|

|

市場調査レポート

商品コード

1482292

ワイヤレステスト市場- 世界および地域別分析:オファリング別、接続技術別、用途別、使用事例別、地域別 - 分析と予測(2024年~2034年)Wireless Testing Market - A Global and Regional Analysis: Focus on Offering, Connectivity Technology, Application, Use Case and Region - Analysis and Forecast, 2024-2034 |

||||||

カスタマイズ可能

|

|||||||

| ワイヤレステスト市場- 世界および地域別分析:オファリング別、接続技術別、用途別、使用事例別、地域別 - 分析と予測(2024年~2034年) |

|

出版日: 2024年05月22日

発行: BIS Research

ページ情報: 英文 100 Pages

納期: 1~5営業日

|

全表示

- 概要

- 目次

ワイヤレステスト市場は、Wi-Fi、Bluetooth、NFC、5G、RF技術など、幅広い技術を含むワイヤレスデバイスやシステムの評価と検証を中心に展開する急成長分野です。

この市場は、ワイヤレスデバイスが安全性、性能、規制基準を満たしていることを保証する上で重要な役割を担っており、様々な用途において信頼性と機能性を維持する上で極めて重要です。楽観的シナリオを考慮すると、ワイヤレステストの市場規模は、2024年の市場規模は237億3,000万米ドルで、CAGR 8.27%で成長し、2034年には525億1,000万米ドルに達すると予想されます。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2024年~2034年 |

| 2024年評価 | 237億3,000万米ドル |

| 2034年予測 | 525億1,000万米ドル |

| CAGR | 8.27% |

同市場は、テストソフトウェア、テストプラットフォーム、シグナルジェネレーターやアナライザーを含むハードウェアデバイスなど、さまざまなコンポーネントで構成されています。これらのコンポーネントは、ストレステスト、性能評価、セキュリティ検証の実施に使用されます。ワイヤレステスト市場のエコシステム分析には、テスト機器メーカー、分析・シミュレーション用ソフトウェアプロバイダー、テストソリューションを提供するサービスプロバイダー、認証機関などが含まれます。また、家電、自動車、ヘルスケア、通信などの分野のエンドユーザーも含まれます。

当レポートでは、世界のワイヤレステスト市場について調査し、市場の概要とともに、オファリング別、接続技術別、用途別、使用事例別、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場:業界の展望

- 動向:現在および将来の影響評価

- サプライチェーンの概要

- 規制状況

- ステークホルダー分析

- 主要な世界的イベントの影響分析

- 市場力学の概要

第2章 ワイヤレステスト市場(用途別)

- 用途のセグメンテーション

- 用途の概要

- ワイヤレステスト市場(用途別)

- ワイヤレステスト市場(使用事例別)

第3章 ワイヤレステスト市場(製品別)

- 製品セグメンテーション

- 製品概要

- ワイヤレステスト市場(オファリング別)

- ワイヤレステスト市場(接続技術別)

第4章 ワイヤレステスト市場(地域別)

- ワイヤレステスト市場(地域別)

- 北米

- 欧州

- アジア太平洋

- その他の地域

第5章 企業プロファイル

- 今後の見通し

- 地理的評価

- SGS Group

- Bureau Veritas

- Intertek Group plc

- DEKRA

- Anritsu

- ALifecom Technology

- Keysight Technologies

- Rohde & Schwarz

- VIAVI Solutions Inc.

- TUV NORD GROUP

- Teradyne Inc.

