|

|

市場調査レポート

商品コード

1462588

アジア太平洋の次世代負極材市場:エンドユーザー別、タイプ別、国別:分析と予測(2023年~2032年)Asia-Pacific Next-Generation Anode Materials Market: Focus on End User, Type, and Country - Analysis and Forecast, 2023-2032 |

||||||

カスタマイズ可能

|

|||||||

| アジア太平洋の次世代負極材市場:エンドユーザー別、タイプ別、国別:分析と予測(2023年~2032年) |

|

出版日: 2024年04月15日

発行: BIS Research

ページ情報: 英文 101 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

アジア太平洋の次世代負極材の市場規模(中国を除く)は、2023年に2億3,890万米ドルとなりました。

同市場は今後、13.89%のCAGRで拡大し、2032年には7億6,980万米ドルに達すると予測されています。アジア太平洋市場では、急速充電機能と出力密度の向上を特徴とする高度な負極材に対する需要の増加により、次世代負極材市場の拡大が推進されると予測されます。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2023年~2032年 |

| 2023年評価 | 2億3,890万米ドル |

| 2032年予測 | 7億6,980万米ドル |

| CAGR | 13.89% |

アジア太平洋の次世代負極材市場は、いくつかの主な促進要因によって急速に拡大しています。自動車、家庭用電子機器、再生可能エネルギー貯蔵などの分野で、より高速充電が可能なバッテリーや、より高い出力密度への需要が高まっているため、改良型負極材料の開発が必要となっています。

強力な製造能力と活発な技術革新で知られるアジア太平洋は、次世代負極材料の進歩を推進する最前線にあります。中国、日本、韓国などの国々における電気自動車(EV)の採用や家電市場の急速な拡大は、高性能負極材の需要を押し上げる重要な要因となっています。

さらに、クリーンエネルギーと持続可能性を奨励する厳しい規制が、アジア太平洋全域で電動モビリティと再生可能エネルギーソリューションへの移行を早めています。その結果、高速充電、電池寿命の延長、総合性能の向上を可能にする負極材料の開発が重視されるようになっています。

当レポートでは、アジア太平洋の次世代負極材市場について調査し、市場の概要とともに、エンドユーザー別、タイプ別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

調査範囲

第1章 市場

- 業界展望

- ビジネスダイナミクス

第2章 地域

- 中国

- 市場

- 応用

- 製品

- アジア太平洋と日本

- 市場

- 応用

- 製品

- アジア太平洋と日本(国別)

第3章 市場-競合ベンチマーキングと企業プロファイル

- 競合ベンチマーキング

- 競争ポジションマトリックス

- 主要企業の製品マトリックス(タイプ別)

- 主要企業の市場シェア分析、2022年

- 企業プロファイル

- Shanghai Shanshan Technology Co., Ltd.

- Talga Group.

- Tianqi Lithium Corporation

- Jiangxi Ganfeng Lithium Co., Ltd.

- POSCO CHEMICAL

第4章 調査手法

List of Figures

- Figure 1: Asia-Pacific Next-Generation Anode Materials Market, $Million, 2022, 2023, and 2032

- Figure 2: Asia-Pacific Next-Generation Anode Materials Market (by End User), $Million, 2022 and 2032

- Figure 3: Asia-Pacific Next-Generation Anode Materials Market (by Type), $Million, 2022 and 2032

- Figure 4: Next-Generation Anode Materials Market (by Region), $Million, 2022 and 2032

- Figure 5: Electric Vehicle Sales, Million Units, 2020, 2025, and 2030

- Figure 6: Production Data of Ferrosilicon and Silicon, Thousand Metric Tons, 2018-2022

- Figure 7: Recycling Process of Silicon into Anode Material for Lithium-Ion Batteries

- Figure 8: Supply Chain Analysis of the Next-Generation Anode Materials Market

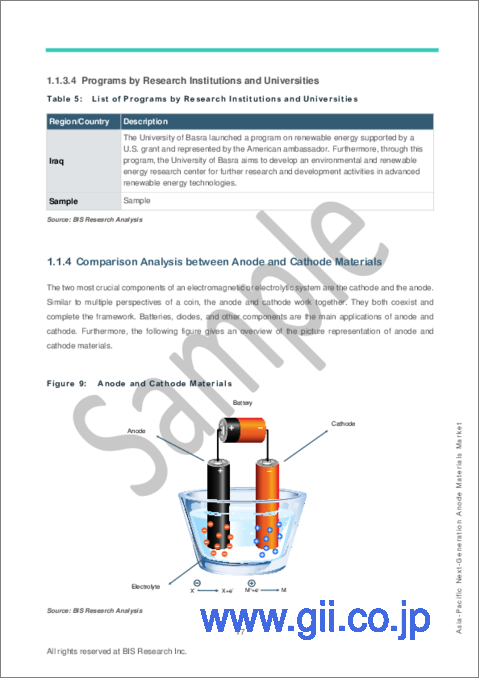

- Figure 9: Anode and Cathode Materials

- Figure 10: Comparison Analysis between Anode and Cathode Materials

- Figure 11: Business Dynamics for Next-Generation Anode Materials Market

- Figure 12: Production and Reserves Data of Silicon, Thousand Metric Tons, 2021 and 2022

