genetic Tests

- 1.8.2 Market Restraints

- 1.8.2.1 High Cost Associated with Testing

- 1.8.2.2 Shortage of Genetic Counselors

- 1.8.3 Market Opportunities

- 1.8.3.1 Expansion into Emerging Markets

- 1.8.1 Market Drivers

2 Global Hereditary Genetic Testing Market (by Product)

- 2.1 Overview

- 2.1.1 Kits and Consumables

- 2.1.2 Services

3 Global Hereditary Genetic Testing Market (by Sample Type)

- 3.1 Overview

- 3.1.1 Tumor Tissue

- 3.1.2 Bone Marrow

- 3.1.3 Saliva

- 3.1.4 Blood

- 3.1.5 Other Sample Types

4 Global Hereditary Genetic Testing Market (by Technology)

- 4.1 Overview

- 4.1.1 Next-Generation Sequencing (NGS)

- 4.1.2 Polymerase Chain Reaction (PCR)

- 4.1.3 Immunohistochemistry (IHC)

- 4.1.4 In-Situ Hybridization (ISH)

- 4.1.5 Microarray Techniques

- 4.1.6 Other Technologies

5 Global Hereditary Genetic Testing Market (by Genetic Testing Type)

- 5.1 Overview

- 5.2 Cardiology

- 5.2.1 Cardiomyopathy

- 5.2.2 Aortopathy

- 5.2.3 Arrhythmia

- 5.2.4 Other Cardiology Hereditary Genetic Testing

- 5.3 Oncology

- 5.3.1 Breast Cancer

- 5.3.2 Lung Cancer

- 5.3.3 Prostate Cancer

- 5.3.4 Colorectal Cancer

- 5.3.5 Melanoma

- 5.3.6 Other Oncology Hereditary Genetic Testing

- 5.4 Neurology

- 5.4.1 Epilepsy

- 5.4.2 Neurodegenerative Disorders

- 5.4.3 Neuromuscular Disorders

- 5.4.4 Other Neurology Hereditary Genetic Testing

- 5.5 Other Genetic Testing Type

- 5.5.1 Newborn Screening

- 5.5.2 Prenatal Screening (NIPT) and Preimplantation Testing

- 5.5.3 Rare Disease Testing

- 5.5.4 Direct-to-Consumer Testing

6 Global Hereditary Genetic Testing Market (by Application Area)

- 6.1 Overview

- 6.1.1 Academic and Research

- 6.1.2 Clinical Diagnostics, Monitoring and Screening

- 6.1.3 Drug Discovery

7 Region

- 7.1 Drivers and Restraints

- 7.2 North America

- 7.2.1 Regional Overview

- 7.2.2 Driving Factors for Market Growth

- 7.2.3 Factors Challenging the Market

- 7.2.4 U.S.

- 7.2.5 Canada

- 7.3 Europe

- 7.3.1 Regional Overview

- 7.3.2 Driving Factors for Market Growth

- 7.3.3 Factors Challenging the Market

- 7.3.4 France

- 7.3.5 Germany

- 7.3.6 U.K.

- 7.3.7 Spain

- 7.3.8 Netherlands

- 7.3.9 Rest-of-Europe

- 7.4 Asia-Pacific

- 7.4.1 Regional Overview

- 7.4.2 Driving Factors for Market Growth

- 7.4.3 Factors Challenging the Market

- 7.4.4 China

- 7.4.5 India

- 7.4.6 Australia

- 7.4.7 Japan

- 7.4.8 Singapore

- 7.4.9 Rest-of-Asia-Pacific

- 7.5 Latin America

- 7.5.1 Regional Overview

- 7.5.2 Driving Factors for Market Growth

- 7.5.3 Factors Challenging the Market

- 7.5.4 Brazil

- 7.5.5 Mexico

- 7.5.6 Rest-of-Latin America

- 7.6 Middle East and Africa

- 7.6.1 Regional Overview

- 7.6.2 Driving Factors for Market Growth

- 7.6.3 Factors Challenging the Market

8 Markets - Competitive Benchmarking & Company Profiles

- 8.1 Competitive Landscape

- 8.1.1 Key Strategies and Development

- 8.1.1.1 Mergers and Acquisitions

- 8.1.1.2 Product Launches

- 8.1.1.3 Synergistic Activities

- 8.1.1.4 Business Expansion Activities and Others

- 8.1.2 Company Share Analysis

- 8.1.1 Key Strategies and Development

- 8.2 Company Profiles

- 8.2.1 Agilent Technologies, Inc.