- Tessolve

- TUV SUD

- eInfochips

- VVDN Technologies

- その他

第6章 調査手法

Introduction to Wireless Testing Market

Wireless testing market a rapidly growing sector that revolves around the evaluation and validation of wireless devices and systems, encompassing a wide range of technologies such as Wi-Fi, Bluetooth, NFC, 5G, and other RF (Radio Frequency) technologies. This market plays a critical role in ensuring that wireless devices meet safety, performance, and regulatory standards, which is crucial for maintaining reliability and functionality in various applications. Considering the optimistic scenario the market is valued at $23.73 Billion in 2024 and is expected to grow at a CAGR of 8.27% to reach $52.51 Billion by 2034.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2024 - 2034 |

| 2024 Evaluation | $23.73 Billion |

| 2034 Forecast | $52.51 Billion |

| CAGR | 8.27% |

The market comprises various components such as testing software, test platforms, and hardware devices that include signal generators and analyzers. These components are used to conduct stress tests, performance assessments, and security validations. The ecosystem of the Wireless Testing market includes manufacturers of testing equipment, software providers for analysis and simulation, service providers offering testing solutions, and certification bodies. It also encompasses end-users from sectors such as consumer electronics, automotive, healthcare, and telecommunications.

Over the past decade, the telecom sector has seen an uptick in cellular network subscriptions worldwide. This trend aligns with the push for faster, more responsive network connections, elevating the demand for testing equipment right from the design and R&D stages through to pre-conformance testing, manufacturing, and network deployment optimization. LTE remains a dominant technology with extensive global deployment, and its advancements into LTE-A and LTE-A Pro are delivering greater bandwidths and speeds, prompting vendors to utilize wireless testing for optimizing performance up to 4.9G standards. Manufacturers are honing their production processes, particularly for mmWave 5G products, balancing the mix of tests across various production stages to enhance efficiency and economics. For instance, Movandi's showcase in October 2021 demonstrated the effectiveness of 5G mmWave technologies in a mobile automotive environment, leveraging cloud control and AI for superior service quality and speed. With the 5G subscriber base expected to surge from 664 million in 2021 to an estimated 4.39 billion within five years, the momentum for 5G is clear. This rapid adoption, underpinned by 5G's low-latency capabilities for extensive machine-to-machine communication and the imperative for devices to meet 5G NR compliance, is significantly driving demand for advanced wireless testing solutions.

The Asia-Pacific region is set to lead the wireless testing market, largely fueled by initiatives like India's recent launch of an experimental license module for 5G labs. This move by India's Department of Telecommunications facilitates the establishment of 5G use case labs across the nation, enabling extensive testing and innovation in 5G technologies. This strategic development not only fosters local expertise in advanced wireless technologies but also positions the region at the forefront of 5G deployment and experimentation.

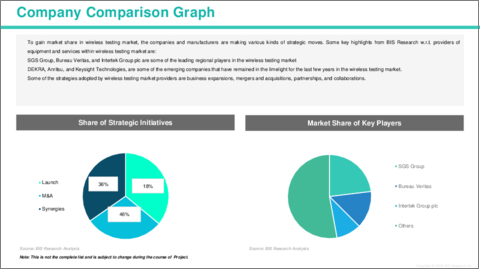

The competitive landscape of the Wireless Testing Market is characterized by intense rivalry among key players striving to maintain and enhance their market positions. Leading companies in this domain, such as Keysight Technologies, Rohde & Schwarz GmbH & Co KG, and VIAVI Solutions Inc., continually innovate and invest in research and development to offer cutting-edge testing solutions that cater to the evolving needs of industries adopting wireless technologies. These market incumbents leverage their extensive product portfolios, global presence, and strong brand recognition to capture market share and expand their customer base. Additionally, strategic initiatives such as partnerships, acquisitions, and collaborations are commonplace as companies seek to broaden their technological capabilities, enhance service offerings, and gain access to new markets. Moreover, emerging players and startups are also making significant strides in the Wireless Testing market, leveraging disruptive technologies and agile business models to challenge established incumbents. As the demand for wireless testing services continues to grow, competition is expected to intensify further, driving innovation, differentiation, and strategic alliances across the industry landscape.

