|

|

市場調査レポート

商品コード

1476538

歯科インプラントおよび補綴市場- 世界と地域別分析:エンドユーザー別、製品別、地域別 - 分析と予測(2024年~2034年)Dental Implants and Prosthetics Market - A Global and Regional Analysis: Focus on End User, Product, and Region - Analysis and Forecast, 2024-2034 |

||||||

カスタマイズ可能

|

|||||||

| 歯科インプラントおよび補綴市場- 世界と地域別分析:エンドユーザー別、製品別、地域別 - 分析と予測(2024年~2034年) |

|

出版日: 2024年05月09日

発行: BIS Research

ページ情報: 英文 100 Pages

納期: 1~5営業日

|

全表示

- 概要

- 目次

世界の歯科インプラントおよび補綴の市場規模は2024年に116億4,000万米ドルになるとみられ、今後、11.41%のCAGRで拡大し、2034年には343億米ドルに達すると予測されています。

歯科インプラントおよび補綴は、欠損した歯の補綴や歯の審美性の改善を求める個人にソリューションを提供し、修復歯科の分野で急成長している市場を表しています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2024年~2034年 |

| 2024年評価 | 116億4,000万米ドル |

| 2034年予測 | 343億米ドル |

| CAGR | 11.41% |

成長が見込まれるとはいえ、市場にはいくつかの抑制要因があります。その1つが、従来の歯科治療と比較して、インプラント治療にかかる初期費用が高いという課題です。さらに、特定の保険プランの下で歯科インプラントのための適切な償還カバーがないことは、これらの治療オプションを追求する一部の患者を抑止する可能性があります。しかし、このような課題の中にも、技術革新と市場拡大のチャンスは潜んでいます。デジタルデンティストリー、コンピュータ支援設計(CAD)、コンピュータ支援製造(CAM)システムの統合などの技術の進歩は、歯科インプラント処置と補綴物製作の効率と精度を高めるための有利な機会を提示します。さらに、審美歯科や個別化された治療オプションに対する需要の高まりが、患者の多様なニーズや嗜好に応えるインプラント材料や補綴設計の技術革新に拍車をかけています。

アジア太平洋では、ヘルスケア支出の増加、口腔の健康に対する意識の高まり、歯科医療を促進する政府の好意的な政策などの要因によって、歯科インプラントおよび補綴物市場は大きな成長を遂げています。中国、インド、日本、韓国などの国々は、歯科サービスへのアクセスを改善し、高度な歯科技術の採用を促進するためのイニシアチブを発表しています。

当レポートでは、世界の歯科インプラントおよび補綴市場について調査し、市場の概要とともに、エンドユーザー別、製品別、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場:業界の展望

- 動向:現在および将来の影響評価

- サプライチェーンの概要

- R&Dレビュー

- 規制状況

- 主要な世界的イベントの影響分析

- 市場力学の概要

第2章 世界の歯科インプラントおよび補綴市場、用途別

- 用途のセグメンテーション

- 用途の概要

- 世界の歯科インプラントおよび補綴市場、エンドユーザー別

第3章世界の歯科インプラントおよび補綴市場、 製品別

- 製品セグメンテーション

- 製品概要

- 世界の歯科インプラントおよび補綴市場、製品別

第4章 世界の歯科インプラントおよび補綴市場、地域別

- 世界の歯科インプラントおよび補綴市場- 地域別

- 北米

- 欧州

- アジア太平洋

- その他の地域

第5章 企業プロファイル

- 今後の見通し

- 地理的評価

- 3M Company

- Bicon, LLC

- Dentsply Sirona

- Envista Holdings Corporation

- Glidewell

- Henry Schein, Inc.

- Institut Straumann AG

- Ivoclar Vivadent

- KeystoneDentalGroup

- Nobel Biocare Services AG

- OSSTEM IMPLANT CO., LTD.

- SHOFU DENTAL Mfg. Co.

- DIO CORPORATION

- Thommen Medical AG

- ZimVive Inc.