- 8.2.1.1 Overview

- 8.2.1.2 Top Products/Product Portfolio

- 8.2.1.3 Top Competitors

- 8.2.1.4 Target Customers

- 8.2.1.5 Key Personnel

- 8.2.1.6 Analyst View

- 8.2.2 BGI Group (Beijing Genomics Institute (BGI))

- 8.2.2.1 Overview

- 8.2.2.2 Top Products

- 8.2.2.3 Top Competitors

- 8.2.2.4 Key Personnel

- 8.2.2.5 Analyst View

- 8.2.3 Centogene AG

- 8.2.3.1 Overview

- 8.2.3.2 Top Products/Product Portfolio

- 8.2.3.3 Top Competitors

- 8.2.3.4 Key Personnel

- 8.2.3.5 Analyst View

- 8.2.4 Eurofins Scientific SE

- 8.2.4.1 Overview

- 8.2.4.2 Top Products

- 8.2.4.3 Top Competitors

- 8.2.4.4 Key Personnel

- 8.2.4.5 Analyst View

- 8.2.5 F. Hoffmann-La Roche Ltd

- 8.2.5.1 Top Products

- 8.2.5.2 Top Competitors

- 8.2.5.3 Key Personnel

- 8.2.5.4 Analyst View

- 8.2.6 Illumina, Inc.

- 8.2.6.1 Overview

- 8.2.6.2 Top Products/Product Portfolio

- 8.2.6.3 Top Competitors

- 8.2.6.4 Key Personnel

- 8.2.6.5 Analyst View

- 8.2.7 Konica Minolta, Inc. (Ambry Genetics)

- 8.2.7.1 Overview

- 8.2.7.2 Top Products/Product Portfolio

- 8.2.7.3 Top Competitors

- 8.2.7.4 Key Personnel

- 8.2.7.5 Analyst View

- 8.2.8 Laboratory Corporation of America Holdings

- 8.2.8.1 Overview

- 8.2.8.2 Top Products/Product Portfolio

- 8.2.8.3 Top Competitors

- 8.2.8.4 Key Personnel

- 8.2.8.5 Analyst View

- 8.2.9 Myriad Genetics, Inc.

- 8.2.9.1 Overview

- 8.2.9.2 Top Products/Product Portfolio

- 8.2.9.3 Top Competitors

- 8.2.9.4 Key Personnel

- 8.2.9.5 Analyst View

- 8.2.10 Revvity, Inc. (PerkinElmer, Inc.)

- 8.2.10.1 Overview

- 8.2.10.2 Top Products/Product Portfolio

- 8.2.10.3 Top Competitors

- 8.2.10.4 Key Personnel

- 8.2.10.5 Analyst View

- 8.2.11 Quest Diagnostics Incorporated

- 8.2.11.1 Overview

- 8.2.11.2 Top Products/Product Portfolio

- 8.2.11.3 Top Competitors

- 8.2.11.4 Key Personnel

- 8.2.11.5 Analyst View

- 8.2.12 Thermo Fisher Scientific, Inc.

- 8.2.12.1 Overview

- 8.2.12.2 Top Products/Product Portfolio

- 8.2.12.3 Top Competitors

- 8.2.12.4 Key Personnel

- 8.2.12.5 Analyst View

- 8.2.13 Emerging Companies in the Hereditary Genetic Testing Market

- 8.2.1 Agilent Technologies, Inc.

9 Research Methodology

- 9.1 Data Sources

- 9.1.1 Primary Data Sources

- 9.1.2 Secondary Data Sources

- 9.1.3 Data Triangulation

- 9.2 Market Estimation and Forecast

- 9.3 Criteria for Company Profiling