Market Segmentation:

Segmentation 1: by Application

- Consumer Electronics

- Automotive

- IT and Telecommunication

- Energy and Power

- Medical Devices

- Aerospace and Defense

- Industrial

- Others

Segmentation 2: by Use Case

- Research and Development

- Production

- Return Merchandise Authorization (RMA)

Segmentation 3: by Offering

- Equipment

- Wireless IC Testing

- Wireless Module Testing

- Wireless Device Testing

- Wireless Network Testing

- Services

- In-house

- Outsourced

Segmentation 4: by Connectivity Technology

- 5G

- Wi-Fi & Bluetooth

- GPS/GNSS

- 2G/3G

- 4G/LTE

- Others

Segmentation 5: by Region

- North America

- Europe

- Asia-Pacific

- Rest-of-the-World

Key Market Players and Competition Synopsis

The companies that are profiled in the global wireless testing market have been selected based on input gathered from primary experts and analyzing company coverage, product portfolio, and market penetration.

Some of the prominent companies in this market are:

- SGS Group

- Bureau Veritas

- Intertek Group plc

- DEKRA

- Anritsu

- ALifecom Technology

- Keysight Technologies

- Rohde & Schwarz

- VIAVI Solutions Inc.

- TUV NORD GROUP

Key Questions Answered in this Report:

- How is the deployment of 5G technology impacting the demand for wireless testing services?

- What are the major challenges faced by the Wireless Testing market?

- Which regions are currently leading in the Wireless Testing market, and which are expected to emerge as key markets in the future?

- Who are the leading players in the Wireless Testing market, and what are their competitive strategies?

- How are innovations in IoT and connected devices influencing the Wireless Testing market?

- What role do regulations play in shaping the demand for wireless testing services?

- What are the emerging technologies that could disrupt the current landscape of the Wireless Testing market?

- How is the market segmented, and which segments are experiencing the fastest growth?

- What are potential opportunities for mergers and acquisitions in the Wireless Testing market?

Table of Contents

Executive Summary

Scope and Definition

Market/Product Definition

Key Questions Answered

Analysis and Forecast Note

1. Markets: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.2 Supply Chain Overview

- 1.2.1 Value Chain Analysis

- 1.2.2 Pricing Forecast

- 1.3 Regulatory Landscape

- 1.4 Stakeholder Analysis

- 1.4.1 Use Case

- 1.4.2 End User and Buying Criteria

- 1.5 Impact Analysis for Key Global Events

- 1.6 Market Dynamics Overview

- 1.6.1 Market Drivers

- 1.6.2 Market Restraints

- 1.6.3 Market Opportunities

2. Wireless Testing Market (by Application)

- 2.1 Application Segmentation

- 2.2 Application Summary

- 2.3 Wireless Testing Market (by Application)

- 2.3.1 Consumer Electronics

- 2.3.2 Automotive

- 2.3.3 IT & Telecommunication

- 2.3.4 Energy & Power

- 2.3.5 Medical Devices

- 2.3.6 Aerospace & Defense

- 2.3.7 Industrial

- 2.3.8 Others

- 2.4 Wireless Testing Market (by Use Case)

- 2.4.1 Research & Development

- 2.4.2 Production

- 2.4.3 Return Merchandise Authorization (RMA)

- 2.4.4 Others

3. Wireless Testing Market (by Product)

- 3.1 Product Segmentation

- 3.2 Product Summary

- 3.3 Wireless Testing Market (by Offering)

- 3.3.1 Equipment

- 3.3.1.1 Wireless IC Testing

- 3.3.1.2 Wireless Module Testing

- 3.3.1.3 Wireless Device Testing

- 3.3.1.4 Wireless Network Testing

- 3.3.2 Services

- 3.3.2.1 In-house

- 3.3.2.2 Outsourced

- 3.3.1 Equipment

- 3.4 Wireless Testing Market (by Connectivity Technology)

- 3.4.1 5G

- 3.4.2 Wi-Fi & Bluetooth

- 3.4.3 GPS/GNSS

- 3.4.4 2G/3G

- 3.4.5 4G/LTE

- 3.4.6 Others

4. Wireless Testing Market (by Region)

- 4.1 Wireless Testing Market (by Region)

- 4.2 North America

- 4.2.1 Regional Overview

- 4.2.2 Driving Factors for Market Growth

- 4.2.3 Factors Challenging the Market

- 4.2.4 Application

- 4.2.5 Product

- 4.2.6 U.S.