- Figure 13: Battery Storage Capabilities (by Country), 2020 and 2026

- Figure 14: Stability of Silicon Particles Varying with Diameter Size

- Figure 15: Clean Energy Investment in the Net Zero Pathway, $Trillion, 2016-2020, 2030, and 2050

- Figure 16: Advancements in Polymer Binders for Silicon based Anodes

- Figure 17: Components of Electrolytes in Lithium-ion Batteries

- Figure 18: Research Methodology

- Figure 19: Top-Down and Bottom-Up Approach

- Figure 20: Next-Generation Anode Materials Market: Influencing Factors

- Figure 21: Assumptions and Limitations

List of Tables

- Table 1: Major Key Investor of Solid-State Batteries

- Table 2: Stakeholders of the Next-Generation Anode Materials Market

- Table 3: List of Regulatory/Certification Bodies

- Table 4: List of Government Programs for the Next-Generation Anode Materials Market

- Table 5: List of Programs by Research Institutions and Universities

- Table 6: Key Investments by Companies

- Table 7: Comparison Table of Key Metrics

- Table 8: Key Product and Market Development

- Table 9: Key Mergers and Acquisitions, Partnerships, Collaborations, and Joint Ventures

- Table 10: Next-Generation Anode Materials Market (by Region), Kilo Tons, 2022-2032

- Table 11: Next-Generation Anode Materials Market (by Region), $Million, 2022-2032

- Table 12: China Next-Generation Anode Materials Market (by End User), Kilo Tons, 2022-2032

- Table 13: China Next-Generation Anode Materials Market (by End User), $Million, 2022-2032

- Table 14: China Next-Generation Anode Materials Market (by Type), Kilo Tons, 2022-2032

- Table 15: China Next-Generation Anode Materials Market (by Type), $Million, 2022-2032

- Table 16: Asia-Pacific and Japan Next-Generation Anode Materials Market (by End User), Tons, 2022-2032

- Table 17: Asia-Pacific and Japan Next-Generation Anode Materials Market (by End User), $Million, 2022-2032

- Table 18: Asia-Pacific and Japan Next-Generation Anode Materials Market (by Type), Tons, 2022-2032

- Table 19: Asia-Pacific and Japan Next-Generation Anode Materials Market (by Type), $Million, 2022-2032

- Table 20: Japan Next-Generation Anode Materials Market (by End User), Tons, 2022-2032

- Table 21: Japan Next-Generation Anode Materials Market (by End User), $Million, 2022-2032

- Table 22: Japan Next-Generation Anode Materials Market (by Type), Tons, 2022-2032

- Table 23: Japan Next-Generation Anode Materials Market (by Type), $Million, 2022-2032

- Table 24: South Korea Next-Generation Anode Materials Market (by End User), Tons, 2022-2032

- Table 25: South Korea Next-Generation Anode Materials Market (by End User), $Million, 2022-2032

- Table 26: South Korea Next-Generation Anode Materials Market (by Type), Tons, 2022-2032

- Table 27: South Korea Next-Generation Anode Materials Market (by Type), $Million, 2022-2032

- Table 28: India Next-Generation Anode Materials Market (by End User), Tons, 2022-2032

- Table 29: India Next-Generation Anode Materials Market (by End User), $Million, 2022-2032

- Table 30: India Next-Generation Anode Materials Market (by Type), Tons, 2022-2032

- Table 31: India Next-Generation Anode Materials Market (by Type), $Million, 2022-2032

- Table 32: Rest-of-Asia-Pacific and Japan Next-Generation Anode Materials Market (by End User), Tons, 2022-2032

- Table 33: Rest-of-Asia-Pacific and Japan Next-Generation Anode Materials Market (by End User), $Million, 2022-2032

- Table 34: Rest-of-Asia-Pacific and Japan Next-Generation Anode Materials Market (by Type), Tons, 2022-2032

- Table 35: Rest-of-Asia-Pacific and Japan Next-Generation Anode Materials Market (by Type), $Million, 2022-2032