- その他

第6章 調査手法

Introduction to Dental Implants and Prosthetics Market

Considering the optimistic scenario, the global dental implants and prosthetics market has been valued at $11.64 billion in 2024 and is expected to grow at a CAGR of 11.41% to reach $34.30 billion by 2034. Dental implants and prosthetics represent a burgeoning market in the field of restorative dentistry, offering solutions for individuals seeking to replace missing teeth or improve their dental aesthetics.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2024 - 2034 |

| 2024 Evaluation | $11.64 Billion |

| 2034 Forecast | $34.30 Billion |

| CAGR | 11.41% |

Despite the promising prospects for growth, the market encounters several restraints. One such challenge is the higher initial cost associated with dental implant procedures compared to traditional dental treatments. Additionally, the lack of adequate reimbursement coverage for dental implants under certain insurance plans may deter some patients from pursuing these treatment options. However, amidst these challenges lie opportunities for innovation and expansion within the market. Advancements in technology, such as the integration of digital dentistry, computer-aided design (CAD), and computer-aided manufacturing (CAM) systems, present lucrative opportunities for enhancing the efficiency and precision of dental implant procedures and prosthetic fabrication. Moreover, the rising demand for aesthetic dentistry and personalized treatment options has spurred innovation in implant materials and prosthetic designs, catering to the diverse needs and preferences of patients.

In the Asia-Pacific region, the dental implants and prosthetics market has been experiencing significant growth, driven by factors such as increasing healthcare expenditure, growing awareness of oral health, and favorable government policies promoting dental care. Countries such as China, India, Japan, and South Korea have announced initiatives to improve access to dental services and promote the adoption of advanced dental technologies.

Key players in the market, including Straumann Group, Dentsply Sirona, and Nobel Biocare Services AG, are investing in research and development to innovate new products and improve treatment outcomes. These companies offer a wide range of implant and prosthetic solutions tailored to meet the needs of patients and dental professionals alike. The dental implants and prosthetics market has witnessed several acquisitions aimed at enhancing product offerings, expanding market presence, and advancing technology in the field. For instance, in May 2023, Straumann Group acquired GalvoSurge, a dental implant manufacturer, to bolster its comprehensive dental implant solutions specifically addressing peri-implantitis. These acquisitions have aided Straumann Group in expanding its dental product offerings, entering new markets, and driving research and development.

Market Segmentation:

Segmentation 1: by End User

- Dental Hospitals and Clinics

- Dental Support Organization

- Other End Users

Segmentation 2: by Product

- Dental Implants

- By Material

Titanium

Zirconium

- By Type

Root Form Implant

Plate Form Implant

- Dental Prosthetics

- Bridges

- Crowns

- Inlays and Onlays

- Dentures

- Others

Segmentation 3: by Region

- North America

- Europe

- Asia-Pacific

- Rest-of-the-World

Key Market Players and Competition Synopsis

The companies that are profiled in the global global dental implants and prosthetics market have been selected based on input gathered from primary experts and analyzing company coverage, product portfolio, and market penetration.

Some of the prominent companies in this market are:

- Dentsply Sirona

- Envista Holdings Corporation

- 3M Company

- Henry Schein, Inc.

- Ivoclar Vivadent

- OSSTEM IMPLANT CO., LTD.

Key Questions Answered in this Report:

- What are the major drivers, challenges, and opportunities within the global dental implants and prosthetics market?

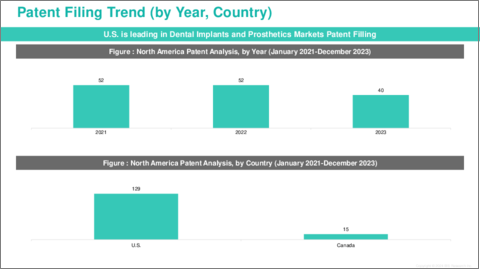

- What are the major patents filed by the companies active in the dental implants and prosthetics market?

- Who are the key players in the dental implants and prosthetics?

- What is the regulatory scenario of the global dental implants and prosthetics market? What are the initiatives implemented by different governmental bodies and guidelines put forward to regulate the commercialization of dental implants and prosthetics market products?

- What partnerships or collaborations are prominent among stakeholders in the dental implants and prosthetics market?

- What are the strategies adopted by the key companies to gain a competitive edge in dental implants and prosthetics market?

- What is the futuristic outlook for the dental implants and prosthetics market in terms of growth potential?

- What is the current estimation of the dental implants and prosthetics market, and what growth trajectory is projected from 2024 to 2034?

- Which end user and product segment is expected to lead the market over the forecast period (2024-2034)?

- Which regions demonstrate the highest adoption rates for dental implants and prosthetics market, and what factors contribute to their leadership?