- 4.2.6.1 Market by Application

- 4.2.6.2 Market by Product

- 4.2.7 Canada

- 4.2.7.1 Market by Application

- 4.2.7.2 Market by Product

- 4.2.8 Mexico

- 4.2.8.1 Market by Application

- 4.2.8.2 Market by Product

- 4.3 Europe

- 4.3.1 Regional Overview

- 4.3.2 Driving Factors for Market Growth

- 4.3.3 Factors Challenging the Market

- 4.3.4 Application

- 4.3.5 Product

- 4.3.6 Germany

- 4.3.6.1 Market by Application

- 4.3.6.2 Market by Product

- 4.3.7 France

- 4.3.7.1 Market by Application

- 4.3.7.2 Market by Product

- 4.3.8 U.K.

- 4.3.8.1 Market by Application

- 4.3.8.2 Market by Product

- 4.3.9 Italy

- 4.3.9.1 Market by Application

- 4.3.9.2 Market by Product

- 4.3.10 Rest-of-Europe

- 4.3.10.1 Market by Application

- 4.3.10.2 Market by Product

- 4.4 Asia-Pacific

- 4.4.1 Regional Overview

- 4.4.2 Driving Factors for Market Growth

- 4.4.3 Factors Challenging the Market

- 4.4.4 Application

- 4.4.5 Product

- 4.4.6 China

- 4.4.6.1 Market by Application

- 4.4.6.2 Market by Product

- 4.4.7 Japan

- 4.4.7.1 Market by Application

- 4.4.7.2 Market by Product

- 4.4.8 India

- 4.4.8.1 Market by Application

- 4.4.8.2 Market by Product

- 4.4.9 South Korea

- 4.4.9.1 Market by Application

- 4.4.9.2 Market by Product

- 4.4.10 Rest-of-Asia-Pacific

- 4.4.10.1 Market by Application

- 4.4.10.2 Market by Product

- 4.5 Rest-of-the-World

- 4.5.1 Regional Overview

- 4.5.2 Driving Factors for Market Growth

- 4.5.3 Factors Challenging the Market

- 4.5.4 Application

- 4.5.5 Product

- 4.5.6 South America

- 4.5.6.1 Market by Application

- 4.5.6.2 Market by Product

- 4.5.7 Middle East and Africa

- 4.5.7.1 Market by Application

- 4.5.7.2 Market by Product

5. Companies Profiled

- 5.1 Next Frontiers

- 5.2 Geographic Assessment

- 5.2.1 SGS Group

- 5.2.1.1 Overview

- 5.2.1.2 Top Products/Product Portfolio

- 5.2.1.3 Top Competitors

- 5.2.1.4 Target Customers

- 5.2.1.5 Key Personnel

- 5.2.1.6 Analyst View

- 5.2.1.7 Market Share

- 5.2.2 Bureau Veritas

- 5.2.2.1 Overview

- 5.2.2.2 Top Products/Product Portfolio

- 5.2.2.3 Top Competitors

- 5.2.2.4 Target Customers

- 5.2.2.5 Key Personnel

- 5.2.2.6 Analyst View

- 5.2.2.7 Market Share

- 5.2.3 Intertek Group plc

- 5.2.3.1 Overview

- 5.2.3.2 Top Products/Product Portfolio

- 5.2.3.3 Top Competitors

- 5.2.3.4 Target Customers

- 5.2.3.5 Key Personnel

- 5.2.3.6 Analyst View

- 5.2.3.7 Market Share

- 5.2.4 DEKRA

- 5.2.4.1 Overview

- 5.2.4.2 Top Products/Product Portfolio

- 5.2.4.3 Top Competitors