- Table 36: Product Matrix of Key Companies (by Type)

- Table 37: Market Shares of Key Companies, 2022

Introduction to Asia-Pacific (APAC) Next-Generation Anode Materials Market

The Asia-Pacific next-generation anode materials market (excluding China) was valued at $238.9 million in 2023, and it is expected to grow at a CAGR of 13.89% and reach $769.8 million by 2032. In the APAC market, the expansion of the next-generation anode materials market is anticipated to be propelled by increasing demand for advanced anode materials characterized by rapid charging capabilities and improved power density.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2023 - 2032 |

| 2023 Evaluation | $238.9 Million |

| 2032 Forecast | $769.8 Million |

| CAGR | 13.89% |

Market Introduction

The next-generation anode material market in Asia-Pacific (APAC) is expanding rapidly due to a number of main drivers. The increased demand for faster-charging batteries and higher power density in areas such as automotive, consumer electronics, and renewable energy storage necessitates the development of improved anode materials.

The APAC area, known for its strong manufacturing capabilities and vibrant technical innovation, is at the forefront of pushing advances in next-generation anode materials. The adoption of electric vehicles (EVs) and the rapid expansion of the consumer electronics market in countries such as China, Japan, and South Korea are important factors driving up demand for high-performance anode materials.

Furthermore, strict regulations encouraging clean energy and sustainability are hastening the shift to electric mobility and renewable energy solutions across APAC. As a result, there is a greater emphasis on creating anode materials that allow for faster charging, longer battery life, and better overall performance.

Collaborations among industry players, research institutions, and government programs aimed at encouraging innovation and investment in the development of next-generation anode materials are also boosting market expansion in APAC.

Overall, the APAC next-generation anode material market offers considerable potential for manufacturers and stakeholders to capitalize on the region's expanding demand for innovative battery technologies in the electric mobility and renewable energy industries.

Market Segmentation:

Segmentation 1: By End User

- Transportation

- Passenger Electric Vehicles

- Commercial Electric Vehicles

- Others

- Electrical and Electronics

- Energy Storage

- Others

Segmentation 2: By Type

- Silicon/Silicon Oxide Blend

- Lithium Titanium Oxide

- Silicon-Carbon Composite

- Silicon-Graphene Composite

- Lithium Metal

- Others

Segmentation 3: by Country

- Japan

- South Korea

- India

- Rest-of-Asia-Pacific and Japan

How can this report add value to an organization?

Product/Innovation Strategy: The product segment helps the reader to understand the different types involved in the next-generation anode materials market. Moreover, the study provides the reader with a detailed understanding of the APAC next-generation anode materials market based on the end user (transportation, electrical and electronics, energy storage, and others). APAC Next-generation anode materials market is gaining traction in end-user industries on the back of sustainability concerns and their higher efficiency properties. APAC Next-generation anode materials are also being used for controlling green house gas (GHG) emissions. Moreover, partnerships and collaborations are expected to play a crucial role in strengthening market position over the coming years, with the companies focusing on bolstering their technological capabilities and gaining a dominant market share in the next-generation anode materials industry.

Growth/Marketing Strategy: The APAC next-generation anode materials market has been growing at a rapid pace. The market offers enormous opportunities for existing and emerging market players. Some of the strategies covered in this segment are mergers and acquisitions, product launches, partnerships and collaborations, business expansions, and investments. The strategies preferred by companies to maintain and strengthen their market position primarily include partnerships, agreements, and collaborations.

Competitive Strategy: The key players in the APAC next-generation anode materials market analyzed and profiled in the study include next-generation anode materials providers that develop, maintain, and market next-generation anode materials. Moreover, a detailed competitive benchmarking of the players operating in the APAC next-generation anode materials market has been done to help the reader understand the ways in which players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on thorough secondary research, which includes analyzing company coverage, product portfolio, market penetration, and insights gathered from primary experts.