Table of Contents

Executive Summary

Scope and Definition

Market/Product Definition

Key Questions Answered

Analysis and Forecast Note

1. Markets: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.2 Supply Chain Overview

- 1.2.1 Value Chain Analysis

- 1.3 R&D Review

- 1.3.1 Patent Filing Trend by Country, by Company

- 1.4 Regulatory Landscape

- 1.5 Impact Analysis for Key Global Events

- 1.6 Market Dynamics Overview

- 1.6.1 Market Drivers

- 1.6.2 Market Restraints

- 1.6.3 Market Opportunities

2. Global Dental Implants and Prosthetics Market, by Application

- 2.1 Application Segmentation

- 2.2 Application Summary

- 2.3 Global Dental Implants and Prosthetics Market by End User

- 2.3.1 Dental Hospitals and Clinics

- 2.3.2 Dental Support Organization

- 2.3.3 Other End Users

3. Global Dental Implants and Prosthetics Market by Products

- 3.1 Product Segmentation

- 3.2 Product Summary

- 3.3 Global Dental Implants and Prosthetics Market by Product

- 3.3.1 Dental Implants

- 3.3.1.1 By Material

- 3.3.1.1.1 Titanium

- 3.3.1.1.2 Zirconium

- 3.3.1.2 By Type

- 3.3.1.2.1 Root Form Implant

- 3.3.1.2.2 Plate Form Implant

- 3.3.1.1 By Material

- 3.3.2 Dental Prosthetics

- 3.3.2.1 Bridges

- 3.3.2.2 Crowns

- 3.3.2.3 Inlays and Onlays

- 3.3.2.4 Dentures

- 3.3.2.5 Others

- 3.3.1 Dental Implants

4. Global Dental Implants and Prosthetics Market by Region

- 4.1 Global Dental Implants and Prosthetics Market - by Region

- 4.2 North America

- 4.2.1 Regional Overview

- 4.2.2 Driving Factors for Market Growth

- 4.2.3 Factors Challenging the Market

- 4.2.4 Application

- 4.2.5 Product

- 4.2.6 U.S.

- 4.2.6.1 Market by Application

- 4.2.6.2 Market by Product

- 4.2.7 Canada

- 4.2.7.1 Market by Application

- 4.2.7.2 Market by Product

- 4.3 Europe

- 4.3.1 Regional Overview

- 4.3.2 Driving Factors for Market Growth

- 4.3.3 Factors Challenging the Market

- 4.3.4 Application

- 4.3.5 Product

- 4.3.6 Germany

- 4.3.6.1 Market by Application

- 4.3.6.2 Market by Product

- 4.3.7 France

- 4.3.7.1 Market by Application

- 4.3.7.2 Market by Product

- 4.3.8 U.K.