- 5.2.4.4 Target Customers

- 5.2.4.5 Key Personnel

- 5.2.4.6 Analyst View

- 5.2.4.7 Market Share

- 5.2.5 Anritsu

- 5.2.5.1 Overview

- 5.2.5.2 Top Products/Product Portfolio

- 5.2.5.3 Top Competitors

- 5.2.5.4 Target Customers

- 5.2.5.5 Key Personnel

- 5.2.5.6 Analyst View

- 5.2.5.7 Market Share

- 5.2.6 ALifecom Technology

- 5.2.6.1 Overview

- 5.2.6.2 Top Products/Product Portfolio

- 5.2.6.3 Top Competitors

- 5.2.6.4 Target Customers

- 5.2.6.5 Key Personnel

- 5.2.6.6 Analyst View

- 5.2.6.7 Market Share

- 5.2.7 Keysight Technologies

- 5.2.7.1 Overview

- 5.2.7.2 Top Products/Product Portfolio

- 5.2.7.3 Top Competitors

- 5.2.7.4 Target Customers

- 5.2.7.5 Key Personnel

- 5.2.7.6 Analyst View

- 5.2.7.7 Market Share

- 5.2.8 Rohde & Schwarz

- 5.2.8.1 Overview

- 5.2.8.2 Top Products/Product Portfolio

- 5.2.8.3 Top Competitors

- 5.2.8.4 Target Customers

- 5.2.8.5 Key Personnel

- 5.2.8.6 Analyst View

- 5.2.8.7 Market Share

- 5.2.9 VIAVI Solutions Inc.

- 5.2.9.1 Overview

- 5.2.9.2 Top Products/Product Portfolio

- 5.2.9.3 Top Competitors

- 5.2.9.4 Target Customers

- 5.2.9.5 Key Personnel

- 5.2.9.6 Analyst View

- 5.2.9.7 Market Share

- 5.2.10 TUV NORD GROUP

- 5.2.10.1 Overview

- 5.2.10.2 Top Products/Product Portfolio

- 5.2.10.3 Top Competitors

- 5.2.10.4 Target Customers

- 5.2.10.5 Key Personnel

- 5.2.10.6 Analyst View

- 5.2.10.7 Market Share

- 5.2.11 Teradyne Inc.

- 5.2.11.1 Overview

- 5.2.11.2 Top Products/Product Portfolio

- 5.2.11.3 Top Competitors

- 5.2.11.4 Target Customers

- 5.2.11.5 Key Personnel

- 5.2.11.6 Analyst View

- 5.2.11.7 Market Share

- 5.2.12 Tessolve

- 5.2.12.1 Overview

- 5.2.12.2 Top Products/Product Portfolio

- 5.2.12.3 Top Competitors

- 5.2.12.4 Target Customers

- 5.2.12.5 Key Personnel

- 5.2.12.6 Analyst View

- 5.2.12.7 Market Share

- 5.2.13 TUV SUD

- 5.2.13.1 Overview

- 5.2.13.2 Top Products/Product Portfolio

- 5.2.13.3 Top Competitors

- 5.2.13.4 Target Customers

- 5.2.13.5 Key Personnel

- 5.2.13.6 Analyst View

- 5.2.13.7 Market Share

- 5.2.14 eInfochips

- 5.2.14.1 Overview

- 5.2.14.2 Top Products/Product Portfolio

- 5.2.14.3 Top Competitors

- 5.2.14.4 Target Customers

- 5.2.14.5 Key Personnel

- 5.2.14.6 Analyst View

- 5.2.14.7 Market Share

- 5.2.15 VVDN Technologies

- 5.2.15.1 Overview

- 5.2.15.2 Top Products/Product Portfolio

- 5.2.15.3 Top Competitors

- 5.2.15.4 Target Customers

- 5.2.15.5 Key Personnel

- 5.2.15.6 Analyst View

- 5.2.15.7 Market Share

- 5.2.16 Others

- 5.2.1 SGS Group