Some prominent names established in this market are:

- Tianqi Lithium Corporation

- POSCO CHEMICAL

Table of Contents

Executive Summary

Scope of the Study

1 Markets

- 1.1 Industry Outlook

- 1.1.1 Trends: Current and Future

- 1.1.1.1 Expanding Market of Next-Generation Anode Materials for Electric Vehicles

- 1.1.1.2 Focus on Silicon Recycling Promotes Applications in Lithium-Ion Batteries

- 1.1.1.3 Growing Demand for Solid-State Lithium-Metal Batteries in Various End-Use Applications

- 1.1.2 Supply Chain Analysis

- 1.1.3 Ecosystem of Next-Generation Anode Materials Market

- 1.1.3.1 Consortiums and Associations

- 1.1.3.2 Regulatory/Certification Bodies

- 1.1.3.3 Government Programs

- 1.1.3.4 Programs by Research Institutions and Universities

- 1.1.4 Comparison Analysis between Anode and Cathode Materials

- 1.1.5 Investment Scenario

- 1.1.1 Trends: Current and Future

- 1.2 Business Dynamics

- 1.2.1 Business Drivers

- 1.2.1.1 Increasing Need for Fast Charging and High-Density Batteries

- 1.2.1.2 Growing Demand of Silicon Material Due to Low Cost, Sustainable, and Abundant Nature

- 1.2.1.3 Increased Frequency of R&D Projects to Enhance Battery Composition

- 1.2.1.4 Increasing Investment in Advanced Energy Storage Technologies

- 1.2.2 Business Restraints

- 1.2.2.1 High Cost of Next-Generation Anode Materials

- 1.2.2.2 Lack of Large-Scale Production of High-Quality Graphene

- 1.2.2.3 Increased Volume and Degradation of Silicon Anodes

- 1.2.3 Business Strategies

- 1.2.3.1 Product and Market Development

- 1.2.4 Corporate Strategies

- 1.2.4.1 Mergers and Acquisitions, Partnerships, Collaborations, and Joint Ventures

- 1.2.5 Business Opportunities

- 1.2.5.1 Increasing Investment in Renewable Energy Sources

- 1.2.5.2 Growing Concern for the Environment and Carbon Neutrality Targets

- 1.2.5.3 Creating Resilient Binders for Assuring the Stability of Silicon Anodes

- 1.2.5.4 Designing New Electrolytes for Lithium Metal Batteries

- 1.2.1 Business Drivers

2 Regions

- 2.1 China

- 2.1.1 Market

- 2.1.1.1 Buyer Attributes

- 2.1.1.2 Key Manufacturers/Suppliers in China

- 2.1.1.3 Regulatory Landscape

- 2.1.1.4 Business Drivers

- 2.1.1.5 Business Challenges

- 2.1.2 Application

- 2.1.2.1 China Next-Generation Anode Materials Market (by End User), Volume and Value Data

- 2.1.3 Product

- 2.1.3.1 China Next-Generation Anode Materials Market (by Type), Volume and Value Data

- 2.1.1 Market

- 2.2 Asia-Pacific and Japan

- 2.2.1 Market

- 2.2.1.1 Key Manufacturers/Suppliers in Asia-Pacific and Japan

- 2.2.1.2 Business Drivers

- 2.2.1.3 Business Challenges

- 2.2.2 Application

- 2.2.2.1 Asia-Pacific and Japan Next-Generation Anode Materials Market (by End User), Volume and Value Data

- 2.2.3 Product

- 2.2.3.1 Asia-Pacific and Japan Next-Generation Anode Materials Market (by Type), Volume and Value Data

- 2.2.4 Asia-Pacific and Japan (by Country)

- 2.2.4.1 Japan

- 2.2.4.1.1 Market

- 2.2.4.1.1.1 Buyer Attributes

- 2.2.4.1.1.2 Key Manufacturers/ Suppliers in Japan

- 2.2.4.1.1.3 Regulatory Landscape

- 2.2.4.1.1.4 Business Drivers

- 2.2.4.1.1.5 Business Challenges

- 2.2.4.1.2 Application

- 2.2.4.1.2.1 Japan Next-Generation Anode Materials Market (by End User), Volume and Value Data

- 2.2.4.1.3 Product

- 2.2.4.1.3.1 Japan Next-Generation Anode Materials Market (by Type), Volume and Value Data

- 2.2.4.1.1 Market

- 2.2.4.2 South Korea

- 2.2.4.2.1 Market

- 2.2.4.2.1.1 Buyer Attributes

- 2.2.4.2.1.2 Key Manufacturers/ Suppliers in South Korea

- 2.2.4.2.1.3 Regulatory Landscape

- 2.2.4.2.1.4 Business Drivers

- 2.2.4.2.1.5 Business Challenges

- 2.2.4.2.2 Application

- 2.2.4.2.2.1 South Korea Next-Generation Anode Materials Market (by End User), Volume and Value Data

- 2.2.4.2.3 Product

- 2.2.4.2.3.1 South Korea Next-Generation Anode Materials Market (by Type), Volume and Value Data