- 4.3.8.1 Market by Application

- 4.3.8.2 Market by Product

- 4.3.9 Italy

- 4.3.9.1 Market by Application

- 4.3.9.2 Market by Product

- 4.3.10 Rest-of-Europe

- 4.3.10.1 Market by Application

- 4.3.10.2 Market by Product

- 4.4 Asia-Pacific

- 4.4.1 Regional Overview

- 4.4.2 Driving Factors for Market Growth

- 4.4.3 Factors Challenging the Market

- 4.4.4 Application

- 4.4.5 Product

- 4.4.6 China

- 4.4.6.1 Market by Application

- 4.4.6.2 Market by Product

- 4.4.7 Japan

- 4.4.7.1 Market by Application

- 4.4.7.2 Market by Product

- 4.4.8 India

- 4.4.8.1 Market by Application

- 4.4.8.2 Market by Product

- 4.4.9 South Korea

- 4.4.9.1 Market by Application

- 4.4.9.2 Market by Product

- 4.4.10 Rest-of-Asia-Pacific

- 4.4.10.1 Market by Application

- 4.4.10.2 Market by Product

- 4.5 Rest-of-the-World

- 4.5.1 Regional Overview

- 4.5.2 Driving Factors for Market Growth

- 4.5.3 Factors Challenging the Market

- 4.5.4 Application

- 4.5.5 Product

- 4.5.6 Latin America

- 4.5.6.1 Market by Application

- 4.5.6.2 Market by Product

- 4.5.7 Middle East and Africa

- 4.5.7.1 Market by Application

- 4.5.7.2 Market by Product

5. Companies Profiled

- 5.1 Next Frontiers

- 5.2 Geographic Assessment

- 5.2.1 3M Company

- 5.2.1.1 Overview

- 5.2.1.2 Top Products/Product Portfolio

- 5.2.1.3 Top Competitors

- 5.2.1.4 Target Customers

- 5.2.1.5 Key Personnel

- 5.2.1.6 Analyst View

- 5.2.1.7 Market Share

- 5.2.2 Bicon, LLC

- 5.2.2.1 Overview

- 5.2.2.2 Top Products/Product Portfolio

- 5.2.2.3 Top Competitors

- 5.2.2.4 Target Customers

- 5.2.2.5 Key Personnel

- 5.2.2.6 Analyst View

- 5.2.2.7 Market Share

- 5.2.3 Dentsply Sirona

- 5.2.3.1 Overview

- 5.2.3.2 Top Products/Product Portfolio

- 5.2.3.3 Top Competitors

- 5.2.3.4 Target Customers

- 5.2.3.5 Key Personnel

- 5.2.3.6 Analyst View

- 5.2.3.7 Market Share

- 5.2.4 Envista Holdings Corporation

- 5.2.4.1 Overview

- 5.2.4.2 Top Products/Product Portfolio

- 5.2.4.3 Top Competitors

- 5.2.4.4 Target Customers

- 5.2.4.5 Key Personnel

- 5.2.4.6 Analyst View

- 5.2.4.7 Market Share

- 5.2.5 Glidewell

- 5.2.5.1 Overview

- 5.2.5.2 Top Products/Product Portfolio

- 5.2.5.3 Top Competitors

- 5.2.5.4 Target Customers

- 5.2.5.5 Key Personnel

- 5.2.5.6 Analyst View

- 5.2.5.7 Market Share

- 5.2.6 Henry Schein, Inc.

- 5.2.6.1 Overview

- 5.2.6.2 Top Products/Product Portfolio

- 5.2.6.3 Top Competitors

- 5.2.6.4 Target Customers

- 5.2.6.5 Key Personnel

- 5.2.6.6 Analyst View

- 5.2.6.7 Market Share

- 5.2.7 Institut Straumann AG

- 5.2.7.1 Overview

- 5.2.7.2 Top Products/Product Portfolio

- 5.2.7.3 Top Competitors

- 5.2.7.4 Target Customers

- 5.2.7.5 Key Personnel

- 5.2.7.6 Analyst View

- 5.2.7.7 Market Share

- 5.2.8 Ivoclar Vivadent

- 5.2.8.1 Overview

- 5.2.8.2 Top Products/Product Portfolio

- 5.2.8.3 Top Competitors

- 5.2.8.4 Target Customers

- 5.2.8.5 Key Personnel

- 5.2.8.6 Analyst View

- 5.2.8.7 Market Share

- 5.2.9 KeystoneDentalGroup

- 5.2.9.1 Overview

- 5.2.9.2 Top Products/Product Portfolio

- 5.2.9.3 Top Competitors

- 5.2.9.4 Target Customers

- 5.2.9.5 Key Personnel

- 5.2.9.6 Analyst View

- 5.2.9.7 Market Share

- 5.2.10 Nobel Biocare Services AG

- 5.2.10.1 Overview

- 5.2.10.2 Top Products/Product Portfolio

- 5.2.10.3 Top Competitors

- 5.2.10.4 Target Customers

- 5.2.10.5 Key Personnel

- 5.2.10.6 Analyst View

- 5.2.10.7 Market Share

- 5.2.11 OSSTEM IMPLANT CO., LTD.

- 5.2.11.1 Overview

- 5.2.11.2 Top Products/Product Portfolio

- 5.2.11.3 Top Competitors

- 5.2.11.4 Target Customers

- 5.2.11.5 Key Personnel

- 5.2.11.6 Analyst View

- 5.2.11.7 Market Share

- 5.2.12 SHOFU DENTAL Mfg. Co.

- 5.2.12.1 Overview

- 5.2.12.2 Top Products/Product Portfolio

- 5.2.12.3 Top Competitors

- 5.2.12.4 Target Customers

- 5.2.12.5 Key Personnel

- 5.2.12.6 Analyst View

- 5.2.12.7 Market Share

- 5.2.13 DIO CORPORATION

- 5.2.13.1 Overview

- 5.2.13.2 Top Products/Product Portfolio

- 5.2.13.3 Top Competitors

- 5.2.13.4 Target Customers

- 5.2.13.5 Key Personnel

- 5.2.13.6 Analyst View

- 5.2.13.7 Market Share

- 5.2.14 Thommen Medical AG

- 5.2.14.1 Overview

- 5.2.14.2 Top Products/Product Portfolio

- 5.2.14.3 Top Competitors

- 5.2.14.4 Target Customers

- 5.2.14.5 Key Personnel

- 5.2.14.6 Analyst View

- 5.2.14.7 Market Share

- 5.2.15 ZimVive Inc.

- 5.2.15.1 Overview

- 5.2.15.2 Top Products/Product Portfolio

- 5.2.15.3 Top Competitors

- 5.2.15.4 Target Customers

- 5.2.15.5 Key Personnel

- 5.2.15.6 Analyst View

- 5.2.15.7 Market Share

- 5.2.16 Others

- 5.2.1 3M Company