- 2.2.4.2.1 Market

- 2.2.4.3 India

- 2.2.4.3.1 Market

- 2.2.4.3.1.1 Buyer Attributes

- 2.2.4.3.1.2 Key Manufacturers/ Suppliers in India

- 2.2.4.3.1.3 Regulatory Landscape

- 2.2.4.3.1.4 Business Drivers

- 2.2.4.3.1.5 Business Challenges

- 2.2.4.3.2 Application

- 2.2.4.3.2.1 India Next-Generation Anode Materials Market (by End User), Volume and Value Data

- 2.2.4.3.3 Product

- 2.2.4.3.3.1 India Next-Generation Anode Materials Market (by Type), Volume and Value Data

- 2.2.4.3.1 Market

- 2.2.4.4 Rest-of-Asia-Pacific and Japan

- 2.2.4.4.1 Market

- 2.2.4.4.1.1 Buyer Attributes

- 2.2.4.4.1.2 Key Manufacturers/ Suppliers in the Rest-of-Asia-Pacific and Japan

- 2.2.4.4.1.3 Business Drivers

- 2.2.4.4.1.4 Business Challenges

- 2.2.4.4.2 Application

- 2.2.4.4.2.1 Rest-of-Asia-Pacific and Japan Next-Generation Anode Materials Market (by End User), Volume and Value Data

- 2.2.4.4.3 Product

- 2.2.4.4.3.1 Rest-of-Asia Pacific and Japan Next-Generation Anode Materials Market (by Type), Volume and Value Data

- 2.2.4.4.1 Market

- 2.2.4.1 Japan

- 2.2.1 Market

3 Markets - Competitive Benchmarking & Company Profiles

- 3.1 Competitive Benchmarking

- 3.1.1 Competitive Position Matrix

- 3.1.2 Product Matrix of Key Companies (by Type)

- 3.1.3 Market Share Analysis of Key Companies, 2022

- 3.2 Company Profiles

- 3.2.1 Shanghai Shanshan Technology Co., Ltd.

- 3.2.1.1 Company Overview

- 3.2.1.1.1 Role of Shanghai Shanshan Technology Co., Ltd. in the Next-Generation Anode Materials Market

- 3.2.1.1.2 Product Portfolio

- 3.2.1.2 Business Strategies

- 3.2.1.2.1 Market Development

- 3.2.1.3 Analyst View

- 3.2.1.1 Company Overview

- 3.2.2 Talga Group.

- 3.2.2.1 Company Overview

- 3.2.2.1.1 Role of Talga Group. in the Next-Generation Anode Materials Market

- 3.2.2.1.2 Product Portfolio

- 3.2.2.2 Business Strategies

- 3.2.2.2.1 Market Development

- 3.2.2.3 Corporate Strategies

- 3.2.2.3.1 Partnerships, Collaborations, and Joint Ventures

- 3.2.2.4 Analyst View

- 3.2.2.1 Company Overview

- 3.2.3 Tianqi Lithium Corporation

- 3.2.3.1 Company Overview

- 3.2.3.1.1 Role of Tianqi Lithium Corporation in the Next-Generation Anode Materials Market

- 3.2.3.1.2 Product Portfolio

- 3.2.3.1.3 Production Sites

- 3.2.3.2 Analyst View

- 3.2.3.1 Company Overview

- 3.2.4 Jiangxi Ganfeng Lithium Co., Ltd.

- 3.2.4.1 Company Overview

- 3.2.4.1.1 Role of Jiangxi Ganfeng Lithium Co., Ltd. in the Next-Generation Anode Materials Market

- 3.2.4.1.2 Product Portfolio

- 3.2.4.1.3 Production Sites

- 3.2.4.2 Business Strategies

- 3.2.4.2.1 Market Development

- 3.2.4.3 Corporate Strategies

- 3.2.4.3.1 Partnerships, Collaborations, and Joint Ventures

- 3.2.4.4 R&D Analysis

- 3.2.4.5 Analyst View

- 3.2.4.1 Company Overview

- 3.2.5 POSCO CHEMICAL

- 3.2.5.1 Company Overview

- 3.2.5.1.1 Role of POSCO CHEMICAL in the Next-Generation Anode Materials Market

- 3.2.5.1.2 Product Portfolio

- 3.2.5.1.3 Production Sites

- 3.2.5.2 Business Strategies

- 3.2.5.2.1 Market Development

- 3.2.5.3 Corporate Strategies

- 3.2.5.3.1 Partnerships, Collaborations, and Joint Ventures

- 3.2.5.4 Analyst View

- 3.2.5.1 Company Overview

- 3.2.1 Shanghai Shanshan Technology Co., Ltd.

4 Research Methodology

- 4.1 Primary Data Sources

- 4.2 BIS Data Sources

- 4.3 Assumptions and Limitations